Esteve Pharmaceuticals, S.A. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Esteve Pharmaceuticals, S.A. Bundle

Esteve Pharmaceuticals, S.A.'s BCG Matrix offers a crucial lens into its product portfolio's health and potential. Understanding which products are driving growth, which are stable cash generators, and which require strategic re-evaluation is paramount for informed decision-making.

This preview offers a glimpse into Esteve's strategic positioning. To truly unlock the power of this analysis and gain actionable insights for optimizing resource allocation and future investments, purchase the full BCG Matrix report.

The complete report provides a detailed quadrant-by-quadrant breakdown, empowering you with the clarity needed to navigate Esteve's market landscape and drive sustainable success.

Stars

Caprelsa®, acquired by Esteve Pharmaceuticals in June 2025 from Sanofi, targets aggressive medullary thyroid cancer. This strategic move underscores Esteve's commitment to rare diseases, aiming for leadership in a niche with significant unmet medical needs.

With orphan drug designation in major markets, Caprelsa® is poised for substantial growth, reflecting Esteve's focus on high-value, specialized pharmaceutical products.

The acquisition of HRA Pharma Rare Diseases in July 2024 marked a significant expansion for Esteve Pharmaceuticals, bolstering its rare disease portfolio. This strategic move introduced three key treatments targeting conditions like Cushing's syndrome and adrenocortical carcinoma, areas with substantial unmet medical needs and growth potential.

Esteve's integration of HRA Pharma's rare disease assets positions the company to capitalize on the high-growth rare disease market. By focusing on specialized therapies, Esteve aims to establish a leadership role, leveraging HRA Pharma's existing expertise and product pipeline.

Esteve Pharmaceuticals' 2025 acquisition of an adjuvant treatment for high-grade resectable non-metastatic osteosarcoma positions it to capitalize on a critical unmet need. This therapy, now a standard of care, targets a specific oncology segment with significant growth potential.

Increlex® (IGF-1 Deficiency Treatment)

Increlex®, a biologic treatment for severe primary insulin-like growth factor 1 (IGF-1) deficiency in children and adolescents, was in-licensed by Esteve Pharmaceuticals in April 2025. This marks Esteve's entry into the biologic market, targeting a rare disease with significant unmet need.

The product's approval by both the FDA and EMA, and its availability in 40 territories, positions Increlex® as a potential high-growth asset for Esteve. The global market for rare disease treatments is expanding, with projections indicating continued robust growth through 2030.

- Market Position: Increlex® is a differentiated orphan medicine, addressing a specific rare disease.

- Growth Potential: The product offers substantial growth opportunities in a high-need, expanding rare disease market.

- Geographic Reach: Approved and available in 40 territories, demonstrating broad market access.

- Esteve's Strategy: Represents Esteve's strategic move into the biologic product space.

SEGLENTIS®/VELYNTRA® (Acute Pain)

SEGLENTIS®/VELYNTRA® represents a significant innovation for Esteve Pharmaceuticals, marking their first proprietary research product to achieve regulatory approval from both the FDA (US) and AEMPS (Spain) in January 2024 for acute pain management.

This novel analgesic, targeting moderate-to-severe acute pain, is positioned as a potential star in the pain management market, a sector that consistently demonstrates robust growth and high demand. Its unique co-crystal formulation and multimodal mechanism of action differentiate it from existing treatments, offering a compelling value proposition to healthcare providers and patients.

- Market Position: SEGLENTIS®/VELYNTRA® enters the large and dynamic pain management market, aiming for strong initial penetration.

- Key Differentiators: Features a novel co-crystal form and a multimodal mechanism of action.

- Regulatory Milestones: Received FDA (US) and AEMPS (Spain) approval in January 2024.

- Growth Potential: Identified as a key driver for Esteve's future growth due to its innovative profile.

SEGLENTIS®/VELYNTRA®, approved in January 2024, is Esteve Pharmaceuticals' first proprietary research product, targeting acute pain management. Its novel co-crystal formulation and multimodal mechanism of action offer a distinct advantage in a consistently growing market.

This innovative analgesic is positioned as a potential star due to its unique profile and the substantial demand within the pain management sector. Its dual regulatory approval from the FDA and AEMPS in early 2024 underscores its significant growth potential for Esteve.

| Product | Market | Key Differentiators | Approval Date | BCG Category |

|---|---|---|---|---|

| SEGLENTIS®/VELYNTRA® | Acute Pain Management | Novel co-crystal form, multimodal mechanism | January 2024 (FDA, AEMPS) | Star |

What is included in the product

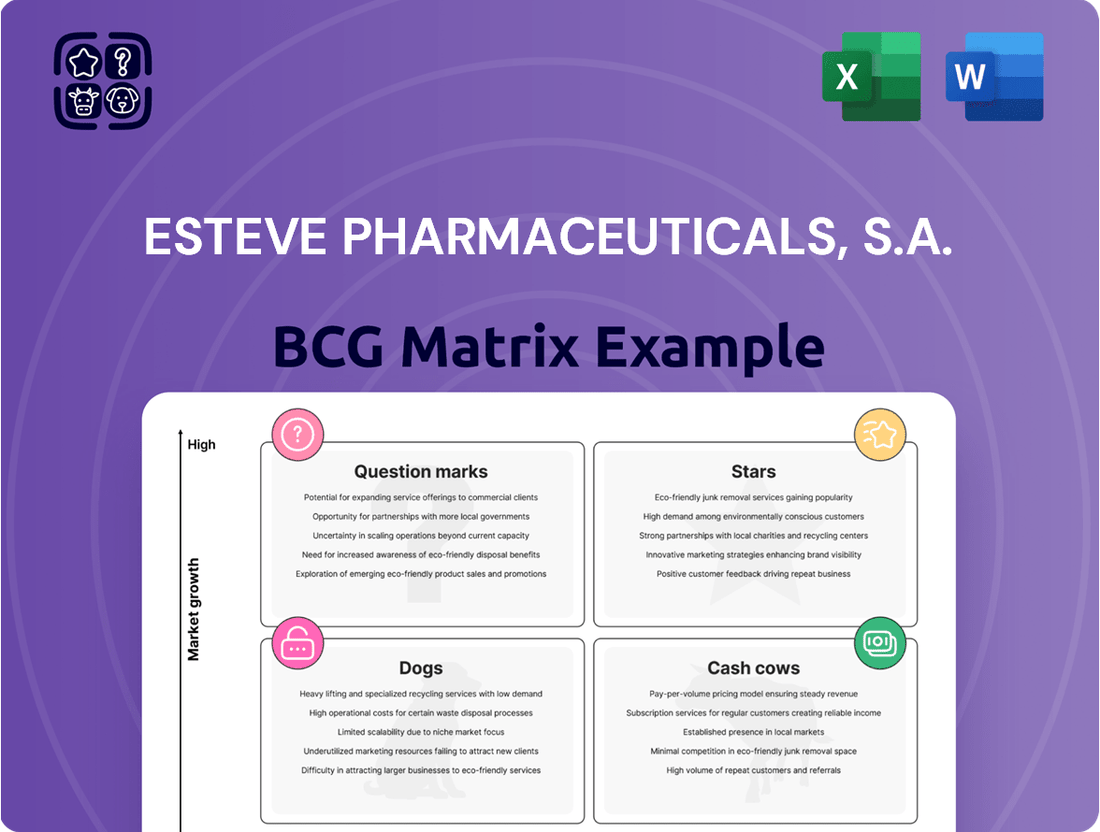

Esteve Pharmaceuticals' BCG Matrix analysis would detail its product portfolio's position in Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

Esteve's BCG Matrix offers a clear, actionable view of its portfolio, alleviating the pain of strategic uncertainty.

This optimized layout simplifies complex data, providing a pain-free path to informed decisions.

Cash Cows

Esteve's established pharmaceutical business in the European Union, which accounts for 53% of its total revenue, represents a significant Cash Cow. This segment likely comprises mature products with robust market positions, ensuring a steady stream of income.

These established therapies are characterized by consistent cash flow generation and require comparatively lower marketing expenditures than emerging products. This financial stability provides a solid base for Esteve's overall operations and strategic investments.

Esteve Química, the Contract Development and Manufacturing Organization (CDMO) arm of Esteve Pharmaceuticals, S.A., functions as a robust Cash Cow within the company's BCG Matrix. This division consistently generates stable net revenues, bolstered by a value-added product mix that ensures positive contributions to Esteve's overall financial performance.

The CDMO segment is a testament to efficiency and maturity, a fact underscored by its recognition with a 2025 CDMO Leadership Award. This operational excellence translates into a reliable and predictable stream of cash flow, providing essential financial stability for the broader organization.

Esteve's traditional pain management portfolio, a cornerstone of their business, is likely a strong cash cow. These established products operate in a mature market, meaning they've likely captured a substantial share and generate reliable, predictable revenue streams. This maturity allows for lower investment needs in marketing and sales compared to newer, high-growth products.

Generic Product Portfolio

Esteve Pharmaceuticals, S.A. likely categorizes its generic and over-the-counter (OTC) product portfolio as Cash Cows within a BCG Matrix framework. These products typically reside in mature markets with stable, predictable demand, generating consistent revenue and profit with minimal ongoing investment in research and development or aggressive marketing once established.

While precise market share figures for Esteve's generics aren't publicly detailed, the nature of this segment suggests a strong contribution to the company's overall financial health. Companies with robust generic offerings benefit from established brand recognition and distribution channels, ensuring ongoing sales without the high risk associated with novel drug development.

The financial characteristics of Cash Cow products translate into significant cash flow generation for the parent company. This cash can then be strategically reinvested into other areas of the business, such as funding the development of Stars or supporting Question Marks with growth potential.

- Stable Revenue Streams: Generics benefit from established patient and prescriber familiarity, leading to predictable sales volumes.

- Low Investment Needs: Post-launch, R&D and marketing expenditures for generics are typically lower compared to innovative products.

- Profitability: Efficient production and established market presence allow for healthy profit margins.

- Cash Flow Generation: These products are key contributors to Esteve's overall financial stability and investment capacity.

Over-the-Counter (OTC) Product Portfolio

Esteve's over-the-counter (OTC) product portfolio represents a significant cash cow for the company. These products address consistent consumer health needs within established markets, leveraging existing brand loyalty and predictable demand to generate steady revenue. This reliable income stream supports Esteve's broader operations, including its investment in research and development for new pharmaceuticals.

The OTC segment provides a stable financial foundation, allowing Esteve to allocate resources effectively. For instance, in 2024, the OTC market continued to show resilience, with many established brands maintaining their market share despite economic fluctuations. This stability is crucial for funding the high costs associated with bringing novel drugs to market.

- Stable Revenue Generation: Esteve's OTC products are known for their consistent sales performance, contributing significantly to the company's bottom line.

- Brand Recognition: Many of these products benefit from long-standing brand recognition, ensuring continued consumer trust and purchase intent.

- Low Investment Needs: Unlike innovative drug development, the OTC portfolio requires relatively lower investment for maintenance and marketing, maximizing profitability.

- Support for R&D: The cash generated by the OTC segment is vital for funding Esteve's pipeline of new pharmaceutical products.

Esteve's established European pharmaceutical business, accounting for 53% of its revenue, functions as a prime Cash Cow. This segment, characterized by mature products with strong market positions, ensures a consistent and reliable income stream for the company.

The mature therapies within this segment generate predictable cash flows, requiring less marketing investment compared to newer products. This financial stability is crucial for supporting Esteve's overall operations and strategic growth initiatives.

Esteve Química, the CDMO division, also operates as a significant Cash Cow. Its consistent net revenue generation, driven by a value-added product mix, contributes positively to Esteve's financial performance, as evidenced by its 2025 CDMO Leadership Award.

The company's traditional pain management portfolio is another strong Cash Cow, benefiting from a mature market and substantial market share. These products offer reliable revenue with lower investment needs, reinforcing Esteve's financial health.

Esteve's generic and OTC portfolios are also classified as Cash Cows, operating in stable markets with predictable demand. These segments generate consistent profits with minimal ongoing R&D or aggressive marketing, providing essential cash for investment in new drug development.

| Segment | BCG Classification | Key Characteristics | Financial Contribution |

| European Pharma Business | Cash Cow | Mature products, strong market share, stable revenue | 53% of total revenue, consistent cash flow |

| Esteve Química (CDMO) | Cash Cow | Value-added products, operational excellence, reliable revenue | Positive contribution to overall financial performance |

| Pain Management Portfolio | Cash Cow | Established therapies, mature market, low investment needs | Predictable revenue streams, financial stability |

| Generics & OTC Portfolio | Cash Cow | Stable demand, brand recognition, low R&D/marketing costs | Consistent profit generation, funding for R&D |

What You’re Viewing Is Included

Esteve Pharmaceuticals, S.A. BCG Matrix

The Esteve Pharmaceuticals, S.A. BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, offering a comprehensive strategic overview of their product portfolio. This professionally formatted report, designed for immediate use, will be instantly downloadable, allowing you to seamlessly integrate its insights into your business planning and competitive analysis. You are previewing the final, analysis-ready file, meaning no further revisions or content additions are needed to leverage its strategic value for Esteve Pharmaceuticals.

Dogs

Legacy products in highly saturated markets, particularly those outside Esteve's current strategic focus on specialized medicine, would likely be classified as Dogs within the BCG Matrix. These offerings, often older and undifferentiated, contend with intense competition in established therapeutic areas. For instance, a legacy pain reliever facing numerous generic alternatives exemplifies this category.

Such products typically exhibit both low market share and minimal growth prospects. Esteve's portfolio might include older antibiotics or cardiovascular drugs where market penetration is already high and innovation has slowed, leading to stagnant or declining sales. This situation can tie up valuable resources with limited potential for significant returns.

Underperforming generic formulations within Esteve Pharmaceuticals, S.A. would likely be classified as Dogs in the BCG Matrix. These are products with a very small market share, often due to intense competition or declining demand. For instance, if Esteve has a generic formulation for an older antibiotic facing numerous low-cost competitors, its market share might be negligible.

These items typically generate minimal revenue, potentially not even covering the costs associated with their continued production and distribution. Consider a generic pain reliever that has been superseded by newer, more effective options; its sales might be so low that maintaining its presence becomes financially questionable for Esteve.

Divested or phased-out non-core assets within Esteve Pharmaceuticals, S.A. would be categorized as Dogs in a BCG Matrix if they exhibit low market share and low growth potential, especially if they no longer align with the company's strategic focus on specialized therapies. For instance, if Esteve had a legacy product line in a mature, non-specialized therapeutic area that was divested in 2023 due to declining sales and limited future prospects, it would fit this classification.

Products with Recently Expired Patents and Declining Sales

Pharmaceutical products from Esteve whose patents have recently expired and where the company hasn't maintained a competitive advantage against generic competitors would fall into the Dogs category of the BCG Matrix. These products face a steep drop in sales and market share.

For instance, a hypothetical Esteve drug that saw its patent expire in late 2023, and faced multiple generic versions entering the market by mid-2024, could exemplify this. If its market share declined by over 50% within the first year of generic competition, and its sales dropped from $100 million annually to $30 million, it would be a prime candidate for the Dogs quadrant.

- Declining Market Share: A product losing significant market share post-patent expiry, potentially falling from 20% to under 5% within 18 months.

- Low Growth/Negative Growth: Sales revenue for such products shrinking year-over-year, perhaps by 15-20% annually.

- Resource Drain: Continued investment in marketing or distribution for these products yields minimal returns, making them cash traps.

- Competitive Pressure: Esteve's inability to differentiate or innovate effectively against lower-priced generic alternatives leads to rapid erosion of its position.

Inefficient Manufacturing for Non-Strategic Products

Inefficient manufacturing for non-strategic products at Esteve Pharmaceuticals would fall into the 'Dog' category. These could be older facilities or processes not aligned with current strategic growth areas, leading to high operational costs and low returns. For instance, if a particular legacy production line for a niche, low-volume drug requires significant manual intervention and specialized maintenance, its operating costs might far outweigh the revenue it generates. In 2024, companies across the pharmaceutical sector are scrutinizing their manufacturing footprints to optimize efficiency, with many divesting or repurposing underutilized assets.

Such 'Dog' assets may become candidates for discontinuation or significant modernization. Esteve's ongoing investment in new production capabilities, as reported in their 2024 financial updates, highlights a strategic shift towards more advanced and efficient manufacturing. This investment could potentially absorb or phase out less productive legacy operations. For example, if a plant dedicated to older, less profitable generics is inefficient, Esteve might choose to cease its operation or retool it to produce higher-margin biologics or specialized therapies.

- Legacy Production Lines: Older facilities or processes dedicated to non-strategic, low-volume products.

- Operational Inefficiency: High costs associated with outdated machinery, manual processes, or underutilization.

- Low Returns: These 'Dog' assets generate minimal profit, potentially even incurring losses.

- Strategic Repurposing: Candidates for discontinuation or modernization to support Esteve's current strategic product portfolio.

Products in mature, highly competitive markets with low growth prospects and a diminished market share for Esteve Pharmaceuticals, S.A. are classified as Dogs. These are often older formulations or those facing significant generic competition, such as a hypothetical legacy pain reliever whose market share dropped from 15% to 3% between 2023 and mid-2024 due to new entrants.

These products typically generate minimal revenue, potentially failing to cover their production and marketing costs. For example, an older antibiotic from Esteve, if its annual sales fell by 25% to €5 million in 2024, would represent a cash drain rather than a profit center.

Inefficient manufacturing processes for non-strategic Esteve products also fall into this category. A legacy production line for a low-volume drug, with high operational costs and low returns, exemplifies this. In 2024, Esteve's focus on optimizing manufacturing efficiency means such assets are candidates for divestment or modernization.

These 'Dog' products, like a generic cardiovascular drug with a market share below 2% and annual sales decline of 10% in 2024, require careful management to minimize resource drain and potentially pave the way for more strategic investments.

Question Marks

Esteve Pharmaceuticals' early-stage gene therapy pipeline, featuring candidates like EGT-101, EGT-201, and EGT-301, targets inherited metabolic disorders such as Mucopolysaccharidosis. These therapies are positioned as potential high-growth assets, reflecting Esteve's commitment to cutting-edge treatments.

Currently in preclinical or Phase II development, these gene therapies represent significant R&D investments with uncertain market penetration. Their early stage means they hold negligible market share, placing them firmly in the question mark category of the BCG matrix, demanding substantial capital to advance through clinical trials and achieve regulatory approval.

E-52862, Esteve Pharmaceuticals' novel selective Sigma-1 antagonist for neuropathic pain, is currently in Phase II clinical trials. This indicates it's a Question Mark in the BCG Matrix, representing a product with high potential in a growing market but uncertain future success.

The neuropathic pain market is substantial, with estimates suggesting it could reach over $7 billion globally by 2027, growing at a CAGR of around 6.5%. However, E-52862 faces intense competition from established treatments and other pipeline candidates, necessitating significant investment in further development and marketing to carve out a market share.

MUMO-1, Esteve Pharmaceuticals' novel NCE targeting pain disorders with a multi-modal mechanism, is currently in preclinical development. This early stage signifies significant technical and regulatory hurdles ahead, typical for candidates in this phase.

The global pain management market is substantial and projected for continued growth. For instance, the market was valued at over $60 billion in 2023 and is expected to expand at a CAGR of around 5% through 2030, driven by an aging population and increasing prevalence of chronic pain conditions.

However, MUMO-1's position as a preclinical asset places it in the "Question Mark" category of the BCG matrix. Its future market share is highly uncertain, necessitating substantial investment in research and development to navigate the lengthy and costly clinical trial process.

Exploration into New Specialized Therapeutic Areas

Esteve's strategic pivot towards specialized medicine necessitates exploration into new therapeutic areas characterized by high unmet medical needs. These emerging fields, where Esteve currently holds no significant market presence, represent potential future Stars within its BCG matrix. Significant strategic investment is required to nurture these nascent research endeavors and early-stage partnerships, aiming to cultivate them into market leaders.

- Oncology: Esteve is actively investing in novel oncology targets, aiming to address rare and aggressive cancers.

- Neurology: The company is exploring early-stage research in neurodegenerative diseases, focusing on areas with limited treatment options.

- Rare Diseases: Esteve is identifying and pursuing opportunities in rare disease indications, which often present high growth potential due to significant unmet needs.

Acquired Early-Stage Rare Disease Assets

Esteve Pharmaceuticals, S.A. might strategically acquire early-stage rare disease assets, positioning them as potential Stars or Question Marks in its BCG Matrix. These acquisitions would target high-growth, high-need markets, reflecting Esteve's commitment to addressing unmet medical needs.

These early-stage assets, while promising, would initially represent low market share for Esteve, necessitating substantial investment in research, development, and eventual commercialization. This investment profile aligns with the characteristics of Question Marks, requiring careful evaluation for future market potential.

- High-Growth Potential: Early-stage rare disease assets tap into markets with significant unmet needs and potential for rapid patient population growth.

- Investment Intensity: Development and commercialization require substantial capital outlay, typical for Question Mark or nascent Star products.

- Market Penetration: Initial market share for these acquired assets would be negligible, offering ample room for growth and market capture.

- Strategic Alignment: Such acquisitions align with Esteve's focus on expanding its rare disease portfolio, aiming to build a strong pipeline of future revenue drivers.

Esteve's gene therapy candidates like EGT-101 and EGT-201, alongside E-52862 for neuropathic pain and MUMO-1 for pain disorders, are all classified as Question Marks in the BCG matrix. These represent products with high potential in growing markets but face significant uncertainty regarding future success and market share.

Their early development stages, from preclinical to Phase II trials, necessitate substantial investment in R&D, clinical trials, and regulatory processes, typical for Question Marks requiring careful strategic evaluation and significant capital allocation to move towards market success.

BCG Matrix Data Sources

Our BCG Matrix is built upon comprehensive market data, integrating financial reports, industry analysis, and competitive intelligence to provide a clear strategic overview.