Equity LifeStyle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity LifeStyle Bundle

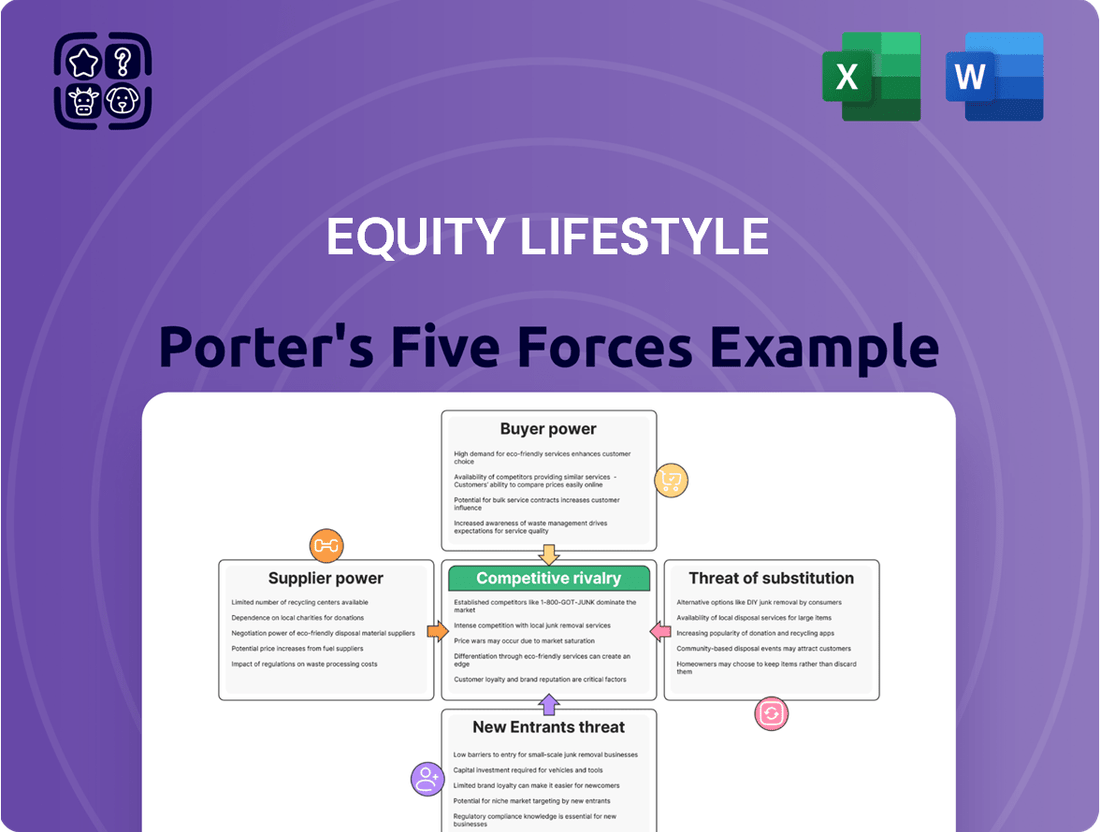

Equity LifeStyle Properties operates in a dynamic market shaped by several key forces. Understanding the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry is crucial for navigating its competitive landscape. The influence of suppliers and the availability of substitutes also play significant roles in its strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Equity LifeStyle’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of developable land, especially in sought-after coastal and Sun Belt areas, is a significant constraint for companies like Equity LifeStyle Properties. This scarcity, combined with the complex and often lengthy process of obtaining zoning approvals from local governments, naturally elevates the bargaining power of landowners. For instance, in many desirable markets, the lead time for securing entitlements can extend for several years, making existing, approved sites exceptionally valuable.

While Equity Lifestyle Properties (ELS) mainly leases land, the company does engage in developing and maintaining community infrastructure, which includes construction materials. Recent data from the Bureau of Labor Statistics in 2024 shows continued, albeit moderating, increases in construction material prices, which could give suppliers more leverage.

However, ELS's substantial size as a Real Estate Investment Trust (REIT) likely allows for significant purchasing power, enabling them to negotiate better terms and mitigate some of the suppliers' influence on material costs for their infrastructure projects.

Equity LifeStyle Properties (ELS) primarily generates revenue from leasing homesites, which significantly diminishes the bargaining power of manufactured home manufacturers. Their involvement in home sales is secondary, meaning manufacturers have less leverage over ELS's core business model.

The growing availability of new manufactured homes in the market, coupled with ELS's strategic acquisitions like MHVillage and Datacomp, further tips the scales in favor of buyers. This increased supply and ELS's enhanced market reach create a buyer's market, effectively reducing the negotiating power of individual manufacturers.

Moderate Influence of Utility Providers

Equity LifeStyle Properties (ELS) sometimes acts as a direct customer for utility providers, particularly in properties where it manages or supplies utilities. This positions ELS as a buyer in the utility market, giving utility providers a degree of bargaining power. This influence is not uniform across all of ELS's operations and is heavily shaped by the specific conditions of each local market.

The bargaining power of utility suppliers for ELS is significantly influenced by the local regulatory framework and the competitive landscape of utility providers in a given area. In regions where only one or very few utility companies operate, these providers naturally hold more sway over pricing and service terms. For instance, in areas with a single electricity provider, ELS has limited options for negotiation, potentially leading to higher input costs.

- Limited Competition: In many of ELS's operating regions, utility services are natural monopolies or highly consolidated, meaning there are few or no alternative suppliers.

- Regulatory Impact: State and local regulations governing utility pricing and service provision can either empower or constrain suppliers' bargaining power.

- Dependence on Essential Services: The essential nature of utilities means ELS cannot easily switch providers or forgo these services, increasing supplier leverage.

Low Bargaining Power of Maintenance and Service Providers

Equity LifeStyle Properties (ELS) benefits from a low bargaining power of maintenance and service providers due to its substantial operational scale. With over 450 properties, ELS commands significant leverage when negotiating contracts for day-to-day operations and upkeep.

This extensive portfolio allows ELS to consolidate its purchasing power, making it less susceptible to price hikes or unfavorable terms from individual suppliers. The sheer volume of business ELS represents to these service providers naturally tips the scales in its favor.

- Scale Advantage: ELS's presence across more than 450 properties provides considerable negotiating leverage with maintenance and service vendors.

- Supplier Dependence: Many smaller service providers may rely heavily on contracts with large entities like ELS, reducing their ability to dictate terms.

- Competitive Vendor Landscape: The market for property maintenance and services often features numerous providers, fostering competition that benefits ELS.

The bargaining power of suppliers for Equity LifeStyle Properties (ELS) is generally moderate, influenced by factors like the essential nature of some services and the company's scale. While ELS's size offers considerable purchasing power, particularly with maintenance and service providers, the essential nature of utilities in its communities can give those suppliers more leverage, especially in markets with limited competition.

| Supplier Type | Bargaining Power Assessment | Key Influencing Factors | ELS Mitigation Strategies |

|---|---|---|---|

| Landowners (for development) | High | Scarcity of developable land, lengthy entitlement processes | Long-term leases, strategic land acquisition |

| Construction Material Suppliers | Moderate | Rising material costs (e.g., lumber, concrete in 2024), but moderated by ELS's scale | Bulk purchasing agreements, long-term supplier relationships |

| Manufactured Home Manufacturers | Low | Growing availability of new homes, ELS's market reach (MHVillage, Datacomp) | Diversified supplier base, focus on home site leasing |

| Utility Providers | Moderate to High | Local monopolies, regulatory frameworks, essential service nature | Negotiating long-term contracts, exploring alternative energy sources where feasible |

| Maintenance & Service Providers | Low | ELS's large operational scale (450+ properties), competitive vendor landscape | Consolidated purchasing, competitive bidding processes |

What is included in the product

Tailored exclusively for Equity LifeStyle, analyzing its position within its competitive landscape by dissecting the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the manufactured housing and recreational vehicle resort industries.

Instantly identify and address competitive threats with a clear, actionable breakdown of Equity LifeStyle's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Manufactured home residents face substantial costs and logistical challenges when moving their homes, acting as a significant barrier to switching communities. This inherently limits their bargaining power against operators like Equity LifeStyle Properties (ELS).

ELS's business model relies heavily on long-term leases for homesites, which averages 10 years in their portfolio, fostering predictable revenue streams and reducing resident leverage for rent negotiations. The average resident tenure in the manufactured housing industry is lengthy, often exceeding 15 years, underscoring the stickiness of these arrangements and further diminishing customer power.

The increasing cost of traditional homeownership has made manufactured homes a vital and sought-after solution for affordable housing. This trend directly benefits Equity Lifestyle Properties (ELS) by boosting demand for its manufactured home sites. For instance, in 2024, the median home price in the U.S. continued its upward trajectory, pushing more individuals and families toward more economical alternatives.

This robust demand is further amplified by the aging Baby Boomer demographic, a significant segment actively seeking affordable retirement living options. As this large cohort enters retirement years, their preference for cost-effective housing solutions naturally translates into increased interest in ELS's offerings, solidifying the company's market position.

Consequently, this strong consumer demand, driven by affordability needs and demographic shifts, enhances ELS's pricing power. Customers have fewer viable alternatives when seeking affordable, well-located housing, which inherently reduces their leverage in negotiations and strengthens ELS's bargaining position.

Equity LifeStyle Properties (ELS) cultivates customer loyalty by offering a lifestyle-oriented experience, complete with appealing amenities and prime locations. These features, such as well-appointed clubhouses, swimming pools, and organized recreational activities, make it less likely for residents to switch providers solely based on price. This strong value proposition directly curbs the bargaining power of customers.

Moderate Bargaining Power for RV and Vacation Renters

While the demand for RV travel is robust and expanding, the transient nature of RV and vacation rentals, whether short-term or annual, grants renters more choices and lower switching costs compared to residents in manufactured homes. This flexibility means customers can more readily move between providers, influencing pricing and service terms.

The bargaining power of these renters is further amplified by their sensitivity to economic shifts and discretionary spending. For instance, a downturn in consumer confidence, which saw a slight dip in early 2024 according to various economic indicators, could lead renters to seek more budget-friendly options or postpone travel, thereby pressuring rental operators.

- Customer Price Sensitivity: Renters can easily compare prices across different RV parks and vacation rental platforms, leading to a more competitive pricing environment.

- Availability of Substitutes: The market offers numerous alternatives to RV travel, including traditional hotels, camping, and other forms of leisure, providing renters with significant choice.

- Low Switching Costs: For short-term rentals, there are minimal costs associated with changing providers, empowering customers to switch if dissatisfied with price or service.

- Impact of Economic Conditions: Discretionary spending on travel, like RV vacations, is often one of the first areas consumers cut back on during economic uncertainty, giving renters leverage.

Demographic Tailwinds Supporting Demand

The growing demographic of Baby Boomers and younger generations showing increased interest in RV travel and more affordable retirement solutions consistently fuels demand for Equity Lifestyle Properties (ELS). This significant demographic trend, particularly the 55-74 age bracket which represents a substantial segment of ELS's clientele, guarantees a continuous flow of prospective residents and visitors, thereby constraining the overall bargaining power of customers.

The robust demand from these key demographics directly translates into higher occupancy rates and pricing power for ELS. For instance, in 2023, ELS reported a significant increase in rental income, driven by strong demand across its portfolio of manufactured home communities and RV resorts.

- Baby Boomer Influence: This generation's increasing retirement and desire for active lifestyles bolster demand for ELS's offerings.

- RV Travel Boom: A sustained surge in recreational vehicle usage directly benefits ELS's RV resort segment.

- Affordable Retirement: ELS provides a more budget-friendly alternative to traditional senior living, attracting a wider customer base.

- Customer Base Stability: The 55-74 age group, a core demographic, ensures consistent demand, reducing customer leverage.

The bargaining power of customers for Equity LifeStyle Properties (ELS) is generally low, primarily due to high switching costs for manufactured home residents and the strong demand for their offerings. For RV renters, while they have more choices, the overall demand trend still limits their leverage.

Manufactured home residents face significant expenses and logistical hurdles when relocating, making it difficult to switch communities. This immobility inherently reduces their ability to negotiate effectively with operators like ELS, whose long-term leases further solidify customer retention.

The increasing cost of traditional housing in 2024 has made manufactured homes a crucial and desirable option for affordable living, boosting demand for ELS's sites. This trend, coupled with the aging Baby Boomer demographic seeking cost-effective retirement solutions, strengthens ELS's pricing power as customer alternatives diminish.

| Factor | Impact on Customer Bargaining Power | ELS Specifics |

| Switching Costs (Manufactured Homes) | High | Substantial costs and logistical challenges to move homes limit resident mobility and negotiation leverage. |

| Lease Terms | Lowers Power | Average 10-year leases provide predictable revenue and reduce resident leverage. |

| Demand for Affordable Housing | Lowers Power | Rising traditional housing costs in 2024 increase demand for ELS's manufactured home sites. |

| Demographics (Baby Boomers) | Lowers Power | Aging population seeking affordable retirement options increases interest in ELS's communities. |

| Customer Loyalty Programs/Amenities | Lowers Power | Lifestyle amenities and prime locations reduce the likelihood of residents switching solely on price. |

| RV Rental Substitutes | Higher Power (relative) | Transient nature of RV rentals offers more choices and lower switching costs for renters. |

| Economic Sensitivity (RV Rentals) | Higher Power (relative) | Discretionary spending on RV travel is sensitive to economic downturns, giving renters leverage. |

Preview the Actual Deliverable

Equity LifeStyle Porter's Five Forces Analysis

This preview showcases the complete Equity LifeStyle Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the manufactured housing and recreational vehicle resort industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

The manufactured home and RV park sector has traditionally been characterized by a high degree of fragmentation, featuring a multitude of smaller, independently owned businesses. This presents a unique competitive landscape where larger entities are actively seeking to acquire these smaller operations.

Major Real Estate Investment Trusts (REITs), such as Equity LifeStyle Properties and Sun Communities, are at the forefront of this consolidation trend. Their aggressive acquisition strategies are reshaping the industry, creating a more concentrated market with fewer, but larger, dominant players. For instance, Equity Life Properties reported owning 467 properties as of the end of 2023, a testament to its growth through acquisitions.

This intensified consolidation directly fuels competition among these REIT giants. They are now vying more fiercely for prime locations and valuable assets, driving up acquisition costs and increasing the pressure to differentiate and capture market share. The rivalry is no longer just about individual property performance but about strategic portfolio expansion and dominance.

The manufactured housing and recreational vehicle resort sector, including Equity Lifestyle Properties (ELS) and competitors like Sun Communities, demonstrates robust fundamentals. High occupancy rates and steady rent increases are common across major players, indicating a healthy demand environment.

This strong demand allows several large companies to operate successfully. However, it also intensifies competition for both retaining current residents and acquiring desirable new properties.

ELS reported a core community base occupancy of 95.1% in early 2024, underscoring the sector's strong appeal and the competitive landscape for securing and maintaining resident bases.

Equity LifeStyle Properties (ELS) stands out by owning premier properties in sought-after retirement and vacation spots, frequently boasting unique natural features such as waterfront access. This strategic positioning in desirable locations inherently limits direct competition from properties lacking similar advantages.

The company further differentiates itself by offering a lifestyle-focused experience, complete with a wide array of amenities designed to attract and retain residents and guests. For instance, in 2023, ELS reported that its properties offer an average of 3.6 amenities per community, contributing to a higher occupancy rate and less susceptibility to price wars with less amenity-rich competitors.

Geographic Concentration and Regional Competition

Equity Lifestyle Properties (ELS) operates nationwide, but its significant presence in Florida and California creates concentrated regional competition. This geographic focus means ELS often faces intense rivalry from both large, established operators and smaller, local players within these key markets.

The need to maintain market share in these highly competitive areas necessitates strategic pricing and differentiated amenity offerings. For instance, in Florida, ELS competes with numerous other manufactured housing and RV resort operators, many of which have deep roots and local brand loyalty.

- Florida Concentration: ELS holds a substantial number of properties in Florida, a state with a high density of retirement communities and seasonal residents, leading to robust competition.

- California Market Dynamics: California's high cost of living and strong demand for affordable housing options intensify competition for ELS's manufactured housing communities.

- Rivalry Impact: Intense regional rivalry can pressure pricing power and increase operational costs as ELS strives to offer superior amenities and services to attract and retain residents.

Capital-Intensive Nature and Access to Capital

The ownership and operation of manufactured home communities and RV resorts demand significant upfront investment, inherently favoring entities with substantial financial backing. Equity Lifestyle Properties (ELS), as a Real Estate Investment Trust (REIT), benefits from this capital-intensive nature.

ELS's strong access to capital allows for continuous portfolio enhancement through acquisitions, expansions, and property upgrades. In 2024, ELS continued its strategic acquisition pace, adding new communities and expanding existing ones, a feat challenging for smaller, less capitalized competitors. This financial muscle enables ELS to maintain and improve the quality of its assets, offering superior amenities and services that attract and retain residents and guests, thereby solidifying its competitive position.

- Capital Intensity: High upfront costs for land acquisition, development, and infrastructure in manufactured home communities and RV resorts.

- Access to Capital: Well-capitalized REITs like ELS have a distinct advantage in securing financing for growth and improvements.

- Competitive Advantage: Superior access to capital allows ELS to outbid smaller players for prime locations and invest more heavily in property modernization.

- Portfolio Enhancement: ELS's ability to fund acquisitions and upgrades in 2024 directly translates to a higher quality and more attractive product offering compared to less funded rivals.

Competitive rivalry within the manufactured home and RV resort sector is intensifying due to industry consolidation, with major players like Equity Lifestyle Properties (ELS) and Sun Communities aggressively acquiring smaller operators. This trend is creating a landscape dominated by larger entities, leading to increased competition for prime locations and assets. ELS's strategy of acquiring and enhancing properties, exemplified by its 95.1% core community base occupancy in early 2024, highlights the pressure to differentiate and maintain market share in this evolving environment.

| Competitor | 2023 Property Count (Approx.) | 2023 Revenue (Approx. Billions USD) | Key Markets |

|---|---|---|---|

| Equity Lifestyle Properties (ELS) | 467 | 1.3 | Florida, California, Midwest |

| Sun Communities | 500+ | 1.5 | Florida, Texas, Midwest |

| U.S. REITs (Sector Average) | Varies | Varies | Nationwide |

SSubstitutes Threaten

The widening affordability gap between traditional site-built homes and manufactured housing significantly diminishes the threat of substitutes from conventional housing. As of 2024, the median sales price of a new single-family home in the U.S. hovered around $400,000, a stark contrast to the average cost of a new manufactured home, which can range from $80,000 to $150,000 depending on size and features. This substantial price difference makes manufactured homes a compelling and accessible alternative for a growing segment of the population seeking permanent housing solutions.

Equity LifeStyle Properties (ELS) cultivates a distinct lifestyle and community appeal, setting its manufactured housing and RV communities apart from conventional rentals. This focus on curated living experiences, often featuring amenities and social activities, creates a unique value proposition that makes direct substitutes like apartments or traditional single-family homes less attractive to its target demographic.

The company's emphasis on age-restricted communities further refines its market niche, catering to specific preferences for a particular lifestyle and social environment. This specialization reduces the direct threat from substitutes, as potential residents seeking these specific community attributes are less likely to consider generic housing options.

For RV resort and campground guests, traditional hotels, short-term vacation rentals like Airbnb, and other leisure travel options represent substitutes. However, the unique appeal of the RV lifestyle, including direct access to nature and community-focused activities at Equity Lifestyle Properties (ELS) resorts, offers an experience that substitutes often cannot match, ensuring continued demand for ELS's offerings.

In 2024, the travel industry saw continued growth, with the vacation rental market alone projected to reach over $100 billion globally. Despite this, the RV segment, particularly for those seeking immersive outdoor experiences and a sense of community, remains a distinct niche. ELS's focus on providing curated experiences and well-maintained properties differentiates it from more generic lodging options.

Limited Direct Substitutes for Long-Term Manufactured Home Sites

For individuals who own their manufactured homes but lease the land, direct substitutes are scarce. These alternatives often fail to replicate the unique blend of affordability, established community, and available amenities without the significant capital outlay of purchasing land outright. This limited substitutability strengthens Equity LifeStyle's market position.

The primary threat of substitutes for Equity LifeStyle Properties (ELS) stems from the limited direct alternatives available to manufactured home owners who lease their land. These residents value a specific combination of factors that are difficult to replicate elsewhere.

- Affordability: Leasing land in an ELS community is typically more budget-friendly than purchasing a traditional single-family home and its associated land, especially in desirable locations.

- Community and Amenities: ELS communities often provide a strong sense of belonging and access to shared facilities like clubhouses, pools, and recreational activities, which are not always readily available in alternative housing arrangements.

- Niche Market: The segment of the population that owns a manufactured home but leases the land is distinct, reducing the direct competitive pressure from other residential real estate sectors.

- Limited Land Availability: In many markets, the availability of suitable land for developing new manufactured home communities is restricted, further diminishing the threat of substitutes.

Economic Sensitivity of Discretionary Travel

The RV resort and campground segment of Equity LifeStyle Properties (ELS) faces a notable threat from substitutes due to its reliance on discretionary consumer spending. While manufactured home site leases offer a stable revenue base, the RV travel market is sensitive to economic conditions.

During economic downturns, consumers often cut back on non-essential expenses like RV vacations. This can lead them to seek cheaper alternatives, such as staying home, visiting local parks, or engaging in other forms of recreation that don't involve significant travel or accommodation costs. For instance, in 2023, while overall travel spending showed resilience, a significant portion of consumers indicated they were prioritizing value and looking for ways to save on trips, a trend likely to continue into 2024.

- Economic Downturn Impact: Reduced discretionary income directly affects the ability and willingness of consumers to spend on RV travel.

- Alternative Recreation: Cheaper or free recreational activities, like local camping or day trips, become more attractive substitutes.

- Shifting Preferences: Changes in consumer preferences towards more budget-friendly travel options can divert demand away from RV resorts.

- 2024 Outlook: Analysts project continued consumer focus on value and cost-saving measures, potentially increasing the appeal of substitutes for ELS's RV segment.

The threat of substitutes for Equity LifeStyle Properties (ELS) is generally low for its manufactured housing segment, primarily due to the unique value proposition of leased land communities. The significant affordability gap, with new single-family homes averaging around $400,000 in 2024 compared to manufactured homes costing $80,000-$150,000, makes traditional housing a less viable substitute. Furthermore, ELS's focus on lifestyle and specialized communities, particularly age-restricted ones, creates a distinct market niche that generic housing options struggle to replicate.

However, the RV resort and campground segment faces a more pronounced threat from substitutes, largely driven by discretionary spending and economic sensitivities. During economic slowdowns, consumers tend to prioritize value, making cheaper alternatives like local camping or staying home more appealing. For instance, consumer surveys in 2023 and the outlook for 2024 indicated a continued focus on cost-saving measures for travel.

| Segment | Primary Substitutes | Key Differentiators for ELS | 2024 Market Context |

|---|---|---|---|

| Manufactured Housing (Leased Land) | Traditional Site-Built Homes, Apartments | Affordability, Community, Amenities, Niche Market | Affordability gap remains wide; limited land availability |

| RV Resorts & Campgrounds | Hotels, Short-Term Rentals (Airbnb), Local Camping, Staying Home | Immersive Outdoor Experience, Community Activities, Curated Properties | Discretionary spending sensitive; consumer focus on value |

Entrants Threaten

The most significant barrier for new manufactured home communities and RV resorts entering the market is the sheer difficulty in securing zoning and permits from local governments. This process can be lengthy, complex, and often involves navigating public opposition.

Municipalities frequently exhibit reluctance to approve new developments of this nature. This hesitancy stems partly from negative public perceptions surrounding manufactured housing and the reality that these properties often contribute less in tax revenue compared to traditional residential developments.

Developing new manufactured housing communities or RV resorts demands immense upfront capital. This includes the significant expense of acquiring sizable tracts of land, often in prime locations. For instance, in 2024, land acquisition costs in desirable Sun Belt states can easily run into millions of dollars per parcel, making it a substantial hurdle for any new player looking to enter the Equity Lifestyle Properties market.

Equity Lifestyle Properties (ELS) benefits from substantial economies of scale, leveraging its extensive portfolio of manufactured home communities and RV resorts across the nation. This scale allows for more efficient property management, centralized purchasing power, and optimized operational costs, creating a significant barrier for new entrants seeking to match these efficiencies. For instance, in 2023, ELS reported total revenue of $1.3 billion, showcasing the financial muscle derived from its widespread operations.

Furthermore, ELS boasts a well-established brand reputation built over decades in the lifestyle and retirement living sector. This brand recognition fosters customer loyalty and trust, making it difficult for newcomers to attract residents and tenants quickly. New entrants would face considerable marketing expenses and time investment to build a comparable level of credibility and market penetration, especially considering ELS's consistent performance and investor confidence, as evidenced by its steady dividend payouts.

Existing Market Saturation in Desirable Locations

Many of Equity LifeStyle Properties' (ELS) most attractive locations, often featuring waterfront access or proximity to popular recreational areas, are already fully developed. This scarcity of prime, irreplaceable sites significantly raises the barrier to entry for new competitors aiming to establish similar high-quality communities.

The limited availability of suitable land in these desirable areas means potential new entrants face substantial challenges in acquiring sites that can rival ELS's established footprint and location advantages. For instance, as of early 2024, the demand for well-located recreational land continues to outstrip supply, making greenfield development in prime spots exceptionally difficult and costly.

- Limited Greenfield Opportunities: Prime locations, particularly coastal or lakeside sites, are largely occupied, restricting new entrants to less desirable or already developed parcels.

- High Acquisition Costs: The scarcity of available land in sought-after areas drives up acquisition costs, making it economically challenging for new players to compete.

- Zoning and Permitting Hurdles: Even when land is available, navigating complex zoning regulations and obtaining permits for new developments, especially in environmentally sensitive or established communities, can be a lengthy and expensive process.

Experienced Management and Industry Expertise

Equity LifeStyle Properties benefits from a seasoned management team boasting extensive industry expertise. Their decades of experience in property management and strategic acquisitions create a formidable barrier for potential newcomers. This deep well of knowledge, essential for navigating the complexities of the manufactured housing and recreational vehicle resort sectors, is not easily replicated.

New entrants would face significant hurdles in developing the same level of operational efficiency and market insight that Equity LifeStyle Properties has cultivated. For instance, as of the first quarter of 2024, Equity LifeStyle Properties reported total revenue of $347.7 million, demonstrating their established scale and operational capacity. This financial strength, coupled with their management's proven ability to identify and integrate new properties, makes it challenging for less experienced entities to compete effectively.

- Deep Industry Knowledge: Equity LifeStyle Properties' management has a long history in the sector, understanding market dynamics and operational best practices.

- Proven Track Record: The team has a history of successful property management and strategic acquisitions, building a reputation and operational infrastructure.

- Barriers to Entry: This accumulated expertise and demonstrated success act as a significant deterrent for new companies attempting to enter the market.

- Operational Scale: With substantial revenue streams, like the $347.7 million in Q1 2024, the company possesses an operational scale that new entrants would struggle to match quickly.

The threat of new entrants for Equity Lifestyle Properties (ELS) is relatively low, primarily due to substantial capital requirements and regulatory complexities. Securing permits and zoning for manufactured home communities and RV resorts is a significant hurdle, often met with municipal reluctance and public opposition, as new developments can be perceived as less beneficial tax-wise compared to traditional housing.

High upfront capital for land acquisition, especially in desirable areas, presents another major barrier. For example, prime land in Sun Belt states in 2024 can cost millions per parcel. Furthermore, ELS benefits from economies of scale, with $1.3 billion in revenue in 2023, and a strong brand reputation, making it difficult for newcomers to achieve similar operational efficiencies and market penetration.

| Barrier | Description | Impact on New Entrants |

| Zoning & Permitting | Lengthy, complex, and often faces public opposition. | Significant delay and cost, potentially blocking entry. |

| Capital Requirements | High upfront costs for land acquisition in prime locations. | Makes entry economically challenging; millions needed for land alone. |

| Economies of Scale | ELS's large portfolio allows for lower per-unit costs. | New entrants struggle to match operational efficiencies and pricing. |

| Brand Reputation | Decades of established trust and customer loyalty. | Newcomers face high marketing costs and time to build credibility. |

Porter's Five Forces Analysis Data Sources

Our Equity Lifestyle Properties Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's SEC filings, investor relations materials, and industry-specific market research reports.

We also incorporate insights from reputable financial data providers and macroeconomic indicators to provide a comprehensive understanding of the competitive landscape.