ESCO Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ESCO Technologies Bundle

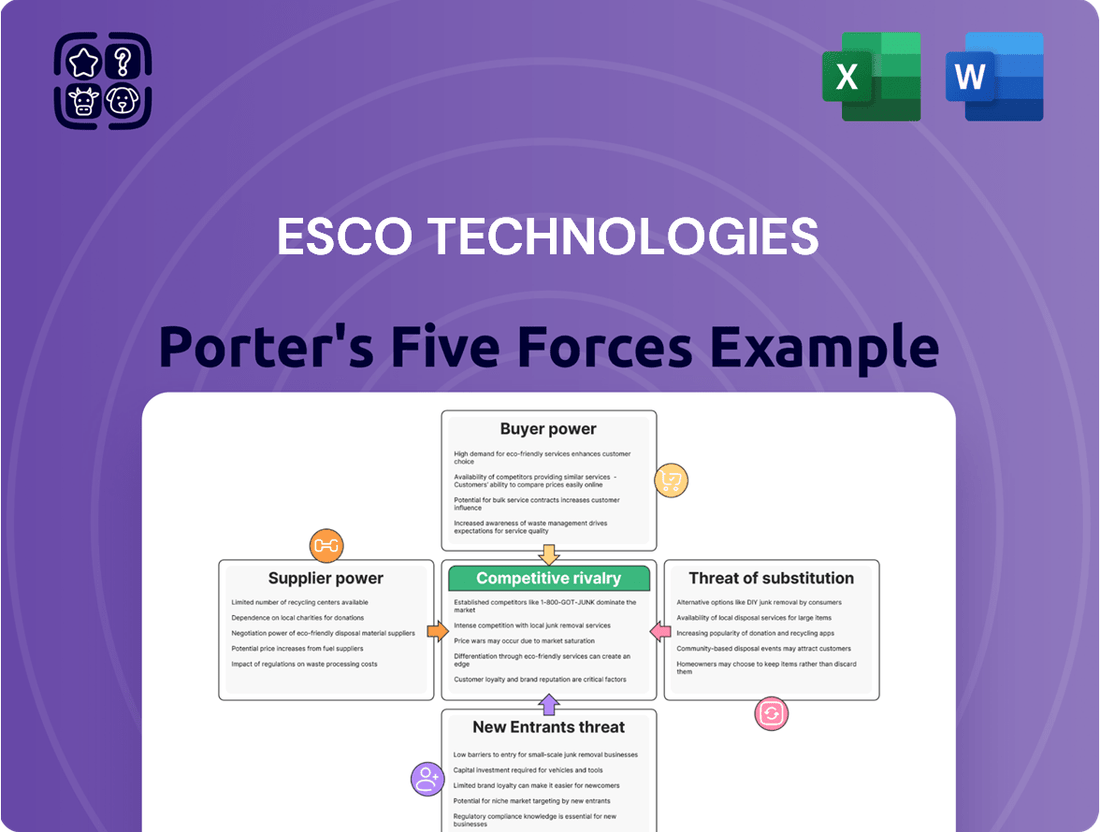

ESCO Technologies operates within a dynamic industrial landscape, where understanding the interplay of competitive forces is crucial for strategic success. Our analysis reveals moderate bargaining power for buyers and suppliers, alongside a significant threat from substitute products. The intensity of rivalry within ESCO's markets is also a key consideration.

The complete report reveals the real forces shaping ESCO Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ESCO Technologies operates in sectors such as aerospace, defense, and utilities, which frequently depend on specialized components and materials. When the number of suppliers for these highly engineered parts is limited, their bargaining power naturally grows because ESCO has fewer viable alternatives.

This supplier concentration can directly impact ESCO Technologies by driving up input costs and introducing potential vulnerabilities within its supply chain. For instance, in the aerospace sector, critical components might only be available from a handful of certified manufacturers, giving those suppliers significant leverage over pricing and delivery schedules.

The bargaining power of suppliers for ESCO Technologies is influenced by significant switching costs. For ESCO's specialized, highly engineered products and systems, the expense and intricacy involved in changing suppliers are substantial. This can encompass the rigorous process of qualifying new vendors, the need for retooling existing production lines, and the potential for considerable delays in receiving critical components.

These high switching costs naturally bolster the leverage of ESCO's current suppliers. They can more effectively dictate pricing and contractual terms because ESCO faces considerable financial penalties and operational disruptions if it attempts to transition to alternative sources. For instance, in the semiconductor equipment sector, where ESCO operates, a single component failure or delay can halt a multi-million dollar production line, making supplier reliability and established relationships paramount.

ESCO Technologies' reliance on unique or proprietary components significantly influences supplier power. For instance, in their specialized filtration and diagnostic equipment segments, suppliers holding patents or unique technological expertise for critical inputs can exert considerable leverage. This is because ESCO's product performance and differentiation often hinge on these specific, hard-to-replicate materials or technologies.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power against ESCO Technologies. If suppliers possess the technical know-how and the financial wherewithal, they might choose to enter ESCO's market by manufacturing their own finished products or offering system integration services, thereby directly competing with ESCO. This risk is amplified if these suppliers hold critical intellectual property or specialized manufacturing capabilities that are difficult for ESCO to replicate.

For instance, a key component supplier to ESCO, if they also possess advanced design capabilities, could potentially develop and market a complete solution that bypasses ESCO's value-added services. This would not only divert potential revenue from ESCO but also put pressure on ESCO's pricing and market share. The strategic advantage of a supplier integrating forward often lies in their control over essential inputs and their existing customer relationships.

- Increased Competition: Suppliers entering ESCO's market directly creates new competitive pressures.

- Price Erosion: Forward integration can lead to price wars, impacting ESCO's profit margins.

- Control over Value Chain: Suppliers gain more control over the entire product lifecycle and customer experience.

- Reduced Supplier Dependence: ESCO might become more reliant on its suppliers if they are also competitors.

Importance of ESCO to Supplier's Business

The relative importance of ESCO Technologies' business to its individual suppliers significantly shapes their bargaining power. If ESCO represents a substantial portion of a supplier's revenue, that supplier is likely more inclined to offer competitive pricing and flexible terms to secure ESCO's continued patronage. For instance, if a key component supplier's sales to ESCO constitute over 15% of their total annual revenue, ESCO gains considerable leverage in negotiations.

Conversely, if ESCO is a minor client for a particular supplier, the supplier's leverage increases. In such scenarios, the supplier might be less motivated to accommodate ESCO's demands, as ESCO's business is not critical to their overall financial health. This dynamic can lead to less favorable terms for ESCO, impacting its cost of goods sold.

Understanding this supplier dependency is crucial for ESCO. By analyzing the revenue concentration of its key suppliers, ESCO can identify opportunities to strengthen its negotiating position. For example, if ESCO discovers that a critical supplier derives less than 5% of its income from ESCO, it might explore alternative suppliers or consolidate purchasing power to enhance its standing.

- Supplier Revenue Dependence: If ESCO accounts for a large percentage of a supplier's sales, ESCO's bargaining power increases.

- ESCO's Market Share: Conversely, if ESCO is a small customer for a supplier, the supplier holds more leverage.

- Negotiation Leverage: This imbalance in importance directly affects the ability to negotiate favorable pricing and terms.

- Strategic Sourcing: ESCO's ability to influence supplier behavior depends on its strategic importance to those suppliers.

The bargaining power of suppliers for ESCO Technologies is a critical factor, especially given the specialized nature of its aerospace, defense, and utility markets. When suppliers provide unique or patented components, their leverage increases significantly, as ESCO's product performance often depends on these specific inputs. For example, in 2024, ESCO's reliance on advanced semiconductor manufacturing equipment components, often sourced from a limited number of highly specialized providers, means these suppliers can command premium pricing due to the difficulty and cost of finding alternatives.

High switching costs also empower ESCO's suppliers. The expense and time required to qualify new vendors, retool production lines, and ensure compatibility for highly engineered parts mean ESCO is often locked into existing relationships. This was evident in 2024 when the lead times for certain aerospace-grade alloys, supplied by only a few global manufacturers, extended, forcing ESCO to accept higher prices to maintain production schedules.

The threat of forward integration by suppliers further amplifies their bargaining power. If these suppliers possess the capability to develop and market finished solutions, they could directly compete with ESCO, leveraging their control over essential inputs. This dynamic was a concern throughout 2024 in the specialized filtration market, where some key material suppliers were exploring direct-to-consumer offerings.

Finally, the relative importance of ESCO as a customer to its suppliers plays a crucial role. If ESCO represents a significant portion of a supplier's revenue, ESCO gains leverage. However, if ESCO is a minor client, suppliers have less incentive to accommodate ESCO's demands, potentially leading to less favorable terms and increased costs for ESCO Technologies.

| Factor | Impact on ESCO Technologies | 2024 Scenario Example |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Aerospace components sourced from few certified manufacturers. |

| Switching Costs | High costs of changing suppliers empower existing ones. | Semiconductor equipment component delays impacting production lines. |

| Unique/Proprietary Components | Patented or technologically advanced inputs give suppliers power. | Filtration and diagnostic equipment relying on specific, hard-to-replicate materials. |

| Threat of Forward Integration | Suppliers entering ESCO's market create competitive pressure. | Material suppliers exploring direct-to-consumer offerings in filtration. |

| Supplier Revenue Dependence | ESCO's importance to a supplier impacts negotiation power. | Key component supplier revenue concentration influencing pricing flexibility. |

What is included in the product

This analysis delves into the competitive forces impacting ESCO Technologies, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its markets.

Effortlessly identify and mitigate competitive threats by visualizing ESCO Technologies' Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

ESCO Technologies often deals with customers in concentrated sectors like utility, aerospace, and defense. These large clients, including major government contractors, wield considerable influence. Their substantial purchase volumes allow them to negotiate favorable pricing and demand customized product specifications, directly impacting ESCO's profitability.

The demand from specific Navy programs and the ongoing development of smart grid infrastructure highlight the critical nature of ESCO's offerings to these concentrated customer groups. This dependence means these customers can leverage their importance to secure advantageous terms, a key factor in their bargaining power.

Customer switching costs for ESCO Technologies' highly engineered products can significantly influence their bargaining power. For critical infrastructure and long-term defense projects, the complexities of integration, stringent regulatory approvals, and the absolute necessity for reliable, consistent performance make switching suppliers a costly and time-consuming endeavor, thereby reducing customer leverage.

Conversely, for ESCO's more standardized product lines, the barriers to switching are considerably lower. This allows customers greater flexibility and bargaining power, as they can more readily explore alternative suppliers without incurring substantial integration or qualification expenses. For instance, in segments where ESCO faces competition from readily available off-the-shelf components, customers can more easily demand price concessions or improved terms.

Customer price sensitivity is a significant factor for ESCO Technologies, particularly in its utility and defense markets. Government agencies, a key customer base, often operate under strict budget limitations and are subject to public scrutiny, making them highly attuned to pricing. This can translate into considerable pressure on ESCO to maintain competitive pricing, even for its highly specialized offerings, potentially impacting profit margins.

Threat of Backward Integration by Customers

Customers possessing substantial in-house engineering and manufacturing expertise present a potential threat of backward integration. This means they could start producing the components or systems that ESCO Technologies currently provides, especially if they aim to lessen dependence on outside suppliers or assert greater command over vital technologies.

The bargaining power of customers is amplified when they have the capacity to bring production in-house. For instance, a major aerospace client of ESCO, known for its advanced manufacturing capabilities, might consider developing its own specialized connectors or shielding solutions if cost savings or strategic control become paramount.

This threat is a key consideration in ESCO's strategic planning, influencing how it structures its customer relationships and pricing. The ability of customers to integrate backward directly impacts ESCO's market share and profitability.

- Customer Integration Capability: Assesses the technical and financial resources customers have to produce ESCO's products internally.

- Strategic Importance of ESCO's Products: Evaluates how critical ESCO's offerings are to the customer's core operations and competitive advantage.

- Market Dynamics: Considers industry trends that might encourage backward integration, such as supply chain disruptions or rapid technological advancements.

- ESCO's Value Proposition: Highlights ESCO's efforts to differentiate itself through innovation, quality, and service to mitigate this threat.

Availability of Substitute Products/Services for Customers

The bargaining power of customers is significantly shaped by the availability of substitute products or services. When customers have readily accessible alternatives, even those that don't perfectly match ESCO Technologies' offerings, their leverage in negotiations grows. This is particularly true if these alternatives come from different industries or can be developed internally.

For ESCO Technologies, the presence of numerous competitors offering similar filtration and fluid handling solutions directly impacts customer power. For instance, in the industrial filtration market, customers can often source comparable components from various global manufacturers, limiting ESCO's pricing flexibility. In 2024, the industrial filtration market, a key sector for ESCO, saw continued global competition, with major players like Donaldson Company and Parker Hannifin also vying for market share.

- Increased Customer Options: The wider the array of available substitutes, the less dependent customers are on ESCO Technologies, thereby enhancing their bargaining position.

- Price Sensitivity: When substitutes are available at competitive price points, customers are more likely to switch, forcing ESCO to consider pricing strategies carefully.

- Innovation Pressure: The threat of substitutes encourages ESCO to continuously innovate and differentiate its products to maintain customer loyalty and pricing power.

ESCO Technologies faces significant customer bargaining power, particularly from its large, concentrated clients in sectors like utility, aerospace, and defense. These major buyers, often government contractors, leverage their substantial purchase volumes to negotiate favorable pricing and demand customized product specifications, directly impacting ESCO's profitability.

The critical nature of ESCO's offerings for specific Navy programs and smart grid infrastructure development means these concentrated customers can leverage their importance to secure advantageous terms. For example, in 2024, defense spending remained a significant factor, with the U.S. Department of Defense awarding substantial contracts, many of which would involve components similar to those ESCO provides.

Customer switching costs for ESCO's highly engineered products are generally high due to integration complexities and regulatory approvals, which typically reduces customer leverage. However, for more standardized product lines, lower switching barriers allow customers greater flexibility and bargaining power, enabling them to more easily demand price concessions or improved terms.

Customer price sensitivity is notable, especially in utility and defense markets where government agencies operate under strict budgets. This sensitivity can exert considerable pressure on ESCO to maintain competitive pricing, potentially impacting profit margins.

| Factor | Impact on ESCO's Customer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Customer Concentration | High for large utility, aerospace, and defense clients | Major government contractors' significant purchase volumes allow for strong negotiation. |

| Switching Costs (Engineered Products) | Lowers customer bargaining power | Complex integration and regulatory hurdles make switching suppliers costly. |

| Switching Costs (Standardized Products) | Increases customer bargaining power | Easier to switch to alternative suppliers for off-the-shelf components. |

| Price Sensitivity | High, especially in government sectors | Budgetary constraints and public scrutiny drive demand for competitive pricing. |

| Threat of Backward Integration | Potential for customers to produce components internally | Large aerospace clients with advanced manufacturing may consider in-house production. |

| Availability of Substitutes | Increases customer bargaining power | Competition in industrial filtration from companies like Donaldson and Parker Hannifin limits ESCO's pricing flexibility. |

Preview Before You Purchase

ESCO Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of ESCO Technologies. You'll gain in-depth insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within ESCO's industries. This detailed analysis is fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

ESCO Technologies navigates a competitive landscape populated by a diverse array of players. This includes formidable industry giants such as Franklin Electric, Donaldson, ITT, and TransDigm, alongside numerous niche specialists. The sheer variety in competitor size, their specific product offerings, and their geographical footprint significantly amplifies the competitive intensity across ESCO's various business segments.

While ESCO Technologies has seen robust sales increases, particularly in its Aerospace & Defense and Utility Solutions divisions, the growth rate of the specific markets it operates within significantly shapes competitive dynamics. For instance, the aerospace sector, a key area for ESCO, experienced a notable rebound in 2024, with Boeing delivering 490 aircraft, up from 397 in 2023, indicating a growing market but also intensified competition for supply chain partners.

When sub-markets exhibit slower growth, the pressure intensifies for existing companies to capture a larger slice of the pie. This can manifest as price wars or increased marketing spend, directly impacting profitability and ESCO's competitive positioning within those segments.

ESCO Technologies focuses on creating highly engineered, proprietary products, which is a key factor in how intensely its competitors battle each other. When ESCO's offerings are genuinely unique, it lessens the pressure for direct price wars. Conversely, if its products become more like standard goods, competition heats up significantly.

A prime example of ESCO's strategy to bolster product differentiation is its recent acquisition of Ultra Maritime's SM&P business. This move is specifically designed to broaden its range of naval products, thereby creating more distinct offerings in the market and reducing the likelihood of direct competition based solely on price.

High Fixed Costs and Exit Barriers

ESCO Technologies operates in sectors demanding substantial investment in research and development, advanced manufacturing, and skilled labor. These high fixed costs mean companies must maintain high production levels to remain profitable, fueling intense rivalry. For instance, the aerospace and defense sector, a key market for ESCO, often involves long product development cycles and significant upfront capital expenditures.

High exit barriers further exacerbate competitive pressures. These barriers can include specialized, non-transferable assets, contractual obligations, and the emotional or strategic commitment of management. When it's difficult or costly for companies to leave an industry, even those struggling financially may continue to compete, driving down prices and margins for everyone. In 2024, many advanced manufacturing industries faced this dynamic, as the cost of retooling or divesting specialized equipment remained prohibitive.

- High Fixed Costs: Industries like aerospace components and advanced filtration require significant upfront investment in R&D and specialized manufacturing capabilities.

- Capacity Utilization Pressure: Companies with high fixed costs are incentivized to operate at or near full capacity, leading to aggressive pricing strategies to cover overhead.

- Exit Barriers: Specialized machinery, long-term contracts, and the difficulty of repurposing unique facilities make it challenging and expensive for companies to exit these markets.

- Intensified Rivalry: The combination of high fixed costs and high exit barriers forces companies to compete fiercely for market share, often through price competition, impacting overall industry profitability.

Strategic Stakes

The utility, aerospace, and defense sectors are critical for many large global corporations. This strategic importance fuels intense competition, as companies often aim for market dominance or technological superiority rather than immediate profits. For instance, in the aerospace sector, major players like Boeing and Airbus continuously invest billions in research and development, influencing pricing and innovation across the industry.

This drive for market share and technological leadership can manifest as aggressive pricing strategies or substantial investments in new technologies. Companies might accept lower margins to secure long-term contracts or to establish a strong foothold in emerging markets. This dynamic directly affects ESCO Technologies by potentially compressing profit margins and necessitating continuous innovation to remain competitive.

- High Strategic Value: Utility, aerospace, and defense markets are vital for global players, driving intense competition.

- Market Share Focus: Companies in these sectors often prioritize gaining market share over short-term profitability.

- Innovation Investment: Significant R&D spending is common, leading to rapid technological advancements and potential price wars.

- Impact on ESCO: ESCO Technologies faces pressure from aggressive strategies and the need for ongoing innovation to stay relevant.

Competitive rivalry for ESCO Technologies is heightened by the presence of large, established players and a multitude of niche competitors across its diverse segments. This intensity is amplified by market growth rates, where faster-growing sectors attract more aggressive competition for market share, potentially leading to price pressures. ESCO's strategy of focusing on highly engineered, proprietary products helps mitigate direct price competition, but the high fixed costs and significant exit barriers inherent in its core industries, such as aerospace and utilities, compel companies to compete fiercely for volume, impacting overall profitability.

| Competitor | Primary Segments | 2024 Revenue (Est. Billions USD) | Key Competitive Factor |

|---|---|---|---|

| Franklin Electric | Utility Solutions (Water Systems) | ~2.0 | Product breadth, distribution network |

| Donaldson Company | Filtration (Aerospace, Industrial) | ~3.5 | Filtration technology, global presence |

| ITT Inc. | Aerospace & Defense, Industrial | ~3.2 | Engineered solutions, market diversification |

| TransDigm Group | Aerospace & Defense | ~7.0 | Acquisition strategy, proprietary products |

SSubstitutes Threaten

The threat of substitutes for ESCO Technologies hinges on the price-performance balance of alternative solutions. If new smart grid technologies or different energy management strategies can fulfill similar customer needs more affordably, they pose a significant threat to ESCO's traditional products.

Customer willingness to switch to alternatives for ESCO Technologies' products hinges on perceived risk, ease of adoption, and the advantages offered by substitutes. For instance, in critical sectors like defense, where reliability and safety are paramount, customers are less likely to embrace unproven alternatives, thereby lowering the propensity to substitute.

Rapid technological progress in fields beyond ESCO Technologies' core markets can introduce novel substitutes. For example, breakthroughs in advanced composites or additive manufacturing could present alternative solutions for filtration and fluid control applications, potentially diminishing the need for ESCO's current product offerings. In 2024, the global advanced materials market was valued at an estimated $230 billion, showcasing the significant innovation happening in adjacent sectors.

Shifting Customer Needs or Preferences

Changes in customer needs or preferences, often spurred by environmental concerns or the pursuit of operational efficiencies, can significantly bolster the threat of substitutes. For instance, a growing demand for renewable energy sources might diminish the need for traditional fossil fuel infrastructure components.

Regulatory shifts also play a crucial role. As governments implement new standards or incentives, alternative technologies or methods that align with these changes can become more attractive, thereby increasing the substitutability of existing solutions. For example, stricter emissions regulations could drive demand for electric vehicles over gasoline-powered ones.

Consider the utility sector: a strong push towards decentralized energy generation or entirely new energy transmission methods could directly reduce the demand for certain legacy utility infrastructure solutions that ESCO Technologies provides. In 2023, global investment in renewable energy reached an estimated $1.7 trillion, signaling a significant shift in infrastructure priorities.

- Environmental Concerns: Growing public awareness of climate change is pushing consumers and businesses towards greener alternatives.

- Technological Advancements: Innovations in areas like battery storage and smart grid technology offer new ways to manage energy, potentially bypassing traditional infrastructure.

- Regulatory Environment: Government policies favoring renewable energy and energy efficiency can accelerate the adoption of substitute solutions.

- Cost-Effectiveness: As substitute technologies mature, their cost often decreases, making them more competitive with established solutions.

Indirect Substitution through System Integration

Customers may choose to adopt comprehensive, integrated systems from competitors that bundle various functionalities. This approach can reduce the demand for ESCO's standalone products or specialized systems, as the integrated solution addresses multiple needs within a single offering. For example, a utility company might select a smart grid platform that includes metering, distribution automation, and data analytics from a single vendor, bypassing the need for separate ESCO components.

This indirect substitution is particularly relevant in rapidly evolving technological landscapes. Companies like ESCO, which specialize in specific components or subsystems, face the threat of being sidelined if larger players offer more holistic, end-to-end solutions. In 2024, the trend toward platform-based solutions in sectors like utilities and telecommunications intensified, with major technology providers consolidating offerings.

- System Integration as a Substitute: Competitors offering integrated platforms can reduce the need for ESCO's specialized products.

- Reduced Demand for Components: Customers opting for bundled solutions may bypass the need for individual ESCO systems.

- Technological Landscape Shift: The rise of end-to-end solutions poses a threat to component-focused providers.

- Market Trends: In 2024, platform-based approaches gained traction in key ESCO markets like utilities.

The threat of substitutes for ESCO Technologies is amplified by evolving customer preferences and technological advancements that offer comparable or superior performance at a lower cost. For instance, the global market for advanced filtration systems, a sector where ESCO operates, is seeing innovation in membrane technology and bio-based filters, which could offer cost efficiencies and environmental benefits. In 2024, the advanced filtration market was projected to reach over $40 billion, indicating robust growth and potential for disruptive substitutes.

Furthermore, the increasing adoption of digital solutions and smart technologies can create indirect substitutes. Companies might opt for software-based energy management systems or predictive maintenance platforms that reduce reliance on physical components, thereby impacting demand for ESCO's traditional offerings. This trend is particularly evident in the smart grid sector, where integrated software solutions are gaining prominence. In 2023, investments in smart grid technologies globally exceeded $30 billion, highlighting the shift towards digital infrastructure.

The willingness of customers to switch is also influenced by the perceived reliability and integration ease of substitutes. In critical infrastructure, such as defense or aerospace, where failure is not an option, customers are more hesitant to adopt unproven alternatives. However, as substitute technologies mature and demonstrate their efficacy, this barrier diminishes. For example, advancements in composite materials for aerospace applications could offer lighter and stronger alternatives to traditional metal components, impacting ESCO's legacy product lines.

| Factor | Impact on ESCO | Supporting Data (2024 Estimates/Trends) |

| Cost-Effectiveness of Substitutes | High | Emerging technologies in filtration and energy management often aim for lower lifecycle costs. |

| Technological Advancement | Moderate to High | Rapid innovation in smart grid, advanced materials, and digital solutions creates new alternatives. |

| Customer Adoption of Integrated Systems | High | Trend towards bundled solutions can bypass specialized component providers. |

| Environmental and Regulatory Shifts | Moderate | Policies favoring renewables and efficiency can accelerate demand for alternative infrastructure. |

Entrants Threaten

Entering the specialized utility, aerospace, and defense sectors, where ESCO Technologies operates, demands significant upfront capital. Companies need to invest heavily in research and development, advanced manufacturing capabilities, and highly specific equipment. For instance, the aerospace industry alone saw R&D spending by major players exceeding tens of billions of dollars annually in recent years, a clear indicator of the financial commitment required.

ESCO Technologies' commitment to highly engineered products for critical sectors like defense and utilities fosters a strong brand identity. This deep-seated trust and loyalty among existing customers present a significant barrier for new companies attempting to enter the market. For instance, in the utility sector, the reliability demanded for grid infrastructure means utilities are often hesitant to switch to unproven suppliers, even if offered at a lower price point.

ESCO Technologies' strength in proprietary technology and patents presents a formidable barrier to new entrants. Their portfolio of highly engineered products, often protected by numerous patents, signifies a deep well of specialized knowledge that is difficult and expensive for competitors to replicate. For instance, in 2024, ESCO continued to invest heavily in research and development, a strategy that underpins its intellectual property portfolio and its ability to maintain a competitive edge.

Access to Distribution Channels

New companies entering the utility, aerospace, and defense sectors face significant hurdles in establishing effective distribution channels. ESCO Technologies has cultivated deep, long-standing relationships with major clients in these demanding industries, creating a formidable barrier to entry. These established networks are not easily replicated, as they are built on trust, proven performance, and often, complex contractual agreements.

The difficulty in accessing established distribution channels acts as a deterrent for potential competitors. For instance, securing contracts with major utility providers often requires extensive pre-qualification and a proven track record, which new entrants lack. In 2023, the aerospace sector saw significant consolidation, with major players like Boeing and Airbus strengthening their supply chain partnerships, further limiting access for newcomers. Similarly, defense contracts are notoriously difficult to break into, often requiring specific security clearances and a history of government engagement.

- Established Relationships: ESCO's existing partnerships with key utility, aerospace, and defense firms provide preferential access and market presence.

- High Switching Costs: Customers in these industries often face high costs and risks associated with switching suppliers, reinforcing ESCO's market position.

- Industry-Specific Channels: The specialized nature of these industries means distribution channels are highly tailored and difficult for new entrants to penetrate without significant investment and time.

Government Regulations and Industry Standards

The utility, aerospace, and defense sectors are characterized by extensive government regulations and rigorous industry standards. For instance, the Federal Aviation Administration (FAA) mandates strict certification processes for aerospace components, which can take years and substantial investment to navigate. Similarly, defense contractors must adhere to Department of Defense (DoD) specifications and security clearances.

These complex regulatory landscapes and certification requirements present significant barriers to entry for potential new competitors. New entrants would likely face considerable time delays and substantial upfront costs to achieve compliance, thereby creating a competitive advantage for established companies like ESCO Technologies, which already possess the necessary certifications and experience.

- High Regulatory Burden: Industries like aerospace and defense require adherence to stringent regulations from bodies such as the FAA and DoD.

- Certification Hurdles: Obtaining necessary certifications for products and processes can be lengthy and expensive, deterring new entrants.

- Established Player Advantage: Companies like ESCO Technologies, with existing compliance and certifications, are better positioned than newcomers.

- Time and Cost Investment: Meeting these standards demands significant investment in time and resources, acting as a substantial barrier.

The threat of new entrants for ESCO Technologies is generally low due to substantial barriers. High capital requirements for specialized R&D and manufacturing, coupled with the need for deep industry expertise, make market entry challenging. For example, the aerospace sector alone demands billions in upfront investment for new players to even begin competing.

ESCO's established brand loyalty and the high switching costs for customers in critical sectors like utilities and defense further solidify its market position. Utilities, for instance, are hesitant to risk operational stability by switching from proven suppliers like ESCO, especially given the critical nature of their infrastructure.

Proprietary technology and a robust patent portfolio, continually strengthened by ESCO's ongoing R&D investments, create a significant knowledge and innovation gap. This intellectual property is difficult and costly for potential competitors to replicate, ensuring ESCO maintains a technological edge.

Access to established distribution channels is another major hurdle. ESCO's long-standing relationships with key clients in its target industries are built on trust and proven performance, making it incredibly difficult for new entrants to penetrate these networks without significant time and investment.

| Barrier Type | Description | Example Impact |

|---|---|---|

| Capital Requirements | High investment needed for R&D, advanced manufacturing, and specialized equipment. | Aerospace R&D spending by major players often exceeds tens of billions annually. |

| Brand Loyalty & Switching Costs | Deep customer trust and high costs/risks associated with changing suppliers. | Utilities prioritize reliability, making them reluctant to switch from proven vendors like ESCO. |

| Proprietary Technology & Patents | Difficult-to-replicate specialized knowledge and protected innovations. | ESCO's 2024 R&D investments continue to bolster its IP portfolio. |

| Distribution Channels | Penetrating established, long-term client relationships requires significant effort. | Securing utility contracts necessitates extensive pre-qualification and a proven track record. |

Porter's Five Forces Analysis Data Sources

Our ESCO Technologies Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available financial statements, investor presentations, and annual reports. We also incorporate insights from reputable industry research firms and market intelligence platforms to capture the competitive landscape.