ESCO Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

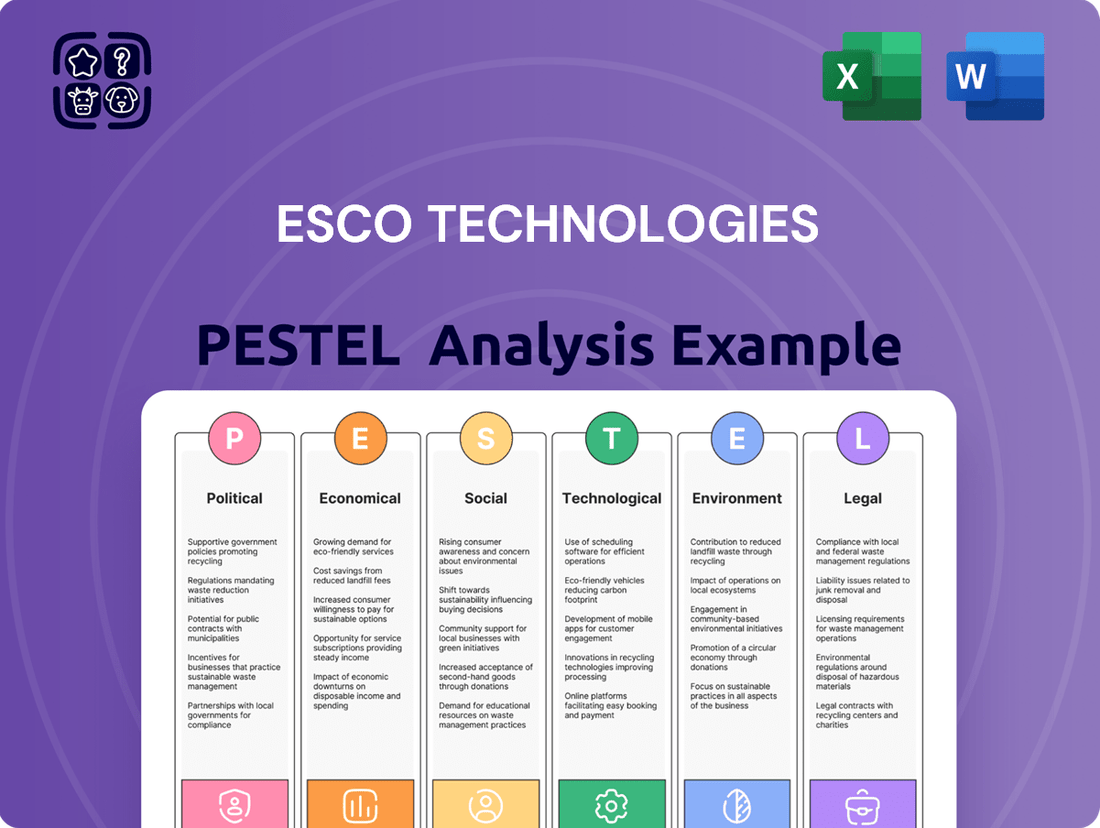

Navigate the dynamic landscape surrounding ESCO Technologies with our comprehensive PESTLE analysis. Uncover the critical political, economic, social, technological, legal, and environmental factors that are shaping its present and future. Gain a strategic advantage by understanding these external forces. Download the full, actionable report now to inform your investment decisions and sharpen your competitive edge.

Political factors

Government budgets and spending allocations for critical infrastructure projects directly influence demand for ESCO Technologies' utility and defense solutions. For instance, the U.S. Infrastructure Investment and Jobs Act of 2021 allocated $1.2 trillion, with a significant portion earmarked for grid modernization and defense enhancements, directly benefiting companies like ESCO.

Increased investment in smart grids, national defense, and aerospace initiatives provides significant growth opportunities for ESCO. In 2024, projected U.S. federal spending on national defense is over $886 billion, and continued investment in upgrading aging power grids offers a robust market for ESCO's specialized products and services.

Conversely, budget cuts or shifts in political priorities could lead to reduced contract awards and project delays for ESCO. A hypothetical reduction in defense appropriations or a slowdown in smart grid deployment due to fiscal constraints would directly impact ESCO's revenue streams and project pipelines.

Shifts in national defense strategies and evolving international relations directly influence ESCO Technologies' defense and aerospace divisions. For instance, increased geopolitical tensions in regions like Eastern Europe and the Middle East in 2024 have historically prompted higher defense spending, potentially boosting demand for ESCO's specialized filtration and testing solutions used in military aircraft and ground vehicles.

Aerospace regulations, particularly those concerning emissions and safety standards, also shape market opportunities for ESCO. The ongoing development of new aerospace technologies and the push for more sustainable aviation practices in 2025 will require advanced materials and testing capabilities, areas where ESCO has a strong presence.

Furthermore, changes in military procurement policies and the impact of export controls and trade agreements are critical. In 2024, many countries reviewed their defense supply chains, which could affect ESCO's ability to export certain technologies, while new procurement contracts, such as those for next-generation fighter jets or surveillance systems, could represent significant revenue streams.

Regulatory frameworks are crucial for ESCO Technologies' Utility Solutions Group. For instance, the Inflation Reduction Act of 2022, with its significant tax credits for clean energy and grid modernization through 2032, directly supports ESCO's offerings in areas like smart grid technology. Conversely, shifts in environmental standards or energy efficiency mandates can introduce compliance costs or necessitate product adjustments, impacting profitability.

Trade Policies and Tariffs

ESCO Technologies' reliance on a global supply chain makes it susceptible to shifts in international trade policies. Tariffs and trade agreements directly influence the cost of imported components and the competitiveness of its exported engineered products and systems. For instance, a rise in tariffs on specialized materials could increase ESCO's production costs, potentially impacting its profit margins.

Protectionist measures enacted by key markets could also restrict ESCO's access, hindering its ability to serve international customers. Conversely, stable and open trade environments, supported by favorable trade agreements, generally benefit ESCO by facilitating smoother operations and expanding its reach to a broader international customer base.

- Impact on Supply Chain: Trade policies can alter the cost and availability of raw materials and components sourced internationally.

- Market Access: Tariffs and trade barriers can affect ESCO's ability to export its products and systems to global markets.

- Competitive Landscape: Changes in trade regulations can shift the competitive dynamics for ESCO and its international rivals.

Geopolitical Stability

Global geopolitical stability significantly impacts ESCO Technologies, especially its defense and aerospace sectors, and its international utility projects. For instance, heightened global tensions in 2024 could increase demand for advanced defense technologies, potentially benefiting ESCO's offerings in this area. Conversely, widespread conflict can disrupt global supply chains, affecting component availability and logistics for ESCO's manufacturing operations.

ESCO's international utility projects are also sensitive to geopolitical shifts. Instability in regions where ESCO undertakes projects can lead to project delays, increased security costs, or even contract cancellations. A stable international environment, on the other hand, typically translates to more predictable business conditions and smoother execution of global projects.

- Global Defense Spending Trends: Global military expenditure reached an estimated $2.44 trillion in 2023, a 6.8% increase in real terms from 2022, according to SIPRI. This upward trend in defense spending can positively influence ESCO's defense-related segments.

- Supply Chain Resilience: The ongoing efforts to build more resilient supply chains, a direct response to geopolitical disruptions experienced in recent years, could lead to increased investment in advanced manufacturing and logistics solutions, areas where ESCO operates.

- International Project Risk: The World Bank's Political Risk Index for various regions where ESCO might operate can provide insights into potential disruptions. For example, regions with higher political instability scores may present greater risks for ESCO's international utility projects.

Government budgets and spending priorities directly shape demand for ESCO's utility and defense solutions. The U.S. Infrastructure Investment and Jobs Act of 2021, allocating $1.2 trillion, significantly boosts grid modernization and defense enhancements, benefiting ESCO. Continued investment in smart grids and national defense, with U.S. federal defense spending projected over $886 billion in 2024, provides a robust market for ESCO's offerings.

Shifts in national defense strategies and geopolitical tensions, such as those in Eastern Europe and the Middle East in 2024, can drive increased defense spending, benefiting ESCO's specialized filtration and testing solutions. Aerospace regulations concerning emissions and safety standards, alongside the push for sustainable aviation in 2025, will require advanced materials and testing, playing to ESCO's strengths.

Changes in military procurement policies and export controls are critical. In 2024, supply chain reviews by many countries could impact ESCO's exports, while new contracts for next-generation military systems offer significant revenue potential. Regulatory frameworks, like the Inflation Reduction Act of 2022's clean energy tax credits through 2032, directly support ESCO's smart grid technologies, though evolving environmental standards can introduce compliance costs.

International trade policies and protectionist measures significantly affect ESCO's global supply chain and market access. Tariffs on specialized materials can increase production costs, impacting profit margins, while favorable trade agreements facilitate smoother operations and broader market reach. Global geopolitical stability is also crucial, with heightened tensions in 2024 potentially increasing demand for defense technologies but also risking supply chain disruptions.

| Political Factor | Impact on ESCO Technologies | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Government Infrastructure Spending | Drives demand for utility solutions (e.g., grid modernization). | U.S. Infrastructure Investment and Jobs Act (2021): $1.2 trillion allocated. |

| National Defense Budgets | Boosts revenue for defense and aerospace segments. | U.S. Federal Defense Spending (2024 est.): >$886 billion. Global military expenditure reached $2.44 trillion in 2023 (SIPRI). |

| Geopolitical Tensions | Can increase defense spending but disrupt supply chains. | Heightened tensions in Eastern Europe and Middle East (2024) influencing defense procurement. |

| Aerospace Regulations | Creates opportunities for advanced materials and testing. | Focus on sustainable aviation and new technologies (2025). |

| Trade Policies & Tariffs | Affects supply chain costs and market access. | Potential impact on imported components and export competitiveness. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing ESCO Technologies, examining the interplay of Political, Economic, Social, Technological, Environmental, and Legal forces.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities across these critical dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of ESCO Technologies' external environment to inform strategic decisions and alleviate concerns about market volatility.

Economic factors

Global economic growth is a critical factor for ESCO Technologies, as it directly influences the spending habits of its core customer base: utilities, aerospace, and defense sectors. A healthy global economy generally means these industries have more capital to invest in infrastructure upgrades, new aircraft development, and military modernization, all of which boost demand for ESCO's specialized components and services.

For instance, projections for global GDP growth in 2024 and 2025, such as those from the IMF, will provide a clearer picture of the economic environment. If global GDP is on an upward trajectory, it suggests increased capital expenditure by ESCO's clients. Conversely, a slowdown or recession could lead to project delays and reduced orders, impacting ESCO's revenue streams.

Rising inflation presents a significant challenge for ESCO Technologies, potentially increasing expenses for raw materials, manufacturing, and labor. For instance, the U.S. Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, indicating rising input costs across industries. If ESCO cannot pass these costs onto customers, profit margins could be squeezed.

Higher interest rates, a common response to inflation, can also impact ESCO's business. Increased borrowing costs for the company itself could affect its ability to fund expansion or research and development. Furthermore, higher rates may deter ESCO's customers, particularly those in infrastructure or capital-intensive sectors, from undertaking new projects, thereby reducing demand for ESCO's products and services. The Federal Reserve's benchmark interest rate remained elevated through much of 2024, reflecting this environment.

Conversely, a stable economic environment with predictable and manageable inflation rates would be advantageous for ESCO Technologies. Such conditions would allow for more effective long-term financial planning, predictable cost structures, and a more stable demand environment for its solutions, particularly in sectors reliant on large capital outlays.

As a global manufacturer, ESCO Technologies is significantly impacted by currency exchange rate fluctuations. A strengthening U.S. dollar, for instance, can make its products pricier for overseas buyers, potentially dampening international sales.

Conversely, a weaker dollar can enhance ESCO's export competitiveness, making its offerings more attractive abroad. For example, the U.S. dollar saw a notable appreciation against several major currencies through much of 2023 and into early 2024, a trend that would have likely presented headwinds for U.S.-based exporters like ESCO.

Effectively managing foreign exchange risk through hedging strategies is therefore a critical component of ESCO's international financial planning and operational stability.

Supply Chain Costs and Availability

Supply chain costs and availability are significant economic factors impacting ESCO Technologies. Fluctuations in commodity prices, labor expenses, and global logistics directly affect ESCO's operational stability and overall expenditure. For instance, the Producer Price Index for manufactured goods saw an increase of 2.0% in the 12 months ending April 2024, indicating rising input costs that could pressure ESCO's margins if not managed effectively.

Disruptions or price volatility for critical components and raw materials pose a direct threat to ESCO's production timelines and profitability. The ongoing geopolitical tensions and their impact on shipping routes, such as those observed in the Red Sea in early 2024, have led to increased freight costs and delivery delays for many industries, a risk ESCO must navigate. A robust and economically viable supply chain is therefore essential for ESCO to maintain competitive pricing and ensure punctual product delivery to its customers.

- Commodity Price Volatility: Rising prices for metals like copper and aluminum, essential for ESCO's products, can directly increase manufacturing costs. For example, copper prices reached multi-year highs in early 2024, trading above $9,000 per metric ton.

- Labor Cost Inflation: Increased wages and a tight labor market, particularly in specialized manufacturing sectors, contribute to higher operational expenses for ESCO. Average hourly earnings for production and non-supervisory employees in manufacturing rose by approximately 4.5% year-over-year through early 2024.

- Global Logistics Challenges: Port congestion, container shortages, and elevated shipping rates, exacerbated by global events, can lead to extended lead times and higher freight bills for ESCO. The Drewry World Container Index, a benchmark for global shipping rates, experienced significant volatility throughout 2023 and into early 2024, reflecting these supply chain pressures.

Customer Capital Expenditure Cycles

ESCO Technologies' performance is significantly influenced by the capital expenditure (CapEx) cycles of its key customer industries, including utilities, aerospace, and defense. These sectors typically operate with extended planning and procurement timelines, meaning ESCO's revenue is closely linked to their investment decisions and budget availability.

For instance, the utility sector's CapEx is often driven by infrastructure upgrades and grid modernization projects. In 2024, global utility CapEx was projected to reach approximately $1.5 trillion, with a notable portion allocated to renewable energy integration and grid resilience, areas where ESCO's products are relevant.

The aerospace and defense industries also exhibit distinct CapEx patterns. Defense spending, in particular, saw a global increase in 2024, with many nations prioritizing modernization and new platform development. This trend supports demand for ESCO's specialized components and systems within these segments.

- Utility Sector CapEx: Global utility capital expenditure was estimated to be around $1.5 trillion in 2024, with ongoing investments in grid modernization and renewable energy infrastructure.

- Aerospace Demand: The commercial aerospace sector's recovery continued in 2024, with airlines placing significant orders for new aircraft, indirectly boosting demand for ESCO's aerospace components.

- Defense Spending: Global defense spending continued its upward trajectory in 2024, driven by geopolitical factors, supporting sustained investment in defense systems that utilize ESCO's technologies.

Economic factors significantly shape ESCO Technologies' operating landscape. Global economic growth directly influences the capital expenditure of its key clients in utilities, aerospace, and defense. For example, projected global GDP growth for 2024 and 2025, as indicated by institutions like the IMF, will signal the demand environment for ESCO's specialized products.

Inflation and interest rates are also crucial considerations. Rising input costs, exemplified by the U.S. Producer Price Index for manufactured goods showing increases in early 2024, can pressure ESCO's profit margins. Elevated interest rates, such as the Federal Reserve's sustained benchmark rate through much of 2024, can increase borrowing costs for ESCO and deter customer investments.

Currency exchange rates present another economic variable. A strengthening U.S. dollar, observed against major currencies in late 2023 and early 2024, can make ESCO's exports more expensive, impacting international sales.

Supply chain dynamics, including commodity price volatility and logistics challenges, directly affect ESCO's costs and delivery capabilities. Copper prices, for instance, reached multi-year highs above $9,000 per metric ton in early 2024, impacting manufacturing expenses.

| Economic Factor | Impact on ESCO Technologies | Relevant Data (2024/2025) |

|---|---|---|

| Global GDP Growth | Influences client capital expenditure and demand for ESCO's products. | IMF projects global growth to remain steady in 2024 and 2025, supporting infrastructure and defense spending. |

| Inflation | Increases raw material, labor, and manufacturing costs. | U.S. PPI for manufactured goods saw a 2.0% increase year-over-year by April 2024, indicating rising input costs. |

| Interest Rates | Affects ESCO's borrowing costs and customer investment decisions. | Federal Reserve maintained elevated interest rates through early 2024. |

| Currency Exchange Rates | Impacts international sales competitiveness. | U.S. dollar appreciated against major currencies in late 2023/early 2024. |

| Commodity Prices | Directly influences manufacturing costs. | Copper prices exceeded $9,000/metric ton in early 2024. |

Preview Before You Purchase

ESCO Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive ESCO Technologies PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a deep understanding of the external forces shaping ESCO's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into market trends and competitive pressures.

Sociological factors

Societies worldwide face a significant challenge with aging utility infrastructure, creating a robust demand for advanced solutions like those offered by ESCO Technologies. For instance, in the United States, the American Society of Civil Engineers' 2021 report card gave the nation's infrastructure a C-minus, highlighting critical deficiencies in the electric grid, which necessitates substantial investment in modernization.

This growing societal imperative to upgrade and secure existing power grids, especially as populations expand and energy consumption rises, directly fuels the market for ESCO's smart grid technologies and diagnostic testing equipment. The increasing strain on these older systems, coupled with a push for greater efficiency and reliability, presents a consistent opportunity for companies providing these essential upgrades.

Growing societal awareness and demand for environmental sustainability are significantly shaping ESCO Technologies' product development, especially in their filtration and utility solutions segments. Consumers and businesses alike are increasingly prioritizing eco-friendly options.

There's a clear upward trend in the demand for cleaner energy sources, reduced industrial emissions, and more efficient resource management. This presents a substantial opportunity for ESCO to offer products that directly address these critical environmental concerns, like advanced filtration systems for air and water purification.

In 2024, for instance, global investment in renewable energy is projected to reach over $2 trillion, highlighting the market's shift towards sustainability. This trend puts pressure on companies like ESCO to not only innovate but also to visibly demonstrate strong environmental stewardship in their operations and product life cycles.

Societal shifts are reshaping the workforce, presenting both challenges and opportunities for ESCO Technologies. An aging workforce in many developed nations means a potential loss of experienced talent, particularly in specialized engineering and manufacturing roles. This trend, coupled with evolving technological demands, contributes to a growing skills gap, making it harder to find qualified personnel.

The availability of skilled engineers, technicians, and IT professionals is paramount for ESCO Technologies, given its focus on highly engineered products and complex systems. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a need for over 3 million new manufacturing jobs by 2030, with a significant portion requiring advanced technical skills that are currently in short supply.

To counter these demographic and skill-related pressures, ESCO Technologies must prioritize investment in robust training and development programs. This proactive approach ensures the existing workforce stays current with new technologies and fosters the next generation of skilled employees, thereby mitigating the impact of the skills gap and securing a competitive edge.

Urbanization and Energy Demand

The relentless march of global urbanization continues to fuel a significant surge in energy demand. As more people flock to cities, the need for dependable and efficient utility infrastructure, particularly for electricity, becomes paramount. This societal trend directly translates into a sustained and growing market for companies like ESCO Technologies, whose smart grid and utility solutions are essential for managing the energy requirements of burgeoning urban populations.

Efficient energy delivery is no longer just a utility concern; it's a critical component of urban planning and development. Cities worldwide are grappling with how to power their expanding metropolises sustainably and reliably. For instance, by 2050, it's projected that 68% of the world's population will reside in urban areas, according to the United Nations. This demographic shift underscores the urgency for advanced solutions that can optimize energy distribution and consumption.

- Urban Population Growth: Global urban population is expected to reach 68% by 2050, up from 56% in 2021.

- Energy Consumption Impact: Urban areas account for over two-thirds of the world's energy consumption and more than 70% of global CO2 emissions.

- Infrastructure Investment: Significant investment in upgrading and modernizing energy grids is required to meet this demand.

Public Perception of Critical Infrastructure

Public sentiment regarding the dependability and safety of essential services like power grids and defense networks significantly shapes both government and corporate spending. A growing understanding of potential infrastructure weaknesses can boost the market for ESCO Technologies' diagnostic, security, and resilience-enhancing products.

For instance, following disruptions, public demand for more robust infrastructure solutions often rises. In 2023, surveys indicated that over 60% of citizens in developed nations expressed concern about the cybersecurity of their national power grids, directly impacting the perceived need for advanced protection. This heightened awareness translates into increased opportunities for companies like ESCO Technologies that offer solutions to these vulnerabilities.

- Public concern over critical infrastructure security remains high, with surveys in 2023 showing over 60% of respondents in developed economies worried about power grid cybersecurity.

- Increased awareness of infrastructure vulnerabilities directly drives demand for diagnostic, security, and mitigation solutions offered by companies like ESCO Technologies.

- Public trust is a crucial element; a perceived lack of reliability can deter investment, while confidence fuels it.

- ESCO Technologies' focus on grid modernization and cybersecurity aligns with public and governmental priorities for enhanced infrastructure resilience.

Societal trends like aging populations and evolving workforce demographics present both challenges and opportunities for ESCO Technologies. The need for skilled labor in advanced manufacturing and engineering is growing, with the U.S. Bureau of Labor Statistics projecting over 3 million new manufacturing jobs by 2030, many requiring specialized skills that are currently scarce.

ESCO must invest in training to bridge this skills gap, ensuring its workforce remains adept with new technologies and can meet the demands of its complex product lines. This focus on workforce development is crucial for maintaining a competitive edge in a rapidly evolving industrial landscape.

Technological factors

The ongoing evolution of smart grid technologies, encompassing advanced metering infrastructure (AMI), grid automation, and robust cybersecurity solutions, directly fuels demand for ESCO Technologies' Utility Solutions Group. The increasing digitization and interconnectedness of the energy grid are creating a sustained need for ESCO's specialized products and services.

For instance, the U.S. Department of Energy projected that by the end of 2024, over 90 million smart meters would be deployed nationwide, highlighting the scale of this digitization. This trend ensures a continuous market for ESCO's offerings in grid modernization and data management.

Technological advancements in advanced manufacturing, including additive manufacturing and robotics, are significantly boosting production efficiency and product quality for companies like ESCO Technologies. Embracing these innovations can lead to substantial cost reductions and faster prototyping cycles.

ESCO Technologies' commitment to investing in modern production capabilities, such as automated assembly lines and sophisticated testing equipment, is crucial for maintaining its competitive edge. For instance, the global industrial automation market was projected to reach over $200 billion in 2024, indicating a strong trend towards increased adoption of these technologies across industries.

Developments in sensor technology and big data analytics present a significant growth avenue for ESCO Technologies, particularly within its diagnostic testing and monitoring equipment segments. Enhanced sensor capabilities are enabling more precise measurements, which directly supports the trend towards predictive maintenance in various industries. For instance, the global market for industrial sensors was projected to reach over $30 billion in 2024, indicating robust demand for advanced sensing solutions.

Advanced analytics, fueled by the increasing volume and sophistication of data collected by these sensors, can transform raw measurements into actionable insights for ESCO's customers. This capability is crucial as businesses increasingly seek to optimize operations and reduce downtime. The market for big data analytics services is expected to continue its rapid expansion, with projections suggesting it could surpass $100 billion globally by 2027, underscoring the value customers place on data-driven decision-making.

Consequently, these technological advancements are driving a clear demand for more intelligent and integrated data-driven solutions from ESCO Technologies. Customers are actively looking for equipment that not only performs diagnostics but also leverages data to provide predictive capabilities and operational intelligence, creating a competitive advantage for ESCO in offering such advanced functionalities.

Cybersecurity Advancements

As critical infrastructure increasingly relies on interconnected systems, the demand for advanced cybersecurity for smart grids and defense applications is paramount. ESCO Technologies, through its Utility Solutions Group, must consistently embed and deliver state-of-the-art cybersecurity capabilities to counter sophisticated and evolving threats.

This focus on cybersecurity is a vital component of ESCO's ongoing research and development efforts. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, underscoring the significant investment and innovation in this sector. ESCO's ability to provide secure solutions directly impacts its competitiveness in these critical markets.

- Growing threat landscape: The increasing sophistication of cyberattacks necessitates continuous adaptation of security protocols.

- Smart grid security: Protecting the integrity and operational continuity of smart grids is a key driver for cybersecurity demand.

- Defense sector needs: Government and defense agencies require highly secure, resilient systems for national security.

- ESCO's R&D investment: Ongoing investment in cybersecurity research and development is crucial for ESCO's product differentiation and market position.

Materials Science Innovations

Breakthroughs in materials science are directly influencing ESCO Technologies' product lines. Innovations leading to lighter, stronger, and more resilient materials can significantly enhance the performance and durability of their filtration and fluid flow solutions. This is particularly relevant for their aerospace and defense sectors, where material properties are critical for operational success.

The adoption of advanced materials offers a tangible competitive advantage. For instance, the development of novel composites or advanced polymers could lead to more efficient filtration systems or lighter, more robust components for aircraft. ESCO's investment in research and development for new material applications is therefore crucial for maintaining market leadership and driving product innovation.

- Advancements in composite materials are enabling lighter and stronger components for aerospace applications, potentially reducing fuel consumption for aircraft manufacturers who are ESCO's clients.

- Nanotechnology integration into filtration membranes can improve particle capture efficiency by up to 20% in certain industrial fluid applications, a key area for ESCO.

- Development of corrosion-resistant alloys extends the lifespan of fluid handling components, crucial for sectors like oil and gas where ESCO operates.

- Research into self-healing polymers could revolutionize the durability of seals and gaskets in high-pressure fluid systems, reducing maintenance needs.

The rapid advancement of smart grid technology, including sophisticated metering and grid automation, directly boosts demand for ESCO Technologies' utility solutions. The increasing digitization of energy infrastructure, with over 90 million smart meters projected for deployment in the U.S. by the end of 2024, ensures a consistent market for ESCO's grid modernization offerings.

Innovations in advanced manufacturing, such as robotics and additive manufacturing, are enhancing ESCO's production efficiency and product quality, contributing to cost reductions and faster development cycles. The global industrial automation market, expected to exceed $200 billion in 2024, reflects a strong industry-wide trend towards adopting these technologies.

Developments in sensor technology and big data analytics are creating significant growth opportunities for ESCO's diagnostic and monitoring equipment. The industrial sensor market alone was projected to surpass $30 billion in 2024, highlighting the demand for precise measurement capabilities that support predictive maintenance strategies.

The increasing reliance on interconnected systems for critical infrastructure mandates robust cybersecurity, a key focus for ESCO's Utility Solutions Group. With the global cybersecurity market projected to exceed $300 billion in 2024, ESCO's ability to deliver secure solutions is vital for its competitiveness.

Legal factors

ESCO Technologies' Utility Solutions Group operates within a stringent legal and regulatory environment that dictates practices in power generation, transmission, and distribution. Compliance with these evolving standards, including those for grid interoperability and safety, is not merely optional but a prerequisite for market entry and product validation. For instance, the U.S. Department of Energy's grid modernization initiatives, with significant funding allocated in 2024-2025, directly influence the performance and interoperability requirements for utility equipment.

ESCO Technologies operates within a landscape of increasingly stringent environmental protection laws, directly influencing its manufacturing and product development, particularly in its filtration segment. Regulations concerning air and water quality, the handling of hazardous materials, and waste management are critical compliance areas. For instance, the U.S. Environmental Protection Agency (EPA) continually updates standards; in 2024, the EPA proposed stricter rules for particulate matter, impacting industrial emissions control, a key area for ESCO's filtration solutions.

Adhering to these environmental mandates is not merely a legal necessity but a cornerstone for maintaining ESCO's corporate reputation and avoiding costly penalties. Non-compliance can lead to significant fines and operational disruptions. In 2023, companies in the manufacturing sector faced an average of $15,000 in fines for environmental violations, underscoring the financial risks involved.

Conversely, these environmental regulations create significant market opportunities for ESCO. Products and technologies that assist customers in meeting or exceeding these environmental standards, such as advanced filtration systems for industrial emissions or water purification, represent a growing demand. The global market for industrial filtration is projected to reach $50 billion by 2027, driven in part by regulatory compliance needs.

ESCO Technologies operates within the defense and aerospace sectors, which are heavily regulated by intricate government procurement laws. These regulations dictate how contracts are awarded and managed, ensuring fairness and national security. For instance, the U.S. Department of Defense awarded approximately $700 billion in contracts in fiscal year 2023, highlighting the scale of these opportunities and the importance of compliance.

Navigating international business in these sensitive industries requires strict adherence to export control regulations like the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR). These laws govern the transfer of defense-related articles and services. In 2024, the U.S. government continued to emphasize enforcement of these regulations, with significant penalties for violations.

Failure to comply with these legal frameworks can lead to severe consequences for companies like ESCO Technologies. These can include contract termination, debarment from future government work, substantial fines, and even criminal charges. For example, companies have faced multi-million dollar penalties for export control violations in recent years, underscoring the critical need for robust legal and compliance programs.

Intellectual Property Rights Protection

Protecting ESCO Technologies' intellectual property, encompassing patents, trademarks, and trade secrets for its advanced engineered products, is a critical legal imperative. Strong legal frameworks are essential to deter infringement and preserve market leadership.

ESCO Technologies actively pursues global enforcement of its intellectual property rights to safeguard its innovations. This proactive stance is vital in maintaining its competitive edge in technologically driven sectors.

- Patent Portfolio Strength: ESCO Technologies holds numerous patents for its unique technologies, particularly in areas like fluid power and electrical solutions. For instance, in 2024, the company continued to file new patent applications to cover advancements in its high-performance connectors and filtration systems.

- Trademark Enforcement: The company's brand names and logos are legally protected trademarks, preventing unauthorized use that could dilute brand value or mislead customers.

- Trade Secret Management: Confidential manufacturing processes and proprietary designs are safeguarded as trade secrets, a crucial element of ESCO's competitive advantage.

Product Liability and Safety Regulations

ESCO Technologies operates under stringent product liability and safety regulations, a critical legal factor impacting its engineered products. Compliance with these laws is paramount to ensure customer safety and maintain the company's standing. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 30,000 consumer product-related injuries requiring medical attention, highlighting the pervasive nature of these risks.

Adherence to industry-specific safety standards, such as those set by UL or ASTM, and robust testing protocols are fundamental for ESCO to mitigate legal exposure. Failure to meet these benchmarks can lead to costly litigation and reputational damage. The potential for product recalls, a significant legal and financial burden, underscores the importance of proactive safety management.

- Regulatory Compliance: ESCO must navigate a complex web of national and international product safety laws.

- Risk Mitigation: Rigorous testing and quality control are essential to prevent safety failures and associated legal liabilities.

- Reputational Impact: Product recalls or safety incidents can severely damage brand trust and market position.

- Financial Consequences: Legal settlements, fines, and recall costs can represent substantial financial drains for the company.

ESCO Technologies faces significant legal and regulatory hurdles across its diverse operating segments. Compliance with evolving utility standards, environmental protection laws, defense procurement rules, and intellectual property rights are critical. Product liability and safety regulations also demand rigorous adherence to prevent litigation and protect the company's reputation.

Environmental factors

The global push to combat climate change is a significant tailwind for ESCO Technologies, particularly its utility solutions segment. Governments worldwide are accelerating investments in renewable energy infrastructure, with the International Energy Agency reporting that global renewable capacity additions reached a record 510 gigawatts (GW) in 2023, a 50% increase from 2022. This surge directly fuels demand for grid modernization technologies that ESCO provides, enabling the integration of these cleaner energy sources.

As nations solidify decarbonization targets, the need for smart grid solutions that enhance energy efficiency and manage the intermittency of renewables becomes paramount. For instance, the US Department of Energy's Grid Deployment Office is allocating billions to upgrade the nation's grid, supporting projects that improve reliability and incorporate distributed energy resources. ESCO's expertise in advanced metering, grid automation, and data analytics positions it as a key player in facilitating this essential energy transition.

Growing global concerns over resource scarcity, especially water and energy, are significantly boosting the market for efficient and sustainable industrial and utility operations. ESCO Technologies' advanced filtration systems are well-positioned to address water purification and reuse needs, while its smart grid technologies offer substantial energy efficiency improvements. In 2024, the global water and wastewater treatment market was valued at approximately $650 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, highlighting the demand for solutions like ESCO's.

Environmental regulations are tightening globally, pushing companies like ESCO Technologies to invest heavily in waste management and pollution control. This includes adhering to strict emission standards, with many regions now targeting reductions in greenhouse gases by 2030, impacting manufacturing processes.

ESCO's filtration solutions play a crucial role in helping its industrial clients meet these environmental demands. For instance, in 2024, the demand for advanced filtration systems in sectors like automotive and power generation saw a notable increase, driven by stricter air quality mandates.

Environmental Compliance and Reporting

ESCO Technologies, like many industrial firms, navigates a complex web of environmental regulations. These mandates, covering everything from greenhouse gas emissions to waste disposal, require diligent compliance and detailed reporting. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine its reporting requirements for greenhouse gas emissions under programs like the Greenhouse Gas Reporting Program (GHGRP), impacting companies with significant emissions. Failure to comply can result in substantial fines and operational disruptions.

Proactive environmental stewardship is becoming a critical differentiator. Companies that transparently report their environmental performance, often through sustainability reports aligned with frameworks like the Global Reporting Initiative (GRI), can bolster their brand image and attract environmentally conscious investors. ESCO's commitment to these practices directly influences its ability to secure capital and maintain positive stakeholder relationships. For example, as of 2024, the demand for ESG (Environmental, Social, and Governance) investments continues to grow, with many funds actively seeking companies with strong environmental track records.

- Regulatory Landscape: Increasing stringency in global environmental regulations, particularly concerning carbon emissions and waste management, necessitates robust compliance strategies for companies like ESCO.

- Reporting Transparency: Investors and stakeholders demand greater transparency regarding environmental impact, pushing companies to adopt comprehensive reporting standards and practices.

- Investor Confidence: Strong environmental performance and clear reporting are increasingly linked to enhanced investor confidence and access to capital, especially within the growing ESG investment sector.

- Operational Impact: Non-compliance with environmental laws can lead to significant financial penalties, reputational damage, and operational restrictions, underscoring the importance of proactive environmental management.

Extreme Weather Events and Grid Resilience

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, are placing immense pressure on existing utility infrastructure, underscoring the urgent need for enhanced grid resilience. In 2023 alone, the U.S. experienced 28 separate weather and climate disasters, each causing at least $1 billion in damages, according to NOAA data. This trend is projected to continue, demanding proactive solutions from companies like ESCO Technologies.

ESCO Technologies is well-positioned to address these challenges through its portfolio of diagnostic testing equipment and smart grid components. These solutions enable utility companies to more effectively assess damage following disruptive events, expedite power restoration efforts, and ultimately construct more robust and adaptable power grids. The growing threat of climate-related disruptions creates a significant and expanding market for these critical products and services.

- Increased Investment in Grid Modernization: Anticipated government spending and utility capital expenditures on grid modernization are expected to reach hundreds of billions of dollars in the coming years, driven by resilience needs.

- Demand for Diagnostic Tools: Utilities are increasingly investing in advanced diagnostic tools to proactively identify vulnerabilities and monitor grid health, a core offering for ESCO.

- Smart Grid Adoption: The global smart grid market is projected for substantial growth, with estimates suggesting it could reach over $100 billion by 2027, fueled by the need for better grid management and resilience.

The global shift towards sustainability and decarbonization presents a significant opportunity for ESCO Technologies. Governments worldwide are implementing policies to promote renewable energy and reduce emissions, directly impacting the demand for ESCO's grid modernization and filtration solutions. For instance, the U.S. Inflation Reduction Act of 2022 includes substantial incentives for clean energy, expected to drive significant investment in grid infrastructure upgrades through 2030.

ESCO's products are vital for utilities aiming to integrate more renewable energy sources and improve energy efficiency. The increasing adoption of smart grid technologies, driven by the need for grid resilience and management of distributed energy resources, is a key growth area. The global smart grid market was valued at approximately $40 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, reaching over $100 billion.

Environmental regulations are becoming more stringent, requiring companies to invest in advanced filtration and emission control technologies. ESCO's filtration segment, providing solutions for water and air purification, is well-positioned to benefit from these trends. The global industrial filtration market was estimated to be worth over $30 billion in 2023 and is expected to see continued growth as environmental compliance becomes more critical.

The increasing focus on ESG (Environmental, Social, and Governance) factors by investors means that companies with strong environmental performance and transparent reporting are more attractive. ESCO's commitment to providing solutions that support sustainability efforts can enhance its appeal to investors and customers alike. Many investment funds now prioritize companies with demonstrable positive environmental impact, influencing capital allocation decisions in 2024 and beyond.

PESTLE Analysis Data Sources

Our PESTLE Analysis for ESCO Technologies is built on a robust foundation of data from reputable sources, including government economic reports, industry-specific market research, and analyses of technological advancements. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting ESCO.