Equals Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equals Group Bundle

Unlock the critical external factors shaping Equals Group's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, environmental concerns, and legal frameworks are creating both challenges and opportunities. Gain the strategic foresight needed to navigate this complex landscape effectively. Download the full PESTLE analysis now and equip yourself with the intelligence to make informed decisions and secure a competitive advantage.

Political factors

Governments, especially in the UK, are actively fostering fintech growth through supportive policies and regulatory adjustments to solidify their standing as leading financial centers. Initiatives include investigating wholesale central bank digital currencies (CBDCs) and simplifying regulations to spur expansion. For Equals Group, this government backing can pave the way for smoother market entry and the development of innovative financial products.

The political climate significantly shapes the regulatory environment for financial services. In 2024, the UK government, for instance, continued its focus on digital asset regulation, with ongoing consultations and potential new legislation expected to bring greater clarity and oversight to the fintech sector. This evolving landscape directly impacts companies like Equals Group, particularly concerning their international payment services.

Shifts in government or policy direction can introduce new compliance burdens or opportunities. For example, a stronger emphasis on consumer protection or data privacy, as seen in various European Union directives and their UK counterparts, necessitates continuous adaptation by Equals Group to ensure adherence. Staying informed about these political currents is crucial for maintaining operational integrity and competitive advantage.

Geopolitical tensions and evolving international trade agreements significantly impact the global payments landscape. For Equals Group, a company focused on international payments, shifts in these areas directly influence the ease and cost of cross-border transactions. For instance, the ongoing trade friction between major economies in 2024 could lead to increased compliance burdens or currency volatility for businesses utilizing international payment services.

Stable international relations and supportive trade policies generally streamline operations for payment providers like Equals Group. Conversely, disruptions, such as the imposition of new tariffs or sanctions, can introduce complexities and higher operational costs. In 2024, the re-evaluation of trade partnerships by several nations highlights the dynamic nature of these factors, potentially affecting currency exchange rates and transaction volumes for Equals Group's clientele.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) Regulations

Political efforts to combat financial crime directly translate into increasingly stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These are not merely bureaucratic hurdles but essential frameworks for financial services companies like Equals Group to maintain trust and operate legally. The global landscape of financial crime is constantly shifting, necessitating a proactive and adaptive approach to compliance.

Adhering to these evolving AML and CTF mandates demands substantial investment in sophisticated technology and robust internal processes. This includes advanced transaction monitoring systems, artificial intelligence for anomaly detection, and comprehensive Know Your Customer (KYC) procedures. For instance, in 2024, financial institutions globally are expected to spend billions on compliance technology, with a significant portion allocated to AML/CTF solutions.

Equals Group must therefore continuously refine and strengthen its compliance frameworks. This involves staying ahead of regulatory changes, investing in employee training, and leveraging technology to ensure both robust security against illicit activities and operational efficiency. Failure to do so can result in severe penalties, reputational damage, and loss of customer confidence, underscoring the critical nature of these political factors.

- Regulatory Scrutiny: Increased political focus on financial crime drives stricter AML/CTF rules, impacting operational costs and strategy.

- Technology Investment: Compliance necessitates significant spending on advanced systems for transaction monitoring and KYC.

- Operational Impact: Balancing stringent compliance with efficient service delivery is a key challenge for Equals Group.

- Global Standards: Adherence to international AML/CTF standards is crucial for maintaining market access and reputation.

Data Protection and Privacy Laws

Governments globally are intensifying their focus on data protection and privacy. Regulations like the EU's General Data Protection Regulation (GDPR) exemplify this trend, setting strict standards for handling personal information. For a fintech firm like Equals Group, which manages sensitive financial and personal data, strict compliance is non-negotiable.

The political drive towards enhanced data privacy means Equals Group must consistently invest in robust data security infrastructure and maintain transparent data handling policies. This commitment is crucial for fostering and preserving customer trust in an increasingly data-conscious environment. For instance, in 2024, the UK's Information Commissioner's Office (ICO) continued to enforce data protection laws, with significant fines issued for breaches, underscoring the financial and reputational risks of non-compliance.

- Regulatory Landscape: Ongoing evolution of data privacy laws worldwide, impacting how fintechs manage customer data.

- Compliance Costs: Significant investment required for data security, legal counsel, and ongoing compliance audits.

- Customer Trust: Data breaches or non-compliance can severely damage reputation and erode customer confidence.

- Competitive Advantage: Proactive and transparent data handling can differentiate Equals Group in the market.

Government policies play a crucial role in shaping the fintech landscape, with initiatives aimed at fostering innovation and ensuring financial stability. For Equals Group, this translates into navigating a dynamic regulatory environment that can either facilitate growth or impose new compliance burdens.

In 2024, governments continued to prioritize digital currency exploration and cybersecurity, directly impacting payment providers. The UK’s commitment to becoming a global fintech hub, as evidenced by ongoing consultations on digital assets in 2024, offers opportunities for companies like Equals Group.

Political stability and international trade agreements are also key, influencing cross-border transactions and currency exchange rates. For Equals Group, understanding these geopolitical shifts is vital for managing operational risks and capitalizing on global market opportunities.

What is included in the product

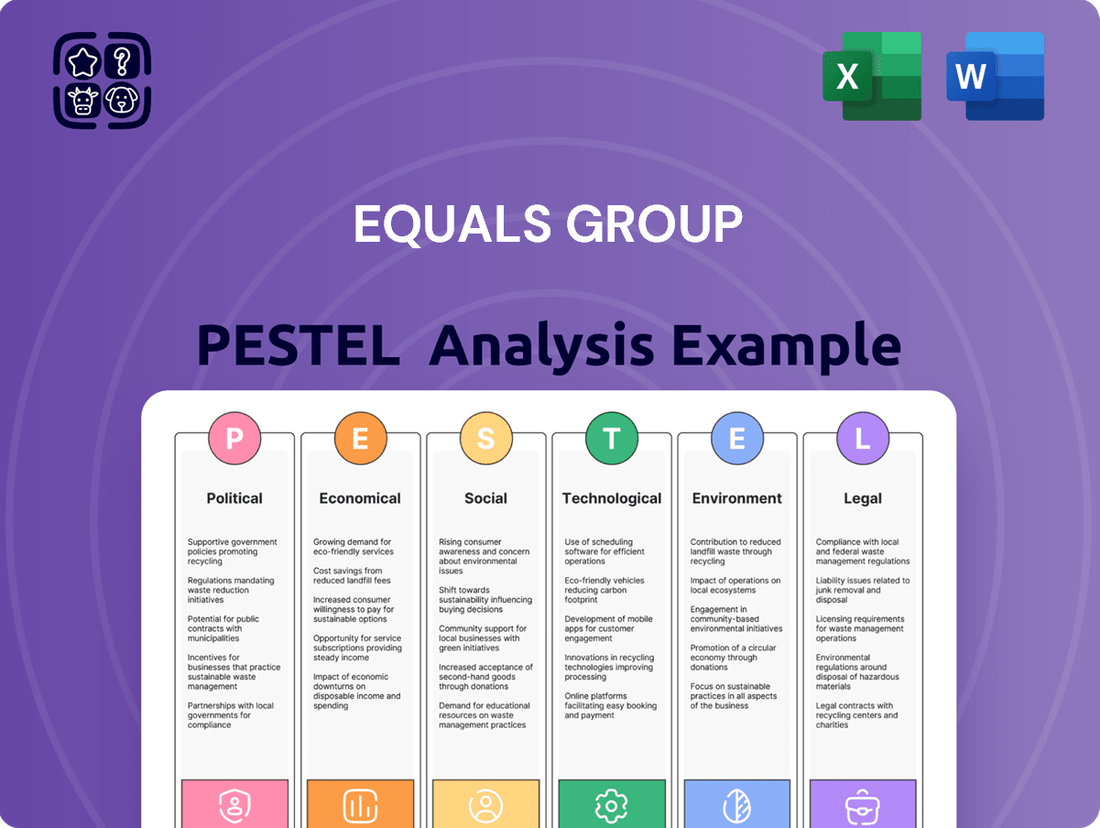

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting the Equals Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking perspectives to equip executives with the knowledge to navigate market dynamics and capitalize on emerging opportunities.

The Equals Group PESTLE analysis provides a clear and concise overview of external factors, simplifying complex market dynamics for easier strategic decision-making and risk mitigation.

Economic factors

Global economic growth is a key driver for Equals Group, influencing transaction volumes and consumer spending on international payments. Strong growth periods, like the projected 3.1% global GDP growth for 2024 by the IMF, typically boost cross-border trade and remittances, directly benefiting companies facilitating these transactions.

However, persistent inflation presents a dual challenge. While it can inflate transaction values, it also increases operational costs for Equals Group. For instance, the IMF forecast for global inflation to be 5.9% in 2024 highlights this pressure. High inflation can also erode consumer purchasing power, potentially dampening the volume of international transactions.

Central banks globally are navigating complex economic landscapes, with many continuing to adjust interest rates. For instance, the US Federal Reserve maintained its benchmark rate in early 2024, signaling a pause after a series of hikes, while the European Central Bank also held rates steady, though discussions around potential cuts in mid-2024 were prominent. These decisions directly affect borrowing costs for businesses and influence currency valuations.

Currency volatility is a constant factor for Equals Group, as its business model relies on facilitating international transactions. The British Pound Sterling (GBP) experienced fluctuations against the US Dollar (USD) and Euro (EUR) throughout 2024, influenced by inflation data and geopolitical events. For example, GBP/USD traded within a range, presenting both trading opportunities and the need for robust hedging to mitigate adverse price movements.

Significant swings in exchange rates, such as those seen in emerging market currencies during 2024 due to global economic uncertainties, create both challenges and opportunities for Equals Group. While volatile markets can lead to increased trading volumes, they also necessitate advanced risk management to protect margins and ensure competitive pricing for customers. The ability to effectively manage these fluctuations is crucial for maintaining profitability.

Consumer spending and disposable income are critical drivers for Equals Group, directly influencing demand for its international money transfer and currency card services. A strong economy, characterized by rising disposable incomes, typically translates to increased personal remittances and higher spending on travel, boosting transaction volumes. For instance, in the UK, real household disposable income saw a modest increase in early 2024, suggesting a supportive environment for such services.

Conversely, economic slowdowns or recessions can significantly dampen consumer confidence and discretionary spending. During periods of economic contraction, individuals tend to cut back on non-essential expenditures, which can include international transfers for personal reasons or foreign currency purchases for travel, leading to lower transaction volumes for Equals Group.

Competition from Traditional Banks and New Entrants

Equals Group operates in an economic environment characterized by fierce competition from both established traditional banks and a burgeoning wave of new fintech challengers. This necessitates continuous innovation in product offerings, pricing strategies, and customer service to capture and maintain market share. For instance, as of early 2024, many traditional banks are investing heavily in digital transformation, aiming to match the agility of fintechs, while neobanks continue to attract customers with low fees and user-friendly interfaces.

The intensity of this competition is directly influenced by broader economic conditions. During economic downturns, consumers and businesses often become more price-sensitive, which can lead to increased competition on fees and margins. This environment may also spur market consolidation as weaker players struggle to compete, potentially creating opportunities for well-capitalized entities like Equals Group to acquire or partner with others. The economic outlook for 2024-2025 suggests continued digital adoption, but also potential headwinds from inflation and interest rate fluctuations, impacting consumer spending and business investment.

- Fintech Market Growth: The global fintech market was projected to reach over $300 billion by 2024, indicating significant growth and attracting substantial investment, thus intensifying competition.

- Traditional Bank Digital Investment: Major banks globally committed billions in 2023-2024 to enhance their digital capabilities, directly challenging fintechs on their home turf.

- Customer Acquisition Costs: In a competitive landscape, customer acquisition costs for financial services remain high, requiring efficient marketing and compelling value propositions.

- Economic Sensitivity: Consumer spending and business investment, key drivers for financial service demand, are sensitive to economic indicators like inflation and employment rates, influencing competitive dynamics.

Remittance Market Dynamics

Remittances, the money sent by individuals working abroad to their home countries, are a substantial part of global financial flows. Factors like migration trends, job availability in countries where people work, and the economic health of the countries receiving the money directly impact how much is sent. Equals Group's performance is closely linked to its capacity to manage these essential international money transfers effectively.

The global remittance market is projected to reach $1.2 trillion by the end of 2024, with significant growth expected in the coming years. In 2023, remittances to low- and middle-income countries alone amounted to $626 billion, according to the World Bank. This highlights the sheer scale of the market and the opportunities it presents.

- Global Remittance Market Growth: Expected to reach $1.2 trillion by end of 2024.

- Low- and Middle-Income Country Inflows: Received $626 billion in 2023.

- Key Drivers: Migration patterns, host country employment rates, recipient country economic stability.

- Equals Group's Role: Success hinges on efficient processing of these cross-border flows.

Global economic growth directly impacts Equals Group by influencing transaction volumes and consumer spending on international payments. The International Monetary Fund (IMF) projected global GDP growth at 3.1% for 2024, a figure that typically supports cross-border trade and remittances.

Inflation remains a significant factor, with the IMF forecasting global inflation at 5.9% for 2024. While higher transaction values might seem beneficial, persistent inflation also raises operational costs for Equals Group and can reduce consumer purchasing power, potentially slowing transaction volumes.

Interest rate policies by central banks, such as the US Federal Reserve and the European Central Bank holding rates steady in early 2024, directly affect borrowing costs and currency valuations, influencing the cost of international transactions for Equals Group's clients.

Currency volatility is inherent to Equals Group's business, with fluctuations in pairs like GBP/USD throughout 2024 creating both opportunities and risks that require robust hedging strategies to manage.

Same Document Delivered

Equals Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of the Equals Group covers all critical external factors influencing its operations. You'll gain a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape affecting the company.

Sociological factors

Globally, digital literacy is on the rise, with a significant portion of the population, especially younger demographics, becoming increasingly comfortable with online financial services. This societal evolution directly fuels the demand for fintech innovations that emphasize user-friendliness and digital accessibility, areas where Equals Group excels.

This growing comfort with digital platforms means more individuals and businesses are actively seeking out and adopting digital payment solutions. For instance, by the end of 2024, it's projected that over 80% of global internet users will engage in online transactions, a clear indicator of this societal shift benefiting companies like Equals Group.

Consumers are actively shifting away from traditional banking, gravitating towards payment methods that offer speed, clarity, and simplicity. This trend is fueled by a growing demand for instant transactions, the widespread adoption of digital wallets, and a preference for financial services accessible via mobile devices.

For instance, a 2024 report indicated that over 70% of global consumers now prefer digital payment methods for everyday transactions, a significant jump from previous years. This demonstrates a clear market appetite for innovative financial solutions.

Equals Group's strategic emphasis on providing transparent and user-friendly payment solutions positions them well to capitalize on this evolving consumer landscape. By aligning with these changing preferences, the company can effectively attract customers seeking modern alternatives to legacy banking systems.

The world is becoming more interconnected than ever before. In 2024, cross-border e-commerce is projected to reach $2.7 trillion, a significant increase from previous years, highlighting the growing demand for seamless international transactions. This trend is driven by increased migration and international travel, with millions of people moving and traveling across borders annually, creating a constant need for efficient ways to send and receive money internationally.

Equals Group is well-positioned to capitalize on this societal shift. By providing specialized international payment services, the company directly supports this growing global connectivity. Their ability to facilitate cross-border transactions for both individuals and businesses addresses a fundamental requirement born from this societal interconnectedness, making their services essential in today's globalized marketplace.

Demand for Financial Inclusion

There's a strong societal movement towards financial inclusion, aiming to bring financial services to those who have been historically excluded. Fintech firms are at the forefront of this, developing solutions that are both accessible and affordable.

Equals Group can leverage this trend by focusing on cost-effective and user-friendly international payment services, especially in emerging markets where traditional banking infrastructure might be less developed. For example, the World Bank reported in 2023 that around 1.4 billion adults globally remained unbanked, highlighting a significant opportunity.

- Growing Demand: Societal pressure for financial inclusion is increasing globally.

- Fintech's Role: Technology companies are key enablers of accessible and affordable financial services.

- Equals Group Opportunity: Providing cost-effective international payments can serve underserved populations.

- Market Potential: Addressing the needs of the unbanked represents a substantial market segment.

Trust and Security Concerns in Digital Payments

Despite widespread digital adoption, consumer trust in the security of online financial transactions remains a significant sociological hurdle. Concerns about data breaches and fraud can deter users from fully embracing digital payment solutions. For instance, a 2024 survey indicated that 45% of consumers cited security fears as a primary reason for hesitating to use new digital payment platforms.

Equals Group must prioritize robust security infrastructure and transparent communication to cultivate and sustain user confidence. Building this trust is paramount for the widespread acceptance of their digital payment services. The company's commitment to data protection and clear communication about security protocols directly addresses these user anxieties, fostering a safer digital payment environment.

- Consumer Trust: A significant portion of the population remains cautious about the security of digital transactions.

- Impact of Breaches: Past data breaches and instances of cybercrime have heightened public awareness and concern.

- Equals Group Strategy: Continuous investment in advanced security measures and transparent communication is essential.

- User Adoption: Addressing security concerns directly influences the rate at which new customers adopt digital payment services.

Societal trends show a strong preference for convenience and speed in financial dealings, with consumers increasingly favoring digital platforms that offer seamless transactions. This inclination is further amplified by a growing global emphasis on financial inclusion, aiming to bring essential financial services to previously underserved populations. Equals Group's focus on user-friendly, accessible payment solutions directly aligns with these evolving societal expectations.

The demand for cross-border transactions is also on the rise, driven by increased global mobility and e-commerce. By 2024, cross-border e-commerce is projected to exceed $2.7 trillion, underscoring the need for efficient international payment services. Equals Group is strategically positioned to meet this demand, facilitating global connectivity for both individuals and businesses.

However, consumer trust in digital security remains a critical factor, with a significant percentage of users expressing concerns about data breaches and fraud. For instance, a 2024 survey revealed that 45% of consumers hesitated to adopt new digital payment platforms due to security fears. Equals Group must therefore prioritize robust security measures and transparent communication to build and maintain user confidence.

| Sociological Factor | Trend Description | Impact on Equals Group | Supporting Data (2024/2025) |

|---|---|---|---|

| Digital Adoption & Convenience | Increasing preference for user-friendly digital financial services. | Drives demand for Equals Group's streamlined payment solutions. | Over 80% of global internet users expected to engage in online transactions by end of 2024. |

| Global Interconnectedness | Growing need for efficient cross-border transactions due to e-commerce and migration. | Creates opportunities for Equals Group's international payment services. | Cross-border e-commerce projected to reach $2.7 trillion in 2024. |

| Financial Inclusion | Societal push to provide financial services to unbanked populations. | Opens market segments for accessible and affordable Equals Group offerings. | Approx. 1.4 billion adults globally remained unbanked as of 2023. |

| Consumer Trust & Security | Persistent concerns about data security and fraud in digital transactions. | Requires Equals Group to invest in robust security and transparent communication. | 45% of consumers cited security fears as a reason for hesitating with new digital payment platforms (2024 survey). |

Technological factors

The global push towards real-time payment systems is accelerating, with countries increasingly implementing national rails for instant transactions. For instance, by the end of 2024, many major economies are expected to have robust real-time payment infrastructure, significantly reducing settlement times for cross-border payments.

Technologies such as SWIFT gpi are already enabling near-instantaneous international transfers, with a significant percentage of eligible SWIFT messages now processed in near real-time. Equals Group can capitalize on this trend by integrating these advanced payment technologies to offer clients faster, more efficient, and transparent cross-border payment solutions, thereby improving customer satisfaction and operational efficiency.

The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the financial services landscape. These advanced technologies are proving invaluable in bolstering fraud detection systems, refining risk management protocols, and crafting highly personalized customer experiences. For instance, in 2024, financial institutions globally are investing billions in AI to combat sophisticated fraud attempts, with some reporting a significant reduction in false positives.

AI and ML offer powerful capabilities for process automation, enabling financial firms to streamline operations and identify subtle anomalies that might otherwise go unnoticed. Their predictive power extends to anticipating liquidity needs, a critical function for maintaining operational stability. By leveraging these tools, companies can proactively manage their financial resources, thereby enhancing resilience and efficiency.

Equals Group can strategically deploy AI and ML to bolster its security infrastructure, optimize operational workflows, and deliver more bespoke solutions to its clientele. This technological adoption is projected to not only improve overall efficiency but also significantly mitigate various operational and financial risks, positioning the company for sustained growth and competitive advantage in the evolving market.

Blockchain and Distributed Ledger Technology (DLT) offer a revolutionary path for cross-border payments, promising enhanced security, decentralization, and transparency. By potentially cutting out traditional intermediaries, these technologies can significantly slash transaction costs and accelerate settlement processes, a key benefit for a company like Equals Group. For instance, RippleNet, a DLT-based payment network, has been actively working with financial institutions to improve cross-border transactions, with partners reporting up to 60% cost reductions and a 40% improvement in settlement times as of early 2024.

While still in development, the integration of blockchain solutions presents a strategic opportunity for Equals Group to innovate its payment services. By leveraging DLT, the company could streamline operations, offer faster and cheaper international transfers, and differentiate itself in a competitive market. The global DLT market is projected to reach over $20 billion by 2025, indicating substantial growth and adoption potential for companies prepared to invest in this transformative technology.

API-driven Open Banking and Open Finance

The increasing adoption of Application Programming Interfaces (APIs) is driving the growth of open banking and open finance, facilitating secure data sharing and integration across financial service providers. This technological shift is a significant catalyst for innovation, paving the way for novel financial products and enhanced customer experiences. For Equals Group, embracing APIs presents a strategic advantage, enabling seamless integration with third-party platforms and expanding its service offerings to create a more robust financial ecosystem.

Open banking initiatives, which mandate banks to share customer data with authorized third-party providers via APIs, are gaining traction globally. For instance, by the end of 2024, the UK's Open Banking Implementation Entity (OBIE) reported over 700 regulated entities accessing bank data, demonstrating the widespread adoption and potential. Equals Group can capitalize on this by developing integrated solutions that offer customers a consolidated view of their finances and access to a wider array of financial tools, thereby increasing customer stickiness and value.

- API Growth: The global API management market was valued at approximately $5.2 billion in 2023 and is projected to reach $24.3 billion by 2028, indicating a strong upward trend in API adoption across industries, including finance.

- Open Finance Expansion: Beyond banking, open finance aims to extend data sharing principles to other financial sectors like insurance and investments, creating a more interconnected financial landscape.

- Equals Group Opportunity: Equals Group can leverage APIs to partner with fintechs, offering embedded finance solutions and expanding its reach into new customer segments by providing specialized financial services through partner platforms.

Enhanced Cybersecurity Measures and Data Encryption

The escalating threat landscape demands significant investment in cybersecurity for fintechs like Equals Group. In 2024, the global average cost of a data breach reached $4.45 million, a stark reminder of the financial and reputational risks involved.

Equals Group's role in international payments necessitates stringent data protection. By continuously adopting advanced encryption and threat detection technologies, the company safeguards customer financial information, a critical factor in maintaining user confidence and regulatory compliance.

- Increased investment in AI-driven threat detection to proactively identify and neutralize cyberattacks.

- Implementation of end-to-end encryption for all customer data, both in transit and at rest.

- Regular security audits and penetration testing to identify and address vulnerabilities.

- Compliance with evolving global data protection regulations, such as GDPR and CCPA, which mandate robust security practices.

The rapid advancement of real-time payment systems globally, with many nations expected to have robust infrastructure by the end of 2024, presents a significant opportunity for faster cross-border transactions.

AI and ML are transforming financial services, enhancing fraud detection and risk management, with global investment in AI for combating fraud reaching billions in 2024.

Blockchain and DLT offer enhanced security and cost reduction for cross-border payments, with platforms like RippleNet reporting substantial improvements in settlement times and costs for their partners as of early 2024.

The growth of APIs, evidenced by a projected market value of $24.3 billion by 2028, fuels open banking and creates avenues for integrated financial solutions and expanded service offerings.

Legal factors

Equals Group operates in a heavily regulated financial services sector, necessitating various licenses and strict adherence to rules for international payments and foreign exchange. For instance, the Financial Conduct Authority (FCA) in the UK, a key regulator, continuously evolves its guidelines, impacting how companies like Equals Group conduct business. Staying compliant with these evolving legal frameworks, especially following recent acquisitions, is absolutely critical for maintaining operational integrity and market trust.

The legal landscape for anti-money laundering (AML) and sanctions compliance is becoming increasingly rigorous, with regulators worldwide actively updating their frameworks to counter financial crime. For Equals Group, this means navigating a complex web of reporting requirements, thorough customer due diligence (CDD), and continuous sanctions screening to ensure adherence to global standards.

Failure to comply with these stringent regulations can result in substantial financial penalties and reputational damage. For instance, in 2023, fines levied for AML and sanctions breaches globally reached billions of dollars, highlighting the critical need for robust internal controls and ongoing employee training within financial institutions like Equals Group.

Global data protection laws like GDPR, which came into full effect in 2018, significantly impact companies handling personal data. For Equals Group, operating internationally and dealing with sensitive financial information, adhering to these stringent regulations is paramount. Failure to comply can result in substantial penalties, with GDPR fines potentially reaching €20 million or 4% of annual global turnover, whichever is higher.

Consumer Protection Regulations

Consumer protection laws are crucial for financial services, focusing on transparency, fairness, and effective dispute resolution for customers. Equals Group must navigate these regulations carefully to maintain customer trust and avoid penalties. For example, the UK's Payment Systems Regulator (PSR) introduced new rules in 2024 mandating reimbursement for Authorized Push Payment (APP) fraud, impacting how firms like Equals Group handle security and customer claims.

These evolving consumer protection frameworks directly influence Equals Group's operational strategies and product development. Compliance ensures fair customer treatment and mitigates risks associated with financial misconduct or service failures.

- Transparency Requirements: Ensuring clear communication on fees, terms, and conditions for all financial products and services offered by Equals Group.

- Fairness in Practices: Adhering to principles that prevent exploitative or deceptive practices towards consumers, especially in areas like fraud prevention and reimbursement.

- Dispute Resolution Mechanisms: Establishing robust and accessible channels for customers to raise and resolve complaints, aligning with regulatory expectations.

- APP Fraud Reimbursement: Implementing systems and processes to comply with the PSR's 2024 mandate for reimbursing victims of APP fraud, a significant shift in consumer protection for payment services.

Cross-Border Payment Regulations and Interoperability Initiatives

The legal framework governing cross-border payments is intricate, requiring adherence to diverse national regulations and international efforts to enhance system interoperability. Equals Group must navigate these complexities, including compliance with evolving payment system rules and the increasing adoption of standards like ISO 20022, to ensure smooth global transactions.

Key legal and regulatory considerations for Equals Group include:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations: Strict compliance with varying AML/KYC requirements across different countries is paramount to prevent illicit financial activities. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting how financial institutions operate globally.

- Data privacy and protection laws: Regulations such as the GDPR in Europe and similar frameworks elsewhere necessitate robust data handling practices for customer information involved in cross-border transactions.

- Payment services directives and licensing: Equals Group must comply with national payment services directives (e.g., PSD2 in Europe) and secure appropriate licenses in each operating jurisdiction, which can significantly influence market access and operational scope.

- Interoperability standards: Adherence to emerging global standards like ISO 20022, which aims to standardize financial messaging, is critical for facilitating efficient and seamless communication between different payment systems and participants worldwide.

The legal and regulatory environment for Equals Group is dynamic, particularly concerning financial crime prevention and consumer protection. New mandates, such as the UK's Payment Systems Regulator (PSR) 2024 rules on Authorized Push Payment (APP) fraud reimbursement, directly impact operational procedures and customer service protocols. Adherence to global standards like those from the Financial Action Task Force (FATF) for Anti-Money Laundering (AML) and Know Your Customer (KYC) remains critical, with ongoing updates influencing due diligence processes.

| Regulatory Area | Key Legislation/Standard | Impact on Equals Group | Year/Update Focus |

|---|---|---|---|

| Financial Crime Prevention | FATF Recommendations (AML/KYC) | Enhanced due diligence, transaction monitoring, reporting obligations | Ongoing, with increased scrutiny on beneficial ownership |

| Consumer Protection | PSR APP Fraud Reimbursement (UK) | Mandatory reimbursement for APP fraud victims, requiring robust fraud detection and customer education | Effective 2024 |

| Data Privacy | GDPR (EU) | Strict data handling, consent management, and breach notification for customer information | Full effect 2018, with ongoing enforcement actions |

| Payment Services | PSD2 (EU) | Open banking requirements, strong customer authentication (SCA) | Implemented 2018, with ongoing evolution |

Environmental factors

There's a significant upswing in demand for financial services that align with Environmental, Social, and Governance (ESG) standards. This means companies are increasingly expected to be transparent, act responsibly, and actively contribute to a more sustainable future. For Equals Group, this translates to a growing need to showcase its dedication to ESG principles, which can directly impact investor confidence and customer loyalty.

Equals Group, while not directly facing physical climate risks, is susceptible to indirect impacts from climate change. These can manifest as broader economic instability or heightened regulatory focus on climate-related financial risks, as seen in the increasing emphasis on ESG disclosures by financial regulators globally.

The firm's operational resilience is therefore a key consideration, especially concerning potential disruptions from extreme weather events that could affect critical infrastructure or supply chains, impacting service delivery.

The increasing reliance on technology infrastructure, like data centers and networks, significantly impacts energy consumption and carbon footprints. For a fintech company such as Equals Group, whose operations are heavily dependent on this infrastructure, this is a critical consideration.

Globally, data centers are estimated to consume around 1% of the world's electricity, a figure projected to rise with the growth of digital services. In 2024, the demand for cloud computing services, a key driver of data center energy use, is expected to continue its upward trajectory, with projections indicating a substantial increase in data traffic.

There's a growing emphasis on the environmental impact of technology, pushing for more energy-efficient solutions and the adoption of renewable energy sources. Many tech companies are setting ambitious targets for carbon neutrality, aiming to power their operations with 100% renewable energy by 2030 or sooner, which could influence infrastructure choices and operational costs for companies like Equals Group.

Regulatory Pressure for Green Finance and Disclosure

Governments worldwide are intensifying their focus on green finance, with new policies and reporting mandates becoming more common. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) continues to shape how financial products are classified and marketed, impacting firms operating within its jurisdiction. This regulatory shift necessitates that companies like Equals Group critically assess their reporting mechanisms to ensure compliance and effectively communicate their commitment to sustainable practices.

The drive for greater transparency extends to climate-related disclosures. Initiatives such as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are increasingly being adopted or mandated by various national regulators. By mid-2024, a significant number of major economies had either implemented or were in the process of implementing TCFD-aligned reporting requirements, affecting a broad range of publicly listed companies. Equals Group must therefore consider how to integrate these climate risk assessments and disclosures into its strategic planning and public reporting to meet evolving stakeholder expectations and regulatory demands.

Furthermore, the regulation of Environmental, Social, and Governance (ESG) ratings providers is gaining traction. Concerns about the consistency and reliability of ESG data are leading to calls for greater oversight. As of early 2025, several key markets are exploring or implementing frameworks to standardize ESG rating methodologies. This evolving landscape means Equals Group needs to be vigilant about the quality and comparability of its ESG data and how it is presented, potentially requiring adjustments to data collection and assurance processes.

- Increased Regulatory Scrutiny: Expect continued development of regulations mandating green finance and climate-related disclosures, impacting financial institutions globally.

- Alignment with Global Standards: Equals Group will likely need to adapt its reporting to align with frameworks like TCFD and emerging sustainability reporting standards to maintain market access and investor confidence.

- ESG Data Integrity: The growing regulation of ESG ratings providers highlights the importance for Equals Group to ensure the accuracy, consistency, and transparency of its own ESG data.

- Strategic Adaptation: Proactive integration of sustainability considerations into business strategy and operations will be crucial for navigating the evolving environmental regulatory landscape.

Reputation and Brand Image related to Sustainability

Equals Group's reputation and brand image are increasingly tied to its environmental performance and commitment to sustainability. Positive environmental initiatives can attract a growing segment of environmentally conscious consumers and socially responsible investors, a trend that gained significant momentum in 2024 and is projected to continue into 2025.

For Equals Group, actively communicating its sustainability efforts can directly enhance its brand appeal. Integrating environmentally friendly practices, even within its financial services operations, can resonate with stakeholders. For instance, a 2024 survey indicated that over 60% of consumers consider a company's sustainability practices when making purchasing decisions.

- Stakeholder Perception: A strong sustainability record builds trust and loyalty among customers, investors, and potential employees.

- Investor Attraction: Environmentally conscious investors, a growing market force, are more likely to allocate capital to companies demonstrating robust ESG (Environmental, Social, and Governance) credentials.

- Consumer Preference: In 2024, a significant portion of consumers actively sought out brands with clear environmental commitments, impacting purchasing behavior.

- Brand Differentiation: Proactive communication of sustainability efforts can set Equals Group apart from competitors in a crowded financial services landscape.

The financial sector faces increasing pressure to adopt sustainable practices, with a notable rise in demand for ESG-aligned services throughout 2024. This trend is expected to intensify, requiring Equals Group to demonstrate its commitment to environmental responsibility to maintain investor confidence and attract customers.

Equals Group's reliance on technology, particularly data centers, contributes to its environmental footprint. Global data center energy consumption is a significant concern, with projections indicating continued growth in demand for cloud services and data traffic in 2024 and beyond.

Regulatory bodies are actively implementing mandates for green finance and climate-related disclosures, such as the TCFD recommendations. By mid-2024, many major economies had adopted or were adopting these requirements, necessitating that Equals Group integrate climate risk assessments into its strategic planning.

The growing emphasis on ESG data integrity, driven by potential regulation of ESG rating providers, means Equals Group must ensure the accuracy and transparency of its environmental performance metrics.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Equals Group is meticulously constructed using a blend of publicly available government data, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the organization.