Eutelsat Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eutelsat Group Bundle

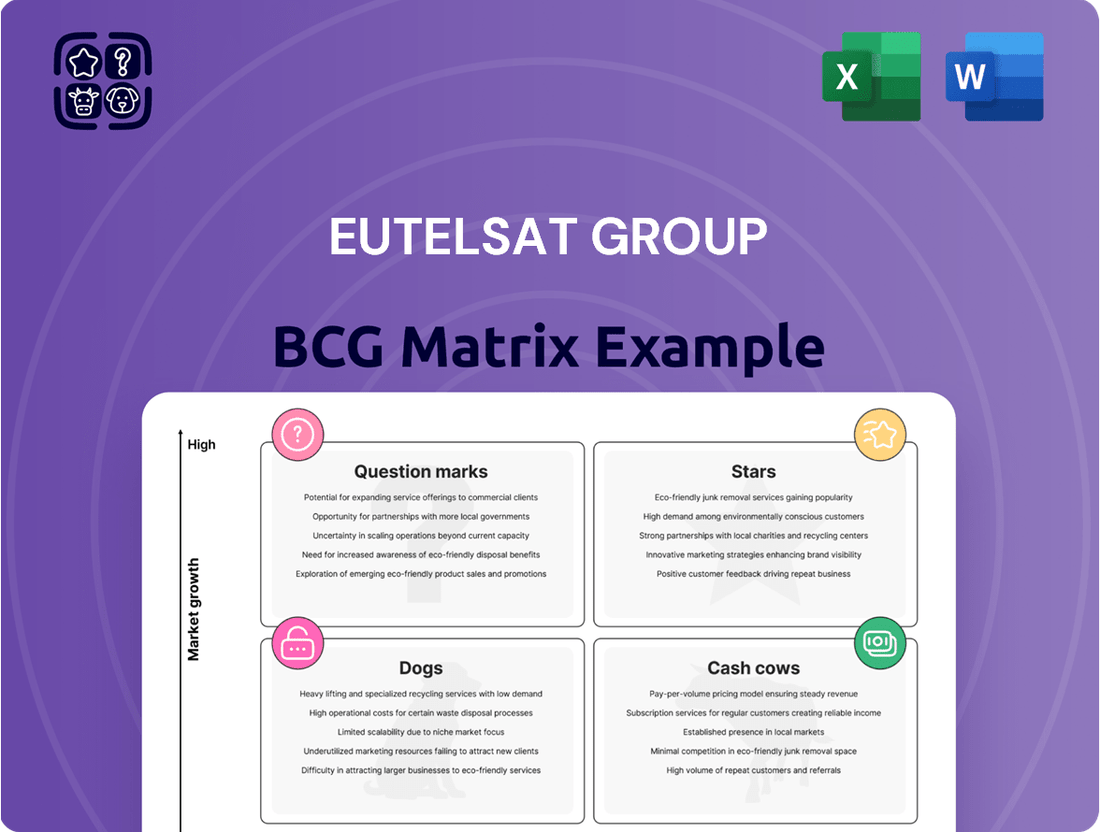

Eutelsat Group's BCG Matrix reveals its product portfolio's strengths and weaknesses in the competitive satellite market. Question marks demand strategic investment choices. Stars shine with growth potential. Cash Cows provide stable revenue. Dogs require careful management. Analyze each quadrant for optimal resource allocation.

Purchase now for a ready-to-use strategic tool.

Stars

LEO Connectivity, led by Eutelsat's OneWeb, targets high-growth markets. Demand for broadband, especially in underserved regions, fuels its expansion. OneWeb aims for global coverage with its satellite constellation. In 2024, OneWeb secured deals to provide connectivity to airlines. By 2023, OneWeb had launched over 600 satellites.

Eutelsat's LEO services are growing, especially for government use. Secure satellite communication needs are rising, and Eutelsat's LEO is helping. In 2024, the government and defense sector represented a significant portion of Eutelsat's revenue. This segment is expected to continue growing, driven by demand for secure and reliable communication.

Fixed connectivity, powered by LEO satellites, is experiencing a surge in demand, especially in underserved regions. Eutelsat's OneWeb constellation is strategically positioned to capture this growth. In 2024, the global market for satellite broadband is projected to reach $8.8 billion. Eutelsat's focus on this area positions it well to capitalize on this.

Mobile Connectivity (LEO-enabled)

Eutelsat's mobile connectivity, especially through Low Earth Orbit (LEO) satellites, is a rising star. This segment, serving aircraft and ships, is experiencing significant expansion. Eutelsat’s multi-orbit strategy, including LEO, is crucial for capitalizing on this. The maritime connectivity market alone is predicted to reach $3.2 billion by 2024.

- Market growth is driven by increasing demand for in-flight and maritime internet.

- Eutelsat's LEO capabilities enhance its service offerings.

- The multi-orbit approach provides broader coverage and resilience.

- This positions Eutelsat for strong revenue growth in mobile services.

Next-Generation Satellite Technologies

Eutelsat's investment in next-generation satellite technologies, like High Throughput Satellites (HTS) and multi-orbit solutions, is key for future growth. This involves significant capital expenditure to stay competitive. In 2024, the satellite industry saw over $30 billion in investments globally, highlighting the importance of innovation. Eutelsat's strategic focus on these technologies positions it for future market opportunities.

- High Throughput Satellites (HTS) offer increased capacity and efficiency.

- Multi-orbit solutions provide global coverage and resilience.

- Investment in R&D is crucial for maintaining a competitive edge.

- The satellite industry is projected to grow significantly by 2030.

Eutelsat's LEO-driven services, especially OneWeb for mobile and fixed connectivity, are clear Stars. These segments operate in high-growth markets like maritime connectivity, projected to reach $3.2 billion by 2024. Eutelsat's multi-orbit strategy and 2024 deals, including airline connectivity, highlight its strong market position and significant growth potential.

| Segment | Market Growth (2024) | Eutelsat Focus |

|---|---|---|

| Mobile Connectivity | Maritime: $3.2B | LEO, Multi-orbit |

| Fixed Connectivity | Global Satellite Broadband: $8.8B | OneWeb LEO |

| Government/Defense | Rising demand for secure comms | LEO services |

What is included in the product

Eutelsat's BCG Matrix overview, investing, holding, or divesting across all quadrants.

Printable summary optimized for A4 and mobile PDFs, streamlining concise, accessible analysis.

Cash Cows

Eutelsat's video broadcasting services are cash cows due to their established market presence. The company holds a substantial market share in video distribution across Europe, the Middle East, and Africa. For instance, Eutelsat distributes over 7,000 channels. This segment generates consistent revenue, critical for overall financial stability. In 2024, the video segment accounted for a significant portion of Eutelsat's revenue, demonstrating its cash-generating capabilities.

Eutelsat's established GEO satellite fleet, crucial for video broadcasting, generates consistent revenue. Long-term contracts underpin this stability, ensuring predictable cash flow. In 2024, video services contributed significantly to Eutelsat's revenue, around 60%. This segment remains a reliable cash generator.

Professional video services are a cash cow for Eutelsat. Despite the overall video market decline, this segment, including broadcast contributions, remains stable. In 2024, the professional video market generated significant revenue, showing resilience. Eutelsat's focus here provides a consistent income stream. This stability is key amid market fluctuations.

Fixed Connectivity (GEO-based)

Fixed connectivity services using traditional GEO satellites generate steady cash flow, especially in areas with persistent demand. These services are a reliable source of revenue for Eutelsat, offering stability. The company’s GEO business in 2024 generated a significant portion of its overall earnings. This segment provides consistent returns, solidifying its position as a cash cow.

- In 2024, Eutelsat's GEO-based services accounted for a substantial share of its revenue, demonstrating its stability.

- These services continue to be essential in regions where other connectivity options are limited.

- The reliable cash flow from GEO services supports investments in new technologies.

Government Services (GEO-based)

Eutelsat's government services, particularly those utilizing GEO satellites, are a strong cash cow. These services, often secured through long-term contracts, offer a dependable revenue stream. The stability is enhanced by the critical nature of these applications, which include secure communications and surveillance. In 2024, this segment contributed significantly to Eutelsat's overall revenue, demonstrating its financial importance.

- Government services revenue represented a substantial portion of Eutelsat's total revenue in 2024.

- Long-term contracts ensure a steady and predictable income flow.

- GEO satellites are key for government applications, offering secure, reliable services.

- This segment's consistent performance supports Eutelsat's financial stability.

Eutelsat's video broadcasting, fixed connectivity, and government services, predominantly GEO-based, are robust cash cows. These segments generated significant revenue in 2024, with video services alone contributing approximately 60% of total revenue. Their stability stems from established market presence, long-term contracts, and essential service provision. This consistent cash flow underpins Eutelsat's financial resilience.

| Cash Cow Segment | 2024 Revenue Contribution | Key Characteristic |

|---|---|---|

| Video Services | ~60% of total revenue | Distributes 7,000+ channels |

| Fixed GEO Connectivity | Significant portion of earnings | Reliable demand in specific regions |

| Government Services | Substantial portion of total revenue | Long-term, critical applications |

Delivered as Shown

Eutelsat Group BCG Matrix

The displayed preview mirrors the complete Eutelsat Group BCG Matrix you'll acquire. Receive the same detailed analysis and professional presentation after purchase, ready for strategic decisions.

Dogs

Legacy Video Services face a declining market, impacted by the rise of streaming. Eutelsat's revenue in video dropped by 6.8% in the 2023-2024 fiscal year. This segment's backlog is also shrinking, reflecting the shift away from traditional broadcasting.

Some of Eutelsat's older GEO assets face challenges, especially in regions with falling demand or tougher competition. These satellites might not bring in much revenue and could even cost money to maintain. For example, in 2024, the company saw a decrease in revenue from video services. This highlights the impact of changing market dynamics.

GEO consumer broadband in specific regions can struggle due to competition. Terrestrial networks or LEO services often offer better speeds and lower costs. For example, in 2024, LEO providers like Starlink have rapidly expanded, impacting GEO's market share. GEO services might see slower growth in areas with strong alternatives. Data from 2024 shows that GEO broadband's revenue growth is projected at a modest 2-3% in competitive areas.

Capacity in Highly Competitive Regions (Video)

In the Eutelsat Group's BCG matrix, GEO capacity in highly competitive regions for video services is a "dog". This implies low market share in a slow-growth market, often resulting in poor financial returns. For instance, the video segment's revenue in 2024 might show a decline in regions with aggressive pricing. This position necessitates strategic decisions, such as cost-cutting or divesting from these areas.

- Low market share in a slow-growth market.

- Potential for poor financial returns.

- Strategic decisions needed, like cost-cutting.

- Consider divesting from competitive areas.

Divested or Phasing Out Assets

In the Eutelsat Group's BCG matrix, "Dogs" represent assets or services being divested or phased out. This strategic move often occurs due to market changes or shifts in company focus. For example, in 2024, Eutelsat might be divesting certain satellite assets. These decisions are crucial for optimizing the portfolio.

- Divestitures can free up capital.

- Phasing out underperforming services improves resource allocation.

- Strategic shifts reflect evolving market demands.

- Focus on core competencies enhances competitiveness.

In the Eutelsat Group's BCG matrix, Dogs encompass legacy video services and specific older GEO assets, marked by low market share in slow-growth markets. Eutelsat's video revenue decreased by 6.8% in FY2023-2024, reflecting declining demand and poor returns. These segments, like GEO broadband facing strong LEO competition in 2024, necessitate strategic divestment or cost-cutting for portfolio optimization.

| Segment | Characteristic | 2024 Data/Trend |

|---|---|---|

| Legacy Video | Declining Market | Revenue down 6.8% (FY23-24) |

| GEO Broadband | Competitive Pressure | LEO expansion impacting share |

| Older GEO Assets | Low Revenue | Decreased video revenue |

Question Marks

Eutelsat's foray into new LEO-enabled services, like those targeting underserved regions or specialized sectors, positions them in high-growth markets. These services, while nascent, typically start with low market share. For instance, the global satellite internet market, where LEOs play a key role, is projected to reach $27.8 billion by 2024, with substantial growth anticipated.

Eutelsat targets emerging markets, focusing on connectivity. These regions, including Africa and the Middle East, offer growth potential. The company aims to build market share in these areas. Eutelsat's strategy includes satellite internet and related services. In 2024, Africa's internet penetration rate was around 40%, signaling room for growth.

Developing new connectivity solutions, including 5G integration, represents a significant growth opportunity for Eutelsat. This area is in a high-growth phase, driven by increasing demand for advanced communication services. However, Eutelsat's current market share in this segment is relatively low, indicating a need for strategic investment. In 2024, the global 5G market was valued at $71.4 billion, with substantial growth expected.

IRIS² Constellation Contribution

Eutelsat's participation in the IRIS² constellation is a strategic move, positioning it for growth in secure government communications. The project aims to provide secure connectivity for the EU, with Eutelsat contributing to this initiative. While the full financial impact is still emerging, this involvement could boost Eutelsat's future revenue streams. This aligns with the company's strategy to capitalize on emerging opportunities within the space sector.

- IRIS² is designed to offer secure, sovereign connectivity for governmental use within the EU.

- Eutelsat's role involves contributing to the infrastructure of this secure network.

- The financial impact is expected to grow as IRIS² becomes fully operational.

- This initiative is part of Eutelsat's broader strategic expansion.

Specific Applications of LEO Connectivity (e.g., IoT, Automation)

Eutelsat's foray into LEO connectivity, particularly for IoT and automation, sits firmly in the Question Marks quadrant of the BCG Matrix. These sectors promise substantial growth, but Eutelsat's current market presence is limited. This requires strategic investment and aggressive market penetration to capitalize on the opportunities. The company will need to quickly establish a foothold in these nascent markets.

- IoT market expected to reach $1.8 trillion by 2028.

- Automation market projected to hit $214 billion by 2029.

- Eutelsat's investment in LEO is key to capturing these markets.

- Success depends on effective partnerships and innovation.

Eutelsat's Question Marks include new LEO services, 5G integration, and emerging market expansion, all in high-growth sectors but where the company holds low market share. These areas, like the global satellite internet market projected at $27.8 billion by 2024, demand significant strategic investment. For instance, the global 5G market reaching $71.4 billion in 2024 highlights the scale of opportunity.

| Area | Market Size (2024) | Eutelsat's Position |

|---|---|---|

| Satellite Internet | $27.8 billion | Low Market Share |

| 5G Market | $71.4 billion | Low Market Share |

| Africa Internet Penetration | ~40% | Building Market Share |

BCG Matrix Data Sources

The Eutelsat Group BCG Matrix draws upon annual reports, market research, and competitor analyses for robust strategic positioning.