ESCO Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

Discover how ESCO Technologies leverages its Product, Price, Place, and Promotion strategies to maintain its market leadership. This analysis offers a foundational understanding of their approach.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for ESCO Technologies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

ESCO Technologies focuses on engineered products and systems, primarily serving the utility, aerospace, and defense industries. These sophisticated solutions are built to meet rigorous industry specifications and demanding performance needs.

In fiscal year 2023, ESCO reported total revenue of $645.2 million, with a significant portion derived from these key sectors, showcasing the breadth of their engineered offerings and their importance in critical infrastructure and defense applications.

The company's broad product range, from utility protection equipment to aerospace components, creates a stable financial foundation. This diversification across multiple high-stakes markets provides resilience and consistent revenue generation for ESCO Technologies.

ESCO Technologies' Filtration and Fluid Control Systems, a key offering within its Aerospace & Defense segment, provides specialized hydraulic filter elements, fluid control devices, and precision-machined components. These critical systems ensure the dependable operation of aircraft, spacecraft, and naval vessels, underscoring their vital role in national security and advanced exploration. In 2024, ESCO's Aerospace & Defense segment reported significant contributions, reflecting the ongoing demand for high-performance filtration and fluid control solutions in these demanding sectors.

The Utility Solutions Group (USG) at ESCO Technologies provides critical diagnostic testing and data management solutions, a key component of their Product strategy. These offerings are vital for electric power grid operators, enabling them to effectively assess and maintain the health of high-voltage power delivery equipment.

The Doble business, a significant contributor to USG, specializes in offline and protection testing products and services. This focus directly addresses the need for reliable grid operation, ensuring the continuous flow of electricity. In 2023, ESCO Technologies reported that its Utility Solutions Group generated approximately $300 million in revenue, highlighting the market demand for these essential services.

RF Test and Measurement Systems

ESCO Technologies' Test segment, a key player in RF Test and Measurement Systems, focuses on designing and manufacturing solutions for measuring and controlling RF and acoustic energy. These systems are critical for advancing research and development, ensuring products meet stringent regulatory standards, and supporting vital applications in the medical and security sectors.

The market for RF test and measurement equipment is substantial and growing. For instance, the global RF test and measurement market was valued at approximately $7.5 billion in 2023 and is projected to reach over $11 billion by 2028, growing at a CAGR of around 7.8%. This growth is driven by the increasing complexity of wireless technologies, the expansion of 5G networks, and the rising demand for advanced testing solutions in sectors like automotive and aerospace.

ESCO's product offerings within this segment are diverse, catering to a wide range of needs:

- RF Measurement and Control: Systems designed for precise measurement and regulation of radio frequency energy, crucial for product development and compliance.

- Acoustic Energy Measurement: Solutions for analyzing and controlling acoustic energy, applicable in various industrial and scientific settings.

- Industrial Shielding: Products that provide electromagnetic interference (EMI) and radio frequency interference (RFI) shielding for sensitive equipment and environments.

- Medical Services: Applications of their core technologies within the healthcare industry, potentially including specialized testing or equipment.

The segment's strategic importance is underscored by its contribution to ESCO Technologies' overall performance. While specific segment revenue figures fluctuate, the broader ESCO Technologies reported net sales of $757.7 million for the fiscal year ending September 30, 2023, with the Test segment consistently contributing to this revenue stream through its specialized offerings.

Naval and Maritime Solutions Expansion

ESCO Technologies has strategically broadened its naval and maritime solutions through key acquisitions, notably integrating the Signature Management & Power (SM&P) business, now operating as ESCO Maritime Solutions. This move significantly enhances their portfolio, offering advanced capabilities in signature and power management tailored for maritime defense applications. For instance, in fiscal year 2023, ESCO reported that its Filtration and Fluid Technologies segment, which includes maritime solutions, saw a substantial increase in revenue, reflecting the growing demand and successful integration of acquired assets.

This expansion directly addresses critical needs within global defense sectors, bolstering ESCO's competitive edge. The company's focus on enhancing signature and power management aligns with evolving naval technology requirements, such as stealth capabilities and efficient energy systems. ESCO's commitment to these specialized areas is evidenced by their continued investment in research and development, aiming to deliver innovative solutions that improve operational effectiveness for naval forces worldwide.

- Acquisition of SM&P: Strengthened ESCO's maritime product line.

- Enhanced Capabilities: Focus on signature and power management for naval applications.

- Market Position: Reinforces ESCO's presence in global defense markets.

- Revenue Growth: Demonstrated by the performance of related segments in fiscal year 2023.

ESCO Technologies offers a diverse product portfolio, including sophisticated filtration and fluid control systems for aerospace and defense, diagnostic testing and data management solutions for utilities, and RF test and measurement systems for various industries. Their engineered products are designed for high-performance and reliability in demanding environments.

The company's product strategy is further strengthened by strategic acquisitions, such as the integration of the Signature Management & Power (SM&P) business, enhancing their maritime solutions. This broad range of specialized products caters to critical infrastructure, national security, and advanced technology sectors.

In fiscal year 2023, ESCO Technologies reported total revenue of $645.2 million, with segments like Utility Solutions Group contributing approximately $300 million. The global RF test and measurement market, where ESCO competes, was valued at about $7.5 billion in 2023, indicating a robust market for their Test segment offerings.

| Product Segment | Key Offerings | Fiscal Year 2023 Revenue Contribution (Approx.) | Market Context (2023) |

|---|---|---|---|

| Filtration & Fluid Control (Aerospace & Defense) | Hydraulic filter elements, fluid control devices, precision components | Significant portion of total revenue | Critical for aerospace and defense applications |

| Utility Solutions Group (USG) | Diagnostic testing, data management, offline and protection testing | ~$300 million | Essential for electric power grid operation and maintenance |

| Test Segment | RF Measurement & Control, Acoustic Energy Measurement, Industrial Shielding | Consistent contributor to overall revenue | Global RF test and measurement market ~$7.5 billion |

What is included in the product

This analysis offers a comprehensive examination of ESCO Technologies' marketing strategies, dissecting its Product, Price, Place, and Promotion efforts with actionable insights.

Simplifies ESCO Technologies' marketing strategy by clearly outlining their Product, Price, Place, and Promotion, alleviating the pain of complex strategic overviews.

Provides a clear, actionable framework for understanding ESCO Technologies' market approach, reducing the burden of deciphering intricate marketing plans.

Place

ESCO Technologies heavily relies on direct sales channels to connect with its global clientele in critical sectors like utilities, aerospace, and defense. This strategy fosters deep client relationships, enabling the delivery of highly customized solutions for their intricate engineered products.

This direct engagement model is crucial for understanding and efficiently meeting the precise technical specifications and unique project demands of these specialized industries. For instance, in fiscal year 2024, ESCO reported that approximately 85% of its revenue was generated through direct sales, highlighting the channel's dominance.

ESCO Technologies operates a robust worldwide manufacturing and office presence, crucial for its global strategy. This extensive network includes facilities across North America, Europe, and Asia, enabling localized support and production for its diverse customer base. For instance, in fiscal year 2023, ESCO reported that its international operations contributed a substantial portion of its revenue, highlighting the importance of this global reach.

Strategic acquisitions are a cornerstone of ESCO Technologies' market penetration strategy. For instance, the acquisition of the Signature Management & Power business, now operating as ESCO Maritime Solutions, significantly broadened ESCO's reach. This move was instrumental in deepening their presence in key geographic markets, particularly within the US and UK naval sectors.

This targeted approach allows ESCO to enhance its market presence and offer greater customer convenience in strategically important industries. By integrating acquired businesses, ESCO can leverage existing customer bases and distribution channels to accelerate growth and solidify its position in specialized markets.

Specialized Distribution Networks

ESCO Technologies likely utilizes specialized distribution networks to reach its niche clientele, complementing its direct sales efforts. These networks are crucial for delivering highly technical and mission-critical products effectively. For instance, their involvement in sectors like aerospace and defense often necessitates partners with specific certifications and technical knowledge.

These specialized channels might include authorized distributors or agents who possess deep expertise in particular industrial or defense applications. This ensures that ESCO's advanced products reach the intended customers, backed by the necessary technical support and understanding. In 2024, ESCO's focus on advanced filtration and fluid handling solutions, particularly for the semiconductor and aerospace industries, underscores the need for such expert distribution.

- Specialized Channels: Authorized distributors and agents with industry-specific expertise.

- Customer Reach: Ensuring delivery to precise industrial and defense application customers.

- Value-Added Support: Providing appropriate technical assistance alongside product delivery.

Long-Term Customer Relationships

ESCO Technologies' approach to 'place' in its marketing mix is deeply rooted in fostering enduring connections with crucial clients within vital infrastructure and defense industries. This strategy prioritizes direct engagement and comprehensive service agreements over fleeting transactions, ensuring consistent product accessibility and dedicated support across the entire product lifespan.

This focus on long-term relationships is evident in ESCO's consistent revenue streams from these sectors. For fiscal year 2023, ESCO reported revenue of $649.6 million, with a significant portion attributable to its engineered products segment, which serves these critical markets. The company's commitment to these relationships translates into high customer retention rates, a key indicator of successful place strategy.

- Direct Contracts: Securing multi-year agreements with major players in aerospace, defense, and utilities.

- Ongoing Service: Providing maintenance, upgrades, and technical support throughout the product lifecycle.

- Customer Retention: Achieving high repeat business percentages due to reliable performance and support.

- Market Stability: Ensuring a predictable revenue base from established infrastructure and defense clients.

ESCO Technologies' 'Place' strategy centers on its global operational footprint and specialized distribution networks. This ensures their engineered products, critical for sectors like aerospace and defense, reach clients effectively, backed by localized support. Their extensive network spans North America, Europe, and Asia, facilitating tailored solutions for diverse customer needs.

| Geographic Presence | Key Sectors Served | Distribution Strategy |

|---|---|---|

| North America, Europe, Asia | Utilities, Aerospace, Defense, Semiconductor | Direct Sales, Specialized Distributors/Agents |

| Fiscal Year 2023 Revenue: $649.6 million | FY2024 Direct Sales Revenue: ~85% | Acquisitions (e.g., ESCO Maritime Solutions) |

| Localized Production & Support | Mission-Critical Product Delivery | Enhanced Market Penetration |

Preview the Actual Deliverable

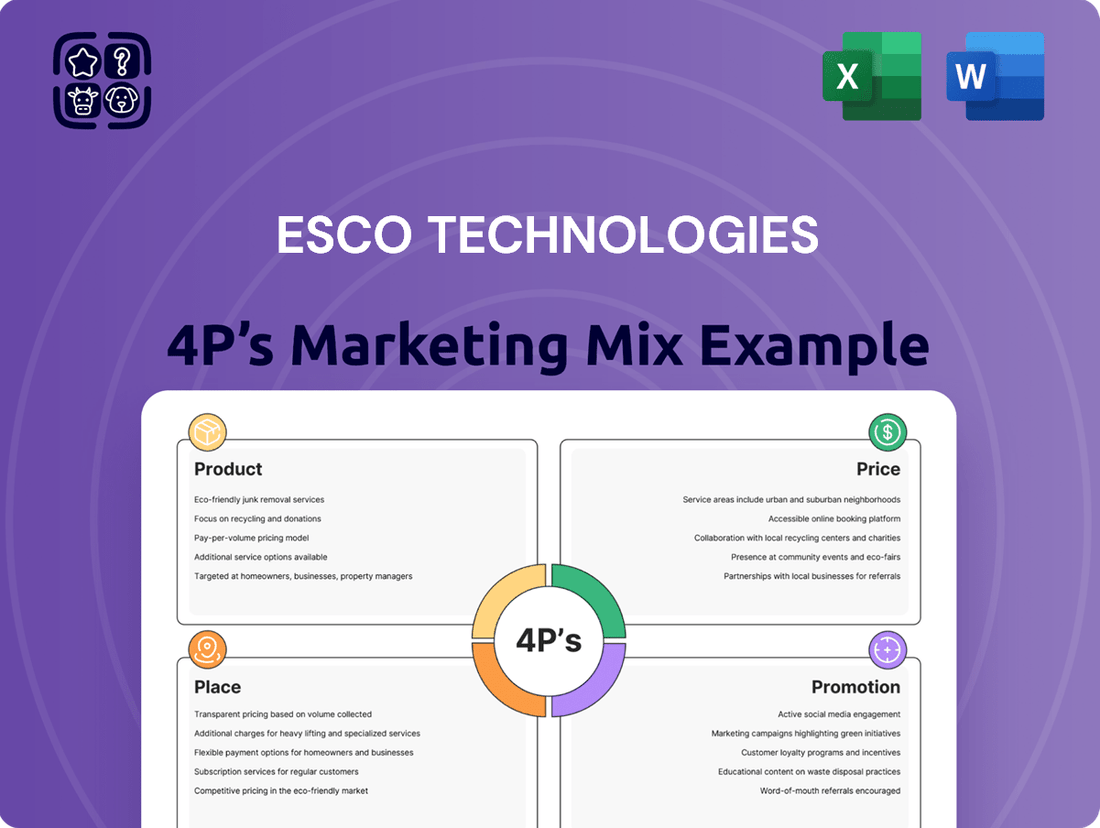

ESCO Technologies 4P's Marketing Mix Analysis

The preview shown here is the actual ESCO Technologies 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis is fully prepared and ready for your immediate use, offering complete insights into ESCO's marketing strategy. You can confidently proceed with your purchase knowing you're getting the exact, finished product.

Promotion

ESCO Technologies' investor relations program is a cornerstone of its communication strategy, ensuring stakeholders are well-informed about its financial health and future plans. This commitment to transparency is evident in their regular earnings calls and detailed press releases, which keep investors updated on key developments. For instance, in fiscal year 2023, ESCO Technologies reported revenue of $630.5 million, a testament to their operational performance that is clearly communicated to the investment community.

The company further enhances stakeholder confidence through comprehensive annual reports and SEC filings. These documents provide in-depth insights into ESCO's financial performance, strategic initiatives, and market positioning. By offering such detailed information, ESCO Technologies cultivates trust and facilitates informed decision-making for individual investors, financial professionals, and business strategists alike.

ESCO Technologies' official website acts as a vital communication channel, providing a centralized location for corporate news, investor relations materials, and detailed product information. This platform is key for engaging with a broad audience, including individual investors and financial professionals.

The website offers direct access to crucial documents like annual reports and quarterly earnings, alongside press releases and investor webcasts, ensuring transparency and accessibility. For instance, in fiscal year 2024, ESCO Technologies consistently updated its investor section with timely financial disclosures, reinforcing its commitment to open communication with stakeholders.

This digital presence is indispensable for reaching financially-literate decision-makers and academic researchers by delivering essential data and strategic insights. The site's user-friendly interface facilitates easy navigation for those seeking to understand ESCO's market position and future outlook.

ESCO Technologies' presence at industry conferences, like the Sidoti Small Cap Conference, is a key part of its promotional strategy. These events are crucial for connecting with potential investors and analysts, offering a platform to share company progress and innovations.

In 2024, ESCO leveraged these engagements to highlight its advancements, aiming to boost its visibility and foster interest in its products and services. Such participation is designed to directly impact investor relations and market perception.

Highlighting Innovation and Operational Excellence

ESCO Technologies consistently highlights its dedication to innovation and operational excellence in its promotional efforts. This focus serves to underscore its competitive advantage, showcasing the company's capability to engineer advanced solutions for demanding applications.

By emphasizing these core strengths, ESCO targets customers who prioritize high-quality, dependable, and technologically superior engineered products. This strategy aims to build brand loyalty and attract new business by demonstrating a clear commitment to pushing technological boundaries and maintaining efficient, high-standard manufacturing processes.

- Innovation Focus: ESCO's R&D investments contribute to its pipeline of new products and technologies, aiming to solve evolving industry challenges.

- Operational Efficiency: The company strives for lean manufacturing and supply chain optimization to ensure product quality and cost-effectiveness.

- Customer Value Proposition: This promotional theme directly appeals to clients seeking reliable, high-performance solutions backed by strong engineering and production capabilities.

- Market Positioning: By consistently communicating these attributes, ESCO reinforces its image as a leader in engineered products and solutions.

Emphasizing Strong Financial Performance

ESCO Technologies consistently emphasizes its robust financial performance as a key component of its marketing strategy. This includes highlighting strong sales growth, increased earnings per share (EPS), and improved profit margins.

In fiscal year 2023, ESCO reported net sales of $615.8 million, a 15.6% increase compared to $532.6 million in fiscal year 2022. The company also saw its diluted EPS rise to $3.02 in FY23, up from $2.55 in FY22, demonstrating a healthy earnings trajectory.

- Sales Growth: Achieved 15.6% net sales growth in FY23.

- Earnings Per Share: Increased diluted EPS to $3.02 in FY23.

- Margin Improvement: Focused on enhancing profitability through operational efficiencies.

- Investor Confidence: This consistent financial strength aims to attract and retain investor interest by showcasing stability and growth potential.

ESCO Technologies leverages a multi-faceted promotional strategy, focusing on investor relations, digital presence, and industry engagement to communicate its value proposition. Their commitment to transparency is evident through regular financial disclosures and accessible reports, fostering trust among stakeholders. By highlighting innovation and operational excellence, ESCO targets customers seeking high-performance engineered products.

The company's participation in industry events like the Sidoti Small Cap Conference in 2024 served to boost visibility and connect with potential investors, showcasing recent advancements. This strategic outreach aims to reinforce ESCO's market position as a leader in engineered solutions.

ESCO's promotional efforts consistently underscore its strong financial performance, including sales growth and improved earnings. For example, in fiscal year 2023, net sales reached $615.8 million, a 15.6% increase from the previous year, with diluted EPS rising to $3.02. This financial strength is a key element in attracting and retaining investor interest.

| Metric | FY 2022 | FY 2023 | Change |

|---|---|---|---|

| Net Sales (Millions USD) | $532.6 | $615.8 | +15.6% |

| Diluted EPS (USD) | $2.55 | $3.02 | +18.4% |

Price

ESCO Technologies utilizes a value-based pricing model for its engineered solutions, a strategy directly tied to the mission-critical nature and advanced engineering of its offerings. This means prices are determined by the substantial value, unwavering reliability, and superior performance ESCO's products provide to its core customer segments in utilities, aerospace, and defense.

This pricing philosophy acknowledges the significant long-term benefits and operational efficiencies customers gain, rather than solely focusing on production costs. For instance, in 2024, ESCO's focus on these high-value sectors, which often have stringent performance requirements and long product lifecycles, supports this premium pricing approach.

ESCO Technologies' pricing reflects its premium engineered products, carefully balancing value with competitive pressures in specialized industries. For instance, in the filtration and fluid management sector, where ESCO operates, average selling prices can be significantly higher for highly customized or advanced filtration solutions compared to standard offerings, reflecting the embedded technology and performance benefits. This strategy aims to capture a fair share of revenue while remaining attractive to its discerning clientele.

ESCO Technologies' pricing strategy is squarely aimed at boosting profitability and enhancing adjusted EBIT margins throughout its various business segments. This deliberate focus on margin improvement is a recurring theme in their financial reporting, often attributed to the benefits of increased sales volume and well-executed strategic price adjustments.

For the nine months ended March 31, 2024, ESCO reported an adjusted EBIT margin of 13.5%, a notable increase from 12.1% in the same period of the prior year. This demonstrates their commitment to disciplined pricing that directly contributes to the company's financial robustness and operational efficiency.

Consideration of Macroeconomic Factors

ESCO Technologies' pricing strategies are not set in stone; they actively consider significant external economic forces. This includes keeping a close eye on market demand, the general health of the economy, and the persistent challenge of inflation.

The company has explicitly stated that implementing price increases is a key method to counteract the effects of inflation. This approach highlights ESCO's commitment to a dynamic pricing model, one that can adjust as economic conditions shift.

This adaptability is crucial for maintaining sustainable pricing. It ensures that ESCO's pricing remains competitive and relevant, even when faced with fluctuating economic environments.

- Inflationary Impact: ESCO's 2023 annual report indicated that price adjustments were implemented to mitigate inflationary pressures, contributing to a slight improvement in gross margins during the year.

- Market Demand Responsiveness: For instance, in Q4 2023, ESCO observed increased demand for specialized filtration products, allowing for a modest price increase on those specific lines.

- Economic Outlook: The company's forward-looking statements in early 2024 acknowledged potential headwinds from a slowing global economy but reiterated their strategy of agile pricing to navigate these challenges.

- Cost Management: By adjusting prices, ESCO aims to maintain profitability, allowing for continued investment in research and development, which is vital for their long-term growth strategy.

Shareholder Value and Dividend Policy

ESCO Technologies' pricing and financial strategies are directly linked to its shareholder value and dividend policy. The company's ability to generate consistent cash flow through its product and service offerings allows for stable dividend distributions, reinforcing investor confidence in its financial health. This commitment to returning value underscores ESCO's long-term financial stability.

For fiscal year 2024, ESCO Technologies reported a strong financial performance, enabling continued shareholder returns. The company's dividend policy reflects a strategic approach to capital allocation, prioritizing sustainable growth and investor rewards. This focus on shareholder value is a key component of ESCO's overall marketing mix.

- Dividend Per Share: ESCO Technologies has a history of consistent dividend payments, with recent data showing a quarterly dividend of $0.20 per share.

- Payout Ratio: The company's dividend payout ratio typically remains within a sustainable range, indicating that dividend payments are well-covered by earnings. For instance, in recent quarters, the payout ratio has been around 25-30%.

- Shareholder Returns: Beyond dividends, ESCO's stock performance and potential for capital appreciation also contribute to overall shareholder value.

- Financial Stability: A stable balance sheet and consistent profitability are foundational to ESCO's ability to maintain and potentially grow its dividend payments, fostering long-term investor loyalty.

ESCO Technologies employs a value-based pricing strategy, aligning prices with the critical function and advanced engineering of its solutions. This approach, evident in its 2024 performance, prioritizes the long-term benefits and operational efficiencies delivered to customers in utilities, aerospace, and defense sectors, rather than just production costs.

This strategy is designed to enhance profitability and adjusted EBIT margins, as seen in the nine months ended March 31, 2024, where the adjusted EBIT margin reached 13.5%, up from 12.1% year-over-year. ESCO actively adjusts prices to counter inflation, a key factor in maintaining margins amidst economic shifts.

The company's pricing is dynamic, responding to market demand and economic conditions, including inflation. For example, in Q4 2023, increased demand for specialized filtration products allowed for modest price adjustments on those lines.

ESCO's pricing directly supports shareholder value through consistent cash flow generation and a stable dividend policy, with a recent quarterly dividend of $0.20 per share and a payout ratio around 25-30%.

| Metric | Value (as of recent reporting) | Significance |

| Adjusted EBIT Margin (9 months ended Mar 31, 2024) | 13.5% | Demonstrates profitability driven by pricing and operational efficiency. |

| Quarterly Dividend Per Share | $0.20 | Reflects consistent shareholder returns and financial stability. |

| Dividend Payout Ratio (recent quarters) | 25-30% | Indicates sustainable dividend payments supported by earnings. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for ESCO Technologies leverages a comprehensive suite of data, including official SEC filings, investor relations materials, and company press releases. We also incorporate insights from industry-specific market research and competitive intelligence reports to ensure a robust understanding of their strategies.