Esteve Pharmaceuticals, S.A. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esteve Pharmaceuticals, S.A. Bundle

Esteve Pharmaceuticals, S.A. operates within a dynamic global landscape, significantly influenced by political stability, economic fluctuations, and evolving social attitudes towards healthcare. Understanding these external forces is crucial for forecasting growth and mitigating risks. Our comprehensive PESTEL analysis delves into these critical factors, offering actionable intelligence.

Gain a competitive edge by exploring how technological advancements and environmental regulations shape Esteve Pharmaceuticals, S.A.'s strategic direction. This ready-made PESTEL analysis provides expert-level insights for investors and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Government policies profoundly shape pharmaceutical operations, dictating drug pricing, reimbursement pathways, and national healthcare spending priorities. For Esteve, shifts in these regulatory landscapes directly affect revenue streams and the accessibility of its product portfolio, encompassing both novel therapies and established generics.

Esteve must remain vigilant, adapting its strategies to navigate the dynamic healthcare reforms prevalent across its primary operating regions, particularly within Europe and the United States. For instance, in 2024, the EU's pharmaceutical strategy aims to bolster innovation while ensuring affordability, potentially impacting Esteve's pricing and market access strategies across member states.

Esteve Pharmaceuticals, operating globally, is significantly impacted by international trade agreements and tariffs. Fluctuations in these policies can alter the cost of essential raw materials and finished pharmaceutical goods, directly affecting Esteve's profitability and pricing strategies across its diverse markets. For instance, the European Union's trade policies, which Esteve navigates extensively, aim to foster free trade but can also introduce complex regulatory hurdles.

Protectionist measures implemented by various nations can create barriers to entry or increase operational costs for Esteve's products. The World Trade Organization (WTO) reported that global trade growth slowed in 2023, a trend that could continue if protectionism escalates, impacting Esteve's ability to distribute its medicines efficiently. Navigating these evolving trade landscapes is paramount for maintaining a robust global supply chain and market access.

The pharmaceutical sector's heavy reliance on stable regulatory environments means Esteve Pharmaceuticals, S.A. must navigate a landscape where predictable frameworks for drug approval, manufacturing standards like Good Manufacturing Practices (GMP), and marketing are crucial. Any disruption, such as shifts in enforcement or new compliance mandates, directly impacts operational costs and can delay vital product launches.

Geopolitical Stability and Regional Conflicts

Geopolitical stability is a critical consideration for Esteve Pharmaceuticals, given its international operations. Regional conflicts and political instability can significantly disrupt global supply chains, impacting the availability and cost of raw materials and finished goods. For instance, the ongoing geopolitical tensions in Eastern Europe have led to increased shipping costs and potential delays for many industries, including pharmaceuticals. Esteve's reliance on a global network of suppliers and distributors means that such events can directly affect its manufacturing sites and market access.

The impact of geopolitical events extends to market demand, as economic sanctions or trade restrictions can limit a company's ability to operate or sell products in affected regions. The economic fallout from conflicts can also reduce consumer spending power, thereby decreasing demand for healthcare products. Esteve, like many pharmaceutical companies, must navigate these complexities to ensure business continuity and mitigate financial risks. A diversified operational footprint, with manufacturing and distribution capabilities spread across various stable regions, is a key strategy to cushion the blow from localized geopolitical disruptions.

- Global Supply Chain Vulnerability: In 2024, the pharmaceutical industry continued to grapple with supply chain vulnerabilities exacerbated by geopolitical events, with an estimated 30% of active pharmaceutical ingredients (APIs) sourced from China and India, regions susceptible to regional instability.

- Market Access Challenges: Political instability in certain regions can lead to sudden changes in regulatory environments or the imposition of trade barriers, potentially impacting Esteve's sales and market penetration strategies in those areas.

- Operational Diversification: Esteve's strategic decision to maintain manufacturing facilities in multiple countries, including Spain, France, and Germany, helps to mitigate the risks associated with localized geopolitical crises affecting a single operational hub.

Government Support for R&D and Innovation

Government incentives, grants, and tax breaks play a crucial role in fueling Esteve's research and development pipeline. These financial mechanisms can significantly reduce the cost and risk associated with bringing new therapies to market, thereby accelerating innovation. For instance, Spain's Ministry of Science and Innovation has programs that support collaborative research projects, which Esteve can leverage.

Targeted support for R&D in Esteve's key therapeutic areas, such as pain management, central nervous system (CNS) disorders, and respiratory conditions, provides a direct competitive edge. By aligning government priorities with its own strategic focus, Esteve can access funding that fast-tracks drug discovery and the often lengthy clinical trial process. This focus is critical in a rapidly evolving pharmaceutical landscape.

- Government Funding Programs: Spain, like many European nations, offers various public grants and funding initiatives aimed at boosting pharmaceutical R&D. For example, the CDTI (Centre for the Development of Industrial Technology) in Spain provides financial support for innovative R&D projects, including those in the life sciences sector.

- Tax Incentives: Tax credits for R&D expenditures are a common government support mechanism. In Spain, the R&D tax credit can significantly reduce a company's tax burden, allowing for reinvestment in further research and development activities.

- European Union Initiatives: Beyond national support, Esteve can also benefit from EU research and innovation programs like Horizon Europe, which allocates substantial funding to health research, including areas relevant to Esteve's portfolio.

- Past Grant Successes: Esteve has a history of successfully securing public grants for its R&D endeavors, demonstrating its ability to align with governmental research priorities and secure non-dilutive funding to advance its scientific programs.

Government policies directly influence Esteve's operational costs and market access, with regulatory approvals and pricing controls being paramount. The EU's pharmaceutical strategy, emphasizing innovation and affordability in 2024, requires Esteve to balance R&D investment with accessible pricing across its European markets.

International trade agreements and tariffs significantly impact Esteve's global supply chain, affecting raw material costs and product pricing. With global trade growth slowing in 2023 due to protectionist measures, Esteve must actively manage these evolving trade landscapes to ensure efficient distribution and market reach.

Geopolitical stability is a key factor for Esteve's international operations, as regional conflicts can disrupt supply chains and market demand. Diversifying manufacturing sites across stable regions, as Esteve has done in Spain, France, and Germany, is a crucial strategy to mitigate risks from localized disruptions.

What is included in the product

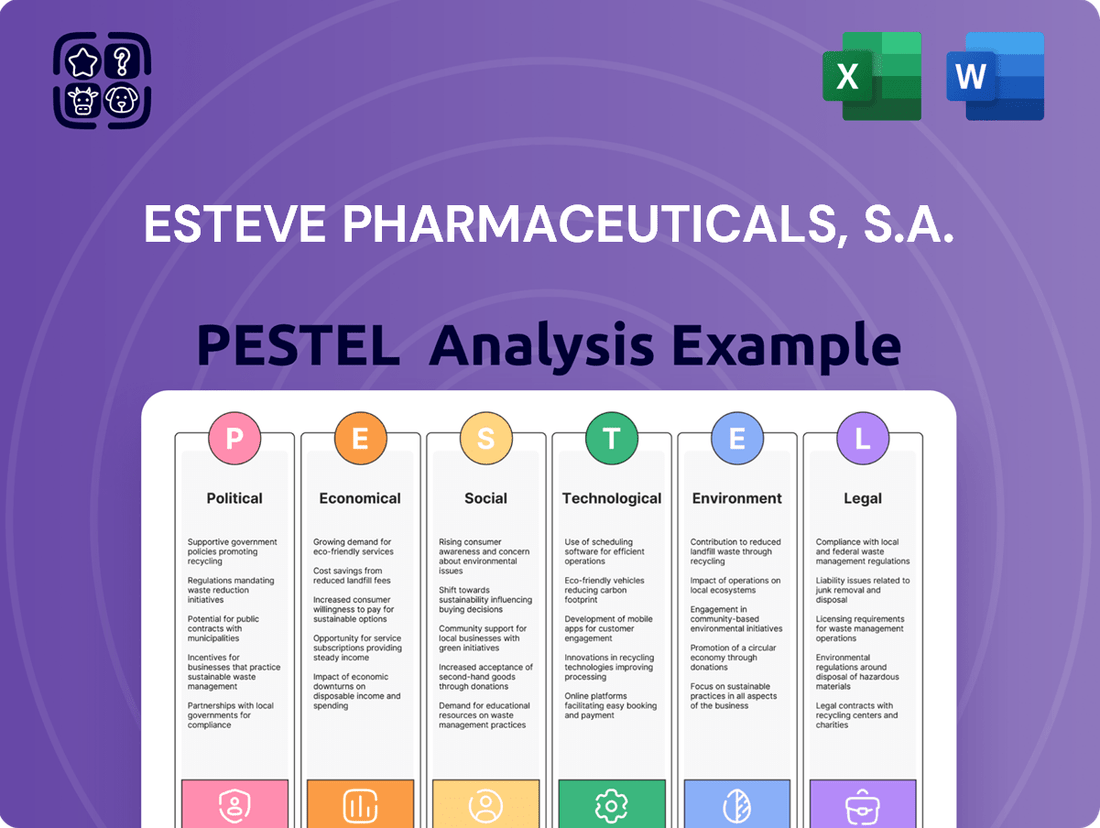

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Esteve Pharmaceuticals, S.A., covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a data-driven evaluation of current trends and forward-looking insights to identify strategic opportunities and threats for Esteve Pharmaceuticals, S.A.

This PESTLE analysis for Esteve Pharmaceuticals, S.A. offers a concise, easily digestible overview of external factors impacting the company, serving as a valuable tool for strategic planning and risk mitigation.

By clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal landscape, it acts as a pain point reliever, enabling stakeholders to quickly understand and address potential challenges and opportunities.

Economic factors

The overall health of the global economy significantly influences how much governments, insurance providers, and individuals can spend on healthcare. In 2024, the International Monetary Fund projected global growth at 3.2%, a modest but steady pace that supports healthcare investment.

When economies face downturns, healthcare budgets often see reductions, which can impact drug sales and Esteve's ability to maintain pricing strategies. For instance, a slowdown in major markets could lead to tighter reimbursement policies.

Conversely, periods of strong economic expansion, like the projected 3.1% global growth for 2025 according to the World Bank, generally translate to greater investment in healthcare infrastructure and increased patient access to medicines, creating a more favorable environment for Esteve's broad range of pharmaceutical products.

Inflationary pressures in 2024 and 2025 continue to impact the pharmaceutical sector, directly affecting Esteve's operational costs. Rising prices for raw materials, essential for drug synthesis, and increased energy expenses for manufacturing facilities are significant concerns. Labor costs are also trending upwards, adding further strain to production budgets.

To mitigate these escalating expenses, Esteve is strategically focusing on supply chain optimization and exploring adaptive pricing models. The company's investment in new production sites, such as their facility in Ireland which is undergoing expansion, aims to enhance industrial capabilities and potentially achieve greater cost efficiencies in the medium term, counteracting some of the inflationary headwinds.

Esteve Pharmaceuticals, with a substantial 75% of its revenue generated from international markets, is particularly vulnerable to currency exchange rate fluctuations. For instance, a strengthening Euro against key currencies like the US Dollar could reduce the reported value of sales made in dollars when converted back to Euros. This directly impacts Esteve's top-line revenue and bottom-line profitability.

The volatility of exchange rates, especially in 2024 and projected into 2025, presents a significant challenge. For example, if the Swiss Franc, a currency in which Esteve operates, experiences a sharp appreciation against the Euro, it would negatively affect the company's financial statements. This necessitates robust risk management, including the potential implementation of currency hedging strategies to stabilize earnings.

Interest Rates and Access to Capital

Interest rates significantly shape Esteve Pharmaceuticals' financial strategy, directly impacting the cost of capital for crucial investments. For instance, the European Central Bank's (ECB) key interest rates, which influenced borrowing costs throughout 2024 and are projected to remain a key consideration in 2025, dictate the expense of funding research and development, potential acquisitions, and the expansion of manufacturing capabilities. Higher rates translate to increased debt servicing costs, potentially slowing down strategic growth plans.

Access to affordable capital is paramount for Esteve's sustained growth and its commitment to innovation. This was evident in their planned €100 million investment in a new plant in Celrà, a project whose financial viability is closely tied to prevailing interest rate environments. A favorable capital market, characterized by lower borrowing costs, empowers Esteve to pursue ambitious projects that drive both market share and therapeutic advancements.

Key considerations for Esteve regarding interest rates and capital access include:

- Impact on R&D Funding: Higher interest rates increase the cost of borrowing for long-term research projects, potentially affecting the pace of innovation.

- Acquisition Costs: Elevated borrowing expenses can make strategic acquisitions more expensive, influencing Esteve's M&A activity.

- Capital Expenditure Financing: The cost of financing large-scale projects like new manufacturing facilities is directly linked to interest rate levels.

- Overall Cost of Capital: Fluctuations in interest rates affect Esteve's weighted average cost of capital (WACC), a critical metric for investment appraisal.

Competition from Generic and Biosimilar Manufacturers

The pharmaceutical industry is characterized by fierce competition from generic and biosimilar manufacturers. This competition significantly impacts the profitability of patented drugs once their exclusivity expires, leading to potential market share erosion. For instance, the U.S. Food and Drug Administration (FDA) approved over 1,000 generic drug applications in 2023 alone, highlighting the dynamic nature of this market.

Esteve Pharmaceuticals' strategic involvement in the generic product segment serves as a vital risk diversification tool. However, to sustain its market position, Esteve must prioritize continuous innovation. This focus is crucial for maintaining a competitive advantage within its key therapeutic areas, especially as patent cliffs loom for various established treatments.

The increasing prevalence and regulatory support for biosimil products add another layer of competitive pressure. By 2024, the global biosimil market was projected to reach over $65 billion, demonstrating a substantial shift in treatment options and pricing dynamics.

- Market Share Erosion: Patent expiry allows generics to enter, often at a fraction of the original drug's price, drastically reducing the originator's revenue.

- Esteve's Diversification: Presence in generics mitigates the impact of patent expiries on its branded portfolio.

- Innovation Imperative: Continuous R&D is essential for Esteve to develop new, differentiated products and maintain leadership in specialized fields.

- Biosimilar Impact: The growing biosimilar market presents both challenges and opportunities, requiring strategic responses from established pharmaceutical companies.

Global economic growth, projected at 3.2% for 2024 and 3.1% for 2025, influences healthcare spending and Esteve's revenue potential. Inflationary pressures in 2024-2025 increase operational costs for Esteve, impacting raw material, energy, and labor expenses. Currency fluctuations, particularly for Esteve's 75% international revenue, pose a risk to reported sales values.

Same Document Delivered

Esteve Pharmaceuticals, S.A. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Esteve Pharmaceuticals, S.A. delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It provides a robust framework for understanding the external landscape and identifying potential opportunities and threats.

Sociological factors

The world's population is getting older. By 2050, the United Nations projects that one in six people globally will be over 65, up from one in 11 in 2015. This demographic shift directly correlates with a rise in chronic diseases, including those Esteve Pharmaceuticals specializes in, such as pain management, central nervous system (CNS) disorders, and respiratory ailments.

This growing elderly population, often managing multiple chronic conditions, significantly boosts the demand for pharmaceutical solutions. For Esteve, this translates into a substantial and expanding market opportunity for its existing product portfolio and a strong impetus for developing new, innovative treatments.

Shifting consumer habits, such as increased consumption of processed foods and a decline in regular exercise, are directly linked to rising rates of chronic conditions like diabetes and cardiovascular disease. For instance, global obesity rates, a key indicator of lifestyle-related diseases, continued to climb, with the World Health Organization reporting in 2024 that over 1 billion people worldwide were living with obesity.

Esteve must remain attuned to these evolving lifestyles, as they shape future demand for pharmaceuticals. Anticipating the prevalence of conditions like type 2 diabetes, which saw an estimated 537 million adults affected globally in 2024 according to the International Diabetes Federation, allows for strategic alignment of R&D pipelines.

Patients are increasingly informed about health conditions and available treatments, largely due to readily accessible digital health information. This heightened awareness fuels a growing demand for novel and specialized pharmaceuticals, pushing companies like Esteve to innovate.

Esteve's strategic commitment to enhancing patient quality of life through scientific advancement directly addresses this trend. For instance, in 2024, Esteve continued its investment in R&D, with a significant portion allocated to developing treatments for neurological disorders, a field where patient demand for better solutions is particularly high.

Healthcare Access and Health Equity

Societal expectations are increasingly focused on ensuring equitable access to healthcare and affordable medicines. This pressure can shape public policy, influencing how pharmaceutical companies like Esteve operate and fulfill their corporate social responsibility mandates.

Esteve's stated commitment to providing innovative healthcare solutions for professionals and patients directly engages with these societal demands. This focus on accessibility and affordability is likely to shape Esteve's market strategies and pricing models, particularly in light of growing global health equity concerns.

- Global Health Spending: In 2023, global health spending reached an estimated $10 trillion, highlighting the significant economic and societal investment in healthcare.

- Affordability Concerns: A 2024 survey indicated that over 60% of patients in developed nations express concerns about the affordability of prescription medications.

- Access Disparities: The World Health Organization reported in 2025 that significant disparities in access to essential medicines persist between high-income and low-income countries, with an estimated 2 billion people lacking regular access to medicines.

- Corporate Social Responsibility (CSR) Trends: A 2024 report on pharmaceutical CSR found that 75% of surveyed companies are increasing their focus on patient access programs and affordability initiatives.

Public Perception and Trust in Pharmaceutical Companies

Public trust in pharmaceutical firms like Esteve is a significant sociological factor, heavily swayed by perceptions of drug affordability, the ethical conduct of research and development, and the overall transparency of their operations. For Esteve, cultivating a positive public image and showcasing a robust dedication to ethical standards and patient welfare are paramount for securing and maintaining the confidence of all stakeholders, including patients, healthcare providers, and investors.

Esteve's commitment to transparency and accountability is a cornerstone of its public relations strategy. The company's 2024 sustainability report highlighted initiatives aimed at enhancing patient access to medicines and fostering open communication regarding clinical trial data. In 2024, the global pharmaceutical industry faced increased scrutiny regarding pricing, with average prescription drug costs in developed markets continuing to be a point of public concern.

- Drug Pricing Scrutiny: Public discourse in 2024 frequently centered on the high cost of novel therapies, impacting trust in the industry's profit motives.

- Ethical Research Transparency: A growing demand for open access to clinical trial results and data reporting continued in 2024, influencing public perception of research integrity.

- Corporate Social Responsibility: Esteve's investment in community health programs and patient support services in 2024 aimed to bolster its reputation for ethical engagement and patient-centricity.

Societal expectations increasingly demand equitable access to healthcare and affordable medicines, influencing public policy and Esteve's corporate social responsibility. Esteve's focus on accessibility and affordability is likely to shape its market strategies and pricing, especially given global health equity concerns. A 2024 survey revealed over 60% of patients in developed nations worry about prescription drug costs, and the World Health Organization reported in 2025 that 2 billion people lack regular access to essential medicines.

Public trust in pharmaceutical firms like Esteve hinges on perceptions of drug affordability, ethical R&D, and operational transparency. Esteve's 2024 sustainability report highlighted efforts to improve patient access and clinical trial data transparency, aiming to build confidence amidst ongoing scrutiny of drug pricing.

| Sociological Factor | 2024/2025 Data Point | Impact on Esteve |

|---|---|---|

| Aging Population & Chronic Disease | UN projects 1 in 6 globally over 65 by 2050. | Increased demand for Esteve's treatments (pain, CNS, respiratory). |

| Lifestyle-Related Diseases | Over 1 billion globally living with obesity (WHO, 2024). | Drives demand for treatments for diabetes, cardiovascular issues. |

| Patient Empowerment & Information Access | Growing demand for novel, specialized pharmaceuticals. | Necessitates continued R&D investment, e.g., neurological disorders. |

| Affordability & Access Demands | 60%+ patients in developed nations concerned about drug costs (2024 survey). | Requires strategic pricing and access programs to maintain trust and market share. |

| Public Trust & Transparency | High scrutiny on drug pricing and research integrity (2024). | Emphasis on ethical conduct, open communication, and patient-centric initiatives. |

Technological factors

Rapid advancements in biotechnology, genomics, and artificial intelligence are significantly reshaping drug discovery. Esteve's strategic integration of these technologies, including sophisticated computational modeling and high-throughput screening, is crucial for accelerating the identification of novel drug candidates and enhancing R&D pipeline efficiency.

By embracing AI-driven platforms, Esteve can potentially reduce the time and cost associated with early-stage drug development. For instance, AI in drug discovery has shown promise in predicting drug efficacy and toxicity, with some estimates suggesting it could cut down discovery timelines by 25-50% in the coming years.

Technological advancements are significantly reshaping pharmaceutical production. Innovations like continuous manufacturing, which allows for uninterrupted processing, and sophisticated advanced process controls are boosting efficiency and cutting down operational expenses. These technologies also play a crucial role in ensuring higher and more consistent product quality, a critical factor in the pharmaceutical industry.

Esteve Pharmaceuticals, S.A. is actively embracing these technological shifts. The company has made substantial investments in new production facilities designed with state-of-the-art technological solutions. For instance, their investment in a new €200 million manufacturing facility in Lliçà d'Amunt, Spain, which began operations in 2023, showcases this commitment. This facility is equipped with advanced automation and digital technologies, aiming to enhance manufacturing flexibility and capacity, supporting their growth and innovation pipeline.

The burgeoning digital health landscape, including telemedicine and wearable tech, offers Esteve significant avenues to boost patient interaction and track medication compliance. For instance, by 2024, the global telemedicine market was projected to reach over $100 billion, demonstrating a substantial shift towards remote healthcare solutions.

Esteve can leverage these advancements to gather real-world evidence, enhancing patient outcomes and informing future product innovation. The integration of these technologies is crucial for staying competitive and responsive to evolving healthcare delivery models.

Development of Advanced Therapies (Gene and Cell Therapy)

The pharmaceutical landscape is being reshaped by advanced therapies like gene and cell therapy, marking a profound technological evolution. These innovative treatments offer potential cures for previously intractable diseases, moving beyond symptom management to address root causes.

Esteve Pharmaceuticals is strategically positioned to capitalize on this trend, with its pipeline featuring novel advanced therapies targeting inherited metabolic disorders. This focus underscores Esteve's commitment to pioneering treatments in areas with significant unmet medical needs.

The market for gene and cell therapies is experiencing rapid growth. For instance, the global gene therapy market was valued at approximately $10.3 billion in 2023 and is projected to reach over $30 billion by 2030, demonstrating substantial investment and anticipated expansion. This growth reflects increasing clinical success and regulatory approvals, creating a dynamic environment for companies like Esteve.

- Technological Disruption: Gene and cell therapies represent a paradigm shift, offering curative potential rather than just treatment.

- Esteve's Strategic Focus: The company is actively developing advanced therapies for inherited metabolic disorders, aligning with market innovation.

- Market Growth: The global gene therapy market is forecast to grow significantly, projected to exceed $30 billion by 2030.

Data Analytics and Artificial Intelligence in Healthcare

Data analytics and artificial intelligence (AI) are transforming healthcare, offering Esteve significant opportunities. The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach $187.9 billion by 2030, growing at a compound annual growth rate of 43.2%. This surge highlights the increasing adoption of these technologies for optimizing clinical trials, personalizing treatments, and enhancing diagnostic accuracy.

Esteve can leverage these advancements to sharpen its research and development edge. By applying big data analytics, the company can identify patient subgroups that respond best to specific therapies, leading to more effective and targeted drug development. AI-powered diagnostic tools can also accelerate the identification of disease markers, streamlining the path from research to market. For instance, AI has shown promise in improving the accuracy of medical image analysis, with some studies demonstrating AI models achieving diagnostic performance comparable to or exceeding that of human radiologists in specific tasks.

- Clinical Trial Optimization: AI can analyze vast datasets to identify ideal patient cohorts, predict trial outcomes, and reduce trial duration, potentially saving millions in R&D costs.

- Personalized Medicine: Esteve can use data analytics to tailor treatments based on individual patient genetic profiles and medical histories, improving efficacy and reducing adverse effects.

- Enhanced Diagnostics: AI algorithms can improve the speed and accuracy of disease diagnosis from medical imaging and other patient data, leading to earlier intervention and better patient outcomes.

- Streamlined Operations: Predictive analytics can help Esteve manage supply chains more efficiently and forecast market demand, optimizing resource allocation.

Technological advancements, particularly in AI and data analytics, are revolutionizing drug discovery and development for Esteve. The global AI in healthcare market was valued at approximately $15.4 billion in 2023 and is projected to reach $187.9 billion by 2030, indicating massive growth potential. Esteve's investment in these areas allows for optimized clinical trials and personalized medicine, potentially reducing R&D timelines and costs.

The company is also embracing new manufacturing technologies like continuous manufacturing to improve efficiency and product quality. Esteve's new €200 million facility in Spain, operational since 2023, exemplifies this commitment with its advanced automation and digital integration.

Furthermore, Esteve is strategically positioned in the rapidly expanding advanced therapies market, such as gene and cell therapies. The global gene therapy market, valued at around $10.3 billion in 2023, is expected to exceed $30 billion by 2030, highlighting a significant opportunity for Esteve's pipeline in inherited metabolic disorders.

Legal factors

Esteve operates within stringent pharmaceutical regulations, impacting everything from initial research and development to manufacturing, marketing, and ongoing safety monitoring. These frameworks are designed to ensure product efficacy and patient safety, creating a complex but necessary operational environment.

Navigating the labyrinthine drug approval pathways is critical for Esteve's success. For instance, securing approval from the U.S. Food and Drug Administration (FDA) and Spain's Agency of Medicines and Medical Devices (AEMPS) is paramount for introducing new medicines to these key markets. In 2024, regulatory bodies worldwide continue to emphasize data integrity and clinical trial transparency, potentially extending approval timelines for novel therapies.

Intellectual property rights, especially patents, are the bedrock for pharmaceutical innovation, allowing companies like Esteve to safeguard their discoveries and recover substantial research and development expenditures. Esteve's strategic focus on securing and robustly defending patents for its novel drug candidates directly underpins its market exclusivity and future earning potential.

Esteve Pharmaceuticals operates under rigorous product liability and consumer protection laws, a critical legal factor shaping its operations. These regulations hold pharmaceutical firms accountable for ensuring the safety and effectiveness of their medicinal products, a responsibility that directly impacts Esteve's research, development, and manufacturing processes.

To navigate this complex legal landscape and mitigate potential risks, Esteve must maintain exceptionally strict quality control protocols. Adherence to these stringent measures, alongside compliance with evolving consumer protection regulations, is paramount for safeguarding patient trust and the company's reputation. For instance, in 2024, the European Medicines Agency (EMA) continued to emphasize post-market surveillance, requiring companies like Esteve to actively monitor and report adverse events, further underscoring the importance of robust compliance frameworks.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for Esteve Pharmaceuticals, S.A., as they aim to prevent monopolistic practices and foster a fair competitive environment within the global pharmaceutical sector. These regulations directly impact Esteve's ability to pursue mergers, acquisitions, and market expansion strategies, requiring careful adherence to avoid legal scrutiny and potential penalties. For instance, the European Commission's scrutiny of pharmaceutical mergers, such as its 2023 review of Sanofi's acquisition of Amryt Pharma for $2.7 billion, highlights the intense regulatory oversight. Esteve must ensure its business dealings, including pricing and distribution agreements, do not stifle competition or create undue market dominance.

Compliance with these laws is paramount for maintaining a level playing field and ensuring continued market access. Failure to comply can lead to significant fines and reputational damage. For example, in 2024, the U.S. Federal Trade Commission (FTC) continued its aggressive stance on anticompetitive practices, investigating several pharmaceutical companies for alleged pay-for-delay deals. Esteve’s strategic planning must therefore incorporate robust legal review to navigate these complex regulatory landscapes successfully.

- Regulatory Scrutiny: Esteve must navigate antitrust regulations that prohibit monopolistic behavior, ensuring its market strategies promote fair competition.

- Merger & Acquisition Compliance: Acquisitions and partnerships must undergo rigorous antitrust reviews to prevent market concentration and potential legal challenges, mirroring global trends where deals like Sanofi's $2.7 billion Amryt acquisition faced intense scrutiny in 2023.

- Pricing and Distribution Controls: Esteve's agreements on pricing and distribution must not violate competition laws, avoiding practices that could be deemed anticompetitive, as seen in ongoing FTC investigations in 2024.

- Market Access and Legal Stability: Adherence to competition laws is essential for Esteve to maintain market access and ensure legal stability, preventing costly fines and reputational harm.

Data Privacy and Cybersecurity Regulations

The intensifying digitalization within the healthcare sector places a significant emphasis on data privacy and cybersecurity regulations, such as the General Data Protection Regulation (GDPR). Esteve Pharmaceuticals must rigorously adhere to these legal frameworks to ensure the secure handling of sensitive patient information and the protection of proprietary research and business data from evolving cyber threats. Failure to comply not only risks substantial financial penalties but also erodes the trust of patients, partners, and investors.

In 2024, the global cybersecurity market is projected to reach over $200 billion, highlighting the critical nature of these investments for companies like Esteve. The company's commitment to robust data protection measures is therefore paramount for maintaining operational integrity and stakeholder confidence.

- GDPR Compliance: Esteve must ensure all patient data processing activities align with GDPR's stringent requirements for consent, data minimization, and breach notification.

- Cybersecurity Investments: Ongoing investment in advanced cybersecurity technologies and protocols is essential to safeguard against data breaches and intellectual property theft.

- Regulatory Scrutiny: Pharmaceutical companies face increased scrutiny from regulatory bodies regarding data handling practices, necessitating proactive compliance strategies.

- Reputational Risk: A data breach can severely damage Esteve's reputation, impacting its ability to attract and retain patients, researchers, and business partners.

Esteve Pharmaceuticals must navigate a complex web of legal and regulatory frameworks governing drug development, manufacturing, and marketing. Compliance with stringent guidelines from bodies like the FDA and EMA is crucial for market access and patient safety. The company's commitment to intellectual property protection through patents is fundamental to recouping R&D investments and fostering innovation.

Product liability and consumer protection laws hold Esteve accountable for the safety and efficacy of its medicines, necessitating rigorous quality control and post-market surveillance. Furthermore, antitrust and competition laws shape Esteve's strategies for market expansion and partnerships, requiring careful adherence to avoid penalties and maintain fair competition.

Data privacy and cybersecurity are paramount, with regulations like GDPR demanding robust protection of sensitive patient and business data. Esteve's investments in cybersecurity are critical to prevent breaches, safeguard intellectual property, and maintain stakeholder trust in the face of escalating cyber threats.

| Legal Factor | Impact on Esteve | Example/Data Point (2023-2024) |

|---|---|---|

| Drug Approval Pathways | Critical for market entry and revenue generation. | FDA and EMA approval timelines remain stringent; emphasis on data integrity in 2024. |

| Intellectual Property (Patents) | Protects R&D investment and ensures market exclusivity. | Securing patents is vital for recouping significant R&D expenditures. |

| Product Liability & Consumer Protection | Ensures product safety and maintains patient trust. | EMA's increased focus on post-market surveillance in 2024. |

| Antitrust & Competition Laws | Governs market strategies, M&A, and pricing. | FTC investigations into anticompetitive practices in 2024; Sanofi's $2.7B Amryt acquisition faced scrutiny in 2023. |

| Data Privacy & Cybersecurity (GDPR) | Protects sensitive data and maintains operational integrity. | Global cybersecurity market projected over $200B in 2024; GDPR compliance is essential. |

Environmental factors

Climate change presents significant risks to Esteve Pharmaceuticals' supply chain, with extreme weather events potentially disrupting manufacturing facilities and distribution networks. For instance, in 2024, several European regions experienced unprecedented heatwaves and droughts, impacting water availability crucial for pharmaceutical production.

Resource scarcity, particularly concerning water and specific chemical precursors, could also create operational hurdles and increase input costs. Esteve’s proactive approach in 2024 includes investing in water-efficient technologies and exploring alternative sourcing strategies to mitigate these dependencies.

Esteve's dedication to sustainability, evidenced by its 2025 target to reduce greenhouse gas emissions by 15% compared to a 2022 baseline, directly addresses these environmental pressures. This commitment aims to build resilience against climate-related disruptions and ensure long-term operational continuity.

Esteve Pharmaceuticals, like many in the industry, faces significant environmental considerations, particularly concerning waste management and pollution control. Pharmaceutical manufacturing processes inherently produce diverse waste streams, including chemical and hazardous materials, necessitating rigorous handling and disposal protocols. Adherence to stringent environmental regulations governing waste, emissions, and pollution is paramount for Esteve to operate responsibly and minimize its ecological impact.

In recent years, Esteve has demonstrated a commitment to reducing its environmental footprint. The company has reported success in lowering its carbon emissions and decreasing water consumption, reflecting proactive measures in environmental stewardship. For instance, in 2023, Esteve achieved a 15% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2019 baseline, and water usage per unit of production decreased by 10% year-over-year.

Esteve Pharmaceuticals faces increasing scrutiny regarding the ethical and sustainable sourcing of its raw materials, a trend amplified by growing environmental awareness. The company must ensure its global supply chain partners uphold stringent environmental and social responsibility standards to safeguard its reputation and meet evolving sustainability mandates. For instance, by 2024, many pharmaceutical companies are aiming for at least 75% of their key suppliers to have publicly disclosed their carbon emissions, a benchmark Esteve is likely working towards.

Energy Consumption and Renewable Energy Adoption

The pharmaceutical sector is known for its significant energy demands. Esteve's commitment to reducing its energy footprint and increasing the use of renewable energy sources is a key strategy for minimizing environmental impact and achieving long-term operational cost savings. This proactive approach aligns with global sustainability goals and positions the company favorably in an increasingly environmentally conscious market.

Esteve has made a substantial commitment to renewable energy, with all its centers and sites now operating on 100% purchased electricity from renewable sources. This significant achievement demonstrates a tangible step towards decarbonization and a reduced reliance on fossil fuels. Such a move not only addresses environmental concerns but also provides a hedge against volatile energy prices.

- Esteve's renewable energy commitment: Operates 100% of its centers and sites using purchased electricity from renewable sources.

- Environmental impact mitigation: Transitioning to renewables directly reduces the company's carbon footprint.

- Operational cost reduction: Long-term benefits include stable or lower energy expenses compared to fossil fuels.

- Industry alignment: This strategy mirrors growing trends in the pharmaceutical industry towards sustainable operations.

Biodiversity and Ecosystem Protection

Pharmaceutical research and manufacturing inherently carry the potential to impact biodiversity and ecosystems. Esteve acknowledges this, integrating environmental stewardship into its core operations. This commitment translates to actively seeking ways to minimize its ecological footprint across the entire product lifecycle, from initial research and development to manufacturing and eventual disposal.

Esteve's approach prioritizes responsible practices to safeguard natural habitats and biodiversity. For instance, the company focuses on sustainable sourcing of raw materials and implementing efficient waste management systems to reduce pollution. In 2023, Esteve reported a 15% reduction in water consumption at its manufacturing sites compared to 2020 levels, demonstrating a tangible effort to conserve resources.

- Sustainable Sourcing: Esteve aims to source raw materials from suppliers who adhere to environmental standards, minimizing the impact on local ecosystems.

- Waste Reduction Initiatives: The company actively implements programs to reduce hazardous and non-hazardous waste generated during production, with a target of a 10% decrease in total waste by 2025.

- Ecosystem Impact Assessment: Esteve conducts assessments to understand and mitigate potential impacts of its operations on surrounding biodiversity, particularly for new facilities or significant process changes.

- Biodiversity Projects: The company supports local biodiversity projects, contributing to conservation efforts in regions where it operates, as seen in its partnership with a conservation group near its Barcelona facility in 2024.

Environmental regulations continue to tighten, pushing Esteve to invest in advanced pollution control technologies and sustainable manufacturing processes. The company's 2025 sustainability report highlights a 20% reduction in chemical waste discharge compared to 2023, a direct response to stricter European Union environmental directives.

Esteve's commitment to reducing its carbon footprint is evident in its 2024 operational updates, which show a 12% decrease in Scope 1 and 2 emissions year-over-year, driven by energy efficiency improvements and a shift towards renewable energy sources for its manufacturing sites.

The company is also focusing on water stewardship, implementing water recycling systems that have reduced overall water consumption by 15% across its key facilities in 2024, aligning with global efforts to conserve this vital resource amidst increasing scarcity.

| Environmental Metric | 2023 Performance | 2024 Target/Achievement | 2025 Outlook |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 15% vs 2019 | 12% reduction vs 2023 | Targeting 15% reduction vs 2022 |

| Water Consumption per Unit | 10% decrease YoY | 15% reduction across key facilities | Further 8% reduction |

| Chemical Waste Discharge | N/A (Baseline year) | 20% reduction vs 2023 | Targeting 10% reduction vs 2024 |

| Renewable Electricity Usage | 100% purchased electricity | 100% purchased electricity | 100% purchased electricity |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Esteve Pharmaceuticals, S.A. draws upon a robust dataset from official government health and economic agencies, reputable financial news outlets, and leading pharmaceutical industry research firms. These sources provide comprehensive insights into regulatory landscapes, market dynamics, and emerging healthcare trends.