ESCO Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

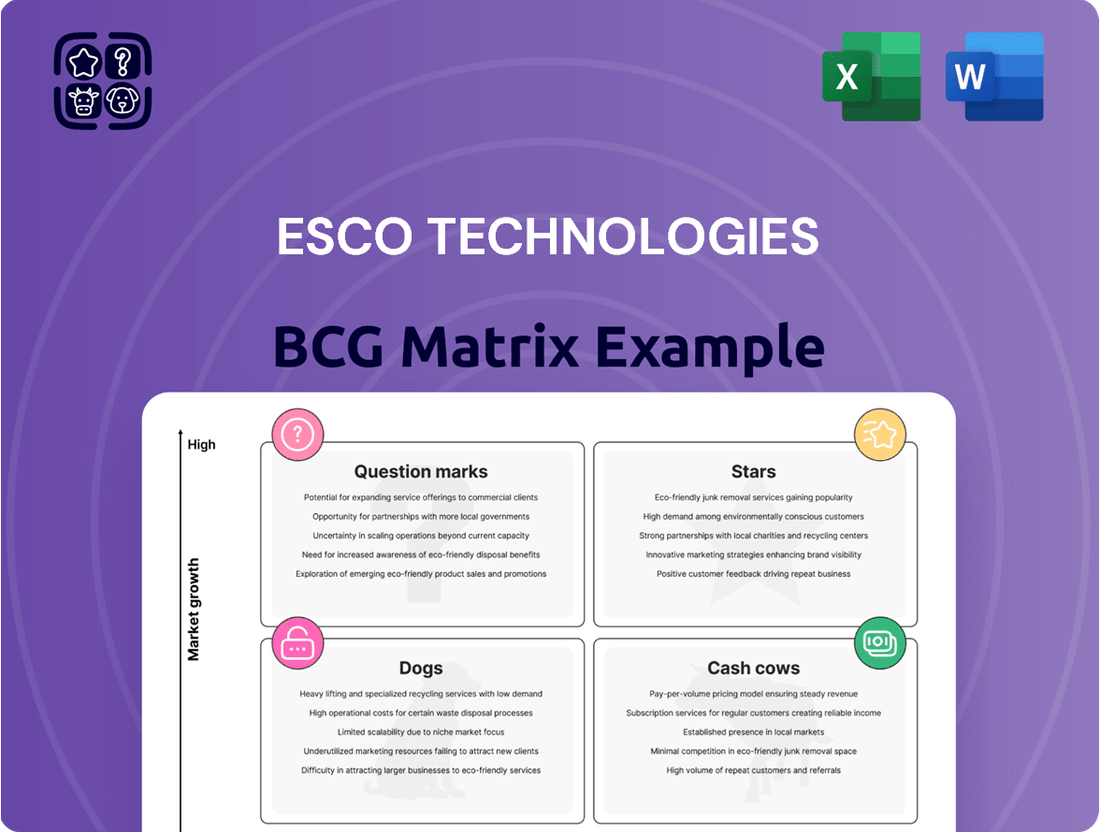

Curious about ESCO Technologies' strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their competitive edge and unlock actionable strategies, dive into the full report.

Don't miss out on the complete picture! Purchase the full ESCO Technologies BCG Matrix to gain detailed quadrant placements, data-backed insights, and a clear roadmap for optimizing your investments and product development. This is your key to informed decision-making.

Stars

ESCO Technologies' Aerospace & Defense (A&D) segment, specifically its Navy and commercial aerospace operations, is a clear Star in the BCG matrix. This segment exhibits both high growth and a dominant market share, reflecting its strong competitive position.

The A&D segment's performance in fiscal year 2025 has been exceptional. Sales in the first quarter of 2025 saw a substantial 21% increase, largely attributed to strong demand within the Navy and commercial aerospace sectors. This upward trend continued into the second quarter of 2025, with an 8% sales increase, further underscoring the segment's robust growth trajectory.

Further bolstering its Star status, ESCO Technologies completed the acquisition of SM&P in April 2025, rebranding it as ESCO Maritime Solutions. This strategic move is anticipated to significantly broaden ESCO's naval product portfolio in both the United States and the United Kingdom, reinforcing its leadership in this high-growth market.

The Test and Measurement segment, particularly its US operations, is a clear Star in ESCO Technologies' portfolio. This is driven by robust growth and a strong market standing within an expanding sector. In the first quarter of fiscal year 2025, the Test business saw impressive double-digit revenue growth and more than 500 basis points of margin expansion, bolstered by an over 40% surge in orders.

This momentum carried into the second quarter of fiscal year 2025, with sales increasing by 9%. The primary drivers for this growth were elevated performance in US-based Test and Measurement products, industrial shielding, and medical services, complemented by significant MPE filter projects. The broader global test and measurement equipment market is forecasted to expand at a compound annual growth rate of 4.5% between 2025 and 2030, underscoring the favorable market conditions for ESCO's products.

Doble Engineering Company, a vital component of ESCO Technologies' Utility Solutions Group, stands out as a Star in the BCG Matrix, specifically for its offline test equipment and services. This segment has demonstrated robust performance, marked by consistent double-digit growth in both orders and revenue, underscoring its strong market position within a crucial utility infrastructure sector.

In the first quarter of fiscal year 2025, Doble experienced a notable 12% increase in sales. This growth was largely propelled by a particularly strong performance in offline and protection testing products and services. A significant contributor to this was a substantial $4.3 million order for offline test equipment received from Phenix, highlighting the demand for Doble's specialized solutions.

Filtration and Fluid Control Products for Aviation and Navy

ESCO's filtration and fluid control products for aviation and Navy are firmly positioned as Stars in the BCG Matrix. This segment thrives due to the overall strength of ESCO's Aerospace & Defense business, which experienced notable sales expansion in 2024, particularly from Navy and commercial aviation sectors. The critical role of these specialized, high-performance products in demanding applications secures a leading market position within the expanding defense and aerospace landscape.

The robust demand for these essential components, often requiring advanced engineering for critical systems, contributes significantly to their Star status. For instance, the Aerospace & Defense segment reported substantial revenue growth, underscoring the market's reliance on ESCO's offerings. This consistent performance highlights the segment's ability to capture and maintain a high market share in a growing industry.

- Market Growth: The Aerospace & Defense sector, a key market for these products, demonstrated strong growth trends through 2024.

- High Market Share: ESCO's specialized filtration and fluid control products maintain a leading position due to their critical nature and advanced engineering.

- Revenue Contribution: Significant sales increases in the Aerospace & Defense segment, driven by Navy and commercial aerospace, validate the Star positioning.

- Essential Applications: The indispensable function of these products in vital aviation and naval systems ensures sustained demand and market dominance.

Signature Management & Power (SM&P) / ESCO Maritime Solutions

The recently acquired Signature Management & Power (SM&P) business, now operating as ESCO Maritime Solutions, is positioned as a Star within ESCO Technologies' BCG Matrix. This strategic acquisition, finalized in April 2025, signals a significant investment in a high-growth sector. The business is expected to bolster ESCO's naval product portfolio in both the US and UK markets, targeting areas with substantial growth potential.

ESCO Maritime Solutions' integration is anticipated to substantially enhance ESCO's overall capabilities. The focus on naval applications aligns with projected growth in defense spending. For instance, global defense spending reached an estimated $2.44 trillion in 2023, with naval modernization being a key component, suggesting a robust market for ESCO's expanded offerings.

- High Growth Market: ESCO Maritime Solutions operates within the defense sector, specifically naval technology, a market experiencing consistent growth driven by geopolitical factors and modernization efforts.

- Strategic Importance: The acquisition strengthens ESCO's position in the defense supply chain, particularly for US and UK naval programs, indicating a move towards higher-margin, specialized products.

- Potential for High Market Share: By integrating SM&P, ESCO aims to capture a significant share of the naval solutions market, leveraging the acquired business's expertise and existing contracts.

- Future Contribution: The business is expected to contribute meaningfully to ESCO's revenue and profitability in the coming years, justifying its classification as a Star.

The Aerospace & Defense (A&D) segment, particularly its Navy and commercial aerospace operations, is a strong Star. This segment shows both high growth and a dominant market share, reflecting its competitive strength. Fiscal year 2025 has seen exceptional performance, with Q1 sales up 21% and Q2 sales up 8%, driven by demand in these sectors.

The Test and Measurement segment, especially its US operations, is also a Star. It enjoys robust growth and a strong market position in an expanding sector. Q1 FY2025 saw double-digit revenue growth and over 500 basis points of margin expansion, supported by over 40% order growth.

Doble Engineering Company's offline test equipment and services are a Star. This segment has achieved consistent double-digit growth in orders and revenue, solidifying its market position. Q1 FY2025 sales increased by 12%, driven by strong offline and protection testing product performance, including a $4.3 million order from Phenix.

ESCO's filtration and fluid control products for aviation and Navy are Stars, benefiting from the overall strength of the A&D business. These specialized, high-performance products hold a leading market position in a growing defense and aerospace landscape, with significant sales increases reported in FY2024.

The recently acquired Signature Management & Power (SM&P) business, now ESCO Maritime Solutions, is a Star. This April 2025 acquisition targets high-growth naval applications, enhancing ESCO's portfolio in the US and UK. Global defense spending reached an estimated $2.44 trillion in 2023, with naval modernization being a key driver.

| Segment | BCG Category | Key Drivers | FY2025 Performance Highlights |

|---|---|---|---|

| Aerospace & Defense (Navy & Commercial) | Star | High market demand, strong competitive position | Q1 sales +21%, Q2 sales +8% |

| Test & Measurement (US Operations) | Star | Robust growth, expanding sector, strong orders | Q1 revenue growth double-digit, margin expansion >500 bps, orders +40% |

| Doble Engineering (Offline Test Equipment & Services) | Star | Consistent double-digit growth, critical infrastructure sector | Q1 sales +12%, $4.3M order from Phenix |

| Filtration & Fluid Control (Aviation & Navy) | Star | Critical applications, advanced engineering, A&D segment strength | Significant sales increases in A&D FY2024 |

| ESCO Maritime Solutions (formerly SM&P) | Star | High-growth naval market, strategic acquisition, defense spending | Acquired April 2025; targets US/UK naval growth |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for ESCO Technologies' Stars, Cash Cows, Question Marks, and Dogs.

A clear, visual ESCO Technologies BCG Matrix instantly clarifies business unit performance, easing the pain of strategic uncertainty.

Cash Cows

The broader Utility Solutions Group, excluding its high-growth segments, operates as a Cash Cow for ESCO Technologies. Its sales growth was 4% in Q1 2025 and remained at 4% in Q2 2025, reflecting its mature market positioning.

Despite slower growth compared to other segments, this division consistently delivers robust EBIT and Adjusted EBIT margins, signaling strong and reliable cash generation. The segment's focus on essential diagnostic instruments, software, and services for industrial power users and the electric utility industry underscores its stability.

ESCO Technologies' legacy Test & Measurement products and systems, while not experiencing the explosive growth of newer applications, function as cash cows within the company's portfolio. These established offerings, serving critical needs in energy measurement and control, likely command a significant market share and generate steady, predictable revenue streams. For example, by the end of fiscal year 2023, ESCO's Test & Measurement segment reported a revenue of $404.5 million, with mature product lines contributing a substantial portion of this, demonstrating their ongoing value and profitability.

ESCO Technologies' industrial shielding and medical services, situated within the Test/Measurement segment, function as cash cows. These divisions demonstrated consistent growth in Q2 2025, reflecting steady market demand for their specialized offerings.

While not exhibiting rapid expansion, these segments likely benefit from entrenched market positions and loyal customer bases, ensuring a dependable generation of cash flow for ESCO.

MPE Filter Sales and Projects

MPE filter sales and projects, especially those targeting established industrial uses, function as cash cows for ESCO Technologies. These offerings experienced robust sales growth in both the first and second quarters of fiscal year 2025. Their consistent demand and revenue contribution highlight a strong market position within a mature sector, ensuring reliable cash generation.

The dependable nature of these MPE filter products fuels ESCO's ability to invest in other areas of the business. For instance, in Q1 2025, MPE segment revenue reached $38.5 million, followed by $40.2 million in Q2 2025, demonstrating steady performance. This consistent cash flow is vital for supporting innovation and expansion initiatives.

- MPE Filter Sales Growth: Q1 2025 saw MPE sales at $38.5 million, increasing to $40.2 million in Q2 2025.

- Mature Market Presence: Established industrial applications provide a stable demand base.

- Cash Generation: Consistent revenue from these filters acts as a reliable source of cash for the company.

- Strategic Importance: These cash cows support ESCO Technologies' investments in growth areas.

Certain Commercial Aerospace Components

Certain commercial aerospace components supplied by ESCO Technologies fit the profile of cash cows. These are parts that have a long history of use and are critical for aircraft operation, leading to a stable demand. ESCO benefits from their established market position, meaning they likely hold a significant share of the market for these specific components. This allows them to generate substantial and consistent revenue without needing to pour significant capital into research and development or market expansion for these particular items.

The aerospace industry, while dynamic, has segments where mature components are essential. For ESCO, these components are vital for their Aerospace & Defense segment, acting as reliable sources of income. In 2023, the Aerospace & Defense segment of ESCO Technologies reported significant revenue contributions, with mature components playing a key role in maintaining profitability within that division. This consistent revenue stream is crucial for funding other areas of the business.

- High Market Share: ESCO holds a dominant position for these standardized aerospace components.

- Stable Revenue Generation: These parts provide consistent income without requiring major new investments.

- Low Investment Needs: Mature products typically have lower R&D and marketing costs.

- Segment Profitability: They are key contributors to the overall financial health of ESCO's Aerospace & Defense business.

ESCO Technologies' Utility Solutions Group, excluding its high-growth segments, functions as a cash cow. Its sales growth remained steady at 4% in both Q1 and Q2 2025, reflecting a mature market position. This segment consistently generates robust EBIT and Adjusted EBIT margins, underscoring its stability and reliable cash generation from essential diagnostic instruments and services.

ESCO's legacy Test & Measurement products, particularly those serving critical energy needs, are also cash cows. By the end of fiscal year 2023, this segment generated $404.5 million in revenue, with mature product lines being significant contributors. These established offerings maintain a strong market share, ensuring predictable revenue streams.

Furthermore, MPE filter sales for established industrial uses and certain commercial aerospace components act as cash cows. MPE segment revenue grew from $38.5 million in Q1 2025 to $40.2 million in Q2 2025, demonstrating consistent demand. These mature products provide dependable cash flow, supporting ESCO's investments in growth areas.

| Segment/Product Line | Role in BCG Matrix | Q1 2025 Revenue (Millions) | Q2 2025 Revenue (Millions) | Sales Growth (YoY) | Key Characteristics |

|---|---|---|---|---|---|

| Utility Solutions Group (Mature Segments) | Cash Cow | N/A | N/A | 4% | Stable EBIT/Adj. EBIT margins, essential services |

| Test & Measurement (Legacy Products) | Cash Cow | N/A | N/A | N/A | Established market share, predictable revenue |

| MPE Filter Sales (Industrial Uses) | Cash Cow | $38.5 | $40.2 | Consistent | Dependable cash generation, supports investment |

| Commercial Aerospace Components | Cash Cow | N/A | N/A | Stable | Long history of use, critical for operations |

Delivered as Shown

ESCO Technologies BCG Matrix

The ESCO Technologies BCG Matrix preview you're examining is the identical, fully rendered document you will receive upon completing your purchase. This means no watermarks, no placeholder text, and no alterations—just the complete, professionally formatted strategic analysis ready for immediate implementation.

Dogs

NRG sales within ESCO Technologies' Utility Solutions Group exhibit characteristics of a Dog in the BCG Matrix. In the first quarter of 2025, NRG sales saw a significant decline of 22%, primarily attributed to a slowdown in renewable energy project development.

This downward trend continued into the second quarter of 2025, with NRG sales remaining flat. This performance suggests a low market share within a segment facing considerable headwinds, pointing towards either declining profitability or a stagnant position in a market that is not expanding rapidly.

ESCO Technologies' Cybersecurity/Compliance (DUCe) Solutions, part of its Utility Solutions Group, appears to be positioned as a Dog in the BCG Matrix. Lower sales observed in Q2 2025 for these specific offerings point towards this classification. This suggests that despite the overall growth in the cybersecurity market, ESCO's products within this niche may be struggling with market share or facing significant competitive pressures.

ESCO Technologies' decision to strategically review and ultimately divest VACCO Industries, including its Space business, strongly suggests this segment operated as a Dog within their BCG Matrix. This move was driven by a desire to streamline their business and enhance shareholder value by shedding units with potentially limited growth or persistent profitability issues.

The anticipation of further profitability declines in VACCO's Space programs during Q4 2024 solidifies its classification as a cash trap. This means the business likely consumed more capital than it generated, hindering overall company performance and requiring ongoing investment without a clear path to significant returns.

Certain Defense Aerospace Products (Lower Growth Areas)

Certain defense aerospace products, particularly those not directly linked to the robust Navy or expanding commercial aerospace sectors, represent ESCO Technologies' lower-growth areas within its portfolio. These segments may be experiencing slower demand or facing increased competition, impacting their overall contribution.

The company's performance in the first quarter of 2025 reflected this, with the Aerospace & Defense segment orders declining by 30%. A portion of this decrease is attributable to lower demand in specific defense aerospace sub-segments. This suggests that these particular product lines are operating in markets with limited growth potential or that ESCO's market share in these niches is not expanding.

- Low Growth Markets: Certain defense aerospace products may be mature or facing reduced government spending priorities.

- Market Share Challenges: In these specific sub-segments, ESCO might not hold a leading market position, limiting its ability to capitalize on available demand.

- Q1 2025 Impact: A 30% drop in A&D segment orders, partly due to defense aerospace, highlights the underperformance of these specific product categories.

- Strategic Focus Needed: These areas might require strategic evaluation, potentially involving divestiture, repositioning, or innovation to improve their growth trajectory.

Older or Niche Filtration Product Lines with Limited Growth

Within ESCO Technologies' Filtration/Fluid Flow segment, certain older or highly specialized product lines may be categorized as question marks or even dogs if their growth prospects have significantly diminished. These are offerings that, while potentially still profitable, have likely reached market saturation or face intense competition, limiting their ability to expand market share. For instance, a specific type of industrial filter that was once a market leader but has been surpassed by newer technologies might fall into this category.

While the Filtration/Fluid Flow segment as a whole demonstrates strength, it is crucial to identify and assess individual product lines within it. Some mature product offerings might no longer represent a substantial portion of ESCO's overall revenue or growth trajectory. For example, if a niche filtration product line, despite its historical importance, accounts for less than 2% of the segment’s sales and has seen zero year-over-year growth in 2024, it would warrant careful consideration.

- Limited Market Share: Product lines with a declining or stagnant market share, potentially below 5% in their specific niche.

- Low Growth Rate: Annual revenue growth rates consistently below 3% for the past three fiscal years, including 2024 projections.

- High Maturity: Products in mature industries where technological advancements are minimal or adoption rates are very slow.

- Declining Profitability: A trend of decreasing gross margins or operating income for these specific product lines over recent periods.

ESCO Technologies' divestiture of VACCO Industries, including its Space business, strongly indicates these operations were Dogs. This strategic move aimed to shed underperforming units with limited growth potential and persistent profitability issues, thereby streamlining the business and enhancing shareholder value.

The anticipation of further profitability declines in VACCO's Space programs during Q4 2024 solidifies its classification as a cash trap, consuming more capital than it generated and hindering overall company performance.

Certain defense aerospace products, particularly those not tied to robust Navy or expanding commercial aerospace sectors, represent ESCO's lower-growth areas. These segments may be experiencing slower demand or facing increased competition, impacting their contribution to overall performance.

The company's performance in Q1 2025 reflected this, with the Aerospace & Defense segment orders declining by 30%, partly due to lower demand in specific defense aerospace sub-segments, suggesting limited growth potential or stagnant market share in these niches.

| Business Unit/Product Line | BCG Category | Key Indicators |

|---|---|---|

| VACCO Industries (Space Business) | Dog | Anticipated profitability declines (Q4 2024), divestiture due to limited growth/profitability issues. |

| Specific Defense Aerospace Products | Dog | 30% decline in A&D segment orders (Q1 2025), slower demand, increased competition, limited growth potential. |

| Mature Filtration/Fluid Flow Products | Potential Dog | Low market share (<5%), low growth rate (<3% YoY in 2024), high maturity, declining profitability. |

Question Marks

Newer renewable energy solutions within ESCO Technologies' Utility Solutions Group are likely positioned as Question Marks in the BCG Matrix. While the overall renewable energy sector is experiencing robust growth, ESCO's specific market share in these nascent technologies is probably still developing, meaning they have low market share in a high-growth industry.

These ventures, though promising, currently demand significant investment to scale and gain market traction. For instance, in 2024, the global renewable energy market was valued at over $1.3 trillion and is projected to grow at a compound annual growth rate (CAGR) of approximately 8.4% through 2030, according to various market research reports. ESCO's participation in this dynamic market, particularly in emerging areas like advanced solar integration or novel energy storage, represents an opportunity but also a cash drain with uncertain immediate returns.

The success of these newer renewable energy solutions hinges on ESCO's ability to innovate, secure market share, and manage costs effectively. If these investments pay off and ESCO captures a significant portion of the growing demand, they could transition into Stars. However, without proven market dominance, they remain cash-consuming ventures with the potential for future high rewards or significant losses.

ESCO Technologies is positioned to capitalize on the burgeoning demand for RF test and measurement solutions driven by 5G and the Internet of Things (IoT). The global test and measurement equipment market is projected for robust growth, with emerging technologies being a key catalyst. For instance, the 5G test equipment market alone was valued at approximately $2.7 billion in 2023 and is expected to reach over $7.5 billion by 2030, growing at a CAGR of over 15%.

While ESCO's broader test and measurement segment demonstrates strength, its specific market share within these rapidly evolving 5G and IoT sub-segments might currently be modest. This presents an opportunity for ESCO to invest strategically in research and development and market penetration to establish a leading position in these high-growth areas. Capturing this nascent market requires focused efforts to develop specialized solutions that meet the unique demands of advanced wireless communication and connected devices.

ESCO Technologies' aggressive expansion into specific international markets, where its presence is currently limited, would likely place these ventures in the Question Mark category of the BCG Matrix. These are regions with high growth potential, but ESCO is still in the process of building market share and brand recognition. Significant investment in sales, marketing, and local infrastructure is necessary to establish a strong foothold, and the success of these endeavors remains uncertain.

Recently Introduced or Developing Proprietary Technologies

ESCO Technologies is actively developing proprietary technologies that could be classified as question marks within a BCG matrix. These innovations are designed to address emerging market demands, particularly in areas like advanced filtration and fluid control systems, and specialized materials for aerospace and defense. The company's investment in these nascent technologies signals a belief in their future growth potential.

These developing technologies, while holding promise for high future returns, currently face challenges such as limited market penetration and the need for substantial capital outlay. ESCO's commitment to research and development, evidenced by its ongoing product pipeline, underscores the strategic importance of these ventures. For example, in its Filtration and Fluid Technologies segment, ESCO is investing in next-generation filtration media that offer enhanced performance characteristics for critical applications, aiming to capture new market segments.

- Advanced Filtration Media: Development of novel materials for ultra-fine particle removal in semiconductor manufacturing and medical devices.

- High-Performance Fluidic Components: Innovations in miniaturized and specialized valves and connectors for aerospace and defense applications, enhancing system efficiency and reliability.

- Smart Materials Integration: Exploration of integrating sensor technology into existing product lines to provide real-time performance monitoring and predictive maintenance capabilities.

Strategic Partnerships or Joint Ventures in New Areas

Strategic partnerships or joint ventures ESCO Technologies enters to explore new areas or technologies would typically be categorized as Question Marks in the BCG Matrix. These ventures often target rapidly expanding markets where ESCO's current market share is low, requiring significant investment to gain traction. The success of these collaborations hinges on their ability to capture substantial market share and transition into Stars.

For instance, if ESCO were to partner with a leading AI firm in 2024 to develop advanced cybersecurity solutions for the burgeoning IoT market, this would represent a classic Question Mark. The IoT security market, projected to grow significantly in the coming years, offers high potential but also intense competition, demanding substantial capital and strategic focus from ESCO to succeed.

- High Growth Potential: Ventures into emerging sectors like advanced materials or renewable energy technologies, where market growth is strong but ESCO's current presence is minimal.

- Significant Investment Required: These partnerships necessitate substantial capital outlay for research, development, and market penetration, reflecting the inherent risk and potential reward.

- Uncertain Future Success: The outcome of these collaborations is uncertain; they could either become highly profitable Stars or fail to gain sufficient market share, becoming Dogs.

- Strategic Importance: Such partnerships are crucial for ESCO's long-term diversification and innovation strategy, allowing entry into potentially lucrative future markets.

New proprietary technologies and strategic international market expansions represent key Question Marks for ESCO Technologies. These ventures are characterized by high growth potential but currently low market share, necessitating significant investment.

For example, ESCO's investment in advanced filtration media for semiconductor manufacturing, a sector experiencing high demand, requires substantial R&D and market penetration efforts. Similarly, expanding into new international territories demands considerable capital for sales and infrastructure development.

The success of these Question Marks hinges on ESCO's ability to innovate and capture market share in these dynamic, high-growth areas. Without established dominance, these remain cash-intensive opportunities with uncertain future outcomes, potentially evolving into Stars or failing to gain traction.

| ESCO Technologies Venture | BCG Category | Market Growth | ESCO Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|---|

| New Renewable Energy Solutions | Question Mark | High | Low | High | Star or Dog |

| 5G/IoT Test & Measurement | Question Mark | High | Modest | High | Star or Dog |

| International Market Expansion | Question Mark | High | Low | High | Star or Dog |

| Proprietary Filtration Media | Question Mark | High | Low | High | Star or Dog |

| Strategic Partnerships (e.g., IoT Security) | Question Mark | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our ESCO Technologies BCG Matrix leverages comprehensive data from financial reports, market research, and industry analysis to provide strategic insights.