Exelixis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exelixis Bundle

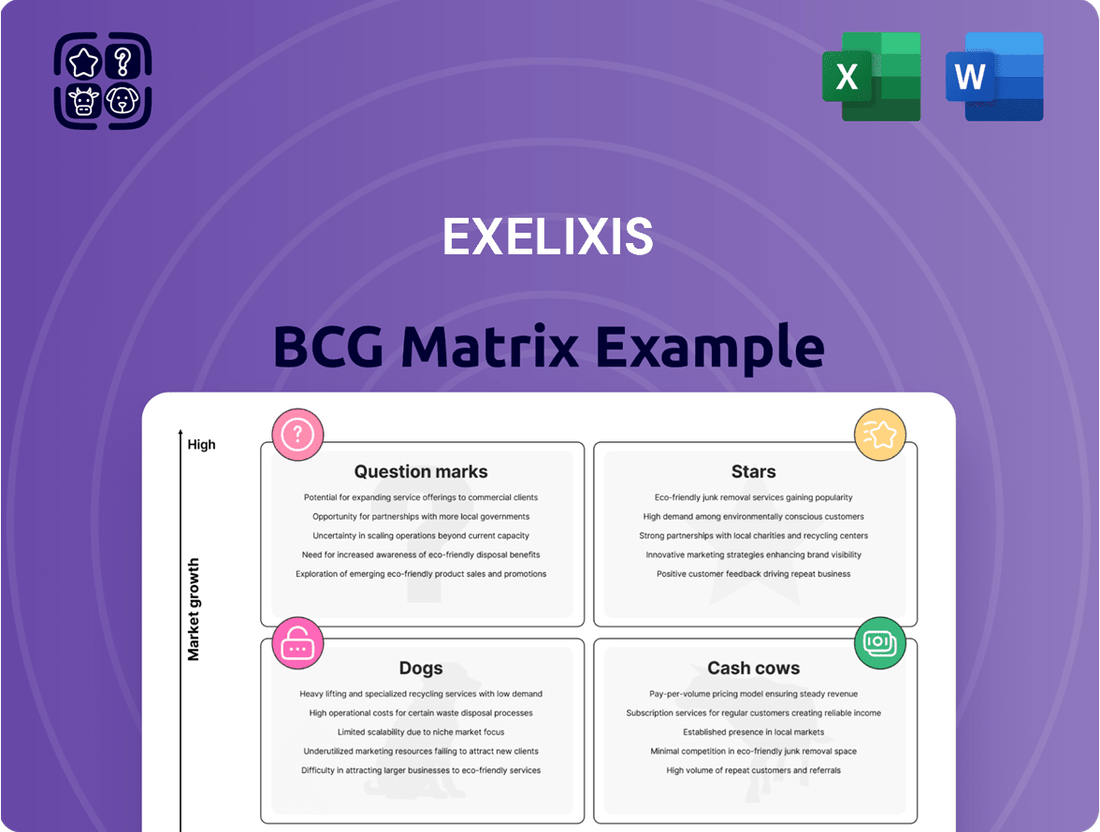

Curious about Exelixis's product portfolio and market position? This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock strategic advantage and make informed decisions about resource allocation and future investments, you need the complete BCG Matrix analysis.

Don't let uncertainty guide your strategy. Purchase the full Exelixis BCG Matrix for a comprehensive breakdown of each product's quadrant placement, backed by data-driven insights and actionable recommendations. Equip yourself with the clarity needed to navigate market dynamics and drive growth.

This is your opportunity to gain a competitive edge. The full Exelixis BCG Matrix isn't just a report; it's a strategic roadmap. Secure your copy today and transform your understanding of Exelixis's market performance into powerful, actionable business intelligence.

Stars

Cabometyx's recent approvals for neuroendocrine tumors (NET) in March 2025 (U.S. FDA) and July 2025 (European Commission) mark a significant expansion. This new indication is quickly capturing market share, achieving approximately 35% of new patient starts in the second-line plus oral therapy segment for NET during Q2 2025.

This strong uptake is a positive driver for Exelixis' revenue growth. The company anticipates this positive trend to persist, potentially leading to upward revisions in its 2025 financial guidance.

Cabometyx stands out as a dominant force in the renal cell carcinoma (RCC) market, holding its position as the leading prescribed tyrosine kinase inhibitor (TKI). Furthermore, it is the top choice for TKI plus immunotherapy combinations in the crucial first-line treatment setting for RCC. This strong market penetration directly fuels Exelixis' revenue streams.

The market share of Cabometyx in RCC has demonstrated a steady upward trajectory, climbing to 45% by the second quarter of 2025. This represents a notable increase from the 41% market share recorded in the same period of the previous year. Such consistent growth underscores its therapeutic value and commercial success.

Cabometyx's use in hepatocellular carcinoma (HCC) for patients who have already received sorafenib treatment is a key factor in its market position. This established indication provides a consistent revenue source for Exelixis within the competitive oncology sector.

In 2024, Cabometyx continued to be a significant contributor to Exelixis's portfolio. While specific HCC revenue figures are often bundled, the drug's overall performance in treating advanced renal cell carcinoma and HCC, among other indications, supported a strong market presence.

Cabometyx in Differentiated Thyroid Cancer (DTC)

Cabometyx is a key player in Exelixis's portfolio, holding a significant position within the differentiated thyroid cancer (DTC) market. Its approval for adult and pediatric patients with advanced or metastatic DTC, particularly those who have progressed on prior therapies and are refractory to radioactive iodine, highlights its therapeutic value and expands Exelixis's market reach beyond its established indications.

While the DTC market segment might be smaller compared to renal cell carcinoma (RCC) or neuroendocrine tumors (NET), it represents a crucial area for Cabometyx's continued growth and utility. This expansion into DTC demonstrates the drug's versatility and its ability to address unmet needs in various oncology settings.

The financial implications of this indication are noteworthy. For instance, in 2023, Exelixis reported total net product revenue of $1.4 billion, with Cabometyx being the primary driver. While specific revenue breakdowns for DTC are not publicly detailed, its inclusion in the treatment paradigm for this indication contributes to the overall revenue stream and market share of Cabometyx.

- Cabometyx Approved for DTC: Indicated for advanced or metastatic differentiated thyroid cancer in adult and pediatric patients who have progressed on prior VEGFR-targeted therapy and are radioactive iodine-refractory or ineligible.

- Market Expansion: This DTC indication broadens Cabometyx's market reach, complementing its established use in other cancer types.

- Revenue Contribution: Cabometyx is a significant revenue generator for Exelixis, contributing to the company's overall financial performance. In 2023, Exelixis's net product revenue reached $1.4 billion, with Cabometyx as the lead product.

- Therapeutic Value: The drug addresses an unmet need in DTC, offering a treatment option for patients with limited alternatives.

Strategic Expansion of Cabozantinib Franchise

Exelixis is aggressively expanding its cabozantinib franchise by pursuing new indications and deepening market penetration. The company anticipates sustained growth in cabozantinib revenue, projecting a strong full-year 2025 performance. This strategic emphasis is designed to fully leverage the significant potential of its flagship product.

Cabozantinib's strategic expansion is a key driver for Exelixis, reflecting a commitment to maximizing its market presence. The company's financial outlook for 2025 highlights continued revenue growth for cabozantinib, underscoring its importance to the franchise. This focus on broadening the drug's applications and reach is central to Exelixis's growth strategy.

- Cabozantinib Franchise Growth: Exelixis is actively pursuing new indications and market penetration for its cabozantinib franchise.

- 2025 Financial Guidance: The company has reaffirmed strong full-year 2025 financial guidance, expecting continued growth in cabozantinib revenue.

- Strategic Focus: The strategy aims to maximize the potential of cabozantinib, its leading product, through expanded use and market access.

Cabometyx's expansion into neuroendocrine tumors (NET) and differentiated thyroid cancer (DTC) positions it as a star product for Exelixis. Its strong market share in renal cell carcinoma (RCC) and growing presence in hepatocellular carcinoma (HCC) further solidify this status. These diverse indications, coupled with aggressive pursuit of new opportunities, drive significant revenue growth for Exelixis.

| Product | Key Indications | 2023 Revenue (Approx.) | Market Share (Q2 2025 Est.) |

|---|---|---|---|

| Cabometyx | RCC, HCC, DTC, NET | $1.4 Billion (Total Exelixis Net Product Revenue) | RCC: 45% (1st Line TKI+IO) NET: 35% (2nd Line+ Oral) |

What is included in the product

The Exelixis BCG Matrix analyzes its product portfolio based on market growth and share, guiding investment decisions.

Exelixis BCG Matrix: A visual tool that simplifies complex portfolio analysis, reducing the pain of strategic decision-making.

Cash Cows

The cabozantinib franchise, comprising Cabometyx and Cometriq, stands as Exelixis's leading revenue generator. In the second quarter of 2025, U.S. net product revenues for this franchise surged by 19% year-over-year, reaching $520 million.

This robust financial performance underscores the franchise's substantial cash-generating capacity. The consistent strength of cabozantinib allows Exelixis to allocate resources towards critical areas such as advancing its pipeline and executing share repurchase programs.

Cabometyx enjoys substantial profit margins in its established indications like renal cell carcinoma (RCC), hepatocellular carcinoma (HCC), and differentiated thyroid cancer (DTC). This profitability stems from a strong competitive edge and reduced marketing expenses in these mature markets, allowing Exelixis to generate consistent cash flow. For instance, in 2023, Cabometyx sales reached approximately $1.2 billion, underscoring its dominance and profitability in these key therapeutic areas.

Cabometyx's established indications, particularly in renal cell carcinoma (RCC) and hepatocellular carcinoma (HCC), contribute significantly to Exelixis's "cash cow" status. The mature nature of these treatment areas translates into a consistent and predictable stream of prescriptions and refills. This stability is crucial for Exelixis, allowing for reliable revenue generation that underpins its financial health and strategic planning.

In 2024, Cabometyx continued to demonstrate strong performance, with net product revenue reaching approximately $1.2 billion for the first nine months of the year. This consistent revenue from long-term prescriptions provides a solid foundation for Exelixis to invest in its pipeline and explore new market opportunities, reinforcing its position as a reliable performer in the oncology sector.

Royalties from International Partnerships

Exelixis benefits significantly from royalties generated through international partnerships, particularly for its drug cabozantinib. These collaborations allow the company to earn revenue without bearing the direct costs of sales and marketing in those specific regions.

Key partners like Ipsen and Takeda contribute to these royalty streams. For instance, in 2023, Exelixis reported collaboration and royalty revenue of $390 million, a substantial portion of which stems from these international agreements.

- Royalties from cabozantinib sales outside the U.S.

- Partnerships with companies like Ipsen and Takeda drive revenue.

- These royalties represent a significant cash flow without direct operational expenses for Exelixis in those markets.

- In 2023, collaboration and royalty revenue reached $390 million.

Disciplined Capital Allocation and Share Repurchases

Exelixis leverages the substantial cash generated by its Cabozantinib products to implement a strategic capital allocation plan. This includes a robust program of share repurchases, aimed at enhancing shareholder value and improving the company's capital efficiency.

The company's commitment to returning capital to shareholders is evident in its buyback activities. As of the second quarter of 2025, Exelixis had successfully repurchased $796.3 million of its common stock. This substantial repurchase program underscores the company's confidence in its financial health and its strategy to optimize its capital structure.

- Disciplined Capital Allocation: Exelixis prioritizes returning value to shareholders through strategic capital deployment.

- Share Repurchase Program: The company actively engages in share buybacks, funded by strong cash flows.

- $796.3 Million Repurchased: As of June 30, 2025, Exelixis had bought back this significant amount of its common stock.

- Shareholder Value Focus: These actions demonstrate a commitment to enhancing shareholder returns and optimizing the capital structure.

The cabozantinib franchise, particularly Cabometyx, functions as Exelixis's primary cash cow. Its strong performance in established indications like renal cell carcinoma and hepatocellular carcinoma generates consistent, predictable revenue streams. This stability allows Exelixis to fund pipeline development and shareholder returns.

In 2024, Cabometyx's net product revenue for the first nine months approximated $1.2 billion, highlighting its robust market presence and profitability. This consistent cash generation from long-term prescriptions solidifies its role as a reliable financial engine for the company.

Royalties from international cabozantinib sales, driven by partnerships with firms like Ipsen and Takeda, further bolster Exelixis's cash flow. In 2023, these collaboration and royalty revenues amounted to $390 million, representing significant income without direct market operational costs.

The substantial cash generated by cabozantinib enables Exelixis to actively repurchase its stock, demonstrating a commitment to shareholder value. By the second quarter of 2025, the company had repurchased $796.3 million of its common stock, underscoring its financial strength and capital efficiency.

| Product Franchise | Key Indications | 2024 (9 Months) Revenue (Approx.) | 2023 Royalty Revenue | 2025 (Q2) Share Repurchases |

|---|---|---|---|---|

| Cabozantinib (Cabometyx & Cometriq) | RCC, HCC, DTC | $1.2 Billion | $390 Million (Total Collaboration & Royalty) | $796.3 Million (Total Common Stock Repurchased) |

What You’re Viewing Is Included

Exelixis BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This ensures you get exactly what you see, with no watermarks or demo content, ready for immediate strategic application. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix analysis that will be yours to download and utilize. This means no surprises, just a complete and actionable tool for your business planning needs. Once purchased, this comprehensive BCG Matrix report is instantly available for your editing, presentation, or integration into your broader strategic initiatives.

Dogs

Exelixis has shown a strategic approach by discontinuing clinical programs that don't meet expectations, such as zanzalintinib for advanced squamous cell carcinoma of the head and neck. This decision, influenced by Phase 2 results and competitive landscapes, reflects a commitment to reallocating resources to more promising ventures. In 2023, Exelixis reported $1.4 billion in revenue, underscoring the importance of efficient pipeline management.

Older Cabozantinib Formulations (e.g., Cometriq in MTC) represent a mature, low-growth segment within Exelixis's oncology portfolio. While Cabometyx is the primary driver of revenue, Cometriq, primarily used for metastatic medullary thyroid cancer, still contributes to the overall cabozantinib franchise.

In the second quarter of 2025, Cometriq generated $2.1 million in net product revenue. This contrasts sharply with the $517.9 million brought in by Cabometyx during the same period. This disparity highlights Cometriq's significantly smaller market share and slower growth trajectory compared to its more dominant sibling drug.

Clinical trial sales for Exelixis have demonstrated considerable volatility, creating significant quarter-over-quarter revenue fluctuations. This unpredictability can make it challenging to forecast overall financial performance accurately.

The segment's revenue can be quite choppydemonstrating this, clinical trial sales plummeted to roughly $600,000 in the second quarter of 2025, a stark contrast to the $12 million recorded in the preceding quarter. This substantial drop highlights the inherent instability within this revenue stream.

Such erratic performance suggests that clinical trial sales may represent a low-growth, low-return area for the company. If not managed with extreme care, this segment could become a significant cash drain, diverting resources from more promising ventures.

Programs with Limited Market Potential

Exelixis' 'Dogs' category would encompass early-stage pipeline assets that, after preclinical or initial Phase 1 trials, demonstrate insufficient efficacy or commercial appeal within the highly competitive oncology market. For instance, if a novel compound targeting a niche cancer indication shows only marginal improvement over existing therapies, it would likely fall into this classification. The company's strategic focus on maximizing returns necessitates the careful management of its portfolio, meaning assets with weaker data profiles or limited market reach may be considered for divestiture or a reduction in development resources.

This strategic approach ensures that capital and expertise are channeled towards programs with the greatest potential for success.

- Limited Efficacy: Assets showing minimal therapeutic benefit in early studies.

- Small Addressable Market: Programs targeting indications with very few patients or strong existing competition.

- Resource Reallocation: Prioritizing high-potential 'Stars' and 'Question Marks' over 'Dogs'.

- Potential Divestiture: Considering selling or discontinuing development of assets with poor commercial outlook.

Investments in Non-Core or Less Promising Research Areas

Investments in non-core or less promising research areas for Exelixis, often categorized as 'dogs' in a BCG matrix framework, represent a strategic challenge. These are typically R&D initiatives that diverge from the company's established oncology expertise or have a low likelihood of yielding commercially viable products. For instance, if Exelixis were to allocate significant resources to a research program in a completely unrelated therapeutic area with limited clinical data or a crowded competitive landscape, it could fall into this 'dog' category.

Such investments, while potentially diversifying, can drain valuable R&D capital and human resources that could otherwise be channeled into their core oncology pipeline. A prime example might be a hypothetical early-stage project exploring a novel mechanism of action for a non-oncology indication that, as of mid-2024, has shown minimal preclinical traction. The company’s commitment to its core oncology focus is evident in its robust pipeline, but any significant diversion would need careful justification.

- Resource Allocation: Projects in non-core areas consume R&D budgets that could be better utilized in high-potential oncology programs.

- Low Commercial Viability: These investments often lack a clear path to market or face significant regulatory and competitive hurdles.

- Opportunity Cost: Focusing on less promising research diverts attention and resources from Exelixis's core strengths in oncology.

- Risk Management: Maintaining a balance is crucial; while diversification can be beneficial, excessive investment in 'dogs' can jeopardize overall financial health.

In Exelixis's portfolio, 'Dogs' represent early-stage pipeline assets or research initiatives that show limited efficacy, target small markets, or are in non-core therapeutic areas. These are typically projects with weak preclinical or early clinical data, facing significant competitive headwinds or lacking a clear path to commercialization. The company's strategy involves carefully managing these assets, often by reallocating resources to more promising 'Stars' and 'Question Marks' or considering divestiture to avoid becoming a cash drain.

For instance, a hypothetical early-stage oncology compound that demonstrates only marginal patient benefit in Phase 1 trials, especially when competing against established therapies, would likely be classified as a 'Dog'. Similarly, investments in research outside Exelixis's core oncology focus, such as a non-oncology indication with minimal preclinical traction as of mid-2024, could also fall into this category. This disciplined approach ensures capital is directed towards maximizing returns and advancing the most viable oncology programs.

Question Marks

Zanzalintinib (XL092) is positioned as a strong contender within Exelixis' portfolio, likely a Star or Question Mark depending on trial outcomes and market penetration. Its status as a novel oral tyrosine kinase inhibitor with high growth prospects, currently in pivotal trials, suggests significant future potential.

The positive top-line results from the STELLAR-303 trial, which evaluated zanzalintinib in combination with atezolizumab for metastatic colorectal cancer and met a primary endpoint for overall survival, are particularly encouraging. This success bolsters its case for becoming Exelixis' second major oncology franchise.

Zanzalintinib is a promising candidate in the non-clear cell renal cell carcinoma (nccRCC) space, a segment where unmet needs remain significant. Its evaluation in the Phase 3 STELLAR-304 trial for treatment-naive advanced nccRCC is a key development. Top-line results are anticipated in the first half of 2026, which could unlock a substantial new market for Exelixis.

Exelixis is strategically positioning zanzalintinib within the neuroendocrine tumor (NET) market, a move that could significantly impact its BCG matrix. The planned STELLAR-311 pivotal trial, set to begin in the first half of 2025, will compare zanzalintinib against everolimus for first-line oral therapy in advanced NET patients. This trial represents a substantial investment in a potentially high-growth area.

This initiative aims to capitalize on the recent approval of Cabometyx in a related indication, suggesting a focused effort to broaden zanzalintinib's therapeutic footprint within the NET landscape. By targeting this specific patient population with a novel oral therapy, Exelixis is aiming to capture market share and establish a strong presence in a growing oncology segment.

Early-Stage Pipeline Assets (e.g., XL309, XB010, XB628, XB371, XL495)

Exelixis is strategically positioning its early-stage pipeline assets, such as XL309 (a USP1 inhibitor), XB010 (an antibody-drug conjugate), XB628 (a PD-L1/NKG2A bispecific antibody), XB371 (a TF-targeting ADC), and XL495 (a PKMYT1 inhibitor), as potential future stars. These candidates are currently in Phase 1 clinical trials, with initiation planned for 2025, reflecting their high-growth potential but currently low market share due to their nascent development stage. Significant investment will be required to demonstrate efficacy and achieve market penetration.

The inclusion of these assets in the BCG matrix highlights Exelixis's commitment to innovation and its long-term growth strategy. By investing in these promising, albeit unproven, therapies, the company aims to build a robust pipeline that can address unmet medical needs and capture significant market share in the future. The ongoing clinical development signifies a crucial phase where these assets will be evaluated for their therapeutic value and commercial viability.

- XL309: USP1 inhibitor, currently in Phase 1 clinical trials.

- XB010: Antibody-drug conjugate, also in early-stage clinical development.

- XB628: PD-L1/NKG2A bispecific antibody, with Phase 1 studies anticipated.

- XB371: TF-targeting ADC, undergoing early clinical evaluation.

- XL495: PKMYT1 inhibitor, with Phase 1 trials expected to commence in 2025.

Potential New IND Filings in 2025

Exelixis is poised for significant pipeline expansion in 2025, with an anticipated three new investigational new drug (IND) filings. This strategic move underscores their commitment to early-stage research and development, aiming to capitalize on novel biotherapeutics.

The specific programs targeted for clinical advancement include XB628, the ILT-2 monoclonal antibody known as XB064, and XB371. These candidates represent potential future revenue streams, although they are currently in the preclinical phase, necessitating considerable investment and carrying inherent development risks.

- Pipeline Expansion: Exelixis plans to file INDs for three biotherapeutics in 2025: XB628, XB064 (ILT-2 monoclonal antibody), and XB371.

- R&D Investment: These early-stage programs require substantial research and development funding, reflecting a high-risk, high-reward investment strategy.

- Future Growth Drivers: Successful clinical progression of these INDs could establish new growth pillars for Exelixis in the coming years.

- Preclinical Data Dependency: The progression to IND filing is contingent on continued positive preclinical data for each of these promising candidates.

Question Marks in Exelixis' BCG Matrix represent products with low market share but high growth potential, demanding significant investment to capture market share. Zanzalintinib, particularly in its evaluation for neuroendocrine tumors (NETs) and non-clear cell renal cell carcinoma (nccRCC), fits this category. The planned STELLAR-311 trial for NETs, starting in the first half of 2025, and the anticipated Phase 3 STELLAR-304 results for nccRCC in the first half of 2026 are key indicators of this high-growth, uncertain future.

The early-stage pipeline assets, including XL309, XB010, XB628, XB371, and XL495, are definitive Question Marks. These compounds are in Phase 1 trials or have Phase 1 studies planned for 2025, signifying substantial future growth prospects but currently minimal market penetration. Exelixis' commitment to filing three new INDs in 2025, including XB628, XB064, and XB371, further solidifies the presence of multiple Question Marks in their strategic pipeline.

The company's investment in these unproven therapies underscores a strategy focused on long-term innovation and market leadership. The success of these Question Marks hinges on positive clinical data and effective market penetration strategies, which will require substantial financial and operational commitment.

The company's strategic focus on expanding its pipeline through new IND filings in 2025, specifically for XB628, XB064, and XB371, highlights a deliberate effort to cultivate future growth drivers. These early-stage assets are quintessential Question Marks, possessing high growth potential but currently holding negligible market share.

| Product | Market Share | Market Growth | BCG Category | Strategic Focus |

| Zanzalintinib (NETs) | Low | High | Question Mark | Pivotal trials (STELLAR-311, H1 2025 start) |

| Zanzalintinib (nccRCC) | Low | High | Question Mark | Pivotal trials (STELLAR-304, H1 2026 results) |

| XL309 | Very Low | High | Question Mark | Phase 1 trials |

| XB010 | Very Low | High | Question Mark | Early-stage clinical development |

| XB628 | Very Low | High | Question Mark | Phase 1 studies anticipated, IND filing planned for 2025 |

| XB371 | Very Low | High | Question Mark | Early clinical evaluation, IND filing planned for 2025 |

| XL495 | Very Low | High | Question Mark | Phase 1 trials expected 2025 |

| XB064 | Very Low | High | Question Mark | IND filing planned for 2025 |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing financial reports, industry growth projections, and competitive landscape analyses for robust strategic guidance.