Exelixis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exelixis Bundle

Navigate the complex external forces shaping Exelixis's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Equip yourself with critical insights to refine your strategic planning and investment decisions. Download the full PESTLE analysis now and gain a decisive market advantage.

Political factors

Government healthcare policies are a significant driver for Exelixis. For instance, the Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, could impact future revenue for Exelixis' oncology treatments if its products become subject to negotiation. This legislation aims to control healthcare costs, potentially affecting market access and pricing strategies for innovative therapies.

Reimbursement models also play a critical role. Changes in how Medicare and other government payers reimburse for cancer treatments, including biologics and targeted therapies, directly influence Exelixis' sales. In 2024, ongoing discussions about value-based care and outcomes-based pricing in oncology could reshape how Exelixis' products are compensated, impacting its financial performance.

The political climate surrounding drug affordability remains a key consideration. Public and governmental pressure to lower prescription drug costs can lead to policy changes that affect pricing flexibility. Exelixis must navigate this environment, balancing innovation investment with market access demands, especially as it seeks to expand its portfolio of cancer therapies.

Regulatory shifts, like those from the FDA and EMA, significantly influence drug development timelines and expenses. For instance, the FDA's accelerated approval pathway, while beneficial for speed, can also lead to post-market requirements that add complexity. In 2024, the FDA continued to emphasize real-world evidence in its decision-making, potentially impacting the long-term regulatory burden for drugs like Exelixis' lead compound, cabozantinib.

Global trade dynamics significantly impact biopharmaceutical firms like Exelixis. Fluctuations in international trade policies and the imposition of tariffs directly affect the cost of sourcing raw materials, manufacturing processes, and the logistics of distributing life-saving treatments. For instance, changes in trade agreements or new tariff structures can increase operational expenses, potentially affecting pricing and market access.

Legislation like the proposed Biosecure Act, which seeks to restrict business dealings with certain foreign entities, presents a notable challenge. Such policies could compel companies to re-evaluate and potentially restructure their supply chains, leading to increased costs and operational complexities. Furthermore, these legislative shifts can hinder international collaborations, which are often crucial for research and development in the biopharmaceutical sector.

In 2023, global trade saw continued adjustments, with various nations implementing new trade regulations. The pharmaceutical sector, in particular, is sensitive to these changes, as it relies on a complex international network for research, development, and manufacturing. For Exelixis, navigating these evolving trade landscapes is essential for maintaining competitive pricing and ensuring the consistent availability of its products worldwide.

Political Stability and R&D Investment

A stable political climate is crucial for fostering confidence in long-term research and development investments. For a company like Exelixis, which relies heavily on continuous innovation in oncology, political stability in key markets directly impacts R&D funding and the predictability of tax incentives. For instance, the United States, a primary market for Exelixis, has historically maintained consistent government support for biomedical research, though shifts in legislative priorities can always introduce uncertainty.

Political instability or abrupt changes in government policy can significantly disrupt R&D pipelines. This could manifest as reduced federal funding for scientific initiatives or alterations in tax credits that encourage pharmaceutical innovation, directly affecting Exelixis' capacity to invest in its promising oncology pipeline. The 2024 election cycle in the US, for example, will be closely watched for any potential shifts in healthcare policy or R&D tax legislation.

- Government Funding: Fluctuations in government grants and funding for cancer research can impact early-stage drug discovery, a critical area for Exelixis.

- Tax Incentives: Changes in R&D tax credits, such as the Tax Cuts and Jobs Act of 2017 and subsequent discussions around its extension or modification, directly influence the cost-effectiveness of Exelixis' innovation efforts.

- Regulatory Environment: Political stability also underpins consistent and predictable regulatory pathways for drug approvals, which is vital for bringing new therapies to market.

Government Funding for Cancer Research

Government funding plays a crucial role in advancing cancer research and treatment, directly impacting companies like Exelixis. Increased public investment can significantly accelerate the pace of discovery, bolster the crucial stages of clinical trials, and ultimately broaden the market reach for novel oncology therapies. For instance, the US National Cancer Institute (NCI) allocated approximately $7.3 billion for cancer research in fiscal year 2024, a substantial sum that fuels innovation across the sector.

This financial support from governmental bodies can translate into tangible benefits for biopharmaceutical firms. Greater public investment often leads to:

- Accelerated Drug Development: Public funding can de-risk early-stage research, enabling companies to pursue more ambitious projects.

- Expanded Clinical Trial Capacity: Government grants can help fund larger, more diverse patient populations in clinical trials, crucial for drug approval.

- Enhanced Market Access: Successful government-backed research can pave the way for new treatment paradigms, creating new market opportunities.

- Support for Precision Medicine: Funding initiatives often focus on understanding the genetic underpinnings of cancer, driving the development of targeted therapies.

Government healthcare policies, such as the Inflation Reduction Act of 2022, directly influence Exelixis' revenue potential by allowing Medicare to negotiate drug prices. This legislation, aimed at controlling costs, could affect market access and pricing for innovative oncology treatments.

Reimbursement models are critical; changes in how government payers like Medicare compensate for cancer therapies impact Exelixis' sales. Value-based care discussions in 2024 could reshape product compensation and financial performance.

The political focus on drug affordability exerts pressure for lower prescription costs, potentially limiting pricing flexibility for companies like Exelixis. Navigating this environment is key to balancing innovation investment with market access demands.

Regulatory shifts from bodies like the FDA and EMA significantly impact drug development timelines and costs. The FDA's emphasis on real-world evidence in 2024 could add to the long-term regulatory burden for Exelixis' products.

| Policy Area | Impact on Exelixis | Key Legislation/Trend |

|---|---|---|

| Drug Price Negotiation | Potential revenue impact from Medicare price negotiations. | Inflation Reduction Act of 2022 |

| Reimbursement Models | Directly influences sales based on value-based and outcomes-based pricing. | Ongoing discussions in 2024 regarding value-based care in oncology |

| R&D Tax Credits | Affects the cost-effectiveness of innovation efforts. | Tax Cuts and Jobs Act of 2017 and potential modifications |

What is included in the product

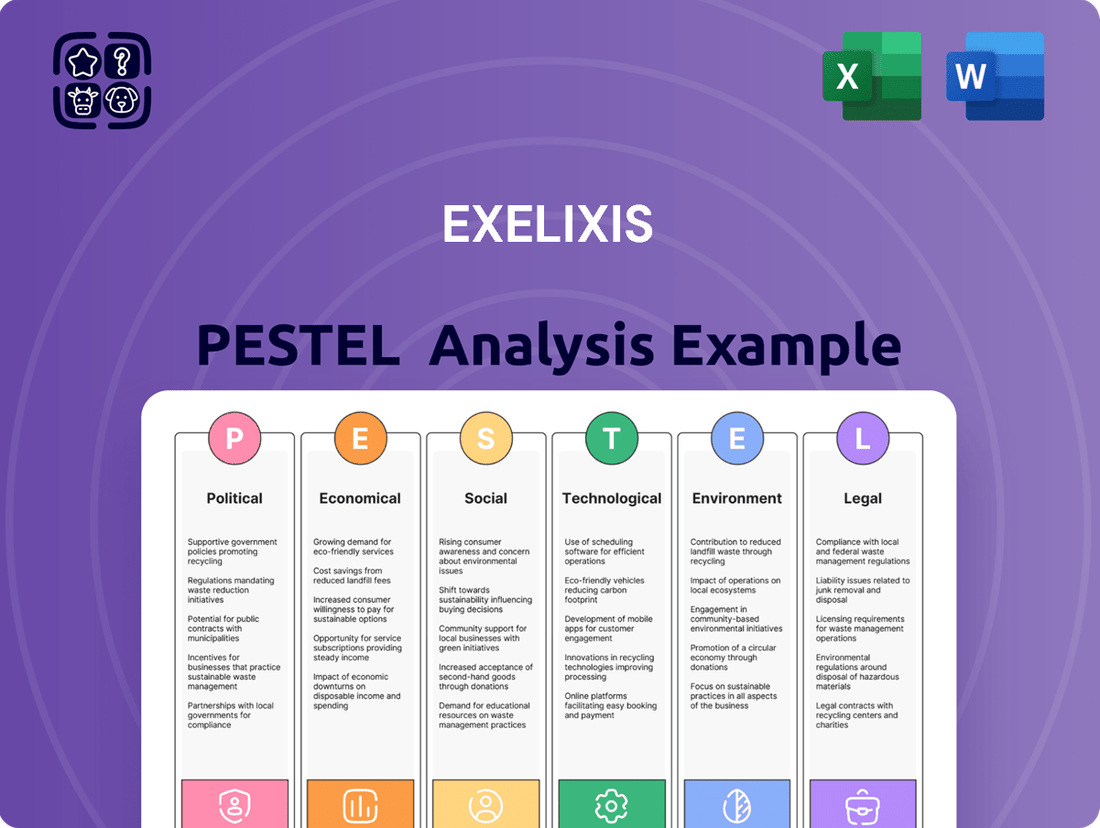

This PESTLE analysis of Exelixis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

It provides a comprehensive understanding of the external landscape, highlighting potential opportunities and threats to inform business strategy and decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Exelixis a clear view of external factors impacting their oncology market strategy.

Economic factors

The overall economic climate, particularly GDP growth and healthcare spending trends, significantly impacts Exelixis. A strong economy often translates to increased healthcare expenditure, which can boost demand and sales for Exelixis' oncology treatments by improving patient affordability and access.

In 2024, global GDP growth is projected to be around 2.6%, according to the IMF, while healthcare spending continues to rise, with the U.S. alone spending an estimated $4.5 trillion on healthcare in 2024. These factors suggest a favorable environment for pharmaceutical companies like Exelixis, provided they can navigate pricing pressures and market access challenges.

The economic landscape for oncology drugs is marked by escalating costs, with new cancer therapies in the U.S. frequently exceeding $200,000 annually. This trend, while potentially boosting revenue for companies like Exelixis, also intensifies scrutiny from governments and insurance providers. For instance, the average annual cost of new cancer drugs approved in the U.S. between 2019 and 2023 has shown a consistent upward trajectory.

This environment creates a dual pressure for Exelixis. Higher drug prices can translate to increased sales, but the growing demand for affordability is leading to more stringent pricing negotiations and the potential for price caps. Furthermore, the looming threat of generic competition for established treatments, as patents expire, necessitates continuous innovation and strategic pricing to maintain market share and profitability.

The pharmaceutical industry faces significant pressure from generic and biosimilar competition, which can erode the market share and pricing power of established branded drugs. Exelixis' flagship product, cabozantinib, benefits from patent protection extending to 2030, offering a degree of insulation against immediate generic threats.

However, the expiration of patents for Exelixis' own products or for competing therapies in the future presents a notable risk. For instance, by 2028, several key oncology drugs are slated to lose patent exclusivity, potentially intensifying competition in therapeutic areas where Exelixis operates.

Mergers and Acquisitions Activity in Biopharma

Mergers and acquisitions (M&A) activity in the biopharma sector is a significant economic factor influencing Exelixis. A robust M&A market can present opportunities for Exelixis to acquire promising assets or technologies, thereby expanding its pipeline and market reach. However, it also intensifies competition for these valuable assets, potentially driving up acquisition costs.

The biopharma M&A landscape in 2024 and early 2025 reflects a dynamic environment. For instance, the total value of biopharma M&A deals in the first half of 2024 reached approximately $70 billion, a notable increase from the previous year, signaling strong investor confidence and strategic consolidation. This trend suggests that companies like Exelixis must remain agile and strategic in pursuing growth opportunities through inorganic means.

- Increased Competition: A heightened M&A environment means Exelixis faces more rivals when seeking to acquire innovative therapies or companies, potentially increasing the cost of deals.

- Pipeline Expansion Opportunities: Conversely, a vibrant M&A market can provide Exelixis with avenues to acquire late-stage assets or complementary technologies that accelerate its growth.

- Strategic Partnerships: M&A trends can also foster strategic partnerships, allowing Exelixis to collaborate with larger entities or gain access to new markets and capabilities.

- Market Consolidation: The ongoing consolidation within the industry may lead to fewer, but larger, competitors, impacting market share dynamics for Exelixis.

R&D Investment Trends and Funding Availability

The biopharmaceutical sector saw significant R&D investment in 2024, with venture capital funding reaching approximately $20 billion globally by mid-year, indicating a robust appetite for innovation. This capital availability directly fuels companies like Exelixis, supporting the advancement of their drug discovery and development pipelines.

However, funding availability can fluctuate. For instance, while 2024 showed strong initial investment, rising interest rates and economic uncertainties in late 2024 and early 2025 could potentially tighten capital markets. This tightening could slow down clinical programs and limit Exelixis' ability to pursue new expansion opportunities or acquisitions.

Key trends influencing R&D investment include:

- Increased focus on oncology and rare diseases: These areas continue to attract substantial R&D funding due to unmet medical needs and potential for high returns.

- Growth in AI and machine learning in drug discovery: Investment is shifting towards technologies that accelerate the identification and validation of drug candidates.

- Partnerships and collaborations: Larger pharmaceutical companies are increasingly partnering with smaller biotechs, providing crucial funding and resources for pipeline development.

- Government grants and incentives: Programs aimed at fostering innovation in critical therapeutic areas remain a significant, albeit variable, source of R&D capital.

Global economic growth, particularly in healthcare spending, directly influences Exelixis' revenue potential. The IMF projected global GDP growth around 2.6% for 2024, with U.S. healthcare spending estimated at $4.5 trillion for the same year. These figures suggest a generally supportive economic environment for pharmaceutical companies, though pricing pressures remain a significant consideration.

The cost of new cancer therapies continues to climb, with many exceeding $200,000 annually in the U.S. While this can boost revenue, it also intensifies scrutiny from payers and policymakers, leading to more rigorous price negotiations. Exelixis must balance its pricing strategies with the growing demand for affordability.

Patent expirations and generic competition pose a constant threat. Exelixis' cabozantinib has patent protection until 2030, offering a buffer, but the loss of exclusivity for other oncology drugs by 2028 will likely increase market competition.

Mergers and acquisitions (M&A) activity in the biopharma sector, valued at approximately $70 billion in the first half of 2024, presents both opportunities for pipeline expansion and increased competition for valuable assets. Exelixis needs to remain strategic in its inorganic growth pursuits.

| Economic Factor | 2024/2025 Data/Projection | Impact on Exelixis |

|---|---|---|

| Global GDP Growth | Projected ~2.6% (IMF) | Supports increased healthcare spending and demand for treatments. |

| U.S. Healthcare Spending | Estimated $4.5 trillion | Indicates a large market for oncology drugs. |

| Annual Cost of New Cancer Therapies (US) | Often >$200,000 | Potential for higher revenue but increased pricing scrutiny. |

| Biopharma M&A Value (H1 2024) | ~$70 billion | Opportunities for pipeline growth, but also increased competition for assets. |

| Patent Expirations (Key Oncology Drugs) | Several by 2028 | Heightened competition in therapeutic areas where Exelixis operates. |

Full Version Awaits

Exelixis PESTLE Analysis

The preview shown here is the exact Exelixis PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive overview of the factors impacting the company.

This is a real screenshot of the product you’re buying—the Exelixis PESTLE Analysis, delivered exactly as shown, no surprises, ensuring you get the detailed insights you need.

The content and structure of this Exelixis PESTLE Analysis shown in the preview is the same document you’ll download after payment, offering a complete strategic framework.

Sociological factors

The global cancer burden is significant and growing, with projections indicating a substantial increase in new cases. For instance, the World Health Organization (WHO) estimated 19.3 million new cancer cases globally in 2020, and this number is expected to rise. This trend, fueled by an aging global population and evolving lifestyle factors like diet and environmental exposures, directly expands the potential patient base for Exelixis' innovative oncology treatments.

An aging demographic is a key driver behind the increasing cancer prevalence. As people live longer, the cumulative risk of developing cancer naturally increases. This demographic shift means a larger proportion of the population will fall into age groups most susceptible to various cancers, thereby increasing the demand for advanced therapeutic options like those developed by Exelixis.

Lifestyle changes also play a critical role in the rising incidence of cancer worldwide. Factors such as sedentary lifestyles, unhealthy diets, and increased exposure to carcinogens contribute to higher cancer rates across different age groups. This societal evolution creates a sustained and growing need for effective cancer therapies, directly benefiting companies like Exelixis that are at the forefront of cancer drug development.

The rise of powerful patient advocacy groups significantly influences the demand for cutting-edge treatments. These organizations actively campaign for access to novel therapies, pushing for faster regulatory approvals and increased research funding. For instance, the Leukemia & Lymphoma Society (LLS) has been instrumental in advocating for advancements in blood cancer treatments, directly impacting the market for innovative drugs.

Exelixis' commitment to developing targeted therapies and immunotherapies directly addresses the growing patient desire for better prognoses and enhanced quality of life. In 2024, the oncology market saw continued growth, with a particular emphasis on personalized medicine, reflecting this patient-driven demand. Exelixis' pipeline, including investigational compounds for various solid tumors, positions them to capitalize on this trend.

The growing awareness and acceptance of targeted therapies and immunotherapies among both medical professionals and patients are significant tailwinds for Exelixis. This increased understanding translates into a greater willingness to consider and utilize these advanced treatment options. For instance, by late 2024, the global oncology market, heavily influenced by these modalities, was projected to reach over $200 billion, with targeted therapies and immunotherapies forming a substantial and rapidly growing segment.

Healthcare Accessibility and Disparities

Healthcare accessibility, a key sociological factor, significantly impacts patient access to advanced cancer treatments like those developed by Exelixis. Disparities in insurance coverage, with millions in the US lacking adequate health insurance, directly affect a patient's ability to afford and receive cutting-edge therapies. For instance, in 2023, approximately 26 million Americans remained uninsured, a figure that fluctuates with economic conditions and policy changes.

Socioeconomic status and geographic location further exacerbate these access issues. Lower-income individuals and those residing in rural areas often face greater hurdles in reaching specialized treatment centers or affording the associated costs, even with insurance. This can limit the market reach for Exelixis' innovative medicines, as patient populations in underserved communities may not have the same opportunities for treatment. Addressing these disparities is crucial for equitable healthcare delivery and expanding the potential patient base for Exelixis' oncology portfolio.

- Insurance Coverage: In 2023, an estimated 26 million Americans were uninsured, impacting their ability to access and afford advanced cancer treatments.

- Socioeconomic Impact: Lower-income individuals often face greater financial barriers to specialized cancer care, limiting their access to novel therapies.

- Geographic Disparities: Patients in rural or underserved areas may have limited access to treatment centers, posing a challenge for equitable distribution of advanced medicines.

- Market Expansion: Addressing these healthcare access issues is vital for Exelixis to broaden its market reach and ensure equitable access to its life-saving treatments.

Public Perception of Pharmaceutical Companies

Public perception of pharmaceutical companies significantly impacts trust and policy. Concerns over drug pricing and ethical practices, especially prominent in 2024, can create headwinds for companies like Exelixis. A recent Gallup poll indicated that a substantial portion of Americans view pharmaceutical companies as having too much influence in Washington and are dissatisfied with drug costs.

Maintaining a positive public image is therefore crucial for Exelixis' long-term viability. Transparency in pricing, research, and development, coupled with clear communication about patient benefits, can foster goodwill. For instance, Exelixis' commitment to developing innovative treatments for cancer, such as cabozantinib, needs to be effectively communicated to build patient and physician confidence.

- Drug Pricing Scrutiny: Public discourse in 2024 continues to focus on the affordability of prescription drugs, directly affecting how pharmaceutical companies are viewed.

- Ethical Conduct: Perceptions of ethical behavior, including marketing practices and clinical trial transparency, are key determinants of public trust.

- Patient Advocacy: The growing influence of patient advocacy groups highlights the importance of Exelixis aligning its strategies with patient well-being and access to treatment.

- Reputational Risk: Negative public sentiment can translate into increased regulatory pressure and impact market access for Exelixis' products.

Societal shifts toward personalized medicine and increased patient engagement are profoundly shaping the oncology landscape. Patients are increasingly informed and actively participate in treatment decisions, demanding therapies that offer better quality of life and improved outcomes. This patient-centric approach, evident in the robust growth of targeted therapies and immunotherapies, directly aligns with Exelixis' development strategy.

The growing awareness and acceptance of advanced treatment modalities like targeted therapies and immunotherapies among both medical professionals and patients are significant tailwinds for Exelixis. This increased understanding translates into a greater willingness to consider and utilize these advanced treatment options. For instance, by late 2024, the global oncology market, heavily influenced by these modalities, was projected to reach over $200 billion, with targeted therapies and immunotherapies forming a substantial and rapidly growing segment.

Healthcare accessibility remains a critical sociological factor, impacting patient access to advanced cancer treatments. Disparities in insurance coverage and socioeconomic status, coupled with geographic location, create significant hurdles for many. In 2023, approximately 26 million Americans remained uninsured, a figure that directly affects a patient's ability to afford and receive cutting-edge therapies, potentially limiting market reach for companies like Exelixis.

Public perception of pharmaceutical companies, particularly concerning drug pricing and ethical practices, significantly influences trust and policy. In 2024, concerns over drug affordability remained high, with a substantial portion of Americans expressing dissatisfaction with prescription drug costs and perceiving undue influence of pharmaceutical companies in policy-making. Maintaining transparency and effectively communicating the value of innovative treatments are therefore crucial for Exelixis.

| Sociological Factor | Impact on Exelixis | Supporting Data/Trend |

|---|---|---|

| Patient Empowerment & Demand for Personalized Medicine | Increases demand for targeted therapies and immunotherapies. | Global oncology market projected over $200 billion by late 2024, with strong growth in targeted/immuno-oncology. |

| Healthcare Accessibility & Disparities | Limits patient access and market reach in underserved populations. | ~26 million uninsured Americans in 2023; socioeconomic and geographic barriers persist. |

| Public Perception of Pharma & Drug Pricing | Affects trust, policy, and market access; necessitates transparency. | High public concern over drug costs and pharma influence in 2024; Gallup polls indicate dissatisfaction. |

Technological factors

Exelixis' core business thrives on ongoing breakthroughs in targeted therapies and immunotherapies, which are its primary therapeutic areas. Continuous innovation in these fields, including the development of novel mechanisms of action, directly fuels the company's pipeline and commercial opportunities.

The oncology market, where Exelixis operates, saw significant growth, with global revenues reaching an estimated $200 billion in 2024. This expansion is largely driven by advancements in precision medicine, including targeted therapies and immunotherapies, which offer improved patient outcomes and represent the future of cancer treatment.

Genomic profiling and precision medicine are revolutionizing cancer care, enabling treatments customized to individual tumor genetics. Exelixis is well-positioned to capitalize on this trend, as its portfolio of targeted therapies, such as cabozantinib, is specifically designed to address certain genetic mutations, thereby improving patient outcomes.

Artificial intelligence and digital health are significantly reshaping drug discovery, with AI algorithms analyzing vast datasets to identify potential drug candidates much faster. This technology is also streamlining clinical trial design, improving patient recruitment and monitoring, which can lead to quicker development cycles for companies like Exelixis.

By adopting these advanced tools, Exelixis can gain a substantial competitive advantage. For instance, AI-driven platforms are demonstrating the ability to reduce early-stage drug discovery timelines by up to 50%, potentially lowering R&D costs and accelerating the delivery of novel therapies to patients.

New Modalities like ADCs and Bispecific Antibodies

The oncology landscape is rapidly evolving with new therapeutic modalities like Antibody-Drug Conjugates (ADCs) and bispecific antibodies. These advancements offer more targeted and potentially more effective treatments by combining the specificity of antibodies with the potency of cytotoxic drugs or the dual targeting capabilities of bispecifics.

Exelixis is strategically positioning itself within these emerging areas. Their pipeline includes programs like XB010, an ADC, and XB628, a bispecific antibody, both currently in clinical development. This diversification into novel modalities demonstrates Exelixis' commitment to innovation and expanding its therapeutic options beyond its established small molecule portfolio.

The growth potential in these advanced therapeutic areas is substantial. For instance, the global ADC market was valued at approximately $7.2 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over $20 billion by 2030. Similarly, the bispecific antibody market is experiencing rapid expansion, driven by their success in hematological malignancies and increasing exploration in solid tumors.

- ADC Market Growth: Projected to exceed $20 billion by 2030.

- Bispecific Antibody Potential: Expanding applications beyond hematology.

- Exelixis Pipeline: XB010 (ADC) and XB628 (bispecific antibody) in clinical trials.

- Strategic Diversification: Moving into advanced therapeutic platforms.

Improvements in Clinical Trial Design and Data Analysis

Innovations in clinical trial design are significantly impacting drug development timelines. The integration of Real-World Evidence (RWE) and sophisticated master protocols allows for more agile and efficient studies. For Exelixis, this means potentially faster validation of its pipeline candidates.

These technological advancements translate into more streamlined data collection and analysis, a crucial factor in accelerating the path to market. For instance, advancements in artificial intelligence (AI) and machine learning (ML) are being applied to analyze vast datasets from clinical trials, identifying patient subgroups and predicting treatment responses with greater accuracy.

The increasing adoption of adaptive trial designs, which allow for modifications based on interim data, further enhances efficiency. This approach can reduce the number of patients needed and shorten overall trial duration. In 2024, the FDA continued to emphasize the importance of RWE in regulatory decision-making, with numerous guidance documents and pilot programs supporting its use.

- Master Protocols: These designs, like basket or umbrella trials, test multiple drugs or multiple cancer types within a single trial framework, reducing operational costs and time.

- Real-World Evidence (RWE): Utilizing data from electronic health records, insurance claims, and patient registries offers broader insights into drug effectiveness and safety in diverse patient populations outside of controlled trial settings.

- AI/ML in Data Analysis: Predictive analytics and AI-driven data interpretation can identify novel biomarkers and optimize patient stratification, leading to more targeted and successful trials.

- Adaptive Trial Designs: These allow for pre-specified modifications to trial parameters based on accumulating data, increasing the probability of success and reducing wasted resources.

The rapid evolution of biotechnology, particularly in areas like gene editing and personalized medicine, presents significant opportunities for companies like Exelixis. These advancements allow for more precise targeting of cancer cells, potentially leading to higher efficacy and fewer side effects.

The integration of artificial intelligence (AI) and machine learning (ML) into drug discovery and development is a game-changer, accelerating the identification of novel drug candidates and optimizing clinical trial design. For instance, AI platforms can analyze vast genomic and proteomic datasets to predict drug responses, a process that previously took years.

Exelixis is actively embracing these technological shifts. Their pipeline includes candidates that leverage advanced modalities such as antibody-drug conjugates (ADCs) and bispecific antibodies, reflecting a strategic move into cutting-edge therapeutic platforms. The global ADC market alone was valued at approximately $7.2 billion in 2023 and is projected for substantial growth.

Furthermore, innovations in clinical trial methodologies, including the use of real-world evidence (RWE) and adaptive trial designs, are streamlining the drug approval process. These approaches can reduce development timelines and costs, enabling faster delivery of life-saving treatments to patients.

| Technology Area | Impact on Exelixis | Market/Data Point (2023-2025) |

|---|---|---|

| Biotechnology Advancements | Enables more precise cancer targeting, improving efficacy. | Personalized medicine market expected to reach $133 billion by 2030. |

| AI/ML in Drug Discovery | Accelerates candidate identification and optimizes trial design. | AI in drug discovery estimated to reduce early-stage timelines by up to 50%. |

| Advanced Therapeutic Modalities (ADCs, Bispecifics) | Diversifies pipeline and expands treatment options. | ADC market valued at $7.2 billion in 2023, projected to exceed $20 billion by 2030. |

| Clinical Trial Innovations (RWE, Adaptive Designs) | Streamlines development, reduces costs, and speeds market entry. | FDA's increasing emphasis on RWE in regulatory decisions (ongoing). |

Legal factors

Exelixis must strictly adhere to drug approval regulations from agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). Failure to comply can result in significant delays or outright rejection of their oncology treatments.

Successfully navigating these complex regulatory pathways, such as obtaining supplemental New Drug Applications (sNDAs) for new indications or achieving Priority Medicine designations, is critical for Exelixis to gain and maintain market access for its innovative cancer therapies.

Intellectual property, especially patents, is the bedrock for biopharma companies like Exelixis, safeguarding their substantial research and development expenditures and securing market exclusivity. The strength of these protections directly impacts a company's ability to recoup its investment and fund future innovation.

Exelixis' strategic reliance on patent protection for its flagship product, cabozantinib, is a prime example. The company has secured patent protection for cabozantinib that extends through 2030, a critical factor for its sustained revenue streams and competitive advantage in the oncology market.

Exelixis faces significant legal hurdles regarding data privacy and cybersecurity. With the increasing reliance on digital platforms for clinical trials and patient data management, compliance with regulations like the EU's General Data Protection Regulation (GDPR) and similar U.S. laws is paramount. Failure to protect sensitive patient information can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Clinical Trial Regulations and Ethics

Exelixis operates within a highly regulated environment for clinical trials, where patient safety, informed consent, and ethical conduct are paramount. Failure to comply with these stringent guidelines, such as those set by the FDA and EMA, can result in significant setbacks, including trial suspension, hefty fines, and severe damage to the company's reputation. For instance, a significant breach in trial protocol could halt the progression of a promising drug candidate, directly impacting future revenue streams.

The financial implications of regulatory non-compliance are substantial. In 2024, the pharmaceutical industry continued to face scrutiny over data integrity and patient protection in clinical studies, with regulatory bodies imposing multi-million dollar penalties for violations. Exelixis' ability to successfully navigate these complex legal frameworks is crucial for advancing its pipeline drugs, such as its oncology portfolio, and securing market approval.

- Regulatory Scrutiny: Exelixis must maintain rigorous adherence to Good Clinical Practice (GCP) guidelines.

- Patient Safety Focus: Ensuring patient well-being and obtaining proper informed consent are non-negotiable legal and ethical obligations.

- Financial Risk: Non-compliance can lead to costly penalties and delays, impacting Exelixis' financial performance and stock valuation.

- Pipeline Impact: Regulatory hurdles can directly affect the timeline and success of advancing new therapies through clinical development.

Antitrust Regulations in Mergers and Acquisitions

Antitrust regulations significantly influence Exelixis' M&A strategy. Increased scrutiny by bodies like the FTC and DOJ in 2024 and 2025 is designed to curb market concentration, particularly in the biopharmaceutical sector. This means potential deals for Exelixis, whether acquiring or being acquired, will face rigorous review to ensure they do not stifle competition.

The regulatory landscape aims to maintain a competitive biopharma market, impacting Exelixis' ability to pursue growth through consolidation. For instance, the FTC's focus on drug pricing and market exclusivity could lead to challenges for mergers involving companies with overlapping therapeutic areas. This heightened oversight is a key consideration for Exelixis' strategic planning in the near term.

- Increased M&A Activity: Industry analysts anticipate a rise in biopharma M&A in 2024-2025, driven by patent expirations and the need for pipeline replenishment.

- Regulatory Focus: Antitrust agencies are prioritizing the prevention of monopolies and the protection of consumer access to affordable medicines.

- Deal Impact: Exelixis must navigate potential antitrust hurdles that could delay or block strategic acquisitions or divestitures, impacting its market position.

Exelixis' legal framework is heavily shaped by stringent regulatory oversight, particularly from the FDA and EMA, impacting drug approvals and market access for its oncology treatments. Intellectual property, especially patents like the one extending cabozantinib's protection through 2030, is crucial for recouping R&D investments and maintaining market exclusivity.

The company must also navigate complex data privacy laws, such as GDPR, with potential fines reaching up to 4% of global annual revenue for breaches, underscoring the critical need for robust cybersecurity measures.

Furthermore, antitrust regulations are increasingly scrutinizing biopharma M&A in 2024-2025, potentially impacting Exelixis' growth strategies through consolidation by requiring careful navigation of competition concerns.

Environmental factors

Pharmaceutical manufacturing faces increasing pressure to adopt sustainable practices, impacting companies like Exelixis. This means focusing on reducing energy consumption and minimizing waste throughout drug production to meet growing environmental expectations.

In 2023, the pharmaceutical industry's global energy consumption was significant, with a growing emphasis on renewable energy sources. Exelixis, like its peers, must integrate energy efficiency measures and explore greener manufacturing technologies to lower its environmental impact.

Exelixis, like all pharmaceutical companies, faces scrutiny over its waste management practices. The discovery, development, and manufacturing of medicines inherently generate hazardous waste, requiring meticulous handling to mitigate environmental harm. Compliance with stringent environmental regulations is paramount, not only to avoid fines but also to maintain public trust and a positive corporate image.

In 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA), which governs hazardous waste. Companies like Exelixis must invest in advanced waste treatment technologies and robust disposal protocols. Failure to manage waste properly can lead to significant ecological damage and substantial financial penalties, impacting overall operational costs and profitability.

Climate change and the increasing frequency of natural disasters pose significant threats to global supply chains, directly impacting the availability of essential raw materials and the timely distribution of critical oncology therapies. For Exelixis, this translates to a heightened need for robust supply chain management.

The COVID-19 pandemic in 2020-2021, for instance, demonstrated the fragility of global logistics, causing widespread disruptions. By 2024, many companies are still grappling with these lingering effects, and the World Economic Forum's Global Risks Report consistently highlights environmental factors as top concerns for business continuity.

Exelixis must proactively build resilient supply chains, potentially through diversification of suppliers and strategic inventory management, to mitigate these risks and ensure uninterrupted access to its vital cancer treatments for patients.

Ethical Considerations in Drug Development and Testing

Environmental ethics are increasingly influencing the pharmaceutical industry, including companies like Exelixis. This means considering the responsible sourcing of raw materials used in drug development and the potential impact of research and testing activities on local ecosystems. While Exelixis’ core mission is to improve human health, a comprehensive approach necessitates acknowledging and mitigating any broader environmental footprint.

Adherence to ethical guidelines in scientific endeavors is paramount. This extends beyond patient safety to encompass the environmental responsibility of research and development processes. For instance, in 2024, the pharmaceutical sector faced growing scrutiny regarding its waste management practices and the energy consumption of its manufacturing facilities, with many companies setting ambitious sustainability targets.

Exelixis, like its peers, must navigate these evolving environmental expectations. This involves implementing robust environmental management systems and transparently reporting on their sustainability performance. The industry is seeing a trend towards greener chemistry principles and the development of more sustainable drug manufacturing processes.

- Responsible Sourcing: Ensuring that all materials used in drug development are sourced ethically and sustainably, minimizing harm to biodiversity and local communities.

- Ecosystem Impact: Evaluating and mitigating the potential impact of laboratory activities, including waste disposal and energy usage, on surrounding environments.

- Green Chemistry: Embracing principles of green chemistry to reduce or eliminate the use and generation of hazardous substances throughout the drug development lifecycle.

- Regulatory Compliance: Staying abreast of and complying with evolving environmental regulations and standards applicable to pharmaceutical research and manufacturing.

Corporate Social Responsibility and Environmental Stewardship

Exelixis' commitment to environmental stewardship is increasingly important as investors and stakeholders prioritize Corporate Social Responsibility (CSR). This focus on sustainability can significantly boost the company's brand reputation and appeal to a growing segment of environmentally conscious investors.

For instance, companies demonstrating strong environmental, social, and governance (ESG) practices often see improved access to capital. In 2024, ESG funds continued to attract substantial investment, with global ESG assets projected to reach over $50 trillion by 2025, highlighting the financial benefits of robust environmental policies.

- Enhanced Brand Image: Demonstrating a genuine commitment to environmental protection can differentiate Exelixis in a competitive market.

- Investor Attraction: A strong ESG profile can attract investors who allocate capital based on sustainability criteria, potentially lowering the cost of capital.

- Long-Term Value Creation: Proactive environmental management can mitigate risks, improve operational efficiency, and contribute to sustainable societal value.

- Regulatory Preparedness: Aligning with evolving environmental regulations proactively can prevent future compliance costs and disruptions.

Environmental factors are increasingly shaping the pharmaceutical landscape, pushing companies like Exelixis towards sustainable operations. This includes managing energy consumption, waste, and the broader ecological impact of research and manufacturing processes.

By 2024, regulatory bodies like the EPA continued to enforce strict waste management laws, such as RCRA, underscoring the need for advanced treatment technologies. Climate change also presents supply chain risks, as evidenced by the 2020-2021 pandemic's disruptions, requiring robust mitigation strategies.

Furthermore, investor focus on Environmental, Social, and Governance (ESG) criteria is growing, with global ESG assets expected to exceed $50 trillion by 2025, making environmental stewardship a key factor for brand image and capital access.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Exelixis is built upon a robust foundation of data from leading financial news outlets, government regulatory filings, and reputable scientific and medical journals. We meticulously gather information on market trends, competitor activities, and advancements in biotechnology to ensure a comprehensive understanding of the external landscape.