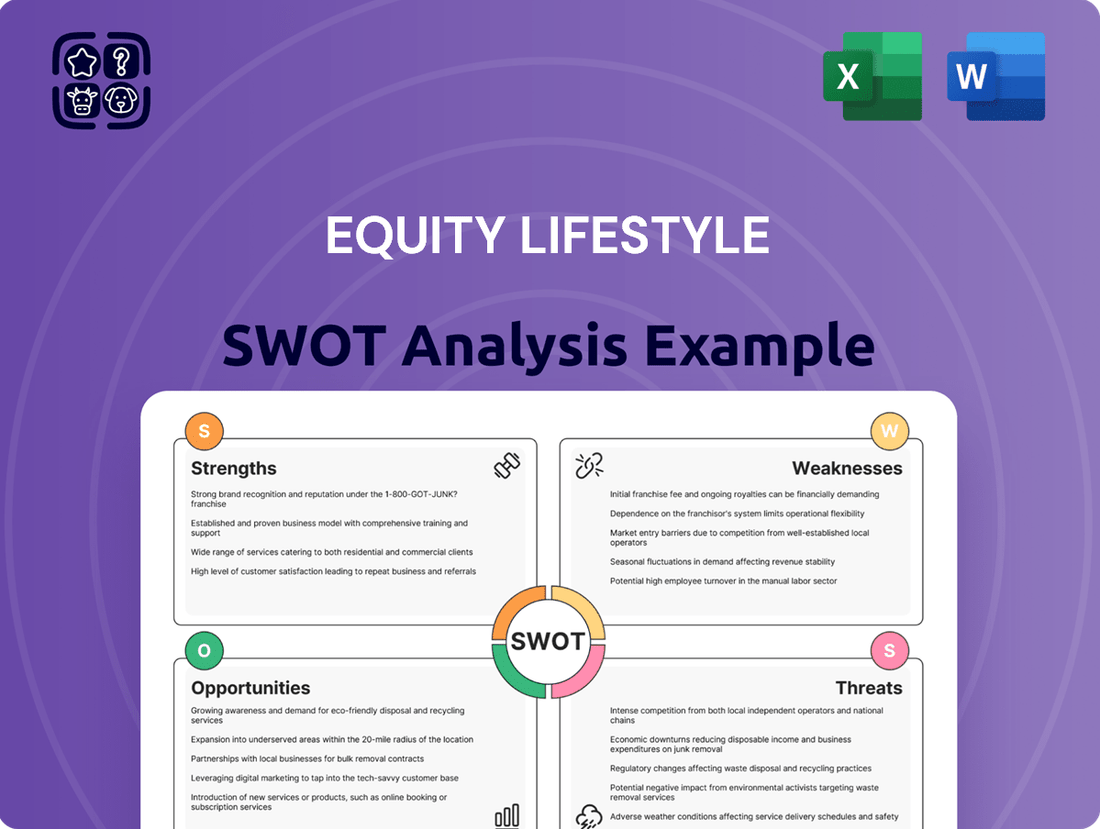

Equity LifeStyle SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity LifeStyle Bundle

Equity Lifestyle's strengths lie in its established portfolio of manufactured home communities and RV resorts, offering a stable revenue stream. However, potential weaknesses include reliance on acquisitions and the cyclical nature of the RV market. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Equity Lifestyle's market position, including detailed opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment decisions and strategic planning.

Strengths

Equity Lifestyle Properties (ELS) boasts a robust and geographically diverse portfolio, featuring manufactured home communities, RV resorts, and campgrounds. With over 171,000 sites spread across 35 states and British Columbia, this extensive reach significantly reduces exposure to localized economic disruptions.

The company's revenue model is anchored by long-term homesite leases, which are a cornerstone of its financial stability. This predictable income stream provides a solid foundation, minimizing volatility and enhancing the reliability of its cash flows.

Equity Lifestyle Properties (ELS) excels by concentrating on lifestyle-centric experiences within sought-after locales, attracting a growing segment of the population interested in active adult communities and vacation spots. This strategic positioning in desirable markets, like Florida and California, ensures sustained demand for their properties.

Their emphasis on creating engaging resident experiences, from curated events to robust amenities, fosters strong tenant loyalty. This focus on lifestyle and location directly translates into high retention rates, with ELS reporting a 96% retention rate for its manufactured home sites in 2023, allowing for predictable revenue streams and consistent rent growth.

Equity Lifestyle Properties (ELS) benefits from remarkably strong occupancy in its manufactured housing communities, a segment that forms a significant part of its operations. By the close of 2023, occupancy rates stood at an impressive 94.7%, demonstrating sustained demand for this housing solution. This high occupancy is complemented by healthy rental growth, which directly contributes to the company's revenue stability and expansion.

Further bolstering this strength, ELS reported robust core operational performance in the first quarter of 2025. The company achieved a 3.8% increase in Net Operating Income (NOI), a key indicator of property profitability. Additionally, normalized Funds From Operations (FFO) per share saw a significant 6.7% rise, underscoring effective property management and strong underlying business momentum.

Favorable Demographic Trends

The aging of the Baby Boomer generation presents a significant tailwind for Equity Lifestyle Properties (ELS). With roughly 10,000 individuals reaching age 65 each day through 2030, the demand for manufactured housing and RV communities is poised for substantial growth.

ELS is strategically positioned to benefit from this demographic shift, as over 70% of its property portfolio is either age-restricted or caters to an older resident base. This focus aligns perfectly with the preferences of this demographic, who often seek housing that is both affordable and requires minimal upkeep, coupled with opportunities for an active lifestyle.

- Demographic Driver: Approximately 10,000 Baby Boomers turn 65 daily through 2030.

- Portfolio Alignment: Over 70% of ELS holdings cater to older residents or are age-restricted.

- Resident Preferences: This demographic often seeks affordable, low-maintenance housing and active lifestyles.

Resilient Business Model with Controlled Expenses

Equity LifeStyle Properties (ELS) benefits from a resilient business model characterized by a low expense load. This is primarily due to its land-lease structure, where residents own their homes but lease the underlying land, significantly reducing ELS's capital expenditure requirements.

The company's proven ability to manage and control operating expenses is a key strength. For instance, in Q1 2025, ELS reported a modest 1.5% increase in core operating expenses, which was substantially lower than the 3.8% growth observed in its Net Operating Income (NOI). This disparity highlights strong operational efficiency and expense management.

- Land-Lease Model: Reduces capital expenditures by shifting home ownership costs to residents.

- Expense Control: Demonstrated by a 1.5% rise in core operating expenses in Q1 2025 against a 3.8% NOI increase.

- Operational Efficiency: Leads to healthy NOI growth and improved profitability.

Equity Lifestyle Properties (ELS) possesses a significant competitive advantage through its extensive and diversified portfolio, spanning 35 states and British Columbia. This broad geographical footprint, encompassing over 171,000 sites, provides resilience against localized economic downturns.

The company's financial stability is deeply rooted in its predictable revenue streams derived from long-term homesite leases. This model ensures consistent cash flow, minimizing financial volatility.

ELS strategically targets desirable lifestyle-centric locations, attracting a growing demographic interested in active adult living and vacation destinations, ensuring sustained demand.

High resident retention, evidenced by a 96% rate for manufactured home sites in 2023, underscores the company's ability to foster loyalty through engaging experiences and prime locations, leading to predictable revenue and consistent rent growth.

| Metric | Q1 2025 | 2023 |

|---|---|---|

| Manufactured Home Site Occupancy | 94.7% | 94.7% |

| Manufactured Home Site Retention | N/A | 96% |

| Core Operating Expense Growth | 1.5% | N/A |

| NOI Growth | 3.8% | N/A |

| Normalized FFO per Share Growth | 6.7% | N/A |

What is included in the product

Delivers a strategic overview of Equity LifeStyle’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and address Equity LifeStyle's market vulnerabilities and operational challenges.

Weaknesses

Equity LifeStyle Properties (ELS) faces a significant weakness due to its heavy reliance on baby boomers for demand in manufactured housing and RV communities. This demographic concentration makes the company vulnerable to shifts in their preferences or migration patterns. For instance, if retirement migration slows or older adults opt for different lifestyle choices, ELS could see reduced occupancy and profitability.

As a real estate investment trust, Equity Lifestyle Properties (ELS) is inherently capital-intensive and thus sensitive to shifts in interest rates. Higher borrowing costs directly affect profitability and the feasibility of financing new acquisitions or property upgrades. While ELS has strategically locked in a substantial portion of its debt at fixed rates, sustained elevated interest rate environments could still present headwinds.

While Equity Lifestyle Properties (ELS) benefits from stable annual leases, its transient rental segment for RVs and cottages presents a potential vulnerability. This segment is inherently more sensitive to economic fluctuations and shifts in consumer travel preferences.

Evidence of this sensitivity was seen in ELS's first quarter 2025 results, which showed a 9.1% year-over-year decline in transient rent. Such a downturn suggests that this particular revenue stream may experience volatility.

A prolonged period of weaker demand in these transient markets could pose a challenge to ELS's overall revenue expansion and profitability, despite the strength of its core annual lease business.

Regulatory and Zoning Challenges

Equity LifeStyle Properties (ELS) faces significant hurdles in developing new manufactured housing communities due to stringent regulatory and zoning challenges. These restrictions often limit the expansion of supply, particularly in desirable, high-demand locations. This 'red tape' can be a major impediment to growth.

The high cost of land, coupled with these regulatory complexities, directly impacts ELS's ability to pursue new development opportunities. This can hinder the company's strategic goal of expanding its portfolio through new construction projects, impacting its long-term growth trajectory.

- Regulatory Hurdles: Obtaining permits and approvals for new manufactured housing communities can be a lengthy and complex process, often involving multiple local, state, and federal agencies.

- Zoning Restrictions: Many municipalities have restrictive zoning laws that either prohibit or severely limit the development of manufactured housing, classifying them as non-conforming uses.

- Land Costs: The escalating cost of suitable land in sought-after areas further exacerbates the challenge, making new developments financially prohibitive in many cases.

- Supply Constraints: These combined factors contribute to a significant constraint on the supply of new manufactured housing communities, limiting ELS's organic growth potential.

Competition within the Niche Market

Equity Lifestyle Properties (ELS) faces growing competition within its specialized niche. Other real estate investment trusts (REITs) and property management companies are increasingly targeting the RV resort and manufactured housing sectors, drawn by the sector's resilience and attractive capitalization rates. For instance, in 2024, the manufactured housing sector continued to show strong investor interest, with several REITs reporting robust occupancy rates and rental growth, signaling a more crowded investment landscape for ELS.

This escalating competition can directly impact ELS's ability to maintain its market position and growth trajectory. As more players enter the space, the pressure on rental rates may intensify, and the availability of attractive acquisition targets could diminish. ELS's strategy of acquiring high-quality, well-located properties might become more challenging and costly to execute, potentially affecting its future expansion plans and overall profitability.

- Increased Competition: Competitors are actively entering the RV resort and manufactured housing markets.

- Pressure on Rates: More players can lead to downward pressure on rental income.

- Acquisition Challenges: Prime property acquisition opportunities may become scarcer and more expensive.

- Impact on Growth: These factors could potentially hinder ELS's future expansion and financial performance.

Equity Lifestyle Properties (ELS) faces a significant weakness due to its heavy reliance on baby boomers for demand in manufactured housing and RV communities. This demographic concentration makes the company vulnerable to shifts in their preferences or migration patterns. For instance, if retirement migration slows or older adults opt for different lifestyle choices, ELS could see reduced occupancy and profitability.

As a real estate investment trust, Equity Lifestyle Properties (ELS) is inherently capital-intensive and thus sensitive to shifts in interest rates. Higher borrowing costs directly affect profitability and the feasibility of financing new acquisitions or property upgrades. While ELS has strategically locked in a substantial portion of its debt at fixed rates, sustained elevated interest rate environments could still present headwinds.

While Equity Lifestyle Properties (ELS) benefits from stable annual leases, its transient rental segment for RVs and cottages presents a potential vulnerability. This segment is inherently more sensitive to economic fluctuations and shifts in consumer travel preferences. Evidence of this sensitivity was seen in ELS's first quarter 2025 results, which showed a 9.1% year-over-year decline in transient rent. Such a downturn suggests that this particular revenue stream may experience volatility. A prolonged period of weaker demand in these transient markets could pose a challenge to ELS's overall revenue expansion and profitability, despite the strength of its core annual lease business.

Equity LifeStyle Properties (ELS) faces significant hurdles in developing new manufactured housing communities due to stringent regulatory and zoning challenges. These restrictions often limit the expansion of supply, particularly in desirable, high-demand locations. This 'red tape' can be a major impediment to growth. The high cost of land, coupled with these regulatory complexities, directly impacts ELS's ability to pursue new development opportunities. This can hinder the company's strategic goal of expanding its portfolio through new construction projects, impacting its long-term growth trajectory.

Equity Lifestyle Properties (ELS) faces growing competition within its specialized niche. Other real estate investment trusts (REITs) and property management companies are increasingly targeting the RV resort and manufactured housing sectors, drawn by the sector's resilience and attractive capitalization rates. For instance, in 2024, the manufactured housing sector continued to show strong investor interest, with several REITs reporting robust occupancy rates and rental growth, signaling a more crowded investment landscape for ELS. This escalating competition can directly impact ELS's ability to maintain its market position and growth trajectory. As more players enter the space, the pressure on rental rates may intensify, and the availability of attractive acquisition targets could diminish. ELS's strategy of acquiring high-quality, well-located properties might become more challenging and costly to execute, potentially affecting its future expansion plans and overall profitability.

| Weakness | Description | Impact | Data Point |

| Demographic Concentration | Heavy reliance on baby boomers for demand in manufactured housing and RV communities. | Vulnerability to shifts in retirement migration or lifestyle preferences. | While specific demographic shifts are ongoing, the 65+ population is projected to grow, but preferences for retirement living can vary. |

| Interest Rate Sensitivity | Capital-intensive nature of REITs makes them sensitive to borrowing costs. | Higher financing costs can reduce profitability and hinder new acquisitions/upgrades. | As of Q1 2025, the Federal Reserve maintained interest rates at elevated levels, impacting borrowing costs across the real estate sector. |

| Transient Rental Volatility | Sensitivity of RV and cottage rentals to economic fluctuations and travel trends. | Potential for revenue volatility in this segment, impacting overall financial performance. | ELS reported a 9.1% year-over-year decline in transient rent in Q1 2025, highlighting this segment's sensitivity. |

| Development Hurdles | Stringent regulatory, zoning, and high land costs limit new community development. | Hinders organic growth and expansion of the property portfolio through new construction. | Land acquisition costs in desirable markets continue to be a significant barrier for new developments across the industry. |

| Increased Competition | Growing competition from other REITs and property managers in the RV and manufactured housing sectors. | Potential pressure on rental rates and increased cost/difficulty in acquiring attractive properties. | Investor interest in the manufactured housing sector remained strong in 2024, with multiple REITs reporting positive performance, indicating a competitive environment. |

Preview the Actual Deliverable

Equity LifeStyle SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive look at Equity Lifestyle's market position.

This is a real excerpt from the complete document, showcasing the detailed analysis of Equity Lifestyle's Strengths, Weaknesses, Opportunities, and Threats. Once purchased, you’ll receive the full, editable version.

You’re viewing a live preview of the actual SWOT analysis file for Equity Lifestyle. The complete version becomes available after checkout, ensuring you have all the strategic insights.

Opportunities

The escalating cost of traditional housing, with median home prices in the U.S. reaching approximately $420,000 in early 2024, is a major catalyst for increased demand in manufactured housing. This affordability gap makes manufactured homes, often priced around $100,000 to $150,000, a compelling choice for a widening demographic, including young families and individuals looking for budget-friendly options.

Equity Lifestyle Properties (ELS) can capitalize on robust demand and the scarcity of new developments by strategically investing in its current property portfolio. By upgrading amenities, enhancing infrastructure, and improving the overall aesthetic of its communities, ELS can attract more residents and boost satisfaction among existing ones.

These enhancements are projected to support rental rate increases, effectively maximizing the return on ELS's existing assets. For instance, in the first quarter of 2024, ELS reported a 7.3% increase in rental income for its manufactured home and RV communities, demonstrating the positive impact of such improvements.

The RV park and campground sector is increasingly adopting smart technology. This includes automated check-in and check-out processes, sophisticated energy management systems, and robust Wi-Fi connectivity, all of which are becoming standard expectations. For Equity Lifestyle Properties (ELS), this presents a significant opportunity to elevate the guest experience.

By integrating these technological advancements, ELS can streamline operations and appeal to a growing demographic of tech-savvy travelers. Younger generations, particularly millennials and Gen Z, are now the dominant force in camping and RVing, and they expect seamless digital interactions. For instance, a 2024 industry report indicated that over 60% of new RV purchases were made by individuals under 45, highlighting the importance of digital integration.

Catering to Evolving RV and Camping Trends

The RV market is experiencing robust growth, with projections indicating continued expansion. For instance, RVIA reported a 12.5% increase in wholesale shipments in 2023 compared to 2022, reaching over 320,000 units. This growth is fueled by a demographic shift, with younger individuals and digital nomads increasingly embracing the RV lifestyle. Equity Lifestyle Properties (ELS) is well-positioned to benefit from this trend by adapting its properties and services to cater to these evolving preferences.

There's a notable surge in demand for sustainable options and enhanced experiences within the camping sector. This includes a growing interest in eco-friendly practices, the integration of electric vehicle (EV) charging stations at campgrounds, and the rise of luxury camping or 'glamping.' ELS can leverage these emerging trends by investing in sustainable infrastructure and offering premium amenities that appeal to a broader customer base seeking comfort and convenience alongside their outdoor adventures.

ELS has a clear opportunity to capitalize on these shifting consumer demands by:

- Expanding RV park amenities to include EV charging stations and more upscale facilities.

- Developing glamping options and unique lodging experiences to attract a wider demographic.

- Highlighting sustainable practices at its properties to appeal to environmentally conscious travelers.

Strategic Acquisitions and Consolidation within the Sector

The manufactured housing and RV park industries are attracting significant investor attention, leading to a wave of consolidation. This trend presents a prime opportunity for Equity Lifestyle Properties (ELS) to strategically expand its footprint and market dominance.

Should interest rates decline in 2024/2025, as some economists predict, the cost of capital for acquisitions would decrease, potentially accelerating deal activity. ELS could leverage this environment to acquire complementary properties, thereby broadening its portfolio and achieving greater operational efficiencies through economies of scale.

- Increased Investor Interest: The manufactured housing and RV park sectors have seen a surge in private equity and REIT investment.

- Potential for Lower Borrowing Costs: A projected easing of monetary policy in 2024/2025 could reduce the cost of debt financing for acquisitions.

- Portfolio Expansion: Strategic acquisitions allow ELS to enter new geographic markets or strengthen its presence in existing ones.

- Enhanced Market Share: Consolidation through acquisitions can lead to a larger overall market share for ELS.

Equity Lifestyle Properties (ELS) can leverage the growing demand for affordable housing by upgrading its existing manufactured home communities. This strategy, as evidenced by a 7.3% increase in rental income in Q1 2024, can attract more residents and justify rental rate hikes.

The increasing adoption of smart technology in RV parks, like automated check-ins and improved Wi-Fi, presents an opportunity for ELS to enhance guest experiences and appeal to younger, tech-savvy travelers who are now a significant portion of RV purchasers, with over 60% of new RV buyers under 45 in 2024.

The robust growth in the RV market, with wholesale shipments up 12.5% in 2023, and the trend towards sustainable and luxury camping options, including EV charging stations, offer ELS avenues for expansion and differentiation, attracting a broader customer base.

Increased investor interest in the manufactured housing and RV sectors, coupled with potential interest rate decreases in 2024/2025, creates a favorable environment for ELS to pursue strategic acquisitions, thereby expanding its market share and achieving greater economies of scale.

Threats

While the Federal Reserve has signaled potential rate cuts, interest rates have largely remained elevated through early 2025, significantly increasing the cost of capital for real estate investment trusts like Equity LifeStyle Properties (ELS). This environment directly impacts ELS by making it more expensive to finance new acquisitions and development projects. For instance, a rise in the benchmark 10-year Treasury yield, which hovered around 4.25% in early 2025, directly translates to higher borrowing costs for REITs.

Higher long-term interest rates also exert downward pressure on property valuations. As the cost of capital rises, the discount rate used in valuation models increases, leading to lower present values for future cash flows. This can make it harder for ELS to acquire properties at attractive prices and may also lead to a decline in the market value of its existing portfolio, impacting its overall balance sheet and potentially limiting its ability to raise equity at favorable terms.

Furthermore, increased financing costs can squeeze profit margins for ELS. With higher interest expenses on existing and new debt, the net operating income available to shareholders is reduced. This pressure could limit the company's capacity for growth through acquisitions, as fewer deals may meet the required return thresholds in a higher-rate environment, and could also impact the affordability of its properties for consumers, potentially affecting occupancy rates.

A significant economic downturn could severely impact Equity Lifestyle Properties (ELS) by reducing consumer spending on discretionary items like RV vacations and vacation rentals. For instance, if inflation remains elevated or unemployment rises sharply in 2024-2025, consumers may cut back on travel, directly affecting ELS's rental and amenity revenues.

While ELS's manufactured home communities provide a more stable, affordable housing option, a deep recession could still strain residents' finances. In a severe economic contraction, even these residents might face challenges in paying rent or affording new manufactured homes, potentially leading to increased delinquencies or slower sales for ELS.

Equity Lifestyle Properties (ELS) faces potential headwinds from evolving regulatory landscapes. Changes in local zoning ordinances, environmental regulations, or even landlord-tenant laws could introduce new compliance costs or operational constraints, impacting profitability. For instance, shifts in zoning could restrict the type or density of housing ELS can develop in certain areas.

Furthermore, local community resistance to new manufactured home communities or RV park developments presents a significant threat to ELS's expansion plans. Such opposition can lead to lengthy approval processes, increased development costs, or outright project cancellations, thereby limiting ELS's ability to grow its portfolio and capitalize on market demand. In 2024, several proposed developments across the US faced community review, highlighting the ongoing challenge of gaining local acceptance.

Increased Competition and Supply

The manufactured housing and RV park industries are experiencing significant investor interest, which naturally brings more competition and new supply into the market. This influx of capital and new developments could impact Equity Lifestyle's market position.

While the manufactured housing sector has seen relatively constrained new supply, the RV park segment is more susceptible to increased competition. This could potentially lead to downward pressure on rental rates and occupancy, especially in specific geographic areas where new parks are established.

- Increased Investor Interest: The attractiveness of the lifestyle-oriented real estate sectors has spurred significant investment, as evidenced by the substantial capital flowing into RV park development and manufactured housing communities.

- Potential for Rate Pressure: A rise in competitive offerings, particularly in the RV park segment, could challenge Equity Lifestyle's ability to maintain current rental rates without adjustments.

- Occupancy Dynamics: New supply entering the market may dilute existing occupancy levels, requiring strategic management to retain high utilization rates across Equity Lifestyle's portfolio.

Natural Disasters and Climate-Related Risks

Equity Lifestyle Properties (ELS) faces significant threats from natural disasters and climate-related risks due to its portfolio's concentration in popular, yet potentially vulnerable, vacation and retirement destinations. For instance, coastal properties are inherently exposed to hurricane activity and rising sea levels, while inland locations can be impacted by wildfires or severe flooding. These events can lead to substantial property damage, operational disruptions, and escalating insurance premiums, directly impacting ELS's financial performance and asset value.

The financial implications of these risks are considerable. In 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $170 billion in damages, according to NOAA. For ELS, a major hurricane or wildfire could result in millions in repair costs and lost rental income. Furthermore, the increasing frequency and intensity of such events may lead to higher insurance deductibles and premiums, or even reduced insurability in certain high-risk areas, adding a persistent cost burden.

- Increased Insurance Costs: Rising claims from climate-related events are pushing up insurance premiums for properties in vulnerable regions.

- Property Damage and Business Interruption: Direct physical damage from storms or fires can lead to costly repairs and prolonged periods of lost revenue.

- Reputational and Market Value Impact: Repeated exposure to natural disasters could deter potential residents and investors, negatively affecting property valuations.

- Operational Challenges: Restoring services and managing resident needs following a disaster requires significant resources and can strain operational capacity.

Elevated interest rates through early 2025 continue to be a significant threat, increasing ELS’s cost of capital for new projects and acquisitions. Higher borrowing costs directly squeeze profit margins by increasing interest expenses on debt. This financial pressure can limit growth opportunities and potentially impact consumer affordability of ELS properties.

Economic downturns pose a substantial risk, as reduced consumer spending on discretionary travel like RV vacations directly impacts ELS's revenue streams. Even the more stable manufactured home communities could face resident financial strain, leading to increased delinquencies or slower sales during a severe contraction.

Increased competition from new entrants in the RV park and manufactured housing sectors could pressure rental rates and occupancy. Furthermore, evolving regulatory landscapes and local community opposition to new developments present ongoing challenges to ELS's expansion and can increase development costs.

Natural disasters and climate-related risks, such as hurricanes and wildfires, represent a direct threat to ELS's portfolio, particularly its coastal and vulnerable locations. These events can cause significant property damage, disrupt operations, and lead to escalating insurance premiums, impacting asset values and financial performance.

SWOT Analysis Data Sources

This Equity Lifestyle SWOT analysis is built on a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.