Equity LifeStyle PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity LifeStyle Bundle

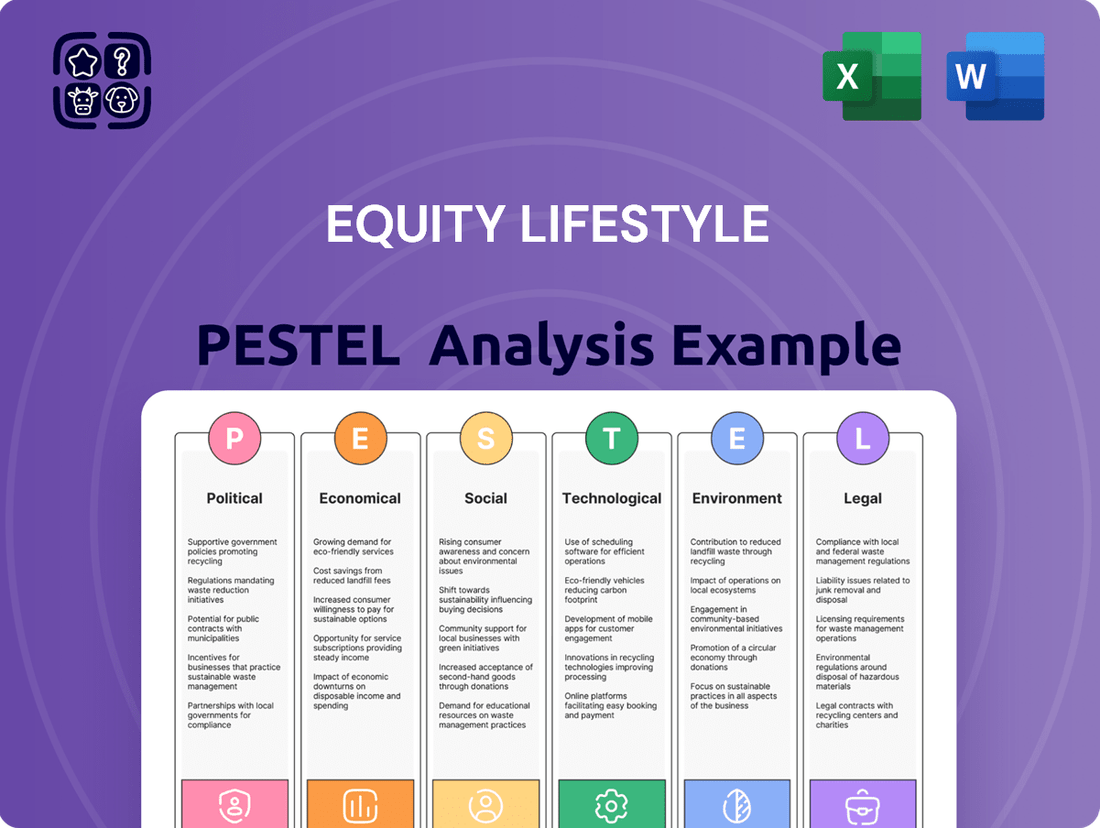

Gain a strategic advantage with our in-depth PESTLE Analysis for Equity Lifestyle. We dissect the political, economic, social, technological, legal, and environmental factors impacting the company's operations and future growth. Understand the landscape to make informed decisions and anticipate market shifts.

Unlock crucial insights into the external forces shaping Equity Lifestyle's success. From evolving consumer preferences to regulatory changes, our comprehensive analysis provides the clarity you need to navigate the complex market. Download the full PESTLE analysis now and empower your strategy.

Political factors

Government policies aimed at addressing housing shortages, particularly affordable housing, can significantly impact Equity Lifestyle Properties (ELS). Initiatives that promote manufactured homes as a viable solution, such as revised zoning laws and expanded financing options, directly benefit the company by increasing the appeal and accessibility of its core product.

For instance, the USDA's expansion of financing for existing manufactured homes, effective March 2025, is projected to boost demand for sites within ELS communities. This policy change is expected to make homeownership more attainable for a wider demographic, potentially leading to higher occupancy rates and rental income for ELS.

Equity LifeStyle Properties' (ELS) operations are significantly shaped by local and federal zoning and land use regulations, impacting everything from community development to expansion. These policies dictate where manufactured home communities and RV parks can be established and how they can be utilized, presenting both opportunities and constraints for ELS.

Recent shifts, such as the U.S. Department of Housing and Urban Development's (HUD) elimination of the Affirmatively Furthering Fair Housing (AFFH) rule in 2020, have amplified the influence of local governments. This change grants municipalities greater autonomy in zoning decisions, potentially leading to a more fragmented landscape of development opportunities and challenges across different regions where ELS operates.

The upcoming updates to the HUD Code for manufactured homes, effective September 2025, are set to significantly reshape the industry. These revisions, which include provisions for multi-unit dwellings and contemporary architectural styles, could boost the desirability and sales potential of homes within Equity LifeStyle Properties (ELS) communities.

For instance, the allowance for multi-unit designs might open new avenues for ELS to develop more diverse housing options, potentially attracting a broader demographic of residents. Furthermore, the embrace of modern aesthetics aligns with evolving consumer preferences, making ELS properties more competitive against traditional housing markets.

Interest Rate Policies of Central Banks

Central bank interest rate policies, like those enacted by the Federal Reserve, directly influence the cost of borrowing for real estate investment trusts (REITs) such as Equity Lifestyle Properties (ELS). For instance, the Fed's decision to maintain its target range for the federal funds rate at 5.25%-5.50% through early 2025, following a series of rate hikes, means that financing costs for ELS remain elevated compared to periods of lower rates. This can temper expansion plans and property development due to increased capital expenses.

Conversely, any anticipated or actual rate cuts, potentially signaled by economic data in late 2024 or early 2025, could significantly benefit ELS. Lower borrowing costs would make it more attractive for ELS to finance new acquisitions and undertake property upgrades, potentially boosting its portfolio growth and profitability. For example, a hypothetical 0.25% rate cut could reduce annual interest expenses on a substantial debt portfolio by millions of dollars.

The market's expectation of future interest rate movements also plays a crucial role. If the market anticipates further rate cuts in 2025 due to moderating inflation, this could provide a positive outlook for ELS's financing environment.

- Federal Reserve's Federal Funds Rate Target: Maintained at 5.25%-5.50% as of early 2025, impacting ELS's borrowing costs.

- Impact of Rate Hikes: Elevated capital costs can slow down acquisition and development activities for ELS.

- Potential Benefit of Rate Cuts: Lower interest rates would reduce financing expenses, encouraging ELS to expand and improve its properties.

- Market Expectations: Anticipation of future rate cuts can positively influence ELS's strategic financial planning.

Regulatory Environment for RV and Campground Industry

The RV and campground industry operates under a complex web of regulations concerning health, safety, and environmental protection. These rules, which vary significantly by state and local jurisdiction, directly influence operational costs and compliance burdens for companies like Equity Lifestyle Properties (ELS). For instance, stringent waste disposal regulations or specific water quality standards can necessitate substantial capital investments in infrastructure upgrades.

ELS must navigate these diverse regulatory landscapes to ensure its numerous RV resorts and campgrounds remain compliant. Failure to adhere to these mandates can result in significant financial penalties and reputational damage. For example, in 2023, the Environmental Protection Agency (EPA) continued to enforce regulations aimed at protecting water resources, impacting campground operations that manage wastewater and stormwater runoff.

- Health and Safety: Regulations often dictate sanitation standards, fire safety protocols, and accessibility requirements for facilities and campsites.

- Environmental Standards: Compliance with rules on waste management, water usage, and protection of natural habitats is critical.

- Zoning and Land Use: Local zoning laws significantly impact where new campgrounds can be established and how existing ones can be expanded or modified.

- Permitting: Obtaining and maintaining various permits for construction, operation, and specific activities (like food service) is a constant requirement.

Government policies encouraging manufactured housing, such as the USDA's expanded financing for existing manufactured homes effective March 2025, directly benefit Equity Lifestyle Properties (ELS) by increasing demand for its sites. Updates to the HUD Code for manufactured homes, slated for September 2025, which allow for multi-unit designs and modern aesthetics, are also poised to enhance the appeal and sales of homes within ELS communities.

What is included in the product

The Equity LifeStyle PESTLE Analysis meticulously examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions shape the company's operational landscape and strategic direction.

A clear and actionable PESTLE analysis for Equity LifeStyle, designed to proactively identify and mitigate external threats, thereby easing concerns about market volatility and competitive pressures.

Economic factors

Inflationary pressures directly affect Equity Lifestyle Properties' (ELS) operational costs. Rising prices for labor, utilities, and essential maintenance services can squeeze profit margins if not effectively managed or passed on to residents.

ELS has demonstrated resilience in cost management, notably achieving a reduction in property and casualty insurance premiums during the first quarter of 2025. This suggests a proactive approach to controlling certain expense categories.

However, sustained high inflation across multiple cost centers, particularly for utilities and labor, could present ongoing challenges for ELS in maintaining its operating expense ratios, even with effective current management strategies.

Consumer spending and disposable income are critical for Equity Lifestyle Properties (ELS), as many of its offerings, like RV and vacation rentals, are discretionary purchases. When people have more money left over after essential expenses, they are more likely to spend on leisure activities such as road trips and camping.

The outlook for 2024 and into 2025 suggests continued resilience in consumer spending, with personal consumption expenditures expected to grow moderately. For instance, in Q1 2024, real disposable income saw an increase, which bodes well for ELS's ability to attract customers to its RV resorts and marina businesses.

The persistent housing affordability crisis is significantly boosting the appeal of manufactured homes as a more budget-friendly option compared to conventional houses. This situation is a key driver for demand in the manufactured housing sector, benefiting companies like Equity LifeStyle Properties that manage communities catering to this growing need for accessible housing solutions.

Data from the U.S. Census Bureau in early 2024 indicated that the median sales price of new manufactured homes was approximately $133,000, a stark contrast to the median price of new site-built single-family homes, which often exceeds $400,000. This substantial price difference makes manufactured homes a compelling choice for a broad segment of the population struggling with rising housing costs.

Real Estate Market Valuations and Cap Rates

Real estate market valuations and cap rates are crucial for Equity Lifestyle Properties (ELS). Fluctuations here directly impact the worth of ELS's existing properties and its ability to acquire new ones. For instance, rising interest rates throughout 2023 and into 2024 generally pushed cap rates higher, meaning investors expected a greater return for the risk, which can depress property values.

However, the outlook for 2025 suggests a potential shift. If interest rates begin to stabilize or even decrease, this could lead to lower cap rates. Lower cap rates typically translate to higher property valuations, making ELS's portfolio more valuable and potentially attracting more investment into the manufactured housing and RV resort sectors.

- 2023-2024 Interest Rate Environment: The Federal Reserve's aggressive rate hikes throughout this period increased borrowing costs, putting pressure on real estate valuations.

- Cap Rate Trends: While specific ELS portfolio cap rates aren't publicly detailed, general market trends for similar asset classes saw cap rates widen by 25-75 basis points in many sectors during 2023.

- 2025 Outlook: Projections for 2025 anticipate a potential easing of monetary policy, which could lead to cap rate compression and a subsequent increase in property values for well-positioned assets like those held by ELS.

- Investment Attraction: A more favorable interest rate environment in 2025 is expected to boost investor confidence and capital flow into real estate, benefiting ELS's growth and acquisition strategies.

Access to Capital and Financing for REITs

Equity Lifestyle Properties (ELS), like all Real Estate Investment Trusts (REITs), relies heavily on its ability to access capital. This is fundamental for acquiring new properties, developing existing ones, and refinancing debt. The cost and availability of this capital are directly tied to broader economic conditions and investor confidence.

Interest rates significantly influence financing costs for REITs. For instance, the Federal Reserve's benchmark interest rate, which impacts borrowing costs across the economy, plays a crucial role. As of early 2024, while rates have stabilized compared to late 2023 highs, they remain elevated, potentially increasing ELS’s cost of capital for new debt or refinancing existing obligations.

Investor sentiment towards the real estate sector, and specifically towards manufactured housing and RV parks where ELS operates, is another key factor. Positive sentiment can lead to greater demand for REIT shares and bonds, making capital raising easier and more affordable. Conversely, negative sentiment can tighten financing conditions and increase borrowing expenses.

- Interest Rate Environment: As of Q1 2024, benchmark rates remain a key consideration, impacting the cost of debt for ELS.

- Investor Confidence: REITs, including ELS, benefit from strong investor demand, which can be influenced by economic outlook and sector performance.

- Capital Markets Access: The ability for ELS to issue new equity or debt at favorable terms is directly linked to the health of capital markets.

- Financing Costs: Higher interest rates generally translate to increased costs for ELS when securing new loans or refinancing existing debt.

Economic factors significantly influence Equity Lifestyle Properties (ELS) operations and valuation. Persistent inflation can increase operational costs, impacting profit margins if not effectively managed through price adjustments or cost containment, as seen in ELS's efforts to reduce insurance premiums in early 2025.

Consumer spending, driven by disposable income, directly fuels demand for ELS's recreational offerings like RV resorts. The projected moderate growth in personal consumption expenditures for 2024 and 2025, supported by increases in real disposable income in early 2024, bodes well for ELS's revenue streams.

The affordability of housing is a strong tailwind for ELS, with manufactured homes offering a substantially cheaper alternative to traditional housing. The median price of new manufactured homes around $133,000 in early 2024, compared to over $400,000 for site-built homes, highlights this trend and benefits ELS's manufactured housing communities.

Interest rates and cap rates are critical for ELS's property valuations and acquisition strategies. While higher rates in 2023-2024 increased borrowing costs and potentially widened cap rates, the 2025 outlook suggests potential rate stabilization or easing, which could compress cap rates and boost property values.

| Economic Factor | Impact on ELS | Key Data/Outlook (2024-2025) |

|---|---|---|

| Inflation | Increases operational costs (utilities, labor) | Proactive cost management, e.g., Q1 2025 insurance premium reduction. Sustained high inflation remains a risk. |

| Consumer Spending/Disposable Income | Drives demand for RV resorts and vacation rentals | Projected moderate growth in personal consumption expenditures; Q1 2024 saw real disposable income increase. |

| Housing Affordability | Boosts demand for manufactured housing | Median new manufactured home price ~$133k (early 2024) vs. site-built homes >$400k. |

| Interest Rates & Cap Rates | Affects property valuation and cost of capital | Rates elevated in 2023-2024; 2025 outlook suggests potential stabilization/easing, possibly compressing cap rates and increasing valuations. |

Full Version Awaits

Equity LifeStyle PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Equity LifeStyle Properties delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed strategic overview.

Sociological factors

The aging population is a significant tailwind for Equity Lifestyle Properties. As more individuals reach retirement age, the demand for housing solutions tailored to their needs, like those offered by Equity Lifestyle, naturally increases. This demographic trend is projected to continue, ensuring a steady stream of potential residents for their communities.

In 2024, the U.S. Census Bureau projects that individuals aged 65 and over will constitute a substantial portion of the population, with this segment expected to grow. Equity Lifestyle's focus on age-restricted communities positions them favorably to capture this expanding market. For instance, by the end of 2023, a significant percentage of their residents were in the retirement age bracket, demonstrating the direct benefit of this demographic shift.

Retirement trends, including a desire for active adult living and a preference for leasing over homeownership, further bolster Equity Lifestyle's business model. Many retirees are seeking hassle-free living arrangements, which their manufactured home communities provide. This aligns with evolving preferences for flexibility and community engagement among older adults, a trend that is expected to persist through 2025 and beyond.

Equity LifeStyle Properties thrives on catering to a growing demand for lifestyle-focused communities. This sociological shift sees people actively seeking environments that offer more than just housing; they want amenities, organized social activities, and a strong sense of community, especially within manufactured housing and RV resort spaces.

This preference is evident as the U.S. population continues to age, with the number of individuals aged 65 and over projected to reach 80 million by 2040, a significant portion of whom may seek community living. For instance, manufactured housing communities, a key focus for Equity LifeStyle, offer a more affordable and social alternative to traditional retirement living, appealing to this demographic's desire for connection and engagement.

The increasing embrace of outdoor recreation, particularly among younger demographics like Gen Z and Millennials, is a significant sociological driver for companies like Equity LifeStyle Properties (ELS). This trend translates directly into heightened demand for RV resorts and campgrounds, as more people seek experiences in nature.

Data from the RV Industry Association indicates a surge in RV shipments, with projections for 2024 and 2025 showing continued robust growth, signaling a sustained interest in this lifestyle. This expanding RV culture directly fuels ELS's core business, as these travelers require destinations.

Demand for Affordable and Flexible Living Options

Societal trends are increasingly pointing towards a need for living arrangements that are both budget-friendly and adaptable. Manufactured homes and the RV lifestyle are emerging as attractive solutions for a broad range of individuals and families looking for cost-effective housing that doesn't sacrifice comfort or personal preferences.

This demand is fueled by economic pressures and a desire for greater financial freedom. For instance, the median home price in the U.S. continued its upward trend through 2024, making traditional homeownership a significant challenge for many. This economic reality makes alternatives like manufactured housing, which can be substantially more affordable, increasingly appealing.

- Affordability: Manufactured homes can cost significantly less than site-built homes, offering a crucial entry point into homeownership.

- Flexibility: RV living and manufactured home communities provide options for those who may need to relocate for work or prefer a less permanent housing commitment.

- Demographic Appeal: These options resonate with various age groups, from young adults seeking independence to retirees looking to downsize or travel.

- Market Growth: The manufactured housing sector saw continued growth in new home shipments, with over 90,000 new manufactured homes shipped in 2023, indicating strong and sustained demand.

Changing Work-Life Balance and Digital Nomads

The increasing emphasis on work-life balance has significantly reshaped employment trends, with remote work becoming a permanent fixture for many. This shift has fueled the rise of digital nomads, a growing demographic actively seeking flexible living arrangements. For Equity Lifestyle (ELS), this translates into a demand for properties that cater to a mobile workforce, requiring robust Wi-Fi and workspaces.

The digital nomad movement is not a fleeting trend; it's a fundamental change in how people work and live. Consider that in 2024, an estimated 35 million Americans identified as digital nomads, a substantial increase from previous years. These individuals often prioritize locations offering both recreational opportunities and reliable infrastructure to support their professional needs.

- Remote Work Growth: By 2025, it's projected that 32% of all jobs will be fully remote, up from just 5% in 2019.

- Digital Nomad Demographics: The average digital nomad is often in their early 30s, with a significant portion working in tech or creative fields.

- Connectivity Needs: Reliable, high-speed internet is a non-negotiable for digital nomads, directly impacting their choice of accommodation.

- Amenities Demand: Beyond just Wi-Fi, these individuals seek community spaces, co-working facilities, and convenient access to services.

The societal shift towards valuing experiences over possessions strongly benefits Equity Lifestyle Properties. Consumers are increasingly prioritizing travel and leisure, which directly fuels demand for RV resorts and manufactured home communities offering lifestyle amenities. This trend is projected to continue through 2025, as individuals seek engaging and active retirement or living arrangements.

The growing acceptance of diverse living arrangements, including manufactured housing and RV lifestyles, caters to a broad demographic seeking affordability and flexibility. As traditional homeownership becomes more challenging, these alternatives offer accessible pathways to secure and comfortable living, appealing to both younger individuals and retirees.

The increasing prevalence of remote work and the rise of digital nomads present a significant opportunity for Equity Lifestyle. These individuals require flexible, well-connected living spaces that accommodate their mobile lifestyles, driving demand for properties offering robust Wi-Fi and community amenities.

| Sociological Factor | Description | Impact on Equity Lifestyle Properties | Relevant Data (2024/2025 Projections) |

|---|---|---|---|

| Aging Population | Increasing number of individuals reaching retirement age. | Drives demand for age-restricted communities and lifestyle-focused housing. | By 2030, all Baby Boomers will be 65 or older; U.S. population aged 65+ projected to reach 73.1 million by 2030. |

| Desire for Experiences | Shift from material possessions to valuing travel and leisure. | Boosts demand for RV resorts and recreational communities. | RV shipments projected to remain strong in 2024-2025, with increased consumer interest in outdoor recreation. |

| Affordability & Flexibility | Need for cost-effective and adaptable housing solutions. | Increases appeal of manufactured homes and RV living. | Median home prices continue to rise, making alternatives like manufactured housing increasingly attractive. |

| Remote Work & Digital Nomads | Growing trend of working remotely and living a mobile lifestyle. | Creates demand for properties with reliable connectivity and amenities for mobile workers. | Projected 32% of all jobs to be fully remote by 2025; estimated 35 million digital nomads in the U.S. in 2024. |

Technological factors

The increasing integration of smart home and Internet of Things (IoT) technologies is transforming the manufactured housing and RV sectors. For Equity Lifestyle Properties (ELS), this means residents can enjoy enhanced convenience, improved safety features like remote monitoring, and greater energy efficiency through smart thermostats and lighting. This trend is already impacting the market, with the global smart home market projected to reach over $200 billion by 2025, indicating a significant consumer appetite for connected living solutions.

ELS can capitalize on these technological advancements by incorporating smart amenities into its communities and rental units. This could involve offering pre-installed smart home hubs, smart locks for enhanced security, or energy management systems that reduce utility costs for both residents and the company. For instance, smart RV parks could offer automated check-in processes and Wi-Fi management, streamlining operations and improving the guest experience.

Technological advancements are revolutionizing home manufacturing. Automation and robotics are streamlining production lines, leading to increased efficiency and consistent quality in manufactured homes. For Equity LifeStyle Properties (ELS), this translates to potentially better-designed homes and a reduction in acquisition costs, enhancing the overall value proposition for residents.

The adoption of advanced construction techniques, such as modular building and 3D printing, is further driving innovation. These methods allow for faster build times and can reduce material waste, contributing to greater affordability. In 2024, the manufactured housing sector is seeing a growing interest in these technologies, with some builders reporting up to a 20% reduction in construction time through prefabrication.

Equity Lifestyle Properties (ELS) leverages digital platforms extensively for marketing and bookings, a strategy proving vital for resident and guest acquisition. The company's website saw a substantial increase in traffic, with over 10 million unique visitors in 2023, underscoring the importance of its online presence for revenue generation, particularly within the transient RV market which relies heavily on digital discovery and booking.

This digital engagement extends to community building, with ELS's social media channels experiencing a 25% year-over-year growth in followers during 2024, fostering resident loyalty and attracting new customers. The ease of online bookings through their platforms directly impacts occupancy rates and revenue, especially as consumers increasingly prefer digital channels for travel arrangements.

Enhanced Connectivity and Infrastructure

Enhanced connectivity is no longer a luxury but a necessity for Equity Lifestyle properties. The increasing prevalence of remote work and the demand for seamless streaming services mean that reliable, high-speed Wi-Fi and strong cellular reception are critical for resident and guest satisfaction. For instance, a 2024 survey indicated that over 70% of RV travelers consider Wi-Fi quality a top factor when choosing a park.

This technological shift necessitates significant investment in robust broadband infrastructure. Equity Lifestyle's communities, whether RV parks or manufactured home neighborhoods, must treat advanced internet access as a fundamental utility, akin to water or electricity. Companies like Equity Lifestyle Properties are likely to see increased capital expenditure in 2024 and 2025 dedicated to upgrading network capabilities to meet these evolving expectations.

- Demand for high-speed Wi-Fi and cellular service is a key driver for property selection.

- Remote work trends amplify the need for reliable internet access in residential communities.

- Broader broadband infrastructure is becoming a standard expectation for RV parks and manufactured home communities.

- Investment in network upgrades is crucial for maintaining competitive advantage and resident satisfaction.

Electric Vehicle (EV) Charging Infrastructure

The growing popularity of electric vehicles, including RVs, directly impacts Equity Lifestyle (ELS) by requiring more charging stations at their properties. This trend is significant, with global EV sales projected to reach approximately 16.5 million units in 2024, a substantial increase from previous years.

ELS must invest in upgrading its electrical systems to handle the increased power needs of EV charging. This presents a strategic opportunity to cater to environmentally aware travelers, a demographic increasingly seeking sustainable travel options. For instance, by mid-2024, over 1.5 million public EV charging points were estimated to be operational worldwide.

- EV Adoption Growth: Global EV sales are on a strong upward trajectory, creating demand for charging infrastructure.

- Infrastructure Investment: ELS needs to allocate capital for electrical upgrades to support EV charging.

- Market Opportunity: Offering EV charging can attract a growing segment of eco-conscious consumers.

- Operational Challenge: Managing higher energy loads requires careful planning and execution.

Technological advancements are reshaping how Equity Lifestyle Properties (ELS) operates and serves its residents. The integration of smart home technology and the Internet of Things (IoT) offers enhanced convenience and safety, with the global smart home market expected to exceed $200 billion by 2025. ELS can leverage these innovations by incorporating smart amenities, improving operational efficiency in RV parks through automated systems, and benefiting from more efficient, cost-effective manufactured home production driven by automation and advanced construction techniques like modular building.

The company's digital presence is crucial for customer acquisition and engagement, as evidenced by over 10 million unique website visitors in 2023 and a 25% year-over-year growth in social media followers during 2024. This digital focus is essential as reliable, high-speed internet access is now a critical expectation for residents and guests, with over 70% of RV travelers in a 2024 survey citing Wi-Fi quality as a top selection factor. Consequently, ELS is likely to see increased capital expenditure in 2024-2025 for network infrastructure upgrades to meet these demands.

The burgeoning electric vehicle (EV) market presents both opportunities and infrastructure requirements for ELS. With global EV sales projected to reach around 16.5 million units in 2024 and over 1.5 million public charging points estimated worldwide by mid-2024, ELS must invest in upgrading electrical systems to accommodate charging stations. This investment caters to the growing segment of eco-conscious consumers and addresses the increasing demand for EV charging facilities within their communities.

| Technology Area | Impact on ELS | Key Data/Projections |

| Smart Home/IoT | Enhanced resident convenience, safety, and energy efficiency; operational improvements in RV parks. | Global smart home market > $200 billion by 2025. |

| Digital Platforms | Crucial for marketing, bookings, and community engagement; drives occupancy and revenue. | 10M+ unique website visitors (2023); 25% YoY social media follower growth (2024). |

| Connectivity (Wi-Fi/Cellular) | Essential for resident/guest satisfaction; influences property selection. | 70%+ RV travelers cite Wi-Fi quality as a top factor (2024). |

| EV Charging Infrastructure | Requires electrical system upgrades; opportunity to attract eco-conscious consumers. | Global EV sales ~16.5M units (2024); 1.5M+ public EV charging points (mid-2024). |

Legal factors

Equity LifeStyle Properties navigates a dense regulatory landscape, encompassing federal and state mandates for manufactured housing. These rules cover everything from how homes are built and made safe to how they're installed and whether they meet accessibility needs.

The U.S. Department of Housing and Urban Development (HUD) Code, with significant updates set for March and September 2025, will directly impact new home installations and any renovation projects. Compliance ensures safety and quality, but also adds to operational costs and complexity.

RV park and campground zoning laws are a critical legal factor for Equity Lifestyle Properties (ELS). These regulations differ greatly across states and even local municipalities, often falling under residential, commercial, or mixed-use classifications. For instance, in 2024, a new development proposed by ELS in a particular county might face stricter regulations if zoned as purely residential compared to a mixed-use designation.

Navigating this intricate web of regulations requires ELS to secure special use permits and meticulously follow development guidelines. Failure to do so can lead to significant legal challenges and operational disruptions. In 2025, ELS will likely continue to invest resources in legal counsel and compliance teams to ensure all their properties, such as those in their Sun Communities portfolio, meet evolving zoning requirements, preventing costly fines or project delays.

Equity Lifestyle Properties (ELS) must navigate a complex landscape of fair housing and anti-discrimination laws. These regulations, such as the Fair Housing Act, prohibit discrimination in housing transactions based on race, color, religion, sex, familial status, national origin, and disability. ELS's commitment to these principles is crucial for ethical operations and to avoid legal repercussions.

The regulatory environment is dynamic. For instance, the Affirmatively Furthering Fair Housing (AFFH) rule's rescission and subsequent potential reinstatement or modification by the Biden administration in late 2023 and into 2024 necessitates ELS's vigilance. This rule encourages proactive steps to address housing segregation and discrimination, impacting how ELS develops and manages its communities. Staying abreast of these evolving federal and local policy shifts is paramount.

Environmental Regulations and Permitting

Environmental regulations, covering water conservation, waste disposal, and land use, are paramount for Equity Lifestyle Properties (ELS), especially at its numerous campgrounds and RV resorts. These rules directly impact how ELS manages its land and facilities, ensuring sustainable operations. For instance, in 2023, ELS reported ongoing efforts to comply with evolving state and local environmental standards across its portfolio, which spans over 450 properties in 33 states.

Compliance with environmental impact assessments and securing the required permits are not just procedural but are fundamental to the continuity of ELS's business. Failure to adhere to these can lead to significant operational disruptions and financial penalties. ELS actively monitors regulatory changes, particularly those concerning water usage in drought-prone areas like California and Arizona, where many of its properties are located.

- Water Conservation: ELS implements water-saving technologies and practices, especially in regions facing water scarcity, aiming to meet or exceed local conservation mandates.

- Waste Management: Strict adherence to waste disposal regulations, including recycling programs and proper handling of potentially hazardous materials, is a key operational focus.

- Land Use Permitting: Obtaining and maintaining land use permits for new developments or expansions is crucial, requiring thorough environmental reviews and community engagement.

- Regulatory Monitoring: ELS dedicates resources to track and adapt to new and changing environmental laws, ensuring ongoing compliance and mitigating potential risks.

Property Rights and Tenant Laws

Equity Lifestyle Properties (ELS) operates fundamentally by leasing homesites, making property rights and tenant laws paramount. These regulations, which differ significantly across states, directly shape ELS's ability to manage rental income and maintain positive resident relationships. For instance, in 2024, states continue to grapple with tenant protection measures, potentially influencing lease renewal terms and rent increase allowances within manufactured home communities.

Key legal considerations for ELS include:

- State-specific landlord-tenant acts: These govern lease agreements, eviction processes, and resident rights, with varying levels of protection.

- Zoning and land use regulations: Local ordinances impact community development and expansion, affecting ELS's strategic growth.

- Property tax laws: Changes in property taxation can directly influence operating costs and, consequently, rental rates.

Legal factors significantly shape Equity Lifestyle Properties' operations, particularly concerning manufactured housing and RV park regulations. The U.S. Department of Housing and Urban Development (HUD) Code, with updates expected in 2025, directly impacts new home installations and renovations, influencing safety standards and compliance costs.

Zoning laws for RV parks and campgrounds vary widely by locality, affecting ELS's development strategies and requiring careful navigation of permits and guidelines to avoid legal challenges and operational disruptions. In 2024, ELS must remain vigilant regarding these diverse local requirements.

Fair housing and anti-discrimination laws, such as the Fair Housing Act, are critical for ELS's ethical operations and legal compliance, requiring proactive adherence to prevent discrimination claims. ELS must also monitor evolving federal policies like the Affirmatively Furthering Fair Housing rule, which could impact community development practices in 2024 and beyond.

Environmental regulations, including water conservation and waste disposal mandates, are crucial for ELS's sustainable operations, especially in water-scarce regions. Compliance with environmental impact assessments and land use permits is essential for business continuity, with ELS actively monitoring changes in 2024.

Environmental factors

Climate change presents a significant environmental challenge for Equity Lifestyle Properties (ELS). The increasing frequency and intensity of extreme weather events, like hurricanes and severe storms, directly threaten ELS's portfolio, especially properties located in coastal or storm-prone regions. In 2024, for instance, the Atlantic hurricane season was projected to be unusually active, with forecasts suggesting a higher-than-average number of storms, which could impact ELS's operational stability and property values in affected areas.

These events can result in substantial financial burdens for ELS. Direct impacts include potential property damage, leading to increased capital expenditures for repairs and recovery. Furthermore, such events often cause temporary or prolonged occupancy losses, directly affecting rental income. The rising cost of insurance premiums, driven by increased climate-related risks, also adds to operating expenses, potentially squeezing profit margins for the company.

Water scarcity is a growing concern, particularly for Equity LifeStyle Properties (ELS) with locations in drought-prone areas like California and Arizona. For instance, California experienced severe drought conditions in 2022-2023, impacting water availability and increasing costs for many businesses. ELS's commitment to water conservation and efficient management systems is therefore crucial for operational continuity and cost control.

Implementing water-saving technologies, such as low-flow fixtures and smart irrigation systems, is becoming a standard practice. These initiatives not only reduce consumption but also contribute to lower utility expenses, a key factor in maintaining profitability. By proactively managing water resources, ELS can mitigate risks associated with water shortages and regulatory changes.

Real estate companies, including Equity Lifestyle Properties (ELS), face increasing demands to integrate energy-efficient designs and embrace renewable energy. This shift is driven by both regulatory pressures and growing consumer preference for sustainable living environments.

ELS can strategically implement solar energy installations across its properties. For instance, as of Q1 2024, ELS reported progress in its solar initiatives, contributing to a reduction in utility expenses and enhancing its appeal to environmentally conscious residents. Smart energy management systems further optimize consumption, leading to operational cost savings.

Waste Management and Zero-Waste Initiatives

Effective waste management and the push for zero-waste initiatives are gaining significant traction, driven by environmentally aware consumers and stricter regulations. Equity LifeStyle Properties (ELS) can bolster its environmental credentials by integrating these practices across its portfolio. For instance, in 2023, the U.S. generated approximately 292.4 million tons of municipal solid waste, with recycling and composting diverting about 94 million tons, showcasing a growing trend towards waste reduction.

Adopting robust recycling and composting programs at ELS properties can significantly reduce landfill contributions and operational costs. This aligns with consumer preferences; a 2024 survey indicated that over 65% of consumers consider a company's environmental practices when making purchasing decisions.

- Recycling Rates: Aim to increase recycling rates by 15% across all communities by the end of 2025.

- Composting Programs: Pilot community composting programs in at least 10 properties by mid-2025 to reduce organic waste.

- Waste Audits: Conduct comprehensive waste audits at 25% of properties in 2024 to identify key areas for improvement.

- Supplier Engagement: Partner with suppliers who demonstrate strong waste reduction and sustainable packaging practices.

Preservation of Natural Habitats and Biodiversity

For Equity Lifestyle Properties (ELS), particularly its campgrounds and RV resorts situated near sensitive ecosystems, the preservation of natural habitats and biodiversity is a critical environmental consideration. ELS must actively manage its operational footprint to minimize disruption to local flora and fauna. For instance, in 2023, ELS reported on its sustainability initiatives, which included efforts to protect wildlife corridors at several of its properties.

The company is increasingly expected to engage in nature-related corporate reporting, detailing its strategies for conservation and biodiversity management. This aligns with growing investor and regulatory demands for transparency on environmental, social, and governance (ESG) performance. ELS’s commitment to these principles can influence its brand reputation and appeal to environmentally conscious customers and investors alike.

ELS's approach to land development and management must therefore integrate ecological impact assessments and mitigation strategies. This could involve:

- Implementing sustainable landscaping practices that favor native plant species.

- Developing wildlife-friendly infrastructure, such as designated crossing areas.

- Participating in local conservation projects and partnerships.

- Monitoring and reporting on biodiversity metrics within its managed areas.

Environmental factors significantly influence Equity Lifestyle Properties (ELS), with climate change posing risks through extreme weather events. For example, the projected active 2024 Atlantic hurricane season could impact ELS properties in vulnerable regions, leading to potential damage and increased insurance costs.

Water scarcity, particularly in drought-prone states like California, necessitates efficient water management for ELS. Implementing water-saving technologies is crucial for operational continuity and cost control, as seen with rising water costs in arid regions.

The push for sustainability drives demand for energy efficiency and renewable energy adoption in real estate. ELS's strategic solar installations, contributing to reduced utility expenses as of Q1 2024, align with this trend and enhance property appeal.

Waste management and zero-waste initiatives are increasingly important, with consumers prioritizing environmental practices. ELS can reduce landfill contributions and operational costs by adopting robust recycling and composting programs, mirroring the growing trend in waste reduction observed in the U.S.

PESTLE Analysis Data Sources

Our PESTLE analysis for Equity Lifestyle is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.