Equals Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equals Group Bundle

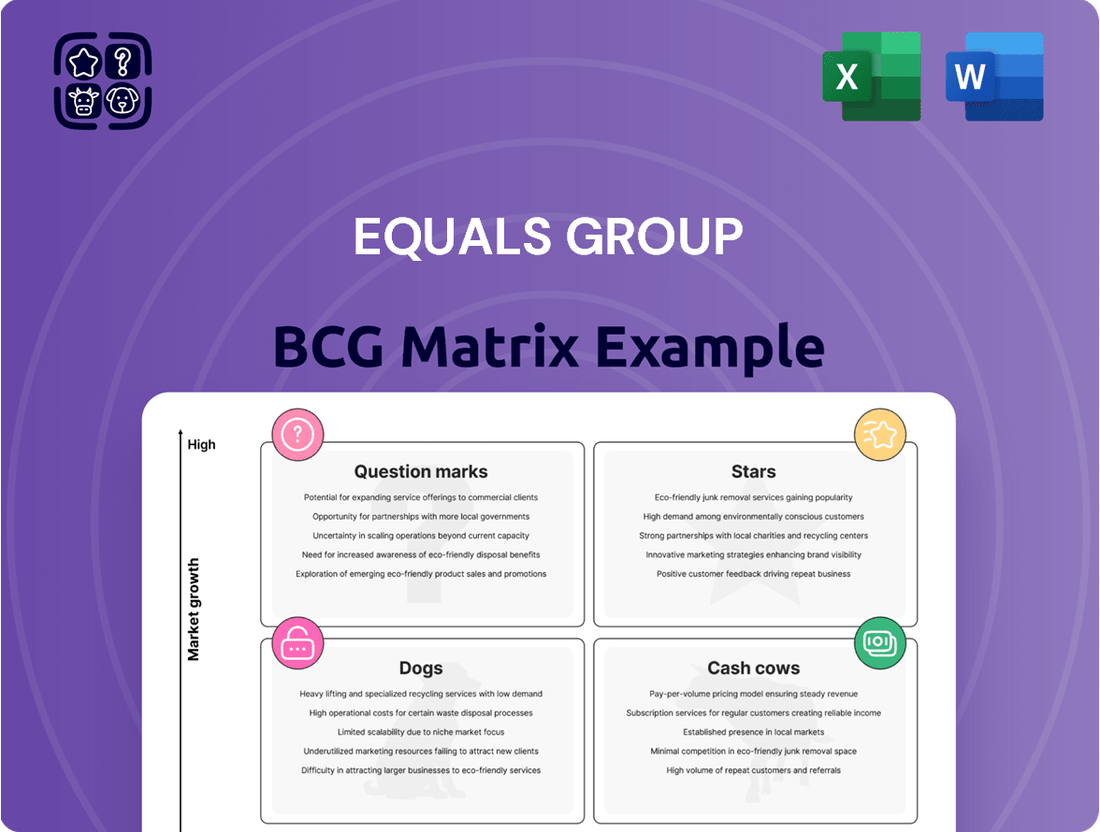

Curious about how this company's portfolio stacks up? Our BCG Matrix preview offers a glimpse into its strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full picture and gain actionable insights to drive growth.

Don't settle for a partial view. Purchase the complete BCG Matrix to receive detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your product portfolio and investment strategies.

This is your opportunity to gain a competitive edge. Invest in the full BCG Matrix report and equip yourself with the knowledge to make informed decisions, allocate resources effectively, and navigate market dynamics with confidence.

Stars

Equals Group's B2B international payments, driven by Equals Money and Solutions, is a core strength. In the first half of 2024, B2B revenue constituted a substantial 87% of the group's total revenue, highlighting its dominance in this expanding market.

The Solutions platform, in particular, experienced remarkable expansion, with its revenue almost doubling in H1 2024. This surge underscores the robust demand and significant growth potential for its sophisticated enterprise payment services.

Equals Group's API-driven and white-label solutions are a powerful engine for growth, enabling corporate clients to act as distribution partners for their platform. This strategic approach is a significant factor in their market leadership and revenue expansion.

The Solutions platform, a prime example of this strategy, demonstrated its strength by contributing a substantial 43% of the group's total revenue in FY2024. This impressive performance, coupled with its high-growth and high-market share positioning, firmly places this segment as a star within the BCG Matrix.

Equals Group's corporate expense management platform, centered on its prepaid card, is a strong performer. This solution directly addresses business needs for cost reduction and process streamlining, positioning it favorably within the expanding corporate financial management sector. The platform's ability to deliver tangible savings makes it a key asset for Equals.

Interest Income from Safeguarded Balances

Interest income from safeguarded balances is a significant growth driver for Equals Group. By the end of 2024, customer balances reached an impressive £625 million. This substantial increase in customer funds directly translates into higher interest earnings for the company.

The generated interest income from these safeguarded balances has doubled, reaching £21.9 million in 2024. This performance highlights a high-growth, high-margin revenue stream that substantially enhances overall profitability. It positions this income source as a strong financial star within the company's portfolio.

- Customer balances reached £625 million by year-end 2024.

- Interest income from these balances doubled to £21.9 million.

- This represents a high-growth, high-margin revenue stream.

- It acts as a strong financial star, boosting profitability.

Robust Compliance and Security Infrastructure

Equals Group's commitment to a robust compliance and security infrastructure acts as a significant differentiator, particularly within the competitive fintech landscape. This focus is evidenced by a substantial investment, with 15% of their workforce dedicated to compliance roles. Furthermore, maintaining ISO 27001 certification underscores their dedication to information security standards.

In an industry where regulatory adherence is not just important but critical, this strong foundation becomes a powerful competitive moat. It directly translates into attracting and retaining corporate clients who prioritize security and compliance. This, in turn, fuels market share expansion and sustained growth for Equals Group.

- Dedicated Compliance Staff: 15% of Equals Group's total workforce is allocated to compliance functions.

- Information Security Certification: Equals Group holds ISO 27001 certification, a globally recognized standard for information security management.

- Competitive Advantage: This robust infrastructure provides a significant advantage in the fintech market, attracting clients who value security and regulatory adherence.

- Client Acquisition and Retention: The strong compliance framework is a key driver for acquiring and retaining corporate clients, thereby boosting market share and growth.

The Solutions platform, a high-growth, high-market share segment, is a clear star in Equals Group's BCG Matrix. Its revenue nearly doubled in H1 2024, and it contributed 43% of the group's total revenue in FY2024, demonstrating its significant impact.

Interest income from safeguarded customer balances is another star performer. With customer balances reaching £625 million by the end of 2024 and interest income doubling to £21.9 million, this represents a high-growth, high-margin revenue stream that bolsters overall profitability.

| BCG Category | Segment | Key Performance Indicators (2024 Data) | Market Position | Growth Trajectory |

|---|---|---|---|---|

| Star | Solutions Platform | Revenue growth nearly doubled (H1 2024); 43% of group revenue (FY2024) | High Market Share | High Growth |

| Star | Interest Income from Safeguarded Balances | Customer balances £625 million (YE 2024); Interest income £21.9 million (doubled) | High Margin | High Growth |

What is included in the product

This BCG Matrix overview provides a strategic breakdown of the Equals Group's portfolio, identifying areas for investment, divestment, or maintenance based on market growth and share.

The Equals Group BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Equals Group's core international money transfer services, often referred to as Direct FX, represent a significant part of their business. These services cater to both businesses and individuals needing to send and receive money across borders. While these offerings continue to generate substantial revenue, they operate within a mature market, indicating a stable but less explosive growth trajectory.

These established money transfer services are a prime example of a cash cow within the Equals Group's portfolio. They are known for providing a consistent and reliable stream of cash flow, a characteristic of mature market products. This steady income generation is crucial for funding other areas of the business, even though their growth rates are comparatively lower than newer, more innovative B2B solutions.

In 2024, Equals Group reported strong performance in its international payments segment. For instance, their transaction volumes in this core area saw a notable increase, contributing significantly to their overall revenue. This segment’s ability to consistently deliver profits, despite the competitive and mature nature of the market, solidifies its position as a dependable cash cow for the company.

The FairFX Travel Card and International Payment Product, under the Equals Group umbrella, fits squarely into the Cash Cows quadrant of the BCG Matrix. This is due to its established position as a mature offering catering to high-net-worth individuals and frequent international travelers.

FairFX has cultivated a strong and recognizable brand within the travel money market, allowing it to generate consistent revenue streams with a solid, existing market share. This established presence means it requires minimal additional marketing spend to maintain its position, a hallmark of a Cash Cow.

For the fiscal year ending December 31, 2023, Equals Group reported that its international payments division, which includes FairFX, saw significant growth. While specific figures for FairFX alone are not always broken out, the overall segment performance indicates its continued contribution to the group's profitability.

CardOneMoney, a key offering from Equals Group, is firmly positioned as a cash cow within the BCG matrix. It caters to both small businesses and individuals for their day-to-day banking needs, operating within the mature and stable UK market.

The product's strength lies in its ability to generate consistent, recurring revenue streams through fees. This steady cash flow, coupled with its established market share in its specific niche, solidifies its cash cow status, indicating low growth potential but significant profitability.

In 2024, Equals Group reported that its UK current account business, which includes CardOneMoney, continued to be a significant contributor to overall revenue, demonstrating its reliable performance.

Legacy B2C Foreign Exchange Services

Equals Group's legacy B2C foreign exchange services are firmly planted in the Cash Cows quadrant of the BCG Matrix. While the company has strategically shifted its focus towards business-to-business (B2B) solutions, these established B2C offerings, especially those not heavily integrated with newer technology, remain a stable revenue generator.

These mature services, despite exhibiting lower growth potential compared to emerging ventures, consistently contribute to Equals Group's overall cash flow. This reliable income stream allows the company to fund investments in its more promising B2B segments. For instance, in 2024, the B2C FX segment continued to represent a significant portion of the Group's transaction volume, albeit with a more modest year-over-year increase.

- Mature Market Position: The B2C foreign exchange services have a well-established presence and customer base.

- Consistent Revenue Generation: These services provide a steady and predictable income stream for Equals Group.

- Lower Growth Prospects: The market for these traditional B2C services is largely saturated, limiting significant expansion.

- Cash Flow Contribution: The profitability of these Cash Cows helps subsidize investments in higher-growth areas of the business.

Established Client Base and Long-Term Contracts

Equals Group's Solutions segment thrives on an established client base, generating predictable revenue through long-term, fee-based contracts. This stability means less capital is needed for customer acquisition, a hallmark of a cash cow. For instance, in the first half of 2024, Equals reported a 23% increase in revenue from its Solutions segment, underscoring the strength of these recurring income streams.

These long-standing relationships are crucial for generating consistent cash flow. The company benefits from a high retention rate within this segment, as clients are locked into multi-year agreements. This reduces the operational burden and allows for efficient resource allocation, typical of mature, high-performing business units.

- Predictable Revenue: Fee-based income from long-term contracts provides a stable cash inflow.

- Low Investment Needs: Established relationships minimize the need for new customer acquisition spending.

- High Client Retention: Multi-year agreements ensure continued revenue generation from existing clients.

- Operational Efficiency: Stable client base allows for optimized resource deployment within the Solutions segment.

Equals Group's core international money transfer services, like Direct FX, are prime examples of cash cows. These established offerings operate in mature markets, generating consistent revenue with lower growth potential. In 2024, this segment continued to be a significant revenue contributor for Equals Group, demonstrating its reliable profitability.

The FairFX Travel Card and International Payment Product also fit the cash cow profile due to their established brand and market share. This mature offering provides steady income streams with minimal marketing investment. Equals Group's overall international payments division, which includes FairFX, showed strong performance in 2023, highlighting the segment's continued profitability.

CardOneMoney, serving UK small businesses and individuals, is another cash cow, generating consistent fee-based revenue in a stable market. In 2024, Equals Group noted the UK current account business, including CardOneMoney, as a reliable revenue driver. These cash cows are vital for funding the company's growth initiatives.

Equals Group's legacy B2C foreign exchange services, despite a shift towards B2B, remain cash cows. They provide stable revenue streams that fund investments in newer ventures. In 2024, the B2C FX segment continued to represent a substantial portion of transaction volume, albeit with modest growth.

| Segment | BCG Quadrant | Key Characteristics | 2024/2023 Data Insights |

|---|---|---|---|

| Direct FX (International Money Transfer) | Cash Cow | Mature market, consistent revenue, stable cash flow | Significant revenue contributor in 2024, notable transaction volume increase. |

| FairFX Travel Card & International Payments | Cash Cow | Established brand, high market share, low marketing needs | Strong performance in international payments division (incl. FairFX) in 2023. |

| CardOneMoney (UK Current Accounts) | Cash Cow | Recurring fee-based revenue, stable UK market | Reliable revenue driver for UK current accounts in 2024. |

| Legacy B2C FX Services | Cash Cow | Stable revenue generator, lower growth potential | Substantial transaction volume in 2024, modest year-over-year increase. |

Full Transparency, Always

Equals Group BCG Matrix

The preview you are currently viewing is the exact, unwatermarked Equals Group BCG Matrix report you will receive immediately after your purchase. This comprehensive document is fully formatted and ready for immediate strategic application, offering a clear, actionable analysis of your business portfolio. You can trust that the insights and structure you see are precisely what you'll be working with, enabling swift integration into your business planning and decision-making processes.

Dogs

Some niche B2C foreign exchange products within Equals Group might be struggling, showing low growth and a small market share. These could be older offerings that haven't kept pace with how customers want to manage their money internationally. For instance, if a product is cumbersome or lacks modern digital features, it's likely to fall behind.

These underperforming products can act like cash traps, consuming valuable resources like development time and marketing spend without generating substantial returns. In 2024, the fintech landscape is highly competitive, and companies like Equals Group need to ensure their entire product suite is relevant and profitable. Failing to adapt means these niche offerings could drain capital that could be better invested in growth areas.

Legacy payment solutions or platforms within Equals Group that haven't been fully integrated into their modern, scalable infrastructure could be classified as dogs. These might include older systems requiring significant upkeep or possessing limited market relevance in the fast-paced fintech sector.

For instance, if Equals Group still relies on an outdated card processing system that handles a small fraction of their transaction volume, say less than 5% as of Q4 2024, it would likely fall into this category. Such systems often demand disproportionate maintenance costs and offer restricted functionality compared to newer, API-driven alternatives.

Geographical segments exhibiting consistently low growth or a declining market share for Equals Group's products are categorized as Dogs within the BCG Matrix. For instance, if a particular European market shows a mere 1% annual growth rate for their payment processing solutions, and Equals' market share within that region has shrunk from 5% to 3% over the past two years, it would likely fall into this category. Continued investment in such underperforming areas may not offer a favorable return on capital.

Services with High Operational Costs and Low Automation

Services that are heavily reliant on manual processes and have seen little to no investment in automation by Equals Group could be classified as Dogs in the BCG Matrix. These offerings often struggle with high operational expenses compared to the revenue they generate, making them inherently unprofitable, especially in a market where efficiency is key.

For instance, if a particular service requires extensive human intervention for tasks like data entry, customer support, or complex transaction processing, its cost base will remain elevated. Equals Group's 2024 financial reports might reveal specific segments where manual labor still constitutes a significant portion of operating costs. Without technological upgrades to streamline these operations, these services face diminishing returns and competitive disadvantages.

- High Labor Dependency: Services requiring significant manual input, such as bespoke client onboarding or complex reconciliation tasks, fall into this category.

- Limited Scalability: Manual processes inherently limit how quickly and cost-effectively a service can grow, hindering its market potential.

- Profitability Erosion: In 2024, services with high fixed labor costs and low revenue growth are likely experiencing negative profit margins.

- Investment Lag: A lack of recent capital expenditure on automation for these specific services indicates they are not a strategic priority for efficiency gains.

Products with Limited Scalability

Products or services that are inherently difficult to scale, especially when contrasted with Equals Group's robust B2B platforms, could be classified as Dogs in the BCG Matrix. These offerings might involve highly personalized services or niche solutions that cannot be easily replicated or expanded to serve a much larger market efficiently.

Such products would likely face challenges in achieving substantial market share, particularly in dynamic, high-growth sectors. Their limited scalability can hinder their ability to capitalize on market expansion, potentially leading to stagnant growth and low profitability.

Consider, for instance, a bespoke consulting service that requires significant individual expertise for each client. While valuable, its growth potential is capped by the availability of specialized personnel. In 2024, Equals Group's focus on digital transformation and scalable fintech solutions means that any product falling into this 'Dog' category would represent a strategic divergence from their core growth strategy.

- Limited Market Share: Difficulty in expanding customer base due to inherent scalability constraints.

- Low Growth Potential: Inability to benefit from broad market expansion or network effects.

- Resource Intensive: May require significant ongoing investment of time and specialized human capital to maintain.

- Strategic Mismatch: Potentially misaligned with Equals Group's overall strategy of leveraging technology for scalable financial services.

Dogs within Equals Group, as per the BCG Matrix, represent products or services with low market share and low growth prospects. These are often legacy offerings or niche solutions that are not strategically aligned with the company's growth objectives. In 2024, the fintech environment demands constant innovation and scalability, making these "dog" segments a drain on resources.

For example, a specific foreign exchange product that has seen minimal uptake, perhaps only 2% of Equals Group's total FX transaction volume in 2024, and operates in a market with less than 3% annual growth, would be classified as a dog. These offerings consume management attention and capital that could otherwise be directed towards more promising ventures.

The key issue with these segments is their inability to generate significant returns or contribute to overall market share expansion. Equals Group's focus in 2024 is on optimizing its portfolio, which often involves divesting or minimizing investment in such underperforming assets.

Consider a scenario where a particular payment processing solution, integrated into a legacy system within Equals Group, has a market share of only 1.5% in its niche and the overall market for that solution is growing at a stagnant 1% annually. This would represent a classic dog, requiring maintenance but offering little prospect for future growth or profitability.

| Category | Market Share | Market Growth | Strategic Implication for Equals Group (2024) |

| Dog Product A (e.g., Niche FX) | Low (e.g., < 5%) | Low (e.g., < 3%) | Resource drain; potential divestment or minimal investment |

| Dog Service B (e.g., Manual Reconciliation) | Low (e.g., < 2%) | Low (e.g., < 1%) | High operational costs; automation required or phase-out |

| Dog Segment C (e.g., Underperforming Geo) | Declining (e.g., 3% from 5%) | Low (e.g., 1%) | Re-evaluation of market strategy; potential exit |

Question Marks

Equals Group's strategic push into new European markets, such as Germany and France, positions them as a potential star in the BCG matrix. These regions represent significant growth potential, with the digital payments market in the EU projected to reach over €1.5 trillion by 2027. However, Equals' market share in these developing territories is currently small, reflecting the early stages of their expansion efforts.

The substantial investment required to build brand awareness, establish local partnerships, and navigate regulatory landscapes means these initiatives are capital-intensive. This investment is crucial for capturing market share and achieving widespread adoption, a hallmark of a strategic move into a high-growth, low-market-share quadrant.

Equals Group's acquisition of Roqqett, an open banking payment platform, places them in a segment with significant future growth potential within the fintech landscape. This strategic move aims to leverage the increasing adoption of open banking solutions by consumers and businesses alike.

Roqqett, while positioned in a high-growth area, likely exhibits a relatively low current market share and adoption rate. For instance, while open banking payments are projected to grow significantly, with estimates suggesting the UK market could reach £11 billion by 2027, Roqqett's specific contribution to this is still nascent.

To prevent Roqqett from becoming a 'dog' in the BCG matrix, Equals Group will need to invest heavily in its development, marketing, and integration. This investment is crucial to scale its operations, enhance its feature set, and gain broader market traction against established payment providers.

Equals Group is actively investing in AI-driven automation for financial processes, recognizing this as a high-growth sector with substantial potential for efficiency improvements and a stronger competitive edge. This strategic focus aligns with the broader trend of digital transformation across the financial industry.

While the promise of AI in finance is significant, the precise market share and profitability of individual AI applications remain somewhat unclear. This uncertainty places these emerging AI solutions in the ‘question mark’ category of the BCG matrix, indicating a need for further development and market validation.

For instance, in 2024, the global AI in finance market was projected to reach over $25 billion, with substantial growth expected. However, the specific contributions and market penetration of new AI tools within this vast market are still being determined, necessitating careful observation and strategic investment.

Development of New, Untested Payment Solutions

New, untested payment solutions, like early-stage blockchain-based cross-border payment systems or novel biometric authentication methods, would be placed in the Question Marks quadrant of the Equals Group BCG Matrix. These innovations hold the promise of significant market disruption and high future growth, but their success is far from guaranteed.

The challenge lies in their unproven market acceptance and the substantial investment needed to build awareness and encourage adoption. For instance, a new digital wallet aiming to integrate decentralized finance features might face hurdles in user education and regulatory compliance, mirroring the initial struggles of early mobile payment systems.

- High Growth Potential: These solutions target emerging needs or offer entirely new functionalities that could capture significant market share if successful.

- High Risk: Lack of a proven track record means substantial uncertainty regarding customer adoption and revenue generation.

- Investment Needs: Significant capital is required for research, development, marketing, and building the necessary infrastructure to support these new solutions.

- Strategic Focus: Equals Group would need to carefully assess which of these nascent solutions align with their long-term vision and have the best chance of evolving into Stars.

Strategic Partnerships for Embedded Finance (post-acquisition)

The proposed acquisition of Equals by a consortium, aiming to merge it with Railsr, positions the combined entity squarely within the burgeoning embedded finance sector. This strategic move targets a market projected for substantial growth, with global embedded finance revenues expected to reach $7.2 trillion by 2030, up from $2.7 trillion in 2022. The integration of Equals' payment processing capabilities with Railsr's embedded finance platform creates a compelling proposition, but the exact market share and operational synergy remain key variables.

The success of this venture hinges on several factors, making it a potential star in the BCG matrix, albeit with significant question marks. Key considerations include:

- Market Integration Challenges: Successfully merging the operational and technological infrastructures of Equals and Railsr will be crucial for realizing projected efficiencies and market penetration.

- Competitive Landscape: The embedded finance space is increasingly crowded, with established players and new entrants vying for market share, demanding a clear differentiation strategy for the combined entity.

- Regulatory Environment: Navigating the evolving regulatory landscape for financial services and embedded finance products will require robust compliance frameworks and adaptability.

- Customer Adoption: The ability to attract and retain customers by offering seamless and valuable embedded finance solutions will ultimately determine the venture's long-term success.

New, untested payment solutions, like early-stage blockchain-based cross-border payment systems or novel biometric authentication methods, would be placed in the Question Marks quadrant of the Equals Group BCG Matrix. These innovations hold the promise of significant market disruption and high future growth, but their success is far from guaranteed.

The challenge lies in their unproven market acceptance and the substantial investment needed to build awareness and encourage adoption. For instance, a new digital wallet aiming to integrate decentralized finance features might face hurdles in user education and regulatory compliance, mirroring the initial struggles of early mobile payment systems.

Equals Group's investment in AI-driven automation for financial processes also falls into this category. While the global AI in finance market was projected to exceed $25 billion in 2024, the specific market share and profitability of individual AI applications within Equals are still being determined, necessitating careful observation and strategic investment.

These 'question mark' ventures require significant capital for research, development, marketing, and infrastructure. Equals Group must strategically assess which of these nascent solutions align with their long-term vision and have the best chance of evolving into Stars.

| BCG Quadrant | Characteristics | Examples for Equals Group | Strategic Implications | Market Data (Illustrative) |

|---|---|---|---|---|

| Question Marks | High Market Growth, Low Relative Market Share | Emerging AI payment solutions, Blockchain-based payment systems, Novel biometric authentication | Invest selectively, Divest if potential is low, Develop to become Stars | Global AI in Finance Market: >$25 billion (2024 projection) |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial statements, market research, and competitive analysis to provide accurate strategic insights.