Evotec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evotec Bundle

Evotec's competitive landscape is shaped by powerful forces, from the bargaining power of its clients to the intense rivalry within the drug discovery sector. Understanding these dynamics is crucial for any stakeholder looking to navigate this complex market.

The complete report reveals the real forces shaping Evotec’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Evotec's reliance on highly specialized technology platforms and unique reagents for advanced drug discovery means suppliers of these critical inputs hold considerable bargaining power. The proprietary nature of cutting-edge tools and materials, essential for innovative therapeutic areas, can significantly influence Evotec's costs and operational flexibility.

The drug discovery and development industry, where Evotec operates, is heavily reliant on a specialized and highly educated workforce. This includes scientists with expertise in chemistry, biology, and data science, all crucial for innovation. The scarcity of individuals possessing these advanced skills significantly amplifies their bargaining power.

Evotec's global presence, supported by a workforce exceeding 5,000 qualified professionals, underscores its dependence on this limited pool of specialized talent. This reliance means that the cost and availability of such human capital directly influence Evotec's operational costs and project timelines, giving skilled employees considerable leverage.

As Evotec leans into AI and advanced tech, suppliers of unique software, algorithms, and data tools are gaining leverage. These specialized digital solutions are crucial for speeding up drug discovery and boosting efficiency. For instance, the global AI in drug discovery market was valued at approximately USD 1.5 billion in 2023 and is projected to grow significantly, highlighting the increasing reliance on these suppliers.

CRO-Specific Equipment and Infrastructure

Suppliers of specialized laboratory equipment, high-throughput screening systems, and advanced research infrastructure possess considerable bargaining power. This is largely due to the substantial capital outlay required for these critical assets, making switching costs for Evotec potentially high if a supplier relationship is deeply integrated.

While Evotec is strategically moving towards a more asset-lighter operational model, the foundational equipment and infrastructure remain indispensable for its core drug discovery and development services. This reliance on specialized suppliers for essential tools means they can exert influence over pricing and terms.

- High Capital Investment: The cost of advanced CRO-specific equipment, such as sophisticated analytical instruments and automated screening platforms, can run into millions of euros, limiting the number of potential suppliers and increasing their leverage.

- Specialized Nature: Many of these systems are highly specialized and proprietary, meaning Evotec cannot easily substitute them with off-the-shelf alternatives, further concentrating supplier power.

- Integration: Deep integration of supplier technology into Evotec's workflows can create lock-in effects, making it costly and time-consuming to change providers.

Contract Manufacturing Inputs

For Evotec's biologics segment, which involves manufacturing, suppliers of critical inputs like raw materials, bioreactors, and specialized components hold significant bargaining power. This power stems from the specialized nature of these materials and equipment, often requiring specific qualifications and reliable delivery for complex biopharmaceutical production.

Evotec's strategic move in 2024 to divest its Toulouse manufacturing facility to Sandoz could reshape its supplier relationships within its contract manufacturing operations. This divestiture might lead to a recalibration of purchasing volumes and negotiation leverage with certain suppliers previously serving that site.

- Supplier Dependence: The reliance on specialized suppliers for high-quality raw materials and advanced manufacturing equipment grants these suppliers considerable influence over pricing and terms.

- Market Concentration: If the market for specific biologics manufacturing inputs is concentrated among a few providers, their bargaining power is amplified.

- Evotec's Strategic Adjustments: The 2024 Sandoz deal for the Toulouse site could alter Evotec's direct purchasing power with certain suppliers, potentially shifting dynamics for remaining manufacturing operations.

Suppliers of specialized technology platforms and unique reagents for advanced drug discovery hold considerable bargaining power over Evotec. The proprietary nature of these essential inputs, coupled with high capital investment required for specialized equipment, limits Evotec's options and can drive up costs. For instance, the global AI in drug discovery market was valued at approximately USD 1.5 billion in 2023, indicating a growing reliance on specialized digital solution providers.

The concentration of suppliers for critical biologics manufacturing inputs, such as specialized bioreactors and high-quality raw materials, further amplifies their leverage. Evotec's strategic divestiture of its Toulouse manufacturing facility in 2024 to Sandoz may also impact its purchasing power and negotiation dynamics with certain suppliers previously serving that site.

| Factor | Impact on Evotec | Supplier Leverage |

|---|---|---|

| Specialized Technology & Reagents | High reliance on proprietary inputs | High |

| Capital Investment for Equipment | Significant costs for advanced systems | High |

| Market Concentration (Biologics Inputs) | Limited providers for critical materials | High |

| 2024 Toulouse Facility Divestiture | Potential shift in purchasing volumes | Moderate to High (depending on new arrangements) |

What is included in the product

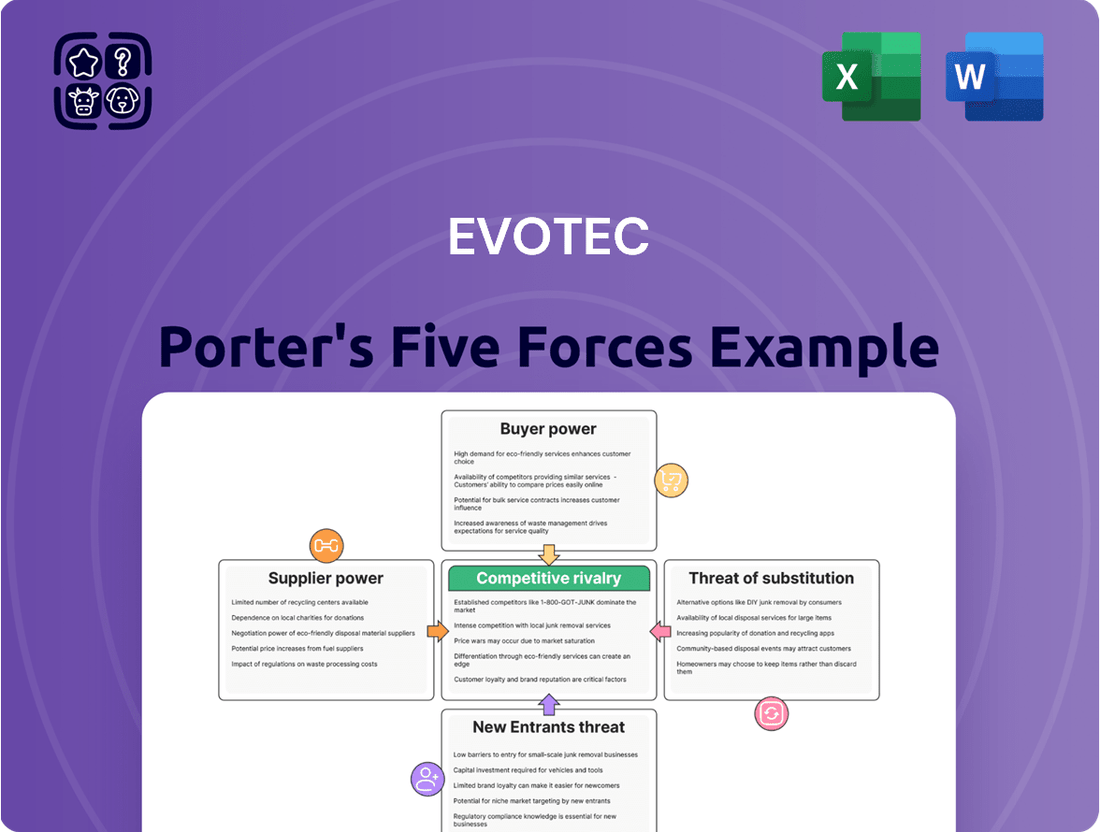

This analysis meticulously examines the five competitive forces impacting Evotec, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and mitigate competitive threats with a clear, actionable overview of all five forces.

Customers Bargaining Power

Evotec's bargaining power of customers is significantly influenced by its large pharmaceutical partners, including giants like Bristol Myers Squibb, Novo Nordisk, Pfizer, and Sandoz. These major players often have substantial financial clout and a wide array of alternative outsourcing providers, enabling them to negotiate favorable pricing and contract terms. Their sheer size and the strategic importance of the services Evotec provides grant them considerable leverage.

The increasing trend of pharmaceutical and biotech companies outsourcing their research and development activities to Contract Research Organizations (CROs) like Evotec significantly bolsters customer bargaining power. This expansion means clients have a wider array of service providers to choose from, intensifying competition among CROs.

The global CRO market is on a significant growth trajectory. Projections indicate it could reach approximately $90 billion by 2034, up from an estimated $45.5 billion in 2023. This substantial market growth directly translates to more options for customers, giving them greater leverage when negotiating terms and pricing with CROs.

Evotec's dual approach of project-based and milestone/royalty models significantly influences customer bargaining power. While fee-for-service models offer predictability, the milestone/royalty structure inherently grants customers leverage. They can effectively dictate project pace and payment by withholding approval for milestones, directly impacting Evotec's revenue realization.

In 2024, the pharmaceutical and biotech sectors continued to emphasize value-based agreements. This trend empowers customers, particularly large pharmaceutical companies, to negotiate terms that tie payments to tangible progress and successful outcomes. For Evotec, this means customers can exert considerable influence by scrutinizing each milestone, potentially delaying payments or demanding renegotiations if deliverables are perceived as not meeting expectations.

Access to In-House Capabilities

Large pharmaceutical companies often possess substantial in-house research and development (R&D) capabilities, which can serve as a powerful alternative to engaging Contract Research Organizations (CROs). This internal capacity acts as a persistent leverage point, influencing the pricing and service packages offered by external providers.

The decision to outsource specific R&D functions is frequently driven by a desire for cost-effectiveness and access to highly specialized expertise that may not be readily available internally. However, the underlying threat of bringing such work back in-house keeps CROs competitive.

For instance, in 2024, major pharmaceutical firms continued to invest heavily in their own R&D infrastructure. Companies like Pfizer and Merck maintained significant internal drug discovery and development pipelines, demonstrating their ability to manage complex projects without full reliance on external partners. This internal strength directly impacts the bargaining power of customers in the CRO market.

- In-house R&D Investment: Major pharmaceutical companies consistently allocate billions to internal R&D, maintaining a baseline capability.

- Strategic Outsourcing Decisions: Outsourcing is evaluated against the cost and feasibility of in-house execution, directly influencing CRO pricing.

- Expertise Leverage: The availability of internal specialists can limit the premium CROs can charge for niche skills.

Diversified Customer Base

Evotec's diverse client base, encompassing major pharmaceutical corporations, nimble biotechnology companies, and academic research institutions, significantly mitigates the bargaining power of any single customer. While a large pharmaceutical partner might exert considerable influence due to the scale of their contracts, Evotec's broad engagement across numerous entities means no single client dictates terms. For instance, in 2023, Evotec continued to expand its collaborations, signing new agreements with various mid-sized biotech firms alongside its established relationships with larger pharma giants.

This wide array of customers, including patient advocacy groups that often fund early-stage research, spreads the risk and reduces reliance on any one segment. The ability to serve different market needs, from early drug discovery to clinical trial support, further strengthens Evotec's position. This diversification means that while individual contract negotiations are important, the overall threat from customer price pressure or demands for exclusivity is managed by the breadth of its client portfolio.

- Diverse Client Segments: Evotec engages with pharmaceutical, biotechnology, academic, and patient advocacy sectors.

- Reduced Reliance: Diversification limits the impact of any single client's bargaining power.

- Strategic Partnerships: Evotec's 2023 collaborations highlighted growth across various client sizes.

- Mitigated Price Pressure: Serving multiple market needs lessens the overall threat of customer-driven price reductions.

Evotec's customers, particularly large pharmaceutical companies, possess significant bargaining power. This stems from their substantial financial resources, the availability of alternative CROs, and their ability to conduct R&D in-house. In 2024, the trend towards value-based agreements further amplified this power, allowing clients to tie payments to project milestones and outcomes, potentially delaying payments if deliverables are not met.

| Customer Type | Leverage Factors | 2024 Impact |

|---|---|---|

| Large Pharmaceutical Companies | High financial clout, multiple outsourcing options, in-house R&D capabilities | Increased negotiation power due to value-based agreements and scrutiny of milestones |

| Biotechnology Companies | Focus on specialized expertise, often smaller contract sizes | Negotiate based on project scope and access to specific technologies |

| Academic Institutions | Grant-funded projects, emphasis on scientific advancement | Bargaining power often tied to the strategic importance of the research to Evotec |

Same Document Delivered

Evotec Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive Porter's Five Forces analysis of Evotec, detailing the competitive landscape and strategic implications. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Evotec's industry.

Rivalry Among Competitors

The drug discovery and preclinical contract research organization (CRO) sector is characterized by intense competition, featuring a wide array of participants from large, comprehensive CROs to highly specialized niche firms. This dynamic landscape is further shaped by ongoing consolidation, where established entities are actively acquiring smaller companies to broaden their service offerings and enhance their market reach.

In 2024, the global CRO market, encompassing drug discovery and preclinical services, was projected to reach approximately $70 billion, demonstrating robust growth. This expansion fuels the consolidation trend, as larger players seek to capture market share and integrate new technologies and expertise. For instance, major CROs have been actively pursuing acquisitions to bolster their capabilities in areas like gene therapy and AI-driven drug discovery.

Evotec operates in a highly competitive landscape, facing significant pressure from established global contract research organizations (CROs). Giants like IQVIA, Labcorp, ICON, Charles River Laboratories, and WuXi AppTec boast extensive service portfolios and broad international reach, presenting a formidable challenge.

These large CROs often possess greater economies of scale, allowing them to offer competitive pricing and invest heavily in cutting-edge technologies. For instance, IQVIA, a leading player, reported revenues exceeding $14 billion in 2023, highlighting its substantial market presence and resource advantage.

The presence of these global behemoths means Evotec must continuously innovate and differentiate its services to capture market share. Their comprehensive offerings, from early-stage research to late-stage clinical trials and data analytics, set a high bar for specialized CROs.

The competitive landscape in drug discovery is intensifying, with technological advancements, especially in AI and machine learning, becoming key differentiators. These technologies boost efficiency and accuracy in identifying and developing new therapies.

Evotec is strategically positioning itself by investing heavily in cutting-edge technology platforms and AI-driven innovation. This focus aims to set them apart from rivals who may not possess similar advanced capabilities.

For instance, in 2024, Evotec announced collaborations leveraging AI for target identification and validation, underscoring their commitment to technological leadership. This approach is crucial as the industry moves towards more data-intensive and predictive drug development models.

Strategic Partnerships and Collaborations

Competitive rivalry in the Contract Research Organization (CRO) sector is intensified through strategic partnerships. Evotec's approach involves forging multi-year collaborations with major pharmaceutical and biotechnology firms. These alliances are crucial for securing predictable, long-term revenue streams, but they also underscore the intense competition to establish and maintain these valuable relationships.

The ability to attract and retain these significant partnerships is a direct measure of a CRO's competitive standing. For instance, Evotec's collaborations often involve upfront payments, milestone payments, and royalties, demonstrating the substantial financial commitments involved and the high stakes in these competitive arenas. Winning these deals requires a strong scientific reputation and a proven track record of successful project delivery.

- Evotec's strategic partnerships aim to secure long-term revenue.

- These collaborations highlight the competitive pressure to win and retain clients.

- The success of these partnerships is a key indicator of competitive strength.

Cost and Efficiency Pressures

The pharmaceutical sector's relentless demand for cost-effective research and development, coupled with a drive for enhanced operational efficiency across its entire value chain, directly fuels fierce competition among Contract Research Organizations (CROs). This environment compels CROs to continuously innovate and optimize their services to remain competitive on price and delivery speed.

Evotec, like its peers, operates under significant pressure to deliver value. For instance, the average cost of bringing a new drug to market has been estimated to be in the billions, with R&D accounting for a substantial portion. This necessitates CROs to demonstrate clear cost advantages and streamlined processes to attract and retain clients.

- R&D Cost Escalation: The pharmaceutical industry grapples with escalating R&D expenditures, placing a premium on cost-effective outsourcing solutions.

- Efficiency Imperative: A strong emphasis on streamlining operations and improving turnaround times is crucial for CROs to gain a competitive edge.

- Price Sensitivity: Clients actively seek CROs that can offer demonstrably lower costs without compromising on quality or scientific rigor.

- Innovation in Service Delivery: Continuous investment in new technologies and process improvements is vital for CROs to offer more efficient and cost-effective services.

The competitive rivalry within the drug discovery CRO sector is intense, with numerous players vying for market share. Evotec faces formidable competition from large, established global CROs like IQVIA and Labcorp, which benefit from significant economies of scale and extensive service portfolios. These larger entities can offer competitive pricing and invest heavily in advanced technologies, setting a high benchmark for specialized firms.

Technological innovation, particularly in AI and machine learning, is a key differentiator, driving efficiency and accuracy in drug development. Evotec's strategic investments in these areas, including AI-driven target identification, are crucial for distinguishing itself in this dynamic market. The global CRO market was projected to reach around $70 billion in 2024, indicating substantial growth and, consequently, heightened competition.

Evotec's strategy of forging long-term partnerships with pharmaceutical and biotech companies is vital for securing predictable revenue but also highlights the intense competition to win and maintain these valuable client relationships. The success of these collaborations, often involving significant financial commitments, directly reflects a CRO's competitive standing and ability to deliver results.

The pharmaceutical industry's drive for cost-effective R&D and operational efficiency places immense pressure on CROs to offer competitive pricing and faster turnaround times. Evotec, like its rivals, must demonstrate clear cost advantages and streamlined processes to attract and retain clients in an environment where R&D costs continue to escalate.

| Competitor | 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|

| IQVIA | $14+ billion | Broad service portfolio, global reach, data analytics |

| Labcorp | N/A (Part of Labcorp Holdings) | Extensive clinical trial services, diagnostics |

| ICON | N/A (Part of ICON plc) | Clinical research services, regulatory expertise |

| Charles River Laboratories | N/A (Part of Charles River Laboratories, Inc.) | Preclinical services, drug development support |

| WuXi AppTec | N/A (Part of WuXi AppTec Co., Ltd.) | Integrated R&D services, manufacturing capabilities |

SSubstitutes Threaten

Pharmaceutical and biotech firms can develop drugs internally, acting as a direct substitute for outsourcing to contract research organizations like Evotec. This in-house option bypasses the need for external partners.

However, the significant capital investment and specialized expertise required for end-to-end drug discovery and development often make this substitute less appealing. For instance, establishing and maintaining state-of-the-art research facilities and hiring top-tier scientific talent represents a substantial financial commitment.

While companies like Pfizer and Merck have robust internal R&D capabilities, the increasing complexity of drug targets and the pressure to accelerate timelines mean that even large players frequently leverage external expertise for specific stages of the process, highlighting the limitations of a purely in-house approach.

Academic and research institutions can act as substitutes for Evotec's early-stage research and target identification services. These organizations, often driven by fundamental science and grant funding, may offer similar capabilities, particularly for initial discovery phases.

While their primary focus isn't commercial drug development, the overlap in early-stage research can create competition for projects, especially those that are grant-funded or in the very nascent stages of scientific exploration. This dynamic means Evotec must continually demonstrate its unique value proposition in accelerating drug discovery beyond what academic labs can readily provide.

Customers seeking specific drug discovery services might bypass integrated providers like Evotec in favor of numerous highly specialized niche players. These smaller firms can offer deep expertise or cost efficiencies in particular stages of the R&D pipeline. For instance, a company needing only advanced computational chemistry might contract with a specialized firm rather than engage a full-service partner.

Alternative Drug Discovery Technologies

Emerging technologies that bypass traditional drug discovery methods pose a long-term threat. For example, advanced computational biology and novel therapeutic modalities could reduce the demand for Evotec's conventional services. This could impact revenue streams if these alternatives become widely adopted and more cost-effective.

However, Evotec is proactively addressing this by integrating artificial intelligence (AI) into its discovery platforms. For instance, in 2024, Evotec announced collaborations leveraging AI for target identification and lead optimization, aiming to stay ahead of these potential substitutes. This strategic integration aims to transform rather than be replaced by these new approaches.

- AI Integration: Evotec's 2024 initiatives demonstrate a commitment to AI-driven drug discovery, aiming to enhance efficiency and identify novel therapeutic candidates.

- Computational Biology: Advances in computational biology offer alternative pathways for identifying drug targets and predicting compound efficacy, potentially reducing reliance on traditional screening methods.

- Novel Modalities: The rise of entirely new therapeutic approaches, such as gene editing or advanced cell therapies, could create substitutes for small molecule or antibody-based discovery services.

- Strategic Response: By investing in and integrating these cutting-edge technologies, Evotec seeks to mitigate the threat of substitutes and position itself as a leader in next-generation drug discovery.

Licensing or Acquisition of Developed Assets

Pharmaceutical giants often opt to license or acquire drug candidates and even complete development pipelines that have progressed beyond the initial discovery stages. This strategic move enables them to sidestep the lengthy and prohibitively expensive early-stage research and preclinical testing phases. For instance, in 2023, the value of pharmaceutical M&A deals reached hundreds of billions of dollars, demonstrating a clear trend towards acquiring established assets.

This preference for later-stage assets directly impacts companies like Evotec, which specialize in early-stage drug discovery. By acquiring or licensing more mature projects, larger pharmaceutical firms can reduce their reliance on, and therefore the demand for, the initial discovery services that are core to Evotec's business model. This shift in strategy can significantly alter the competitive landscape for contract research organizations.

- Reduced Demand for Early-Stage Discovery: Pharmaceutical companies increasingly favor acquiring assets in later development stages, bypassing initial discovery services.

- M&A Trends: The significant volume of pharmaceutical M&A in 2023, valued in the hundreds of billions, underscores this trend of acquiring developed assets.

- Strategic Shift: This licensing and acquisition strategy allows pharma companies to accelerate their pipeline development and reduce R&D costs associated with early-stage research.

- Impact on CROs: The shift directly diminishes the demand for early-stage discovery services offered by contract research organizations (CROs) like Evotec.

The threat of substitutes for Evotec's services is multifaceted, ranging from in-house capabilities of large pharmaceutical companies to specialized niche players and emerging technologies. While internal R&D departments can perform drug discovery, the immense capital and expertise required often make outsourcing to CROs like Evotec more efficient. However, academic institutions can offer early-stage research, and niche firms provide specialized services, potentially fragmenting demand.

Emerging technologies like AI and novel therapeutic modalities present a longer-term substitution risk, potentially bypassing traditional discovery methods. Evotec is actively integrating AI, as seen in its 2024 collaborations, to proactively address this by enhancing its platforms rather than being replaced. This strategic move aims to leverage these advancements for improved efficiency and novel candidate identification.

| Substitute Type | Description | Impact on Evotec | 2024/2023 Data/Trend |

|---|---|---|---|

| In-house R&D | Pharmaceutical firms conducting drug discovery internally. | Reduced demand for outsourced early-stage services. | Large pharma companies continue significant R&D investment, but often focus on core strengths. |

| Academic Institutions | Universities and research centers performing early-stage scientific exploration. | Competition for early-stage, grant-funded projects. | Increased funding for academic research in areas like genomics and AI-driven biology. |

| Niche Service Providers | Highly specialized firms focusing on specific R&D stages. | Potential for project fragmentation; Evotec must demonstrate integrated value. | Growth in specialized biotech and AI-driven drug discovery startups. |

| Emerging Technologies (AI, Novel Modalities) | New technological approaches that may bypass traditional discovery. | Long-term threat to conventional service offerings. | Evotec announced AI collaborations in 2024 to integrate these technologies. |

Entrants Threaten

Establishing a comprehensive drug discovery and development services company like Evotec demands considerable capital. Think about the cost of cutting-edge laboratories, sophisticated equipment, and unique technology platforms. For instance, building a new biopharmaceutical research facility can easily run into hundreds of millions of dollars, creating a substantial hurdle for any new player looking to enter the market.

The pharmaceutical and biotechnology sectors are defined by rigorous regulatory landscapes. Companies must navigate complex requirements like Good Laboratory Practice (GLP) and Good Clinical Practice (GCP), which are non-negotiable for market entry and operation. For instance, the U.S. Food and Drug Administration (FDA) approval process alone can take years and cost millions, creating a substantial barrier for newcomers.

The pharmaceutical and biotechnology sectors, where Evotec operates, demand a profound level of scientific expertise. Success in drug discovery and development hinges on specialized knowledge in areas like molecular biology, chemistry, and pharmacology, which takes years to cultivate. New entrants face a significant hurdle in assembling a team with this depth of experience, a process that is both time-consuming and resource-intensive.

Evotec's established reputation and its extensive history in research and development have allowed it to build a formidable scientific talent pool. This accumulated expertise, coupled with a robust culture of innovation, creates a powerful barrier to entry for potential competitors. For instance, as of early 2024, Evotec continued to invest heavily in its R&D capabilities, employing thousands of scientists globally, underscoring the importance of human capital in this field.

Established Client Relationships and Reputation

Evotec's established client relationships pose a significant barrier. The company has cultivated deep, long-term strategic partnerships with major pharmaceutical and biotechnology firms, a testament to its proven track record and reliability. For instance, in 2024, Evotec continued to expand its collaborations, announcing new drug discovery and development agreements with several leading industry players, reinforcing its trusted position.

New entrants would face immense difficulty in replicating Evotec's reputation and the trust it has earned over years of successful project delivery. Building these extensive client networks and a strong brand image in the highly competitive contract research organization (CRO) and drug discovery space requires substantial time, investment, and consistent performance. This makes it challenging for newcomers to secure the initial projects needed to gain traction and establish credibility.

- Long-term Partnerships: Evotec's existing agreements with global pharma giants are difficult for new companies to penetrate.

- Reputational Capital: Years of successful drug discovery and development projects have built significant goodwill.

- Client Trust: New entrants would need to overcome the hurdle of proving their capabilities and reliability to potential clients accustomed to Evotec's performance.

Proprietary Technology and IP

Evotec's threat of new entrants is significantly mitigated by its deeply entrenched proprietary technology platforms and intellectual property (IP). These assets, developed through substantial and sustained investment, create a formidable barrier. For instance, Evotec's integrated drug discovery and development platforms, which combine advanced screening, chemistry, and biology capabilities, are not easily replicated.

The sheer R&D expenditure and the time required to build comparable technological infrastructure and patent portfolios make it exceedingly challenging for newcomers to enter the market on a competitive footing. In 2024, the global pharmaceutical R&D spending was projected to exceed $250 billion, highlighting the immense capital commitment necessary to even approach Evotec's established technological depth.

- Proprietary Platforms: Evotec's integrated technology platforms offer a significant competitive moat.

- Intellectual Property: A robust IP portfolio protects its innovations and deters imitation.

- R&D Investment: High R&D costs create a substantial barrier to entry for potential competitors.

- Time to Develop: The extensive time needed to replicate Evotec's technological capabilities further limits new entrants.

The threat of new entrants for Evotec is significantly low due to the immense capital requirements for establishing advanced research facilities and acquiring specialized technology. Building a state-of-the-art drug discovery laboratory can cost hundreds of millions, a substantial barrier for any newcomer aiming to compete in this capital-intensive industry.

Navigating the stringent regulatory environment, including GLP and GCP standards, demands significant time and financial investment, further deterring new players. For example, the FDA approval process can span years and incur millions in costs, creating a formidable hurdle for nascent companies.

Evotec's established reputation, deep scientific expertise, and extensive client relationships, cultivated over years of successful project delivery, also present a significant barrier. New entrants would struggle to replicate the trust and long-term partnerships Evotec has built with major pharmaceutical firms.

The company's proprietary technology platforms and intellectual property, developed through sustained R&D investment, create a strong competitive moat. Replicating Evotec's integrated drug discovery capabilities and patent portfolio is exceedingly challenging and time-consuming for potential competitors.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High cost of R&D facilities and technology | Very High |

| Regulatory Hurdles | Complex and time-consuming compliance (e.g., FDA approval) | High |

| Expertise & Reputation | Need for specialized scientific talent and established client trust | High |

| Proprietary Technology & IP | Investment in unique platforms and patent portfolios | Very High |

Porter's Five Forces Analysis Data Sources

Our Evotec Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Evotec's annual reports, investor presentations, and SEC filings. We supplement this with insights from reputable industry analysis firms and market research reports to provide a comprehensive view of the competitive landscape.