Ericsson Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

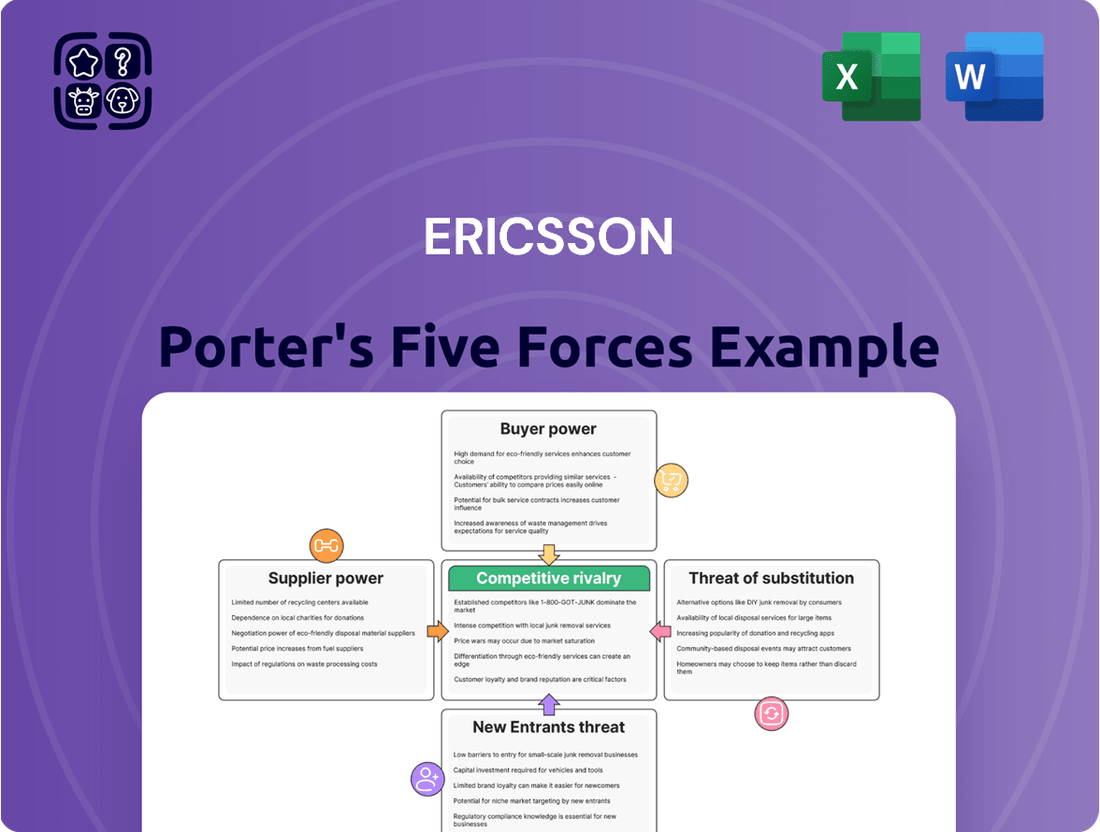

Ericsson operates in a dynamic telecom infrastructure market, facing intense rivalry and significant buyer power from large mobile operators. Understanding these pressures is crucial for any stakeholder. The full Porter's Five Forces Analysis reveals the real forces shaping Ericsson’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications equipment sector, including giants like Ericsson, often depends on a limited pool of highly specialized suppliers for essential components such as advanced semiconductors and optical modules. This concentration means these suppliers can wield considerable influence, particularly when manufacturers need cutting-edge technology for next-generation networks.

For instance, the market for high-performance application-specific integrated circuits (ASICs) used in 5G infrastructure is dominated by a few key players. Ericsson's strategic focus on diversifying its supplier base and securing long-term agreements is a direct response to this concentrated supplier power, aiming to mitigate risks and manage costs effectively in a dynamic market.

Ericsson faces significant supplier bargaining power due to high switching costs for its deeply integrated and complex telecommunications equipment. These costs involve substantial investment in redesigning products, rigorous re-qualification of new components, and extensive adjustments to manufacturing processes. This complexity inherently favors established suppliers who can leverage these barriers to maintain their pricing power.

Suppliers possessing proprietary technologies or advanced manufacturing processes, especially in critical areas like cutting-edge semiconductors or highly specialized antenna components, can wield significant leverage. For instance, in 2024, the demand for advanced 5G and future 6G chipsets, often produced by a limited number of highly specialized manufacturers, directly impacts production costs and availability for telecommunications equipment providers like Ericsson.

Ericsson's strategic response involves continuous investment in research and development, aiming for product leadership, particularly in the evolving landscape of programmable networks. This R&D focus is crucial for maintaining a competitive edge and securing access to necessary components, even when dealing with suppliers who hold a strong technological advantage.

Supplier Integration and Partnerships

Supplier integration can significantly shift bargaining power. When suppliers offer bundled solutions or exclusive agreements, it can reduce a company's options and increase the supplier's leverage. For instance, a critical component supplier might integrate its software and hardware, making it harder for Ericsson to switch to alternatives.

Ericsson's strategy involves fostering strong, collaborative partnerships with its suppliers. This approach aims to build trust and ensure that suppliers meet Ericsson's stringent quality and performance standards. This focus on long-term relationships can mitigate some of the supplier power by creating mutual dependency and shared goals.

- Supplier Integration: Some suppliers may bundle services or offer exclusive deals, potentially limiting Ericsson's procurement flexibility.

- Partnership Focus: Ericsson actively cultivates trusted supplier relationships to ensure adherence to its standards and promote collaborative value creation.

- Impact on Power: Closer supplier integration can increase their bargaining power by making it more difficult for Ericsson to source components or services elsewhere.

- Mitigation Strategies: Ericsson's emphasis on partnerships aims to balance power by fostering loyalty and shared objectives with key suppliers.

Geopolitical and Supply Chain Risks

Global geopolitical tensions and trade disputes have significantly amplified the bargaining power of suppliers, especially those with more resilient or localized production capabilities. Recent years have seen widespread disruptions to global supply chains, creating situations where suppliers with alternative sourcing or manufacturing can command better terms. For instance, the semiconductor shortage that began in late 2020 and continued through 2023, impacting numerous industries including telecommunications, highlighted the leverage held by chip manufacturers. Ericsson, recognizing this, has actively pursued a diversified production strategy. This includes increasing localized manufacturing in key markets and building greater supply chain flexibility to mitigate the impact of such global disruptions.

Ericsson's strategic moves to bolster its supply chain resilience are crucial in navigating these supplier power dynamics. By diversifying its manufacturing footprint, the company aims to reduce its reliance on any single region or supplier. This approach is designed to insulate Ericsson from the volatility associated with geopolitical events and trade policy shifts, thereby strengthening its negotiating position with suppliers.

- Geopolitical Instability: Events like the Russia-Ukraine conflict (ongoing since 2022) have disrupted raw material flows and logistics, increasing supplier leverage.

- Trade Disputes: Tariffs and trade barriers imposed between major economic blocs can force companies to seek alternative, potentially more expensive, suppliers.

- Supply Chain Diversification: Ericsson's investment in localized production, for example, its facilities in North America and Europe, aims to create more stable supply lines.

- Supplier Concentration: In critical component areas, such as advanced chip manufacturing, a limited number of suppliers can exert considerable power, as demonstrated by the persistent semiconductor shortages impacting the tech sector through 2024.

Ericsson faces substantial bargaining power from its suppliers, particularly those providing specialized components like advanced semiconductors. The limited number of manufacturers capable of producing cutting-edge chips for 5G and future 6G networks means these suppliers can dictate terms, impacting Ericsson's production costs and timelines. For instance, the ongoing demand for high-performance chipsets in 2024 continues to favor these specialized suppliers.

High switching costs, stemming from the deep integration of components and rigorous qualification processes, further empower suppliers. These barriers make it economically and technically challenging for Ericsson to change suppliers, solidifying the leverage of established partners. This situation is particularly acute for proprietary technology providers, who can maintain pricing power due to these inherent complexities.

Geopolitical instability and trade disputes have exacerbated supplier power by disrupting global supply chains. Companies with localized production or alternative sourcing, like those Ericsson is investing in, gain an advantage. The semiconductor shortages experienced through 2024 underscored the leverage of chip manufacturers, prompting Ericsson to diversify its production footprint to enhance resilience and negotiating strength.

| Supplier Characteristic | Impact on Ericsson | Example (2024 Focus) |

|---|---|---|

| Supplier Concentration | High leverage for few specialized providers | Limited manufacturers for advanced 5G/6G chipsets |

| Switching Costs | Increased dependence on existing suppliers | Redesign and re-qualification of complex components |

| Proprietary Technology | Suppliers command premium pricing | Exclusive access to novel semiconductor designs |

| Geopolitical Factors | Amplified supplier power due to supply chain disruptions | Resilient suppliers benefit from global trade volatility |

What is included in the product

This analysis dissects the competitive forces impacting Ericsson, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications sector.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Quickly identify and quantify the impact of each force on Ericsson's profitability, enabling targeted strategic responses.

Customers Bargaining Power

Ericsson's customer base is dominated by large, consolidated telecommunications operators. These major players, such as AT&T and Verizon, wield substantial bargaining power due to their immense scale and the critical nature of the network infrastructure Ericsson supplies. For instance, in 2024, major operators continued to consolidate, with ongoing discussions and potential mergers shaping the landscape, further concentrating purchasing power.

While customers hold significant sway, the practicalities of switching telecommunications infrastructure providers are far from simple. These transitions can incur substantial costs, encompassing potential network disruptions, intricate integration processes with existing systems, and the necessity for extensive personnel retraining. These factors can temper a customer's leverage once a network is firmly established.

Despite these switching costs, the initial contract negotiations remain fiercely competitive, as customers seek the best terms. However, the evolving landscape, particularly with the emergence of Open RAN technologies, is actively working to diminish vendor lock-in, potentially shifting the balance further towards customer power in the long run.

Customers are increasingly seeking sophisticated solutions, especially in areas like 5G, the Internet of Things (IoT), and cloud services. This strong demand pressures companies like Ericsson to constantly innovate and develop advanced technologies. For instance, the global IoT market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, indicating a substantial customer appetite for connected solutions.

This drive for cutting-edge features and superior performance empowers customers, giving them leverage to negotiate better terms and demand more value for their investments. Such customer expectations directly influence Ericsson's research and development priorities and shape its product development roadmap, as the company strives to meet evolving market needs.

Customer Focus on Cost Efficiency and ROI

Telecommunication operators are acutely focused on optimizing their capital expenditures and ensuring a strong return on their substantial network investments. This financial pressure directly translates into a heightened demand for cost-effective solutions and demonstrable return on investment (ROI) from their suppliers.

This customer focus significantly amplifies their bargaining power during the procurement process. For instance, in 2024, many operators continued to scrutinize vendor pricing, seeking long-term contracts with built-in cost reductions to manage their ongoing operational expenses and capital deployment strategies effectively.

- Cost Efficiency Demand: Operators actively seek solutions that reduce upfront costs and ongoing operational expenditures.

- ROI Scrutiny: Suppliers must clearly articulate and prove the return on investment for their products and services.

- Procurement Leverage: The drive for cost savings gives customers considerable leverage in negotiating terms and pricing.

- 2024 Market Trend: Continued pressure on CapEx and OpEx for telcos reinforced the importance of value-driven purchasing decisions.

Emergence of Open RAN and Multi-Vendor Strategies

The rise of Open RAN is a significant development, empowering telecom operators by breaking free from single-vendor reliance. This shift allows them to source components from multiple providers, directly increasing their bargaining leverage.

By enabling a multi-vendor strategy, operators can cherry-pick best-in-class solutions for different network functions. This flexibility not only drives down costs through increased competition but also fosters innovation as vendors vie for market share.

- Open RAN Adoption: Telecom operators are increasingly adopting Open RAN to diversify their supplier base and avoid vendor lock-in.

- Increased Choice: This technology allows operators to mix and match network components from various vendors, enhancing their purchasing power.

- Market Momentum: Despite some initial challenges, Open RAN deployments are gaining traction and are projected to accelerate in the coming years, with significant investments expected in 2024 and beyond.

- Cost Reduction Potential: The competitive landscape fostered by Open RAN can lead to more favorable pricing for operators.

Ericsson's customers, primarily large telecommunications operators, possess significant bargaining power due to their substantial market share and the critical nature of network infrastructure. In 2024, ongoing consolidation among these operators further concentrated this purchasing power, intensifying negotiations.

| Customer Segment | Bargaining Power Factors | Impact on Ericsson | 2024 Trend Example |

|---|---|---|---|

| Major Telecom Operators | High volume purchases, consolidation, switching costs (high but not prohibitive) | Price pressure, demand for tailored solutions, strong negotiation leverage | Continued scrutiny of CapEx and OpEx, driving demand for cost-effective 5G rollouts. |

| Emerging Market Operators | Price sensitivity, dependence on vendor financing, developing infrastructure needs | Price concessions, need for flexible payment terms, potential for market entry | Focus on affordable, scalable solutions to expand network coverage. |

Preview Before You Purchase

Ericsson Porter's Five Forces Analysis

This preview displays the complete Ericsson Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the telecommunications industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive instantly upon completing your purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The telecommunications equipment sector is highly concentrated, with giants like Nokia, Huawei, and Samsung vying alongside Ericsson for global dominance. This intense competition is particularly evident in the crucial 5G infrastructure market, where these major players aggressively pursue market share. For instance, in 2023, Huawei reported revenues of approximately $89 billion, while Nokia's comparable revenue stood around €23 billion ($25 billion USD), highlighting the scale of these formidable rivals.

The telecommunications infrastructure sector, where Ericsson operates, is burdened by substantial fixed costs. These include significant investments in research and development to stay at the forefront of technology, the complex manufacturing processes for network equipment, and the extensive global sales and support networks required to serve diverse markets. For instance, in 2023, Ericsson reported R&D expenses of SEK 51.8 billion, highlighting the continuous need for innovation.

These high fixed costs create a strong incentive for companies to pursue market share aggressively. By scaling up operations and increasing production volumes, firms can spread these costs over a larger revenue base, leading to greater economies of scale and improved profitability. This pursuit of scale often results in intense price competition as companies vie for larger portions of the market.

Consequently, the industry has witnessed a trend towards consolidation. Companies that fail to achieve sufficient scale or competitive pricing may struggle to remain viable, leading to mergers, acquisitions, or the exit of smaller players. This dynamic can further intensify rivalry among the remaining, larger entities, as they seek to leverage their scale to outcompete others.

Competitive rivalry in the telecommunications infrastructure sector is intensely fueled by relentless technological innovation. Companies like Ericsson are constantly pushing boundaries in areas such as 5G, 5G Advanced, and the creation of programmable networks with open APIs. This drive for innovation is crucial for differentiation, as firms compete on superior performance, enhanced energy efficiency, and the introduction of novel network capabilities. For instance, Ericsson's 2024 financial reports highlight significant R&D investments aimed at maintaining this technological edge.

Geopolitical Factors and Trade Policies

Geopolitical shifts and evolving trade policies are major forces shaping the telecommunications industry. Restrictions placed on specific vendors in key markets, such as those seen in various countries concerning Chinese network equipment providers, directly alter the competitive playing field for companies like Ericsson. This creates a dynamic environment where regional government stances and international relations can either open up new avenues for business or present significant hurdles.

For Ericsson, these geopolitical factors can translate into tangible business impacts. For instance, in 2023, the company continued to navigate differing national security concerns and vendor diversification mandates across Europe and North America. These policies often favor local or allied suppliers, potentially reducing competition from certain rivals in specific regions, while simultaneously increasing demand for Ericsson’s solutions in others where vendor restrictions are in place.

The influence of these policies can be seen in market share shifts. For example, as some nations have implemented restrictions on specific vendors, Ericsson has seen opportunities to expand its 5G network deployments. In 2023, Ericsson reported securing new contracts in several European countries that were actively diversifying their network infrastructure providers, underscoring the direct correlation between geopolitical directives and market access.

- Vendor Restrictions: Government decisions to restrict or ban certain vendors from participating in national 5G infrastructure projects directly impact market access and competitive dynamics.

- Trade Wars and Tariffs: Imposed tariffs on components or finished goods can increase operational costs and affect pricing strategies for telecommunications equipment manufacturers.

- National Security Concerns: Heightened geopolitical tensions often lead to increased scrutiny of supply chains and technology providers, influencing vendor selection processes.

- Regional Market Opportunities: Conversely, geopolitical alignments can create preferential market access for companies from allied nations, fostering new business opportunities.

Shift Towards Enterprise and Private Networks

The competitive landscape for Ericsson is evolving beyond traditional telecom operators, with a significant shift occurring in the enterprise and private network solutions market. New entrants and innovative business models are intensifying rivalry in this burgeoning sector.

Ericsson's strategic expansion into enterprise and private networks signals a new arena for competition. This move acknowledges the growing demand from businesses for dedicated, high-performance networks tailored to their specific needs.

- Growing Enterprise Demand: Businesses are increasingly seeking private 5G networks for enhanced security, lower latency, and greater control over their operations, driving competition.

- New Entrants: Beyond established telecom vendors, cloud providers and specialized network integrators are entering the private network space, offering diverse solutions.

- Ericsson's Focus: In 2023, Ericsson reported strong growth in its Enterprise segment, highlighting the strategic importance of this market.

- Partnership Strategies: Companies are forming alliances to leverage expertise, with Ericsson collaborating with various industry players to deliver comprehensive private network solutions.

The telecommunications equipment sector is characterized by intense competition among a few dominant global players. This rivalry is amplified by substantial fixed costs, necessitating aggressive pursuit of market share and continuous innovation, particularly in the 5G infrastructure market. Geopolitical factors and government policies significantly influence market access and vendor selection, creating dynamic opportunities and challenges for companies like Ericsson.

| Rival | 2023 Revenue (approx.) | Key Focus Area |

|---|---|---|

| Nokia | $25 billion USD | 5G Networks, Cloud, Licensing |

| Huawei | $89 billion USD | 5G Networks, Consumer Devices, Cloud |

| Samsung | KRW 258.94 trillion ($190 billion USD) | 5G Networks, Consumer Electronics, Semiconductors |

SSubstitutes Threaten

The burgeoning field of direct-to-device satellite communication presents a significant threat of substitution for traditional terrestrial mobile networks. Companies such as SpaceX, through its Starlink service, and AST SpaceMobile are actively developing technology that allows smartphones to connect directly to satellites, bypassing ground infrastructure entirely. This innovation is particularly disruptive in remote or underserved regions where building and maintaining terrestrial networks is economically unfeasible.

The threat of substitutes for traditional telecom services is significant due to Over-the-Top (OTT) communication platforms like WhatsApp and Zoom. These services offer voice and video calls, effectively replacing the need for many traditional voice and SMS services provided by telecom operators. In 2024, it's estimated that over 2.7 billion people globally use WhatsApp, highlighting its immense reach and the substitution effect it has on traditional mobile voice revenue.

While Ericsson's core business is infrastructure, the declining usage of core telecom services by end-users directly impacts the revenue streams of their clients, the telecom operators. This reduced operator revenue can lead to decreased willingness to invest in new network infrastructure, such as 5G expansion or upgrades, which are crucial for Ericsson's growth. For instance, many operators are already facing pressure to diversify revenue beyond traditional connectivity, a trend exacerbated by the widespread adoption of OTT services.

Wi-Fi and other local wireless technologies present a significant threat of substitution for cellular connectivity, particularly for localized needs. For instance, in office buildings or homes, Wi-Fi often replaces the need for cellular data, especially as it's typically free or included in existing plans. This can limit the revenue potential for mobile operators in these specific use cases.

However, the growing landscape of the Internet of Things (IoT) and smart applications is actually fostering a symbiotic relationship rather than pure substitution. While Wi-Fi handles many local connections, the need for broader, seamless, and secure connectivity across diverse environments often necessitates cellular technologies. For example, a smart city initiative might rely on a combination of Wi-Fi for dense indoor areas and 5G for outdoor and mobile device connectivity, showcasing how these technologies can complement each other.

The global Wi-Fi market is substantial, with projections indicating continued growth. In 2024, the Wi-Fi market size was estimated to be around $20 billion, with a compound annual growth rate expected to remain robust. This demonstrates the widespread adoption and capability of Wi-Fi as a viable alternative for many data transmission needs that might otherwise be met by cellular networks.

Private Networks and Neutral Host Models

The rise of private networks and neutral host models presents a notable threat of substitution for traditional public operator networks, impacting companies like Ericsson. Enterprises are increasingly exploring dedicated cellular solutions for enhanced control, security, and performance, potentially bypassing incumbent telcos. This trend is particularly evident in sectors like manufacturing, logistics, and utilities, where specialized connectivity is paramount.

Ericsson is proactively addressing this shift by offering its own private network solutions and participating in neutral host infrastructure. For instance, in 2024, the enterprise private wireless market was projected to see significant growth, with analysts anticipating a compound annual growth rate (CAGR) of over 20% through 2028. This strategic pivot allows Ericsson to capture value from this evolving demand, rather than solely relying on public network deployments.

- Growing Enterprise Demand: Industries like manufacturing and logistics are adopting private networks for improved operational efficiency and data security.

- Ericsson's Strategic Response: Ericsson is actively developing and marketing private network solutions and engaging with neutral host providers.

- Market Growth: The global private wireless market is experiencing robust expansion, with significant investment anticipated in the coming years.

- Neutral Host Opportunities: Collaboration with neutral host providers offers a pathway to serve multiple enterprises on shared infrastructure, diversifying revenue streams.

Fixed Wireless Access (FWA) as a Broadband Substitute

Fixed Wireless Access (FWA), powered by technologies like 5G, offers a compelling alternative to traditional wired broadband. This means consumers and businesses can get internet service without needing a physical cable connection to their premises.

While FWA deployment can leverage Ericsson's existing mobile network infrastructure, its increasing adoption reshapes the competitive landscape for broadband providers. This shift can impact market share and revenue streams for established players.

The threat of FWA as a substitute is growing, particularly in areas where fixed-line infrastructure is less developed or costly to upgrade. For example, by the end of 2023, global FWA connections were projected to reach over 100 million, indicating significant market penetration.

- Growing FWA Adoption: FWA is increasingly viable due to advancements in wireless technology, offering speeds comparable to some fixed-line options.

- Infrastructure Leverage: Mobile network operators can utilize their existing cellular infrastructure to deploy FWA, potentially lowering deployment costs compared to laying new fiber.

- Market Disruption: The rise of FWA presents a direct substitute for traditional cable and fiber broadband, potentially leading to increased competition and pricing pressure.

- 5G's Role: The rollout of 5G networks significantly enhances FWA capabilities, enabling higher speeds and lower latency, making it a more attractive alternative.

The threat of substitutes for traditional mobile communication services is intensifying, driven by advancements in satellite technology and the widespread adoption of Over-the-Top (OTT) platforms. Direct-to-device satellite services are emerging as a viable alternative, especially in remote areas, while OTT apps like WhatsApp are significantly impacting voice and SMS revenues for telecom operators. In 2024, with over 2.7 billion WhatsApp users globally, this substitution effect is substantial.

Wi-Fi and private networks also pose considerable threats. Wi-Fi offers a free or low-cost alternative for data in localized settings, impacting cellular data usage. The enterprise private wireless market, projected to grow at over 20% CAGR in 2024, shows a clear trend of businesses seeking dedicated solutions, potentially bypassing traditional telcos. Fixed Wireless Access (FWA), with over 100 million global connections by late 2023, is also directly substituting wired broadband services.

| Substitute Technology | Impact on Telecom Operators | 2024 Data/Projections |

|---|---|---|

| Direct-to-Device Satellite | Bypasses terrestrial networks, especially in underserved areas. | Emerging technology with significant disruptive potential. |

| OTT Platforms (e.g., WhatsApp) | Reduces demand for traditional voice and SMS services. | Over 2.7 billion global users in 2024. |

| Wi-Fi | Replaces cellular data in localized environments (homes, offices). | Global Wi-Fi market valued around $20 billion in 2024. |

| Private Networks | Enterprise demand for dedicated, secure connectivity. | Enterprise private wireless market CAGR projected over 20% in 2024. |

| Fixed Wireless Access (FWA) | Offers alternative to wired broadband. | Over 100 million global connections by end of 2023. |

Entrants Threaten

The telecommunications sector demands colossal upfront capital for research, development, and the establishment of robust manufacturing and global support systems. For instance, deploying 5G infrastructure alone involves billions in spectrum licenses and network build-out, presenting a formidable hurdle for any newcomer.

The telecommunications sector is a minefield of regulations, demanding new players secure extensive licenses, meet stringent technical standards, and comply with national security and data privacy mandates. For instance, in 2024, many countries continued to refine their 5G spectrum allocation rules, adding layers of complexity for any aspiring operator. This intricate web of compliance acts as a significant barrier, deterring many potential entrants.

Ericsson benefits significantly from established relationships with major telecommunications operators, often built over decades. These deep-seated ties, coupled with the substantial costs and complexities involved in replacing existing network infrastructure, create a powerful vendor lock-in effect. For instance, a single 5G network deployment can cost billions of dollars, making operators hesitant to switch providers due to the financial and operational risks involved.

Technological Expertise and R&D Intensity

The telecommunications infrastructure sector, where Ericsson operates, is characterized by an exceptionally high demand for specialized technological expertise. Companies must invest heavily and continuously in research and development (R&D) to keep pace with advancements like 5G, artificial intelligence (AI), and cloud computing. For instance, in 2023, the global telecom R&D spending reached hundreds of billions of dollars, reflecting this intense innovation drive.

New entrants face a significant hurdle in rapidly acquiring or developing the necessary deep technological knowledge base. This often requires substantial upfront investment in talent acquisition, specialized equipment, and ongoing R&D efforts. Without this, a new player would struggle to offer competitive solutions and could quickly fall behind.

- High R&D Investment: Companies in this space typically allocate 10-15% or more of their revenue to R&D to maintain a competitive edge.

- Talent Acquisition Costs: Recruiting and retaining engineers with expertise in areas like radio access networks, core network technologies, and software development is costly and competitive.

- Intellectual Property Barriers: Established players hold significant patents, creating a barrier for newcomers needing to develop or license essential technologies.

- Rapid Technological Obsolescence: The pace of innovation means that new technologies can quickly render existing infrastructure outdated, requiring constant reinvestment.

Emergence of Cloud-Native and Software-Centric Approaches

The increasing adoption of cloud-native architectures and software-defined networking, such as Open RAN, presents a nuanced threat. These shifts can lower traditional capital expenditure barriers, potentially allowing more agile, software-focused companies to enter the telecommunications infrastructure market.

However, this doesn't eliminate all entry hurdles. Companies still need substantial integration expertise and a profound grasp of complex network operations to succeed, even with these more flexible approaches. For instance, while Open RAN aims to disaggregate hardware and software, successful deployment demands sophisticated system integration, a capability that remains a significant differentiator.

Consider the 2024 landscape: investments in 5G core network virtualization and cloudification are accelerating. Companies that can effectively leverage these software-centric models, despite the inherent complexities, could indeed emerge as new competitors, challenging incumbent hardware vendors. The threat lies not just in the technology itself, but in the potential for new business models built around software and services to gain traction.

- Cloud-Native & Software-Defined Networks: Lowering capital barriers for software-centric entrants.

- Integration Capabilities: Still a significant requirement, even with new architectures.

- Open RAN: Example of disaggregation requiring deep integration understanding.

- 2024 Trends: Accelerated investment in 5G core virtualization and cloudification.

The threat of new entrants for Ericsson is significantly mitigated by the immense capital required for infrastructure development and the complex regulatory environment. These factors, coupled with established customer relationships and high R&D spending, create substantial barriers to entry in the telecommunications sector.

While new technologies like Open RAN might lower some capital barriers, the need for deep integration expertise and a thorough understanding of network operations remains a critical differentiator. For instance, the ongoing 2024 trend of 5G core network virtualization demands sophisticated system integration capabilities, which are difficult for newcomers to replicate quickly.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024/2023) |

|---|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and infrastructure deployment. | Formidable hurdle, limiting the number of potential entrants. | 5G infrastructure deployment costs often in the billions of dollars per operator. Global telecom R&D spending in the hundreds of billions in 2023. |

| Regulatory Hurdles | Securing licenses, meeting technical standards, and complying with data privacy. | Adds complexity and cost, deterring many potential entrants. | Refined 5G spectrum allocation rules in many countries in 2024. |

| Customer Relationships & Switching Costs | Established vendor lock-in due to long-term partnerships and high costs of changing providers. | Makes it difficult for new players to gain market share. | Replacing a single 5G network can cost billions, creating significant operator reluctance to switch. |

| Technological Expertise & R&D Intensity | Need for deep knowledge in areas like AI, cloud computing, and rapid innovation. | Requires substantial investment in talent and continuous R&D. | Telecom companies often allocate 10-15%+ of revenue to R&D. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ericsson leverages data from Ericsson's annual reports, investor presentations, and official press releases, alongside industry-specific market research from firms like Gartner and IDC, and macroeconomic data from sources such as Statista and the World Bank.