Eutelsat Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eutelsat Group Bundle

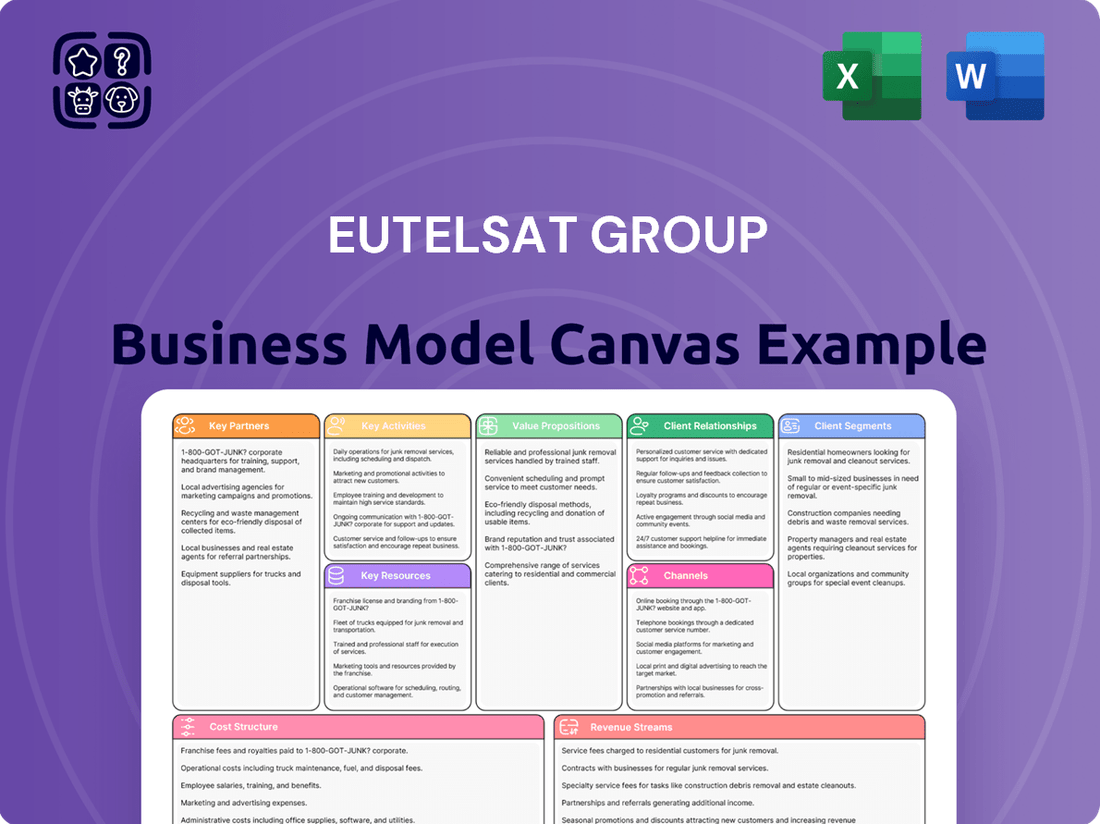

Explore the intricate strategic framework of Eutelsat Group with our comprehensive Business Model Canvas. This detailed analysis unpacks their key partners, customer segments, and value propositions in the satellite communications industry.

Discover Eutelsat's revenue streams and cost structure, essential elements for understanding their financial success and operational efficiency.

Unlock actionable insights into how Eutelsat leverages its core competencies and key resources to maintain a competitive edge in the global market.

Want to understand the driving forces behind Eutelsat's market dominance? Our full Business Model Canvas provides a clear, section-by-section breakdown, perfect for strategic planning and competitive analysis.

Gain a deep understanding of Eutelsat's customer relationships and distribution channels, crucial for anyone looking to emulate their success.

Ready to dissect Eutelsat's winning strategy? Download the complete Business Model Canvas to get a professionally written snapshot of their entire operation, ready for your own strategic development.

Partnerships

The strategic alliance with OneWeb is central to Eutelsat Group's 2024 strategy, establishing the first integrated GEO-LEO satellite operator globally.

This partnership leverages Eutelsat’s robust GEO fleet, optimized for broadcasting, alongside OneWeb’s low-latency LEO constellation, which completed its initial deployment of over 600 satellites by May 2023, enabling global, high-speed connectivity.

For investors, this represents a unique competitive advantage, pivoting the group towards high-growth connectivity markets and diversifying its revenue streams beyond traditional broadcasting.

Eutelsat Group maintains essential alliances with aerospace leaders such as Thales Alenia Space and Airbus Defence and Space for satellite design and construction.

Launch services are primarily secured through partners like SpaceX and Arianespace, crucial for deploying multi-million dollar assets.

For instance, Eutelsat launched its EUTELSAT 36D satellite with SpaceX in March 2024, highlighting ongoing collaboration.

These relationships directly influence Eutelsat's capital expenditure efficiency, which was €231 million for the nine months ending March 31, 2024, and bolster its service capabilities.

Eutelsat Group critically relies on partnerships with major telecommunication operators, internet service providers, and system integrators to expand its market reach and ensure robust service delivery. These key partners act as vital distribution channels, seamlessly integrating Eutelsat's satellite capacity into comprehensive end-user solutions. For instance, they bundle services for cellular backhaul, enterprise networking, and consumer broadband, leveraging Eutelsat OneWeb’s multi-orbit capabilities. This B2B2C model, particularly strengthened by the Eutelsat OneWeb merger, allows the company to scale its global services efficiently without managing every end-customer relationship, contributing to the €714 million revenue reported for the first nine months of fiscal year 2024.

Government & Defense Agencies

Eutelsat Group maintains vital partnerships with national governments and defense agencies, serving as a key customer segment for secure and resilient communications. These collaborations are crucial for regulatory approvals, especially for spectrum allocation, and often involve significant research and development funding. Such relationships provide stable, long-term revenue streams and strategic alignment for Eutelsat's defense and government services, which contributed to its overall revenue in 2024.

- Government contracts represent a stable, long-term revenue source for Eutelsat.

- Strategic alignment with defense agencies drives innovation in secure satellite services.

- Regulatory approvals and spectrum allocation are facilitated by these partnerships.

- Collaborations often lead to R&D funding for advanced communication technologies.

Key Technology and Ground Segment Partners

Eutelsat Group relies on crucial collaborations with technology firms specializing in modems, antennas, and network management software, such as ST Engineering iDirect and Gilat Satellite Networks. These partnerships are vital as they provide the critical ground equipment and software necessary for robust end-to-end satellite services. Such relationships ensure seamless interoperability and drive the development of innovative, highly efficient solutions for Eutelsat’s diverse global customer base, supporting services like broadband connectivity. In 2024, the focus remains on advancing ground segment capabilities to handle increased data traffic and ensure network resilience.

- ST Engineering iDirect is a key partner, supplying advanced ground infrastructure, including modems and hub systems.

- Gilat Satellite Networks provides crucial very small aperture terminal (VSAT) technology for various applications.

- These collaborations are essential for managing Eutelsat’s network of over 30 geostationary satellites.

- Ground segment innovation supports the delivery of services generating billions in annual revenues, with continued investment in 2024.

Eutelsat Group’s key partnerships are foundational, from the strategic OneWeb merger establishing global GEO-LEO connectivity to essential alliances with aerospace and launch providers like SpaceX, which deployed EUTELSAT 36D in March 2024.

Collaborations with telecom operators and governments are crucial for market reach and stable revenue, contributing to €714 million in revenue for the first nine months of fiscal year 2024.

Additionally, technology firms ensure robust ground segment infrastructure, critical for service delivery and network resilience.

| Partner Type | Key Partner Example | Strategic Impact |

|---|---|---|

| Satellite Operators | OneWeb | Integrated GEO-LEO services, global coverage |

| Aerospace & Launch | SpaceX (EUTELSAT 36D, March 2024) | Asset deployment, capital expenditure efficiency (€231M 9M FY24) |

| Distribution Channels | Telecom Operators, ISPs | Market reach, B2B2C model, revenue growth (€714M 9M FY24) |

| Technology Providers | ST Engineering iDirect | Ground segment innovation, network resilience |

| Government & Defense | National Governments | Regulatory approvals, stable revenue streams |

What is included in the product

This Business Model Canvas provides a detailed, strategic overview of Eutelsat Group's operations, outlining key customer segments, value propositions, and channels.

It reflects Eutelsat's real-world business, offering insights into revenue streams and cost structures, making it ideal for investors and strategic analysis.

The Eutelsat Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex satellite communications operations, enabling quick understanding and strategic alignment.

This structured approach simplifies the identification of key customer segments and value propositions, alleviating the pain of navigating intricate global service delivery and infrastructure management.

Activities

The core activity for Eutelsat Group involves the 24/7 operation and management of its extensive satellite fleet, including approximately 35 GEO satellites and over 600 OneWeb LEO satellites, alongside their ground network. This encompasses continuous satellite command and control, intricate traffic management, and proactive service monitoring to ensure high availability and performance. For instance, the company aims for near 99.9% network uptime for critical services. This operational excellence is fundamental to Eutelsat Group’s value proposition and strengthens its brand reputation as a reliable global connectivity provider in 2024.

Eutelsat Group's Service Provisioning and Capacity Management focuses on optimally allocating its extensive satellite fleet, including GEO and the new LEO constellation from OneWeb, to meet diverse customer demands in video, data, and mobility. This involves sophisticated yield management to maximize revenue from finite transponder and LEO bandwidth resources. Efficient capacity utilization is crucial for profitability; for instance, Eutelsat's FY2024 revenue guidance for its combined entity is between €1.25 billion and €1.3 billion, heavily reliant on effective capacity deployment. Maximizing fill rates directly enhances the return on invested capital across its global infrastructure.

Eutelsat Group actively invests in research and development to lead satellite communication innovation, particularly in advanced software-defined satellites, cutting-edge antenna systems, and integrated GEO-LEO service platforms. This strategic focus is essential for developing new applications and enhancing service efficiency, crucial for defending against growing market competition. For instance, Eutelsat's 2024 investments continue to prioritize these next-generation technologies to maintain its competitive edge. This commitment signals to investors a clear path for sustained long-term growth and continuous innovation within the evolving space sector.

Sales, Marketing & Business Development

Eutelsat Group's Sales, Marketing & Business Development focuses on securing long-term contracts across broadcast, government, and mobility verticals. This process is highly complex and relationship-driven, demanding deep technical and market expertise to meet client needs. These efforts are crucial, directly driving the company's revenue backlog and future growth prospects. For instance, Eutelsat's firm order backlog was approximately €4.1 billion as of December 31, 2023, reflecting these critical activities.

- Securing long-term contracts with key customers.

- Focus on broadcast, government, and mobility sectors.

- Complex, relationship-driven sales process.

- Primary driver of revenue backlog and future growth.

Regulatory, Spectrum & Orbital Slot Management

A critical activity for Eutelsat Group involves navigating the intricate international regulatory landscape to secure and defend vital orbital slots and spectrum rights. This is managed primarily through the International Telecommunication Union (ITU), a UN specialized agency that coordinates global spectrum use. These exclusive rights, often acquired through complex and lengthy processes, represent significant intangible assets for Eutelsat, bolstering its market position and acting as substantial barriers to entry for competitors. As of 2024, Eutelsat OneWeb's LEO constellation and Eutelsat's GEO fleet collectively hold numerous filings, vital for delivering services like broadband connectivity.

- Eutelsat Group operates over 35 GEO satellites and a growing LEO constellation via OneWeb, each requiring specific ITU-registered orbital slots.

- ITU filings for new satellite systems can take years, often exceeding 7 years from initial coordination requests to launch, highlighting the long-term strategic nature.

- Spectrum licenses, such as those for Ku-band and Ka-band, are essential for Eutelsat's diverse service offerings including fixed satellite services and mobile connectivity.

- The value of Eutelsat's spectrum and orbital rights is implicitly reflected in its asset base, crucial for its approximately €1.2 billion revenue reported for the first nine months of fiscal year 2024.

Eutelsat Group's core activities involve 24/7 operation of its 35 GEO and 600+ OneWeb LEO satellites, ensuring near 99.9% network uptime. This includes sophisticated capacity management to optimize revenue, with FY2024 guidance between €1.25B and €1.3B. The company also drives innovation through R&D in next-gen technologies and secures long-term contracts, reflecting a €4.1B backlog as of December 2023.

| Metric | 2024 Data |

|---|---|

| Satellites Operated | ~35 GEO, >600 LEO |

| FY2024 Revenue Guidance | €1.25B - €1.3B |

| Order Backlog (Dec 2023) | €4.1B |

Delivered as Displayed

Business Model Canvas

The Eutelsat Group Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This means all sections, data, and strategic insights are present and accurately represented, offering a genuine glimpse into the comprehensive analysis. You can be assured that the final deliverable will be this same, fully unlocked document, ready for immediate use and application to your business strategy.

Resources

Eutelsat Group’s most significant asset is its combined fleet of Geostationary (GEO) and Low Earth Orbit (LEO) satellites. This physical infrastructure, enhanced by the 2023 OneWeb merger, now includes 36 GEO satellites and over 600 LEO satellites, representing a multi-billion dollar investment. This dual-orbit capability provides unparalleled global coverage, supporting diverse services from broadband to broadcast. The integration of GEO and LEO assets, a major strategic move in 2024, positions Eutelsat as a powerful competitive differentiator in the evolving satellite communications market.

Orbital rights and spectrum licenses are indispensable intangible assets for Eutelsat Group, creating a formidable barrier to entry in the satellite communication industry. As of 2024, Eutelsat holds internationally-regulated rights to operate satellites in prime orbital positions and utilize specific radio frequencies across various bands. The scarcity and strategic value of these exclusive licenses, governed by the ITU, are a core component of the company's long-term valuation and competitive advantage. These assets are critical for delivering services like broadband, video, and mobile connectivity globally.

Eutelsat Group's global ground infrastructure, a critical asset, encompasses a worldwide network of teleports, gateways, and extensive fiber-optic links. This robust ground segment is indispensable for seamless service delivery, stringent quality control, and ensuring network resilience for its satellite operations. The strategic placement and advanced technological sophistication of these facilities are key operational assets, supporting services like Eutelsat OneWeb's low-latency connectivity, which aims for global coverage by 2024.

Human Capital & Specialized Expertise

Eutelsat Group relies on a highly skilled workforce, encompassing satellite engineers, network operators, RF experts, and regulatory specialists. This deep pool of specialized knowledge is critical for operating complex space and ground assets, developing innovative solutions, and navigating the industry’s unique challenges. This intellectual capital is a key source of competitive advantage, enabling Eutelsat to maintain its leadership in satellite communications. For instance, as of their 2023 fiscal year, Eutelsat reported approximately 1,100 employees, many possessing this critical expertise.

- Specialized engineers and operators manage complex satellite infrastructure.

- RF experts and regulatory specialists ensure optimal spectrum use and compliance.

- Intellectual capital drives innovation in connectivity and broadcasting solutions.

- A highly skilled workforce is crucial for navigating industry challenges and competitive landscapes.

Financial Strength & Brand Reputation

A robust balance sheet is essential for Eutelsat Group to fund the high capital expenditure needed for new satellite programs, such as the EUTELSAT KONNECT VHTS which commenced service in 2023. This financial strength, coupled with a long-standing brand reputation built on decades of reliability and service quality, is paramount. Such a reputation is crucial for securing high-value contracts with governments and blue-chip corporate clients globally. Eutelsat's revenue for the first nine months of fiscal year 2024 stood at €730 million, underpinning its investment capacity.

- Eutelsat's capital expenditure guidance for FY2024 is approximately €500-530 million.

- The company has a 45-year operational history, fostering trust and reliability.

- Government and corporate contracts often span many years, requiring stable partners.

- EUTELSAT KONNECT VHTS, a high-capacity satellite, began commercial service in 2023.

A robust balance sheet is essential for Eutelsat Group, enabling significant capital expenditure like the €500-530 million guided for fiscal year 2024. This financial stability, underscored by €730 million in revenue for the first nine months of fiscal year 2024, supports high-value satellite programs. Decades of operational history have built a robust brand reputation, crucial for securing long-term government and corporate contracts. This blend of financial strength and trusted reputation is a core competitive advantage.

| Resource Category | Key Metric/Fact | 2024 Data Point |

|---|---|---|

| Financial Strength | FY2024 Capital Expenditure Guidance | €500-530 million |

| Financial Strength | 9M FY2024 Revenue | €730 million |

| Brand Reputation | Operational History | 45+ years |

Value Propositions

Eutelsat Group offers a unique, unified GEO-LEO connectivity solution, combining the wide-beam coverage of its GEO satellites with the low-latency, high-speed capabilities of its OneWeb LEO constellation, which completed its global deployment in 2024. This multi-orbit approach allows Eutelsat to serve a diverse range of applications, from video broadcasting to latency-sensitive enterprise networking and government services. By integrating these capabilities, the Group provides a comprehensive offering addressing the full spectrum of market needs from a single provider. This strategy leverages the combined assets, aiming to optimize network efficiency and customer experience across various segments.

Eutelsat Group's ubiquitous global coverage ensures connectivity and broadcast services reach virtually any point on Earth, including remote landmasses, vast oceans, and airspace beyond terrestrial networks. This capability is crucial for sectors like maritime shipping, aviation, and government agencies requiring universal communication. By leveraging its combined GEO and LEO satellite fleet, which includes the expanding OneWeb constellation expected to be fully operational by 2024, Eutelsat positions itself as a fundamental enabler of essential global communication infrastructure. This wide reach supports critical operations and digital inclusion in underserved areas worldwide.

Eutelsat Group delivers mission-critical reliability with over 99.9% service availability, essential for government, defense, and major enterprise clients.

The inherent security and resilience of satellite networks offer a crucial alternative or backup to terrestrial systems, ensuring continuous operations.

This unwavering focus on secure, resilient communications underpins the long-term, high-value contracts that are a core part of Eutelsat's business model in 2024.

Leading Video Broadcasting Platform

Eutelsat remains a leading video broadcasting platform, delivering over 6,000 television channels to hundreds of millions of households across its DTH satellite neighborhoods globally as of early 2024. For broadcasters, this offers unparalleled audience reach, premium quality, and a proven, cost-effective distribution model, with video services contributing a significant portion of Eutelsat's revenue, estimated around 60% of total revenues in fiscal year 2024. This robust legacy business generates stable cash flows crucial for funding investments in emerging growth areas.

- Global reach to hundreds of millions of households.

- Distribution of over 6,000 television channels.

- Video services contributing approximately 60% of fiscal year 2024 revenues.

- Enables stable cash flow for strategic investments.

Scalable, Managed End-to-End Solutions

Eutelsat Group delivers scalable, managed end-to-end solutions for enterprise and mobility clients, extending beyond raw capacity. This approach simplifies satellite communications procurement, offering a single point of contact for global service. By providing fully managed solutions, Eutelsat enhances customer loyalty and secures premium pricing, as evidenced by a projected 2024 revenue for Connectivity services.

- For fiscal year 2024, Eutelsat Group anticipates Connectivity revenues to be between 700-740 million euros.

- These solutions streamline client operations by managing the entire service lifecycle.

- The bundled service model fosters stronger, more enduring customer relationships.

- This value proposition supports higher average revenue per user (ARPU) compared to pure capacity sales.

Eutelsat Group delivers a unique multi-orbit GEO-LEO connectivity solution, with its OneWeb LEO constellation globally deployed in 2024, ensuring ubiquitous coverage and mission-critical reliability. It remains a leading video broadcasting platform, distributing over 6,000 channels and generating a significant portion of its fiscal year 2024 revenue. The Group also provides scalable, managed end-to-end solutions, with Connectivity revenues projected to reach 700-740 million euros in fiscal year 2024.

| Value Proposition | Key Metric (2024) | Data Point |

|---|---|---|

| Multi-Orbit Connectivity | OneWeb LEO Deployment | Global deployment completed |

| Video Broadcasting | FY2024 Revenue Contribution | ~60% of total revenues |

| Managed Solutions | FY2024 Connectivity Revenue | 700-740 million euros |

Customer Relationships

Eutelsat Group cultivates long-term strategic partnerships, particularly with major customers in the video and government sectors. These relationships are cemented through multi-year contracts, often extending for the entire operational life of a satellite. Dedicated strategic account teams manage these key accounts, fostering deep integration and ensuring high levels of customer retention. This model provides substantial revenue visibility and stability, with Eutelsat reporting a firm order backlog of approximately 4.2 billion euros as of March 2024, underpinning future revenue streams.

Eutelsat Group provides dedicated 24/7 technical and operational support through its global Network Operations Centers (NOCs). These centers continuously monitor satellite services, ensuring swift resolution of any issues that arise. This robust support is crucial for maintaining the high reliability essential for mission-critical services, like those supporting government communications or maritime connectivity. For instance, in their fiscal year ending June 2024, Eutelsat's focus on operational uptime remained paramount, directly impacting customer satisfaction and service level agreements. This continuous oversight reinforces Eutelsat's commitment to uninterrupted connectivity.

Eutelsat Group engages large government and enterprise clients in a consultative process to co-develop bespoke communication solutions. This approach involves deeply understanding each client's unique operational, security, and performance requirements. For instance, in 2024, specialized satellite capacity for secure government communications remains a key focus. This collaborative method builds robust relationships, ensuring high-value service delivery tailored to precise needs.

Indirect Channel Partner Programs

Eutelsat Group actively cultivates relationships with a global network of service providers and integrators through structured indirect channel partner programs. These programs are designed to empower partners, offering comprehensive training, essential certification, and robust marketing support. By providing tiered benefits, Eutelsat ensures its channel partners are well-equipped to effectively sell and support a wide array of satellite services, significantly extending the company's market reach. This strategy is crucial for leveraging the expanded capabilities following the OneWeb merger, enhancing distribution for both GEO and LEO services globally in 2024.

- Eutelsat's global footprint, enhanced by the OneWeb merger, now covers over 150 countries, significantly increasing potential partner territories.

- Channel partners contribute substantially to Eutelsat's diverse revenue streams, particularly in enterprise and government segments.

- Training initiatives ensure partners are proficient in the latest satellite technologies, including multi-orbit solutions.

- The tiered benefits incentivize deeper partner engagement and performance across various market verticals.

Direct Engagement with Key Vertical Markets

Eutelsat Group fosters direct engagement with key vertical markets, employing dedicated teams with deep expertise in sectors like maritime, aviation, and enterprise data.

These specialized teams directly engage industry players to understand their unique challenges and evolving needs, particularly as demand for high-throughput connectivity grows in 2024.

This direct feedback loop is crucial, informing product development and ensuring Eutelsat's solutions remain relevant and competitive, aligning with strategic priorities for its Mobile Connectivity and Fixed Broadband segments.

- Eutelsat Group's Mobile Connectivity revenue, which includes maritime and aviation, saw a 21.6% increase in Q3 FY2024.

- The company targets over 50% of its revenues from data and connectivity by fiscal year 2027.

- Direct engagement supports innovation for new services, such as LEO-GEO hybrid solutions for enterprise clients.

- This approach helps secure long-term contracts and partnerships within these critical sectors.

Eutelsat Group builds enduring customer relationships through long-term contracts, dedicated account management, and 24/7 operational support. They co-develop bespoke solutions with major clients and empower a global network of channel partners, extending their market reach. This strategy, reinforced by a 4.2 billion euro firm order backlog as of March 2024, drives stable revenue streams and growth in key segments like Mobile Connectivity.

| Customer Relationship Metric | Value | Context (2024 Data) |

|---|---|---|

| Firm Order Backlog | €4.2 billion | As of March 2024, indicating revenue visibility. |

| Mobile Connectivity Revenue Growth | +21.6% | Q3 FY2024, reflecting strong vertical market engagement. |

| Global Footprint (post-OneWeb) | Over 150 countries | Enhanced reach for direct and indirect channels. |

Channels

A highly skilled direct sales team serves as Eutelsat Group's primary channel for securing large, complex, and high-value contracts. This channel specifically targets major broadcasters, government entities, and global corporations. It is essential for relationship-based selling, offering technical consultation and customized satellite solutions. This approach ensures handling of strategically important accounts, contributing to recurring revenues, such as the €1.15 billion in backlog reported for the combined Eutelsat and OneWeb entity for fiscal year 2024.

A global network of Value-Added Resellers and System Integrators is essential for Eutelsat Group to access diverse, fragmented customer bases, particularly across enterprise and land mobility sectors. These partners integrate Eutelsat's satellite capacity with their own hardware, software, and tailored managed services, providing a comprehensive, end-to-end solution for the end-user. This indirect channel model enables scalable market penetration and broad reach, capitalizing on specialized local expertise. For instance, in 2024, such partnerships continue to be crucial for expanding satellite broadband solutions in underserved regions, leveraging a collaborative ecosystem.

Telecommunication service providers and ISPs are crucial channels for Eutelsat Group, especially for fixed data services like cellular backhaul in remote regions and as robust trunking solutions. Eutelsat sells wholesale satellite capacity to these operators, who then seamlessly integrate it into their public network offerings. This vital B2B channel leverages the extensive, established customer bases of these telcos, which in 2024 continue to expand their reach into underserved areas. Eutelsat's wholesale approach supports the expansion of 4G and 5G networks where terrestrial infrastructure is limited, representing a significant portion of their professional video and data segment revenue.

Digital Portals and APIs

Eutelsat Group increasingly leverages digital platforms, including dedicated portals and APIs, to enhance efficiency for its diverse partners and customers. These digital portals empower partners to seamlessly order services, manage terminal configurations, monitor usage, and access vital technical support, streamlining operations. For instance, the integration of Eutelsat OneWeb's network in 2024 significantly expanded the range of services manageable via these digital channels. APIs facilitate a deeper, more integrated connection with partners' existing Operational Support Systems (OSS) and Business Support Systems (BSS), crucial for large-scale deployments.

- Digital portals enhance partner self-service capabilities for ordering and management.

- APIs enable robust, automated integration with partner OSS/BSS for operational efficiency.

- These digital tools support the expanded Eutelsat OneWeb offerings from 2024.

- Improved digital access aims to boost customer satisfaction and service delivery.

Industry Trade Shows & Strategic Marketing

Eutelsat Group actively engages in major industry events like Satellite 2024 and IBC, showcasing its advanced satellite communication technologies and generating new leads. These platforms are vital for brand building and demonstrating thought leadership in the evolving space sector. Strategic marketing campaigns complement these efforts, targeting specific verticals such as maritime and aviation to support both direct and indirect sales channels. This integrated approach ensures broad market reach and strengthens customer relationships, aligning with 2024 business development goals.

- Participation in Satellite 2024 and IBC demonstrates Eutelsat's market presence.

- Strategic marketing campaigns target key verticals, bolstering sales initiatives.

- These channels are crucial for lead generation and showcasing new technologies like Eutelsat Konnect VHTS.

- Thought leadership is established through expert presentations at global expos.

Eutelsat Group utilizes a multi-faceted channel strategy, combining direct sales for high-value contracts, contributing to a €1.15 billion backlog for FY2024, with indirect channels. Value-Added Resellers and telecom service providers are crucial for broad market penetration, especially for 2024 broadband and 4G/5G backhaul expansion. Digital platforms and strategic industry events, including Satellite 2024, enhance partner engagement and market reach.

| Channel Type | Primary Function | 2024 Relevance |

|---|---|---|

| Direct Sales | Large contract acquisition | €1.15B combined backlog FY2024 |

| VARs/SIs | Broad market access, integration | Crucial for satellite broadband expansion |

| Telcos/ISPs | Wholesale capacity, network integration | Supports 4G/5G expansion in remote areas |

| Digital Platforms | Partner self-service, operational efficiency | Enhanced Eutelsat OneWeb integration |

| Industry Events | Lead generation, brand building | Participation in Satellite 2024, IBC |

Customer Segments

Video Broadcasters and DTH Providers represent Eutelsat Group's foundational customer segment, including major players like Sky and Canal+. These entities lease satellite capacity for Direct-to-Home television distribution, leveraging satellite's wide coverage to reach millions of viewers simultaneously. This segment values the high quality and established reach of Eutelsat's video neighborhoods, traditionally providing stable, long-term cash flow. While evolving, this segment still contributes significantly, with Eutelsat's Broadcast segment generating €442 million in revenue for the nine months ending March 31, 2024.

Government, defense, and security agencies are a critical customer segment, demanding highly secure, reliable, and globally available satellite communications for sensitive applications like intelligence, surveillance, reconnaissance (ISR) and command and control. This segment requires robust, resilient connectivity for both fixed and mobile assets across diverse operational environments. It represents a high-value, strategic market for providers, characterized by long contract cycles. For instance, in 2024, government and defense spending on satellite communications continues to drive significant revenue, with global government satellite service revenues projected to exceed $10 billion annually by mid-decade.

Mobile Connectivity Providers represent a primary growth segment for Eutelsat Group, serving the critical maritime and aviation industries. Companies like cruise lines, major shipping firms, and global airlines procure satellite capacity to deliver vital in-flight and at-sea broadband connectivity for both passengers and crew, alongside essential operational data. This segment highly values high-throughput, global coverage, and seamless mobility solutions. In 2024, Eutelsat OneWeb's low Earth orbit constellation is significantly enhancing their capacity to address this demand, complementing existing geostationary assets.

Fixed Data: Telecom Operators & Enterprises

This customer segment for Eutelsat Group encompasses telecom operators and diverse enterprises. Telecommunication companies utilize satellite services for cellular backhaul, extending network reach to remote regions where terrestrial infrastructure is limited. For instance, in 2024, the demand for satellite-enabled connectivity in underserved areas continues to grow. Enterprises, including those in banking and energy sectors, rely on Eutelsat for primary or backup connectivity, ensuring robust and resilient corporate networks. They prioritize cost-effective, high-availability data links to maintain critical operations.

- Eutelsat's Fixed Data segment saw revenues of €106 million for the first nine months of FY2023-24, reflecting consistent demand.

- Satellite backhaul supports over 50,000 cellular sites globally, showcasing its vital role.

- Enterprises seek 99.99% uptime for business continuity, often leveraging hybrid satellite-terrestrial solutions.

- Cost-efficiency drives adoption, with satellite offering competitive rates for remote and distributed operations.

Emerging LEO Enterprise & IoT

The Emerging LEO Enterprise & IoT segment, powered by the OneWeb constellation, targets enterprises, communities, and governments requiring low-latency, high-speed internet. This includes vital applications like community Wi-Fi, remote school connectivity, and enterprise SD-WAN solutions. Eutelsat Group anticipates this segment to be a primary growth driver, with OneWeb’s commercial service launch accelerating adoption in 2024, aiming for global coverage by late 2024.

- OneWeb's LEO network targets latency-sensitive applications.

- Key customers include remote communities and businesses needing high-speed links.

- Applications range from IoT deployments to educational connectivity.

- This segment is pivotal for Eutelsat Group's future revenue growth beyond 2024.

Eutelsat Group serves diverse customer segments, including foundational video broadcasters and DTH providers, critical government and defense agencies, and growing mobile connectivity clients in maritime and aviation. Telecom operators and enterprises rely on their services for robust fixed data links and cellular backhaul. The emerging LEO Enterprise & IoT segment, powered by OneWeb, targets low-latency, high-speed applications for communities and businesses, driving future growth. This diversified base ensures stable revenue streams and capitalizes on new market opportunities.

| Segment | FY24 Revenue (9 Months) | 2024 Trend |

|---|---|---|

| Broadcast | €442M | Foundational, stable cash flow |

| Fixed Data | €106M | Consistent demand, telecom/enterprise |

| Government | N/A | Global spending over $10B annually |

| Mobile/LEO | N/A | High growth, OneWeb commercial launch |

Cost Structure

Satellite design, manufacturing, and launch represent the most substantial capital expenditure for Eutelsat Group, demanding significant upfront investment. Building and launching a single advanced geostationary satellite can cost hundreds of millions of dollars, with some estimates for large, complex units exceeding $400 million in 2024. These massive costs are capitalized on the balance sheet and systematically depreciated over the satellite's operational lifespan, which typically spans around 15 years for geostationary orbit assets. For instance, Eutelsat's recent capital expenditure for the nine months ending March 31, 2024, was €475 million, primarily driven by satellite programs. This investment is critical for maintaining and expanding their global connectivity infrastructure.

Satellite insurance premiums represent a critical operating expense for Eutelsat Group, mitigating significant financial risks associated with high-value assets. These premiums cover potential launch failures and in-orbit malfunctions, which can be catastrophic given the multi-million dollar cost of each satellite. For example, a typical in-orbit insurance premium can range from 2-4% of the satellite's value annually. The cost of this essential recurring expense fluctuates based on the perceived risk and claims history within the global space insurance market, impacting Eutelsat’s 2024 financial outlook.

The Ground Segment & Network Operating Costs for Eutelsat Group encompass the extensive expenses of operating and maintaining its worldwide network of teleports, gateways, antennas, and terrestrial fiber connections. These fundamental operational costs also include personnel for the Network Operations Centers, which manage the satellite fleet and service delivery around the clock. For instance, Eutelsat's operational expenses, excluding depreciation and amortization, were €385 million for the first nine months of fiscal year 2024, highlighting these significant ongoing outlays.

Research & Development (R&D) Investment

Research & Development (R&D) investment is a strategic cost center for Eutelsat Group, essential for maintaining its technological edge in the competitive satellite communications industry. This includes significant investments in developing next-generation technologies like software-defined payloads and advanced ground systems, crucial for future service offerings. Furthermore, R&D focuses on the seamless integration of GEO and LEO networks, enhancing global connectivity and resilience. These expenditures are vital for long-term competitiveness and creating new revenue streams, especially following the Eutelsat OneWeb merger which amplifies the need for integrated innovation. In 2024, Eutelsat continues to allocate substantial resources to these forward-looking initiatives.

- R&D drives the development of cutting-edge satellite technologies.

- Investment targets software-defined payloads and advanced ground systems.

- Focus includes the integration of GEO and LEO satellite networks.

- Crucial for future revenue growth and sustained market competitiveness.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses for Eutelsat Group encompass crucial costs like the global sales force, extensive marketing initiatives, and regulatory affairs teams. As a prominent global satellite operator, these expenditures are vital for securing complex customer contracts and ensuring strict compliance with international regulations. While significant, these costs are fundamental for driving revenue growth and maintaining operational integrity, reflecting the demanding nature of the satellite communications sector.

- Eutelsat Communications reported SG&A expenses of €106 million for the first half of fiscal year 2023-2024.

- These expenses include costs for commercial teams engaging with diverse global clients.

- Marketing activities are essential for promoting new services like OneWeb integration.

- Regulatory compliance ensures adherence to global spectrum and licensing requirements.

Eutelsat Group's cost structure is dominated by capital-intensive satellite programs, with €475 million in capex for the nine months ending March 31, 2024. Significant operational expenses include ground segment network operations, totaling €385 million for the same period. Essential satellite insurance premiums and strategic R&D investments are critical. Sales, General & Administrative costs, at €106 million for H1 FY2023-2024, support global market presence and regulatory compliance.

| Cost Category | Primary Nature | 2024 Financial Data |

|---|---|---|

| Satellite Programs | Capital Expenditure | €475M (9M to Mar 31, 2024) |

| Ground Segment & Network Ops | Operating Expense | €385M (9M FY2024) |

| SG&A Expenses | Operating Expense | €106M (H1 FY2023-2024) |

Revenue Streams

Video Services, historically Eutelsat Group's largest revenue stream, stems from long-term leases of satellite transponders to DTH providers and broadcasters for TV channel distribution. This revenue is highly recurring, often contracted for multiple years, providing a stable cash flow base. The segment benefits from high-fill rates in prime orbital slots, contributing significantly to the company's financial stability. For instance, in its fiscal year ending June 2024, Eutelsat anticipated video revenues to remain a substantial component of its overall performance.

Fixed Connectivity revenue for Eutelsat Group stems from selling satellite capacity for cellular backhaul to telecom operators, providing consumer broadband services through ISPs, and enabling corporate networking for enterprises.

This revenue is primarily generated via wholesale capacity agreements or managed service contracts. While a mature segment, it remains essential, contributing significantly to Eutelsat's overall revenue, with the Fixed Broadband segment contributing around 120 million euros in the first nine months of the 2023-2024 fiscal year.

Eutelsat Group generates significant revenue from providing highly secure and resilient communication services to government, defense, and institutional clients globally. These are often long-term, high-value contracts supporting both fixed and mobile applications. This stream offers critical stability and strategic importance to the group's financial profile. For instance, in its fiscal year ending June 2024, Eutelsat's Government Services segment continued to be a foundational element, contributing reliably to overall revenue.

Mobile Connectivity (Maritime & In-Flight)

Mobile Connectivity, particularly for maritime and in-flight services, stands as a pivotal growth driver for Eutelsat Group. This revenue stream involves providing high-throughput satellite capacity and managed services to specialized service providers who then serve airlines and shipping companies worldwide. The market demands extensive global coverage and robust performance, capabilities increasingly met by Eutelsat's combined GEO and OneWeb LEO satellite fleet.

- Eutelsat's maritime and in-flight revenue for the first nine months of FY2023-24 showed strong growth, reaching €132 million.

- The group's LEO services, through OneWeb, are expected to contribute significantly to this segment's expansion, targeting over $1 billion in revenue by 2027-28.

- Aviation connectivity alone is projected to represent a $5.6 billion market by 2030, highlighting the substantial potential.

- The multi-orbit strategy positions Eutelsat to capture increasing demand for seamless, high-speed connectivity across oceans and air routes.

LEO Connectivity Services

LEO Connectivity Services represent a significant, high-growth revenue stream for Eutelsat Group, primarily driven by the OneWeb constellation. This segment delivers low-latency, high-speed internet to diverse clients including governments, enterprises utilizing SD-WAN, and telcos for 5G backhaul. It also supports community broadband initiatives, crucial for bridging digital divides. This emerging service is central to the Group's future growth strategy, counterbalancing traditional video revenue declines.

- OneWeb contributed €42 million to Group revenues for the nine months ended March 31, 2024.

- The OneWeb constellation is fully deployed, enhancing global service capabilities.

- This stream targets a broad customer base, from governmental bodies to rural communities.

- LEO services are a key driver for Eutelsat's future financial performance and strategic direction.

Eutelsat Group diversifies its revenue through traditional video services and fixed connectivity, alongside stable government contracts. Growth is driven by mobile connectivity, particularly maritime and in-flight services, which generated €132 million in the first nine months of FY2023-24. LEO Connectivity, led by OneWeb, contributed €42 million in the same period, marking a significant future growth area. This multi-orbit strategy positions the group for future expansion in high-demand segments.

| Revenue Stream | 9M FY2023-24 (EUR) |

|---|---|

| Mobile Connectivity | €132 million |

| Fixed Broadband | €120 million |

| LEO (OneWeb) | €42 million |

Business Model Canvas Data Sources

The Eutelsat Group Business Model Canvas is built using a combination of internal financial reporting, extensive market research on satellite and connectivity services, and strategic analysis of competitive landscapes. These data sources ensure that each component of the canvas is grounded in factual information and industry understanding.