Evotec Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evotec Bundle

Evotec's marketing success is built on a strategic foundation. This analysis dives into their innovative product development, competitive pricing, targeted distribution, and impactful promotional campaigns.

Discover how Evotec leverages each element of the 4Ps to connect with its audience and achieve market leadership. Get the full, editable report to understand their winning formula.

Product

Evotec's integrated drug discovery and development services represent its Product in the marketing mix. This offering covers the entire journey from initial target identification and validation through to clinical development, aiming to speed up the delivery of new medicines to patients.

The company's expertise spans diverse therapeutic areas like oncology, neurology, and infectious diseases. Evotec reported €744.8 million in revenue for 2023, highlighting its significant market presence and the demand for its comprehensive service portfolio.

Evotec leverages cutting-edge proprietary technology platforms, including PanOmics and iPSC-based disease modeling, to drive innovation in drug discovery. These advanced systems are instrumental in boosting efficiency and ensuring the delivery of superior outcomes for their partners.

The strategic integration of artificial intelligence (AI) is a cornerstone of Evotec's approach, aiming to significantly expedite the transition from initial concept to a final therapeutic cure. This AI-driven innovation is key to their commitment to accelerating the drug development pipeline.

Evotec's Just – Evotec Biologics segment is dedicated to the full spectrum of biologics, from initial discovery through to large-scale manufacturing, with a particular focus on antibodies. This division champions innovative continuous manufacturing, positioning itself as a key provider of scalable technology solutions for the biopharmaceutical industry.

The strategic decision to divest its Toulouse manufacturing site to Sandoz in late 2023 marks a pivot towards an asset-lighter operational model. Despite this divestment, Evotec retains its core biologics development and manufacturing expertise, securing future revenue streams through retained economic benefits like royalties and milestone payments.

Strategic Co-creation Partnerships

Evotec's strategic co-creation partnerships are a cornerstone of its 'Product' strategy, extending its capabilities beyond internal R&D. These collaborations with pharmaceutical giants like Bristol Myers Squibb and Pfizer, as well as academic bodies and patient groups, allow Evotec to leverage external expertise and resources. This approach is designed to accelerate drug discovery and development, sharing in the potential success through milestone and royalty payments.

These partnerships are not merely transactional; they are deeply integrated, long-term engagements. By sharing the risks and rewards, Evotec aligns its interests with its partners, fostering a mutual drive for innovation. For instance, in 2024, Evotec announced an expansion of its partnership with Sanofi, focusing on the discovery and development of novel small molecule therapeutics for metabolic diseases, underscoring the ongoing commitment to this model.

- Co-creation with Pharma: Collaborations with leading companies like Bristol Myers Squibb and Pfizer to advance drug pipelines.

- Academic & Patient Engagement: Partnerships with research institutions and patient advocacy groups to incorporate diverse perspectives and expertise.

- Risk-Sharing Model: Structuring agreements to include milestone payments and royalties, aligning Evotec's success with partner outcomes.

- Strategic Focus: Long-term alliances aimed at accelerating the development of innovative therapies across various disease areas.

Therapeutic Area Focus

Evotec's product strategy centers on a focused approach to therapeutic areas that often present significant unmet medical needs. This includes a strategic emphasis on neurology, oncology, metabolic diseases, and infectious diseases. By concentrating its efforts, Evotec aims to leverage its advanced platforms and deep scientific expertise to develop novel treatments.

This specialization allows Evotec to tackle complex biological challenges and build a robust pipeline of co-owned innovative therapeutics. For instance, in the neurology space, the company is actively pursuing treatments for conditions like Alzheimer's and Parkinson's disease, areas with substantial patient populations and limited effective therapies.

Evotec's commitment to these underserved markets is underscored by its significant investment in research and development. As of their 2024 reports, a substantial portion of their R&D expenditure is allocated to these core therapeutic areas, reflecting a clear strategic priority. The company reported a total R&D investment of €317 million for 2023, with a significant portion dedicated to advancing its pipeline in these key indications.

- Neurology: Targeting neurodegenerative diseases with high unmet need.

- Oncology: Developing novel cancer therapies, including immuno-oncology approaches.

- Metabolic Diseases: Addressing conditions like diabetes and obesity through innovative mechanisms.

- Infectious Diseases: Focusing on novel antivirals and antibacterial agents to combat resistance.

Evotec's Product is its comprehensive suite of integrated drug discovery and development services, augmented by cutting-edge technology platforms and strategic co-creation partnerships. The company's offerings span the entire drug development lifecycle, from target identification to clinical development, with a particular focus on key therapeutic areas like oncology, neurology, and metabolic diseases. This integrated approach, reinforced by AI and proprietary platforms, aims to accelerate the delivery of novel medicines.

The company's revenue for 2023 reached €744.8 million, demonstrating the strong market demand for its diverse service portfolio. Evotec's commitment to innovation is further evidenced by its substantial R&D investment, with €317 million allocated in 2023 to advance its pipeline, particularly in high-unmet-need areas.

Evotec's strategic co-creation model involves deep, long-term partnerships with major pharmaceutical companies such as Sanofi, Bristol Myers Squibb, and Pfizer, as well as academic institutions and patient groups. This collaborative approach, which includes risk-sharing via milestone and royalty payments, aims to accelerate the development of innovative therapies and share in their potential success.

| Key Product Aspects | Description | Financial Impact/Data |

| Integrated Services | End-to-end drug discovery and development, from target validation to clinical support. | €744.8 million revenue in 2023. |

| Technology Platforms | Proprietary AI, PanOmics, and iPSC-based disease modeling for enhanced efficiency. | Drives innovation and superior partner outcomes. |

| Therapeutic Focus | Neurology, Oncology, Metabolic Diseases, Infectious Diseases. | €317 million R&D investment in 2023, with significant allocation to these areas. |

| Co-creation Partnerships | Risk-sharing collaborations with major pharma, academia, and patient groups. | Expands capabilities and accelerates pipeline development through milestone and royalty agreements. |

What is included in the product

This analysis delves into Evotec's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning and competitive landscape.

It's designed for professionals seeking a data-driven, actionable breakdown of Evotec's marketing approach, perfect for strategic planning and benchmarking.

Simplifies complex marketing strategies into actionable insights, relieving the pain of information overload for strategic decision-making.

Provides a clear, concise framework for understanding Evotec's market positioning, easing the burden of detailed competitive analysis.

Place

Evotec boasts an extensive global network of research and development sites, strategically positioned across Europe and the USA. This widespread presence isn't just about scale; these locations operate as interconnected hubs of specialized knowledge and cutting-edge technology. For instance, as of early 2024, Evotec maintained over 15 sites, each contributing unique capabilities to their integrated service offerings.

These centers of excellence are designed to complement each other, fostering a synergistic approach to drug discovery and development. By clustering specific technological platforms and scientific expertise in different regions, Evotec can offer a comprehensive suite of services that are both broad and deeply specialized. This structure allows them to efficiently tackle complex research challenges.

This robust global footprint is critical for serving a diverse international clientele. It enables Evotec to tap into varied talent pools and scientific ecosystems, ensuring they can always find the right expertise for any given project. This geographical diversification also provides resilience and adaptability in the face of regional market shifts or regulatory changes, a key advantage in the fast-paced pharmaceutical industry.

Evotec's primary 'place' of business is built on direct partnerships, a strategy that places them at the heart of innovation. They actively engage with the top 20 pharmaceutical giants and a vast network of over 800 biotechnology firms, fostering collaborative environments for drug discovery and development. This direct approach is further amplified by strong ties with leading academic institutions and other key players in the healthcare ecosystem, ensuring their solutions are precisely aligned with evolving industry needs.

Evotec leverages advanced digital platforms as its 'Place' for collaboration, enabling secure and efficient data exchange with its global network of partners. These virtual spaces are essential for managing intricate research and development projects, facilitating the rapid sharing of scientific discoveries, and ensuring smooth communication across its international teams. For instance, in 2023, Evotec's digital infrastructure supported collaborations that led to advancements in drug discovery pipelines, underscoring the critical role of these platforms in its operational success and market reach.

Conferences and Industry Events

Evotec's presence at key industry conferences and scientific events is a cornerstone of its marketing strategy, fostering vital connections within the life sciences ecosystem. These gatherings, such as the BIO International Convention and the JP Morgan Healthcare Conference, provide unparalleled opportunities for networking and showcasing Evotec's integrated drug discovery and development platforms.

By actively participating, Evotec strengthens its brand visibility and engages directly with potential clients, collaborators, and investors, reinforcing its position as a leading partner in innovation. For instance, in 2024, Evotec showcased its latest advancements in areas like AI-driven drug discovery at over a dozen major international forums, directly contributing to lead generation and partnership discussions.

- Global Reach: Evotec's attendance at events like the European Pharma Summit and the World ADC Summit in 2024 highlights its commitment to engaging with diverse scientific and business communities worldwide.

- Partnership Focus: These events are critical for identifying and nurturing new collaborations, with Evotec reporting a significant uptick in partnership inquiries following its participation in key 2024 conferences.

- Showcasing Innovation: Presentations and exhibits at these forums allow Evotec to demonstrate its technological prowess, including its expanded capabilities in targeted protein degradation and cell therapy development.

- Market Intelligence: Attending these events also provides valuable insights into emerging trends, competitive landscapes, and unmet needs within the pharmaceutical and biotechnology sectors.

Strategic Asset Management (e.g., Toulouse Site)

Evotec's strategic decision regarding the potential sale of its Just – Evotec Biologics Toulouse site to Sandoz is a significant move impacting its 'Place' strategy. This divestment signals a shift towards an asset-lighter, capital-efficient business model. By focusing on its technological expertise and intellectual property, Evotec aims to streamline operations and enhance financial flexibility.

This transition allows Evotec to concentrate on its core competencies in drug discovery and development, while still ensuring access to critical manufacturing capabilities through strategic partnerships. This approach is particularly relevant in the evolving biopharmaceutical landscape, where flexibility and efficient capital allocation are paramount for sustained growth and innovation. For instance, Evotec has consistently reported strong revenue growth, with reported revenues reaching €766.9 million in 2023, indicating the underlying strength of its operational model even as it optimizes its physical footprint.

The strategic asset management, exemplified by the Toulouse site, underscores Evotec's commitment to adapting its 'Place' in the market. Key aspects include:

- Focus on Asset-Light Model: Reducing direct ownership of manufacturing facilities to improve capital efficiency.

- Strategic Partnerships: Ensuring continued access to essential manufacturing capabilities through collaborations.

- Technology and IP Leverage: Prioritizing the monetization of its technological platforms and intellectual property.

- Financial Flexibility: Enhancing its ability to invest in core research and development activities.

Evotec's 'Place' strategy is multifaceted, encompassing a global network of R&D sites and a strong emphasis on digital collaboration platforms. Their physical presence, with over 15 sites across Europe and the USA as of early 2024, creates specialized hubs that complement each other, facilitating integrated drug discovery. This geographical diversification also taps into diverse talent pools and provides market resilience.

Beyond physical locations, Evotec utilizes advanced digital platforms to foster secure and efficient data exchange with its global partners, essential for managing complex projects and accelerating scientific discovery. Their active participation in key industry conferences, such as the BIO International Convention and JP Morgan Healthcare Conference in 2024, further extends their 'Place' by enabling vital networking and showcasing their technological advancements.

The potential sale of the Just – Evotec Biologics Toulouse site to Sandoz exemplifies Evotec's strategic shift towards an asset-lighter, capital-efficient model. This move allows them to focus on core competencies and intellectual property, leveraging strategic partnerships for manufacturing while enhancing financial flexibility. Evotec's reported revenues of €766.9 million in 2023 underscore the operational strength driving this strategic optimization.

| Aspect of 'Place' | Description | Key Data/Examples |

|---|---|---|

| Global R&D Network | Interconnected specialized sites | Over 15 sites across Europe and USA (early 2024) |

| Digital Collaboration | Secure platforms for data exchange | Supported advancements in drug discovery pipelines (2023) |

| Industry Engagement | Presence at conferences and events | Participation in BIO International, JP Morgan Healthcare (2024); showcased AI-driven discovery at 12+ forums |

| Strategic Asset Management | Focus on asset-light model | Potential divestment of Toulouse site; €766.9 million revenue (2023) |

Preview the Actual Deliverable

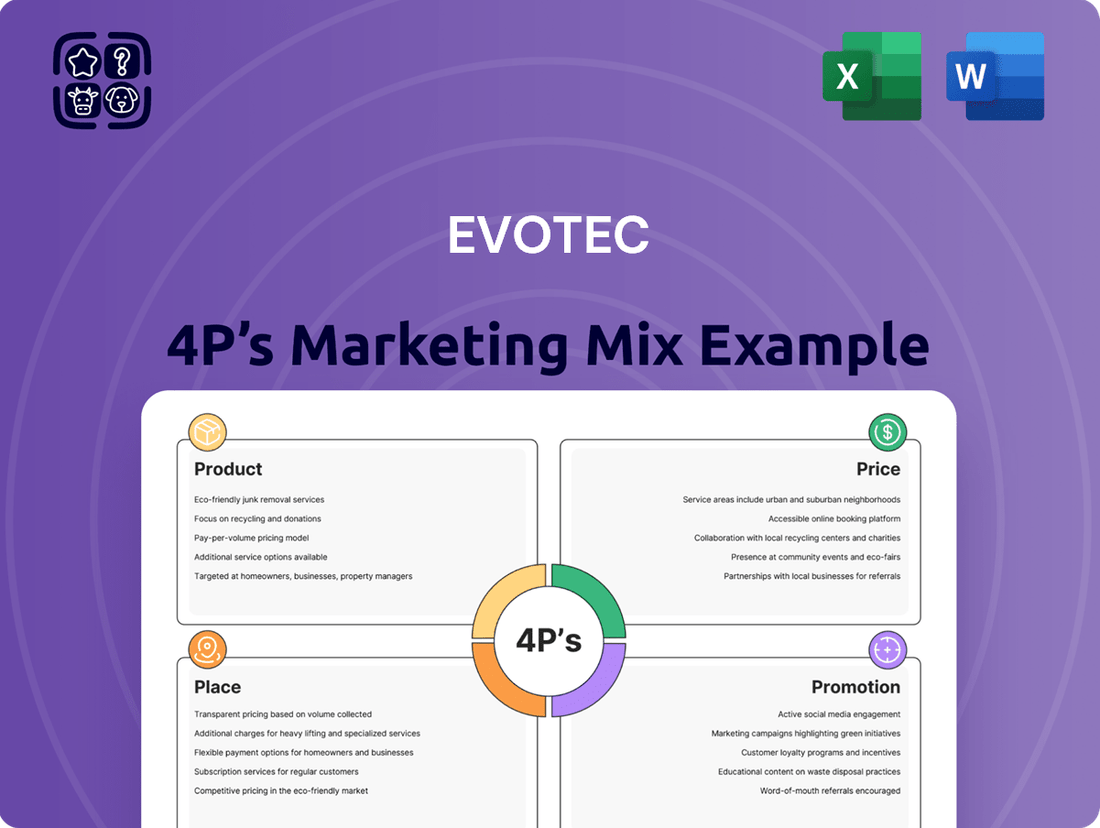

Evotec 4P's Marketing Mix Analysis

The preview shown here is the actual Evotec 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details Evotec's strategic approach to product, price, place, and promotion, offering a complete picture of their marketing efforts. You can confidently assess the value and depth of this analysis, knowing it's the exact version you'll own.

Promotion

Evotec actively engages its investor base through consistent updates via financial publications and dedicated analyst calls. This commitment to transparency ensures shareholders and analysts are well-informed about the company's financial performance and strategic trajectory.

In 2024, Evotec's investor relations efforts focused on detailing its progress in drug discovery and development pipelines, highlighting key milestones. The company reported a revenue of €691.1 million for the fiscal year 2023, demonstrating continued operational strength and growth potential to the investment community.

This proactive communication strategy is designed to foster investor confidence and attract capital, underscoring Evotec's dedication to building strong relationships with its stakeholders and clearly articulating its value proposition in the competitive biotechnology sector.

Evotec strategically leverages its partnerships, announcing key scientific achievements with industry leaders like Bristol Myers Squibb, Sandoz, Novo Nordisk, and Pfizer. These collaborations, often highlighted through press releases, underscore Evotec's scientific prowess and its capacity to forge valuable alliances, reinforcing its market standing.

These announcements are crucial for showcasing Evotec's progress in its drug development pipeline and its attractiveness to major pharmaceutical players. For instance, in 2024, Evotec continued to emphasize its progress in areas like neurodegenerative diseases through these strategic collaborations.

Evotec actively showcases its scientific prowess and innovative capabilities through publications in peer-reviewed journals and presentations at major industry conferences. This strategy positions Evotec as a key opinion leader, highlighting their platform advancements and service efficacy to a worldwide scientific community.

For instance, in 2024, Evotec presented its latest research on novel drug discovery approaches at the highly regarded Bio-IT World Conference and Expo, demonstrating tangible progress in their oncology pipeline. Their commitment to open science and knowledge sharing reinforces their credibility and attracts potential partners and clients seeking cutting-edge solutions.

Digital Presence and Social Media Engagement

Evotec actively manages its digital footprint, with its official website acting as a primary source for corporate news, investor relations, and service information. This digital hub is crucial for disseminating updates and engaging with its broad audience.

The company leverages social media, particularly X/Twitter and LinkedIn, to amplify its reach. These platforms are used to share company announcements, foster dialogue with stakeholders, and highlight Evotec's scientific advancements and brand identity. As of early 2024, Evotec's LinkedIn page boasts over 60,000 followers, indicating a significant level of engagement within the professional scientific and investment communities.

- Website as Central Information Hub: Evotec's website provides comprehensive details on its drug discovery and development services, corporate strategy, and financial reports.

- Social Media for Outreach: Platforms like X/Twitter and LinkedIn are utilized for real-time news dissemination and stakeholder interaction.

- Engagement Metrics: Evotec's social media presence, with a notable following on LinkedIn, demonstrates its commitment to transparent communication and brand building within the scientific and financial sectors.

Corporate Messaging and Strategic Reset Communications

Evotec's corporate messaging, particularly around its 'Priority Reset' initiative, aims to clearly articulate its strategic direction. This communication highlights a renewed focus on core competencies and high-growth market segments, designed to instill confidence in its stakeholders regarding the company's future trajectory. The emphasis on operational excellence underscores a commitment to efficient execution and sustainable, profitable expansion.

The company's strategic reset is underpinned by a commitment to financial discipline and targeted growth. For instance, in the first half of 2024, Evotec reported a revenue of €292.6 million, with a significant portion attributed to its core drug discovery and development services. This financial performance, coupled with strategic partnerships, demonstrates the tangible impact of their communicated priorities.

- Strategic Focus: Evotec is realigning its efforts towards its most promising therapeutic areas and platforms.

- Stakeholder Reassurance: Communications aim to build trust by detailing the rationale and expected outcomes of the 'Priority Reset'.

- Growth Segments: The messaging identifies and prioritizes investment in areas with high market potential and scientific innovation.

- Operational Efficiency: Evotec is emphasizing improvements in its operational processes to drive profitability and delivery.

Evotec's promotional strategy centers on transparent communication and highlighting scientific achievements. This includes regular investor updates, analyst calls, and press releases detailing progress in drug discovery and development pipelines, such as advancements in neurodegenerative diseases in 2024.

The company leverages strategic partnerships with industry leaders like Bristol Myers Squibb and Pfizer to showcase its scientific capabilities and attract investment. These collaborations, often announced publicly, reinforce Evotec's market position and its ability to deliver cutting-edge solutions.

Evotec maintains a strong digital presence through its website and social media platforms like LinkedIn, where it shares corporate news and scientific advancements. This digital engagement, with over 60,000 LinkedIn followers as of early 2024, effectively builds brand identity and fosters stakeholder dialogue.

The 'Priority Reset' initiative is a key communication point, emphasizing Evotec's renewed focus on core competencies and high-growth areas. This messaging aims to build stakeholder confidence by detailing strategic direction and a commitment to operational excellence and financial discipline, as evidenced by its first-half 2024 revenue of €292.6 million.

Price

Evotec's fee-for-service model underpins its pricing strategy, allowing clients to pay for specific drug discovery and development tasks. This approach offers significant flexibility, enabling partners to engage Evotec for precisely defined stages of research and development, ensuring clarity on costs incurred for services rendered.

This model is crucial for managing project budgets and resource allocation, particularly in the high-stakes pharmaceutical industry. For instance, in 2023, Evotec reported revenue from its integrated services, which heavily rely on this fee-for-service structure, highlighting its importance in their financial performance.

Evotec's revenue model heavily relies on milestone payments and future royalties, especially within its co-creation partnerships. This approach directly links Evotec's financial gains to the successful development and commercialization of partnered drug candidates, embodying a shared risk and reward philosophy.

For instance, in 2023, Evotec reported total revenue of €753 million, with a significant portion stemming from these performance-based payments. The company's strategy is to earn upfront fees, development milestones, and ultimately, royalties on net sales of approved products, demonstrating a commitment to long-term value creation alongside its partners.

Evotec's proprietary platforms like PanOmics and AI-driven drug design are priced based on the significant value they deliver, including faster development timelines and higher success probabilities. This value-based approach acknowledges the advanced nature and competitive edge these technologies provide to partners in the pharmaceutical industry.

Long-Term Strategic Partnership Pricing

For its long-term strategic partnerships, Evotec's pricing likely incorporates a blended model. This typically includes upfront fees for services rendered, a per-full-time-equivalent (FTE) rate for ongoing research, and crucially, substantial milestone payments tied to the progression of drug candidates. Royalties on future commercial sales are also a key component, aligning Evotec's success directly with the long-term value of the collaboration.

This multifaceted pricing strategy aims to build robust, enduring relationships by sharing in the ultimate commercial success of the partnered assets. For instance, in 2024, similar strategic collaborations in the biotech sector have seen upfront payments ranging from USD 5 million to USD 20 million, with potential milestones reaching several hundred million dollars per successful drug candidate.

- Fee-for-Service: Covers initial research and development activities.

- FTE-Based Research: Provides ongoing scientific support and expertise.

- Milestone Payments: Rewards achievement of predefined development targets.

- Royalty Streams: Captures a share of future commercial revenues.

Asset-Lighter Model Impact on Pricing

Evotec's move towards an asset-lighter model, highlighted by the planned sale of its Toulouse biologics manufacturing site, is set to refine its revenue streams and boost profitability. This strategic pivot signals a greater emphasis on high-margin intellectual property and technology licensing, directly influencing how future offerings will be priced to maximize capital efficiency and returns.

This shift is anticipated to enhance Evotec's profit margins by reducing the capital expenditure associated with physical manufacturing. For instance, the divestment of such assets allows for reinvestment into core research and development, potentially leading to a more robust pipeline of high-value intellectual property. This focus on IP licensing, rather than capital-intensive production, is a key driver for future pricing strategies, aiming for premium valuations on its technological innovations.

- Enhanced Profit Margins: By divesting manufacturing assets, Evotec can focus resources on its core competencies, leading to higher operating margins.

- Improved Capital Efficiency: Reducing the asset base frees up capital, allowing for more strategic investments in R&D and technology development, thereby increasing return on capital employed.

- Focus on IP Licensing: The strategy emphasizes monetizing intellectual property and technological platforms, which typically command higher margins than contract manufacturing.

- Pricing Strategy Evolution: Future pricing will likely reflect the value of proprietary technology and data, moving away from cost-plus models towards value-based pricing for its licensing agreements.

Evotec's pricing strategy is deeply integrated with its service offerings, primarily operating on a fee-for-service model for specific research tasks. This allows clients to pay for defined stages of drug discovery and development, ensuring cost transparency and budget control. For example, in 2023, Evotec's revenue from integrated services, which are central to this pricing approach, demonstrated its financial significance.

Beyond upfront fees, Evotec heavily utilizes milestone payments and royalties, particularly in co-creation partnerships. This means their earnings are directly tied to the success of partnered drug candidates, reflecting a shared risk and reward dynamic. In 2023, the company reported €753 million in total revenue, with performance-based payments forming a substantial part of this figure.

Proprietary platforms like PanOmics and AI-driven drug design are priced based on the significant value they bring, such as accelerated timelines and improved success rates. This value-based pricing acknowledges the competitive advantage these advanced technologies offer. For long-term partnerships, a blended model including upfront fees, FTE rates, milestones, and royalties is common, aligning Evotec's compensation with the ultimate commercial success of the assets.

Evotec's strategic shift towards an asset-lighter model, exemplified by the planned sale of its biologics manufacturing site in Toulouse, is refining its revenue streams and profitability. This move emphasizes high-margin intellectual property and technology licensing, which will shape future pricing towards maximizing capital efficiency and returns on its innovations.

| Pricing Component | Description | Example (Illustrative) | 2023 Impact |

| Fee-for-Service | Payment for specific R&D tasks. | Upfront fees for initial screening. | Core revenue driver for integrated services. |

| FTE-Based Research | Ongoing scientific support. | Monthly billing for dedicated research teams. | Supports long-term partnership models. |

| Milestone Payments | Tied to development progress. | Payment upon successful preclinical data. | Contributes to performance-based revenue. |

| Royalties | Share of future commercial sales. | Percentage of net sales for approved drugs. | Long-term value creation component. |

| Value-Based Pricing (Proprietary Tech) | Reflects enhanced timelines/success rates. | Premium for AI-driven compound optimization. | Drives higher margins on IP. |

4P's Marketing Mix Analysis Data Sources

Our Evotec 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including official company disclosures, investor relations materials, and detailed product portfolio information. We also incorporate insights from scientific publications, patent filings, and industry-specific market research to provide a robust understanding of their strategic approach.