Exelixis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exelixis Bundle

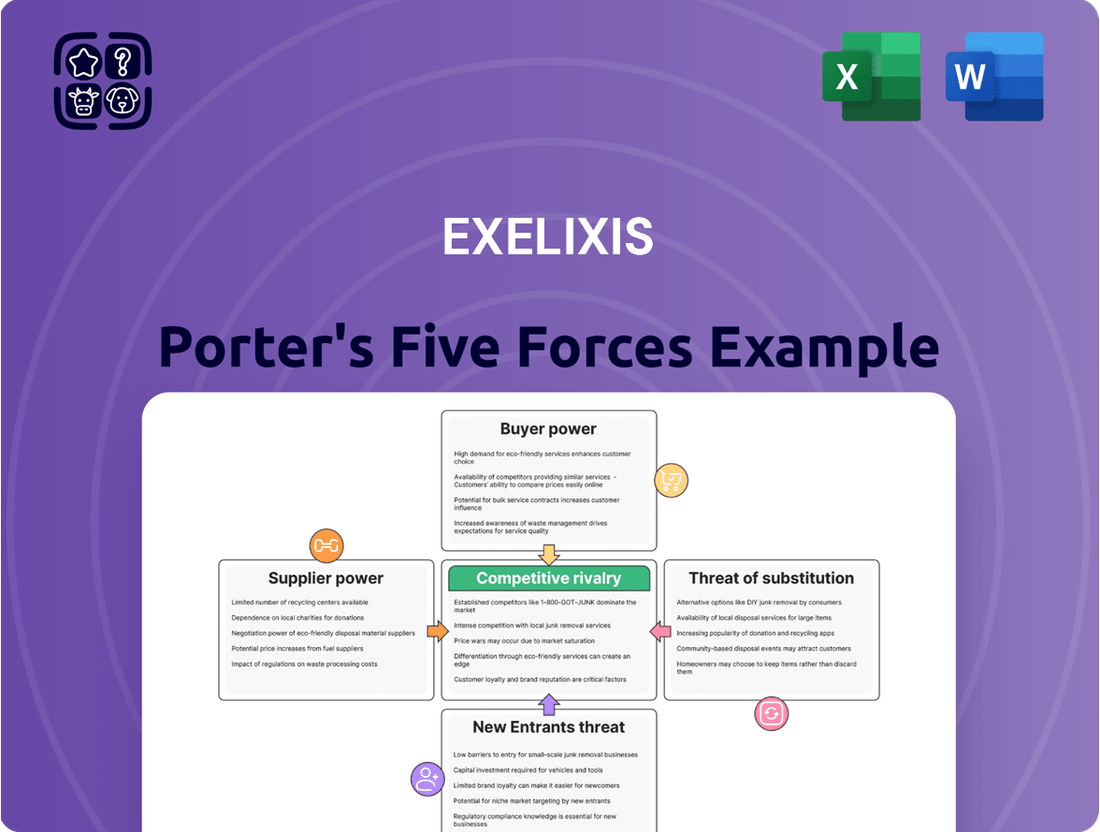

Exelixis navigates a complex landscape shaped by powerful industry forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic advantage. This brief overview only scratches the surface of these dynamics.

The complete report reveals the real forces shaping Exelixis’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The biopharmaceutical sector, including companies like Exelixis, often faces a concentrated supplier base for essential components. This means a few specialized firms might control the supply of critical raw materials, active pharmaceutical ingredients (APIs), or even intricate manufacturing processes. For instance, in 2024, the global API market saw significant consolidation, with a few major players dominating specific therapeutic areas, potentially increasing their bargaining power.

This reliance on a limited number of suppliers grants them considerable leverage. If a key supplier for a proprietary component used in Exelixis's cancer therapies were to increase prices or face production issues, it could directly affect Exelixis's ability to manufacture and bring its drugs to market, impacting revenue and market share.

In the biopharmaceutical industry, switching suppliers is a complex and costly undertaking. For a company like Exelixis, the process involves navigating significant regulatory hurdles, revalidating intricate manufacturing processes, and facing the potential for substantial delays in critical drug development timelines. These factors inherently increase the bargaining power of Exelixis's current suppliers, as the cost and risk associated with finding and onboarding a new vendor are exceptionally high.

Suppliers wielding proprietary technologies or specialized expertise, particularly in advanced oncology drug development, hold significant sway over Exelixis. For instance, companies providing unique gene-editing tools or novel delivery systems for targeted therapies can command higher prices due to their irreplaceable contributions. Exelixis's reliance on such specialized inputs for its cutting-edge treatments, like those in its pipeline, means these suppliers face fewer competitive pressures and can thus exert greater bargaining power.

Regulatory Requirements and Quality Standards

The pharmaceutical industry, including companies like Exelixis, operates under a rigorous regulatory framework. Suppliers of raw materials, active pharmaceutical ingredients (APIs), and specialized components must adhere to stringent quality control and compliance standards, such as Good Manufacturing Practices (GMP). Failure to meet these requirements can result in significant penalties, product recalls, and damage to a company's reputation, thus increasing the bargaining power of compliant suppliers.

Suppliers who consistently demonstrate high quality and regulatory compliance, often backed by certifications and a strong audit history, are highly valued. For instance, in 2024, the global pharmaceutical excipients market was valued at approximately $9.7 billion, with a significant portion driven by the demand for high-purity and compliant ingredients. These reliable suppliers can leverage their proven track record to command premium pricing, as the cost and complexity of achieving and maintaining these standards create a barrier to entry for potential new suppliers.

- High Quality and Compliance: Suppliers must meet stringent GMP and other regulatory standards, a necessity for pharmaceutical companies like Exelixis.

- Barriers to Entry: The difficulty and cost associated with meeting these rigorous standards limit the number of qualified suppliers.

- Supplier Leverage: Proven compliance and a consistent track record allow these suppliers to negotiate higher prices for their critical products.

- Market Value: The global pharmaceutical excipients market, a key area for suppliers, demonstrates the significant economic value placed on compliant materials.

Importance of Supplier's Input to Product Quality

The quality and consistency of raw materials and specialized components are paramount for Exelixis, directly impacting the efficacy and safety of its oncology drugs. For instance, the specific chemical purity of active pharmaceutical ingredients (APIs) or the integrity of cell culture media used in advanced therapies are non-negotiable. Suppliers who can reliably deliver these critical inputs at the highest standards gain significant leverage in pricing and terms, as Exelixis cannot afford to compromise on quality for its life-saving treatments.

This dependency is amplified for novel therapeutic modalities. For antibody-drug conjugates (ADCs), the quality of the antibody, the linker, and the cytotoxic payload must be exceptionally high and precisely manufactured. Similarly, for cell therapies, the viability and genetic stability of the cellular starting materials are crucial. Suppliers possessing proprietary manufacturing processes or unique technological capabilities in these specialized areas further strengthen their bargaining power.

- Criticality of Inputs: The efficacy of Exelixis's oncology treatments, such as its flagship drug, depends heavily on the precise quality of its sourced materials.

- Supplier Specialization: Companies providing highly specialized components, like those essential for antibody-drug conjugates (ADCs), often hold more negotiation power due to limited alternative suppliers.

- Regulatory Scrutiny: The biopharmaceutical industry's stringent regulatory environment means that any compromise in input quality could lead to significant delays, recalls, and reputational damage, reinforcing the importance of reliable suppliers.

The bargaining power of suppliers for Exelixis is a significant factor, primarily driven by the specialized nature of inputs required for biopharmaceutical development and manufacturing. Limited availability of high-quality, regulatory-compliant materials, particularly for advanced therapies, means a few key suppliers can exert considerable influence.

This leverage is amplified by the high costs and complexities associated with switching suppliers in this highly regulated industry. For Exelixis, the rigorous validation processes and potential for development delays make it difficult to change vendors, thus strengthening the position of existing suppliers.

Suppliers who possess proprietary technologies or offer unique, specialized components essential for Exelixis's cutting-edge oncology treatments, such as those used in antibody-drug conjugates or cell therapies, can command premium pricing due to their irreplaceable contributions.

In 2024, the global market for specialized pharmaceutical ingredients, a critical area for companies like Exelixis, continued to show concentration. For instance, the market for certain high-purity excipients, vital for drug formulation, remained dominated by a few key manufacturers who could dictate terms due to their established quality and compliance records.

| Factor | Impact on Exelixis | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited suppliers for critical raw materials and APIs increase their leverage. | Consolidation in the API market in 2024 meant fewer dominant players in specific therapeutic areas. |

| Switching Costs | High costs and regulatory hurdles for changing suppliers benefit incumbent vendors. | Revalidation of manufacturing processes and potential development delays remain significant barriers. |

| Proprietary Technology | Suppliers with unique technologies for advanced therapies hold strong bargaining power. | Demand for specialized components in ADCs and cell therapies continues to grow, empowering niche suppliers. |

| Quality & Compliance | Suppliers meeting stringent GMP standards are highly valued and can charge more. | The global pharmaceutical excipients market, valued around $9.7 billion in 2024, highlights the premium on compliant materials. |

What is included in the product

This analysis unpacks the competitive forces shaping Exelixis's market, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a clear, actionable breakdown of Exelixis's market landscape.

Customers Bargaining Power

Major customers for Exelixis's oncology drugs are large healthcare systems, insurance companies, and government healthcare programs. These entities wield substantial purchasing power due to the sheer volume of drugs they buy. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) in the US, a significant government payer, represented a substantial portion of healthcare spending, influencing drug pricing across the board.

Their ability to dictate which drugs are included in formularies and to negotiate reimbursement rates creates significant pricing pressure on Exelixis. This bargaining power can directly impact the profitability and market access of Exelixis's key products, such as Cabometyx and Cometriq.

The presence of alternative treatments significantly impacts Exelixis's customer bargaining power. While Exelixis develops innovative therapies, the oncology landscape is diverse, offering established options like chemotherapy, radiation, and surgery. In 2024, the market continues to see advancements in these traditional methods alongside novel approaches, providing patients and healthcare providers with a range of choices.

The potential for biosimilars and generics, particularly as patents for existing treatments expire, further amplifies customer leverage. This availability of lower-cost alternatives creates a ceiling for pricing and encourages negotiation, as payers and patients can readily compare costs and efficacy across different treatment modalities.

Exelixis faces significant bargaining power from customers due to mounting public and political pressure on drug pricing, especially for expensive cancer treatments. In 2024, the average out-of-pocket cost for a specialty cancer drug can exceed $10,000 annually, prompting patients and payers to demand greater affordability.

These affordability concerns, coupled with tightening healthcare budgets, empower customers to negotiate lower prices or seek discounts from Exelixis. This pressure is particularly acute in markets where healthcare expenditure is a prominent societal issue, potentially impacting Exelixis's revenue streams.

Physician and Hospital Formularies

Hospitals and health systems wield significant influence through their formularies, which are essentially preferred drug lists. For Exelixis's oncology drugs to gain traction, they need to earn a spot on these lists. This requires a compelling case for clinical superiority and economic value. In 2024, the pressure on drug pricing and formulary placement intensified, with payers and providers scrutinizing the real-world effectiveness and cost-benefit analyses of new therapies more than ever before.

This formulary control grants customers, like hospital pharmacy and therapeutics committees, considerable bargaining power. They can effectively dictate which drugs are readily available and reimbursed within their institutions. Exelixis must navigate these gatekeepers by providing robust data that supports their products’ inclusion, often negotiating pricing and access agreements to secure favorable formulary status.

- Formulary Influence: Hospitals and medical institutions use formularies to guide drug selection, impacting prescription patterns.

- Clinical and Economic Value: Exelixis must demonstrate clear clinical benefits and cost-effectiveness to secure favorable formulary placement.

- 2024 Market Dynamics: Increased scrutiny on drug pricing and real-world effectiveness by payers and providers in 2024.

- Negotiation Leverage: Formulary control gives healthcare institutions bargaining power, necessitating strategic pricing and access negotiations by Exelixis.

Patient Advocacy and Awareness

Patient advocacy groups can significantly influence drug adoption and pricing. By highlighting unmet medical needs or championing specific treatments, these organizations can shape market demand. For Exelixis, this translates to potential pressure on drug pricing as affordability concerns are brought to the forefront, especially in cases where patient access is a key advocacy point.

For instance, in 2024, several patient advocacy organizations actively campaigned for broader insurance coverage of advanced cancer therapies, directly impacting the market access strategies of companies like Exelixis. This heightened awareness can amplify the bargaining power of patients by creating a public mandate for more accessible treatments.

- Increased Demand: Advocacy can drive demand for specific drugs, potentially benefiting Exelixis.

- Pricing Scrutiny: Advocacy groups often scrutinize drug prices, creating downward pressure.

- Market Access: Patient groups can lobby for improved insurance coverage and reimbursement.

- Unmet Needs: Highlighting unmet needs can justify the existence of therapies, but also the need for affordability.

The bargaining power of customers for Exelixis is substantial, primarily driven by large payers like healthcare systems and insurance companies. These entities, by controlling formularies and negotiating reimbursement, exert significant pricing pressure. In 2024, the increasing focus on drug affordability, with average out-of-pocket costs for specialty cancer drugs exceeding $10,000 annually, further empowers these customers to demand lower prices.

The availability of alternative treatments, including established therapies and emerging biosimilars, also strengthens customer leverage. Exelixis must continuously demonstrate the clinical and economic value of its products, such as Cabometyx, to secure favorable formulary placement against a backdrop of intense pricing scrutiny. Patient advocacy groups, by highlighting affordability concerns and lobbying for broader coverage, also contribute to this customer power.

| Factor | Impact on Exelixis | 2024 Data/Trend |

| Payer Concentration | High bargaining power due to volume purchasing | CMS and major insurers are key decision-makers |

| Formulary Control | Gatekeepers for drug access and reimbursement | Increased scrutiny on real-world effectiveness and cost-benefit |

| Availability of Alternatives | Limits pricing power, encourages negotiation | Growth in biosimilars and other oncology treatments |

| Pricing Pressure | Demand for affordability due to high treatment costs | Average annual out-of-pocket costs for specialty cancer drugs can exceed $10,000 |

Preview the Actual Deliverable

Exelixis Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Exelixis, detailing the competitive landscape and strategic positioning of the company. The document you see here is the exact, fully formatted report you will receive immediately after purchase, providing actionable insights for your business strategy.

Rivalry Among Competitors

The oncology market is a crowded space, with a vast array of biopharmaceutical companies, from established giants to nimble startups, all vying to develop and market new cancer therapies. Exelixis navigates this landscape against numerous competitors, including major players like Bristol Myers Squibb, Merck, and Pfizer, as well as a multitude of smaller, innovative biotech firms. This intense competition means that new entrants and existing rivals are constantly pushing the boundaries of research and development, aiming to capture market share with novel treatments.

The oncology market is a hotbed of innovation, attracting massive research and development (R&D) spending due to the potential for high rewards. In 2024, the global oncology market was valued at approximately $220 billion, with a significant portion dedicated to R&D. This intense focus means companies like Exelixis face a relentless pursuit of breakthrough therapies, creating a crowded pipeline and a fierce race to bring novel compounds to market, thereby amplifying competitive pressure.

Competitive rivalry at Exelixis largely hinges on product differentiation, especially through novel mechanisms of action and enhanced safety profiles. In 2024, the oncology landscape continues to be fiercely competitive, demanding constant innovation. Exelixis's commitment to developing targeted therapies and immunotherapies that demonstrate superior value is crucial for standing out against competitors offering similar or alternative treatment options.

Aggressive Marketing and Sales Strategies

Competitors in the oncology space, including companies like Pfizer and Bristol Myers Squibb, are known for their robust marketing and sales efforts. These often involve significant spending on direct-to-consumer advertising and building strong ties with oncologists and treatment centers. For instance, in 2023, the pharmaceutical industry's advertising spend in the US alone was estimated to be in the billions, with a substantial portion directed towards promoting established and newly launched cancer therapies.

Exelixis must allocate considerable resources to its commercial operations to counter these aggressive tactics and ensure its products, like Cabometyx, remain competitive. This includes investing in sales force expansion, targeted promotional campaigns, and patient support programs. The company's own sales and marketing expenses reflect this reality, with significant portions of its operating budget dedicated to these activities to maintain market share and drive growth.

- Aggressive competitor marketing requires substantial Exelixis investment.

- Direct-to-consumer advertising and healthcare provider relationships are key tactics.

- Pharmaceutical advertising spend in the US reached billions in 2023.

- Exelixis's commercial budget reflects the need to compete on marketing and sales.

Mergers, Acquisitions, and Strategic Alliances

The oncology sector is dynamic, with frequent mergers, acquisitions, and strategic alliances. These moves aim to consolidate market share, acquire novel technologies, and broaden drug pipelines. For instance, in 2024, several significant collaborations were announced, including partnerships focused on developing next-generation immunotherapies and targeted agents. These consolidations can lead to the emergence of larger, more competitive entities that present a greater challenge to existing players like Exelixis.

These strategic maneuvers directly impact competitive rivalry by altering the market structure. Companies that successfully integrate acquired assets or technologies can gain a significant advantage in terms of research and development capabilities, commercial reach, and therapeutic portfolio breadth. This can intensify pressure on companies that do not participate in such consolidations, potentially leading to market share erosion if they cannot keep pace with innovation and scale.

- Market Consolidation: Acquisitions and mergers in oncology can create larger, more dominant players, increasing competitive intensity.

- Technology Access: Alliances and acquisitions are key for companies seeking to incorporate cutting-edge technologies, such as AI-driven drug discovery or advanced gene editing, into their R&D efforts.

- Pipeline Expansion: Companies acquire or partner to fill gaps in their therapeutic pipelines, aiming for broader market coverage and reduced reliance on single blockbuster drugs.

- Reshaping the Landscape: These activities can fundamentally alter the competitive dynamics, forcing companies like Exelixis to adapt their strategies to counter new, formidable rivals.

The competitive rivalry in the oncology market is exceptionally high due to the significant R&D investment and the constant drive for innovation. Exelixis faces intense pressure from large pharmaceutical companies and emerging biotech firms, all striving to develop and market novel cancer therapies. This dynamic landscape demands continuous differentiation through superior product profiles and effective commercial strategies.

Companies like Exelixis must invest heavily in marketing and sales to maintain market share against competitors with established brand recognition and extensive promotional reach. The global oncology market, valued at approximately $220 billion in 2024, fuels this competition, with billions spent annually on advertising and building relationships with healthcare providers.

Strategic alliances and mergers are prevalent, creating larger, more formidable competitors and intensifying the race for market dominance. Exelixis must adapt to these shifts by securing access to new technologies and expanding its therapeutic pipeline to remain competitive.

| Key Competitors | Key Therapies/Focus Areas | 2024 Market Presence/Strategy |

| Bristol Myers Squibb | Immunotherapy (e.g., Opdivo), Targeted Therapies | Strong established presence, aggressive R&D in next-gen immunotherapies. |

| Merck | Immunotherapy (e.g., Keytruda), HPV vaccines | Dominant player in immunotherapy, expanding into combination therapies. |

| Pfizer | Targeted therapies, Antibody-Drug Conjugates (ADCs) | Broad oncology portfolio, significant investment in ADCs and mRNA-based cancer vaccines. |

| Roche | Targeted therapies (e.g., Herceptin, Avastin), Immunotherapy | Leader in personalized medicine, strong diagnostics integration. |

SSubstitutes Threaten

While Exelixis is at the forefront of targeted therapies and immunotherapies, conventional treatments like chemotherapy, radiation, and surgery remain potent substitutes. These traditional methods are often the go-to options for earlier stages of cancer or in areas where access to advanced treatments is restricted due to cost or infrastructure.

The oncology landscape is rapidly evolving, with novel therapeutic modalities like gene therapy, cell therapy (e.g., CAR-T), and radioligand therapy emerging as potential substitutes for Exelixis's current drug classes. These distinct approaches offer alternative treatment pathways for cancer patients.

For instance, the CAR-T therapy market, a significant area of cell therapy, was valued at approximately $1.3 billion in 2023 and is projected to grow substantially, indicating a growing acceptance and adoption of these substitute treatments. This expansion directly challenges the market share of traditional small molecule and antibody-based therapies that Exelixis currently offers.

While not direct drug substitutes, long-term lifestyle changes and preventative measures can indirectly affect the demand for cancer treatments by reducing the incidence or slowing the progression of certain cancers. For instance, increased awareness and adoption of healthy lifestyles, including improved diet and exercise, could potentially lower the overall patient population requiring advanced therapies over time. Public health campaigns promoting early detection, such as increased screening rates for common cancers, also play a role in managing the disease landscape.

Off-label Use of Existing Drugs

The off-label use of existing drugs presents a significant threat of substitutes for companies like Exelixis. Physicians may prescribe medications approved for other conditions to treat cancer if clinical data indicates potential efficacy, especially when these alternatives are more cost-effective than newer, patented oncology treatments. This practice can erode the market share of innovative drugs by offering a lower-priced option, even if it lacks formal regulatory approval for that specific use.

This dynamic is particularly relevant in oncology, where the cost of treatment can be substantial. For instance, a study published in 2024 highlighted that a significant percentage of cancer prescriptions involve off-label uses, driven by both physician experience and patient affordability concerns. This directly impacts the revenue potential of novel therapies, as payers and patients might favor cheaper, albeit unproven for the specific indication, alternatives.

- Cost Advantage: Off-label drugs often carry lower price tags compared to newly approved, branded oncology medications.

- Physician Discretion: Medical professionals can prescribe drugs for unapproved uses if they believe it benefits the patient based on available evidence.

- Market Penetration Challenge: The availability of cheaper substitutes can hinder the market penetration and adoption rates of innovative cancer therapies.

- Regulatory Landscape: While off-label prescribing is legal, it operates in a complex regulatory environment that can influence physician and payer decisions.

Best Supportive Care or Palliative Care

For patients with advanced or refractory cancers, best supportive care or palliative care can act as a substitute for aggressive treatments like those offered by Exelixis. This is particularly true when the perceived benefits of a drug, such as improved survival or quality of life, do not clearly outweigh the associated side effects or financial costs.

This presents a threat by potentially shrinking the addressable market for Exelixis's oncology drugs. If patients and their physicians opt for palliative measures instead of or in addition to Exelixis's therapies, it directly impacts sales volumes. For instance, in 2024, the increasing emphasis on patient-centric care and managing treatment burdens means that the decision to pursue aggressive therapy versus supportive care is becoming more nuanced. Data from various oncology conferences in late 2023 and early 2024 highlighted discussions around optimizing treatment pathways to minimize toxicity, which could favor less aggressive approaches for certain patient segments.

- Reduced Market Penetration: The availability of effective supportive care can limit the number of patients who opt for Exelixis's treatments, especially in later lines of therapy.

- Value Proposition Scrutiny: Exelixis's drug pricing and demonstrated clinical benefit must be compelling enough to justify the choice over less intensive, potentially lower-cost palliative options.

- Shifting Treatment Paradigms: As palliative care evolves to include more active symptom management and even some targeted interventions, its substitutive power increases.

The threat of substitutes for Exelixis's oncology drugs is multifaceted, encompassing traditional treatments, emerging therapies, and even lifestyle changes. Conventional methods like chemotherapy and radiation remain viable alternatives, particularly in early-stage cancers or where advanced treatments are less accessible. Emerging modalities such as gene therapy and CAR-T cell therapy, with the CAR-T market valued at approximately $1.3 billion in 2023, offer distinct treatment pathways that can supplant Exelixis's current offerings.

Furthermore, the off-label use of existing, more affordable drugs poses a significant challenge, with a 2024 study indicating a substantial prevalence of such practices in oncology due to cost and physician discretion. Even supportive and palliative care are considered substitutes when the benefits of aggressive therapies like Exelixis's do not clearly outweigh their costs and side effects, a consideration increasingly emphasized in patient-centric care discussions throughout late 2023 and early 2024.

| Substitute Category | Examples | Impact on Exelixis | Key Data Point |

|---|---|---|---|

| Traditional Treatments | Chemotherapy, Radiation, Surgery | Primary option for early-stage cancers; limited by access/cost for advanced therapies. | Established treatment modalities with broad applicability. |

| Emerging Therapies | Gene Therapy, CAR-T Cell Therapy, Radioligand Therapy | Offer alternative mechanisms of action; CAR-T market ~$1.3B in 2023, growing. | Represents innovation and potential disruption of current drug classes. |

| Off-Label Drug Use | Existing drugs prescribed for unapproved cancer indications | Provides lower-cost alternatives, eroding market share for novel therapies. | Significant percentage of cancer prescriptions involve off-label uses (2024 study). |

| Supportive/Palliative Care | Best Supportive Care, Palliative Care | Chosen when treatment benefits are unclear or costs/side effects are high; impacts addressable market. | Increasing emphasis on patient-centric care and managing treatment burdens (late 2023/early 2024 discussions). |

Entrants Threaten

Developing novel biopharmaceutical treatments, particularly in the competitive oncology space, demands colossal and ongoing financial commitments to research and development. These costs are a significant hurdle, effectively acting as a formidable barrier to entry for aspiring competitors.

Bringing a new drug from initial discovery through rigorous preclinical and extensive clinical trials to market approval is an exceptionally costly and time-consuming undertaking. Estimates suggest the average cost can exceed $2 billion, with timelines often spanning 10 to 15 years, a daunting prospect for most potential new players.

The pharmaceutical industry, including companies like Exelixis, faces a significant threat from new entrants due to the complex regulatory approval process. Agencies such as the U.S. Food and Drug Administration (FDA) mandate rigorous testing and documentation to demonstrate a drug's safety and efficacy, a process that can take years and cost hundreds of millions of dollars. For instance, the average cost to develop a new drug, including failed attempts, was estimated to be around $2.6 billion as of 2023, a substantial hurdle for any new player.

Successfully navigating these intricate and lengthy regulatory pathways requires specialized expertise and substantial financial resources. New companies often lack the established track record and deep understanding of regulatory requirements, making it difficult to gain approval for their products and compete with established firms that have proven experience in this area.

The oncology drug market, where Exelixis operates, requires immense specialized knowledge in areas like molecular biology, clinical trial design, and regulatory affairs. New companies entering this space must either cultivate these skills internally or acquire them, a process that is both time-consuming and incredibly expensive. For instance, the average cost to bring a new drug to market can exceed $2 billion, a significant barrier for potential competitors.

Furthermore, the infrastructure needed for developing and distributing cancer therapies is equally demanding. This includes state-of-the-art research facilities, complex manufacturing capabilities for biologics, and a robust, temperature-controlled supply chain. Building these essential components from scratch represents a substantial capital investment, effectively deterring many new entrants from challenging established players like Exelixis.

Strong Patent Protection and Intellectual Property

Strong patent protection acts as a formidable barrier to entry in the biopharmaceutical sector. Exelixis, for instance, relies on its intellectual property for key drugs, such as cabozantinib (marketed as Cabometyx and Cometriq). These patents provide market exclusivity, preventing competitors from launching generic versions or developing biosimil alternatives for a defined period, typically 20 years from the filing date.

This exclusivity is crucial for recouping the substantial research and development costs associated with bringing a new drug to market. For example, the average cost to develop a new drug was estimated to be around $2.6 billion as of 2023, underscoring the need for robust patent protection to ensure profitability and fund future innovation.

The threat of new entrants is therefore significantly diminished when established players hold strong patent portfolios. This allows companies like Exelixis to maintain pricing power and market share without immediate competition from generic manufacturers.

- Patent Exclusivity: Patents grant market exclusivity, preventing generic or biosimilar competition.

- R&D Investment Protection: Patents safeguard the massive investments required for drug development.

- Barriers to Entry: Strong IP rights create substantial hurdles for new companies entering the market.

- Market Stability: Patent protection contributes to market stability for innovative biopharmaceutical companies.

Established Brand Recognition and Physician Relationships

The threat of new entrants for Exelixis is significantly mitigated by the deep-rooted brand recognition and established physician relationships within the oncology sector. Companies like Exelixis have cultivated trust over years, making it difficult for newcomers to gain traction.

New entrants would struggle to replicate Exelixis's existing network of oncologists and key opinion leaders who are loyal to established therapies. Building this level of credibility and displacing physician preferences in a market as critical as cancer treatment demands substantial time and resources.

For example, in 2024, the oncology drug market is characterized by high R&D costs and lengthy regulatory approval processes. New companies entering this space face not only the challenge of developing novel treatments but also the immense task of building a comparable sales force and marketing infrastructure to compete with established players like Exelixis, which reported $1.5 billion in revenue for 2023.

- Established Brand Recognition: Exelixis's Cabometyx has achieved significant market penetration and physician familiarity.

- Physician Relationships: Years of engagement have fostered strong ties between Exelixis's sales teams and oncologists.

- High Barrier to Entry: The cost and time required to build similar trust and market presence are prohibitive for most new entrants.

- Competitive Oncology Landscape: The oncology market in 2024 is crowded, with established players having significant advantages in market access and physician loyalty.

The threat of new entrants for Exelixis is considerably low due to the immense capital required for drug development, estimated at over $2 billion per drug, and the lengthy 10-15 year development timeline. These financial and temporal barriers, coupled with the need for specialized expertise in areas like molecular biology and regulatory affairs, make it exceptionally difficult for new companies to compete effectively in the oncology space.

Furthermore, strong patent protection, like that held by Exelixis for its key drugs, grants market exclusivity and safeguards substantial R&D investments, creating significant hurdles for potential competitors. The established brand recognition and deep physician relationships cultivated by companies like Exelixis in 2024, where oncology market competition is fierce, also present a formidable barrier, requiring new entrants to invest heavily in building similar trust and market presence.

| Factor | Impact on Exelixis | Barriers to Entry |

|---|---|---|

| R&D Costs | High, requiring significant capital | Very High |

| Development Timeline | 10-15 years | Very High |

| Regulatory Hurdles | Complex and costly (e.g., FDA approval) | Very High |

| Patent Exclusivity | Protects market share and R&D investment | High |

| Brand Recognition & Physician Relationships | Established loyalty and trust | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Exelixis leverages data from SEC filings, investor presentations, and industry-specific market research reports to assess competitive intensity.