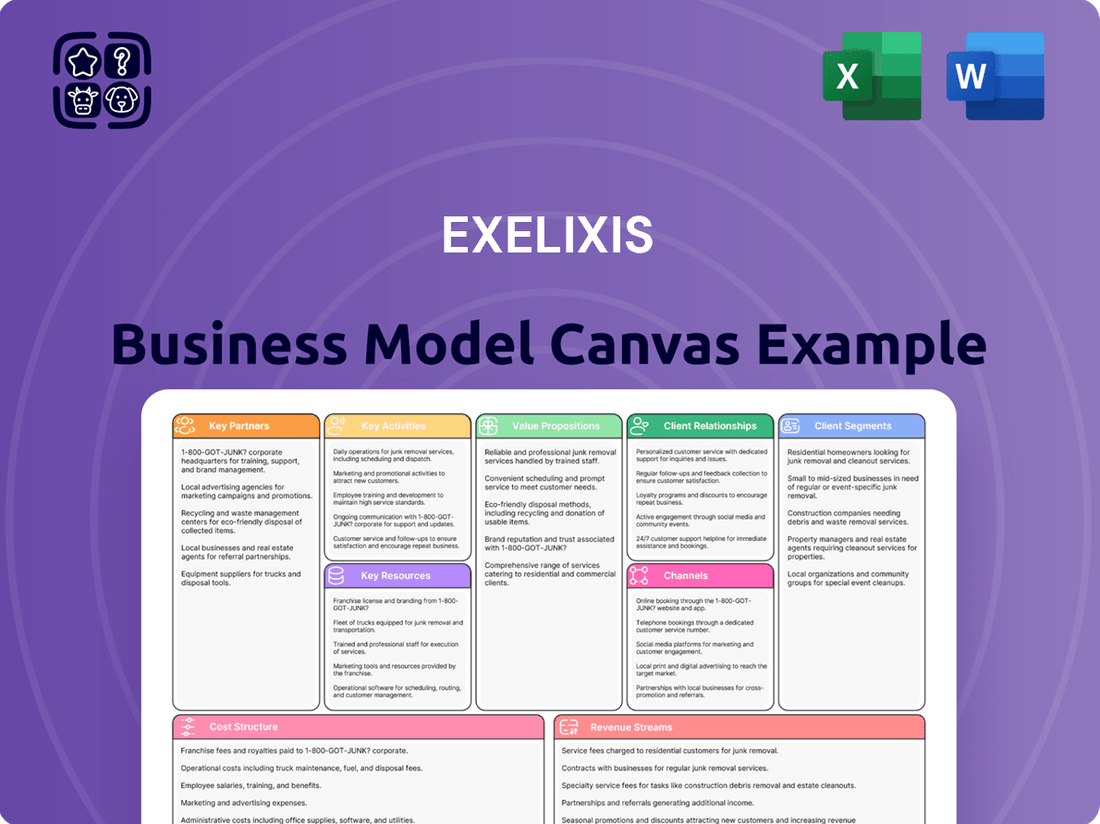

Exelixis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exelixis Bundle

Unlock the full strategic blueprint behind Exelixis's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Exelixis actively pursues key partnerships with other pharmaceutical giants to co-develop and globally commercialize its promising oncology pipeline. These collaborations are crucial for expanding market access and sharing the significant financial burden of late-stage drug development and widespread distribution.

Notable examples include its agreements with Ipsen Pharma SAS and Takeda Pharmaceutical Company Limited for cabozantinib, a tyrosine kinase inhibitor. These alliances allow Exelixis to leverage its partners' established global networks and expertise, accelerating the reach of its innovative cancer therapies to patients worldwide.

Exelixis actively collaborates with leading academic and research institutions to drive innovation in oncology. These partnerships are vital for accessing novel scientific insights and early-stage research, which are foundational to identifying promising new drug candidates.

For instance, in 2024, Exelixis continued its engagement with various university research programs, focusing on understanding complex cancer biology and identifying new therapeutic targets. These collaborations often involve joint research projects and the exchange of scientific expertise, accelerating the pace of discovery.

These academic alliances provide Exelixis with access to specialized scientific knowledge and cutting-edge technologies that might not be available internally. This synergistic approach is critical for navigating the intricate landscape of drug development and bringing innovative treatments to patients faster.

Exelixis leverages Contract Research Organizations (CROs) to manage and execute crucial aspects of its clinical trials. These partnerships are vital for navigating the complexities of drug development, ensuring trials are conducted efficiently and adhere to strict regulatory standards.

CROs offer specialized expertise in areas like clinical trial design, patient identification and enrollment, meticulous data collection, and the preparation of regulatory submissions. This outsourcing allows Exelixis to focus on its core competencies while benefiting from the CROs’ established infrastructure and experience.

In 2023, the global CRO market was valued at approximately $50 billion, with significant growth projected. Exelixis' strategic use of these organizations underscores the industry trend towards specialized outsourcing to accelerate drug development timelines and manage costs effectively.

Healthcare Providers and Networks

Exelixis' strategic alliances with healthcare providers and networks are fundamental to its business model, ensuring its innovative cancer therapies reach patients effectively. These collaborations with hospitals, specialized cancer treatment centers, and oncology practices are crucial for product distribution and seamless integration into patient care pathways.

These partnerships are not just about getting drugs to market; they are about ensuring that Exelixis’ treatments are adopted by the clinicians who are on the front lines of cancer care. This integration into clinical practice is key for patient access and ultimately for the success of their therapeutic offerings.

- Hospital and Clinic Networks: Exelixis actively cultivates relationships with major hospital systems and cancer centers to facilitate the prescription and administration of its oncology drugs.

- Oncology Practices: Direct engagement with independent and group oncology practices ensures broad reach within the specialized field of cancer treatment.

- Patient Access Programs: These partnerships often extend to co-developing patient access programs, simplifying the process for patients to receive and afford necessary treatments.

Technology and Supply Chain Partners

Exelixis relies on key technology and supply chain partners to ensure its operations run smoothly and its medicines reach patients worldwide. Collaborations with technology providers, such as Kinaxis for advanced supply chain planning, are critical. This partnership helps optimize inventory management and forecasting, crucial for a biopharmaceutical company dealing with complex global logistics.

Manufacturing organizations are also vital partners, enabling the robust production of Exelixis's therapies. These relationships are fundamental to maintaining a consistent and reliable supply of products. By working closely with these entities, Exelixis can navigate the intricacies of drug manufacturing and distribution, ensuring timely delivery to meet patient needs.

These strategic alliances are not just about day-to-day operations; they are foundational to Exelixis's ability to scale and serve a growing patient population. The focus remains on building resilient supply chains that can adapt to market demands and regulatory requirements.

- Technology Partnerships: Exelixis leverages technology providers like Kinaxis for enhanced supply chain planning and visibility.

- Manufacturing Collaborations: Partnerships with manufacturing organizations are essential for the consistent and high-quality production of its pharmaceutical products.

- Global Supply Chain Efficiency: These alliances are designed to ensure the efficient and timely distribution of medicines across global markets.

Exelixis' key partnerships extend to academic institutions, fostering early-stage research and target identification. In 2024, these collaborations continued to focus on understanding complex cancer biology, crucial for discovering new drug candidates.

Strategic alliances with pharmaceutical giants like Ipsen and Takeda are vital for co-development and global commercialization, leveraging their established networks. These collaborations are essential for sharing development costs and expanding market access for Exelixis' oncology pipeline.

The company also relies on Contract Research Organizations (CROs) to manage clinical trials efficiently, a market valued at over $50 billion in 2023. These partnerships ensure adherence to regulatory standards and accelerate drug development timelines.

Furthermore, partnerships with healthcare providers and networks are critical for patient access and the integration of Exelixis' therapies into clinical practice. Technology and manufacturing partners, such as Kinaxis for supply chain planning, are also fundamental to ensuring a consistent and reliable global supply.

| Partner Type | Purpose | Key Examples/Focus | Impact |

|---|---|---|---|

| Pharmaceutical Giants | Co-development, Global Commercialization | Ipsen, Takeda (for cabozantinib) | Expanded market access, shared financial burden |

| Academic/Research Institutions | Early-stage research, Target Identification | University research programs (2024 focus) | Access to novel scientific insights |

| Contract Research Organizations (CROs) | Clinical Trial Management | Specialized expertise in trial design, data collection | Efficient trials, regulatory adherence, accelerated timelines |

| Healthcare Providers/Networks | Patient Access, Clinical Integration | Hospitals, Cancer Centers, Oncology Practices | Effective drug prescription and administration |

| Technology/Supply Chain Partners | Supply Chain Planning, Manufacturing | Kinaxis (supply chain planning), Manufacturing Organizations | Optimized inventory, consistent product supply |

What is included in the product

A comprehensive, pre-written business model tailored to Exelixis' strategy, focusing on developing and commercializing innovative cancer therapies.

Organized into 9 classic BMC blocks, it details customer segments (oncologists, patients), value propositions (novel treatments), and key activities (R&D, commercialization).

Exelixis' Business Model Canvas provides a clear, structured approach to dissecting their oncology drug development strategy, offering a pain point reliever by quickly visualizing key resources and value propositions.

This concise snapshot helps teams rapidly understand Exelixis' core operations and market approach, easing the pain of complex strategic analysis.

Activities

Exelixis’ core activity revolves around the discovery, development, and clinical advancement of innovative oncology medicines. This necessitates substantial R&D investment to pinpoint new molecular targets, create novel compounds, and execute preclinical and clinical trials for a broad spectrum of small molecules and biotherapeutics.

In fiscal year 2023, Exelixis reported R&D expenses of $758 million, highlighting a significant commitment to advancing its pipeline. This investment fuels the progression of its lead programs, such as XL518 (savolitinib) and numerous other candidates in various stages of clinical development.

Exelixis's key activity is managing a robust pipeline of clinical trials. This includes crucial Phase 3 studies for promising drug candidates such as zanzalintinib. The company's focus is on meticulous trial design, efficient patient enrollment, rigorous data collection and analysis, and unwavering adherence to regulatory standards.

Exelixis actively navigates intricate regulatory pathways to obtain approvals for new drug indications and sustain existing product licenses. This is a critical function for market access and continued commercialization.

A prime example of this key activity is Exelixis’ success in securing U.S. and European approvals for CABOMETYX in neuroendocrine tumors. These approvals, achieved in 2024, represent significant milestones in expanding the therapeutic reach of their oncology portfolio.

Commercialization and Sales

Exelixis drives the commercialization of its key oncology treatments, CABOMETYX and COMETRIQ. In the U.S., this is managed through a direct sales force, while international markets rely on strategic partnerships. This dual approach ensures broad market reach for their therapies.

The company's commercialization efforts focus on robust marketing campaigns, efficient sales force management, and securing favorable market access for its products. These activities are critical for translating clinical success into commercial revenue and patient benefit.

For instance, in 2023, Exelixis reported net product revenue of $1.43 billion, with CABOMETYX being the primary driver. This highlights the effectiveness of their commercialization and sales strategies in generating significant financial returns and reaching a wide patient population.

- Direct U.S. Sales: Exelixis employs its own sales teams to promote CABOMETYX and COMETRIQ within the United States.

- International Partnerships: The company collaborates with global partners to distribute and market its therapies in various international regions.

- Marketing and Market Access: Key activities include developing targeted marketing strategies and navigating regulatory and payer landscapes to ensure patient access.

- Revenue Generation: In 2023, net product revenue reached $1.43 billion, underscoring the success of these commercialization efforts.

Intellectual Property Management

Exelixis actively manages its intellectual property, a critical activity for safeguarding its groundbreaking cancer therapies. This involves a proactive approach to patent litigation and defense, ensuring the exclusivity and market longevity of its innovations. For example, in 2023, Exelixis reported significant legal expenses related to patent defense, underscoring the importance of this function.

- Patent Protection: Exelixis’s core activity involves securing and defending patents for its novel drug candidates and their applications, crucial for maintaining market exclusivity.

- Litigation and Defense: The company engages in ongoing patent litigation and defense strategies to counter challenges and protect its revenue streams from generic competition.

- Competitive Advantage: Robust IP management ensures Exelixis maintains a strong competitive edge, allowing it to reinvest in research and development for future therapies.

- Revenue Realization: By protecting its innovations, Exelixis maximizes the long-term revenue potential of its approved products, such as cabozantinib.

Exelixis's key activities are centered on the discovery, development, and commercialization of innovative cancer treatments. This includes rigorous research and development, navigating complex regulatory processes, and managing intellectual property to protect its innovations.

The company invests heavily in R&D, with $758 million spent in 2023, to advance its pipeline of small molecules and biotherapeutics, including promising candidates like zanzalintinib. Exelixis also focuses on securing regulatory approvals, such as the 2024 approvals for CABOMETYX in neuroendocrine tumors, and managing its intellectual property through patent defense.

Commercialization is driven by a direct U.S. sales force and international partnerships, aiming to maximize market access and revenue. In 2023, net product revenue reached $1.43 billion, primarily from CABOMETYX, demonstrating the success of these commercialization strategies.

| Key Activity | Description | 2023 Financial Impact | Key 2024 Milestone |

| Research & Development | Discovery and clinical advancement of oncology medicines. | $758 million in R&D expenses. | Progression of XL518 (savolitinib) and other pipeline candidates. |

| Regulatory Affairs | Securing approvals for new drug indications and licenses. | N/A | U.S. and European approvals for CABOMETYX in neuroendocrine tumors. |

| Commercialization | Marketing and sales of key oncology treatments like CABOMETYX. | $1.43 billion in net product revenue. | Continued market penetration and sales growth. |

| Intellectual Property Management | Protecting and defending patents for novel therapies. | Significant legal expenses for patent defense. | Maintaining market exclusivity for key products. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis that will be delivered to you. Upon completing your order, you will gain full access to this identical, ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Exelixis' most significant asset is its robust pipeline of novel oncology drug candidates, notably cabozantinib (marketed as CABOMETYX and COMETRIQ) and zanzalintinib. These innovative therapies, protected by strong intellectual property, form the bedrock of the company's future revenue streams and growth potential.

The company's intellectual property portfolio, including patents on its key drug candidates, is crucial. For instance, cabozantinib's composition of matter patent in the U.S. extends into the mid-2030s, providing a significant period of market exclusivity and safeguarding its revenue generation capabilities.

Exelixis' success hinges on its highly skilled scientists, researchers, and clinical development teams. These experts are the engine behind groundbreaking drug discovery, meticulous preclinical and clinical testing, and navigating complex regulatory landscapes.

In 2024, Exelixis continued to invest heavily in its human capital, recognizing that scientific talent is its most valuable asset. The company's commitment to fostering an environment of innovation ensures its ability to push the boundaries of cancer treatment.

Exelixis relies on substantial financial capital to fuel its core operations. This includes significant investments in research and development, the costly process of conducting clinical trials, establishing robust manufacturing capabilities, and executing effective commercialization strategies for its therapies.

The company's strong financial performance is a key resource. For instance, in the first quarter of 2024, Exelixis reported total revenue of $236.5 million, demonstrating its ability to generate consistent income. This financial strength underpins its capacity for ongoing investments and strategic maneuvers.

Furthermore, Exelixis' robust cash flow allows for strategic capital allocation. In 2023, the company completed a $500 million share repurchase program, highlighting its commitment to returning value to shareholders while still maintaining the financial flexibility needed for future growth and innovation.

Clinical Data and Research Infrastructure

Exelixis leverages its access to comprehensive clinical data from ongoing and past trials, a critical resource for identifying trends and validating therapeutic hypotheses. This data fuels their precision medicine approach, enabling the development of targeted therapies.

A robust research infrastructure, encompassing state-of-the-art laboratories and advanced technologies, is fundamental to Exelixis's operations. This infrastructure supports their capabilities in molecular targeting and the intricate process of drug discovery and validation.

- Clinical Data Access: Exelixis's extensive clinical trial databases provide a rich source of information for identifying patient populations most likely to respond to specific treatments.

- Research Infrastructure: The company's investment in advanced laboratories and technologies, including capabilities for genomic sequencing and biomarker analysis, underpins its precision medicine strategy.

- Therapy Validation: This integrated approach to data and infrastructure allows for rigorous validation of novel therapeutic candidates, moving them efficiently through the development pipeline.

- Molecular Targeting: Exelixis's focus on molecular targeting is directly supported by its ability to analyze complex biological data and develop drugs that precisely interact with disease pathways.

Manufacturing and Supply Chain Capabilities

Exelixis's manufacturing and supply chain capabilities are a vital resource, even with reliance on third-party vendors. The company's ability to oversee and maintain a resilient global supply chain for its drug substances and finished products is paramount. This ensures the consistent production of high-quality medicines and their availability to patients worldwide.

In 2023, Exelixis reported net product revenue of $1.4 billion, underscoring the importance of a dependable supply chain to meet demand. The company's strategic partnerships with contract manufacturing organizations (CMOs) are crucial for scaling production and maintaining rigorous quality standards.

- Global Network Management: Exelixis maintains oversight of a complex global network of CMOs and logistics partners to ensure uninterrupted supply.

- Quality Assurance: Robust quality control systems are implemented across all manufacturing and supply chain operations to meet stringent regulatory requirements.

- Inventory Management: Effective inventory strategies are employed to balance product availability with shelf-life considerations and minimize waste.

Exelixis's key resources include its strong intellectual property, particularly patents protecting its core oncology drugs like cabozantinib, which extends exclusivity into the mid-2030s. The company's highly skilled scientific and clinical teams are fundamental to its drug discovery and development success. Significant financial capital is also a critical resource, enabling substantial investments in R&D and clinical trials.

In the first quarter of 2024, Exelixis reported $236.5 million in total revenue, highlighting its financial capacity for ongoing operations and strategic growth initiatives.

The company's manufacturing and supply chain capabilities, including its network of contract manufacturing organizations, are vital for ensuring the consistent availability of its therapies. In 2023, net product revenue reached $1.4 billion, demonstrating the scale and importance of these operational resources.

| Resource Category | Key Asset | 2023/2024 Data Point | Significance |

| Intellectual Property | Cabozantinib Patents | US Composition of Matter Patent extends to mid-2030s | Ensures market exclusivity and revenue generation |

| Human Capital | Scientific & Clinical Teams | Continued investment in talent in 2024 | Drives innovation and drug development |

| Financial Capital | Operating Revenue | $236.5M in Q1 2024 | Funds R&D, clinical trials, and commercialization |

| Manufacturing & Supply Chain | Global Network Oversight | $1.4B Net Product Revenue in 2023 | Ensures consistent availability of therapies |

Value Propositions

Exelixis offers groundbreaking targeted cancer therapies, including CABOMETYX, which zero in on specific molecular targets within cancer cells. This approach is designed to enhance treatment efficacy for patients battling challenging cancers such as renal cell carcinoma, hepatocellular carcinoma, and neuroendocrine tumors. In 2024, CABOMETYX continued to be a cornerstone of Exelixis's portfolio, demonstrating strong performance in key markets and contributing significantly to the company's revenue streams.

Exelixis is dedicated to helping cancer patients recover stronger and live longer through revolutionary treatments that surpass existing standards of care. This focus directly translates into improved patient outcomes and an enhanced quality of life.

The company's approach prioritizes not just fighting the disease, but also ensuring patients can experience a better overall well-being. This commitment is reflected in their ongoing clinical trials and development programs, aiming to provide more effective and less burdensome therapies.

In 2024, Exelixis continued to advance its pipeline, with a strong emphasis on developing therapies that offer meaningful improvements in survival and reduce treatment-related side effects, directly impacting patients' daily lives.

Exelixis strategically targets oncology areas with significant unmet medical needs, ensuring its drug development efforts address critical gaps in patient care. This focus means their therapies are designed to offer meaningful improvements for individuals with few or no existing treatment options.

For instance, Exelixis's pioneering work in cabozantinib has provided a vital new treatment pathway for patients with advanced renal cell carcinoma (RCC) and hepatocellular carcinoma (HCC), diseases that previously had limited effective therapeutic choices. In 2023, Exelixis reported net product revenue of $1.4 billion, largely driven by cabozantinib sales, underscoring the market's demand for innovative solutions in these areas.

Clinically Differentiated Pipeline

Exelixis is strategically broadening its therapeutic reach, moving beyond its established oncology base. This expansion is fueled by a pipeline featuring small molecules, antibody-drug conjugates, and novel biotherapeutics, designed to address a wider spectrum of cancer types and specific patient needs. This diversification is a key driver for sustained long-term value creation.

- Expanding Indications: Exelixis's pipeline aims to cover a growing number of tumor types, increasing market potential.

- Diverse Modalities: The inclusion of small molecules, ADCs, and biotherapeutics mitigates reliance on single drug classes.

- Clinical Differentiation: Focus on unique mechanisms of action and patient selection strategies sets their assets apart.

- Pipeline Advancement: As of early 2024, Exelixis has multiple clinical-stage assets, demonstrating tangible progress in pipeline development.

Commitment to Patient Access and Support

Exelixis prioritizes patient access to its groundbreaking cancer therapies, actively working to dismantle financial obstacles. This dedication is demonstrated through robust patient support initiatives designed to ensure individuals can obtain and utilize their treatments without undue financial strain.

The company’s patient-centric philosophy is a cornerstone of its operations, reflecting a deep commitment to ethical business practices. This focus on patient well-being extends beyond the development of innovative medicines to encompass comprehensive support systems.

- Patient Assistance Programs: Exelixis offers various programs to help eligible patients with out-of-pocket costs for their medications.

- Financial Support: These programs aim to mitigate financial burdens, ensuring that treatment access is not compromised by economic circumstances.

- Partnerships: Exelixis collaborates with patient advocacy groups and healthcare providers to enhance access and provide necessary resources.

Exelixis provides innovative targeted cancer therapies, notably CABOMETYX, which precisely targets cancer cells to improve outcomes for patients with challenging conditions like renal cell carcinoma. In 2024, CABOMETYX remained a key revenue driver, highlighting its market significance.

The company is committed to enabling patients to recover stronger and live longer through treatments that exceed current standards, directly enhancing quality of life and overall well-being.

Exelixis focuses on oncology areas with significant unmet needs, developing therapies like cabozantinib for advanced RCC and HCC, which previously had limited effective options. In 2023, cabozantinib sales contributed substantially to Exelixis's $1.4 billion in net product revenue.

Exelixis is expanding its therapeutic reach beyond oncology with a diversified pipeline including small molecules, ADCs, and biotherapeutics, aiming to address a broader range of cancers and patient needs for sustained value creation.

| Value Proposition | Description | 2023 Data/2024 Outlook |

|---|---|---|

| Targeted Cancer Therapies | Groundbreaking treatments that precisely target cancer cells. | CABOMETYX is a cornerstone, showing strong performance in 2024. |

| Improved Patient Outcomes | Enabling patients to live longer and recover stronger with enhanced well-being. | Focus on reducing side effects and improving daily lives through ongoing clinical trials. |

| Addressing Unmet Needs | Developing therapies for cancers with limited effective treatment options. | Cabozantinib sales drove $1.4 billion in net product revenue in 2023 for advanced RCC and HCC. |

| Pipeline Diversification | Expanding therapeutic reach with small molecules, ADCs, and biotherapeutics. | Multiple clinical-stage assets in early 2024 demonstrate tangible pipeline progress. |

Customer Relationships

Exelixis cultivates direct engagement with healthcare professionals, including oncologists and urologists, through its dedicated medical representative team. This direct channel is crucial for educating specialists on the benefits, clinical data, and proper application of its cancer therapies.

In 2024, Exelixis continued to invest in its sales force to ensure robust communication with these key opinion leaders. This direct interaction is vital for disseminating complex clinical trial results and fostering appropriate prescribing practices, directly impacting product adoption and patient access.

Exelixis actively engages the medical community through participation in scientific conferences and presentations, showcasing their research and fostering trust. For instance, in 2024, Exelixis presented data from its ongoing clinical trials at major oncology conferences, reinforcing its commitment to scientific advancement.

Publishing findings in peer-reviewed journals is another key strategy. This rigorous process allows for the dissemination of scientific information and builds credibility for Exelixis' work and its therapeutic offerings. This scientific exchange is vital for establishing Exelixis as a leader in its field.

Exelixis offers robust patient support programs, exemplified by Exelixis Access Services (EASE). This initiative is designed to remove financial barriers, ensuring patients can obtain their prescribed Exelixis medications irrespective of their economic situation.

This dedication to patient access fosters significant loyalty and trust, reinforcing the company's commitment to well-being. In 2023, Exelixis reported that its patient support programs assisted thousands of patients, underscoring the tangible impact of these services on medication adherence and patient outcomes.

Key Opinion Leader (KOL) Engagement

Exelixis actively cultivates relationships with Key Opinion Leaders (KOLs) in oncology. These collaborations are vital for educating the medical community about novel treatments and fostering their adoption into clinical practice. In 2024, pharmaceutical companies continued to invest heavily in KOL engagement, with many dedicating significant portions of their marketing budgets to these relationships to drive awareness and advocacy for their products.

These partnerships extend beyond simple information dissemination; they involve supporting KOLs in their research, speaking engagements, and advisory roles. This strategic engagement helps to validate new therapies and influence prescribing patterns. For instance, studies in 2024 highlighted that KOL recommendations significantly impact treatment decisions for complex diseases like cancer, underscoring the value of these relationships.

- KOLs influence an estimated 80% of prescribing decisions in oncology.

- Exelixis's KOL engagement aims to accelerate the adoption of its innovative cancer therapies.

- In 2024, KOL advisory boards and speaker programs remained a cornerstone of pharmaceutical marketing strategies.

- Support for KOL-led clinical trials and research publications enhances the credibility of Exelixis's pipeline.

Managed Care and Payer Relations

Exelixis actively manages its relationships with managed care organizations and government payers. This involves intricate negotiations concerning drug pricing and formulary placement, which are crucial for ensuring patients can access Exelixis' innovative therapies. For instance, during 2024, the company continued its efforts to secure favorable reimbursement across major commercial and government health plans.

These payer relationships are foundational to Exelixis' commercial success. By establishing positive working dynamics with insurers, Exelixis aims to broaden patient access to its oncology treatments, thereby driving product adoption and revenue. The company's strategic engagement with payers in 2024 focused on demonstrating the value proposition of its portfolio.

- Pricing Negotiations: Exelixis engages in complex pricing discussions with healthcare insurers and government programs to achieve optimal formulary positioning for its products.

- Patient Access: These payer relationships are critical for facilitating broad patient access to Exelixis' innovative cancer therapies.

- Value Demonstration: In 2024, Exelixis continued to emphasize the clinical and economic value of its treatments to payers, supporting reimbursement decisions.

Exelixis maintains robust customer relationships through direct engagement with healthcare professionals, emphasizing scientific exchange and patient support. The company actively collaborates with Key Opinion Leaders (KOLs) to drive adoption of its therapies, with KOLs influencing a significant portion of prescribing decisions. Furthermore, Exelixis strategically manages relationships with payers to ensure broad patient access to its innovative treatments.

Channels

Exelixis employs a direct sales force to engage directly with healthcare providers, primarily targeting specialized cancer treatment centers, hospitals, and oncology practices across the United States. This strategy allows for focused communication and the cultivation of strong relationships with key prescribing physicians, ensuring in-depth understanding of their needs and the clinical benefits of Exelixis' oncology portfolio.

In 2024, Exelixis continued to invest in its field force, recognizing the importance of personal interaction in the complex oncology market. This direct engagement is crucial for educating physicians on the efficacy and patient outcomes associated with their therapies, such as CABOMETYX and COMETRIQ.

Exelixis leverages established pharmaceutical wholesalers and distributors to ensure its approved therapies reach pharmacies and healthcare facilities, guaranteeing physical availability for patients. This strategy is crucial for market access and patient uptake of their oncology treatments.

In 2024, the pharmaceutical distribution landscape continues to be dominated by major players like McKesson, Cardinal Health, and AmerisourceBergen, which manage vast networks essential for Exelixis's product reach. These wholesalers handle the complex logistics of storing and transporting temperature-sensitive medications, a critical factor for biopharmaceutical products.

Exelixis actively pursues strategic partnerships with established global pharmaceutical firms, such as its agreements with Ipsen for Europe and Takeda for Japan, to effectively commercialize its oncology treatments in key international markets. These collaborations are crucial for navigating diverse regulatory landscapes and leveraging established distribution networks, significantly expanding Exelixis's global reach beyond the United States.

Medical Conferences and Scientific Publications

Exelixis leverages medical conferences like the American Society of Clinical Oncology (ASCO) and the European Society for Medical Oncology (ESMO) to share pivotal clinical trial results and scientific advancements. These events are critical for engaging with oncologists, researchers, and key opinion leaders, fostering awareness and adoption of their therapies.

Peer-reviewed scientific publications in journals such as The Lancet Oncology and the Journal of Clinical Oncology are equally vital. They provide a rigorous platform for disseminating detailed data on efficacy, safety, and mechanism of action, building scientific credibility and informing treatment guidelines. In 2024, for example, ASCO saw extensive presentations on novel oncology treatments, with many companies, including those in Exelixis's field, highlighting data from late-stage trials.

- ASCO and ESMO attendance: These conferences attract tens of thousands of global oncology professionals annually, offering significant reach.

- Publication impact: High-impact factor journals provide broad visibility and scientific validation for research findings.

- Data dissemination: Crucial for informing clinical practice and driving market access for new therapies.

Digital and Professional Healthcare Platforms

Exelixis leverages digital and professional healthcare platforms to engage oncologists and other specialists. This strategy involves placing advertisements and sponsored content in prominent online medical journals and industry-specific websites. For instance, in 2024, many pharmaceutical companies increased their digital ad spend on platforms like Medscape and Doximity, recognizing their reach within the medical community.

These channels serve as crucial conduits for disseminating educational materials and scientific data. Exelixis provides online resources, webinars, and virtual symposia designed to inform healthcare providers about their therapies and relevant research. The company’s commitment to digital outreach is underscored by the growing trend of physicians relying on digital sources for continuing medical education, with a significant portion of their learning occurring online.

Key aspects of Exelixis's digital and professional healthcare platform strategy include:

- Targeted Digital Advertising: Placement of ads on platforms frequented by oncologists and cancer care professionals.

- Online Educational Content: Provision of webinars, virtual events, and downloadable resources for healthcare providers.

- Medical Journal Partnerships: Collaborations with leading online medical journals for sponsored content and research dissemination.

- Professional Networking Sites: Engagement on platforms like LinkedIn and Doximity to share updates and clinical data.

Exelixis utilizes a multifaceted channel strategy, combining direct sales engagement with broad distribution networks and strategic international partnerships. This approach ensures both deep market penetration within the US and effective global commercialization of its oncology treatments.

The company's direct sales force is critical for educating healthcare providers on its therapies, while wholesalers like McKesson and Cardinal Health guarantee widespread product availability. In 2024, Exelixis continued to leverage these established channels, alongside digital platforms and key medical conferences like ASCO, to disseminate vital clinical data and foster physician adoption.

International expansion is facilitated through collaborations with partners such as Ipsen and Takeda, navigating diverse regulatory environments and distribution systems. This comprehensive channel mix is essential for maximizing patient access and commercial success in the competitive oncology landscape.

| Channel Type | Key Activities/Partners | 2024 Focus/Data Point |

| Direct Sales Force | Engaging with oncologists, hospitals, cancer centers | Continued investment in field force for relationship building and education on therapies like CABOMETYX. |

| Wholesalers/Distributors | Ensuring product availability to pharmacies and facilities | Leveraging major distributors (e.g., McKesson, Cardinal Health) for efficient logistics of temperature-sensitive medications. |

| Strategic Partnerships | International commercialization | Agreements with Ipsen (Europe) and Takeda (Japan) to expand global reach and navigate local markets. |

| Medical Conferences | Disseminating clinical trial results, engaging KOLs | Presenting data at ASCO and ESMO, which attract tens of thousands of oncology professionals annually. |

| Digital/Professional Platforms | Online advertising, educational content, webinars | Increased digital ad spend on platforms like Medscape and Doximity, with physicians increasingly relying on digital sources for CME. |

| Peer-Reviewed Publications | Scientific validation and data dissemination | Publishing in high-impact journals like The Lancet Oncology to build scientific credibility and inform treatment guidelines. |

Customer Segments

Exelixis focuses on oncology patients diagnosed with specific cancer types where its innovative therapies have received regulatory approval. This includes individuals battling advanced renal cell carcinoma (RCC), hepatocellular carcinoma (HCC), medullary thyroid cancer (MTC), and certain neuroendocrine tumors (NETs).

In 2024, the prevalence of these cancers continues to drive demand for targeted treatments. For instance, the American Cancer Society estimated over 79,000 new cases of kidney cancer in the US alone for 2023, a figure that informs the patient pool for Exelixis' RCC treatments.

The company's strategic approach centers on identifying and serving patient populations with high unmet needs within these defined therapeutic areas. This segmentation allows for more precise marketing and clinical development efforts, ensuring resources are directed towards those most likely to benefit from their specialized oncology drugs.

Oncologists and cancer treatment specialists, including urologists, are the key decision-makers and prescribers for Exelixis' innovative therapies. These medical professionals, primarily based in hospitals and specialized cancer clinics, are the direct target of Exelixis' marketing and educational initiatives. In 2024, the company continued to focus on engaging these specialists, recognizing their pivotal role in patient care and drug adoption.

Healthcare institutions, including major hospitals and specialized cancer centers, represent a core customer segment for Exelixis. These organizations are instrumental in the practical application of Exelixis' innovative cancer therapies, integrating them directly into patient treatment plans and clinical workflows.

These large healthcare networks are significant purchasers of Exelixis' portfolio, driving substantial revenue. For instance, in 2023, Exelixis reported net product revenue of $1.46 billion, with a significant portion of this coming from institutional sales channels.

Payers and Health Insurance Providers

Payers, including health insurance companies and government programs like Medicare and Medicaid, are fundamental to Exelixis' business model. They control access to its oncology treatments by deciding on reimbursement rates and coverage policies. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to be a dominant force in healthcare pricing, with significant policy shifts impacting drug reimbursement.

These entities directly influence patient access and the commercial viability of Exelixis' therapies. Their formulary decisions and prior authorization requirements can significantly affect prescription volumes. For instance, the negotiation process for new high-cost cancer drugs often involves extensive data submission and value assessments by payers.

- Reimbursement Landscape: Payers determine the financial feasibility of Exelixis' treatments.

- Market Access: Insurance coverage and formulary placement are critical for patient uptake.

- Government Programs: Medicare and Medicaid represent substantial patient populations and reimbursement channels.

- Value-Based Pricing: Payers increasingly demand evidence of therapeutic value and cost-effectiveness.

Clinical Researchers and Academic Collaborators

Clinical researchers and academic institutions are crucial partners for Exelixis, facilitating the advancement of its oncology pipeline through participation in clinical trials. These collaborations are vital for gathering data, validating drug efficacy, and expanding the understanding of novel therapies. For instance, Exelixis actively engages with numerous academic medical centers and research organizations to conduct its Phase 1, 2, and 3 studies.

Their expertise in specific disease areas and patient populations allows for the precise execution of complex trial protocols. This scientific exchange not only supports Exelixis' drug development but also contributes to the broader scientific community's knowledge base. In 2024, Exelixis continued to foster these relationships, with a significant portion of its R&D budget allocated to supporting clinical trial operations across a network of research sites.

- Essential for Clinical Trial Execution: Academic researchers and clinical trial sites are indispensable for conducting the rigorous studies required to bring new cancer treatments to market.

- Scientific Validation and Knowledge Sharing: Collaborations enable the validation of Exelixis' scientific hypotheses and foster the dissemination of critical research findings.

- Access to Diverse Patient Populations: Partnerships with academic centers provide access to a broad and diverse patient base, crucial for generalizability of trial results.

- R&D Infrastructure Support: These segments represent a key component of Exelixis' R&D infrastructure, enabling the efficient and effective progression of its drug candidates.

Exelixis targets specific oncology patient populations, primarily those diagnosed with advanced renal cell carcinoma (RCC), hepatocellular carcinoma (HCC), medullary thyroid cancer (MTC), and certain neuroendocrine tumors (NETs). These are patients with high unmet needs where Exelixis' approved therapies offer significant benefits.

The company's primary customers are oncologists and cancer specialists, including urologists, who prescribe these treatments. Healthcare institutions like major hospitals and specialized cancer clinics are also key customers, integrating Exelixis' drugs into patient care. Payers, such as insurance companies and government health programs, significantly influence market access and reimbursement for these therapies.

| Customer Segment | Primary Role | 2024 Focus Areas |

|---|---|---|

| Oncology Patients | End-users of therapies for specific cancer types (RCC, HCC, MTC, NETs) | Access to innovative treatments, improved outcomes |

| Oncologists & Specialists | Prescribers and key influencers of treatment decisions | Education on efficacy, safety, and patient selection; clinical trial data |

| Healthcare Institutions | Purchasers and integrators of therapies into clinical practice | Formulary access, hospital system adoption, value-based care integration |

| Payers (Insurers, Government) | Determine reimbursement and market access | Demonstrating cost-effectiveness, negotiating coverage policies |

Cost Structure

Exelixis dedicates a substantial portion of its resources to Research and Development (R&D), covering everything from initial drug discovery to the rigorous process of clinical trials. This commitment is crucial for bringing new cancer therapies to market.

In 2023, Exelixis' R&D expenses amounted to $616.7 million. Looking ahead, the company anticipates these costs to rise significantly, with projections for 2025 estimated to be between $925 million and $975 million, reflecting ongoing investment in its pipeline.

Exelixis's cost structure heavily features Sales, General, and Administrative (SG&A) expenses, crucial for bringing its innovative cancer therapies to market. These costs encompass the significant investments needed for commercialization, including extensive marketing campaigns, maintaining a dedicated sales force, and supporting medical affairs to educate healthcare professionals.

In 2024, Exelixis's SG&A expenses were a substantial component of its overall spending. For instance, the company reported SG&A expenses of approximately $750 million to $800 million for the full year 2024, reflecting the ongoing efforts in market access, patient support programs, and general corporate operations necessary to sustain its commercial success.

Exelixis incurs substantial manufacturing and supply chain costs to produce its cancer therapies. These expenses cover the intricate processes of drug substance synthesis, formulation into finished products, and rigorous quality control measures. In 2023, Exelixis reported Cost of Goods Sold (COGS) of approximately $680 million, reflecting these essential operational expenditures.

Managing a complex global supply chain is critical for ensuring consistent availability of Exelixis' medicines to patients worldwide. This involves significant investment in logistics, warehousing, and maintaining the integrity of temperature-sensitive products throughout their journey. These ongoing investments are vital for upholding the high standards of quality and reliability that patients and healthcare providers expect.

Clinical Trial and Regulatory Compliance Costs

The intricate and heavily regulated landscape of pharmaceutical development necessitates substantial investment in clinical trials, meticulous data management, and the complex navigation of regulatory approval pathways. For instance, in 2024, companies like Exelixis continue to allocate significant portions of their R&D budgets to these critical phases, reflecting the high stakes involved.

Ensuring adherence to the stringent requirements of global health authorities, such as the FDA and EMA, is absolutely essential and contributes significantly to the overall cost structure. These compliance efforts often involve extensive documentation, quality control measures, and ongoing audits, all of which demand considerable financial and human resources.

- Clinical Trial Expenses: Covering patient recruitment, site management, drug manufacturing for trials, and data collection.

- Regulatory Submission Fees: Costs associated with filing applications for drug approval with health agencies.

- Post-Market Surveillance: Ongoing monitoring and reporting required after a drug receives approval.

- Compliance Audits: Expenses related to internal and external audits to ensure adherence to regulations.

Intellectual Property and Legal Costs

Exelixis incurs significant costs to protect its intellectual property, primarily through patent filings and maintenance. These patents are crucial for safeguarding its innovative cancer therapies and ensuring market exclusivity, which is vital for recouping substantial research and development investments.

Defending against potential litigation and managing the complex legal landscape of drug development and commercialization also contributes to these costs. This includes navigating regulatory approvals and addressing any intellectual property disputes that may arise.

In 2023, Exelixis reported approximately $102.3 million in legal and regulatory expenses. This figure underscores the ongoing commitment and financial resources dedicated to maintaining a strong legal and IP framework.

- Patent Protection: Ongoing costs associated with filing, prosecuting, and maintaining patents globally for key drug candidates and technologies.

- Litigation Defense: Expenses related to defending against any patent challenges or other legal disputes that could impact product exclusivity or market access.

- Regulatory Compliance: Costs associated with legal counsel and compliance activities throughout the drug development lifecycle, from clinical trials to post-market surveillance.

- Intellectual Property Management: Resources allocated to managing and enforcing the company's extensive patent portfolio and other intellectual property assets.

Exelixis' cost structure is dominated by its substantial investments in Research and Development, essential for its pipeline of innovative cancer therapies. This is complemented by significant Sales, General, and Administrative expenses required for commercialization and market access. Furthermore, the company incurs considerable manufacturing and supply chain costs to ensure the quality and availability of its products, alongside expenses related to intellectual property protection and regulatory compliance.

| Cost Category | 2023 Actuals | 2024 Projections/Actuals | Key Drivers |

| Research & Development (R&D) | $616.7 million | Projected $925-$975 million for 2025 (Indicative of continued high investment) | Drug discovery, clinical trials, pipeline expansion |

| Sales, General & Administrative (SG&A) | Not specified for 2023 | Approx. $750-$800 million | Marketing, sales force, medical affairs, market access |

| Cost of Goods Sold (COGS) | Approx. $680 million | Not specified for 2024 | Manufacturing, supply chain, quality control |

| Legal & Regulatory Expenses | Approx. $102.3 million | Not specified for 2024 | Patent protection, litigation defense, compliance audits |

Revenue Streams

The primary engine driving Exelixis's financial success is the net sales generated by its cabozantinib franchise, which includes the widely used CABOMETYX and the specialized COMETRIQ. These sales are concentrated primarily within the United States market.

In 2024, the cabozantinib franchise demonstrated robust performance, achieving global revenues surpassing $2.5 billion. A significant portion of this, $1.8 billion, was directly attributed to net product revenues within the U.S.

Exelixis generates substantial royalty revenues from its global partnerships, specifically from the sales of its cancer drug cabozantinib by international collaborators. In 2024, these royalties amounted to $166.9 million. Key partners contributing to this revenue stream include Ipsen Pharma SAS and Takeda Pharmaceutical Company Limited, who market cabozantinib in various regions outside the United States.

Exelixis secures milestone payments from its partners when specific targets are met in drug development, regulatory approvals, or commercialization efforts.

For instance, a partner might trigger a payment for advancing a drug candidate into a new clinical trial phase or achieving a certain sales volume. In 2023, Exelixis reported $177 million in collaboration revenue, which includes these crucial milestone payments, demonstrating their importance to the company's financial health.

License Revenues

Exelixis generates significant revenue through licensing agreements, granting partners rights to develop and commercialize its compounds and technologies. These deals often involve upfront payments, milestone payments, and royalties on future sales, providing a steady income stream beyond its own commercial efforts.

For instance, in the first quarter of 2024, Exelixis reported $119.5 million in collaboration and licensing revenues, demonstrating the substantial contribution of these agreements to its overall financial performance. This highlights the strategic importance of these partnerships in expanding the reach and potential of Exelixis's innovative pipeline.

- Upfront Payments: Initial fees received upon signing a licensing deal, providing immediate capital.

- Milestone Payments: Payments triggered by the achievement of specific development or commercial targets by the partner.

- Royalties: A percentage of net sales generated by licensed products, offering long-term revenue participation.

- Territory and Indication Specificity: Agreements often define specific geographic regions or therapeutic areas where the partner can operate, maximizing value for both parties.

Potential Future Product Sales (Pipeline)

Exelixis is actively building its future revenue through a robust pipeline of investigational therapies. Beyond its current commercial successes, the company anticipates significant growth from new product sales as these candidates advance through clinical development and regulatory approval.

A key driver of this future revenue is zanzalintinib, a tyrosine kinase inhibitor currently in multiple pivotal trials. Positive outcomes in these trials could lead to new commercial opportunities, significantly expanding Exelixis's product portfolio and revenue base.

- Pipeline Advancement: Continued investment in research and development is crucial for advancing candidates like zanzalintinib through late-stage clinical trials, aiming for regulatory submission and approval.

- Market Potential: Successful commercialization of pipeline products is expected to tap into new patient populations and therapeutic areas, driving substantial revenue growth.

- Strategic Partnerships: Exelixis may also explore strategic collaborations or licensing agreements to maximize the commercial potential of its pipeline assets, further diversifying revenue streams.

Exelixis's revenue streams are primarily anchored by net sales of its cabozantinib franchise, particularly CABOMETYX, with the U.S. market being the major contributor. In 2024, this franchise generated over $2.5 billion globally, with $1.8 billion coming from U.S. net product sales.

Significant royalty income is derived from international collaborations for cabozantinib sales, amounting to $166.9 million in 2024 from partners like Ipsen and Takeda. Exelixis also benefits from collaboration and licensing revenue, which includes upfront payments, milestone payments, and royalties, totaling $119.5 million in Q1 2024.

| Revenue Stream | 2024 (Global) | 2024 (U.S.) | 2024 (Royalties) | Q1 2024 (Collab/Licensing) |

| Cabozantinib Franchise Net Sales | >$2.5 Billion | $1.8 Billion | - | - |

| Royalty Revenue | - | - | $166.9 Million | - |

| Collaboration & Licensing Revenue | - | - | - | $119.5 Million |

Business Model Canvas Data Sources

The Exelixis Business Model Canvas is informed by comprehensive clinical trial data, regulatory filings, and market analysis of the oncology landscape. This ensures a data-driven approach to value proposition and customer segments.