Exide Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exide Industries Bundle

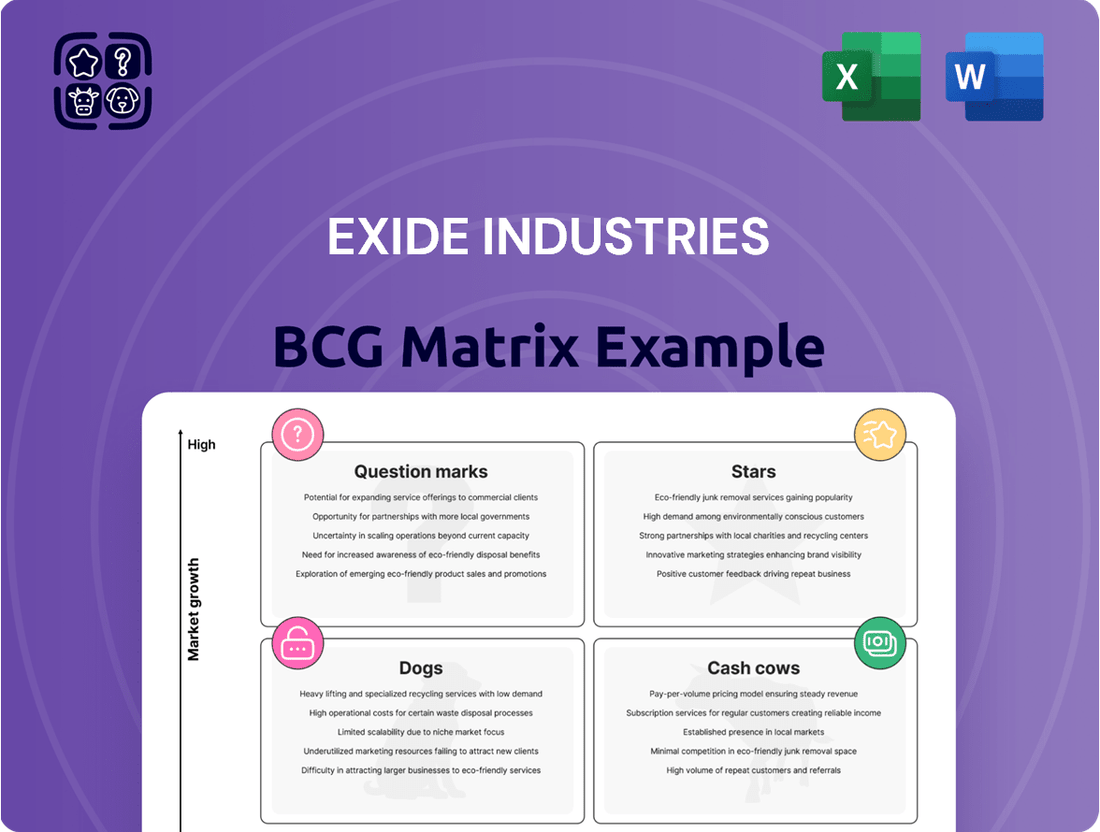

Curious about Exide Industries' strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, revealing potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for navigating the competitive battery market.

Where does Exide's innovation truly shine, and which segments are demanding more resources than they're yielding? This preview is just a starting point.

To truly unlock Exide Industries' strategic blueprint and gain actionable insights, you need the complete BCG Matrix. It's your key to identifying growth opportunities and optimizing resource allocation.

Purchase the full report now for a comprehensive breakdown of Exide's market share and growth rates, empowering you to make informed investment decisions and drive future success.

Don't miss out on the detailed quadrant placements and strategic recommendations that will give you a competitive edge. Get the full BCG Matrix today!

Stars

Exide's wholly-owned subsidiary, Exide Energy Solutions Ltd (EESL), is making a substantial investment in a 12 GWh lithium-ion cell manufacturing facility in Bengaluru. Phase 1 of this facility is slated to begin commercial operations in fiscal year 2025-26. This strategic move positions Exide to strongly compete in India's burgeoning electric vehicle battery market, which is anticipated to expand at a compound annual growth rate exceeding 22% until 2033.

The company's commitment to this high-growth sector is further underscored by its strategic alliances with leading automotive manufacturers, including Hyundai and Kia. These partnerships are instrumental in cementing Exide's presence and influence within the rapidly expanding EV battery segment, driven by increasing demand for sustainable transportation solutions.

Exide Industries is strategically positioning its new lithium-ion battery production for the burgeoning energy storage systems (ESS) market. This includes crucial grid-scale applications and the integration of renewable energy sources like solar and wind power. The company’s focus extends beyond electric vehicles to capture this significant growth opportunity.

The Indian battery market, a key focus for Exide, is projected for substantial expansion, largely fueled by the increasing demand for reliable energy storage solutions. Exide's ambition is to offer complete cell-to-system solutions, a move designed to fully leverage this market growth and provide integrated offerings to customers.

Government policies in India are actively supporting the renewable energy sector and energy storage, creating a favorable environment for companies like Exide. These initiatives, aimed at boosting clean energy adoption, directly benefit Exide's ESS business segment by driving demand and encouraging investment in storage technologies.

As of late 2024, India's renewable energy capacity has surpassed 180 GW, highlighting the urgent need for robust energy storage to manage intermittency. Exide's entry into the ESS lithium-ion market, with an anticipated initial production capacity of 1.5 GWh, is well-timed to address this critical infrastructure gap.

Exide Industries is making a significant push into advanced chemistry cell (ACC) manufacturing, investing ₹3,602 crore in a new facility. This strategic move positions them to capitalize on the rapidly growing demand for battery storage solutions. The company's entry into ACC production is a key step in its evolution, moving beyond traditional lead-acid batteries into a more technologically advanced and high-growth sector.

This substantial investment is further bolstered by government support through schemes like the Production Linked Incentive (PLI) for ACC battery storage. The PLI scheme is designed to foster domestic manufacturing capabilities and reduce import dependence, creating a favorable environment for Exide's new venture. By aligning with these national initiatives, Exide is not only securing its future but also contributing to India's broader goals of energy security and technological self-reliance.

The decision to manufacture advanced chemistry cells places Exide higher up the value chain in a market characterized by rapid technological advancements and increasing consumer and industrial demand. This transition is crucial for sustained growth and competitiveness in the evolving energy landscape. The company's foresight in investing in this critical technology is expected to yield significant returns as the electric vehicle and renewable energy storage markets continue their upward trajectory.

Auxiliary Batteries for EVs

Exide Industries is strategically positioning itself within the burgeoning electric vehicle (EV) market by developing and supplying auxiliary batteries. These specialized batteries are crucial for the operation of EVs, powering essential systems like infotainment, lighting, and safety features, which are separate from the main drive battery. Exide's focus on this niche segment, catering to both electric two-wheelers and four-wheelers for various Original Equipment Manufacturers (OEMs), highlights a proactive approach to capturing early market share in a high-growth sector.

The demand for EV auxiliary batteries is directly tied to the overall expansion of the EV market. For instance, global EV sales, including plug-in hybrids, reached approximately 13.6 million units in 2023, marking a significant increase from previous years. This growth trend directly translates into a growing need for reliable auxiliary battery solutions, an area where Exide aims to leverage its established automotive battery expertise.

- Market Entry: Exide is actively supplying auxiliary batteries to EV OEMs, establishing a foothold in a critical segment of the EV supply chain.

- Growth Potential: This niche represents a high-growth area within the rapidly expanding electric vehicle ecosystem, driven by increasing EV adoption.

- Technological Importance: Auxiliary batteries are vital for the functionality and safety of EVs, powering essential onboard electronics.

- Strategic Leverage: Exide is capitalizing on its existing automotive battery expertise to gain an early advantage in this specialized battery market.

Strategic Partnerships in EV Sector

Exide Industries' strategic partnerships are crucial for its growth, particularly in the burgeoning electric vehicle (EV) sector. The binding term sheet with Hyundai Motor India and Kia Corporation to produce and supply lithium-ion cells and battery packs exclusively for their Indian EVs is a prime example. This move not only secures a consistent demand for Exide's EV battery products but also establishes the company as a key domestic supplier for major global automotive players entering the Indian market. This collaboration is projected to significantly boost Exide's market share in the EV battery segment, which is expected to grow substantially in the coming years. For instance, India's electric vehicle market is anticipated to reach $150 billion by 2030, with battery manufacturing being a critical component of this growth.

These alliances are instrumental in Exide's strategy to capture a significant portion of the rapidly expanding Indian EV market. By aligning with global automotive giants, Exide gains access to advanced technology and ensures its products meet international quality standards. This positions Exide favorably to capitalize on the increasing adoption of electric mobility in India. The company's commitment to localizing battery production is also aligned with the Indian government's Make in India initiative and Production Linked Incentive (PLI) schemes for advanced chemistry cell (ACC) battery storage. Exide aims to leverage these partnerships to become a leader in the domestic EV battery ecosystem, fostering innovation and contributing to India's sustainable transportation goals.

- Strategic Alliance: Binding term sheet with Hyundai Motor India and Kia Corporation for exclusive supply of lithium-ion cells and battery packs for their Indian EVs.

- Market Access: Secures a steady demand pipeline and positions Exide as a preferred domestic supplier for leading global automakers.

- Growth Trajectory: Indicates strong market entry and growth potential in the competitive EV space, aligning with India's EV market growth projections.

- Localization Focus: Supports Make in India and PLI schemes, reinforcing Exide's commitment to domestic EV battery manufacturing.

Exide's investment in lithium-ion cell manufacturing positions its new ventures as potential Stars in the BCG matrix. The company's dedicated focus on the high-growth electric vehicle (EV) and energy storage systems (ESS) markets, driven by substantial investments and strategic partnerships, indicates strong market share potential. As India's EV market is projected to reach $150 billion by 2030 and renewable energy capacity grows, these new ventures are poised for significant expansion.

The substantial investment of ₹3,602 crore in advanced chemistry cell (ACC) manufacturing and the establishment of a 12 GWh lithium-ion cell facility in Bengaluru are key indicators of Exide's ambition to capture a leading position. These initiatives, supported by government schemes like the Production Linked Incentive (PLI), are designed to foster rapid growth and market penetration in a sector with high demand and technological evolution.

What is included in the product

Exide's BCG Matrix likely shows its established automotive batteries as Cash Cows, while newer product lines may be Stars or Question Marks needing strategic focus.

A clear BCG matrix for Exide Industries simplifies strategic decisions by visually categorizing business units, acting as a pain point reliever for complex portfolio management.

Cash Cows

Exide's lead-acid automotive batteries for the replacement market are a clear Cash Cow. The company commands a significant portion of India's aftermarket battery sales, a sector characterized by consistent demand from the nation's vast vehicle fleet. This mature market requires minimal growth investment but yields substantial, stable profits and cash generation.

In fiscal year 2024, Exide Industries reported that its automotive battery segment, which includes the aftermarket, demonstrated robust performance. The company's strong brand recall and extensive distribution network ensure continued sales even as the overall automotive market evolves. This segment's high profitability is a key contributor to Exide's overall financial strength.

Exide's industrial battery segment, particularly for UPS and telecom applications, acts as a significant cash cow. These markets are mature, characterized by stable demand for dependable backup power, a crucial element for infrastructure reliability.

The company's robust brand equity and well-established distribution channels in these sectors solidify its high market share. This dominance translates into consistent revenue streams, underscoring its cash cow status.

In fiscal year 2024, Exide Industries reported strong performance across its industrial segments, with the UPS and telecom battery divisions contributing substantially to overall profitability. While specific segment-wise revenue isn't always publicly detailed, the company's continued investment and market leadership in these areas highlight their ongoing importance.

Submarine batteries represent a strong cash cow for Exide Industries. Their established expertise in this highly specialized sector, serving a critical defense need, positions them as a leader with likely limited competition. This niche market allows Exide to command premium pricing due to the advanced technology and reliability required for submarine operations.

In 2023, Exide Industries reported a consolidated revenue of INR 15,179 crore. While specific revenue breakdowns for submarine batteries aren't publicly detailed, the segment's high-margin nature, driven by its specialized application and technological complexity, significantly contributes to the company's overall profitability. This enduring demand in a defense-critical area solidifies its cash cow status.

Inverters and Home UPS Systems

Exide's inverters and home UPS systems are strong cash cows. Despite a subdued demand noted for home UPS in FY25, Exide's long-standing market presence and trusted brand name in this segment continue to generate consistent cash flow. This segment benefits from India's widespread need for reliable power backup solutions. Even with potentially slower growth, a substantial installed base ensures ongoing revenue streams through both product sales and essential servicing.

- Established Brand Recognition: Exide is a dominant player in the Indian inverter and home UPS market, fostering customer loyalty.

- Steady Cash Generation: Despite economic headwinds, the essential nature of power backup drives consistent sales and service revenue.

- Large Installed Base: Exide's extensive network of existing users provides a continuous source of income through maintenance and replacement sales.

- Market Penetration: The product's widespread adoption across diverse Indian households solidifies its cash cow status.

Traditional Lead-Acid Battery Exports

Exide Industries' traditional lead-acid battery exports represent a significant cash cow for the company. The automotive battery segment, in particular, has demonstrated strong international performance, leveraging India's cost advantages.

While the global market for lead-acid batteries is considered mature, Exide's competitive pricing strategy and unwavering commitment to quality enable it to generate stable and consistent revenue streams from its export operations. This is particularly true in emerging markets where lead-acid technology remains a cost-effective and practical solution.

In the fiscal year 2023, Exide Industries reported a consolidated revenue of INR 15,066 crore, with exports contributing a notable portion. The company's focus on established markets and its ability to offer reliable products at competitive price points solidify its position in the international lead-acid battery landscape.

- Strong export performance in automotive batteries, capitalizing on cost advantages.

- Mature market segment generating consistent revenue due to competitive pricing and quality.

- Continued relevance in markets where lead-acid technology is preferred for cost-effectiveness.

- Fiscal year 2023 consolidated revenue reached INR 15,066 crore, with exports playing a key role.

Exide's automotive battery replacement market is a prime example of a cash cow. This segment enjoys consistent demand from India's large vehicle population, requiring minimal investment for growth but delivering substantial, stable profits.

In fiscal year 2024, Exide’s automotive division, including aftermarket sales, showed strong performance. The company’s brand recognition and widespread distribution ensure ongoing sales. This segment's profitability is a major contributor to Exide's financial health.

The industrial battery segment, serving UPS and telecom needs, also functions as a cash cow. These mature markets depend on reliable backup power, a critical infrastructure component.

Exide's strong brand and distribution in these sectors maintain its high market share, leading to predictable revenue streams.

In fiscal year 2024, Exide reported solid industrial segment results, with UPS and telecom batteries significantly boosting profitability.

| Segment | BCG Classification | Key Characteristics | FY24 Performance Indicator |

| Automotive Replacement Batteries | Cash Cow | Mature market, consistent demand, high market share | Robust performance, strong brand recall |

| Industrial Batteries (UPS, Telecom) | Cash Cow | Stable demand for backup power, market leadership | Substantial contribution to profitability |

What You’re Viewing Is Included

Exide Industries BCG Matrix

The BCG Matrix analysis for Exide Industries that you see here is the complete and final report you will receive upon purchase. This preview accurately represents the comprehensive strategic insights, including detailed positioning of Exide's business units within the matrix, that will be delivered to you, ready for immediate application in your business planning and decision-making processes.

Dogs

Within Exide Industries' portfolio, certain lead-acid battery technologies, particularly those considered obsolete or serving highly niche markets, are likely positioned in the Dogs quadrant of the BCG Matrix. These products often face declining demand as newer, more efficient battery chemistries emerge, limiting their growth potential and future applicability.

These specific lead-acid segments, characterized by low market share within shrinking or stagnant segments of the broader battery market, generate minimal returns for Exide. For instance, while the overall automotive battery market is robust, older industrial or specialized lead-acid applications might represent a shrinking revenue stream.

Products in this category represent a challenge, potentially tying up valuable capital and resources that could be redirected to more promising growth areas. Their low profitability and limited future prospects necessitate careful management and strategic consideration for their future within Exide's product lifecycle.

Within Exide Industries' home UPS business, specific sub-segments that saw reduced demand in FY25, possibly due to improved grid power availability or heightened competition, can be categorized as Dogs. For instance, the market for basic, lower-capacity UPS units in urban areas with more stable electricity might have contracted. If these segments continue to exhibit sluggish sales or a downward trend without clear avenues for revival, they represent areas that consume capital without yielding substantial returns.

Exide Industries faces challenges in certain industrial battery segments, particularly those in declining European markets experiencing economic slowdown. These less competitive offerings, where Exide holds a low market share and differentiation is minimal, represent potential 'Dogs' in their BCG Matrix.

For instance, while Exide's industrial battery business thrives in India, specific product lines catering to niche, shrinking industrial applications in regions like parts of Eastern Europe could fall into this category. These markets often see intense price competition without significant technological advantages for Exide.

In 2024, the global industrial battery market, while generally growing, exhibits regional disparities. Sectors heavily reliant on traditional lead-acid technologies in economically stagnant European nations might show an approximate 2-3% annual decline in demand, impacting Exide's market position in those specific sub-segments.

Low-Margin, High-Volume Traditional Products with Intense Competition

In the traditional battery market, Exide Industries faces segments characterized by intense competition and thin profit margins. Products in these areas, while selling in high volumes, often struggle to contribute substantially to overall profitability due to price pressures. For instance, the automotive replacement battery segment, a key area for Exide, is highly commoditized. In fiscal year 2024, Exide reported revenue from its automotive business, but the pressure on margins in this mature segment is a constant challenge.

- High Volume, Low Margin: These products, like standard automotive batteries, require significant sales volume to achieve even modest profitability.

- Intense Competition: The market for traditional batteries includes numerous domestic and international players, driving down prices.

- Limited Growth Prospects: Mature markets for traditional products offer less potential for significant expansion.

- Break-Even Potential: Without strong growth or margin improvement, these products may only cover their costs, acting as cash cows that simply sustain operations.

Legacy Product Lines Without R&D Investment

Exide Industries' legacy product lines that are not receiving significant R&D investment are potentially facing a "dog" status in the BCG matrix. These are products that have seen better days and are slowly being replaced by newer, more advanced offerings. Without a strategic plan for their future, they risk becoming obsolete.

These older products, such as certain traditional lead-acid battery types that are being phased out in favor of lithium-ion or advanced AGM technologies, would likely experience declining sales and market share. For instance, while Exide is a leader in the automotive battery segment, older, less efficient battery technologies within their portfolio might be experiencing this trend. In 2023-24, Exide's focus has been on expanding its presence in the EV battery segment and advanced battery chemistries, indicating a strategic shift away from older technologies.

- Diminishing Market Relevance: Legacy products often struggle to compete with innovative alternatives, leading to a shrinking customer base.

- Declining Sales and Profitability: As newer technologies gain traction, sales of older products naturally decrease, impacting revenue and profit margins.

- Lack of Strategic Focus: Without R&D, these products lack the necessary updates to remain competitive, making them candidates for divestment or discontinuation.

- Resource Misallocation: Continuing to support products with low growth potential can divert resources from more promising growth areas within the company.

Certain legacy lead-acid battery technologies within Exide Industries, particularly those serving highly niche or declining industrial applications, can be classified as Dogs. These products face stagnant or shrinking demand due to the rise of advanced battery chemistries and evolving market needs. For example, specific industrial battery types used in older manufacturing equipment in economically challenged regions might represent this category.

These 'Dog' products typically have a low market share in low-growth segments, contributing minimally to Exide's overall revenue and profitability. Their limited future prospects mean they consume resources without generating substantial returns. In fiscal year 2024, Exide's strategic focus on expanding into EV and advanced battery solutions highlights a deliberate shift away from such legacy segments.

The challenge with these 'Dog' products lies in their potential to tie up capital and management attention that could be better allocated to high-growth areas like lithium-ion batteries. Careful evaluation is needed to decide whether to divest, discontinue, or attempt a niche revival for these offerings.

Question Marks

Exide Industries is positioning its rooftop solar energy solutions as a significant growth opportunity, aiming to capture a substantial share of the burgeoning renewable energy market. This venture enters a sector experiencing rapid expansion, driven by government incentives and increasing environmental awareness.

While the precise market share for Exide's integrated rooftop solar solutions in 2024 is likely still developing, it's positioned as a Question Mark in the BCG Matrix. This indicates high market growth potential but currently low relative market share, demanding strategic investment to gain traction.

The company's strategy involves offering comprehensive packages, suggesting a commitment to building a strong presence in this segment. Success hinges on market adoption and Exide's ability to compete effectively against established players and emerging technologies.

The Indian solar rooftop market, for instance, saw significant growth. In 2023, the cumulative rooftop solar capacity reached over 10 GW, with projections for continued expansion. Exide’s entry targets this dynamic landscape, aiming to transition this business from a Question Mark to a Star performer.

Exide Industries is strategically expanding its battery offerings with new product lines designed for the burgeoning commercial vehicle and e-rickshaw markets. This move is a direct response to the accelerating adoption of electric mobility in these crucial segments, which are experiencing significant growth. For instance, India's e-rickshaw market alone is projected to reach $1.5 billion by 2027, presenting a substantial opportunity.

The company is investing heavily in these high-growth areas to capture a meaningful market share. This necessitates focused marketing efforts and ongoing product development to meet the specific demands of commercial applications, which often require robust performance and extended lifecycles. These new products are positioned to address the unique power and durability needs of these vehicle types.

Exide Industries is strategically focusing on electric vehicles (EVs) and energy storage systems (ESS) for lithium-ion batteries. However, other promising sectors exist, such as portable electronics, medical devices, and aerospace, which represent potential growth areas. These are classified as question marks in the BCG matrix, requiring careful analysis and targeted investment to gauge their market potential and Exide's competitive positioning.

The global market for lithium-ion batteries in applications beyond EVs and ESS is projected to grow significantly. For instance, the portable electronics market alone was valued at over $100 billion in 2023 and is expected to see a compound annual growth rate (CAGR) of around 7% through 2030. Exide's exploration in these segments could unlock new revenue streams if they can establish a strong foothold.

Medical devices, in particular, are increasingly relying on advanced battery technology for portability and reliability. The market for medical batteries was estimated at $2.5 billion in 2023 and is anticipated to expand at a CAGR of approximately 8.5% by 2028, driven by advancements in implantable devices and wearable health monitors. Exide's potential entry or expansion into this niche requires significant R&D and regulatory navigation.

Aerospace and defense also present a smaller but high-value segment for specialized lithium-ion solutions, demanding robust performance and safety standards. While specific market size figures are often proprietary, the trend towards electrification in aviation and the need for lightweight, high-density power sources indicate a growing demand. Exide's ability to meet these stringent requirements will determine its success in this domain.

Global Expansion into New Markets

Exide Industries is strategically focusing on global expansion into new markets, particularly in Southeast Asia and Europe, to capitalize on the growing demand for batteries driven by electrification trends. The company is aiming for a robust 15% year-on-year increase in its export sales. These new territories represent a classic 'question mark' scenario in the BCG matrix due to their high growth potential but relatively low initial brand recognition and market share for Exide.

The battery market in Southeast Asia and Europe is experiencing significant growth, with projections indicating a compound annual growth rate (CAGR) of over 10% for the automotive battery segment through 2027, and even higher for industrial and EV batteries. For Exide, entering these markets requires careful planning and substantial investment to build brand awareness and establish a competitive presence. This strategic push is crucial for diversifying revenue streams and achieving long-term global market penetration.

- High Growth Potential: Southeast Asia and Europe are key growth regions for electrification, presenting substantial opportunities for battery sales.

- Low Initial Market Share: Exide faces the challenge of building brand recognition and market share from a low base in these new geographies.

- Strategic Investment Required: Significant investment in marketing, distribution, and potentially local partnerships is necessary to succeed.

- Targeted Export Growth: The company's objective of a 15% year-on-year increase in export sales underscores the importance of these new market entries.

Advanced Lead-Acid Technologies for Niche Applications (e.g., SLI AGM for export)

Exide Industries is actively pursuing the development of advanced lead-acid technologies, specifically targeting the export market with products like Separator Glass Mat (AGM) batteries for Starting, Lighting, and Ignition (SLI) applications. This strategic move aims to capitalize on evolving automotive demands and potentially higher performance requirements in certain international segments. While AGM represents a technological advancement over traditional flooded lead-acid batteries, its current market penetration within these specific export niches requires careful evaluation.

The market for SLI AGM batteries, especially for export, can be characterized as a high-growth opportunity situated within the broader, more mature lead-acid battery sector. However, due to the nascent stage of Exide's market share in these targeted export regions, this product line fits the profile of a 'Question Mark' in the BCG matrix. Significant investment will be necessary to build brand recognition, establish distribution channels, and gain competitive footing against established players or alternative technologies.

- Product Development: Exide is investing in advanced lead-acid technologies like SLI AGM batteries.

- Market Positioning: Targeted for export markets, indicating a niche focus.

- Growth Potential: High growth within a mature technology segment.

- Current Status: Low initial market share in targeted export niches categorizes it as a 'Question Mark'.

- Strategic Need: Requires substantial investment to achieve market traction and growth.

Exide's ventures into new, high-growth markets like rooftop solar and specialized lithium-ion applications for portable electronics and medical devices are currently classified as Question Marks. These areas offer substantial future potential but require significant investment to establish market share and overcome nascent brand recognition.

The company's strategic expansion into Southeast Asia and Europe for batteries, along with the development of advanced lead-acid technologies for specific export markets, also represent Question Marks. These initiatives aim for significant export growth, targeting a 15% year-on-year increase, but face the challenge of building presence in unfamiliar territories.

Success for these Question Mark businesses hinges on effective market penetration strategies, continued product innovation, and substantial resource allocation to compete against established players and evolving technological landscapes.

The Indian rooftop solar market alone exceeded 10 GW in cumulative capacity by the end of 2023, highlighting the growth potential Exide is targeting. Similarly, the global market for lithium-ion batteries in portable electronics was valued over $100 billion in 2023, with a projected 7% CAGR through 2030, underscoring the opportunities Exide is exploring.

BCG Matrix Data Sources

Our Exide Industries BCG Matrix is built on a foundation of robust data, including their annual reports, market research on battery industry growth rates, and competitor analysis.