Equity LifeStyle Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity LifeStyle Bundle

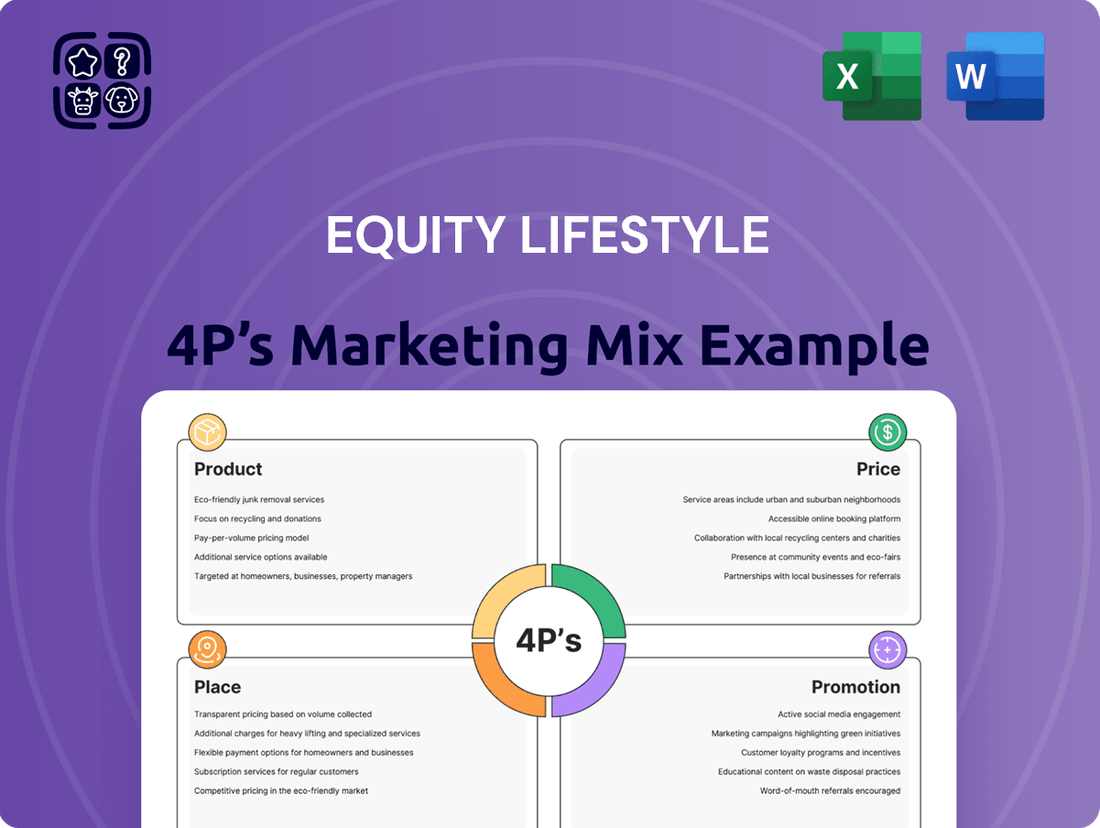

Equity LifeStyle's marketing success hinges on a masterful blend of its 4Ps. Discover how their innovative product offerings cater to specific lifestyle needs, their strategic pricing creates value, and their carefully selected distribution channels ensure accessibility. Uncover the promotional tactics that build brand loyalty and drive engagement.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Equity LifeStyle's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Manufactured home communities are a core product for Equity LifeStyle Properties, focusing on long-term leases for homesites. This model allows residents to own their homes while leasing the land, creating a stable housing option particularly attractive to retirees. As of Q1 2025, these communities boast impressive occupancy rates, hovering around 94-95%, underscoring consistent demand for this housing solution.

Equity Lifestyle Properties (ELS) offers vacation rentals and annual leases for RVs and cottages within its vast network of resorts and campgrounds. This product is designed for a broad audience interested in leisure and outdoor activities, providing a gateway to diverse vacation experiences.

While the RV market has seen some fluctuations, ELS differentiates its product by emphasizing a premium lifestyle experience. This includes robust amenities and community-focused offerings, aiming to foster guest loyalty and attract new visitors seeking more than just a place to park their RV.

For the fiscal year 2023, ELS reported total revenue of $1.45 billion, with its properties segment, which includes RV resorts and campgrounds, being a significant contributor. The company's strategy to enhance the product offering through improved amenities and services is crucial for navigating market dynamics and maintaining competitive advantage.

Equity Lifestyle Properties (ELS) differentiates itself by offering more than just RV or manufactured home sites; it curates a lifestyle. This focus on experience is evident in the extensive amenities provided, including resort-style pools, modern clubhouses, and diverse recreational facilities designed to enhance resident well-being and engagement.

ELS actively cultivates a strong community atmosphere through a calendar packed with organized activities and events. These gatherings, from holiday celebrations to themed parties, are crucial in fostering a sense of belonging among residents, turning properties into vibrant social hubs.

In 2024, ELS continued to invest in enhancing these lifestyle offerings. For instance, capital expenditures on property improvements and amenity upgrades are a significant part of their strategy, aiming to retain residents and attract new ones seeking an active, amenity-rich lifestyle. This commitment to experience is a key driver of customer loyalty and property value appreciation.

Community Enhancements and Development

Equity Lifestyle Properties (ELS) actively invests in its portfolio by upgrading existing amenities and broadening services, directly impacting community development. For example, in 2023, ELS reported a significant increase in capital expenditures, with a substantial portion allocated to property enhancements and new development projects across its network of manufactured home and RV communities.

These enhancements are designed to boost resident satisfaction and attract new customers, thereby strengthening ELS's market position. The company's strategy includes expanding existing communities by adding new sites and strategically acquiring new properties to broaden its geographic reach and diversify its offerings.

ELS's commitment to development is reflected in its financial reports, which detail ongoing investments aimed at increasing the overall value proposition for its residents and guests. This proactive approach ensures that its communities remain desirable and competitive in the market.

- Property Enhancements: Continued investment in amenities and services at existing communities.

- Site Expansion: Adding new sites to current properties to increase capacity.

- Strategic Acquisitions: Pursuing new property purchases to expand market presence.

- Value Proposition: Aiming to increase resident and guest satisfaction through development.

Home Sales within Communities

Equity LifeStyle Properties (ELS) extends its offering beyond land leases by actively selling both new and pre-owned manufactured homes within its communities. This integrated approach provides a comprehensive housing solution, making it easier for individuals to become part of the ELS lifestyle.

In the first quarter of 2025, ELS reported an average sales price of approximately $81,000 for new homes sold. This figure highlights a key aspect of their product strategy, catering to a segment of the market seeking a complete, ready-to-move-in housing option.

The home sales component of ELS's marketing mix is crucial for several reasons:

- Complete Housing Solution: Offering homes alongside land leases simplifies the acquisition process for residents.

- Revenue Diversification: Home sales provide an additional revenue stream, complementing rental income from land leases.

- Market Appeal: The availability of homes at various price points, including the Q1 2025 average of $81,000 for new units, broadens the appeal to a wider demographic.

Equity LifeStyle Properties' product encompasses manufactured homes and RV sites, offering both land leases and the sale of homes. This dual approach provides a complete housing solution, simplifying the move-in process for residents and diversifying ELS's revenue streams.

The company's product strategy emphasizes a curated lifestyle, evident in the extensive amenities and community events offered. This focus on experience aims to enhance resident satisfaction and foster loyalty, as seen in their continued investment in property upgrades and new developments.

As of Q1 2025, ELS reported an average sales price of $81,000 for new manufactured homes, demonstrating their commitment to providing accessible, ready-to-occupy housing options within their communities.

The product offering is further strengthened by strategic acquisitions and site expansions, aiming to increase capacity and broaden market reach. These developments are designed to boost resident satisfaction and maintain a competitive edge.

| Product Offering | Key Features | 2023/2024/Q1 2025 Data Points |

| Manufactured Home Sites | Long-term land leases, own your home | Occupancy ~94-95% (Q1 2025) |

| Vacation Rentals & RV/Cottage Leases | Leisure and outdoor focus, premium lifestyle | Significant revenue contributor to $1.45B total revenue (FY 2023) |

| Manufactured Home Sales | Integrated housing solution, new and pre-owned | Average new home sales price ~$81,000 (Q1 2025) |

| Lifestyle & Community | Resort-style amenities, organized events | Continued capital expenditures on property improvements and amenity upgrades (2024) |

What is included in the product

This analysis provides a comprehensive look at Equity LifeStyle's marketing strategies, detailing their Product offerings, pricing models, distribution Place, and promotional activities.

It's designed for professionals seeking a deep understanding of Equity LifeStyle's market positioning and competitive advantages, grounded in real-world practices.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of understanding how Equity Lifestyle's 4Ps drive customer satisfaction.

Provides a clear, concise overview of Equity Lifestyle's product, price, place, and promotion strategies, easing the burden of deciphering their market approach.

Place

Equity LifeStyle Properties boasts an extensive property portfolio, managing over 450 locations with more than 173,000 sites. This significant presence spans 35 U.S. states and extends into British Columbia, Canada, offering diverse manufactured housing and RV resort options to a broad customer base.

The strategic concentration of these properties in sought-after areas, especially the Sunbelt region and Florida, is a cornerstone of their market approach. This focus on desirable locations enhances accessibility and appeal for their target demographic.

Equity Lifestyle Properties (ELS) primarily utilizes direct-to-consumer channels for its offerings, focusing on direct leasing and rental agreements. This model allows individuals and families to engage directly with ELS or its on-site management for homesite leases and RV/cottage rentals, fostering personalized service and strong customer relationships.

In 2023, ELS reported total rental and related revenue of $1.49 billion, with the majority stemming from its manufactured home and RV communities. This direct sales approach allows ELS to capture the full revenue stream and build loyalty, as evidenced by their high occupancy rates, consistently above 95% in their core manufactured home communities.

Equity Lifestyle Properties (ELS) actively uses its corporate website as a central hub for showcasing its diverse portfolio of manufactured home communities and RV resorts. This digital platform provides prospective residents and vacationers with detailed property information, virtual tours, and amenity highlights, aiming to attract a wide audience. In 2024, ELS continued to invest in its online presence, recognizing its importance for lead generation and direct bookings, a strategy that has proven effective in driving occupancy rates across its properties.

On-Site Property Management

Equity Lifestyle Properties (ELS) emphasizes dedicated on-site property management across its communities and resorts. This localized approach is crucial for smooth day-to-day operations and fostering high resident and guest satisfaction. It directly impacts the upkeep of facilities and the responsiveness to customer service needs, ultimately elevating the living and vacation experience.

For instance, ELS reported that in Q1 2024, their property operations and management segment contributed significantly to their overall financial performance. The efficient management provided by on-site teams supports their strategy of maintaining high occupancy rates and rental income, a key factor in their consistent dividend payouts.

- Dedicated On-Site Teams: Each ELS property benefits from a local management presence focused on operational efficiency.

- Resident & Guest Satisfaction: This direct management ensures prompt attention to resident needs and guest experiences.

- Facility Maintenance: On-site teams are responsible for the upkeep and quality of community amenities and resort facilities.

- Operational Efficiency: Local management is key to addressing customer service requirements and maintaining high standards across the portfolio.

Strategic Acquisitions and Expansions

Equity Lifestyle Properties' (ELS) strategy includes ongoing market expansion through key acquisitions and the development of new sites within its existing portfolio. ELS consistently targets properties in high-demand geographic locations to enhance its overall market presence and optimize its portfolio. This approach is designed to boost cash flows and drive property value appreciation.

In 2023, ELS completed acquisitions totaling $150 million, adding 1,200 sites to its portfolio. The company also initiated development on 300 new sites across its existing properties, anticipating these to contribute an additional $15 million in annual rental income by 2025. This strategic growth is a cornerstone of ELS's long-term value creation plan.

- Acquisition Focus: ELS prioritizes acquiring properties in markets with strong demographic trends and limited new supply.

- Organic Growth: Development of new sites within existing communities aims to maximize land utilization and revenue potential.

- Financial Impact: Acquisitions and expansions are projected to increase Funds From Operations (FFO) per share by approximately 2-3% annually.

- Portfolio Enhancement: The strategy aims to elevate the quality and geographic diversification of ELS's overall property holdings.

Place, as a key element of Equity LifeStyle Properties' marketing mix, is defined by its strategic geographic positioning and the quality of its locations. ELS focuses on high-demand areas, particularly the Sunbelt region and Florida, which attract a consistent influx of residents and vacationers. This deliberate placement leverages favorable climate, lifestyle amenities, and population growth trends.

The company's portfolio of over 450 properties, encompassing more than 173,000 sites across 35 U.S. states and Canada, underscores its commitment to prime real estate. By concentrating on desirable locales, ELS ensures high occupancy and rental demand, a strategy that has proven robust, with manufactured home communities consistently maintaining over 95% occupancy.

ELS's expansion strategy, including $150 million in acquisitions in 2023 adding 1,200 sites, further solidifies its presence in key markets. The development of 300 new sites is also targeted for high-demand areas, projecting an additional $15 million in annual rental income by 2025, reinforcing the importance of strategic placement for revenue growth.

The company's emphasis on on-site management further enhances the value of its placed assets, ensuring well-maintained communities and responsive service that contributes to resident satisfaction and loyalty.

What You See Is What You Get

Equity LifeStyle 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Equity LifeStyle 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. It's a complete, ready-to-use resource for understanding their market approach.

Promotion

Equity LifeStyle Properties (ELS) leverages targeted digital marketing to connect with potential residents and guests. This strategy is crucial for driving occupancy and revenue in their manufactured housing and RV resort segments. For instance, in Q1 2024, ELS reported a 7.4% increase in total revenue, partly fueled by effective online outreach.

Their digital approach includes optimizing search engine visibility for terms related to retirement living and RV travel, alongside paid online advertising campaigns. These efforts aim to capture individuals actively seeking lifestyle communities, supporting ELS's growth objectives and enhancing brand presence within key demographic groups.

Equity LifeStyle Properties leverages membership programs, like the Thousand Trails camping pass, to draw in and keep RV and camping fans. These initiatives provide special access and perks, driving repeat business and building strong customer loyalty.

The membership segment is a key profit driver, generating substantial contributions to net income through yearly subscriptions and premium plan upgrades. In 2023, Equity LifeStyle Properties reported that its membership segment revenue grew by 8.5% year-over-year, highlighting the success of these loyalty initiatives.

Equity Lifestyle Properties (ELS) actively cultivates a community-centric brand by showcasing the vibrant social fabric and high quality of life within its manufactured home communities and RV resorts. This approach directly appeals to individuals seeking more than just a dwelling, but a true sense of belonging and engaging lifestyle experiences.

Marketing efforts for ELS consistently highlight the attractive lifestyle benefits, including a wide array of amenities and organized social activities designed to foster resident interaction and enjoyment. For instance, many ELS properties feature community centers, pools, and planned events, contributing to a desirable living and vacation environment that resonates with their target demographic.

This branding strategy is particularly effective in the current market, where consumers increasingly value experiences and social connections. In 2024, ELS continued to leverage this by promoting testimonials and resident stories, underscoring the strong community bonds that are a hallmark of their properties, thereby differentiating themselves from competitors.

Public Relations and Investor Communications

Equity Lifestyle Properties (ELS) actively manages its public relations and investor communications to bolster brand perception and trust. Beyond direct marketing, the company prioritizes consistent engagement with investors through quarterly earnings calls and detailed financial reports, ensuring transparency about its performance and strategic direction.

These efforts are crucial for cultivating investor confidence and communicating ELS's financial health and growth plans to a wider audience, including potential shareholders and industry analysts. For instance, ELS reported a revenue of $1.4 billion for the fiscal year ending December 31, 2023, demonstrating its financial stability.

ELS leverages its positive financial results and commitment to consistent dividend payouts as key promotional elements. The company’s dividend payout for the first quarter of 2024 was $0.40 per share, reinforcing its value proposition to investors.

- Brand Awareness: ELS's investor communications highlight its market leadership and operational excellence, enhancing its public image.

- Investor Confidence: Regular updates and strong financial reporting, such as a 2023 net income of $406 million, help maintain and grow investor trust.

- Financial Strength: Disclosing key metrics, like a 2023 Funds From Operations (FFO) per diluted share of $3.45, showcases the company's robust financial performance.

- Strategic Initiatives: Communications often detail ELS's expansion plans and property acquisitions, signaling future growth potential to the market.

Referral Programs and Word-of-Mouth

Referral programs and word-of-mouth are crucial promotional tools for Equity Lifestyle Properties (ELS), capitalizing on its strong community focus and resident loyalty. The company understands that satisfied residents are its most powerful advocates. These organic promotions are driven by personal trust and positive experiences shared among friends and family.

ELS actively cultivates an environment where residents feel valued, knowing this directly fuels positive recommendations. This strategy is particularly effective given the long-term nature of resident relationships within its communities. For instance, in 2024, ELS reported high occupancy rates across its portfolio, indicating a strong base of satisfied residents likely to engage in word-of-mouth marketing.

- Community Focus: ELS properties foster a sense of belonging, encouraging residents to share positive experiences.

- Resident Loyalty: Long-term residents often become brand ambassadors, recommending ELS to their networks.

- Trust and Personal Experience: Word-of-mouth referrals are highly trusted, stemming from genuine satisfaction.

- Organic Promotion: High customer satisfaction directly translates into valuable, cost-effective marketing.

Equity Lifestyle Properties (ELS) employs a multi-faceted promotional strategy, blending digital outreach, community building, and robust investor relations. Their focus on creating a desirable lifestyle, supported by strong financial performance and resident loyalty, serves as a powerful promotional engine. This comprehensive approach ensures consistent brand visibility and trust across both customer and investor bases.

| Promotional Tactic | Description | 2023/2024 Data Point |

|---|---|---|

| Digital Marketing | Targeted online advertising and SEO to reach prospective residents and guests. | Q1 2024 revenue increase of 7.4% |

| Membership Programs | Loyalty initiatives like the Thousand Trails pass to drive repeat business. | 2023 membership segment revenue grew 8.5% |

| Community Branding | Highlighting lifestyle benefits, social activities, and resident testimonials. | Continued promotion of testimonials and resident stories in 2024 |

| Investor Relations | Transparent communication through earnings calls and financial reports. | 2023 revenue of $1.4 billion; Q1 2024 dividend of $0.40 per share |

| Referral Programs | Leveraging satisfied residents for word-of-mouth marketing. | High occupancy rates reported in 2024 |

Price

Equity LifeStyle Properties' core revenue stream comes from long-term leases of homesites to manufactured home owners. This strategy creates a reliable and substantial income base, ensuring predictable cash flows for the company.

The company anticipates manufactured home rent growth to be in the range of 4.8% to 5.8% for the entirety of 2025. This projection highlights Equity LifeStyle Properties' consistent ability to manage pricing effectively within its market.

Equity Lifestyle Properties (ELS) provides adaptable rental choices for RVs and cottages, featuring pricing from nightly to annual leases. This variety ensures they can meet the needs of different customers, boosting both occupancy and income.

For 2025, ELS anticipates RV and marina rental income to increase between 2.2% and 3.2%. This growth reflects the company's strategy of offering flexible leasing terms that appeal to a broad customer base.

Equity Lifestyle Properties (ELS) employs a value-based pricing strategy, aligning its rental rates and property sales with the perceived value of its lifestyle-focused communities. This approach considers the comprehensive amenities, social engagement opportunities, and the overall quality of life offered, which often command a premium over standard housing. For instance, the average monthly rent for a manufactured home site in ELS communities reflects the extensive services and upkeep provided.

ELS actively positions its properties as a compelling and cost-effective alternative to traditional homeownership or vacation rentals. The company's manufactured housing segment, in particular, emphasizes affordability, with average home prices in its communities hovering around $80,000 as of recent data, making it an attractive option for a broad demographic seeking a desirable lifestyle without the high costs associated with conventional real estate.

Consideration of Market Dynamics and Competitor Pricing

Equity Lifestyle Properties (ELS) navigates pricing by considering market demand, competitor strategies, and the broader economic climate. Their goal is to offer competitive rates that reflect their market standing and boost revenue.

While the overall campground sector experienced some softening in 2024, largely due to elevated interest rates, ELS demonstrated resilience. The company's ability to maintain strong performance indicates effective pricing strategies and a robust value proposition that resonates with its customer base.

- Market Demand: ELS monitors occupancy rates and booking trends to inform pricing adjustments.

- Competitor Analysis: Benchmarking against similar properties helps ELS set attractive price points.

- Economic Factors: Interest rate changes and inflation are key considerations in their pricing models.

- Revenue Maximization: Pricing is strategically set to capture market share while optimizing profitability.

Dividend Policy and Shareholder Value

Equity Lifestyle Properties' (ELS) dividend policy is a crucial element in its value proposition to shareholders, demonstrating a sustained commitment to returning capital. The company boasts an impressive 21 consecutive years of dividend growth, a testament to its financial stability and operational success. This consistent increase signals confidence in future earnings and can attract investors seeking reliable income streams.

The Q1 2025 dividend declaration of $0.515 per common share further reinforces this shareholder-centric approach. Such consistent dividend payouts not only reward existing investors but also enhance ELS's market perception, potentially lowering its cost of capital and supporting its strategic initiatives. This financial discipline indirectly bolsters the company's capacity to invest in property enhancements and new developments, ultimately benefiting all stakeholders.

- 21 Consecutive Years of Dividend Growth: Highlights ELS's commitment to shareholder returns.

- Q1 2025 Dividend: Declared at $0.515 per common share, reflecting ongoing payout strength.

- Investor Confidence: Consistent dividend growth is a key driver for attracting and retaining investors.

- Indirect Support for Property Enhancement: Shareholder value creation can facilitate reinvestment in the business.

Equity LifeStyle Properties employs a value-based pricing strategy, aligning rental rates with the perceived lifestyle benefits of its communities. The company anticipates manufactured home rent growth between 4.8% and 5.8% for 2025, while RV and marina rental income is projected to rise 2.2% to 3.2% in the same year. ELS positions its properties as a cost-effective lifestyle choice, with average manufactured home prices around $80,000, making it an attractive alternative to traditional housing.

| Revenue Segment | 2025 Projected Growth | Key Pricing Strategy Aspect |

|---|---|---|

| Manufactured Home Sites | 4.8% - 5.8% | Value-based, reflecting lifestyle amenities |

| RV & Marina Rentals | 2.2% - 3.2% | Flexible leasing terms (nightly to annual) |

| Manufactured Home Sales | N/A | Cost-effective lifestyle alternative (avg. $80,000) |

4P's Marketing Mix Analysis Data Sources

Our Equity Lifestyle 4P's Marketing Mix Analysis is built upon a foundation of verified data, including official company disclosures, investor relations materials, and direct brand communications. We rigorously analyze pricing strategies, product portfolios, distribution networks, and promotional activities as presented by the company and observed within the market.