Evotec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evotec Bundle

Uncover the strategic positioning of Evotec's product portfolio with this insightful BCG Matrix preview. See where their innovations are poised for growth and where they generate consistent returns. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant breakdowns and actionable strategies to optimize Evotec's market performance and investment decisions.

Stars

The Just – Evotec Biologics segment is a clear Star in Evotec's BCG Matrix. In 2024, this division saw remarkable growth, with revenues surging by 71% year-over-year, a substantial contributor to Evotec's total revenue. This robust performance continued into the first quarter of 2025, showing an 11% increase in external revenues, underscoring its position as a rapidly expanding technology provider in the biologics sector.

Evotec's strategic partnerships are a cornerstone of its 2024-2025 growth trajectory. The company has seen significant progress with Bristol Myers Squibb in areas like neuroscience and targeted protein degradation, leading to substantial milestone payments that bolster Evotec's financial performance.

The evolving collaboration with Sandoz, including the potential divestment of the Toulouse facility while maintaining crucial technology access, exemplifies Evotec's strategic shift towards an asset-lighter model focused on high-margin services.

Evotec's proprietary technology platforms, including AI-driven innovation and PanOmics, are central to its strategy. These advanced capabilities allow for accelerated drug discovery by providing deeper disease understanding and enhancing human relevance in preclinical models.

The company's investment in technologies like induced pluripotent stem cells (iPSC) further strengthens its position. In 2024, Evotec continued to expand its AI capabilities, integrating them across its discovery and development pipelines to improve efficiency and success rates for its partners.

Co-owned Pipeline of R&D Projects

Evotec's co-owned R&D projects form a significant part of its innovation engine, contributing to a pipeline exceeding 100 proprietary and co-owned endeavors. These collaborations are crucial for sharing risk and accelerating development, particularly in areas with high unmet medical needs.

The strategic focus on neurology, oncology, metabolic, and infectious diseases within this co-owned portfolio highlights Evotec's commitment to tackling complex health challenges. By partnering on these projects, Evotec aims to unlock future revenue streams and solidify its position in key therapeutic markets.

- Pipeline Breadth: Over 100 proprietary and co-owned R&D projects.

- Therapeutic Focus: Neurology, oncology, metabolic, and infectious diseases.

- Strategic Value: Significant future revenue potential and market leadership.

Global Footprint and Integrated Service Offerings

Evotec operates a robust global network, boasting over 4,800 skilled employees across its facilities in Europe and the USA. These strategically located sites offer a synergistic blend of cutting-edge technologies and comprehensive services, from initial target identification through to clinical development.

This integrated service model positions Evotec as a highly sought-after partner for leading pharmaceutical and biotechnology firms. Their ability to manage the entire drug discovery and development pipeline, supported by a broad geographic presence, underpins their strong market standing and consistent demand for their expertise.

- Global Presence: Operations spanning Europe and the USA.

- Workforce: Over 4,800 highly qualified individuals.

- Synergistic Offerings: Integrated technologies and services for end-to-end drug development.

- Market Position: Preferred partner for top pharmaceutical and biotechnology companies.

The Just – Evotec Biologics segment stands out as a Star within Evotec's BCG Matrix, demonstrating exceptional growth. In 2024, this division experienced a significant revenue increase of 71% year-over-year, contributing substantially to Evotec's overall financial performance. This upward trend continued into early 2025, with external revenues climbing by 11%, solidifying its position as a leading, rapidly expanding technology provider in the biologics sector.

Evotec's strategic focus on high-growth areas and proprietary platforms, like AI-driven discovery and PanOmics, fuels its Star status. These advanced capabilities accelerate drug development by enhancing disease understanding and improving the relevance of preclinical models. The company’s investment in technologies such as induced pluripotent stem cells (iPSC) further strengthens its competitive edge, with continued expansion of AI integration in 2024 aimed at boosting efficiency and success rates for its partners.

The broad pipeline, encompassing over 100 proprietary and co-owned R&D projects focused on key therapeutic areas like neurology and oncology, represents significant future revenue potential. Evotec’s global operational footprint, with over 4,800 employees across Europe and the USA, provides integrated, end-to-end drug development services, making it a preferred partner for major pharmaceutical and biotechnology firms.

| Metric | 2024 Performance | Early 2025 Performance | Significance |

| Just – Evotec Biologics Revenue Growth | +71% YoY | +11% External Revenue | Key growth driver, market leadership |

| R&D Projects | 100+ (proprietary & co-owned) | N/A | Future revenue potential, pipeline breadth |

| Employee Base | 4,800+ | N/A | Global operational capacity, expertise |

What is included in the product

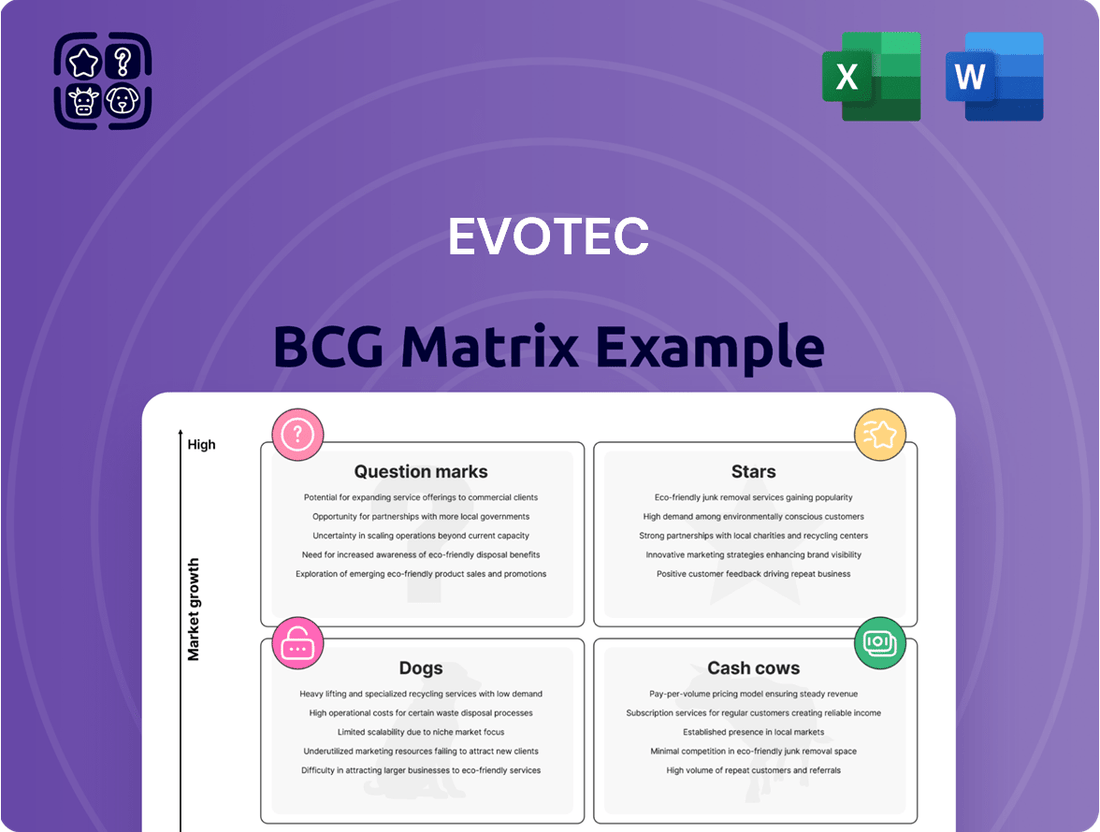

The Evotec BCG Matrix categorizes its business units by market share and growth, guiding investment decisions.

Simplified visualization of Evotec's portfolio, easing strategic decision-making.

Cash Cows

Evotec's hybrid business model, blending fee-for-service with milestone and royalty streams, creates a robust financial foundation. This dual approach ensures a predictable revenue base through service contracts while offering significant upside potential from successful drug development collaborations.

The fee-for-service aspect provides a steady income, cushioning against the inherent risks of drug discovery. For instance, in 2024, Evotec continued to secure numerous research collaborations, generating consistent revenue from these foundational agreements.

Milestone and royalty payments represent the high-margin returns, reflecting the value generated from partnered drug candidates reaching critical development stages. These payments are crucial for maximizing profitability from mature, successful partnerships, contributing significantly to overall financial performance.

Evotec's established collaborations with all of the Top 20 pharmaceutical companies, alongside over 800 biotechnology firms and academic institutions, firmly place its drug discovery and development services within the Cash Cows quadrant of the BCG Matrix. This extensive network signifies a mature market where Evotec leverages its strong competitive advantage.

These deep-rooted, long-standing relationships are a testament to Evotec's consistent performance and reliability, ensuring a significant and stable cash flow. The ongoing nature of these partnerships underscores a predictable and substantial revenue stream, a hallmark of a successful Cash Cow.

Shared R&D Services, while seeing a slight dip in revenue in 2024 and Q1 2025 due to prevailing market conditions, continues to be a bedrock of Evotec's financial stability. This segment offers a predictable, though not high-growth, income that is crucial for managing overhead and supporting core business activities.

Evotec anticipates Shared R&D revenues to hover near their 2024 figures, underscoring the segment's established and mature market standing. This stability provides a reliable revenue base, acting as a consistent contributor to the company's overall financial health.

Existing Biologics Manufacturing Contracts (Pre-Sandoz Sale)

Before the potential sale of its Toulouse facility, Evotec's existing biologics manufacturing contracts, especially with Sandoz, were a substantial cash generator. This facility had been exclusively serving Sandoz since July 2024, ensuring a consistent revenue stream from its ongoing manufacturing activities.

The company's strategy to sell the physical plant while retaining access to its technology is designed to improve how efficiently it uses its capital. This move allows Evotec to focus on its core competencies and potentially reinvest in higher-growth areas.

- Sandoz Contract: The facility was dedicated to Sandoz from July 2024, providing a stable income.

- Cash Generation: These existing contracts acted as a significant cash cow for Evotec prior to the divestment.

- Strategic Shift: Divesting the physical asset while keeping technology access aims to boost capital efficiency.

Operational Excellence and Cost Savings Initiatives

Evotec's 'Priority Reset' program is a key driver of its operational excellence, targeting €40 million in annualized recurring gross savings by 2025. This program is crucial for strengthening its Cash Cows by enhancing efficiency and bolstering cash flow from existing operations.

These cost-saving measures are designed to streamline Evotec's business model, directly contributing to the profitability and robustness of its established, high-performing assets.

The company's ambition extends to achieving an EBITDA margin exceeding 20% by 2028, underscoring a strategic commitment to maximizing returns from its current operational strengths.

- Targeted Savings: €40 million in annualized recurring gross savings by 2025 through the 'Priority Reset' program.

- Efficiency Gains: Streamlining the business model to improve operational excellence and boost cash flow.

- Future Outlook: Aiming for an EBITDA margin above 20% by 2028, signaling a focus on maximizing returns from existing assets.

Evotec's established partnerships with major pharmaceutical companies and numerous biotech firms position its drug discovery and development services as strong Cash Cows. These mature, high-volume relationships generate consistent revenue, reflecting Evotec's competitive advantage in a stable market segment.

The fee-for-service model, complemented by milestone and royalty streams, ensures a predictable and substantial cash flow. This stability is further enhanced by the 'Priority Reset' program, which aims to achieve €40 million in annualized recurring gross savings by 2025, directly bolstering the profitability of these core operations.

| Segment | Market Position | Cash Flow Contribution |

|---|---|---|

| Drug Discovery & Development Services | Mature, High Market Share | Stable and Significant |

| Shared R&D Services | Established, Predictable | Consistent, Supports Operations |

| Biologics Manufacturing (e.g., Sandoz Contract) | Mature, Contractual | Substantial Prior to Divestment |

What You See Is What You Get

Evotec BCG Matrix

The Evotec BCG Matrix document you are currently previewing is the identical, fully comprehensive report you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content—just the polished, analysis-ready strategic tool. You can confidently expect to download the exact same professionally formatted BCG Matrix, designed to provide clear insights for your business planning. This preview ensures you know precisely the quality and completeness of the strategic asset you are acquiring, ready for immediate application.

Dogs

Evotec's strategic review involves divesting non-core business areas. This includes a planned exit from the gene therapy segment, a move designed to streamline operations and reallocate capital.

The company is also closing sites in France and Austria, signaling a focus on optimizing its geographic footprint and operational efficiency. These actions are intended to enhance financial performance by concentrating on core competencies and high-growth opportunities.

By shedding underperforming assets, Evotec aims to improve its overall profitability and shareholder value. This strategic realignment is a critical step in its transformation plan to boost its competitive position in the market.

Evotec is strategically exiting equity participations that no longer fit its streamlined business model. These underperforming assets, likely characterized by low market share and limited growth potential, are being divested to unlock capital and reduce financial burdens.

These participations are akin to the Dogs in the BCG matrix, consuming resources without generating significant returns. For instance, in 2023, Evotec reported a €11.6 million loss from discontinued operations, which may include some of these non-core equity participations, highlighting their drag on profitability.

Evotec's strategic 'Priority Reset' initiative, announced in late 2023, aims to optimize its R&D pipeline by reducing the project portfolio by roughly 30%. This recalibration directly addresses the challenge of legacy R&D projects exhibiting low potential. These are typically characterized by a lack of significant market traction or uncertain future growth trajectories, making them prime candidates for discontinuation to reallocate capital and expertise more effectively.

The rationale behind shedding these low-potential projects is to prevent resource drain. In 2024, companies across the biotech sector are facing increased pressure to demonstrate tangible returns on R&D investment. Projects that consume substantial funding without a clear, near-term path to commercialization or significant scientific breakthrough are increasingly viewed as liabilities, hindering the progress of more promising ventures.

By identifying and potentially discontinuing these legacy R&D efforts, Evotec can sharpen its focus on assets with higher probability of success and greater market impact. This strategic pruning is crucial for maintaining financial discipline and ensuring that the company's resources are directed towards innovation that can yield substantial future revenue streams, rather than being diluted across a broad, less productive portfolio.

Segments Affected by Temporary Pharma Restructuring

The Shared R&D segment experienced a revenue dip due to temporary restructuring within the pharmaceutical industry and a more focused approach to biotechnology funding in 2024 and the first quarter of 2025. This external market pressure resulted in a decrease in revenue for these particular services, signaling a period of low growth for certain offerings within this area.

These conditions can position some parts of the Shared R&D segment as 'dogs' in the Evotec BCG Matrix if they consistently struggle with reduced demand or market opportunities. For instance, if specific early-stage research collaborations that were heavily reliant on the affected funding streams saw a significant slowdown.

- Shared R&D Revenue Decline: Faced headwinds from pharma restructuring and selective biotech funding in 2024-Q1 2025.

- Low Growth Environment: Indicative of reduced demand for certain services within the segment.

- Potential 'Dog' Classification: Aspects with consistently lower demand due to these external market challenges.

- Impact on Evotec's Portfolio: Highlights the need to assess and potentially reallocate resources from underperforming areas.

Operational Inefficiencies in Certain Areas

Despite Evotec's commitment to operational excellence, certain segments might still grapple with inefficiencies or a substantial fixed cost burden, impacting profitability. These specific areas, rather than entire product categories, could be consuming more capital than they generate, functioning like 'dogs' in an operational context.

The company's Priority Reset initiative is specifically designed to target and rectify these underperforming operational pockets, aiming for a significant uplift in overall performance and resource allocation efficiency.

- Addressing Pockets of Inefficiency: Evotec's strategy includes identifying and optimizing specific operational units that exhibit higher costs relative to their output.

- Cash Consumption: These identified areas may consume more cash than they generate, a characteristic similar to 'dogs' in a BCG matrix analysis.

- Impact on Profitability: Such inefficiencies can weigh down overall company profitability, even if other business units are performing strongly.

- Priority Reset Focus: The Priority Reset program is a key strategic lever to improve the performance of these identified areas.

Evotec's strategic divestments and restructuring efforts align with identifying and addressing 'dog' assets within its portfolio. These are typically business segments or equity participations that exhibit low market share and limited growth potential, consuming resources without generating substantial returns.

The company's Priority Reset initiative is designed to pinpoint and rectify these underperforming operational pockets, which can be characterized by a high fixed cost burden or inefficiencies that drain capital. For example, in 2023, Evotec reported a €11.6 million loss from discontinued operations, which likely included some of these non-core participations.

Furthermore, certain aspects of the Shared R&D segment might be classified as dogs if they consistently face reduced demand due to external market pressures, such as pharmaceutical industry restructuring and selective biotechnology funding observed in 2024 and early 2025.

These 'dog' elements, whether they are legacy R&D projects with low potential or inefficient operational units, are being systematically pruned to reallocate capital and expertise towards more promising, high-growth opportunities, thereby enhancing overall financial performance and shareholder value.

Question Marks

Evotec's collaboration with Novo Nordisk to advance cell therapies exemplifies a strategic move into a high-potential, yet unproven, market segment. These partnerships, akin to 'question marks' in the BCG matrix, represent areas with substantial future growth prospects but currently lack established market share.

The significant research and development investment required for cell therapies underscores their 'question mark' status. For instance, the global cell therapy market was valued at approximately USD 7.1 billion in 2023 and is projected to reach USD 31.7 billion by 2030, demonstrating immense growth potential but also the inherent uncertainty and capital intensity involved in capturing this nascent market.

Evotec's multi-year master research collaborations, such as the one with Pfizer targeting early discovery in metabolic and infectious diseases, are prime examples of 'question marks' in the BCG matrix. These ventures tap into high-growth potential markets, but their success is far from guaranteed.

For instance, the metabolic disease market alone was projected to reach over $600 billion globally by 2025, highlighting the significant upside. However, the substantial upfront investment and the inherent uncertainty of early-stage research mean these collaborations require careful management and strategic nurturing to transition into 'stars'.

Evotec's collaboration with Bristol Myers Squibb on molecular glue degraders, while generating milestone payments, highlights a nascent but promising field. The market adoption for these advanced therapeutic modalities is still developing, indicating a growth phase rather than established dominance.

While specific financial details of the Bristol Myers Squibb partnership are proprietary, the broader landscape of targeted protein degradation, including molecular glues, is attracting significant investment. Companies in this space are focused on building pipelines and demonstrating clinical efficacy to capture future market share, which is projected to grow substantially in the coming years.

Expansion into Underserved Therapeutic Areas with New Modalities

Evotec is actively pursuing expansion into therapeutic areas that are currently underserved, a strategic move designed to build leading co-owned pipelines for novel treatments. This focus on niche or emerging areas, often involving new therapeutic modalities, presents significant growth potential. However, these ventures typically start with a low market share, demanding substantial investment in both marketing and development to realize their full value.

These initiatives align with Evotec's strategy to diversify its portfolio and tap into areas with unmet medical needs. For instance, in 2024, the company continued to invest in its early-stage pipeline, with a portion allocated to these less-crowded therapeutic spaces. Such strategic bets are crucial for long-term value creation, even though they require patience and sustained effort.

- Focus on Unmet Needs: Evotec targets therapeutic areas with significant patient populations lacking effective treatment options.

- Novel Modalities: Investment in new technologies like cell and gene therapies or advanced biologics to address these needs.

- Co-Owned Pipelines: Building proprietary assets through partnerships and internal R&D, aiming for shared future success.

- High Growth Potential: These niche areas, while currently small, are projected to experience substantial market growth as treatments mature.

Future Development Revenues and Royalties from New Technologies

The potential sale of Evotec's Toulouse facility to Sandoz introduces significant future development revenues and royalties. These are tied to Sandoz's utilization and commercial success of Evotec's advanced continuous manufacturing technology. This represents a new, promising revenue stream for Evotec, contingent on market adoption and product performance.

While the exact financial impact of these future revenues and royalties is still unfolding, they are categorized as 'question marks' within the BCG Matrix framework. This classification acknowledges their high growth potential but also the inherent uncertainty surrounding their realization. For instance, the successful scaling of continuous manufacturing by Sandoz could unlock substantial royalty payments, but this depends on numerous market factors.

- Potential Revenue Streams: Future development revenues, milestones, and product royalties from Sandoz's use of Evotec's continuous manufacturing technology.

- Growth Potential: High, as success is linked to the commercial performance of Sandoz's products manufactured using Evotec's innovative technology.

- Uncertainty Factor: The precise scale and timing of these revenues are not yet fully predictable, placing them in the 'question mark' category.

- Strategic Importance: Demonstrates Evotec's ability to generate ongoing income from its technological advancements beyond initial sales.

Evotec's investments in areas like cell therapies and novel modalities, exemplified by collaborations with Novo Nordisk and Pfizer, represent significant 'question marks'. These ventures target high-growth potential markets but require substantial R&D investment and face inherent uncertainties regarding market adoption and success.

The global cell therapy market, valued at approximately USD 7.1 billion in 2023 and projected to reach USD 31.7 billion by 2030, illustrates the immense growth potential. Similarly, the metabolic disease market's projected reach of over $600 billion by 2025 highlights the upside for Evotec's early-stage research collaborations.

These 'question mark' initiatives, including partnerships focused on molecular glue degraders with Bristol Myers Squibb, are crucial for Evotec's long-term strategy of diversifying its portfolio and building co-owned pipelines in underserved therapeutic areas.

The company's focus on developing and commercializing new therapeutic approaches, while demanding significant upfront capital and patience, is designed to capture future market share in rapidly expanding segments.

| Initiative Type | Market Potential | Current Market Share | Investment Required | Key Uncertainty |

| Cell Therapies (e.g., Novo Nordisk collaboration) | High (USD 7.1B in 2023, projected USD 31.7B by 2030) | Low | High | Clinical efficacy, regulatory approval, market adoption |

| Early-Stage Discovery (e.g., Pfizer collaboration) | High (Metabolic diseases >$600B by 2025) | Low | High | Translational success, competitive landscape |

| Molecular Glue Degraders (e.g., Bristol Myers Squibb collaboration) | Growing (Specific figures proprietary, but sector expanding) | Low | Moderate to High | Target specificity, off-target effects, therapeutic window |

BCG Matrix Data Sources

Our Evotec BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market research reports, and internal performance metrics to provide strategic clarity.