Ericsson Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

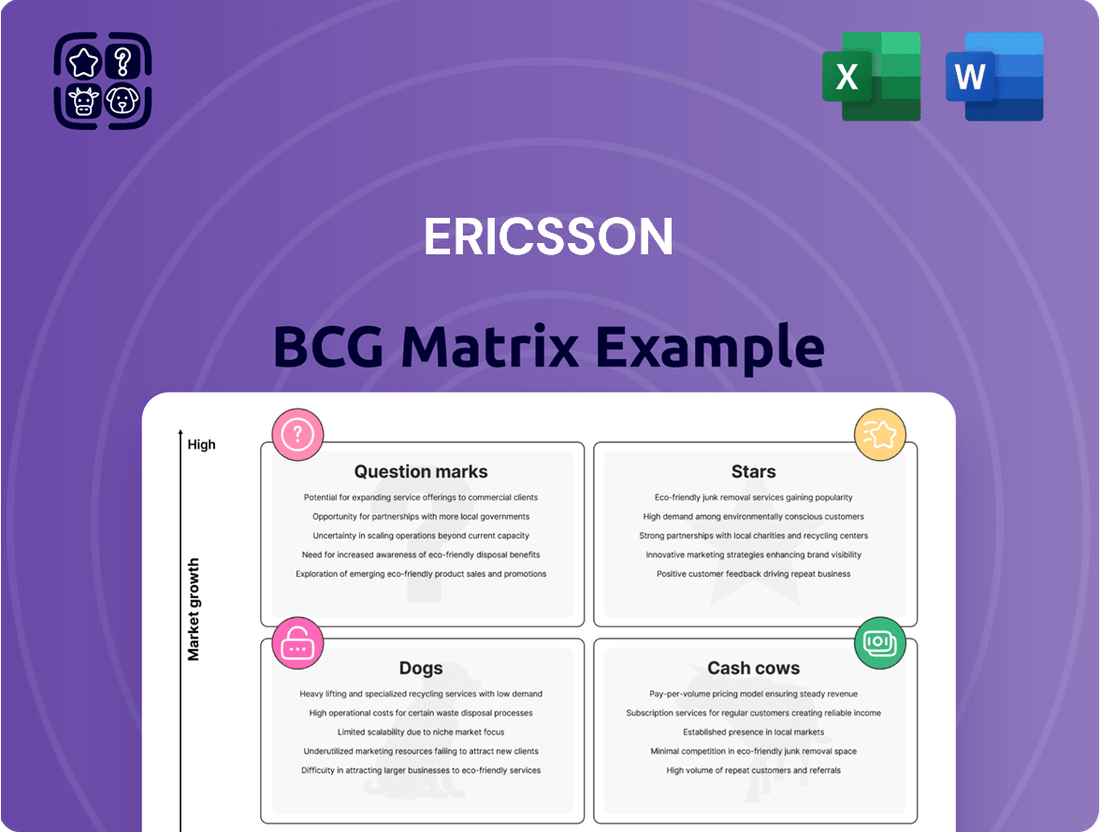

Curious about Ericsson's strategic product portfolio? Our preview of their BCG Matrix offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational concepts and see where the conversation is headed.

To truly unlock the strategic advantage, dive into the full Ericsson BCG Matrix. This comprehensive report provides detailed quadrant placements, market share data, and growth rate analysis, empowering you to make informed decisions about resource allocation and future investments.

Don't just guess where Ericsson's products stand; know it with certainty. Purchase the complete BCG Matrix for a clear, actionable roadmap to optimize your understanding of their competitive landscape and drive your own business forward.

Stars

Ericsson stands as a dominant force in 5G network infrastructure, frequently leading market share reports due to its extensive product range and ongoing research and development. The company is instrumental in deploying a substantial portion of the world's active 5G networks, with North America exhibiting particularly robust expansion and high adoption rates.

In 2023, Ericsson reported its largest ever market share in 5G core networks, a testament to its strong competitive standing. This leadership in a sector experiencing rapid technological advancement and widespread deployment firmly places 5G network infrastructure in the Star category for Ericsson.

Ericsson is making significant strides in programmable networks and network APIs, a key component of its strategic growth. This focus is clearly demonstrated through its Aduna joint venture with leading global communication service providers. This collaboration is designed to open up new revenue avenues by making 5G network functionalities accessible to application developers, tapping into a rapidly expanding sector within the telecommunications landscape.

The strategic push into network APIs is positioned to foster a high-growth market. By enabling application developers to leverage 5G capabilities, Ericsson is cultivating an ecosystem for innovative services and applications. This early market positioning is crucial, as the demand for sophisticated network services continues to surge, driven by the increasing adoption of 5G technology and its diverse use cases.

North America has been a powerhouse for Ericsson's mobile broadband sales, with substantial growth observed through 2024 and into Q1 2025. This robust performance is fueled by major operator contracts and ongoing investments in 5G infrastructure across the region.

Ericsson's strong market position in North America, a rapidly expanding 5G market, solidifies mobile broadband's status as a Star in their portfolio. The company secured significant deals in 2024, contributing to this upward trajectory.

Enterprise Wireless Solutions (Private 5G)

Ericsson's Enterprise Wireless Solutions, encompassing private 5G and Cradlepoint offerings, has experienced robust expansion. This division is positioned in a burgeoning market, with projections indicating substantial growth in enterprise adoption of private 5G for improved connectivity and operational efficiency.

The private 5G market is anticipated to grow significantly, driven by enterprises seeking advanced solutions for automation and enhanced network capabilities. Ericsson is strategically investing in this segment to capture a larger market share.

- Market Growth: The global private 5G market was valued at approximately $3.5 billion in 2023 and is projected to reach over $15 billion by 2028, growing at a CAGR of over 30%.

- Ericsson's Position: Ericsson's acquisition of Cradlepoint in 2020 bolstered its enterprise wireless capabilities, particularly in fixed wireless access and private cellular networks, positioning it as a key player.

- Key Drivers: Increased demand for reliable, high-bandwidth, low-latency connectivity in sectors like manufacturing, logistics, and public safety are fueling private 5G adoption.

- Strategic Focus: Ericsson is actively expanding its private 5G portfolio and partnerships to address diverse enterprise needs, aiming to become a leading provider in this high-potential market.

AI and Automation in Network Operations

Ericsson is heavily investing in AI and automation to create smarter, more efficient network operations. This strategic push is key for future growth, especially in enabling AI applications at the network edge. For example, in 2024, the company highlighted advancements in its AI-powered network orchestration platforms, which aim to reduce operational costs by up to 30% for telecom operators.

This focus on AI and automation positions Ericsson at the forefront of a rapidly expanding technological frontier. By developing capabilities for AI-driven network management, they are not only improving their own offerings but also paving the way for new services and revenue streams. Industry analysts projected the AI in network automation market to reach over $10 billion by 2025, underscoring the significant market opportunity.

- Smart Networks: Ericsson's AI and automation initiatives are designed to create self-optimizing and self-healing networks.

- Efficiency Gains: Automation in network operations can lead to significant reductions in manual intervention and associated costs.

- Edge AI Support: A key driver is enabling and managing AI workloads directly at the network edge for low latency applications.

- Market Leadership: This strategic investment aims to solidify Ericsson's position in a high-growth segment of the telecommunications infrastructure market.

Ericsson's 5G network infrastructure and mobile broadband services are clear Stars due to their dominant market share and significant growth. The company's substantial investments in AI and automation for network operations, along with its expansion into enterprise wireless solutions like private 5G, also position these segments as Stars. These areas are characterized by high growth potential and strong competitive advantages for Ericsson.

| Business Unit | BCG Category | Key Growth Drivers | 2024/2025 Outlook | Ericsson's Competitive Edge |

| 5G Network Infrastructure | Star | Global 5G rollout, network upgrades | Continued expansion, North America strength | Largest market share, R&D leadership |

| Mobile Broadband | Star | 5G adoption, data consumption growth | Robust sales in North America, major deals secured | Strong operator relationships, infrastructure deployment |

| AI & Automation in Networks | Star | Network efficiency demands, edge AI enablement | Projected market growth exceeding $10 billion by 2025 | AI-powered orchestration platforms, cost reduction focus |

| Enterprise Wireless (Private 5G) | Star | Enterprise digital transformation, IoT adoption | Market projected to exceed $15 billion by 2028 (CAGR >30%) | Cradlepoint acquisition, expanding private 5G portfolio |

What is included in the product

The Ericsson BCG Matrix provides a strategic overview of its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

The Ericsson BCG Matrix provides a clear, one-page overview to identify and strategically manage underperforming business units, alleviating the pain of resource misallocation.

Cash Cows

Ericsson's traditional managed services, focusing on network operations and optimization, remain a robust cash generator for the company. These mature services benefit from an established market position and reduced marketing spend, contributing to high profit margins.

Despite potentially slower market growth compared to newer technologies, the stability and profitability of these offerings are crucial. In 2023, Ericsson reported that managed services represented a significant portion of its revenue, demonstrating their ongoing importance in generating consistent cash flow.

Ericsson's existing 4G/LTE network infrastructure acts as a significant cash cow. The company boasts a vast global installed base, which continues to yield steady revenue from maintenance, essential upgrades, and ongoing support services. This mature market segment, despite the ongoing shift to 5G, is characterized by Ericsson's strong market position, ensuring consistent cash flow with minimal need for substantial new capital expenditure.

Ericsson's substantial patent portfolio and robust IPR licensing agreements are a significant revenue driver. This segment operates as a high-margin, low-cost business, generating consistent and substantial cash flow for the company.

In 2023, Ericsson reported a notable increase in IPR licensing revenue, partly due to improved gains from retrospective licensing periods. This highlights the ongoing strength and profitability of their intellectual property monetization strategy.

Mature Core Network Solutions

Mature Core Network Solutions represent a stable revenue stream for Ericsson, comprising essential services that underpin current communication networks. These are not directly linked to the high-growth 5G deployment but are critical for the day-to-day operations of service providers, ensuring consistent cash flow.

These mature products boast significant market penetration, providing Ericsson with a reliable source of income. For instance, in 2023, while 5G investments were prominent, the ongoing demand for robust core network infrastructure continued to support Ericsson's financial stability. The company reported strong performance in its Networks segment, which includes these foundational solutions.

Key aspects of Ericsson's Mature Core Network Solutions include:

- Continued demand for established network technologies.

- High market share in existing communication infrastructure.

- Steady cash generation supporting R&D and future growth areas.

- Essential for maintaining service provider operations.

Fixed Wireless Access (FWA) Solutions

Fixed Wireless Access (FWA) solutions represent a mature application of mobile technology, utilizing existing network infrastructure to deliver broadband. Ericsson's FWA offerings are particularly strong in markets like North America, where they consistently generate significant revenue.

- Mature Technology: FWA leverages established mobile networks for broadband delivery.

- Strong Revenue Generation: Ericsson's FWA solutions, especially in North America, are consistent cash generators.

- Market Growth: FWA is expected to capture a substantial share of new fixed broadband connections, indicating stable cash flow.

Ericsson's legacy managed services, particularly for 4G/LTE networks, continue to be significant cash cows. These established offerings benefit from a large installed base and ongoing support contracts, providing a predictable revenue stream with lower investment needs compared to newer technologies.

The company's intellectual property licensing, a high-margin business, also functions as a strong cash generator. In 2023, Ericsson saw increased revenue from these licensing agreements, underscoring the consistent profitability of its patent portfolio monetization.

Mature core network solutions, essential for current telecommunications infrastructure, also contribute steadily to Ericsson's cash flow. Despite the focus on 5G, the demand for reliable core network maintenance and upgrades remains robust, ensuring stable income.

| Service Area | BCG Category | Revenue Contribution (Illustrative) | Profitability | Growth Outlook |

|---|---|---|---|---|

| 4G/LTE Managed Services | Cash Cow | Significant | High | Mature/Stable |

| IPR Licensing | Cash Cow | Substantial | Very High | Stable |

| Mature Core Network Solutions | Cash Cow | Consistent | High | Stable |

Delivered as Shown

Ericsson BCG Matrix

The Ericsson BCG Matrix document you are previewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks or demo content, just a comprehensive strategic analysis ready for immediate application in your business planning. You can trust that the insights and structure you see now are precisely what you'll be able to edit, present, or integrate into your decision-making processes. This preview serves as a direct representation of the valuable, professionally designed strategic tool you'll acquire.

Dogs

Legacy 2G and 3G networks are firmly in the Dogs quadrant of the Ericsson BCG Matrix. As the world races towards 5G, these older technologies are being phased out. For instance, many operators in North America and Europe have already shut down their 3G networks, with 2G following suit.

Ericsson's continued investment in these declining technologies would yield minimal returns and a shrinking market share. The focus for these segments should be on managing their decline efficiently, potentially through divestiture or significantly reduced operational expenditure, rather than further development.

While Ericsson is strategically focusing on growth areas within cloud, certain non-strategic cloud software and services have seen sales dips, especially outside North America. For instance, in Q1 2024, Ericsson’s Networks segment, which includes some cloud-related offerings, saw a 14% decline in net sales year-over-year, highlighting challenges in specific sub-segments.

These underperforming areas within the broader cloud segment might have low market share in slow-growing or declining markets. Such segments could become cash traps, consuming resources without generating significant returns, impacting overall profitability.

Ericsson has seen notable year-on-year sales decreases in specific regions like Southeast Asia, Oceania, India, Africa, and the Middle East. These areas, characterized by falling sales and a diminished market presence, fit the description of Dogs in the BCG Matrix.

For instance, in India, the normalization of investments following a period of high spending has contributed to sales declines. Similarly, macroeconomic challenges and aggressive price competition have impacted sales in Africa and the Middle East, further solidifying their position as Dogs.

Non-Core, Underperforming Enterprise Segments

Non-core, underperforming enterprise segments within Ericsson's portfolio would be classified as Dogs in the BCG matrix. These are areas with low growth prospects and a small market share, meaning they are not contributing significantly to the company's overall success and may even be a drain on resources. For instance, a legacy enterprise software solution that has seen declining adoption due to newer, more competitive offerings could fit this description.

These segments are characterized by their inability to gain traction in competitive markets, leading to minimal revenue generation and often requiring ongoing investment for maintenance or support without a clear path to improvement. Such areas consume capital and management attention that could be better allocated to more promising business units.

- Low Market Share: These segments struggle to capture a meaningful portion of their respective markets.

- Low Growth Environment: The overall market for these offerings is not expanding, limiting potential for future gains.

- Resource Drain: They often require continued investment for upkeep or support, yielding low returns.

Older Mobile Broadband Equipment (Non-5G)

Older mobile broadband equipment, those not supporting 5G, are increasingly becoming question marks in the telecommunications landscape. As the industry races towards 5G deployment, the demand for these legacy systems is naturally expected to decline. For instance, while 5G subscriptions are projected to reach over 1.5 billion globally by the end of 2024, the market share for 4G-only equipment will inevitably shrink.

These products, though still within the broader Networks segment, face a challenging future. Their growth prospects are limited, and market share is set to decrease as operators prioritize investments in newer, more capable 5G infrastructure. Companies heavily reliant on this older equipment might need to strategize for a transition, as the technological tide is clearly shifting.

Consider the following implications:

- Declining Market Demand: As 5G adoption accelerates, the need for non-5G equipment will diminish significantly.

- Reduced Investment: Telecom operators are redirecting capital expenditure towards 5G networks, leaving less for older technologies.

- Limited Upgrade Paths: Many older systems lack the architecture to be easily upgraded to 5G, making them less attractive for future-proofing.

- Competitive Disadvantage: Businesses still relying on older mobile broadband may face competitive disadvantages due to slower speeds and reduced capacity compared to 5G users.

Dogs represent business units or product lines with low market share in low-growth or declining markets. For Ericsson, legacy 2G and 3G network technologies are prime examples, as operators worldwide decommission them in favor of 5G. While specific figures for these legacy segments are often embedded within broader reporting, the clear trend shows a shrinking market and minimal investment from operators, directly impacting Ericsson's sales in these areas.

The strategic implication is to manage these declining assets efficiently, perhaps through cost reduction or eventual divestiture, rather than continued development. Ericsson’s Q1 2024 results, for example, showed a 14% year-over-year decline in the Networks segment, which would encompass some of these legacy components, underscoring the challenges in these low-growth areas.

These segments are characterized by their inability to gain traction in competitive markets, leading to minimal revenue generation and often requiring ongoing investment for maintenance or support without a clear path to improvement. Such areas consume capital and management attention that could be better allocated to more promising business units.

Low market share and a low growth environment define these segments. They often represent a resource drain, requiring continued investment for upkeep with low returns, impacting overall profitability.

Question Marks

While cellular IoT continues its upward trajectory, the overall Internet of Things landscape is incredibly diverse and often fragmented. Ericsson's portfolio extends beyond just cellular, encompassing various innovative IoT solutions. These solutions tap into a rapidly expanding market, but many may still be in their nascent stages with limited market penetration.

For instance, consider solutions leveraging LPWAN (Low-Power Wide-Area Network) technologies like LoRaWAN or Sigfox, or even proprietary short-range wireless protocols for specific industrial applications. These areas, while experiencing significant growth, often see Ericsson competing with numerous specialized players, suggesting a potentially lower current market share for these specific offerings.

The sheer breadth of the IoT market means that while the growth potential is immense, achieving dominance in every niche requires substantial and sustained investment. This positions many of Ericsson's non-cellular IoT solutions as potential question marks, needing strategic focus and development to transition into market-leading Stars. For example, the global IoT market was projected to reach over $1.1 trillion by 2024, with a significant portion driven by non-cellular connectivity and specialized platforms.

Emerging technologies within Ericsson's Cloud Software and Services are poised to redefine connectivity and enterprise solutions. Think about advancements like edge computing platforms, which bring processing power closer to the user for faster response times, and specialized AI-driven network management tools designed for specific industry needs, such as smart manufacturing or autonomous logistics.

These nascent technologies represent significant growth opportunities in high-demand markets. For instance, the global edge computing market was projected to reach approximately $30 billion in 2024, with a compound annual growth rate expected to exceed 30% in the coming years. Ericsson's investment in these areas, while requiring substantial research and development, aims to capture a leading position in these rapidly expanding sectors.

Expanding into new geographic markets, particularly in regions like Africa and parts of Asia, positions Ericsson's offerings as potential Stars in the BCG matrix. These areas often present high growth potential for telecommunications infrastructure and services. For instance, sub-Saharan Africa's mobile penetration is projected to reach 60% by 2025, indicating a significant opportunity for network expansion.

However, these ventures are capital-intensive, demanding substantial investment in network build-out and local partnerships. Ericsson's strategic execution in navigating regulatory landscapes and competitive pressures in these emerging markets will be crucial. The company's ability to secure large contracts, as seen with its ongoing investments in 5G deployment in various African nations, will determine its success in these high-potential, but challenging, territories.

Advanced 5G Standalone (SA) Deployments and Use Cases

While 5G is a strong growth area, the true potential of 5G Standalone (SA) is just beginning to be realized. Ericsson is heavily investing in these advanced capabilities, recognizing their high-growth trajectory, even though widespread commercial adoption is still in its early stages.

5G SA unlocks a new realm of possibilities, moving beyond faster speeds to enable truly transformative applications. This emerging market segment, while currently having lower adoption rates than non-standalone 5G, represents a significant future opportunity for market leadership.

- Emerging Use Cases: 5G SA is crucial for low-latency applications like industrial automation, real-time remote surgery, and autonomous vehicles, which require the full capabilities of the 5G core.

- Investment Focus: Ericsson's strategic investments are geared towards developing and deploying the core network technologies that underpin these advanced 5G SA services.

- Market Potential: While adoption is still building, the potential market for 5G SA services is projected to grow substantially, driven by enterprise demand for mission-critical communications and enhanced mobile broadband.

- 2024 Data: By the end of 2024, it's estimated that over 100 operators globally had launched 5G SA networks, with a significant portion of these deployments involving Ericsson's technology.

AI-driven Network Monetization (beyond Aduna's initial scope)

Ericsson's exploration into AI-driven network monetization, extending beyond its initial Aduna platform's focus on network APIs, positions it within the Question Mark quadrant of the BCG Matrix. This strategic direction aims to unlock new revenue streams by leveraging the vast amounts of data and intelligence generated by telecommunications networks. The company is looking at innovative business models that capitalize on network capabilities, such as enhanced network slicing for specific enterprise needs or predictive maintenance services powered by AI analytics.

This pivot represents a significant investment in research and development, as well as market cultivation. While the potential for high growth is evident, the current market share for these advanced AI-driven monetization services is relatively nascent. For instance, the global market for AI in telecommunications was projected to reach approximately $7.5 billion by 2024, with significant growth expected in areas like network optimization and customer experience, but specific monetization models beyond traditional services are still emerging.

- New Revenue Streams: Ericsson aims to generate revenue from network data insights and AI-powered services, a largely untapped market.

- High Growth Potential: The increasing demand for specialized network capabilities and data-driven solutions indicates substantial future growth opportunities.

- Low Current Market Share: These advanced monetization strategies are still in their early stages, meaning Ericsson currently holds a small share of this emerging market.

- Substantial Investment Required: Developing and scaling AI capabilities, alongside creating new business models, necessitates significant financial and technological investment.

Ericsson's diverse IoT solutions, particularly those leveraging technologies beyond cellular like LPWAN, often fall into the Question Mark category. While the overall IoT market is expanding rapidly, these specific areas are fragmented with many specialized competitors, suggesting Ericsson's current market share might be limited in these niches. Significant investment is required to nurture these offerings and help them evolve into market leaders.

Emerging cloud software and services, such as edge computing platforms and AI-driven network management tools, also represent potential Question Marks. These areas show strong projected growth, with the global edge computing market anticipated to reach around $30 billion in 2024. Ericsson's substantial R&D investment aims to establish a leading position, but success hinges on navigating these nascent, high-growth sectors effectively.

Furthermore, Ericsson's strategic move into AI-driven network monetization, moving beyond established API platforms, places it firmly in the Question Mark quadrant. This venture targets new revenue streams by leveraging network data and AI, a market projected to grow significantly within the broader AI in telecommunications sector, which was expected to reach approximately $7.5 billion by 2024. However, these advanced monetization models are still in their infancy, requiring substantial investment to gain traction.

BCG Matrix Data Sources

Our BCG Matrix is built upon a foundation of robust market data, incorporating financial disclosures, industry growth rates, and competitive landscape analysis to provide strategic direction.