Evotec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evotec Bundle

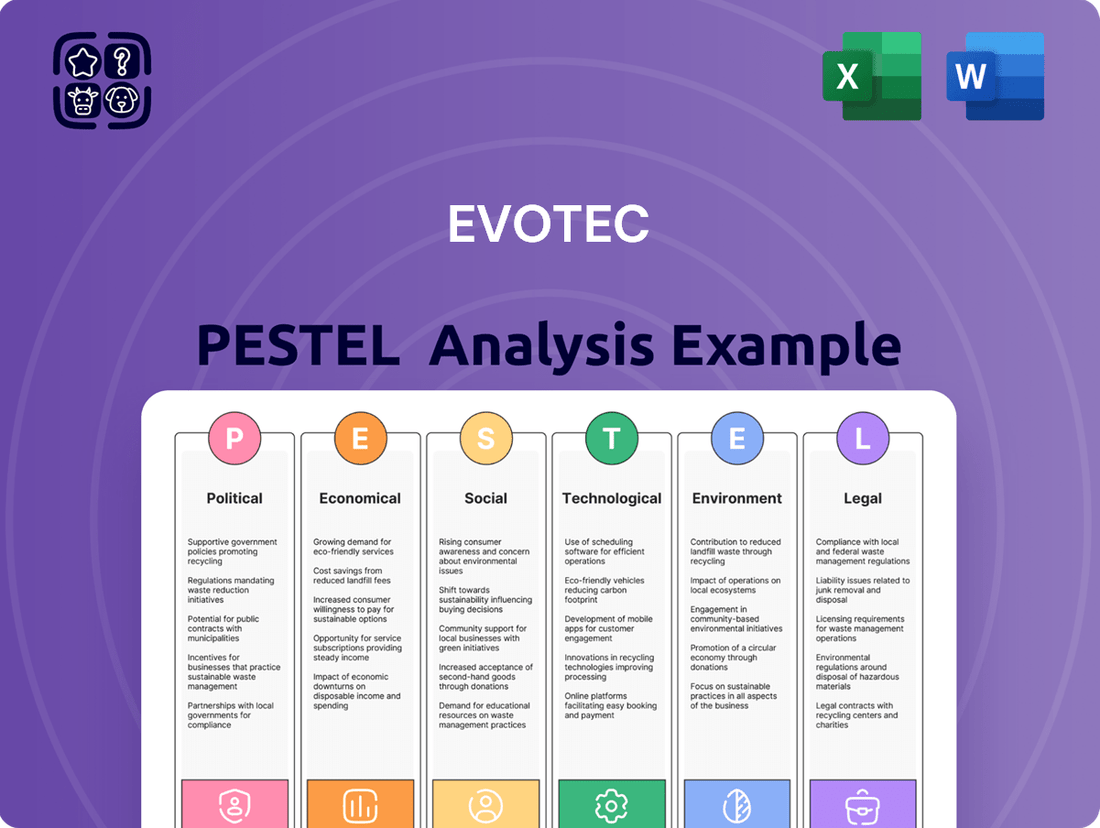

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Evotec's trajectory. This comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and make informed strategic decisions. Download the full version now to gain a significant competitive advantage.

Political factors

The US administration continues to push for lower drug prices, seeking to bring them closer to international benchmarks. This pressure extends to Medicaid patients and new drug launches, potentially impacting industry revenue significantly.

For companies like Evotec, these evolving policies introduce considerable uncertainty regarding the future revenue streams and profit margins of their partnered assets. For instance, the Inflation Reduction Act of 2022 has already empowered Medicare to negotiate prices for certain high-cost drugs, a trend that could expand.

The pharmaceutical regulatory arena is dynamic, with agencies like the FDA and EMA constantly updating their guidelines to manage complex drug development, including novel therapies. This evolution necessitates continuous adaptation by companies like Evotec.

A significant trend is the drive for global regulatory harmonization, aiming to simplify processes for multinational drug development. While promising for efficiency, it demands vigilance regarding diverse regional requirements.

The EU's Health Technology Assessment Regulation (HTAR), commencing in 2025, will standardize the evaluation of new treatments across member states, directly influencing market access strategies for pharmaceutical innovations.

Geopolitical tensions, like the proposed BIOSECURE Act in the US, are a significant factor for Evotec. This act aims to restrict US federally-funded drug companies from partnering with specific Chinese biotech firms, citing national security and intellectual property concerns. Such a move could disrupt established global biopharma supply chains and curtail vital international collaborations essential for drug discovery and development.

Furthermore, the imposition of tariffs on imported raw materials and critical medical components directly impacts supply chain costs and forces companies like Evotec to reassess their sourcing strategies. For instance, ongoing trade disputes can lead to unpredictable price fluctuations, potentially affecting research and development budgets and the overall cost-effectiveness of manufacturing processes.

Government Funding for R&D

Government and public funding are crucial drivers for biopharmaceutical research and development, directly impacting the speed of new drug discovery. In 2024, there was a notable uptick in biopharma funding, but the outlook for 2025 presents some uncertainty, with potential cuts to federal research budgets posing a risk to the sector's growth trajectory.

Evotec's partnership-driven business model makes it particularly susceptible to shifts in the broader R&D investment climate. Reduced government investment could lead to fewer collaborative opportunities and a slowdown in the pipeline of innovative projects.

- Increased Biopharma Funding in 2024: Reports indicated a rise in overall investment within the biopharmaceutical sector during 2024.

- 2025 Funding Uncertainty: Projections for 2025 suggest potential reductions in federal research funding, creating a less predictable environment.

- Evotec's Partnership Sensitivity: The company's reliance on strategic alliances means it's directly affected by the availability of R&D capital across the industry.

- Impact on Drug Development Pace: Fluctuations in R&D funding can directly influence the speed at which new therapies move from discovery to clinical trials.

Political Influence on Regulatory Agencies

Changes in political administrations directly impact regulatory agencies such as the USPTO and FDA, potentially altering leadership and priorities. These shifts can influence patent policy and drug approval timelines, though established checks and balances usually temper abrupt policy overhauls. For instance, a new administration might prioritize accelerating innovation, potentially streamlining certain review processes. In 2024, the US government continued to invest in AI initiatives, with the National Science Foundation awarding significant grants for AI research, which could indirectly influence how regulatory bodies adopt AI in their operations.

The current administration's emphasis on automation and AI-driven processes is likely to shape how agencies like the FDA and USPTO conduct their reviews. This focus could lead to faster processing times for patent applications and drug approvals, provided the technology is effectively integrated. By mid-2025, we anticipate further policy discussions around the ethical and regulatory frameworks for AI in scientific and industrial applications, which will undoubtedly affect companies like Evotec operating in these sectors.

Geopolitical tensions, such as the US BIOSECURE Act, threaten to disrupt global biopharma supply chains by restricting partnerships with certain Chinese biotech firms. Tariffs on imported raw materials also increase operational costs, forcing companies like Evotec to adapt sourcing strategies amidst trade disputes. Government funding for R&D is crucial, with a notable increase in biopharma funding in 2024, though 2025 projections show uncertainty due to potential federal budget cuts.

Shifts in political administrations can alter priorities at agencies like the FDA and USPTO, potentially impacting patent policies and drug approval timelines. The US government's continued investment in AI, with significant NSF grants awarded in 2024, may influence regulatory adoption of AI technologies. By mid-2025, expect further policy discussions on AI frameworks impacting companies like Evotec.

| Factor | Impact on Evotec | 2024/2025 Data/Trend |

|---|---|---|

| US Drug Pricing Policy | Potential revenue and profit margin reduction for partnered assets. | Inflation Reduction Act of 2022 empowers Medicare price negotiation; continued pressure expected. |

| Geopolitical Tensions (e.g., BIOSECURE Act) | Disruption of supply chains and international collaborations. | Act aims to restrict partnerships with specific Chinese biotech firms, impacting global R&D networks. |

| R&D Funding Environment | Affects partnership opportunities and project pipeline. | Notable uptick in biopharma funding in 2024; 2025 outlook uncertain with potential federal budget cuts. |

| AI Integration in Regulation | Potential for faster patent and drug approval processes. | US government investment in AI; policy discussions on AI frameworks anticipated by mid-2025. |

What is included in the product

This Evotec PESTLE analysis delves into the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions. It provides actionable insights for strategic decision-making.

Evotec's PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain point of sifting through extensive data.

Economic factors

Global healthcare spending is anticipated to continue its upward trajectory, with projections indicating an average growth rate of approximately 5.5% in 2025. This surge is largely fueled by ongoing technological innovations and the development of new pharmaceuticals.

Developed economies are particularly expected to witness substantial increases in health expenditure. A significant portion of this rise is attributed to escalating pharmacy costs, directly linked to the introduction of novel and advanced drug therapies.

This persistent growth in healthcare expenditure underscores a growing demand for efficient and cost-effective solutions in drug discovery and development. Evotec is strategically positioned to address this market need with its integrated platforms and expertise.

The biotech venture capital scene in 2025 is showing a comeback, though investors are being more discerning. They're really zeroing in on areas like cancer treatments, gene therapy, rare diseases, and drug development powered by artificial intelligence. This increased selectivity means companies need to demonstrate strong potential in these hot sectors to attract investment.

For Evotec, this trend directly impacts its business. The availability and specific focus of venture capital funding shape the financial capacity and research priorities of both its current partners and potential new clients. If funding is tight or directed elsewhere, it can affect the R&D budgets of these biotech firms, influencing their ability to engage in collaborations or invest in new projects with Evotec.

While funding for companies at the very beginning of their journey has held up reasonably well, later-stage startups are encountering more challenges. This suggests a more cautious approach from investors when it comes to scaling up existing biotech ventures, potentially leading to longer development timelines or a need for more robust proof-of-concept data before significant capital is deployed.

Mergers and acquisitions (M&A) in the pharmaceutical and biotech sectors showed significant strength in the first half of 2025. A key observation was the increased acquisition of companies with post-proof-of-concept but pre-Phase III assets, indicating a strategic shift by larger pharmaceutical firms aiming to secure less risky growth drivers for their future pipelines.

This heightened M&A activity, particularly in acquiring companies with de-risked assets, presents a potential avenue for Evotec. By leveraging its existing partnerships and its stake in jointly owned development pipelines, Evotec could capitalize on these trends. The strategy of larger companies to acquire assets that have already demonstrated some level of efficacy suggests a market ripe for collaboration and potential exits for companies like Evotec.

While the first half of 2025 saw a surge in deal volume, it's important to note the broader M&A landscape in 2024. Deal values during that year were generally subdued compared to prior periods, with a prevailing emphasis on smaller transactions and investments in earlier-stage development assets. This suggests a more cautious approach from some acquirers, potentially focusing on specific therapeutic areas or technologies.

Drug Pricing Pressure and Patent Cliffs

The pharmaceutical industry faces intense pressure to lower drug prices, a trend amplified by the approaching patent cliff. This phenomenon, where a significant number of high-revenue drugs are set to lose patent protection, threatens substantial revenue declines for major pharmaceutical companies. For instance, a substantial portion of branded drug revenues are projected to face generic competition in the coming years, creating a critical need for innovation and cost-efficiency.

This challenging environment creates a strategic opportunity for companies like Evotec, which offers drug discovery and development services. As Big Pharma grapples with revenue shortfalls from expiring patents, they are increasingly likely to outsource research and development to more agile and cost-effective partners. Evotec's business model, which includes fee-for-service and milestone/royalty arrangements, is well-positioned to benefit from this shift.

The impact of the patent cliff is particularly pronounced for biologic drugs, with the peak effect anticipated around 2029. This means that by this period, a considerable number of blockbuster biologics will have their exclusivity expire, opening the door for biosimilar competition and further pressuring established revenue streams. This timeline highlights the urgency for pharmaceutical companies to build new pipelines and explore external innovation.

- Anticipated revenue loss from patent expiries for major pharmaceutical companies is in the tens of billions of dollars annually in the near term.

- The patent cliff for biologics is expected to accelerate significantly, with a substantial number of high-value products losing exclusivity in the late 2020s.

- Increased outsourcing of R&D by Big Pharma is a direct consequence of patent expirations and the need to replenish product pipelines efficiently.

Evotec's Financial Performance and Outlook

Evotec reported a strong performance for fiscal year 2024, with revenues climbing thanks to advancements in its Just-Evotec Biologics division. Looking ahead to fiscal year 2025, the company anticipates continued revenue expansion, signaling a positive trajectory.

The company is strategically shifting its focus back to its core competencies in technology and scientific innovation, projecting an acceleration in overall group revenue growth. This robust financial standing provides Evotec with the capacity to sustain investments in its proprietary platforms and ongoing research and development initiatives.

- FY2024 Revenue Growth: Driven by Just-Evotec Biologics.

- FY2025 Outlook: Positive, with expected revenue growth.

- Strategic Focus: Re-emphasizing technology and science leadership.

- Investment Capacity: Strong financial position enables continued R&D investment.

The economic landscape for 2024-2025 presents a dual dynamic for Evotec. While global healthcare spending is projected to rise, driven by innovation, pharmaceutical companies face immense pressure from an impending patent cliff, particularly for biologics around 2029. This situation fuels an increased demand for outsourced R&D and strategic acquisitions of de-risked assets.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Trend | Impact on Evotec |

|---|---|---|---|

| Global Healthcare Spending | Steady growth | Projected 5.5% average growth | Increased demand for drug discovery services |

| Patent Cliff | Growing pressure on revenues | Accelerating for biologics by late 2020s | Opportunity for outsourcing and partnerships |

| M&A Activity | Subdued deal values in 2024, focus on early-stage | Increased acquisition of post-proof-of-concept assets in H1 2025 | Potential for strategic collaborations and exits |

| Venture Capital Funding | Cautious approach, focus on specific areas | Discernment in biotech VC, favoring AI and specific therapies | Influences partner R&D budgets and project prioritization |

Preview the Actual Deliverable

Evotec PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Evotec PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Evotec's strategic landscape.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, one in six people globally will be 65 or older, a significant jump from one in ten in 2020. This demographic shift directly fuels a greater need for healthcare solutions, particularly for age-related and chronic conditions. Evotec's strategic alignment with therapeutic areas like neurology, oncology, and metabolic diseases positions it to capitalize on this escalating demand for innovative treatments.

The increasing prevalence of diseases such as Alzheimer's, cardiovascular issues, and diabetes, which are often linked to aging, creates a sustained market for pharmaceutical and biotechnology companies. For instance, the global Alzheimer's disease market alone was valued at approximately $5.1 billion in 2023 and is expected to grow substantially. Evotec's commitment to pioneering drug discovery in these critical areas ensures its relevance and potential for growth in addressing these pressing public health challenges.

Patient advocacy groups are wielding significant influence, impacting everything from how drugs are developed to how they get approved. These organizations are pushing for a stronger voice in decision-making, ensuring that the patient's viewpoint is central to the process.

Evotec's collaborators and the wider pharmaceutical sector are actively seeking engagement with patient communities. This increased dialogue aims to gather crucial insights and foster trust, ultimately speeding up the delivery of new therapies to those who need them.

Societal expectations are increasingly shifting towards healthcare solutions that are precisely tailored to individual needs, fueling a significant demand for personalized medicine. This trend is particularly evident in the growing patient and physician interest in treatments that leverage genetic, environmental, and lifestyle data to optimize efficacy and minimize side effects.

Evotec's strategic focus on advanced therapy medicinal products, such as gene and cell therapies, directly addresses this burgeoning demand. For instance, the company's work in developing novel approaches for rare genetic diseases exemplifies its commitment to personalized treatment modalities, aligning with the growing patient advocacy for bespoke therapeutic interventions.

Furthermore, the integration of artificial intelligence (AI) and machine learning in drug discovery and development is a key enabler for personalized medicine. Evotec's investment in these technologies allows for the identification of patient subgroups most likely to respond to specific therapies, thereby enhancing the precision and effectiveness of treatments, a critical aspect for realizing the full potential of personalized healthcare.

Public Perception of Pharmaceutical Industry

Public perception of the pharmaceutical industry significantly impacts companies like Evotec. Concerns over drug pricing and equitable access to medicines are major drivers of public discourse, directly influencing government policy and creating societal pressure for change. For instance, in 2024, surveys indicated that a substantial majority of the public in key markets like the US and Europe expressed dissatisfaction with pharmaceutical pricing practices.

This negative sentiment can translate into increased regulatory scrutiny and demands for stricter oversight. Companies are therefore increasingly prioritizing transparent communication about the value and innovation behind their products, alongside efforts to address affordability issues. Evotec, like its peers, must navigate this landscape by demonstrating its commitment to delivering accessible and impactful healthcare solutions.

- Public Concern: Over 70% of Americans surveyed in early 2024 expressed concern about the high cost of prescription drugs, according to a Pew Research Center report.

- Policy Influence: This public pressure has led to legislative proposals in numerous countries aimed at controlling drug prices, impacting market access and profitability for pharmaceutical firms.

- Corporate Response: Companies are investing more in patient assistance programs and value-based pricing models to mitigate negative perceptions and build trust.

- Reputational Risk: Negative public perception can damage brand reputation, affecting talent acquisition and investor confidence, critical factors for research-intensive companies like Evotec.

Workforce Dynamics and Talent Acquisition

The global healthcare sector is grappling with significant labor shortages and rising personnel costs, directly impacting research and development capabilities and overall operational efficiency. Evotec, with its substantial workforce of over 4,800 highly skilled professionals, must adeptly manage these evolving workforce dynamics.

Attracting and retaining premier scientific and technical talent is absolutely vital for maintaining Evotec's momentum in drug discovery innovation. The company's success hinges on its ability to secure and keep the best minds in the field.

- Global Healthcare Labor Shortages: The World Health Organization projects a shortage of 10 million healthcare workers by 2030, a trend impacting specialized scientific roles.

- Rising Personnel Costs: Increased demand for skilled labor in the life sciences sector has driven up salary expectations and benefits packages.

- Evotec's Workforce: As of December 31, 2023, Evotec employed approximately 4,800 individuals, underscoring the scale of its talent management challenge.

- Talent Retention Strategies: Companies like Evotec are investing in competitive compensation, professional development programs, and a strong research-oriented culture to retain top talent.

Societal attitudes towards health and wellness are increasingly proactive, with a growing emphasis on preventative care and lifestyle choices over reactive treatment. This shift encourages demand for diagnostics, health monitoring technologies, and therapies that support long-term well-being.

The growing influence of patient advocacy groups is a significant sociological factor. These groups actively engage with pharmaceutical companies, pushing for greater transparency in drug development and equitable access to treatments, impacting how companies like Evotec approach patient engagement and clinical trial design.

Public perception of the pharmaceutical industry, particularly concerning drug pricing and accessibility, continues to shape the operating environment. In early 2024, over 70% of Americans expressed concern about prescription drug costs, influencing policy and corporate strategies to address affordability.

The increasing demand for personalized medicine, driven by societal expectations for tailored healthcare, directly influences Evotec's strategic focus on advanced therapies. For example, the company's work on gene and cell therapies aligns with this trend, aiming to provide bespoke treatment solutions.

Technological factors

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping the pharmaceutical landscape, particularly in drug discovery and development. These technologies are accelerating the identification of promising drug candidates, enabling the optimization of molecular structures, and ultimately driving down costs associated with bringing new therapies to market. Evotec actively harnesses AI-driven innovation and its integrated technology platforms to streamline research and development workflows, ensuring enhanced data integrity which is vital for improving efficiency and reproducibility in its scientific endeavors.

The impact of AI in this sector is substantial and growing. For instance, the global AI drug discovery market was valued at approximately $1.5 billion in 2023 and is projected to reach over $11 billion by 2030, demonstrating a compound annual growth rate of over 30%. This rapid expansion underscores the critical role AI and ML play for companies like Evotec in staying competitive and advancing scientific breakthroughs.

Evotec's core strength lies in its proprietary technology platforms, which are central to its business model. These platforms integrate innovative technologies with vast datasets and scientific expertise, creating a unique offering in drug discovery. For instance, in 2023, Evotec continued to invest significantly in expanding its data capabilities and AI-driven platforms to enhance drug development efficiency.

A significant technological trend Evotec is capitalizing on is the increased use of data in AI-powered drug discovery. The company's strategy emphasizes extracting greater value from diverse data sources by employing multimodal and self-supervised learning techniques. This data integration is crucial for accelerating the journey of new medicines from concept to clinic.

The pharmaceutical industry is heavily investing in automation and industrialization to overcome scalability hurdles and meet stringent regulatory demands. This push for efficiency and reproducibility in research and development is a significant technological trend. For instance, companies are adopting AI-driven platforms and robotic systems to accelerate compound screening and data analysis, aiming to reduce the time and cost associated with bringing new drugs to market.

Technologies that can streamline complex R&D workflows and ensure robust data integrity are poised for significant growth. This includes advanced laboratory information management systems (LIMS) and integrated digital platforms that offer end-to-end process management. The ability to generate high-quality, auditable data is paramount in this evolving landscape, directly impacting regulatory approval and market competitiveness.

Evotec's strategic direction clearly reflects this technological shift, with a pronounced emphasis on leveraging automation. By integrating automated systems into its drug discovery processes, Evotec aims to expedite its clients' development timelines and improve the overall success rate of their drug candidates. This focus is crucial for maintaining a competitive edge and delivering value in a rapidly advancing scientific field.

Digital Health and Telemedicine Solutions

The digital health and telemedicine landscape is rapidly evolving, with significant implications for drug development. By 2024, it's estimated that the global digital health market will reach over $660 billion, showcasing a substantial shift towards tech-enabled healthcare. This trend is directly influencing how clinical trials are managed, with remote monitoring and virtual consultations becoming more common.

Regulatory bodies are actively adapting to these changes. For instance, the U.S. Food and Drug Administration (FDA) continues to refine its approach to digital therapeutics and mobile health applications, issuing guidance to ensure patient safety and data integrity. This evolving regulatory environment means that Evotec's partners are likely to increasingly leverage these digital tools, potentially streamlining drug development processes and improving data collection efficiency.

The integration of these technologies presents both opportunities and challenges for companies like Evotec:

- Increased Efficiency: Telemedicine and remote monitoring can accelerate patient recruitment and data collection in clinical trials, potentially reducing development timelines.

- Broader Reach: Digital health solutions allow for greater patient access to trials, especially for those in remote areas or with mobility issues.

- Data-Driven Insights: The wealth of data generated by digital health tools can provide deeper insights into drug efficacy and patient outcomes.

- Regulatory Adaptation: Navigating the evolving regulatory frameworks for digital health products will be crucial for successful implementation.

Breakthroughs in Advanced Therapies

Breakthroughs in advanced therapies, including gene and cell therapies, are revolutionizing medicine, with regulatory bodies actively working to streamline their development. Evotec's strategic focus and partnerships in these high-impact areas position it to capitalize on this rapidly growing sector, which saw significant investment in 2024.

The market for advanced therapies is experiencing substantial growth. For instance, the global gene therapy market was valued at approximately $8.5 billion in 2023 and is projected to reach over $30 billion by 2029, demonstrating a compound annual growth rate (CAGR) of over 20% during this period. This expansion is fueled by increasing R&D investment and a growing pipeline of innovative treatments.

- Gene Therapy Market Growth: Projected to exceed $30 billion by 2029, with a CAGR over 20%.

- Cell Therapy Advancements: Significant progress in CAR-T therapies and regenerative medicine.

- Tissue Engineering Innovations: Development of bio-engineered tissues and organs for transplantation.

- Regulatory Support: Increased focus from agencies like the FDA and EMA to accelerate ATMP approvals.

Technological advancements, particularly in AI and automation, are significantly accelerating drug discovery and development timelines. Evotec's investment in AI-driven platforms and integrated data capabilities in 2023 aims to enhance efficiency and reproducibility in its research. The global AI drug discovery market is projected to exceed $11 billion by 2030, highlighting the critical role of these technologies for companies like Evotec.

The increasing use of data in AI-powered drug discovery, with Evotec focusing on multimodal learning, is crucial for bringing new medicines to market faster. Automation in R&D, including AI platforms and robotics, is a key trend to reduce time and cost, with companies adopting these to improve compound screening and data analysis.

Digital health and telemedicine are transforming healthcare, with the global digital health market expected to surpass $660 billion by 2024. This shift impacts clinical trials through remote monitoring and virtual consultations, offering opportunities for increased efficiency and broader patient access, though regulatory adaptation remains key.

Evotec is strategically positioned to benefit from advancements in gene and cell therapies, a sector that saw substantial investment in 2024. The gene therapy market alone is projected to exceed $30 billion by 2029, underscoring the significant growth and innovation in advanced therapies.

| Technological Trend | Impact on Drug Development | Evotec's Engagement | Market Data (2023-2029 Projections) |

|---|---|---|---|

| AI & Machine Learning | Accelerated drug candidate identification, optimized molecular structures, reduced R&D costs | Harnessing AI for R&D workflows, enhancing data integrity | AI Drug Discovery Market: $1.5B (2023) to $11B+ (2030) |

| Automation & Industrialization | Increased efficiency, reproducibility, faster compound screening and data analysis | Integrating automated systems to expedite development timelines | N/A (Industry-wide trend) |

| Digital Health & Telemedicine | Streamlined clinical trials (remote monitoring, virtual consultations), improved data collection | Leveraging digital tools for potential process improvements | Global Digital Health Market: Projected >$660B (2024) |

| Advanced Therapies (Gene/Cell) | Revolutionizing medicine, novel treatment modalities | Strategic focus and partnerships in high-impact areas | Gene Therapy Market: $8.5B (2023) to $30B+ (2029) |

Legal factors

Intellectual property (IP) protection, especially patent law for biologics and biosimilars, is a crucial legal consideration for Evotec. The company must navigate a complex landscape where patenting strategies and the rising number of patent disputes, particularly concerning biosimilars, directly affect its innovation pipeline and market access. For instance, the US patent system has seen ongoing discussions and potential shifts, impacting how new drug discoveries are shielded.

Changes in US patent policy and potential new legislation, including those addressing drug pricing and the patentability of AI-driven inventions, will significantly influence the protection and commercialization of novel therapeutics. This evolving legal framework demands constant vigilance and strategic adaptation to safeguard Evotec's research and development investments.

Global regulatory bodies are actively updating drug approval processes, particularly for novel treatments like gene therapies and AI-driven diagnostics. The European Union's AI Act, anticipated for finalization in 2025, will introduce specific guidelines for AI in healthcare, impacting companies like Evotec. Navigating these dynamic legal landscapes is crucial for ensuring both Evotec's compliance and the successful market entry of its partners' innovations.

Regulatory bodies globally are intensifying scrutiny on data privacy and cybersecurity. This is largely due to escalating concerns about data breaches and the responsible handling of sensitive patient information, particularly as artificial intelligence and digital health solutions become more prevalent. Evotec, like its peers, faces increased compliance burdens.

Compliance with regulations such as the EU's General Data Protection Regulation (GDPR) is paramount. For instance, GDPR mandates strict rules on consent, data minimization, and breach notification, carrying substantial penalties for non-compliance. In 2023, fines under GDPR exceeded €300 million, highlighting the financial risks involved.

Evotec must therefore invest heavily in robust data security infrastructure and ongoing compliance efforts. This includes implementing advanced cybersecurity measures, conducting regular audits, and ensuring personnel are trained on data protection protocols. These investments are critical to safeguarding intellectual property and maintaining trust with partners and patients.

Anti-Competitive Practices and Pricing Regulations

Proposed legislation in 2024 and 2025 continues to focus on reducing drug costs through government negotiation and curbing patent strategies that delay generic competition. These reforms are sparking legal debate regarding their potential impact on pharmaceutical innovation. For instance, bills like the Stop STALLING Act specifically address anti-competitive practices that hinder generic drug market entry.

The U.S. Inflation Reduction Act (IRA), enacted in 2022, began its phased implementation in 2023, with key provisions impacting drug pricing taking effect in 2024 and 2025. This act empowers Medicare to negotiate prices for certain high-cost prescription drugs. In 2024, the first ten drugs selected for negotiation were announced, with negotiated prices expected to be published in September 2024 and take effect in 2026. This represents a significant shift in pricing regulation.

- Government Negotiation: The IRA allows Medicare to negotiate prices for a select number of high-cost drugs, a process that began with the selection of ten drugs in 2024.

- Patent Reform Debates: Ongoing discussions surround patent strategies that extend market exclusivity, with proposed bills aiming to increase generic competition.

- Anti-Competitive Practices: Legislation like the Stop STALLING Act targets practices that unlawfully delay the entry of generic and biosimilar drugs into the market.

- Impact on Innovation: Legal and industry stakeholders are actively debating the long-term effects of these pricing and patent reforms on R&D investment and drug development pipelines.

International Trade and Biosecurity Legislation

Legislation like the BIOSECURE Act, enacted in 2024, introduces significant legal hurdles for companies like Evotec that engage with specific foreign biotechnology entities, citing national security concerns. This could directly impact Evotec's global operations, particularly its collaborations and supply chains spanning Europe and the USA.

The implications of such acts extend to potential legal disputes concerning data sharing agreements and the integrity of international research partnerships. For Evotec, navigating these evolving trade regulations is crucial for maintaining operational continuity and mitigating legal risks.

- BIOSECURE Act (2024): Targets collaborations with certain foreign biotech firms due to national security.

- Supply Chain Risks: Potential legal challenges for companies with international partnerships.

- Data Sharing Concerns: Increased scrutiny on cross-border data exchange in biotech.

- Global Operations Impact: Evotec must adapt to complex international trade laws affecting its European and US presence.

Legal factors significantly shape Evotec's operational landscape, particularly concerning intellectual property and regulatory compliance. The company must adeptly manage patent law, especially for biologics and biosimilars, as patent disputes and evolving patent policies, such as those discussed in the US, directly influence its innovation and market access. Furthermore, global regulatory bodies are continuously updating drug approval processes for novel treatments, with new legislation like the EU's AI Act in 2025 poised to impact AI in healthcare.

The increasing focus on data privacy and cybersecurity, driven by concerns over breaches and the responsible handling of patient data, necessitates robust compliance with regulations like GDPR. Fines for GDPR non-compliance exceeded €300 million in 2023 alone, underscoring the financial risks. Evotec's investments in data security infrastructure and training are therefore critical for safeguarding IP and maintaining trust.

Recent legislative efforts, including the U.S. Inflation Reduction Act (IRA) and proposed bills, aim to reduce drug costs and curb patent strategies that delay generic competition. The IRA, with key provisions impacting drug pricing taking effect in 2024 and 2025, allows Medicare to negotiate prices for certain high-cost drugs, a significant regulatory shift. Moreover, the 2024 BIOSECURE Act introduces legal challenges for companies collaborating with specific foreign biotech entities, impacting global operations and supply chains.

Environmental factors

The EU's Corporate Sustainability Reporting Directive (CSRD), which fully takes effect in 2025, mandates comprehensive disclosure of environmental, social, and governance (ESG) activities for companies, including those in the pharmaceutical sector. Evotec has proactively embraced the CSRD framework for its 2024 financial year, signaling a dedication to enhanced transparency regarding its sustainability initiatives.

This early adoption means Evotec must establish and maintain rigorous internal systems for meticulously monitoring and reporting its environmental footprint and broader ESG performance. Such a commitment aligns with growing investor and regulatory demands for detailed and verifiable sustainability data.

Pharmaceutical manufacturing, including Evotec's operations, inherently involves chemical and biological materials, necessitating robust environmental management and pollution prevention. Evotec is actively implementing a new environmental strategy in 2025, aiming for more centralized policies to enhance pollution control across its sites.

Compliance with local environmental regulations and permits is critical for assessing the effectiveness of pollution prevention systems. For instance, in 2024, Evotec reported adherence to all applicable environmental laws and regulations at its operating facilities, underscoring its commitment to responsible environmental stewardship.

The pharmaceutical sector, vital for drug discovery and development, is a significant consumer of resources and a generator of diverse waste streams. As environmental regulations tighten and corporate responsibility grows, optimizing resource use and managing waste effectively are paramount for companies like Evotec. Evotec is actively investigating the integration of more circular economy principles to bolster its long-term sustainable competitive advantage.

Climate Change and Supply Chain Resilience

Climate change poses a significant, albeit indirect, threat to Evotec's operations by potentially disrupting global pharmaceutical supply chains. Extreme weather events, such as floods or droughts, can impact the availability of raw materials or halt transportation routes, affecting production timelines and costs. For instance, the increasing frequency of severe weather events globally, as highlighted by the World Meteorological Organization's 2024 reports, underscores the growing vulnerability of logistics networks.

In response to these growing risks, the pharmaceutical industry, including companies like Evotec, is prioritizing supply chain resilience. This involves investing in technologies that enhance visibility and traceability, with blockchain emerging as a key solution. A 2024 report by Deloitte indicated that over 60% of pharmaceutical companies are exploring or have implemented blockchain for supply chain management to mitigate risks and ensure product integrity.

- Supply Chain Vulnerability: Climate change-induced extreme weather events can disrupt the sourcing of chemical precursors and the delivery of finished goods, potentially impacting Evotec's production schedules.

- Technological Mitigation: The adoption of blockchain technology is increasing within the pharmaceutical sector to bolster supply chain transparency and security, a trend Evotec may leverage.

- Resource Scarcity: Changes in climate patterns could lead to scarcity of certain natural resources essential for drug manufacturing, thereby increasing input costs and supply chain complexity.

- Regulatory Scrutiny: As climate-related risks become more apparent, regulatory bodies may impose stricter requirements on supply chain sustainability and risk management for pharmaceutical companies.

ESG Integration into Business Strategy

Environmental, Social, and Governance (ESG) considerations are now central to business strategy and investor choices. Evotec's 2024 Sustainability Report highlights its dedication to building a sustainable business model across all operations. This focus is further underscored by planned sustainability training for its Supervisory Board in 2025, aiming to bolster oversight of these critical areas.

Evotec's ESG integration is demonstrated by its proactive approach to environmental stewardship and social responsibility. The company's commitment extends to ensuring robust governance structures that support long-term sustainability objectives. This strategic alignment is becoming a key differentiator in the competitive landscape.

- ESG Integration: Growing importance in business strategy and investment decisions.

- Evotec's Commitment: Detailed in the 2024 Sustainability Report, covering all business aspects.

- Supervisory Board Training: Scheduled for 2025 to enhance sustainability oversight.

Evotec's environmental strategy for 2025 emphasizes centralized policies for enhanced pollution control across its global sites, a move driven by tightening regulations and a commitment to sustainability. The company reported adherence to all applicable environmental laws and regulations at its operating facilities in 2024, demonstrating a foundation for this new strategy.

The pharmaceutical sector faces increasing pressure to optimize resource use and manage waste, with Evotec actively exploring circular economy principles to enhance its long-term competitive advantage. This proactive approach is crucial as environmental regulations continue to evolve and corporate responsibility expectations grow.

Climate change presents a growing risk to pharmaceutical supply chains, with extreme weather events potentially disrupting raw material sourcing and product delivery, as noted in 2024 reports by the World Meteorological Organization. Evotec is responding by prioritizing supply chain resilience, a trend mirrored across the industry with over 60% of pharmaceutical companies exploring blockchain for supply chain management, according to a 2024 Deloitte report.

| Environmental Factor | Evotec's Response/Action | Data/Context |

|---|---|---|

| Pollution Control | Implementing new, centralized environmental strategy in 2025. | Aiming for enhanced pollution control across all sites. |

| Resource Management | Investigating integration of circular economy principles. | To bolster long-term sustainable competitive advantage. |

| Climate Change Impact | Prioritizing supply chain resilience. | Industry trend: 60%+ pharma companies exploring blockchain for supply chain management (Deloitte, 2024). |

| Regulatory Compliance | Adherence to all applicable environmental laws. | Reported for 2024 at operating facilities. |

PESTLE Analysis Data Sources

Our Evotec PESTLE Analysis is meticulously constructed using a blend of public and proprietary data, encompassing regulatory updates from key markets, economic indicators from leading financial institutions, and technological advancements from industry-specific reports. This ensures a comprehensive and relevant assessment of the macro-environmental factors impacting Evotec's operations and strategic decisions.