Ericsson PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

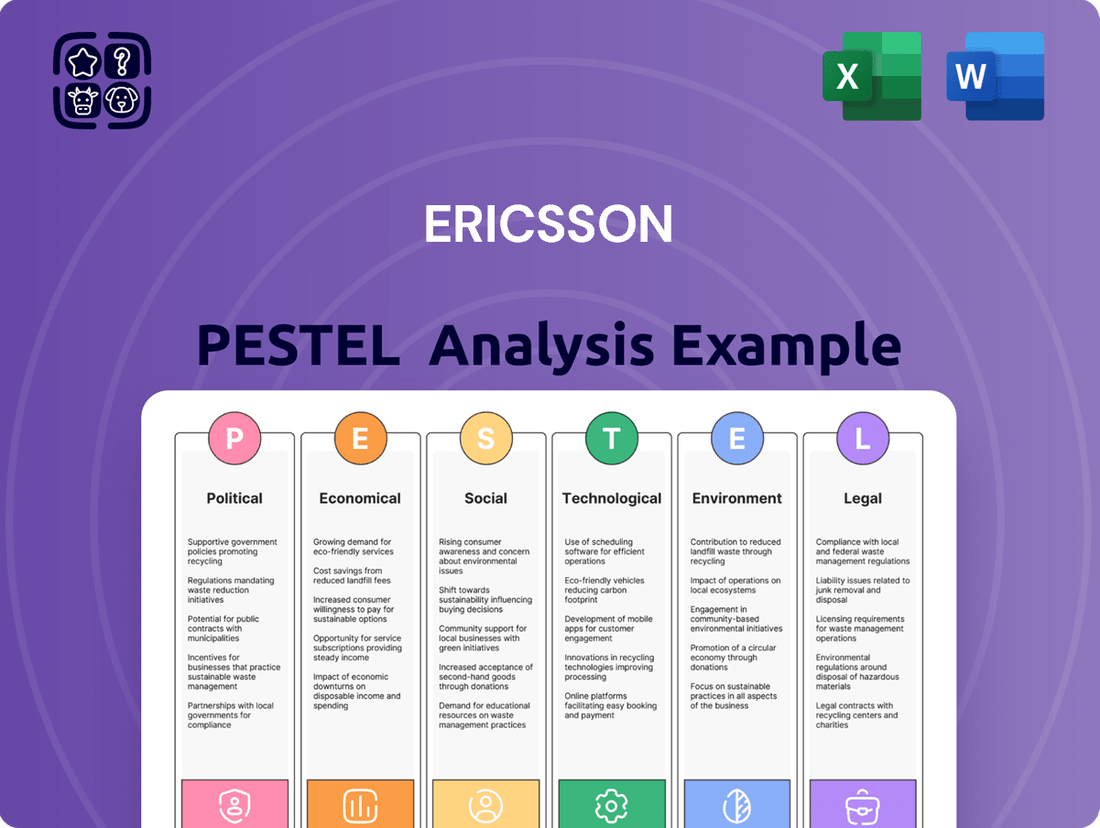

Unlock Ericsson's strategic landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. This expert-crafted report provides actionable intelligence to inform your own market strategies.

Gain a critical advantage by delving into the external forces shaping Ericsson's success. Our PESTLE analysis offers a deep dive into the trends that matter most, from evolving regulations to technological disruptions. Purchase the full version now for unparalleled strategic clarity.

Political factors

Geopolitical tensions, like the ongoing trade friction between the United States and China, directly affect global supply chains. For Ericsson, this can mean increased costs for components and potential disruptions in manufacturing and distribution networks. In 2024, these tensions continue to shape how multinational corporations manage their international operations.

Trade disputes can also lead to market access restrictions. For instance, countries might impose tariffs or outright bans on certain telecommunications equipment, impacting Ericsson's ability to sell its products and services in key markets. This dynamic necessitates agile strategies to navigate evolving trade landscapes.

The telecommunications sector is particularly sensitive to national security concerns, leading to heightened scrutiny of foreign ownership. The US Federal Communications Commission's (FCC) ongoing focus on submarine cables, for example, underscores this trend. In 2024, regulatory bodies globally are increasingly vigilant about the security implications of critical infrastructure, influencing investment and partnership decisions for companies like Ericsson.

Governments globally are prioritizing 5G, seeing it as crucial for economic growth and digital transformation. For instance, the US allocated $9 billion in 2023 for broadband infrastructure, including 5G, while the EU's Digital Decade targets aim for nationwide 5G coverage by 2030. These initiatives translate into significant opportunities for companies like Ericsson, which are at the forefront of supplying the necessary technology.

The telecommunications industry faces a dynamic regulatory environment, with evolving rules around supplier diversity, cybersecurity, and data privacy significantly impacting companies like Ericsson. Navigating these diverse and often conflicting regulations across its global operations, which span over 180 countries, presents a substantial challenge.

New policies, such as the EU's Critical Entities Resilience Directive, are coming into effect, requiring telecommunications infrastructure providers to enhance their resilience against various threats. This directive, alongside other national security-focused regulations, can influence procurement decisions and operational standards.

Public-Private Partnerships (PPPs)

Ericsson actively pursues Public-Private Partnerships (PPPs) with governments and local authorities worldwide. These collaborations are crucial for expanding 5G infrastructure, especially in underserved rural regions, aiming to bridge the digital divide. For instance, in 2024, several European nations announced new PPP initiatives to accelerate rural broadband deployment, with Ericsson being a key technology provider in many of these projects.

These partnerships serve as a significant political channel for Ericsson to secure large-scale network deployment contracts and gain access to public funding and regulatory support. The company's involvement in such initiatives directly influences its market penetration and revenue streams in regions where private investment alone might be insufficient. By aligning with government digital agendas, Ericsson solidifies its position as a strategic partner in national connectivity strategies.

- 5G Deployment Acceleration: PPPs enable faster rollout of 5G networks, crucial for economic development and digital inclusion.

- Rural Connectivity Focus: Partnerships are instrumental in extending high-speed internet to areas previously lacking adequate service.

- Securing Contracts: Political engagement through PPPs helps Ericsson win significant infrastructure projects.

- Government Support: These collaborations often unlock access to subsidies, spectrum, and favorable regulatory frameworks.

National Security and Infrastructure Resilience

Governments worldwide are increasingly prioritizing the security of critical connectivity networks, especially in light of rising geopolitical tensions and the growing threat of natural disasters. This heightened focus on resilience and security directly fuels demand for robust and trustworthy telecommunications infrastructure, significantly shaping procurement decisions for companies like Ericsson.

This emphasis on national security and infrastructure resilience translates into a greater demand for secure 5G deployments and advanced network protection solutions. For instance, many nations are investing heavily in upgrading their critical infrastructure to withstand cyber threats and physical disruptions. Ericsson, a key player in this space, benefits from this trend as governments seek reliable partners capable of delivering secure and resilient solutions.

- Increased government spending on secure telecommunications infrastructure is a key driver.

- Supply chain security is paramount, influencing vendor selection and partnerships.

- Resilience against cyberattacks and natural disasters is a non-negotiable requirement for network operators.

- The demand for trusted vendors with proven security track records is at an all-time high.

Geopolitical shifts and trade disputes continue to impact global supply chains, potentially increasing costs and causing disruptions for Ericsson. In 2024, national security concerns are also driving heightened scrutiny of foreign telecommunications equipment, influencing investment and partnership decisions.

Governments are actively promoting 5G deployment for economic growth, with significant public investment in infrastructure, creating substantial opportunities for Ericsson. However, navigating diverse and evolving regulations across over 180 countries, including new directives on critical entity resilience, presents a considerable challenge for the company.

Ericsson's engagement in Public-Private Partnerships (PPPs) with governments is crucial for expanding 5G, particularly in rural areas, and securing large-scale contracts. These collaborations are often supported by government funding and favorable regulatory frameworks, aligning with national digital agendas.

The increasing government focus on the security and resilience of critical connectivity networks directly fuels demand for robust telecommunications infrastructure. This trend benefits Ericsson as nations invest in upgrading their networks to withstand cyber threats and physical disruptions, prioritizing trusted vendors.

What is included in the product

This Ericsson PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's global operations and strategic direction.

It provides actionable insights into how these external forces create both challenges and opportunities for Ericsson in the telecommunications sector.

Provides a concise, actionable overview of external factors impacting Ericsson, enabling quicker strategic decision-making and risk mitigation.

Economic factors

The global 5G technology market is on a rapid expansion trajectory, with forecasts indicating it will reach a substantial $1.6 trillion by 2025. This surge is fueled by increasing demand for faster connectivity and new applications across various sectors.

Ericsson is a significant player benefiting from this growth, having secured a considerable number of commercial 5G agreements worldwide. The company is experiencing robust sales in its network infrastructure as operators accelerate their 5G network deployments.

Currency fluctuations significantly impact Ericsson's financial results, particularly in regions with volatile exchange rates. For instance, a stronger Swedish Krona (SEK) against currencies where Ericsson generates substantial revenue, such as the US Dollar or Euro, can erode its reported earnings. This sensitivity is amplified in emerging markets where macroeconomic instability often leads to sharper currency swings, directly affecting sales volumes and profit margins for its network equipment and services.

Macroeconomic instability, encompassing factors like inflation, interest rate hikes, and geopolitical tensions, creates an unpredictable operating environment for Ericsson. These conditions can dampen demand for telecommunications infrastructure as operators become more cautious with capital expenditures. For example, high inflation rates in key markets can increase operational costs for Ericsson while simultaneously reducing the purchasing power of its clients, leading to potential project delays or cancellations.

In 2024, global economic uncertainty persists, with the IMF forecasting varied growth rates across regions. Emerging markets, in particular, face headwinds from higher borrowing costs and potential capital outflows, directly impacting their ability to invest in 5G and other advanced network technologies. Ericsson's strategy to mitigate these risks involves robust hedging policies and a diversified geographical presence, aiming to balance exposure to individual currency and economic shocks.

Ericsson's focus on cost management and supply chain efficiency significantly bolsters its profitability. In Q1 2025, the company reported a gross margin of 42.5%, a direct reflection of these ongoing efforts to streamline operations and reduce expenditures.

These strategic initiatives are crucial for maintaining a competitive edge in the telecommunications sector. By optimizing logistics and controlling costs, Ericsson can better navigate market pressures and invest in innovation, as seen in their continued R&D spending.

Increased Investment in Digital Infrastructure

The global push towards digitalization is fueling significant economic growth in digital infrastructure. This trend is evident in the increasing demand for robust telecommunications networks, essential for everything from remote work to advanced manufacturing. For instance, global spending on IT infrastructure, including networking and data centers, was projected to reach over $2.8 trillion in 2024, a notable increase from previous years.

This sustained investment creates a highly favorable economic landscape for companies like Ericsson, which are central to building and upgrading these networks. The ongoing need for higher bandwidth and faster mobile data speeds, especially with the rollout of 5G and the anticipation of 6G technologies, ensures a continuous demand for Ericsson's core products and services.

- Global IT infrastructure spending is a key indicator of this trend.

- Demand for high-speed internet and mobile data is a primary driver.

- 5G and future 6G development necessitate ongoing infrastructure upgrades.

- This economic environment directly benefits Ericsson's core business segments.

Fixed Wireless Access (FWA) Market Growth

The global Fixed Wireless Access (FWA) market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond. This surge is fueled by increasing demand for high-speed internet in underserved areas and a competitive landscape driving innovation. In 2024, FWA connections are expected to surpass 175 million globally, representing a substantial increase from previous years and a significant opportunity for infrastructure providers like Ericsson.

This widespread adoption of FWA is directly translating into increased network traffic, placing greater demands on existing infrastructure and necessitating network upgrades. For Ericsson, this trend creates new revenue streams as operators invest in enhancing their FWA capabilities, including upgrades to 5G and beyond. The market is not just about connecting more users, but also about delivering higher quality of service, which requires advanced network solutions.

- FWA Customer Growth: Over 160 million FWA customers globally, with projections for continued expansion.

- Network Traffic Increase: Significant rise in network traffic due to FWA adoption, driving demand for capacity upgrades.

- Revenue Opportunities: New revenue streams for telecom operators and infrastructure vendors like Ericsson from FWA network investments.

- Technological Advancement: FWA growth is pushing advancements in 5G and future wireless technologies to meet demand.

Economic factors significantly shape Ericsson's operating environment. The global push for digitalization and the expansion of 5G infrastructure are creating substantial demand for Ericsson's network solutions. For instance, global IT infrastructure spending was projected to exceed $2.8 trillion in 2024, highlighting the scale of investment in digital connectivity.

However, macroeconomic instability, including inflation and fluctuating interest rates, can temper operator spending on new infrastructure. Currency volatility also directly impacts Ericsson's reported earnings, particularly when the Swedish Krona strengthens against major revenue-generating currencies. Ericsson's strategic focus on cost management, evidenced by a Q1 2025 gross margin of 42.5%, is crucial for navigating these economic headwinds and maintaining profitability.

| Economic Factor | Impact on Ericsson | Data/Trend (2024-2025) |

|---|---|---|

| Digitalization & 5G Rollout | Drives demand for network infrastructure and services. | Global 5G market projected to reach $1.6 trillion by 2025. |

| Macroeconomic Instability (Inflation, Interest Rates) | Can lead to cautious operator CapEx and increased operational costs. | IMF forecasts varied regional growth; emerging markets face higher borrowing costs. |

| Currency Fluctuations | Affects reported earnings, especially with a strong SEK. | Sensitivity to USD and EUR exchange rates for revenue generation. |

| Fixed Wireless Access (FWA) Growth | Creates new revenue streams and drives network upgrade demand. | FWA connections expected to exceed 175 million globally in 2024. |

Full Version Awaits

Ericsson PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ericsson PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of how external forces shape Ericsson's operations and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into market dynamics and competitive pressures, empowering informed decision-making.

Sociological factors

The world's population is expanding, with a significant portion being young individuals eager to access mobile data and cutting-edge digital services. This trend is particularly evident in emerging markets. For instance, by the end of 2024, it's projected that over 6.8 billion people will be mobile subscribers globally, a number expected to climb to 7.5 billion by 2029, according to GSMA Intelligence.

This demographic surge directly translates into a heightened need for advanced telecommunications infrastructure capable of supporting this data consumption. Ericsson, as a leading provider of network equipment and services, is strategically positioned to capitalize on this growing demand for faster speeds and more sophisticated mobile solutions, including 5G and beyond.

Ericsson's dedication to digital inclusion is a significant sociological factor, aiming to bridge the digital divide. Through initiatives like Connect to Learn, they're fostering socio-economic development by providing access to digital learning and skills. This directly addresses the need for connectivity among underserved populations, a crucial element for societal progress.

The ongoing shift towards remote work and online education, significantly amplified by recent global events, has dramatically increased reliance on robust digital infrastructure. This societal trend directly fuels demand for high-capacity mobile broadband and cloud solutions, areas where Ericsson is a key player.

By 2024, it's projected that over 30% of the global workforce will be working remotely at least part-time, a substantial increase from pre-pandemic levels. This sustained adoption of flexible work arrangements, coupled with the growing popularity of digital entertainment platforms, underscores the critical need for advanced network capabilities that Ericsson provides.

Privacy Concerns and Data Security Awareness

Public awareness around data privacy and security is a significant sociological factor impacting telecommunications firms like Ericsson. Consumers are increasingly vigilant about how their personal information is collected, stored, and used, demanding greater transparency and control. This heightened awareness pressures companies to invest heavily in robust data protection measures and secure infrastructure to maintain customer trust.

Regulatory bodies worldwide are responding to these concerns with stricter data protection laws. For instance, the General Data Protection Regulation (GDPR) in Europe and similar legislation in other regions impose substantial penalties for non-compliance. In 2023, fines under GDPR alone exceeded €1.5 billion, underscoring the financial risks associated with data breaches and privacy violations, which directly affect companies like Ericsson.

- Growing Consumer Demand for Privacy: Surveys indicate a significant majority of consumers (e.g., over 80% in some studies) are concerned about how their data is handled by tech companies.

- Increased Regulatory Scrutiny: Governments are enacting and enforcing stricter data protection laws, leading to higher compliance costs and potential fines for data mishandling.

- Impact on Brand Reputation: Data breaches or perceived privacy violations can severely damage a company's reputation, leading to customer churn and reduced market share.

- Investment in Security Technologies: Companies are compelled to allocate substantial resources towards cybersecurity and privacy-enhancing technologies to meet evolving societal expectations and legal requirements.

Talent Attraction and Retention

The telecommunications sector, particularly with advancements in 5G, AI, and cloud technologies, is experiencing a significant talent crunch. This makes attracting and retaining skilled engineers and technical professionals crucial for companies like Ericsson to stay ahead. In 2024, the global demand for cybersecurity professionals, a key area for telcos, saw an estimated shortage of 3.4 million workers, highlighting the competitive landscape for specialized skills.

Ericsson's ability to innovate and maintain its market position hinges on securing top-tier talent. Companies are increasingly investing in robust employee development programs and competitive compensation packages to lure and keep these in-demand professionals. For instance, a 2025 LinkedIn report indicated that companies offering strong learning and development opportunities saw a 20% higher retention rate among their tech staff.

- High Demand for Specialized Skills: The rapid pace of technological change in 5G, AI, and cloud computing creates an urgent need for highly skilled engineers and developers.

- Competitive Talent Market: Companies globally are vying for the same pool of specialized talent, driving up recruitment costs and retention challenges.

- Impact on Innovation: Ericsson's capacity to develop cutting-edge solutions and maintain its technological leadership is directly tied to its success in attracting and retaining top engineering minds.

- Strategic Importance of Retention: Keeping experienced professionals is vital not only for continuity but also for fostering a culture of innovation and knowledge transfer.

Societal shifts toward digital lifestyles are a major driver for telecommunications. The global mobile subscriber base is projected to exceed 7.5 billion by 2029, indicating a vast and growing market for Ericsson's services. This increasing reliance on mobile data for everything from communication to entertainment directly fuels demand for advanced network infrastructure like 5G.

The growing emphasis on digital inclusion, with initiatives aiming to connect underserved populations, presents both a social responsibility and a market opportunity for Ericsson. Furthermore, the sustained trend of remote work and online learning, accelerated by global events, necessitates robust and high-capacity connectivity solutions, playing directly into Ericsson's core offerings.

Public concern over data privacy and security is intensifying, pushing companies like Ericsson to prioritize and invest heavily in robust data protection measures. This societal expectation, coupled with stricter regulations such as GDPR, means compliance and trust are paramount for maintaining brand reputation and customer loyalty.

The telecommunications sector faces a significant talent shortage, particularly in specialized areas like cybersecurity and AI. Ericsson's ability to attract and retain skilled professionals is critical for its innovation pipeline and competitive edge in a market demanding constant technological advancement.

Technological factors

The global rollout of 5G Standalone (SA) networks is accelerating, with projections indicating around 70 operators will have deployed these advanced networks by 2025. This technological leap is a major catalyst for companies like Ericsson, as 5G SA unlocks the full potential of the technology, including ultra-low latency and sophisticated network slicing capabilities.

These enhanced features are particularly vital for driving innovation in areas like industrial automation and the burgeoning field of artificial intelligence, creating new revenue streams and demand for Ericsson's infrastructure and solutions.

The telecom industry's move towards cloud-based infrastructure, often called telco cloudification, is fundamentally reshaping network operations. This transition replaces traditional, rigid hardware with flexible, software-defined solutions, enabling greater agility and scalability. Ericsson is a key player in this shift, offering cloud-native solutions designed to meet the evolving demands of network operators.

This virtualization trend allows for more dynamic resource allocation and faster service deployment, crucial for areas like 5G. For instance, by 2025, it's projected that a significant portion of telecom workloads will be running on cloud-native architectures, driving efficiency gains. Ericsson’s investment in this area, including its Cloud RAN and 5G Core offerings, positions it to capitalize on this substantial market transformation.

Ericsson is heavily investing in AI and machine learning, recognizing their critical role in boosting network efficiency and automation. This focus is particularly evident in their leadership within the AI-RAN (Radio Access Network) sector, where these technologies are fundamental for advancing 5G and future 6G capabilities.

By leveraging AI, Ericsson aims to unlock new avenues for service differentiation and achieve significant operational efficiencies. For instance, in 2024, the company highlighted AI's potential to reduce energy consumption in networks by up to 10%, a crucial factor as data traffic continues to surge.

Growth of IoT and Emerging Business Solutions

The Internet of Things (IoT) market is experiencing significant growth, with projections indicating over 7 billion cellular IoT connections by 2030. This expansion fuels demand for sophisticated connectivity solutions. Ericsson's strategic focus on IoT, including advancements like Broadband IoT and 5G RedCap, positions it to capitalize on this trend by offering solutions for an increasingly connected world.

Ericsson's commitment to IoT is evident in its product development and market strategy. The company is actively developing and deploying technologies that enable a vast array of connected devices and applications. This includes solutions designed for diverse sectors, from smart cities and industrial automation to connected healthcare and automotive.

- IoT Market Expansion: Cellular IoT connections are expected to exceed 7 billion by 2030, highlighting a massive growth opportunity.

- Ericsson's IoT Solutions: The company offers Broadband IoT and 5G RedCap, directly addressing the increasing need for efficient IoT connectivity.

- Industry Adoption: Various sectors are integrating IoT, driving demand for reliable and scalable network infrastructure.

Development of Network APIs and Open Platforms

The evolution of network Application Programming Interfaces (APIs) and the push towards open platforms are significant technological drivers for companies like Ericsson. Initiatives such as Aduna, a collaboration between Ericsson and other major communication service providers, exemplify this trend. These platforms are designed to unlock new avenues for revenue generation and speed up the introduction of innovative services by allowing developers to directly utilize network functionalities.

This strategic move cultivates a more open and collaborative environment for the creation and deployment of novel digital services. For instance, by exposing network capabilities through APIs, companies can enable third-party developers to build applications that leverage real-time network data or performance metrics. This can lead to the development of specialized services in areas like enhanced mobile broadband, low-latency communication for gaming, or IoT solutions.

- API Economy Growth: The global API management market was projected to reach over $10 billion by 2025, indicating a strong demand for platforms that facilitate service integration.

- Open Platform Adoption: Many communication service providers are actively exploring open platform strategies to foster innovation and create new ecosystems around their networks.

- Developer Ecosystems: The success of platforms often hinges on the vibrancy of their developer communities, with companies investing in tools and support to attract and retain talent.

The ongoing expansion of 5G Standalone (SA) networks, with an anticipated 70 operators deploying by 2025, is a significant technological factor benefiting Ericsson. This advancement enables critical features like ultra-low latency and network slicing, which are essential for industrial automation and AI applications.

Furthermore, the telecom industry's shift towards cloud-native architectures, or telco cloudification, is reshaping network operations. Ericsson's cloud-native solutions are positioned to meet this demand, as a substantial portion of telecom workloads are expected to run on these architectures by 2025, driving efficiency.

Ericsson's investment in AI and machine learning, particularly in the AI-RAN sector, is crucial for advancing 5G and future 6G capabilities. AI integration is projected to reduce network energy consumption by up to 10% in 2024, a key benefit given increasing data traffic.

The burgeoning Internet of Things (IoT) market, with over 7 billion cellular IoT connections projected by 2030, fuels demand for Ericsson's connectivity solutions like Broadband IoT and 5G RedCap.

The increasing adoption of open network APIs and platforms, exemplified by collaborations like Aduna, is creating new revenue streams and accelerating service innovation by allowing developers to leverage network functionalities.

Legal factors

Stringent global data privacy regulations, like the EU's GDPR and California's CPRA, significantly impact Ericsson. These laws mandate careful handling of personal data, requiring robust consent mechanisms and data protection measures. Failure to comply can result in substantial penalties; for example, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Operating in the telecommunications sector necessitates strict compliance with intricate licensing and spectrum allocation rules that vary by nation. These regulations directly influence a company's capacity to deliver services and roll out innovative technologies, impacting market access and operational costs.

For instance, the ongoing global transition to 5G technology involves significant spectrum auctions and reallocations. In 2024, countries like Germany continued to refine their 5G spectrum strategies, with potential implications for network deployment timelines and investment requirements for companies like Ericsson. Similarly, upcoming spectrum availability in 2025 for mid-band frequencies in key markets will be crucial for expanding 5G capabilities and will be closely monitored by industry players.

Governments worldwide are enacting stricter cybersecurity laws, particularly for critical infrastructure like telecommunications. For instance, the European Union's NIS2 Directive, which came into effect in January 2023 and is being transposed into national laws throughout 2024 and 2025, significantly expands cybersecurity obligations for entities in the digital sector, including network operators. Ericsson must navigate these evolving regulatory landscapes, ensuring its systems and services meet increasingly stringent standards for resilience and data protection to avoid penalties and maintain trust.

Anti-Trust and Competition Laws

Ericsson, as a significant entity in the global telecommunications sector, must navigate a complex web of anti-trust and competition laws. These regulations are designed to foster a competitive marketplace and prevent any single company from unfairly dominating the industry. For instance, in 2024, the European Commission continued its active oversight of the tech sector, examining potential anti-competitive practices.

Any strategic moves by Ericsson, such as mergers or acquisitions, are subject to rigorous review by competition authorities worldwide. This scrutiny ensures that such actions do not stifle innovation or harm consumers through reduced choice or inflated prices. In 2024, several major tech mergers faced significant regulatory hurdles, underscoring the strictness of these oversight bodies.

- Regulatory Scrutiny: Ericsson's market share and business strategies are constantly monitored by regulators to ensure compliance with competition rules.

- Merger & Acquisition Oversight: Any proposed consolidation or acquisition by Ericsson requires approval from competition authorities to prevent market monopolization.

- Fair Market Practices: Laws mandate that Ericsson must engage in fair competition, avoiding practices that could disadvantage rivals or consumers.

Intellectual Property Rights (IPR) Protection

Intellectual Property Rights (IPR) protection is fundamental for Ericsson's sustained competitive edge and revenue streams, especially through its significant IPR licensing activities. The company's vast patent portfolio, covering areas like 5G and mobile communication technologies, requires robust legal frameworks to prevent infringement and ensure fair compensation for its innovations. In 2024, Ericsson continued to actively manage its IPR, with licensing agreements forming a substantial part of its financial performance, contributing billions in revenue annually.

Legal frameworks governing intellectual property are indispensable for safeguarding Ericsson's continuous innovation pipeline. These laws enable the company to defend its technological advancements against unauthorized use, thereby maintaining its market position. As of early 2025, ongoing legal actions and settlements related to patent disputes underscore the critical importance of strong IPR enforcement for companies like Ericsson operating in the highly competitive telecommunications sector.

- Global Patent Portfolio: Ericsson held over 60,000 granted patents as of late 2024, a testament to its R&D investment.

- Licensing Revenue: IPR licensing is a significant revenue driver, consistently contributing billions of dollars to Ericsson's top line.

- Enforcement Actions: Ericsson actively pursues legal remedies against patent infringers to protect its market share and financial interests.

- 5G Standards: The company's foundational patents in 5G technology are crucial for its licensing strategy and industry influence.

Ericsson operates under a complex global regulatory environment, necessitating strict adherence to data privacy laws like GDPR and CPRA, with non-compliance potentially leading to fines up to 4% of global annual revenue.

Navigating national licensing and spectrum allocation rules is critical for service delivery and technological deployment, with 5G spectrum auctions in 2024 and 2025 significantly influencing market access and investment for companies like Ericsson.

Evolving cybersecurity legislation, such as the EU's NIS2 Directive, imposes enhanced obligations on telecom infrastructure, demanding robust resilience and data protection measures from Ericsson to maintain trust and avoid penalties.

The company also faces scrutiny under anti-trust and competition laws, with regulatory bodies actively monitoring market practices and reviewing any proposed mergers or acquisitions to prevent monopolization and ensure fair competition.

Robust intellectual property rights protection is vital, with Ericsson's extensive patent portfolio, exceeding 60,000 granted patents by late 2024, underpinning its licensing revenue, which consistently contributes billions annually.

| Legal Factor | Impact on Ericsson | Key Considerations (2024-2025) |

| Data Privacy | Mandates careful data handling, consent mechanisms, and protection measures. | GDPR/CPRA compliance; potential fines up to 4% of global revenue. |

| Licensing & Spectrum | Dictates service delivery capabilities and technology rollout. | 5G spectrum availability and auctions in key markets. |

| Cybersecurity | Requires enhanced resilience and data protection for critical infrastructure. | NIS2 Directive implementation and evolving national laws. |

| Competition Law | Governs market practices and requires oversight for M&A. | Scrutiny of market share and strategic business moves. |

| Intellectual Property | Protects innovation and drives licensing revenue. | Over 60,000 granted patents; active enforcement against infringers. |

Environmental factors

The telecommunications sector faces mounting pressure to curb energy usage and lower its carbon impact. Ericsson is actively pursuing this by developing energy-efficient technologies. In 2023, the company reported a 44% reduction in its Scope 1 and 2 absolute emissions compared to 2017, demonstrating its commitment to sustainability.

The telecommunications industry, including companies like Ericsson, faces a significant challenge with the escalating volume of electronic waste (e-waste). By 2027, global e-waste is projected to reach 165 million metric tons, a stark increase from 53.6 million metric tons in 2019. This growing stream of discarded electronics, from network equipment to consumer devices, demands robust and responsible management strategies to mitigate environmental harm.

Ericsson's proactive embrace of circular economy principles is therefore vital for its long-term environmental sustainability. This commitment translates into dedicated efforts in product lifecycle management, focusing on durability, repairability, and eventual recycling. For instance, Ericsson's 2023 sustainability report highlights their progress in increasing the use of recycled materials in their products, aiming for a 50% reduction in the environmental footprint of their portfolio by 2030.

Climate change poses a significant threat to global infrastructure, including telecommunications networks. Extreme weather events, such as floods, heatwaves, and storms, are becoming more frequent and intense, directly impacting Ericsson's network infrastructure and operational continuity. For instance, the increasing frequency of severe storms in regions like Northern Europe during 2024 has led to temporary outages for mobile operators, highlighting the vulnerability of physical network components.

Ericsson must prioritize climate resilience in its network designs and operational strategies to mitigate these risks and ensure uninterrupted service delivery for its customers. This involves investing in more robust equipment, developing advanced disaster recovery plans, and potentially relocating critical infrastructure to less vulnerable areas. The company's 2024 sustainability report noted a 15% increase in spending on climate adaptation measures for its network solutions.

Sustainable Supply Chain Management

Ericsson is deeply focused on ensuring environmental sustainability across its entire supply chain, from how it sources raw materials to how its products are manufactured. This commitment means actively collaborating with suppliers to ensure they meet stringent environmental standards and are working to reduce their own ecological footprint. For example, in 2023, Ericsson reported that 96% of its key suppliers had environmental management systems in place, a significant step towards a greener operation.

This focus extends to minimizing the environmental impact of logistics and product end-of-life management. Ericsson aims to reduce greenhouse gas emissions within its supply chain, targeting a 50% reduction in Scope 3 emissions by 2030 compared to a 2020 baseline. This involves optimizing transportation routes and promoting circular economy principles for its products.

- Supplier Environmental Audits: Ericsson regularly assesses its suppliers' environmental performance, ensuring compliance with its Supplier Code of Conduct.

- Resource Efficiency: The company encourages suppliers to adopt practices that improve energy efficiency and reduce waste in their manufacturing processes.

- Sustainable Materials: Efforts are underway to increase the use of recycled and renewable materials in product components, aiming for a 50% reduction in the use of virgin plastics by 2030.

- Carbon Footprint Reduction: Ericsson works with suppliers to identify and implement strategies for lowering their carbon emissions, contributing to the company's overall climate goals.

Compliance with Environmental Regulations

Ericsson navigates a complex web of environmental regulations worldwide, covering everything from emissions and hazardous materials to waste management. Failure to comply can lead to significant legal repercussions and damage its brand image, as seen in past environmental fines levied against telecommunications companies. Staying ahead of these evolving standards is critical for maintaining operational continuity and stakeholder trust.

Key areas of environmental compliance for Ericsson include:

- Emissions Control: Managing greenhouse gas emissions from manufacturing and operations, with targets for reduction.

- Hazardous Substance Management: Adhering to regulations like RoHS (Restriction of Hazardous Substances) in electronic components.

- Waste Management and Circularity: Implementing strategies for responsible disposal and recycling of electronic waste, aiming for a circular economy model.

- Energy Efficiency: Meeting standards for energy consumption in its products and facilities, contributing to sustainability goals.

Ericsson is actively reducing its environmental footprint, achieving a 44% decrease in Scope 1 and 2 emissions by 2023 compared to 2017. The company is also committed to circular economy principles, aiming to halve the environmental impact of its portfolio by 2030 through increased use of recycled materials.

The growing challenge of e-waste, projected to reach 165 million metric tons globally by 2027, necessitates robust management strategies. Ericsson is addressing this by focusing on product durability, repairability, and recycling, with a target to reduce virgin plastic usage by 50% by 2030.

Climate change poses a direct threat to network infrastructure, with extreme weather events causing disruptions. Ericsson is investing in climate resilience, increasing spending on adaptation measures by 15% in 2024 for its network solutions.

Ericsson's supply chain sustainability is crucial, with 96% of key suppliers having environmental management systems in place by 2023. The company targets a 50% reduction in Scope 3 emissions by 2030, focusing on logistics and product end-of-life management.

| Environmental Metric | 2023 Status/Target | Context/Impact |

|---|---|---|

| Scope 1 & 2 Emissions Reduction | 44% reduction vs. 2017 | Demonstrates commitment to operational sustainability. |

| Circular Economy (Recycled Materials) | Aiming for 50% portfolio footprint reduction by 2030 | Focus on product lifecycle management and resource efficiency. |

| E-waste Management | Addressing projected 165M metric tons by 2027 | Requires robust strategies for responsible disposal and recycling. |

| Climate Resilience Investment | 15% increase in adaptation spending (2024) | Mitigating risks from extreme weather events on network infrastructure. |

| Supplier Environmental Systems | 96% of key suppliers compliant (2023) | Ensuring environmental standards across the supply chain. |

| Scope 3 Emissions Reduction | Target 50% reduction vs. 2020 baseline by 2030 | Focus on logistics and end-of-life product management. |

PESTLE Analysis Data Sources

Our Ericsson PESTLE Analysis is built on a comprehensive review of data from leading telecommunications industry analysts, global economic forums, and regulatory bodies. We integrate insights from technology trend reports, market research firms, and government publications to ensure a robust understanding of the external environment.