Ericsson Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ericsson Bundle

Discover the intricate workings of Ericsson's global operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Ready to dissect a titan of the telecom industry?

Partnerships

Ericsson’s strategic alliances with telecom operators are foundational, focusing on collaborative network deployment and the advancement of mobile broadband. These long-term relationships, often spanning multiple years, are vital for executing large-scale infrastructure projects and ensuring continuous service delivery. For example, in 2024, Ericsson continued to secure significant multi-year contracts with leading operators worldwide for 5G network expansion and upgrades.

Ericsson actively collaborates with technology providers, cloud hyperscalers like AWS, Google Cloud, and Microsoft Azure, and a broad spectrum of software vendors. This synergy is crucial for bolstering Ericsson's portfolio, particularly in areas such as cloud-native network functions, advanced AI/ML capabilities, and robust IoT platforms. For instance, in 2024, Ericsson continued to deepen its partnerships with hyperscalers to deliver its 5G core solutions, aiming to leverage their global reach and advanced cloud infrastructure.

These strategic alliances empower Ericsson to offer integrated, end-to-end solutions that are designed to slot smoothly into diverse and intricate network infrastructures. Joint development initiatives and shared go-to-market strategies are hallmarks of these relationships, allowing for the co-creation and efficient deployment of cutting-edge technologies. Ericsson's 2024 roadmap emphasized further integration with these partners to accelerate 5G Standalone adoption and explore new enterprise use cases.

Ericsson actively partners with leading universities and research institutions worldwide to push the boundaries of fundamental research and explore next-generation technologies. These collaborations are crucial for Ericsson's innovation pipeline, focusing on areas like 6G, advanced artificial intelligence, and quantum computing, ensuring they remain at the cutting edge of technological development and help shape future industry standards.

Standardization Bodies and Industry Consortia

Ericsson's active participation in global standardization bodies like 3GPP and ETSI is fundamental to its business model. This engagement allows Ericsson to influence the direction of future mobile technologies, ensuring its solutions are aligned with industry-wide advancements. For instance, 3GPP is the primary body for developing cellular communication standards, including 5G and upcoming 6G initiatives, which directly impacts Ericsson's product roadmap and market competitiveness.

These partnerships are not just about influence; they are crucial for fostering interoperability and innovation across the entire telecommunications ecosystem. By collaborating within industry consortia, Ericsson helps create a more robust and interconnected network environment, benefiting both service providers and end-users. This collaborative approach accelerates the adoption of new technologies, such as private 5G networks, where consortia play a key role in defining best practices and use cases.

- Influence on Standards: Ericsson actively contributes to 3GPP, shaping specifications for 5G Advanced and future 6G research, ensuring its technology aligns with global advancements.

- Interoperability: Participation in ETSI (European Telecommunications Standards Institute) helps guarantee that Ericsson's equipment works seamlessly with other vendors' solutions.

- Ecosystem Growth: Collaboration in industry consortia, such as the O-RAN Alliance, drives innovation in open radio access network technologies, expanding market opportunities.

System Integrators and Channel Partners

Ericsson leverages system integrators and channel partners to expand its market presence, especially in enterprise solutions, private networks, and specialized industry sectors. These collaborations are crucial for reaching new geographies and customer segments.

These partners bring invaluable local knowledge and offer essential implementation and support services. This allows Ericsson to scale its network deployments effectively and cater to a wide array of customer requirements.

By working with these partners, Ericsson significantly broadens its market access and strengthens its go-to-market strategy. For instance, in 2024, Ericsson highlighted its growing ecosystem of partners for its private 5G offerings, aiming to capture a larger share of the enterprise connectivity market.

- Market Expansion: System integrators and channel partners are key to entering new markets for enterprise and private network solutions.

- Localized Expertise: Partners provide crucial on-the-ground knowledge and service delivery capabilities.

- Scalability: This partnership model enables Ericsson to efficiently scale its deployment capacity.

- Broadened Access: The collaborations enhance Ericsson's reach across diverse vertical industries and customer bases.

Ericsson's key partnerships are diverse, encompassing telecom operators, technology providers, cloud hyperscalers, system integrators, and research institutions. These alliances are critical for co-creating solutions, expanding market reach, and driving innovation in areas like 5G, AI, and future network technologies. For example, in 2024, Ericsson continued to deepen its collaboration with hyperscalers to enhance its 5G core offerings and expand its enterprise private network solutions through system integrators.

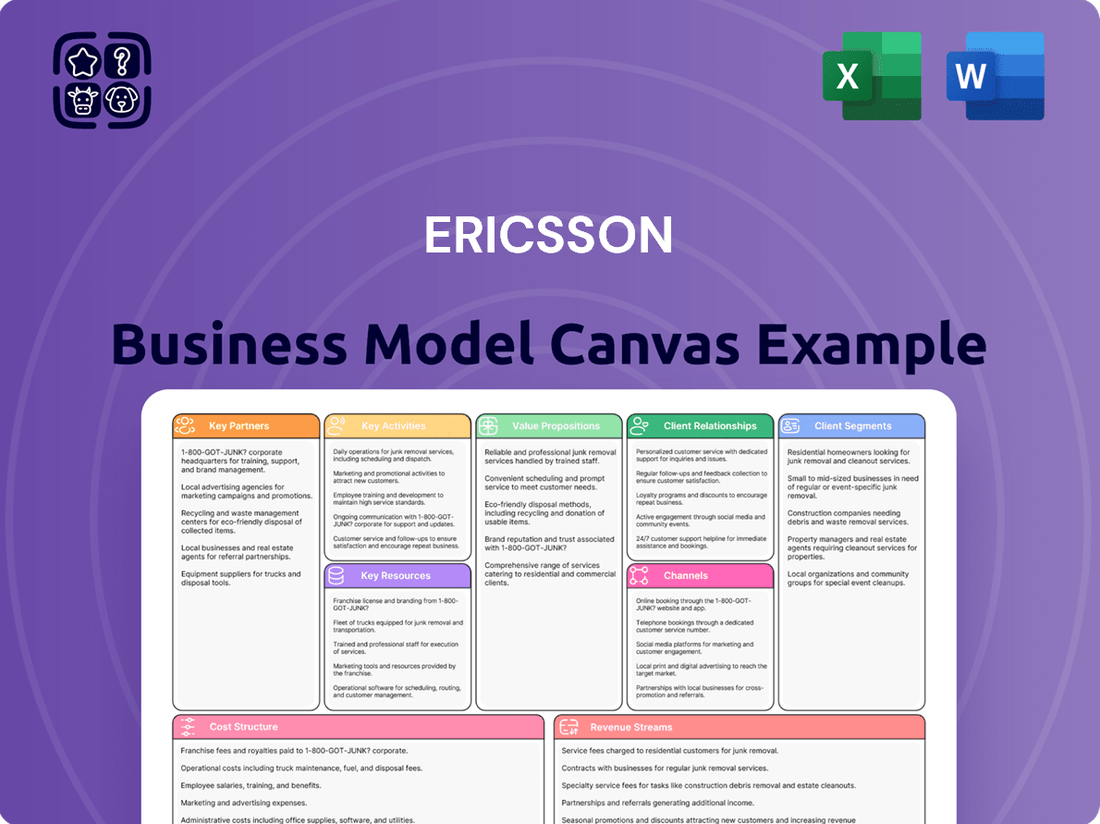

What is included in the product

A detailed breakdown of Ericsson's strategy, outlining its core customer segments, value propositions, and revenue streams in the telecommunications industry.

This model showcases Ericsson's key partnerships, resources, and activities, illustrating how it delivers advanced network solutions and services.

Provides a clear, visual framework to diagnose and address operational inefficiencies, streamlining complex telecom strategies.

Helps pinpoint and resolve customer pain points by mapping value propositions to specific customer segments.

Activities

Ericsson dedicates substantial resources to Research and Development, focusing on advancing mobile broadband, 5G, and the emerging 6G technologies. This commitment fuels the creation of novel network architectures and sophisticated software and hardware components. In 2023, Ericsson's R&D spending reached SEK 37.9 billion (approximately $3.6 billion USD), underscoring its dedication to staying at the forefront of technological innovation.

This relentless pursuit of innovation is critical for Ericsson to maintain its competitive advantage in the rapidly evolving telecommunications sector. By pioneering new solutions for IoT and cloud integration, Ericsson addresses the dynamic needs of communication service providers and enterprise clients. The company's ongoing investments ensure its offerings remain relevant and cutting-edge in a market that demands continuous technological advancement.

Ericsson's key activities center on the meticulous planning, deployment, and integration of sophisticated mobile network infrastructure. This encompasses radio access networks (RAN), core network components, and the crucial transport solutions that connect them all. It's a complex dance requiring deep engineering knowledge and precise project management to ensure everything works together seamlessly.

This process demands extensive project management capabilities and specialized engineering expertise. Ericsson must coordinate closely with customer operations to ensure successful implementation and ongoing network functionality. The goal is to deliver robust, high-performing, and scalable networks that meet evolving demands.

In 2024, Ericsson continued to be a major player in 5G network deployments globally. For instance, they secured significant contracts for 5G infrastructure in various markets, contributing to the ongoing build-out of next-generation mobile services. The company's focus remains on enabling efficient and reliable network performance for its clients.

Ericsson's core activities revolve around developing and delivering sophisticated software solutions. These range from network management and orchestration to BSS/OSS systems and specialized applications tailored for 5G and the Internet of Things (IoT). This development process emphasizes cloud-native architectures and a commitment to continuous updates.

A key aspect of their delivery is the customization of these software offerings to precisely match the unique requirements of individual network operators. This ensures that clients receive solutions optimized for their specific operational environments and strategic goals.

The overarching aim of Ericsson's software development and delivery is to foster greater agility, drive automation, and enhance overall efficiency within network operations. This focus directly supports telecommunication providers in managing increasingly complex and dynamic network infrastructures, particularly in the evolving 5G landscape.

Managed Services and Network Optimization

Ericsson's managed services and network optimization are central to their business model, enabling telecom operators to offload complex network operations. This allows clients to concentrate on strategic growth and customer experience, rather than day-to-day network upkeep. In 2024, Ericsson continued to expand its global managed services footprint, supporting a significant portion of the world's mobile traffic.

These services encompass a wide range of functions, including continuous network monitoring, proactive performance management, robust security protocols, and comprehensive lifecycle management for network infrastructure. This holistic approach ensures networks are not only operational but also performing at peak efficiency and security. By leveraging Ericsson's deep technical expertise, operators can achieve greater agility and cost-effectiveness in their network operations.

- Network Operations and Maintenance: Ericsson manages the daily operations, ensuring high availability and performance for customer networks.

- Performance Optimization: Continuous analysis and tuning of network parameters to enhance user experience and resource utilization.

- Security and Compliance: Implementing and managing security measures to protect networks against threats and ensure regulatory adherence.

- Lifecycle Management: Overseeing the entire lifecycle of network components, from deployment to upgrades and decommissioning.

Sales, Marketing, and Customer Support

Ericsson's sales and marketing activities are centered on direct engagement with telecom operators and enterprise clients worldwide. This involves dedicated sales teams and strategic account managers who work to understand specific customer requirements and present customized solutions. In 2024, Ericsson continued to focus on these direct relationships, leveraging its global presence to secure significant deals.

The company's marketing efforts aim to build brand awareness and highlight its technological leadership in areas like 5G and cloud-native networks. This includes participation in industry events, digital marketing campaigns, and thought leadership content. A key aspect is demonstrating value through innovative solutions that address evolving market demands.

Customer support and professional services are integral to Ericsson's business model, ensuring client satisfaction and long-term partnerships. This encompasses providing ongoing technical assistance, network deployment, and optimization services. Building and maintaining strong customer relationships is paramount for repeat business and market share growth.

- Direct Sales and Account Management: Ericsson employs a global sales force to directly engage with telecom operators and enterprise customers, focusing on understanding their unique needs and proposing tailored solutions.

- Marketing and Brand Building: Extensive marketing efforts, including digital campaigns and industry participation, are undertaken to showcase Ericsson's technological advancements and value proposition.

- Customer Support and Professional Services: Providing robust technical support, network deployment, and optimization services are critical for fostering strong, long-term customer relationships and ensuring client success.

- Contract Negotiation and Deal Closure: The sales process involves complex contract negotiations to finalize agreements that reflect the value of Ericsson's offerings and meet customer objectives.

Ericsson's key activities are deeply rooted in innovation and execution. They focus on the research and development of next-generation mobile technologies, including 5G and the emerging 6G, alongside the deployment and integration of complex mobile network infrastructure. This is complemented by the development and delivery of sophisticated software solutions, crucial for network management and optimization.

Furthermore, Ericsson provides extensive managed services and network optimization, allowing operators to outsource critical network functions. Their sales and marketing efforts are geared towards direct engagement with clients, supported by robust customer support and professional services to ensure successful implementation and ongoing client satisfaction.

| Key Activity | Description | 2023/2024 Data/Impact |

|---|---|---|

| Research & Development | Advancing mobile broadband, 5G, and 6G technologies, creating new network architectures, software, and hardware. | 2023 R&D spending: SEK 37.9 billion (~$3.6 billion USD). Focus on IoT and cloud integration. |

| Network Deployment & Integration | Planning, deploying, and integrating RAN, core network, and transport solutions. | Significant global 5G infrastructure contracts secured in 2024. |

| Software Development & Delivery | Creating network management, orchestration, BSS/OSS systems, and IoT applications. | Emphasis on cloud-native architectures and continuous updates for agility and automation. |

| Managed Services & Optimization | Operating, maintaining, and optimizing customer networks for performance, security, and lifecycle management. | Expanded global managed services footprint in 2024, supporting significant mobile traffic. |

| Sales, Marketing & Support | Direct client engagement, brand building, technical assistance, and professional services. | Focus on direct relationships and showcasing technological leadership in 5G and cloud-native networks. |

Full Document Unlocks After Purchase

Business Model Canvas

The Ericsson Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable. You're not seeing a sample; you're getting a direct glimpse of the complete, ready-to-use business model documentation.

Resources

Ericsson's intellectual property, particularly its extensive patent portfolio, is a cornerstone of its business model. This IP covers critical technologies across mobile generations, from 2G to the latest 5G advancements. In 2024, Ericsson continued to be a leading patent filer in the telecommunications sector, reinforcing its commitment to innovation and technological leadership.

This vast IP asset not only protects Ericsson's innovations but also serves as a significant revenue generator through licensing agreements. These licensing revenues are vital, contributing substantially to the company's financial performance and enabling continued investment in research and development. The strength of this patent portfolio solidifies Ericsson's competitive advantage and market position.

Ericsson's highly skilled human capital is a cornerstone of its business model, featuring a global team of specialized engineers, researchers, software developers, project managers, and sales professionals. Their deep expertise across telecommunications, software, cloud technologies, and intricate project management is vital for creating, implementing, and maintaining Ericsson's cutting-edge solutions.

In 2024, Ericsson continued to emphasize talent acquisition and retention, recognizing that this specialized workforce is indispensable for innovation and competitive advantage in the rapidly evolving tech landscape.

Ericsson's global R&D facilities and innovation hubs are the engine of its technological advancement, spanning numerous countries. These centers are crucial for developing next-generation mobile networks, cloud solutions, and digital services.

In 2024, Ericsson continued to invest heavily in its R&D infrastructure, recognizing its importance for staying ahead in the competitive telecom landscape. These hubs foster collaboration among thousands of engineers and researchers, driving the creation of new patents and technologies.

These innovation hubs are not just research centers; they are also where Ericsson tests and refines its cutting-edge solutions, such as 5G advanced features and early 6G concepts. This hands-on approach ensures that new products are market-ready and meet the evolving demands of global communication networks.

Strong Brand Reputation and Customer Relationships

Ericsson leverages decades of experience and successful deployments to maintain a robust global brand reputation, signifying reliability and technological leadership. This hard-earned trust is a critical asset in the competitive telecommunications sector.

The company's deep, long-standing relationships with major communication service providers worldwide are invaluable. These partnerships are crucial for securing new business opportunities and defending its existing market share.

- Brand Trust: Ericsson's reputation for reliability and innovation is a key differentiator, fostering customer loyalty.

- Customer Relationships: Long-term partnerships with leading telecom operators are vital for sustained growth and market presence.

- Market Share: These strong relationships directly contribute to maintaining and expanding Ericsson's position in the global market.

Financial Capital and Strategic Investments

Ericsson requires significant financial capital to fuel its ambitious research and development efforts, pursue strategic acquisitions, and manage its extensive global operations. For instance, the company's commitment to innovation is evident in its substantial R&D spending, which reached approximately SEK 37.9 billion in 2023, underscoring the need for robust financial backing.

This financial strength is crucial for Ericsson to invest in cutting-edge technologies like 5G Advanced and beyond, thereby expanding its market reach and ensuring it can navigate and endure economic downturns. Their ability to secure and deploy capital effectively allows for sustained investment in future growth avenues and maintains a strong competitive edge in the telecommunications sector.

- Research & Development Funding: Significant capital allocation towards developing next-generation network technologies.

- Strategic Acquisitions: Financial resources to acquire companies that enhance technological capabilities or market presence.

- Global Operations: Capital needed to support manufacturing, sales, and service networks worldwide.

- Market Expansion: Investment in new geographical markets and service offerings.

Ericsson's key resources include its extensive patent portfolio, highly skilled workforce, global R&D facilities, strong brand reputation, and robust customer relationships. These assets are fundamental to its innovation, market leadership, and financial performance. In 2024, continued investment in these areas solidified Ericsson's competitive advantage in the rapidly evolving telecommunications industry.

| Key Resource | Description | 2023 Data/Context |

|---|---|---|

| Intellectual Property | Extensive patent portfolio covering mobile technologies from 2G to 5G. | Significant revenue generated through licensing agreements. |

| Human Capital | Global team of specialized engineers, researchers, and software developers. | Emphasis on talent acquisition and retention for innovation. |

| R&D Facilities | Global network of innovation hubs for developing next-generation networks. | Substantial investment in R&D infrastructure to maintain technological edge. |

| Brand Reputation | Decades of experience signifying reliability and technological leadership. | Fosters customer loyalty and market trust. |

| Customer Relationships | Long-standing partnerships with major global communication service providers. | Crucial for securing new business and defending market share. |

Value Propositions

Ericsson provides leading-edge 5G and mobile network technology, including advanced Radio Access Network (RAN) and Core solutions. This infrastructure empowers communication service providers to construct networks that are not only high-performing but also boast low latency and exceptional reliability.

With Ericsson's technology, operators can deliver superior broadband experiences to their customers. Furthermore, it lays the groundwork for innovative new services such as the Internet of Things (IoT) and enhanced mobile broadband (eMBB), pushing the boundaries of what mobile networks can achieve.

Ericsson's commitment to innovation places its technology at the very forefront of mobile network evolution. For instance, in 2024, Ericsson continued to secure 5G deals globally, with a significant focus on expanding 5G Standalone (5G SA) deployments, a key indicator of network advancement.

Ericsson’s solutions are engineered to boost network performance, capacity, and overall efficiency. This directly assists telecom operators in lowering their operational expenses while simultaneously elevating the quality of services they provide to their customers.

By leveraging sophisticated software, extensive automation capabilities, and comprehensive managed services, Ericsson empowers networks to operate with greater smoothness and cost-effectiveness. This optimization leads to a demonstrably improved return on investment for Ericsson's clientele.

In 2023, Ericsson reported a significant increase in revenue from its Managed Network Services, highlighting the growing demand for operational efficiency solutions. This segment saw a year-over-year growth of 7%, reflecting the tangible benefits customers realize.

Ericsson's cloud-native network functions and software empower operators to build agile, scalable, and secure networks. This approach allows for rapid deployment of new services and enhanced resilience, crucial for both public telecom networks and private enterprise solutions. Security and scalability are fundamental design principles, not afterthoughts.

By leveraging cloud infrastructure, Ericsson's solutions enable telecom operators to achieve greater flexibility. For instance, in 2024, many operators are focusing on 5G Standalone deployments which heavily rely on cloud-native architectures for efficient resource utilization and faster service innovation.

Comprehensive Managed Services and End-to-End Support

Ericsson's comprehensive managed services offer operators a complete solution for network operations, maintenance, and optimization. This allows them to offload complex tasks, reduce operational burdens, and concentrate on strategic growth initiatives.

By leveraging Ericsson's global expertise and economies of scale, customers gain access to advanced capabilities and efficient network management. This partnership approach ensures networks are not only maintained but also continuously improved for optimal performance.

- Streamlined Operations: Operators can simplify their IT and network management by outsourcing these functions to Ericsson.

- Reduced Complexity: Ericsson handles the intricacies of network upkeep, freeing up customer resources.

- Focus on Core Business: Customers can dedicate more attention to innovation and service development.

- Global Expertise: Access to Ericsson's worldwide experience in network management and optimization.

Innovation and Future-Proofing for Long-Term Growth

Ericsson’s commitment to innovation, evident in its substantial research and development (R&D) investments, is a cornerstone of its value proposition. For instance, in 2023, Ericsson reported R&D expenses of SEK 48.6 billion (approximately $4.6 billion USD), underscoring its dedication to staying ahead.

By focusing on next-generation technologies such as 6G, the Internet of Things (IoT), and Artificial Intelligence (AI), Ericsson empowers its clients to future-proof their network infrastructure. This proactive approach ensures that operators can adapt to evolving market demands and capitalize on emerging revenue streams.

- Future-Proofing Investments: Ericsson’s R&D in areas like 6G and AI ensures customers’ network investments remain relevant and capable of handling future traffic and service demands.

- Enabling New Revenue Streams: By developing advanced solutions for IoT and AI, Ericsson helps operators unlock new business models and revenue opportunities.

- Long-Term Strategic Advantage: This continuous innovation provides customers with a sustained competitive edge in the rapidly changing telecommunications landscape.

Ericsson's value proposition centers on providing advanced, reliable 5G and mobile network infrastructure that enables communication service providers to deliver superior broadband experiences and unlock new services like IoT. Their solutions are designed for enhanced performance and efficiency, helping operators reduce costs and improve service quality. For example, in 2024, Ericsson's continued global 5G deals, particularly in 5G Standalone, demonstrate their leadership in network evolution.

Customer Relationships

Ericsson cultivates enduring strategic partnerships with its core clientele, often deploying specialized account management teams to address intricate requirements. This includes consistent executive interaction and joint strategic planning to synchronize technological advancements with overarching business goals, positioning Ericsson as a valued advisor.

Ericsson frequently solidifies customer relationships through multi-year service agreements and support contracts, covering equipment, software, and managed services. These long-term commitments, often spanning several years, are crucial for ensuring network reliability and continuity for their clients.

These comprehensive agreements typically include ongoing technical support, essential maintenance, and regular software updates. For instance, in 2024, a significant portion of Ericsson's revenue is derived from these recurring service contracts, underscoring their importance in maintaining customer loyalty and predictable income streams.

Ericsson actively pursues joint innovation with key customers, co-creating solutions and piloting emerging technologies. This ensures their offerings precisely meet the evolving needs of major operators, fostering mutual growth and market relevance.

Professional Services and Consulting Engagements

Ericsson goes far beyond just selling hardware and software. They offer a comprehensive suite of professional services, acting as expert partners in network planning, design, integration, and ongoing optimization. These consulting engagements are vital for customers to successfully deploy and manage intricate network solutions, ensuring they get the most out of their technology investments.

- Network Implementation & Support: Ericsson's professional services teams are directly involved in bringing complex network solutions to life, from initial concept to full operational status.

- Customer Success & Value Realization: These services are designed to ensure customers achieve their desired outcomes and maximize the return on their Ericsson technology investments through expert guidance.

- Expertise Delivery: The knowledge and skills of Ericsson's specialists are delivered directly to clients, fostering successful project execution and long-term network performance.

Global Customer Support and Service Level Agreements (SLAs)

Ericsson operates a robust global customer support network, offering round-the-clock technical assistance and swift problem resolution. This commitment is underscored by rigorous Service Level Agreements (SLAs), which set clear benchmarks for response times and performance metrics. These SLAs are crucial for guaranteeing the high availability and unwavering reliability of the networks Ericsson manages for its clients.

- Global Reach: Ericsson's support infrastructure spans multiple continents, ensuring localized expertise and timely assistance for a diverse international customer base.

- SLA Guarantees: For example, in 2024, many of Ericsson's enterprise and service provider contracts included SLAs guaranteeing response times as low as 15 minutes for critical incidents, with resolution targets often set within a few hours.

- Network Uptime: These stringent support measures directly contribute to maintaining exceptionally high network uptime, often exceeding 99.9% for critical infrastructure, which is vital for service continuity.

- Trust and Loyalty: Consistently delivering high-quality, reliable support fosters deep trust and long-term loyalty among Ericsson's customers, reinforcing their reliance on Ericsson's solutions and services.

Ericsson builds strong customer relationships through dedicated account management and executive engagement, fostering strategic alignment. This approach, often involving joint planning, ensures their technology roadmaps directly support client business objectives.

Long-term service agreements are a cornerstone of Ericsson's customer strategy, providing predictable revenue and ensuring network reliability. These multi-year contracts, a significant revenue driver in 2024, cover equipment, software, and managed services.

Co-innovation with major clients is a key differentiator, with Ericsson actively piloting new technologies to meet evolving market demands. This collaborative innovation ensures their solutions remain relevant and competitive.

| Customer Relationship Aspect | Description | 2024 Data/Example |

| Strategic Partnerships | Dedicated account teams, executive interaction, joint planning | Focus on aligning technology with client business goals. |

| Long-Term Agreements | Multi-year service and support contracts | Crucial for network reliability and predictable revenue streams. |

| Joint Innovation | Co-creation of solutions, piloting emerging technologies | Ensures offerings meet evolving operator needs. |

Channels

Ericsson's direct sales force and strategic account teams are the backbone of its customer engagement, primarily serving telecommunication operators. These teams are crucial for understanding intricate customer needs and securing substantial deals for network infrastructure and services. This direct approach fosters deep, ongoing relationships.

In 2024, Ericsson continued to emphasize these direct channels, as evidenced by its focus on enterprise solutions and managed services. While specific figures for the direct sales force size aren't publicly detailed, the company's significant revenue from service contracts and network deployments underscores the effectiveness of these teams in managing complex, long-term customer partnerships.

Ericsson operates a robust network of global and regional sales offices, a critical component of its Business Model Canvas. This extensive footprint allows the company to cultivate strong, localized relationships with telecommunications operators worldwide. In 2024, Ericsson's commitment to a physical presence in key markets continued to drive customer engagement and market penetration, ensuring tailored support and sales strategies that resonate with specific regional needs and regulatory landscapes.

Ericsson actively cultivates a robust partner network, including system integrators and value-added resellers, to amplify its market presence, particularly in enterprise and specialized technology deployments. These collaborations are crucial for delivering end-to-end solutions and localized implementation expertise, thereby broadening Ericsson's ecosystem and service capabilities.

Industry Conferences, Trade Shows, and Webinars

Ericsson leverages industry conferences, trade shows, and webinars as key channels to connect with its audience. Participation in major global events like Mobile World Congress (MWC) provides a platform to demonstrate cutting-edge solutions and engage directly with a vast ecosystem of partners and customers. In 2023, MWC Barcelona saw over 100,000 attendees, highlighting the scale of these opportunities for visibility and lead generation.

These events are instrumental for thought leadership and brand building. By hosting and participating in technical sessions and product showcases, Ericsson reinforces its position as an innovator in 5G, cloud, and AI technologies. For instance, Ericsson's presence at MWC 2024 focused on advancements in AI-driven network automation and sustainable connectivity, attracting significant industry attention.

Specialized trade shows and targeted webinars further enable Ericsson to reach niche markets and specific customer segments. This multi-channel approach ensures broad reach while allowing for focused engagement on particular product lines or technological advancements. The company's consistent investment in these platforms underscores their importance for market penetration and customer relationship management.

- Global Reach: Participation in events like MWC connects Ericsson with over 100,000 industry professionals, crucial for global brand visibility.

- Technology Showcase: Demonstrating innovations in 5G and AI at these events solidifies Ericsson's market leadership and attracts potential clients.

- Lead Generation: Networking opportunities at trade shows and webinars directly contribute to building a robust sales pipeline.

- Customer Engagement: Direct interaction at events allows for gathering feedback and strengthening relationships with existing customers.

Online Portals and Digital Engagement Platforms

Ericsson leverages its corporate website and dedicated customer portals as primary hubs for information sharing and technical support. These platforms provide extensive resources, including product specifications, software updates, and troubleshooting guides, ensuring customers have access to critical data. In 2024, Ericsson reported a significant increase in digital engagement, with its customer portals seeing a 15% rise in user activity compared to the previous year, highlighting the growing reliance on these online resources for efficient operations.

Professional social media platforms, such as LinkedIn, are actively used by Ericsson to disseminate company news, industry insights, and thought leadership content. This digital engagement strategy aims to foster a community around its brand, facilitating communication and collaboration with a global network of customers and partners. Ericsson’s LinkedIn presence, for instance, saw a 20% growth in followership in 2024, underscoring its effectiveness in reaching a wider professional audience and reinforcing its market position.

These digital channels are instrumental in supporting remote collaboration, enabling Ericsson to maintain strong relationships and provide seamless support to its international clientele. The accessibility of these platforms ensures that customers, regardless of their geographical location, can readily access necessary information and engage with Ericsson’s support teams. This digital-first approach not only enhances customer satisfaction but also streamlines operational efficiency, a key factor in maintaining competitive advantage in the telecommunications sector.

The strategic use of online portals and digital engagement platforms contributes to Ericsson's broader reach and market penetration. By offering easily accessible and comprehensive digital resources, Ericsson strengthens its brand visibility and customer loyalty. This digital infrastructure is crucial for disseminating technical documentation and providing ongoing customer support, thereby solidifying its role as a key player in the global technology landscape.

Ericsson utilizes a multi-channel strategy, blending direct engagement with indirect partnerships to reach its global customer base. This approach ensures comprehensive market coverage and tailored customer experiences.

The company's direct sales force and global sales offices are fundamental for building deep relationships with telecommunication operators, particularly for large-scale network infrastructure projects. Complementing this, a network of system integrators and resellers extends Ericsson's reach into specialized markets and enterprise solutions.

Digital channels, including its corporate website and social media platforms, serve as vital hubs for information dissemination, technical support, and brand building, facilitating broad engagement and efficient customer interaction.

| Channel Type | Description | 2024 Focus/Data |

|---|---|---|

| Direct Sales | Dedicated teams for large accounts and complex solutions. | Emphasis on enterprise solutions and managed services. |

| Partner Network | System integrators, value-added resellers. | Amplifying market presence in specialized technology deployments. |

| Industry Events | Trade shows (e.g., MWC), conferences, webinars. | Showcasing AI-driven network automation and sustainable connectivity. |

| Digital Platforms | Corporate website, customer portals, social media (LinkedIn). | 15% rise in customer portal user activity; 20% follower growth on LinkedIn. |

Customer Segments

Large Global Mobile Network Operators represent Ericsson's cornerstone customer segment. These are the major multinational telecommunication giants that rely on Ericsson for extensive mobile network infrastructure, software solutions, and crucial managed services to support their massive subscriber bases.

These operators are heavily invested in deploying 5G technology and modernizing their existing networks to boost operational efficiency. For instance, in 2024, many of these operators continued to expand their 5G coverage, with global 5G subscriptions projected to reach over 1.5 billion by the end of the year, according to industry reports.

Ericsson's role as a critical vendor for these operators means they are deeply integrated into their core business operations. Ericsson's ability to provide end-to-end solutions, from radio access networks to core network components and services, makes them an indispensable partner in the ongoing evolution of mobile communications.

Regional and national telecommunication providers represent a crucial customer segment for Ericsson, particularly those operating within specific countries or localized markets. These operators, often smaller to medium-sized, still demand high-performance mobile broadband infrastructure, but their scaling and operational requirements can differ significantly from larger, global players.

Ericsson addresses this by offering tailored solutions and dedicated support, recognizing that each regional market has unique demands and competitive dynamics. For instance, in 2024, many such providers were focused on expanding 5G coverage in less densely populated areas, a task requiring adaptable and cost-efficient network deployments that Ericsson's portfolio supports.

The adaptability of Ericsson's technology is paramount for these clients. They need solutions that can be scaled precisely to their subscriber base and geographic footprint, avoiding the over-provisioning that might occur with one-size-fits-all approaches. This flexibility allows them to optimize investments while still delivering competitive services.

A significant and expanding customer base for Ericsson comprises large enterprises, particularly those in demanding sectors like manufacturing, mining, and port operations. These businesses are increasingly seeking private 5G networks and robust IoT solutions to support their critical operational technology.

Ericsson's offerings are designed to facilitate digital transformation, drive automation, and bolster security within these vital industrial applications. This focus on enterprise solutions represents a key avenue for new market expansion.

By 2024, the global market for private wireless networks was projected to reach tens of billions of dollars, with industrial use cases being a primary driver. Ericsson's engagement in this space directly addresses this burgeoning demand for dedicated, high-performance connectivity.

Government and Public Safety Agencies

Ericsson serves government and public safety agencies by delivering secure, resilient communication solutions, including mission-critical networks essential for emergency services. These clients demand unwavering reliability, robust security, and specialized functionalities for their critical communications infrastructure.

Trust and adherence to stringent compliance standards are paramount for these sectors. For instance, in 2024, public safety agencies continued to invest heavily in upgrading their communication systems, with a significant portion of government IT spending allocated to network modernization and cybersecurity, reflecting the critical nature of these services.

- Reliability: Ensuring uninterrupted communication during emergencies is a non-negotiable requirement.

- Security: Protecting sensitive data and preventing unauthorized access to critical networks is vital.

- Compliance: Meeting rigorous regulatory and operational standards specific to public safety is essential.

- Specialized Features: Access to advanced capabilities like push-to-talk over cellular (PoC) and enhanced location services are often required.

Managed Service Providers

Managed Service Providers (MSPs) and Cloud Service Providers are crucial partners for Ericsson. These entities often leverage Ericsson's robust network infrastructure and advanced software platforms to build and deliver their own specialized services to a broad customer base, including enterprises and individual end-users. By integrating Ericsson's technology, MSPs can offer enhanced connectivity, cloud solutions, and digital services, effectively extending Ericsson's market reach indirectly.

This symbiotic relationship allows Ericsson to act as a foundational technology enabler, empowering its partners to innovate and compete. For instance, in 2024, the global managed services market was projected to reach over $300 billion, with a significant portion driven by network and cloud infrastructure providers. Ericsson's participation in this ecosystem means its technology underpins a substantial segment of these outsourced IT and network operations.

- Foundational Technology Provider: Ericsson supplies the core network and software capabilities that MSPs build upon.

- Expanded Market Reach: Partnerships with MSPs grant Ericsson access to markets and customer segments it might not reach directly.

- Service Innovation: MSPs utilize Ericsson's platforms to create unique, value-added services for their clients.

- Market Growth Contribution: Ericsson's technology is instrumental in the growth of the managed services sector, which saw substantial expansion in 2024.

Ericsson's customer segments are diverse, ranging from major global mobile network operators to specialized enterprises and public sector entities. These segments are unified by a need for advanced, reliable, and secure communication infrastructure. The company's strategy involves tailoring solutions to meet the unique demands of each group, from large-scale 5G deployments by operators to private network solutions for industrial clients and critical communication systems for government agencies.

The company also partners with Managed Service Providers (MSPs) and Cloud Service Providers, enabling them to leverage Ericsson's technology to offer enhanced connectivity and digital services. This partnership model is crucial for extending Ericsson's market reach and fostering innovation across various sectors.

Cost Structure

Ericsson's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are fundamental to staying ahead in rapidly evolving fields like 5G, the emerging 6G standards, the Internet of Things (IoT), and advanced cloud technologies. This investment fuels the development of next-generation network infrastructure and software solutions.

The R&D budget encompasses a wide array of expenditures, including competitive salaries for highly skilled engineers and researchers, the acquisition and maintenance of sophisticated laboratory equipment for testing and prototyping, and the crucial process of developing and protecting intellectual property. In 2023, Ericsson reported R&D expenses of SEK 53.1 billion (approximately $5.1 billion USD), underscoring the scale of their innovation drive.

Ericsson's Cost of Goods Sold (COGS) for hardware and software encompasses the direct expenses tied to creating and acquiring their network infrastructure. This includes the manufacturing costs for physical components like radio base stations and core network equipment, as well as the expenses for developing and licensing the sophisticated software that powers these systems.

Material and production costs are substantial drivers within this COGS category. For instance, in 2023, Ericsson reported a gross margin of 42.2%, indicating the significant portion of revenue that goes into producing their goods and services. Efficient supply chain management and controlling component costs are therefore critical for maintaining profitability.

Sales, General, and Administrative (SG&A) expenses for Ericsson are critical for maintaining market presence and operational efficiency. These costs cover everything from engaging potential clients and running marketing campaigns to managing the company's legal, finance, and HR functions. In 2023, Ericsson reported SG&A expenses of SEK 50.2 billion, a slight decrease from SEK 51.8 billion in 2022. This highlights a focus on optimizing these overheads.

Efficient management of SG&A is directly linked to Ericsson's overall profitability. For instance, a well-executed sales strategy can drive revenue, while streamlined administrative processes reduce unnecessary expenditure. The company's ability to control these costs, while still investing in growth areas like 5G and AI, is a key determinant of its financial health and competitive standing in the telecommunications sector.

Personnel Costs and Workforce Compensation

Personnel costs represent a significant portion of Ericsson's expenses. This includes the compensation, benefits, and ongoing training for their extensive global workforce. These individuals are crucial, encompassing engineers, project managers, sales teams, and essential support personnel who drive all aspects of the business.

- Salaries and Wages: The core of personnel costs, reflecting competitive compensation for a highly skilled workforce.

- Employee Benefits: This includes health insurance, retirement plans, and other welfare programs essential for attracting and retaining talent.

- Training and Development: Investment in continuous learning to keep employees updated with rapidly evolving telecommunications technology.

- Global Workforce Distribution: Costs vary by region due to differing labor markets and compensation standards.

In 2023, Ericsson reported total employee-related expenses, including salaries and social costs, amounting to SEK 112.7 billion (approximately $10.7 billion USD at the average 2023 exchange rate). This highlights human capital as a primary cost driver for the company's operations and innovation.

Supply Chain and Logistics Costs

Ericsson's global supply chain, a critical component of its operations, involves substantial costs related to managing hardware components, manufacturing, and worldwide equipment distribution. These expenses encompass logistics, warehousing, transportation, and the intricate process of inventory management. For instance, in 2023, the company's cost of goods sold, which includes many of these supply chain elements, was SEK 174.7 billion.

Optimizing these supply chain operations is paramount for effective cost control and ensuring that Ericsson's products reach customers on time. Efficiently navigating these complexities directly impacts profitability and customer satisfaction.

- Global Component Sourcing: Costs associated with procuring diverse hardware components from international suppliers.

- Manufacturing Overhead: Expenses related to production facilities, labor, and quality control for network equipment.

- Worldwide Distribution: Significant outlays for shipping, freight, and customs clearance to deliver products globally.

- Inventory Management: Costs tied to holding and managing stock across various warehouses to meet demand.

Ericsson's cost structure is heavily influenced by its significant investment in Research and Development (R&D) to maintain leadership in telecommunications technology. Personnel costs, encompassing salaries, benefits, and training for a global workforce, represent a major expenditure. The company also incurs substantial costs in its global supply chain, covering component sourcing, manufacturing, and distribution.

| Cost Category | 2023 (SEK billions) | Approx. USD billions (avg. 2023 rate) |

|---|---|---|

| R&D Expenses | 53.1 | 5.1 |

| Personnel Costs (incl. social) | 112.7 | 10.7 |

| Cost of Goods Sold (incl. supply chain elements) | 174.7 | 16.7 |

| SG&A Expenses | 50.2 | 4.8 |

Revenue Streams

Ericsson's primary revenue stream originates from the sale of mobile network infrastructure. This includes essential components like Radio Access Network (RAN) equipment, such as base stations and antennas, alongside core network solutions and transport equipment. These sales are directed towards telecommunication operators worldwide, forming the bedrock of their business.

This segment encompasses the fundamental sales of both hardware and the necessary software licenses to operate these advanced networks. It truly represents the core product offering that underpins mobile communication services globally. For instance, in the first quarter of 2024, Ericsson reported net sales of SEK 62.4 billion, with a significant portion attributed to their Networks segment.

Ericsson generates revenue by licensing its vast software portfolio, encompassing network management, orchestration, BSS/OSS, and cloud-native functions. This model often incorporates recurring subscription fees for software access and ongoing updates, creating a stable and predictable income source.

The increasing criticality of software in telecommunications underpins this revenue stream. For instance, in 2024, Ericsson continued to see strong demand for its cloud-native 5G software solutions, contributing significantly to its overall financial performance.

Managed Services Contracts are a cornerstone of Ericsson's revenue, generating substantial income through long-term agreements where the company assumes responsibility for operating, optimizing, and maintaining customer networks. These contracts typically cover essential functions like network monitoring, field support, performance enhancement, and robust security measures.

This model provides Ericsson with a predictable and recurring revenue stream, underpinned by stringent service level agreements. As of the first quarter of 2024, Ericsson reported that its managed services segment continued to be a vital contributor to its financial stability, demonstrating its sticky and growing nature within the business.

Professional Services and Consulting

Ericsson generates revenue through extensive professional services, offering expertise in network planning, design, integration, and optimization. These services are crucial for communication service providers, ensuring the effective deployment and ongoing operation of complex network infrastructures.

This revenue stream is primarily project-based, directly supporting and enhancing the sales of Ericsson's hardware and software solutions. It represents a significant way for Ericsson to monetize its deep technical knowledge and operational experience.

- Network Planning and Design: Expert consultation on future network architectures and capacity planning.

- Integration and Deployment: Services for seamless installation and rollout of new technologies, like 5G.

- Network Optimization: Ongoing support to maximize performance, efficiency, and user experience.

- Managed Services: Outsourced management and operation of network infrastructure for clients.

In 2023, Ericsson's Professional Services segment played a vital role in its financial performance, contributing to the company's overall revenue by ensuring successful customer implementations and fostering long-term partnerships. While specific segment breakdowns can fluctuate, the strategic importance of these services remains a constant driver for customer satisfaction and recurring revenue opportunities.

Intellectual Property (IP) Licensing

Ericsson's intellectual property licensing is a significant revenue driver, primarily stemming from its extensive patent portfolio in mobile communication standards. This allows other technology firms to utilize Ericsson's foundational innovations.

This passive income stream is a direct result of Ericsson's continuous and substantial investments in research and development over many years. It represents a high-margin component of their overall revenue generation strategy.

- Licensing of foundational mobile communication patents

- Leverages historical R&D investments

- High-margin revenue stream

- Enables other companies to utilize core technologies

Ericsson's Digital Services segment is a growing revenue stream, focusing on software and solutions for service providers' digital transformation. This includes cloud-native applications, analytics, and AI-driven tools that enhance customer experience and operational efficiency. For example, in the first quarter of 2024, Ericsson highlighted progress in its cloud-native portfolio, indicating a strategic push in this area.

Business Model Canvas Data Sources

The Ericsson Business Model Canvas is informed by a robust blend of internal financial data, comprehensive market research reports, and strategic analyses of the telecommunications landscape. These diverse sources provide the foundation for understanding customer needs, competitive positioning, and revenue generation opportunities.