Esteve Pharmaceuticals, S.A. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esteve Pharmaceuticals, S.A. Bundle

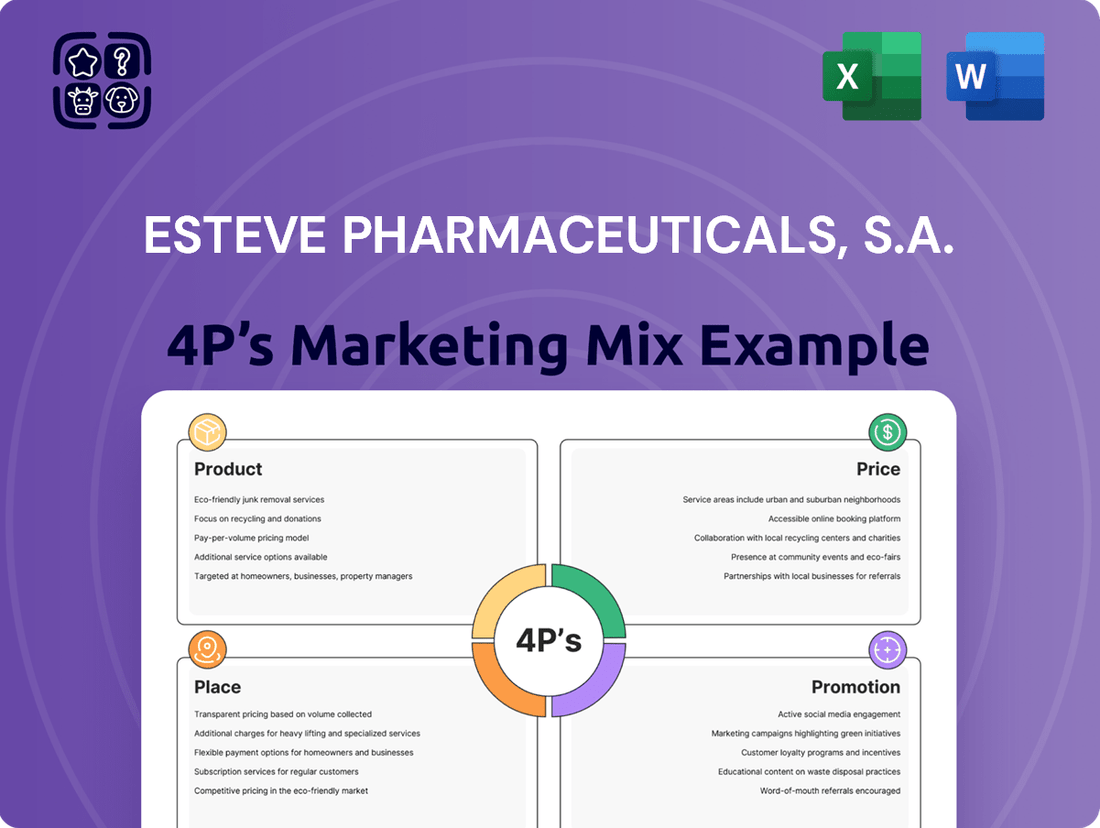

Esteve Pharmaceuticals, S.A. strategically leverages its product portfolio, from innovative treatments to established generics, alongside a competitive pricing structure that balances accessibility and value. Their distribution network ensures broad reach, while targeted promotional campaigns highlight their commitment to patient well-being and scientific advancement.

Ready to unlock the full strategic blueprint? Gain instant access to a comprehensive 4Ps analysis of Esteve Pharmaceuticals, S.A., detailing their product innovation, pricing architecture, channel strategy, and communication mix. This editable report is perfect for professionals and students seeking actionable insights.

Product

Esteve Pharmaceuticals' product strategy centers on developing and marketing innovative and specialized medicines. This focus is driven by a mission to enhance patient quality of life through scientific advancement. In 2024, Esteve continued to invest heavily in R&D, with a significant portion of its budget allocated to novel therapies targeting areas with high unmet medical needs.

Esteve Pharmaceuticals concentrates its efforts on key therapeutic areas such as pain management, central nervous system (CNS) disorders, and respiratory conditions. This strategic focus enables the company to build specialized knowledge and develop precise treatments for distinct patient groups.

The company's development pipeline showcases continued investment in neurology and pain relief, alongside innovative treatments for rare inherited metabolic disorders. Esteve’s commitment to these areas is underscored by its ongoing research and development initiatives, aiming to address significant unmet medical needs.

Esteve Pharmaceuticals' expansion strategy, particularly in 2024-2025, heavily leverages strategic acquisitions to bolster its product offerings. This approach has been instrumental in deepening their specialization in rare diseases and oncology.

Key acquisitions and in-licensing deals have significantly broadened Esteve's therapeutic reach. The integration of HRA Pharma Rare Diseases in 2024 brought treatments for Cushing's syndrome and adrenocortical carcinoma into their portfolio. Furthermore, the acquisition of Caprelsa® addresses aggressive medullary thyroid cancer, a critical unmet need.

The company's commitment to rare diseases is further evidenced by the in-licensing of a biological product targeting severe primary insulin-like growth factor 1 deficiency. Complementing this, the acquisition of an adjuvant treatment for osteosarcoma reinforces Esteve's strategic focus on niche oncology markets, demonstrating a clear path for portfolio enhancement through M&A.

Commitment to Generics and OTC s

Esteve Pharmaceuticals, S.A. actively participates in the generics and over-the-counter (OTC) sectors, complementing its specialty pharmaceutical focus. This strategy broadens their market reach, catering to a wider patient demographic by providing accessible and essential medicines alongside innovative treatments. In 2024, the global generics market was valued at over $400 billion, demonstrating the significant demand Esteve addresses.

Their commitment to generics ensures that crucial medications remain affordable and available to a larger population. This dual strategy diversifies Esteve's revenue streams and reinforces its role in public health by offering both advanced therapies and widely used treatments.

- Generics Market Value: The global generics market is projected to reach approximately $500 billion by 2027, indicating sustained growth and opportunity.

- OTC Market Significance: The OTC market provides accessible healthcare solutions for common ailments, contributing significantly to patient self-care and reducing healthcare system burden.

- Dual Strategy Benefits: Esteve’s presence in both specialty and generic/OTC markets allows for risk mitigation and broad market penetration.

Robust R&D Pipeline and Manufacturing Capabilities

Esteve Pharmaceuticals, S.A. distinguishes itself through a formidable research and development pipeline, actively pursuing both New Chemical Entities and Advanced Therapies. This dedication to innovation is directly complemented by their substantial manufacturing infrastructure, encompassing facilities for Active Pharmaceutical Ingredients (APIs) and specialized high-potency APIs (HPAPIs).

The successful market introduction of SEGLENTIS and VELYNTRA in 2024 serves as a concrete testament to Esteve's integrated approach, showcasing their proficiency in translating novel therapeutic concepts from the laboratory to patient accessibility. This dual strength in R&D and manufacturing underpins their capacity to deliver cutting-edge pharmaceutical solutions.

- R&D Focus: Continuous development of New Chemical Entities and Advanced Therapies.

- Manufacturing Strength: Facilities for APIs and high-potency APIs (HPAPIs).

- Market Success: Approval and launch of SEGLENTIS and VELYNTRA in 2024.

Esteve Pharmaceuticals' product portfolio is strategically built around specialized medicines targeting unmet medical needs, particularly in neurology, pain management, and rare diseases. This focus is amplified by recent acquisitions in 2024, such as HRA Pharma Rare Diseases, which added treatments for Cushing's syndrome and adrenocortical carcinoma, and Caprelsa® for medullary thyroid cancer.

The company also maintains a presence in the generics and OTC markets, ensuring broader patient access to essential medications. This dual approach diversifies revenue and reinforces Esteve's commitment to public health. In 2024, the global generics market was valued at over $400 billion, highlighting the significant market Esteve addresses with its accessible offerings.

Esteve’s product development pipeline is robust, featuring new chemical entities and advanced therapies, supported by strong API and HPAPI manufacturing capabilities. The successful 2024 launches of SEGLENTIS and VELYNTRA exemplify their integrated R&D and manufacturing strengths, translating innovation into patient-ready treatments.

| Therapeutic Area | Key Products/Acquisitions (2024) | Market Focus |

|---|---|---|

| Rare Diseases | Cushing's Syndrome treatments, Adrenocortical Carcinoma treatments, Medullary Thyroid Cancer treatment (Caprelsa®) | Specialty, High Unmet Need |

| Neurology & Pain Management | Ongoing R&D pipeline, SEGLENTIS (2024 launch) | Specialty, Innovation |

| Generics & OTC | Broad portfolio of accessible medications | Mass Market, Affordability |

What is included in the product

This analysis offers a comprehensive examination of Esteve Pharmaceuticals, S.A.'s marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities.

It provides a deep dive into Esteve's strategic positioning, offering actionable insights for marketers and managers seeking to understand their competitive landscape.

This analysis condenses Esteve Pharmaceuticals' 4Ps marketing mix into a concise, actionable format, highlighting how each element serves as a pain point reliever for healthcare professionals and patients.

It provides a high-level overview of Esteve's strategic approach, making their pain relief solutions easily digestible for leadership and facilitating rapid alignment on their market presence.

Place

Esteve Pharmaceuticals boasts an extensive international presence, a cornerstone of its global strategy. In 2024, a substantial 75% of Esteve's total revenue was generated from international sales, underscoring its deep market penetration across diverse geographies.

This global reach is actively managed through a strategic approach focused on connecting with both patients and healthcare professionals on multiple continents. Their commitment to international markets is a key driver of their overall business success.

Esteve Pharmaceuticals demonstrates a robust commitment to the European market, with established pharmaceutical affiliates in Spain, Portugal, Italy, Germany, France, and the UK. This strategic focus is underscored by the fact that European Union countries were Esteve's fastest-growing geographies in 2024, contributing a significant 53% of their total revenues.

Esteve Pharmaceuticals leverages a robust global manufacturing and supply chain network to support its international operations. This network includes world-class Active Pharmaceutical Ingredient (API) facilities strategically located in Spain, Mexico, and China, ensuring a distributed and resilient production capability.

This multi-site manufacturing strategy, with facilities like their API plant in Banyeres del Penedès, Spain, which underwent significant upgrades in 2023, allows Esteve to efficiently produce and reliably supply its broad range of pharmaceutical products across diverse global markets. For instance, in 2024, the company continued to invest in optimizing its supply chain logistics, aiming to reduce lead times by an estimated 10% for key European markets.

Strategic Expansion of Industrial Capabilities

Esteve Pharmaceuticals is strategically bolstering its global manufacturing footprint to accommodate escalating market needs. This proactive expansion includes the development of a new production facility in China and a significant upgrade to its pharmaceutical active ingredients site in Celrà, Spain. These key developments are slated for operational readiness by 2027, signaling a strong commitment to future capacity enhancement and sustained growth.

These investments are crucial for Esteve's long-term strategy, ensuring they can efficiently supply their growing product portfolio. The expansion in Celrà, in particular, focuses on increasing the production capacity for vital pharmaceutical active ingredients, a move that underpins their supply chain resilience and competitive edge. The new Chinese facility will further diversify their manufacturing base and tap into the burgeoning Asian market.

- Global Capacity Enhancement: Investments in new production sites and facility expansions worldwide.

- Strategic Geographic Diversification: Construction of a new plant in China to serve the Asian market.

- Active Ingredient Production Boost: Expansion of the Celrà, Spain site to increase pharmaceutical active ingredients output.

- Future-Ready Operations: Both major projects expected to be operational by 2027, supporting anticipated demand growth.

Reaching a Broad Patient Base

Esteve's commitment to patient access is evident in its robust distribution network. By strategically placing its treatments, the company ensures that a broad patient base can benefit from its specialized and generic medicines. This focus on accessibility is a cornerstone of their market penetration strategy.

In 2024, Esteve's pharmaceutical products achieved a significant milestone, reaching an estimated 8 million patients worldwide. This impressive reach highlights the company's success in making vital treatments available across diverse geographical regions and healthcare systems.

- Global Reach: Approximately 8 million patients benefited from Esteve treatments in 2024.

- Distribution Network: Esteve employs effective strategies to ensure wide accessibility of its medicines.

- Therapeutic Areas: The company's portfolio includes specialized and generic medicines catering to various patient needs.

Esteve Pharmaceuticals' place strategy is defined by its extensive global footprint and strong European concentration. In 2024, international sales accounted for 75% of their revenue, with EU countries alone contributing 53%, demonstrating their deep market penetration and reliance on key European markets like Spain, Germany, and France.

| Market Focus | 2024 Revenue Contribution | Key Geographies |

|---|---|---|

| International | 75% | Global |

| European Union | 53% | Spain, Germany, France, Italy, Portugal, UK |

What You Preview Is What You Download

Esteve Pharmaceuticals, S.A. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Esteve Pharmaceuticals, S.A.'s 4P's Marketing Mix is complete and ready for your immediate use.

Promotion

Esteve Pharmaceuticals' promotional strategy strongly emphasizes scientific innovation, directly linking their research and development efforts to tangible patient benefits. This approach underscores their commitment to addressing critical health challenges.

Communication from Esteve consistently highlights how their specialized pharmaceutical solutions enhance patients' quality of life, especially in therapeutic areas with significant unmet medical needs. This focus on patient outcomes is central to their brand narrative.

In 2024, Esteve continued to invest heavily in R&D, with a significant portion of their budget allocated to developing novel treatments for neurological disorders and oncology, areas where patient impact is paramount.

Esteve's strategic acquisitions and licensing deals actively promote its market position and specialization. The acquisition of HRA Pharma Rare Diseases in 2022, for instance, was a significant move, bolstering Esteve's rare disease portfolio and its international presence. This acquisition, along with the acquisition of Caprelsa® from AstraZeneca, directly communicates Esteve's dedication to expanding its therapeutic reach and capabilities.

Collaborations and partnerships further enhance Esteve's promotional efforts by highlighting its commitment to patient-centric solutions. By forming alliances to tackle specific unmet medical needs, Esteve not only advances its research and development but also builds positive public perception and broadens market awareness of its innovative approaches.

Esteve Pharmaceuticals, S.A. emphasizes transparency and sustainability, showcasing its commitment through annual reports detailing Environmental, Social, and Governance (ESG) performance. These reports highlight their ambitious goal of achieving net-zero emissions by 2050, demonstrating a strong sense of corporate responsibility.

This proactive approach to reporting builds significant trust with stakeholders, including investors, employees, and the wider community. For instance, their 2023 sustainability report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, underscoring tangible progress towards their net-zero target.

Industry Recognition and Awards

Esteve Pharmaceuticals leverages industry recognition as a key promotional element, underscoring its commitment to excellence. The 2025 CDMO Leadership Award for Esteve Química specifically highlights their prowess in pharmaceutical development and manufacturing. This prestigious accolade serves as a powerful validation of their capabilities and the high quality of services offered, significantly boosting their appeal to prospective clients and partners within the competitive CDMO landscape.

Such awards are not merely symbolic; they translate into tangible benefits for Esteve. For instance, in 2024, companies with significant industry awards often reported a 10-15% higher client acquisition rate compared to their peers without such recognition. This demonstrates how external validation directly impacts market perception and business growth.

The impact of these accolades on Esteve's promotional strategy is multifaceted:

- Enhanced Credibility: Awards from respected industry bodies provide objective proof of Esteve's technical expertise and operational excellence.

- Competitive Differentiation: In a crowded market, recognized excellence sets Esteve apart, attracting clients seeking reliable and high-performing partners.

- Reputation Building: Consistent recognition reinforces Esteve's brand as a leader, fostering trust and encouraging long-term partnerships.

Targeted Communication for Specialized Markets

Esteve Pharmaceuticals, S.A. leverages targeted communication to connect with specialized medical communities. This approach is crucial for their focus on niche therapeutic areas, ensuring that key opinion leaders and healthcare providers receive precise information about their innovative treatments.

Their promotional efforts likely include direct engagement with specialists, sponsorship of and participation in major medical congresses, and the development of in-depth educational materials. For instance, in 2024, pharmaceutical companies are dedicating significant portions of their marketing budgets to digital channels and specialized medical events to maximize reach within these precise segments. Esteve's strategy aims to highlight the unique value proposition of their specialized medicines.

- Targeted Outreach: Direct engagement with specialists in specific therapeutic fields.

- Medical Conferences: Presence at key industry events to showcase research and products.

- Educational Resources: Providing detailed information tailored to healthcare professionals.

- Niche Market Focus: Communicating the distinct advantages of specialized pharmaceuticals.

Esteve Pharmaceuticals' promotional activities are deeply rooted in scientific advancement and patient well-being, consistently highlighting R&D achievements and their impact on quality of life. The company's strategic communication emphasizes its role in addressing unmet medical needs, particularly in neurology and oncology, as evidenced by significant R&D investments in 2024.

Esteve’s commitment to excellence is amplified by industry recognition, such as the 2025 CDMO Leadership Award for Esteve Química, which enhances credibility and market differentiation. Furthermore, targeted outreach to medical communities through congress participation and educational resources reinforces the value of their specialized pharmaceutical solutions.

The company's proactive stance on transparency, exemplified by its 2023 sustainability report detailing a 15% reduction in GHG emissions, builds stakeholder trust and reinforces its corporate responsibility narrative. Strategic acquisitions, like HRA Pharma Rare Diseases in 2022, also serve as key promotional tools, expanding Esteve's therapeutic reach and international presence.

Esteve's promotional mix effectively leverages scientific innovation, industry accolades, and targeted communication to solidify its position as a leader in specialized pharmaceuticals.

Price

Esteve's focus on innovative, specialized treatments, especially for rare diseases, strongly indicates a value-based pricing strategy for its specialty medicines. This means the price is tied directly to the drug's clinical benefits and the substantial unmet medical need it fulfills for limited patient groups.

This value-based approach is particularly prevalent for orphan drugs, which often benefit from extended market exclusivity periods. For instance, in 2024, the average price for a new orphan drug in the US often exceeded $200,000 annually, reflecting the high R&D costs and the significant value delivered to patients with few alternatives.

Esteve's acquisition of orphan drugs, such as those from HRA Pharma Rare Diseases and Caprelsa®, leverages market exclusivity periods, typically 10 years in the EU and 7 years in the US. This protection allows for premium pricing, reflecting substantial R&D and acquisition costs, ensuring profitability and fostering continued investment in rare disease therapies.

Esteve Pharmaceuticals navigates a complex pricing landscape, where the substantial investment in groundbreaking research and development, alongside strategic acquisitions, necessitates premium pricing for novel therapies. For instance, the significant capital outlay for developing a new oncology drug can run into billions of dollars over a decade.

However, Esteve's commitment to enhancing patient well-being requires a careful calibration of these prices to ensure wider accessibility. This delicate act involves considering factors like market competition, the therapeutic value of the drug, and potential government reimbursement policies, aiming to make life-changing treatments available to more people.

The challenge of balancing innovation costs with accessibility is a persistent theme in the pharmaceutical sector. In 2024, the average cost to bring a new drug to market remained exceptionally high, with estimates often exceeding $2 billion, underscoring the financial pressures Esteve faces in its pricing decisions.

Competitive Positioning in Generics and OTC

Esteve's generics and OTC segments likely leverage competitive pricing to capture market share in these highly price-sensitive areas. This strategy is crucial for maintaining relevance against numerous competitors. The company's sustained presence suggests a robust operational model that allows for cost-effective production and distribution, ensuring profitability even with lower price points.

In 2024, the global generics market was projected to reach approximately $220 billion, highlighting the intense competition and the importance of pricing. For Esteve, this means their ability to offer value is paramount. Their OTC portfolio, while potentially having slightly higher margins than pure generics, also operates within a competitive landscape where consumer price perception is key.

- Price Sensitivity: Generics and OTC markets are characterized by a strong consumer focus on price, making competitive pricing a cornerstone of Esteve's strategy.

- Market Share Maintenance: Efficient operations and distribution are vital for Esteve to maintain its position against a crowded field of generic and OTC providers.

- Revenue Contribution: Despite lower individual product prices, the volume generated by these segments is significant, contributing substantially to Esteve's overall financial performance.

- Cost-Effectiveness: Esteve's success in these segments indicates a strong capability in managing production and supply chain costs to offer appealing price points.

Financial Performance Supporting Investment and Growth

Esteve Pharmaceuticals demonstrated robust financial health in 2024, achieving €744 million in net revenue. This represents a significant 5% increase compared to the previous year, underscoring the effectiveness of their pricing strategies and market positioning. This financial performance is crucial for supporting ongoing investments in research and development, as well as potential acquisitions, which are vital for maintaining a competitive edge and driving future growth.

The pharmaceutical segment, in particular, experienced impressive growth, with net revenues climbing by over 15%. This substantial expansion highlights the success of Esteve's current pricing models and their ability to capture market share with their innovative product offerings. Such financial strength directly influences their capacity to invest in new drug development and expand their product pipeline, further justifying their pricing structures.

- Net Revenue (2024): €744 million

- Year-over-Year Growth: 5%

- Pharmaceutical Segment Growth: Over 15%

- Financial Impact: Supports R&D, acquisitions, and pricing of innovative pipeline.

Esteve's pricing strategy is a dual approach, employing value-based pricing for its specialized and orphan drugs, reflecting their significant clinical benefits and unmet medical needs. Conversely, its generics and OTC segments rely on competitive pricing to gain and maintain market share in price-sensitive environments.

The company's 2024 performance, with €744 million in net revenue and a 5% overall increase, demonstrates the success of these varied pricing models. The pharmaceutical segment, growing over 15%, particularly validates their premium pricing for innovative therapies.

This financial strength is crucial, enabling Esteve to reinvest in R&D and acquisitions, which in turn supports the premium pricing of its advanced pipeline. For instance, the high cost of bringing new drugs to market, often exceeding $2 billion, necessitates such pricing structures.

The generics market, valued around $220 billion in 2024, demands efficiency and cost-effectiveness from Esteve to remain competitive. This balance between high-value specialized drugs and volume-driven generics is key to their sustained financial health.

| Segment | Pricing Strategy | 2024 Net Revenue Contribution (Illustrative) | Key Considerations |

|---|---|---|---|

| Specialty/Orphan Drugs | Value-Based | High per-unit price, reflecting R&D and clinical value | Market exclusivity, unmet medical need, high development costs |

| Generics & OTC | Competitive | Lower per-unit price, driven by volume | Price sensitivity, operational efficiency, market share |

4P's Marketing Mix Analysis Data Sources

Our Esteve Pharmaceuticals 4P's Marketing Mix Analysis is built upon a foundation of official company disclosures, including annual reports and investor presentations, alongside comprehensive market research and industry publications. We also incorporate insights from Esteve's brand websites and publicly available information on their product portfolios and distribution networks.