Eutelsat Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eutelsat Group Bundle

Gain a competitive edge with our comprehensive PESTLE analysis of Eutelsat Group. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the satellite communications landscape. Discover the technological advancements and regulatory frameworks that will define Eutelsat's future. Don't miss out on critical insights—download the full analysis now to unlock actionable intelligence for your strategic planning.

Political factors

Increasing geopolitical tensions significantly challenge Eutelsat Group's operations and ability to secure vital landing rights globally. The ongoing conflict in Ukraine has, for example, impacted broadcasting contracts, though Eutelsat minimized exposure to Russian channels by H1 2024. Furthermore, escalating competition between space powers like the U.S. and China creates a more fragmented regulatory environment, potentially hindering Eutelsat's market access and service deployment in key regions through 2025.

Governments act as crucial stakeholders in the satellite sector, serving as both significant customers and key regulators for companies like Eutelsat Group.

The 2023 merger of Eutelsat and OneWeb necessitated securing approvals from numerous national governments, underscoring the complex regulatory landscape.

Notably, the UK government retained a special share in OneWeb, granting it exclusive rights to safeguard national security interests, particularly concerning critical infrastructure.

This highlights the essential need for Eutelsat Group to align its operations with national strategic objectives, especially for defense and secure communications contracts, which remain a significant focus into 2025.

Eutelsat Group's global satellite operations are significantly influenced by international bodies like the International Telecommunication Union (ITU). The ITU allocates critical radio-frequency spectrum and satellite orbital slots essential for Eutelsat's services. Regulations, updated through World Radiocommunication Conferences (WRCs), are crucial for managing global satellite services and preventing interference. The 2024 edition of the ITU Radio Regulations, effective January 2025, directly shapes the regulatory environment for new satellite technologies and services, impacting Eutelsat's future strategic deployments.

Public-Private Partnerships

Public-private partnerships are increasingly vital for satellite companies like Eutelsat, fostering collaboration between governments and private entities for strategic goals. This trend is evident in projects such as the EU's €6 billion IRIS² constellation, where Eutelsat is a key consortium member, targeting secure connectivity by 2027. Such alliances provide access to substantial public funding and shared resources, driving innovation in space exploration and national infrastructure. These collaborations are set to expand through 2025, offering Eutelsat enhanced project stability and market opportunities.

- EU's IRIS² program: €6 billion investment by 2027.

- Eutelsat: Key consortium member in the IRIS² project.

- Partnerships: Access to public funding and shared resources.

- Forecast: Continued growth in collaborative space initiatives through 2025.

Trade Policies and Sanctions

Global trade policies and the imposition of sanctions significantly impact Eutelsat Group's revenue and operations. For instance, EU regulations enacted in 2022 led to Eutelsat suspending the broadcasting of several Russian channels, affecting service agreements. Protectionist trade policies and ongoing trade disputes between major economic blocs, such as the US and China, could elevate the cost of satellite components and disrupt supply chains for manufacturing. This uncertainty necessitates Eutelsat to diversify its procurement strategies and monitor geopolitical shifts closely through 2025.

- EU sanctions in 2022 directly curtailed Eutelsat's service provision in certain markets.

- Potential trade tariffs could increase satellite component costs by an estimated 5-10% for new procurements.

- Geopolitical tensions influence supply chain stability for high-tech satellite parts.

Eutelsat Group operates within a complex political environment, influenced by geopolitical tensions that impact market access and broadcasting contracts. Governments act as crucial regulators and customers, with merger approvals and national security interests, like the UK's special share in OneWeb, being paramount. International bodies such as the ITU significantly shape the regulatory framework, with the 2024 Radio Regulations effective January 2025. Furthermore, public-private partnerships, exemplified by the EU's €6 billion IRIS² program by 2027, offer strategic funding and growth opportunities.

| Political Factor | Impact on Eutelsat | 2024/2025 Data Point |

|---|---|---|

| Geopolitical Tensions | Market access, contract stability | Minimized Russian channel exposure by H1 2024 |

| Governmental Regulation | Merger approvals, national security alignment | UK government retained special share in OneWeb post-2023 merger |

| International Regulatory Bodies | Spectrum allocation, orbital slots | ITU Radio Regulations effective January 2025 |

| Public-Private Partnerships | Funding, strategic project participation | EU IRIS² program: €6 billion investment by 2027 |

| Trade Policies & Sanctions | Revenue, supply chain stability | EU sanctions in 2022 led to Russian channel suspensions |

What is included in the product

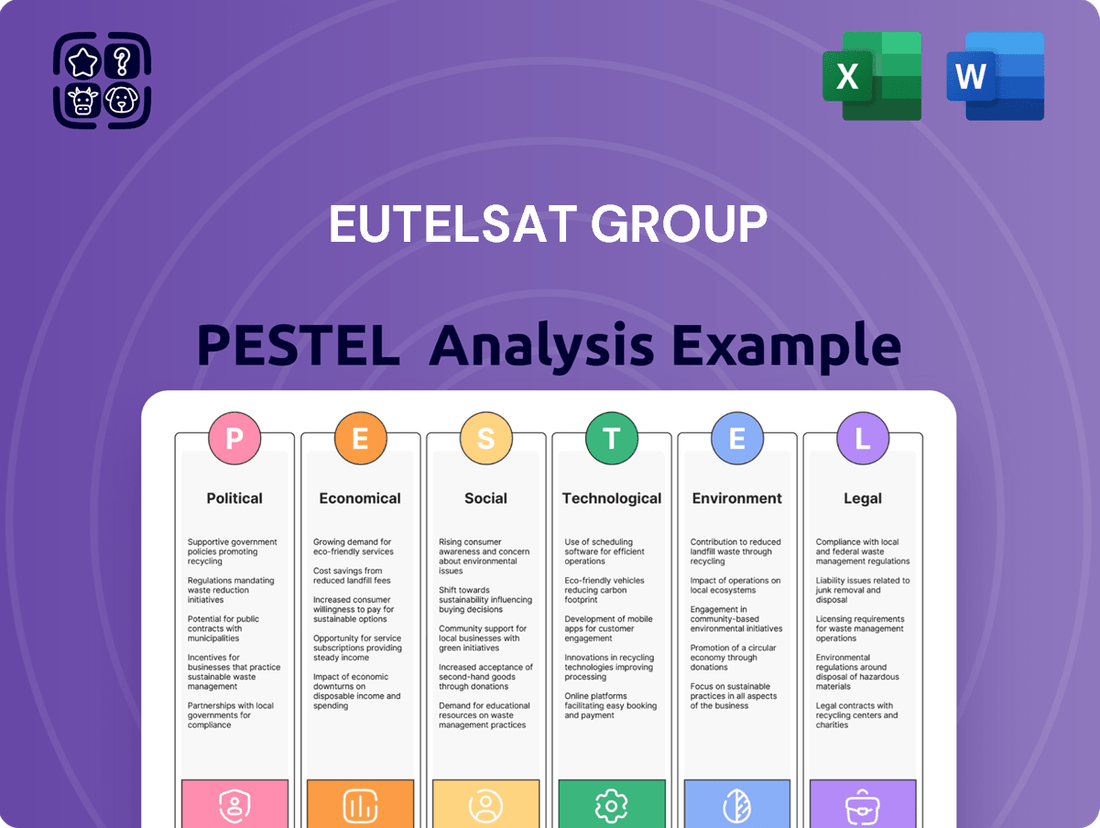

This Eutelsat Group PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

It provides a comprehensive overview of the macro-environmental landscape, highlighting key trends and their implications for the satellite telecommunications sector.

A concise Eutelsat Group PESTLE analysis, presented in a clear, summarized format, acts as a pain point reliver by offering immediate insights into external factors impacting the business, thus streamlining strategic decision-making and fostering cross-functional alignment.

Economic factors

The global satellite market is experiencing robust growth, with projections indicating it could exceed $600 billion by 2030, driven by the escalating demand for ubiquitous connectivity, particularly in remote and emerging regions. This expansion intensifies competition for Eutelsat, as new mega-constellations like SpaceX's Starlink, which surpassed 3 million subscribers in early 2025, and Amazon's Project Kuiper rapidly deploy thousands of low-Earth orbit satellites. These new entrants offer high-speed, low-latency services, challenging traditional geostationary satellite operators and reshaping market dynamics.

Eutelsat Group is actively reshaping its revenue streams, moving away from traditional video services which saw a 4.6% decline in Q3 FY2024. This strategic shift is crucial as the company prioritizes high-growth connectivity segments, particularly LEO-enabled solutions. Connectivity services, including government and mobile applications, are demonstrating robust expansion, projected to drive growth for FY2025 with strong demand for satellite broadband. This diversification helps offset the ongoing structural decline in the video segment, supporting overall revenue stability and future growth.

The satellite industry inherently demands substantial capital, requiring significant investment in satellite manufacturing, launch services, and ground infrastructure. Eutelsat Group projects its capital expenditure to be between €500 million and €600 million for the 2024-2025 fiscal year, reflecting ongoing investments in its satellite assets. Successfully managing these considerable investments is crucial for the company's financial health. Maintaining a healthy financial leverage ratio while undertaking these large outlays is paramount for Eutelsat Group's long-term sustainability.

Merger Synergies and Financial Outlook

The Eutelsat-OneWeb merger projects over €1.5 billion in value creation, driven by revenue, capex, and cost synergies. The combined entity targets double-digit revenue and EBITDA growth over the medium to long term, reflecting significant post-merger potential. For the 2024-2025 fiscal year, Eutelsat anticipates stable revenues for its operating activities, demonstrating a steady financial base.

- Synergies from the OneWeb merger are projected to exceed €1.5 billion.

- The combined group aims for double-digit revenue and EBITDA growth in the medium to long term.

- Eutelsat expects stable operating revenues for the 2024-2025 fiscal period.

Currency Fluctuations

As a global satellite operator, Eutelsat Group faces significant exposure to currency exchange rate fluctuations, particularly between the Euro and the US Dollar. Favorable movements, such as a stronger US Dollar against the Euro, can positively impact reported revenues and EBITDA, given a substantial portion of their contracts are denominated in USD. Conversely, unfavorable shifts can notably reduce financial performance. For instance, in its FY2024 H1 report, Eutelsat noted currency effects, primarily USD/EUR, impacted reported revenues, highlighting this ongoing sensitivity.

- Eutelsat's FY2024 H1 revenue reported a -0.6% impact from currency effects.

- A stronger US Dollar generally benefits Eutelsat's USD-denominated revenues when translated to Euros.

- The company actively manages currency risks, though full mitigation is challenging.

- Future movements remain a key variable for 2025 financial outlooks.

Eutelsat Group projects capital expenditure between €500 million and €600 million for FY2024-2025, reflecting substantial investment needs. The OneWeb merger anticipates over €1.5 billion in value creation, targeting double-digit revenue and EBITDA growth medium to long term. Stable operating revenues are expected for FY2024-2025, though currency fluctuations, like the -0.6% impact on FY2024 H1 revenues from USD/EUR shifts, remain a key factor.

| Factor | Outlook (FY2024-2025) | Impact | ||

|---|---|---|---|---|

| Capital Expenditure | €500-€600 million | Significant investment for infrastructure | ||

| OneWeb Merger Synergies | >€1.5 billion | Drives medium-term growth targets | ||

| Currency Fluctuations | USD/EUR sensitivity | FY2024 H1 revenue impact: -0.6% |

What You See Is What You Get

Eutelsat Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Eutelsat Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the satellite communications industry. It provides an in-depth understanding of the external forces shaping Eutelsat's strategic landscape. The insights presented are crucial for identifying opportunities and mitigating risks in a dynamic global market.

The content and structure shown in the preview is the same document you’ll download after payment.

You will gain a clear picture of regulatory shifts, economic trends influencing investment, and societal adoption of satellite services. Furthermore, the analysis covers technological advancements driving innovation and legal frameworks governing operations, alongside environmental considerations paramount in the space sector.

Sociological factors

There is a significant societal demand for high-speed internet in remote areas, with approximately 2.6 billion people globally still lacking connectivity as of early 2024. Satellite internet, like that offered by Eutelsat Group through its OneWeb constellation, is a crucial solution to bridge this digital divide, enabling access to vital education, healthcare, and economic opportunities. Eutelsat is actively involved in global initiatives, such as the ITU's Partner2Connect Digital Coalition, aiming to connect underserved populations worldwide and contribute to digital inclusion targets for 2025.

The decline in traditional satellite TV broadcasting, driven by evolving media consumption habits, significantly impacts Eutelsat Group's legacy video business. Consumers increasingly favor on-demand streaming services, leading to a projected 5% annual decline in global linear TV viewership through 2025. In response, Eutelsat is strategically pivoting, with its connectivity services, including broadband and mobile connectivity, expected to comprise over 80% of its revenue by fiscal year 2025, up from 60% in fiscal year 2023. This shift addresses the changing preferences, focusing on high-growth connectivity markets to adapt to the evolving digital landscape.

There is a rising expectation for seamless, high-speed internet connectivity while traveling, whether by air or sea. This creates a significant market opportunity for satellite operators like Eutelsat Group to provide broadband services. The global in-flight connectivity market is projected to reach $10-12 billion by 2025, driven by passenger demand for entertainment and productivity. Similarly, the maritime industry seeks robust connectivity for operational efficiency and crew welfare, with a strong uptake in high-throughput satellite services.

Increased Remote Working and Education

The global surge in remote work and online education has significantly heightened the demand for reliable, high-quality internet, particularly in residential and rural areas. Satellite internet offers a vital connectivity solution for households requiring robust broadband for professional and academic pursuits. This trend directly fuels the expansion of the home satellite internet market, representing a key growth driver for Eutelsat Group in 2024-2025.

- Global remote work adoption remains strong, with projections indicating over 30% of the workforce operating remotely or hybrid by mid-2025.

- Demand for reliable broadband in rural areas, often underserved by fiber, is projected to increase by 15-20% through 2025.

- Eutelsat's satellite broadband services are strategically positioned to capture this growing market segment.

Public Perception of Space Activities

Public perception significantly impacts the space sector, with growing awareness of environmental concerns like space debris influencing public opinion and potential regulatory action on satellite operators. Companies demonstrating strong commitments to sustainable practices, such as de-orbiting older satellites or using less polluting propellants, often build a more favorable public image. Eutelsat Group, for instance, holds a high rating for space sustainability, reflecting its efforts to address these critical environmental concerns and maintain public trust. This proactive stance is crucial as the number of active satellites approaches 12,000 by early 2025.

- By Q1 2025, over 12,000 active satellites are projected to be in orbit, intensifying space debris concerns.

- Public sentiment increasingly favors satellite operators with robust environmental, social, and governance (ESG) frameworks.

- Eutelsat Group's high sustainability rating enhances its reputation and competitive edge among stakeholders.

- Future regulations, potentially influenced by public pressure, may mandate stricter debris mitigation standards for all operators.

The global push for digital inclusion drives demand for satellite internet, with 2.6 billion people still lacking connectivity by early 2024. Evolving media habits see a 5% annual decline in linear TV viewership through 2025, prompting Eutelsat to pivot towards connectivity, projected to be 80% of its revenue by FY2025. Rising remote work and mobility connectivity needs, alongside public concern over space debris, shape market opportunities and operational sustainability for Eutelsat.

| Factor | Trend (2024-2025) | Impact on Eutelsat |

|---|---|---|

| Digital Divide | 2.6B unserved internet | Drives demand for satellite broadband |

| Media Consumption | 5% annual TV decline | Shifts revenue to connectivity |

| Remote Work | 30%+ workforce remote | Expands home internet market |

| Sustainability | 12K+ satellites by Q1 2025 | Influences public perception, regulation |

Technological factors

The satellite industry is rapidly transforming with the deployment of large Low Earth Orbit (LEO) constellations, which offer significantly lower latency and global coverage compared to traditional Geostationary Earth Orbit (GEO) satellites. Eutelsat's merger with OneWeb, finalized in Q4 2023, established the first integrated GEO-LEO operator globally. This strategic hybrid approach allows Eutelsat Group to provide complementary services, leveraging GEO for broadcast and high-capacity data and LEO for low-latency connectivity, addressing a wider range of customer needs across diverse markets. This diversified capability is a key competitive advantage, with Eutelsat targeting a 2025 revenue of approximately €1.2 billion through this enhanced service portfolio.

Continuous innovation drives more advanced and efficient satellite capabilities within the Eutelsat Group. High-throughput satellites (HTS) like Eutelsat Konnect VHTS, launched in Q3 2022, deliver over 500 Gbps capacity, significantly enhancing broadband services across Europe and Africa. The Group is strategically investing in next-generation technologies, including the planned second-generation OneWeb constellation set for deployment by 2028. These advancements focus on software-defined satellites and flexible payloads, crucial for expanding service offerings and improving data speeds for customers by 2025.

A key technological shift involves the convergence of satellite and terrestrial networks, particularly 5G. Eutelsat Group is actively leveraging this by successfully trialing 5G Non-Terrestrial Network (NTN) technology over its LEO satellites, including tests in early 2024. This integration is set to provide seamless global connectivity for 5G devices, expanding market opportunities significantly. It unlocks new applications for the burgeoning Internet of Things (IoT) sector, projected to reach a global market value of over $1.5 trillion by 2030, and the automotive industry, enhancing connected vehicle capabilities.

Artificial Intelligence and Automation

Artificial intelligence (AI) is increasingly vital for the satellite industry, optimizing Eutelsat's network management and automating traffic control. By 2025, the global AI in space market is projected to reach over $3 billion, with a significant portion dedicated to enhancing satellite operations. Eutelsat is expected to leverage AI to streamline operations, improving service quality and efficiency across its fleet. AI also enhances data analytics for diverse applications, from precise environmental monitoring to tracking illicit activities, providing deeper insights from vast satellite data.

- Satellite AI market value projected to exceed $3 billion by 2025.

- AI adoption aims to reduce operational costs by 15-20% for satellite operators.

- Enhanced data analytics from AI can boost satellite data utilization by 30% for various applications.

- Eutelsat's integration of AI targets improved network resilience and real-time anomaly detection.

Advanced Video and Data Compression

Advanced video and data compression significantly boosts the efficiency of Eutelsat's satellite transmissions, especially for high-bandwidth video broadcasting. The company actively leverages formats like HEVC (High Efficiency Video Coding) and VVC (Versatile Video Coding) to deliver superior quality content, including Ultra HD and 4K/8K, using considerably less bandwidth. This technological edge allows Eutelsat to optimize its satellite capacity, supporting the growing demand for high-definition media services. By early 2025, the adoption of VVC is expected to provide up to 50% better compression than HEVC, enabling more channels or higher resolutions within existing spectrum. This efficiency directly impacts operational costs and service scalability for its broadcast clients.

- HEVC adoption has already reduced bandwidth needs by up to 40% for many HD transmissions.

- VVC is projected to offer an additional 25-50% compression improvement over HEVC by 2025.

- Eutelsat's utilization of these codecs supports the expansion of 4K/8K content delivery services.

- Enhanced compression facilitates more efficient use of satellite transponder capacity for broadcasting.

Eutelsat Group's technological edge stems from its Q4 2023 OneWeb merger, forming the first integrated GEO-LEO operator globally, targeting €1.2 billion revenue by 2025. Continuous innovation, including the Eutelsat Konnect VHTS launched in Q3 2022 with over 500 Gbps capacity and early 2024 5G NTN trials, enhances connectivity. AI adoption, with the market exceeding $3 billion by 2025, streamlines operations, while VVC compression offers 50% better efficiency by early 2025 for broadcast services.

| Technological Factor | Key Development | Impact/Metric (2024/2025) |

|---|---|---|

| GEO-LEO Integration | OneWeb Merger Finalized | Targeted 2025 Revenue: €1.2 Billion |

| Next-Gen Satellites | Eutelsat Konnect VHTS | 500+ Gbps Capacity (Launched Q3 2022) |

| Network Convergence | 5G NTN Trials | Successful Trials in Early 2024 |

| AI Integration | AI in Space Market | Projected Value: >$3 Billion by 2025 |

| Video Compression | VVC Adoption | Up to 50% Better Compression by Early 2025 |

Legal factors

Eutelsat Group's operations hinge on securing vital radio-frequency spectrum and orbital slot licenses from national and international bodies like the ITU. These licenses are crucial for preventing signal interference and represent a finite resource, intensifying competition from new satellite constellations in 2024. The ITU's Radio Regulations, updated at conferences such as WRC-23 in late 2023, govern this complex allocation process. The next World Radiocommunication Conference is slated for 2027, shaping future access.

National security and investment acts significantly impact mergers and acquisitions within the satellite sector. The Eutelsat-OneWeb merger, for instance, faced scrutiny under the UK's National Security and Investment Act 2021, which became fully effective in January 2022. Such regulations are crucial for safeguarding critical national infrastructure and sensitive technologies, ensuring governmental oversight on foreign investments. This legislative framework, increasingly prevalent globally in 2024, adds a layer of complexity to strategic consolidations like the €3.4 billion Eutelsat-OneWeb combination, which officially completed in September 2023.

Growing international focus on space debris is driving new regulations and standards for mitigation. Eutelsat Group adheres to these, with its debris mitigation plan aligned with both international guidelines and the stringent French Space Operations Act, effective as of 2025, which mandates end-of-life satellite re-orbiting and passivation. This ensures that satellites, like those in the OneWeb constellation, are safely de-orbited or moved to graveyard orbits. Eutelsat's CEO has advocated for regulations denying market access to operators failing to comply with these critical debris reduction rules, impacting future licensing and operational frameworks.

Corporate Sustainability Reporting Directive (CSRD)

Eutelsat Group faces increasing regulatory pressure from evolving ESG reporting requirements, notably the EU’s Corporate Sustainability Reporting Directive (CSRD).

The company is actively preparing for these new mandates, which require more comprehensive disclosure on sustainability matters, becoming effective for large companies from January 1, 2024, for fiscal year 2024 reporting.

This preparation includes developing a double materiality matrix to identify significant ESG impacts, risks, and opportunities, ensuring compliance by the 2025 reporting deadline for 2024 data.

- CSRD mandates detailed ESG disclosures for Eutelsat from FY2024.

- Compliance requires extensive data collection and reporting infrastructure.

- The directive impacts over 50,000 EU companies.

- Eutelsat is developing a double materiality matrix to manage this transition.

Sanctions and Broadcasting Regulations

Eutelsat Group must rigorously comply with international sanctions and national broadcasting regulations, directly affecting its client base and revenue streams. For instance, the company implemented EU regulations leading to the suspension of broadcasting services for several Russian media groups in late 2022 and early 2023, impacting potential recurring revenue. These legal requirements are dynamic, necessitating constant monitoring and adaptation by Eutelsat to navigate evolving geopolitical landscapes and maintain operational legality. The ongoing compliance costs and potential market restrictions remain a factor for its 2024-2025 fiscal outlook.

- EU sanctions continue to influence Eutelsat's service offerings.

- Regulatory compliance costs are an ongoing operational expense.

- Geopolitical shifts can introduce new broadcasting restrictions.

- Client portfolio diversification is crucial given sanction risks.

Eutelsat Group faces stringent legal frameworks, from securing vital radio-frequency licenses governed by ITU regulations, with WRC-27 on the horizon, to adhering to national security acts impacting M&A like the €3.4 billion OneWeb merger. The French Space Operations Act, effective 2025, mandates strict space debris mitigation. Additionally, the EU’s CSRD requires comprehensive ESG disclosures for FY2024, due in 2025, alongside ongoing international sanctions affecting broadcasting services and 2024-2025 revenue streams.

| Legal Factor | Key Legislation/Body | Impact on Eutelsat (2024-2025) |

|---|---|---|

| Spectrum/Orbital Rights | ITU Radio Regulations | Ensures operational access; WRC-27 shapes future. |

| Space Debris | French Space Operations Act | Mandates mitigation from 2025; operational costs. |

| ESG Reporting | EU CSRD | Requires FY2024 disclosures by 2025 deadline. |

Environmental factors

The escalating problem of space debris poses a critical collision risk to operational satellites, a major environmental concern for the industry. Eutelsat has implemented a comprehensive mitigation policy for its GEO and LEO fleets, earning a high Space Sustainability Rating of 4.3 out of 5 for its efforts as of early 2024. The company is also a founding member of the Net Zero Space initiative, which aims to achieve orbital sustainability by 2030. This proactive approach underscores Eutelsat's commitment to responsible space operations amidst growing orbital congestion.

Eutelsat Group is actively committed to significantly reducing its carbon footprint and greenhouse gas emissions on Earth. The company has established ambitious science-based targets, which are officially validated by the Science Based Targets initiative (SBTi). By 2030, Eutelsat aims for a 50% absolute reduction in its Scope 1 and 2 emissions. Additionally, it targets a 52% reduction in the carbon intensity of its Scope 3 emissions, reflecting a comprehensive environmental strategy.

Eutelsat Group's ground-based teleports and facilities are major energy consumers, driving significant operational costs. To mitigate this impact, the company is actively investing in renewable energy solutions, such as installing solar panel systems at various teleport locations. For instance, Eutelsat has been expanding its use of solar power at sites like Rambouillet, France. Furthermore, Eutelsat is transitioning to green energy contracts, aiming to reduce its carbon footprint and operational emissions across its global infrastructure by leveraging certified renewable sources for its electricity needs, aligning with 2025 sustainability targets.

Climate Change-Related Financial Disclosures

Eutelsat Group is proactively aligning its financial reporting with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). This commitment, increasingly vital for investors in 2024, involves rigorously assessing and disclosing the potential financial risks and opportunities stemming from climate change. This enhanced transparency reflects the growing demand from stakeholders for clear insights into environmental governance and resilience. The company’s 2024 reporting highlights its efforts to integrate climate considerations into strategic planning, providing crucial data for environmentally conscious investment decisions.

- Eutelsat’s 2024 disclosures emphasize climate risk integration.

- TCFD alignment boosts investor confidence and transparency.

- Financial opportunities from sustainable practices are being identified.

- Increased stakeholder demand for climate-related financial data is a key driver.

Environmental Management Systems

Eutelsat Group is actively enhancing its environmental stewardship by pursuing ISO 14001 certification for its key operational sites, aiming to systematically manage its environmental impact. This initiative builds on existing certifications, as the company’s GEO satellite operations already hold ISO 9001 for quality management and ISO 27001 for information security management. These internationally recognized standards demonstrate Eutelsat’s robust commitment to operational excellence and environmental responsibility, which is crucial for its 2024/2025 strategic objectives.

- Eutelsat is working towards ISO 14001 certification for principal operational sites.

- GEO satellite operations are ISO 9001 certified for quality management.

- GEO satellite operations are ISO 27001 certified for information security.

Eutelsat Group actively addresses environmental challenges, particularly space debris and carbon emissions, with a high Space Sustainability Rating of 4.3 out of 5 in early 2024. The company targets a 50% absolute reduction in Scope 1 and 2 emissions by 2030, supported by investments in renewable energy and green contracts for ground facilities, aligning with 2025 goals. Furthermore, Eutelsat is pursuing ISO 14001 certification for key operational sites and aligning 2024 financial reporting with TCFD recommendations for climate risk transparency.

| Environmental Aspect | 2024/2025 Status/Target | Key Metric |

|---|---|---|

| Space Debris Mitigation | Achieved 4.3/5 SSR | Space Sustainability Rating |

| Carbon Emission Reduction | 50% Scope 1 & 2 cut by 2030 | SBTi validated targets |

| Renewable Energy Use | Expanding solar, green contracts | Operational cost reduction |

PESTLE Analysis Data Sources

Our Eutelsat Group PESTLE Analysis draws on data from leading international organizations like the ITU and ESA, alongside reports from major financial institutions and market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the satellite communications industry.