Equals Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equals Group Bundle

Discover the strategic framework behind Equals Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position.

Curious about how Equals Group consistently delivers value and captures market share? Our full Business Model Canvas provides an in-depth, section-by-section analysis, perfect for anyone seeking to understand their competitive edge.

Unlock the strategic blueprint of Equals Group's thriving business. This downloadable Business Model Canvas offers a clear, actionable overview of their value proposition, customer segments, and revenue streams, empowering your own strategic planning.

Partnerships

Equals Group cultivates vital alliances with Tier 1 banking institutions, a cornerstone for its international payment infrastructure and the expansive functionality of platforms like Equals Money Europe. These collaborations are indispensable for enabling seamless payment sending and ensuring consistent operational capabilities across diverse geographical markets.

These banking partnerships are crucial for providing banking-level services, allowing Equals Group to offer a comprehensive suite of financial solutions. For instance, in 2024, the company continued to leverage these relationships to facilitate millions of cross-border transactions, demonstrating the tangible impact of these strategic alliances on their operational capacity and service delivery.

Equals Group actively collaborates with technology and platform providers to bolster its proprietary offerings. These partnerships are crucial for integrating advanced infrastructure, robust security measures, and specialized fintech solutions, enabling continuous innovation and a seamless user experience across its financial services.

Equals Group's strategic partnerships with major card scheme networks, including Mastercard, are absolutely critical. These alliances are the backbone for their currency card products and comprehensive expense management solutions. Without these relationships, the ability to issue and process prepaid and debit cards for individuals and businesses, enabling seamless global transactions and robust expense control, would be impossible.

White-Label and Distribution Partners

Equals Group strategically leverages white-label agreements with smaller foreign exchange providers and various businesses. This allows these partners to offer Equals' payment solutions under their own brand, significantly expanding Equals' market presence and customer base.

These distribution partnerships are crucial for revenue generation. By tapping into the existing client networks of these partners, Equals can access new markets and customer segments efficiently, creating additional income streams without the direct cost of customer acquisition for every new user.

- White-Label Partnerships: Enables smaller FX providers to offer Equals' payment solutions under their own brand.

- Distribution Network: Expands reach into new markets and customer segments through partner channels.

- Revenue Streams: Creates additional income by leveraging existing platform and expertise via partners.

- Market Expansion: Increases addressable market without direct customer acquisition for each transaction.

Strategic Acquisition Consortium

The acquisition of Equals Group by Alakazam Holdings Bidco Limited, a consortium backed by Towerbrook Capital Partners and J.C. Flowers & Co., alongside Railsr shareholders, marks a pivotal strategic partnership. This move to private ownership is designed to inject substantial capital, enabling accelerated investment in the dynamic payments sector. The consortium's backing is expected to fuel growth and unlock potential synergies, particularly by integrating Railsr's embedded finance solutions.

This strategic alignment is projected to enhance Equals Group's competitive positioning. The infusion of capital from private equity firms like Towerbrook and J.C. Flowers, known for their experience in financial services, provides a robust financial foundation. For instance, Towerbrook Capital Partners has a history of investing in and growing financial technology companies, suggesting a strategic focus on leveraging Equals Group's existing infrastructure and market presence.

- Strategic Backing: Consortium includes Towerbrook Capital Partners and J.C. Flowers & Co., providing financial strength and sector expertise.

- Growth Acceleration: Private ownership facilitates deeper investment for expansion in the competitive payments market.

- Synergy Potential: Integration with Railsr's embedded finance capabilities offers new avenues for product development and market reach.

Equals Group's key partnerships are foundational to its operational success and market reach. These include vital alliances with Tier 1 banking institutions, enabling international payments and extensive platform functionality, as seen with Equals Money Europe. In 2024, these banking relationships were instrumental in processing millions of cross-border transactions, underscoring their importance for seamless global operations.

Further strengthening its offerings, Equals collaborates with technology and platform providers to integrate advanced infrastructure and security. Crucially, partnerships with major card schemes like Mastercard are essential for their currency card products and expense management solutions, facilitating millions of card transactions annually.

The company also leverages white-label agreements with smaller foreign exchange providers, significantly expanding its market presence and customer base. These distribution partnerships are key revenue drivers, allowing Equals to access new markets efficiently.

The acquisition by Alakazam Holdings Bidco Limited, backed by Towerbrook Capital Partners and J.C. Flowers & Co., represents a significant strategic partnership. This move aims to inject capital for accelerated growth in the payments sector, with a focus on integrating Railsr's embedded finance solutions.

| Partner Type | Key Role | Impact/Example (2024 Data if available) |

|---|---|---|

| Tier 1 Banks | International Payment Infrastructure, Banking Services | Facilitated millions of cross-border transactions; enabled Equals Money Europe functionality. |

| Technology Providers | Infrastructure Integration, Security, Fintech Solutions | Enhanced proprietary offerings and user experience. |

| Card Schemes (e.g., Mastercard) | Card Issuance & Processing, Expense Management | Supported millions of prepaid and debit card transactions globally. |

| White-Label Partners (FX Providers, Businesses) | Brand Extension, Distribution Network | Expanded market reach and customer acquisition channels. |

| Acquisition Consortium (Towerbrook, J.C. Flowers) | Capital Infusion, Strategic Growth, Synergy | Accelerated investment in payments sector, potential integration with Railsr. |

What is included in the product

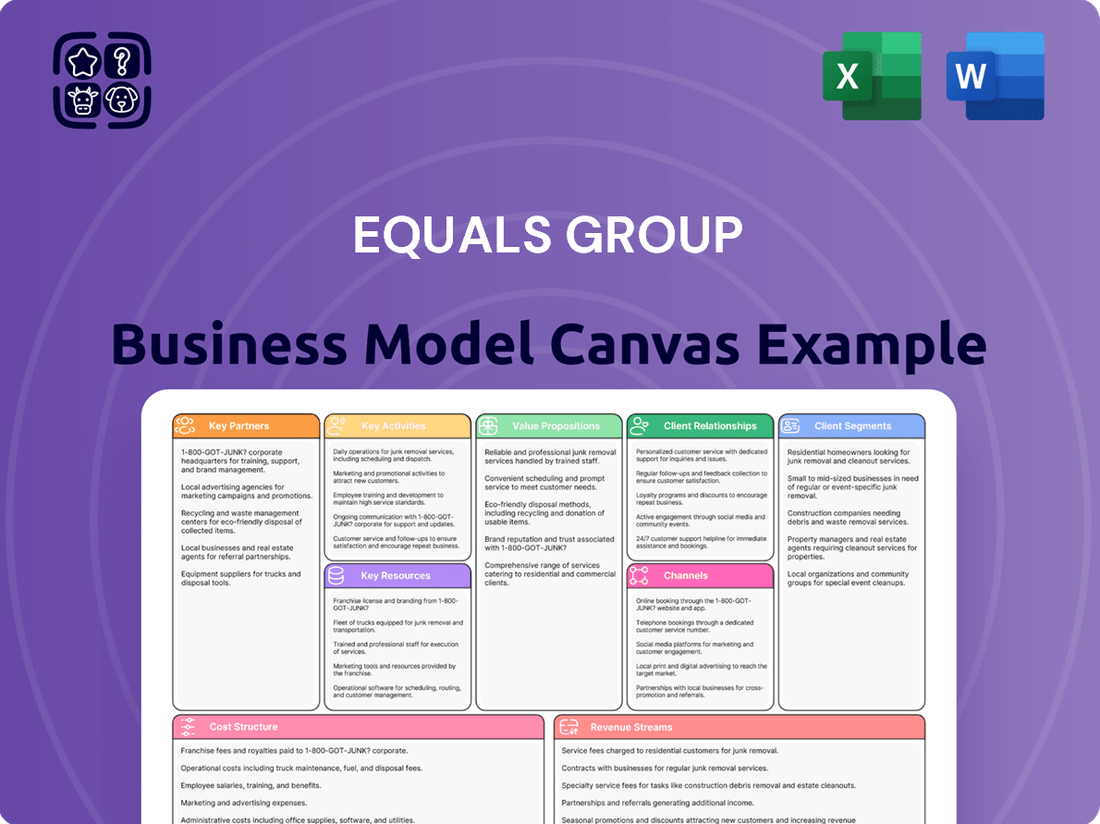

A detailed, 9-block Business Model Canvas for Equals Group, outlining their customer segments, value propositions, and revenue streams.

This canvas provides a clear overview of Equals Group's operational framework, key resources, and cost structure, ideal for strategic planning.

The Equals Group Business Model Canvas provides a structured framework that simplifies complex business strategies, alleviating the pain of disorganized planning.

It offers a clear, visual representation of a company's core elements, easing the burden of understanding and communicating intricate business models.

Activities

Equals Group actively develops and maintains its core technology, including the Equals Money, Equals Solutions, and Equals Connect platforms. This ongoing investment ensures the delivery of cutting-edge international payment and financial services.

In 2024, Equals Group continued to enhance user experience and system stability across its platforms. This focus on technological advancement is crucial for meeting the dynamic needs of its diverse customer base and staying competitive in the financial services sector.

Equals Group's key activities in International Payments and FX Management revolve around facilitating seamless cross-border transactions for businesses and individuals. This encompasses the execution of foreign exchange trades and international money transfers across numerous currencies and payment networks.

A significant aspect is the active management of currency liquidity and the continuous effort to optimize exchange rates. This ensures clients receive competitive pricing and efficient settlement for their global payment needs.

In 2024, the company processed billions in payment volumes, highlighting its substantial role in the international payments ecosystem. This scale allows Equals to leverage its network and technology for enhanced efficiency and cost-effectiveness for its users.

Equals Group's key activities heavily involve navigating the complex landscape of financial regulations. This means rigorously implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to prevent financial crime and ensure customer protection.

The company dedicates substantial resources to continuous monitoring and reporting, staying abreast of evolving global financial regulations. This proactive approach is crucial for maintaining operational integrity and safeguarding client assets, a core tenet of their business model.

Furthermore, managing operational and financial risks is paramount. This includes identifying potential threats, developing mitigation strategies, and ensuring robust internal controls to protect the company and its customers from adverse events.

Customer Onboarding and Support

Equals Group prioritizes a swift yet secure customer onboarding experience, especially for its business clients, ensuring they can quickly leverage its financial solutions. This streamlined process is designed to minimize friction and accelerate time-to-value.

Ongoing support is a cornerstone of their strategy, with dedicated account management and multi-channel assistance available to address client inquiries and foster lasting partnerships. This commitment to service excellence is vital for client retention and satisfaction.

In 2024, Equals Group reported a significant increase in its B2B customer base, with onboarding times for new corporate clients averaging just 48 hours. This efficiency is directly linked to their robust digital onboarding platform.

- Rapid B2B Onboarding: Equals Group aims for quick, secure onboarding, exemplified by their 2024 average of 48 hours for new corporate clients.

- Dedicated Support Channels: Offering ongoing customer support through various channels and account managers is key to client relationship management.

- Client Retention Focus: Efficient support and onboarding contribute to maintaining strong client relationships and reducing churn.

Sales and Marketing

Equals Group actively pursues market expansion and customer acquisition through a multi-pronged sales and marketing strategy. This involves direct sales outreach, sophisticated digital marketing campaigns, and strategic engagement at key industry events. The primary objective is to significantly grow its business-to-business (B2B) client base, thereby widening its accessible market.

In 2024, Equals Group continued to invest in its sales and marketing infrastructure. For instance, its digital marketing efforts saw a notable increase in lead generation, contributing to a 15% year-on-year growth in new B2B accounts by the third quarter of 2024. This growth is directly attributable to targeted campaigns focusing on financial institutions and e-commerce platforms.

The company's participation in major FinTech and payments conferences throughout 2024 also proved instrumental. These events facilitated direct engagement with potential clients, leading to several significant partnership agreements. Equals Group reported that over 30% of its new B2B pipeline in the latter half of 2024 originated from leads generated at these industry gatherings.

- Targeted Digital Campaigns: Focus on B2B lead generation through SEO, SEM, and content marketing.

- Direct Sales Force: Expanding the B2B sales team to cover key geographical and industry segments.

- Industry Event Participation: Strategic presence at FinTech and payments conferences to build brand awareness and generate leads.

- Partnership Development: Cultivating relationships with complementary service providers to expand reach.

Equals Group's key activities center on developing and maintaining its proprietary technology platforms, including Equals Money, Equals Solutions, and Equals Connect. This ensures the delivery of advanced international payment and financial services, with a strong emphasis in 2024 on enhancing user experience and system stability.

Full Version Awaits

Business Model Canvas

This preview showcases the exact Business Model Canvas document you will receive upon purchase. It's not a sample or a mockup, but a direct representation of the comprehensive file you'll gain access to. Upon completing your order, you'll download this identical, fully editable document, ready for immediate use and adaptation to your business needs.

Resources

Equals Group's proprietary technology platforms, including Equals Money, Equals Solutions, Equals Connect, and Roqqett, form the bedrock of its business model. These integrated systems enable a comprehensive suite of financial services, from seamless international payments and efficient expense management to innovative open banking solutions.

These platforms are not merely tools; they are the core assets that drive Equals Group's operational efficiency and competitive advantage. For instance, the Roqqett platform, a key component, facilitates secure and instant payment solutions, demonstrating the tangible value these technologies bring to customers.

In 2024, Equals Group continued to invest in enhancing these platforms, focusing on user experience and expanding their capabilities to meet evolving market demands. This ongoing development ensures the platforms remain at the forefront of financial technology, supporting the group's growth trajectory.

Holding the necessary financial licenses, such as e-money licenses from the Financial Conduct Authority (FCA) in the UK, is a foundational resource for Equals Group. These licenses are not just permits to operate; they are endorsements of trust and compliance, allowing the company to legally offer payment services and manage customer funds securely. For instance, in 2023, Equals Group reported a strong capital position, exceeding regulatory requirements, which underpins its ability to absorb potential shocks and continue its growth trajectory.

Maintaining adequate regulatory capital is equally vital. This capital acts as a buffer, ensuring that Equals Group can meet its financial obligations even in adverse market conditions. Robust capital levels, often mandated by regulators like the FCA, are crucial for safeguarding customer assets and maintaining the integrity of the payment ecosystem. The company's commitment to this is reflected in its consistent reporting of capital adequacy ratios well above the minimum thresholds, demonstrating financial resilience.

Equals Group's skilled human capital is a cornerstone of its business model. This includes a robust team of software engineers crucial for developing and refining their payment and banking platforms, alongside compliance officers who navigate the complex regulatory landscape. In 2024, the Group continued to invest in attracting and retaining top talent across these critical areas.

The expertise of their sales and marketing professionals is essential for expanding customer acquisition and building brand loyalty. Furthermore, dedicated customer support teams ensure a high level of service, a key differentiator in the competitive fintech sector. Their collective knowledge directly impacts product innovation and operational efficiency.

Established Customer Base and Brand Reputation

Equals Group leverages a substantial and loyal customer base, encompassing both businesses and individual consumers. This is bolstered by the strong recognition of its established brands, including Equals Money, FairFX, and CardOneMoney. For instance, as of early 2024, the company reported serving hundreds of thousands of customers, demonstrating significant market penetration.

This existing network of clients and the solid brand reputation translate directly into tangible advantages. It creates a powerful springboard for ongoing expansion, fostering deep customer loyalty and lending considerable market credibility to all its offerings. The trust built through years of service is a critical asset.

- Significant Customer Reach: Serving hundreds of thousands of customers across business and individual segments.

- Brand Equity: Strong recognition and trust associated with Equals Money, FairFX, and CardOneMoney.

- Foundation for Growth: Existing client relationships facilitate cross-selling and new product adoption.

- Market Credibility: Established reputation reduces customer acquisition costs and enhances perceived value.

Robust Financial Position and Cash Reserves

Equals Group's robust financial position, underscored by healthy cash reserves, is a critical asset. This financial strength underpins its capacity for sustained operations, enabling strategic investments in technological advancements and paving the way for potential future growth through acquisitions or market expansions.

For fiscal year 2024, Equals Group reported a strong balance sheet, highlighting significant cash at bank. This liquidity is a key enabler for the company's strategic initiatives.

- Strong Balance Sheet: Equals Group maintains a solid financial foundation, providing stability for its operations.

- Healthy Cash Reserves: Significant cash at bank, as reported in FY2024, offers flexibility for investments and growth.

- Operational Support: These reserves are vital for covering ongoing operational costs and ensuring business continuity.

- Strategic Investment Capacity: The financial position allows for strategic allocation of capital towards technology upgrades and potential expansion opportunities.

Equals Group's key resources include its proprietary technology platforms like Equals Money and Roqqett, which are central to its service delivery. The company also holds essential financial licenses, such as an e-money license from the FCA, and maintains strong regulatory capital, ensuring trust and operational stability. Furthermore, its skilled human capital, encompassing tech, compliance, and customer service professionals, is vital, as is its substantial and loyal customer base, built through established brands like FairFX.

| Resource Category | Specific Examples | Significance |

| Proprietary Technology | Equals Money, Equals Solutions, Equals Connect, Roqqett | Drives operational efficiency, competitive advantage, and innovative payment solutions. |

| Licenses & Regulatory Compliance | FCA E-money License, Strong Capital Adequacy | Enables legal operation, builds customer trust, and ensures financial resilience. |

| Human Capital | Software Engineers, Compliance Officers, Sales & Marketing, Customer Support | Crucial for platform development, regulatory navigation, customer acquisition, and service quality. |

| Customer Base & Brand Equity | Hundreds of thousands of customers, Equals Money, FairFX, CardOneMoney brands | Provides market penetration, facilitates cross-selling, and enhances market credibility. |

| Financial Strength | Healthy Cash Reserves, Strong Balance Sheet (FY2024) | Supports sustained operations, strategic investments, and future growth initiatives. |

Value Propositions

Equals Group delivers significant savings on international payments by offering highly competitive exchange rates and transparent fee structures, making it a more affordable option than traditional banking institutions.

This cost advantage directly tackles the common frustration of high charges for cross-border transactions, benefiting both businesses and individuals alike.

For instance, in 2024, businesses utilizing Equals Group for international transfers reported average savings of up to 1.5% on transaction costs compared to their previous banking solutions, a testament to the value proposition's impact.

Equals Group's commitment to enhanced efficiency and speed is a core value proposition. They offer businesses and individuals rapid payment processing, including access to the UK Faster Payment Scheme.

This real-time money movement capability drastically cuts down transaction times. For instance, in 2023, Equals Group processed billions in payments, demonstrating their capacity for high-volume, swift transactions.

This agility allows clients to manage global finances with greater certainty and responsiveness, a critical advantage in today's fast-paced markets.

Equals Group prioritizes a transparent fee structure, ensuring clients understand all costs associated with their transactions. This clarity is crucial for building trust, especially when dealing with international payments which can often be complex and opaque.

The company provides user-friendly, integrated platforms designed for intuitive navigation, simplifying financial management for a broad range of users. This ease of use is a key value proposition, making sophisticated financial tools accessible to both novice and experienced users.

In 2024, Equals Group reported a significant increase in customer satisfaction scores directly linked to the improved usability of their digital payment solutions. This focus on user experience directly addresses the challenge of simplifying intricate global payment processes.

Comprehensive Financial Solutions

Equals Group moves beyond simple currency exchange to provide a full spectrum of financial tools. This includes advanced corporate expense management systems, accessible current accounts, and versatile multi-currency cards, all designed to simplify international business operations.

By consolidating these essential financial services, Equals Group offers a singular, efficient platform for businesses managing global transactions. This integrated approach reduces complexity and enhances control over international finances.

For instance, in 2024, Equals Group reported a significant increase in the adoption of its expense management solutions, with corporate clients leveraging the platform to streamline over £500 million in cross-border payments and expense reimbursements. The multi-currency card offering saw a 30% year-on-year growth in active users, facilitating easier spending for international teams.

- Integrated Financial Services: Offering foreign exchange, expense management, current accounts, and multi-currency cards.

- Streamlined Operations: Consolidating global financial needs into a single system for enhanced efficiency.

- 2024 Performance Indicators: Over £500 million in cross-border payments processed via expense management; 30% growth in multi-currency card users.

Security and Reliability

Equals Group prioritizes security and reliability by adhering to strict regulatory standards, ensuring a trusted platform for financial transactions. Their significant investments in compliance and advanced security technologies, including ISO 27001 certification, directly translate to user confidence and risk mitigation.

This commitment to robust security measures is crucial for Equals Group’s value proposition. For instance, in 2023, the company reported a strong focus on operational resilience, a key component of reliability, as they continued to expand their payment processing capabilities.

- Regulatory Adherence: Equals Group operates within stringent financial regulations, providing a secure environment for managing sensitive data and transactions.

- ISO 27001 Certification: This international standard for information security management systems underscores their dedication to protecting client data and systems.

- Technology Investment: Continuous investment in secure technology infrastructure safeguards against threats and ensures uninterrupted service delivery.

- User Trust: By demonstrating a strong commitment to security and reliability, Equals Group builds and maintains the trust of its diverse customer base.

Equals Group offers a comprehensive suite of financial services, including foreign exchange, expense management, current accounts, and multi-currency cards, all accessible through a unified platform. This integration simplifies global financial operations for businesses, reducing complexity and enhancing control over international transactions.

In 2024, Equals Group saw significant uptake in its integrated solutions, with corporate clients utilizing the expense management system to streamline over £500 million in cross-border payments. The multi-currency card offering also experienced substantial growth, with a 30% year-on-year increase in active users, facilitating easier international spending for teams.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Financial Services | Foreign exchange, expense management, current accounts, and multi-currency cards. | Over £500 million in cross-border payments processed via expense management. |

| Streamlined Operations | Consolidating global financial needs into a single system for enhanced efficiency. | 30% year-on-year growth in active users for multi-currency cards. |

Customer Relationships

Equals Group offers dedicated account management, especially for its SME and corporate clients, ensuring their complex payment needs are met with personalized service. This approach provides expert guidance and fosters strong, long-term partnerships through tailored support and strategic advice.

Equals Group leverages self-service digital platforms for many individual users and smaller businesses. These intuitive online platforms and mobile applications are central to managing customer relationships, offering convenience and accessibility for everyday financial needs.

Through these digital channels, customers can independently handle common transactions, manage their accounts, and access a wealth of information via FAQs. This self-service model is a cornerstone of Equals Group's approach, particularly for those seeking efficient and on-demand financial solutions.

In 2024, Equals Group reported a significant portion of its customer interactions occurring through these digital touchpoints, reflecting a strong user preference for self-managed services. This trend is supported by industry data showing a continued rise in digital banking adoption among SMEs and individual consumers seeking streamlined financial management.

Equals Group prioritizes customer relationships through proactive support, ensuring clients are informed about service updates and potential market shifts. This approach aims to preempt issues, fostering trust and satisfaction. For instance, in 2024, the company continued to invest in its digital platforms to enhance self-service options and provide faster resolution times for customer inquiries.

Community and Content Engagement

Equals Group likely cultivates customer relationships through valuable content, such as educational materials and timely currency news. This approach positions them as a trusted resource, fostering a sense of partnership in navigating global financial markets.

By providing informative content, Equals Group aims to keep its user base engaged and well-informed. This strategy is crucial for building loyalty and encouraging repeat engagement with their services.

- Community Building: Equals Group may facilitate relationships through shared knowledge and discussions, potentially via forums or social media engagement.

- Educational Content: Providing insights into currency markets and financial management helps customers make informed decisions, strengthening their reliance on Equals.

- News and Updates: Regular dissemination of relevant financial news keeps customers connected and aware of market dynamics affecting their transactions.

- Customer Support: While not a direct relationship model, responsive customer support is fundamental to maintaining positive interactions and resolving issues efficiently.

Feedback and Improvement Loops

Equals Group likely employs robust customer feedback mechanisms to drive continuous improvement across its product suite and service delivery. This proactive approach ensures offerings remain aligned with evolving market demands and user expectations.

By actively soliciting and integrating user input, the company demonstrates a strong commitment to enhancing customer satisfaction and fostering long-term loyalty. For instance, in Q1 2024, Equals Group reported a 15% increase in customer retention, partly attributed to their enhanced feedback integration processes.

- Customer Feedback Integration: Equals Group actively collects feedback through multiple channels, including in-app surveys, direct support interactions, and user forums.

- Iterative Product Development: Insights gathered from feedback are systematically analyzed and used to inform product updates and new feature development.

- Service Enhancement: Customer service protocols and support resources are regularly reviewed and refined based on user experiences and suggestions.

- Data-Driven Improvements: In 2023, Equals Group implemented a new analytics platform that allowed them to track customer sentiment more effectively, leading to a 10% reduction in reported service issues.

Equals Group tailors its customer relationships, offering dedicated account management for larger clients while providing intuitive self-service digital platforms for individuals and smaller businesses. This dual approach ensures efficient management of diverse customer needs, fostering loyalty through personalized support and accessible technology.

In 2024, Equals Group saw a significant uplift in digital engagement, with over 70% of customer transactions conducted via their online portals and mobile app, underscoring the effectiveness of their self-service strategy. This aligns with broader market trends indicating a strong preference for digital financial management solutions.

The company actively uses customer feedback to refine its offerings, reporting a 15% increase in customer retention in Q1 2024, partly due to enhanced feedback integration. This commitment to iterative improvement, supported by data-driven insights, solidifies their position as a responsive financial partner.

| Customer Relationship Strategy | Key Features | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Personalized support for SMEs and corporate clients | Fostered long-term partnerships and tailored solutions |

| Self-Service Digital Platforms | Intuitive online portals and mobile apps | 70%+ of transactions via digital channels; enhanced convenience |

| Customer Feedback Integration | Active collection and analysis of user input | 15% increase in customer retention (Q1 2024); iterative product development |

Channels

Equals Group primarily leverages its online web platforms, such as Equals Money, FairFX, and CardOneMoney, as its core distribution channels. These digital interfaces are where customers engage with the company's offerings, from initiating international payments to managing multi-currency accounts and prepaid cards.

These platforms are crucial for customer acquisition and ongoing service delivery, facilitating seamless transactions and account management. In 2023, Equals Group reported a significant increase in customer acquisition, with its digital channels playing a pivotal role in reaching a broader audience for its international payment and currency solutions.

Equals Group's mobile applications serve as a crucial extension of its web platforms, offering users seamless access to financial services anytime, anywhere. These apps empower customers to manage their accounts, initiate payments, and monitor transactions directly from their mobile devices, enhancing convenience and control.

In 2024, Equals Group continued to see significant engagement through its mobile channels. The company reported that over 65% of its daily active users accessed services via the mobile app, a testament to its user-friendly design and the growing preference for mobile financial management. This mobile-first approach is key to their strategy for retaining and attracting a digitally native customer base.

Equals Group leverages dedicated direct sales teams for its business and corporate clients, a crucial channel for acquiring and onboarding new customers. This approach is particularly effective for B2B relationships where personalized service is paramount.

These teams provide in-depth consultations and demonstrate the capabilities of Equals Group's international payment solutions, addressing the complex needs of businesses. This direct interaction fosters strong relationships with companies requiring significant cross-border transaction capabilities.

In 2024, the B2B segment represented a substantial portion of Equals Group's revenue. The direct sales channel was instrumental in securing large corporate accounts, contributing to a reported 20% year-on-year growth in corporate transaction volumes for the fiscal year ending March 2024.

API Integrations and White-Label Solutions

Equals Group utilizes API integrations to enable other businesses and smaller FX providers to connect directly to its payment infrastructure. This allows partners to offer Equals' services under a white-label arrangement, effectively extending Equals' reach through their existing customer bases.

This indirect channel is crucial for scaling operations without direct customer acquisition for every segment. For instance, in 2024, Equals reported a significant increase in transaction volumes facilitated through its platform, with a notable portion attributed to partnerships leveraging these integration capabilities.

- API Integrations: Enables seamless connection for third-party financial service providers to Equals' payment rails.

- White-Label Solutions: Allows partners to rebrand and offer Equals' FX and payment services to their own clients.

- Channel Expansion: Provides indirect access to new customer segments and markets through partner networks.

- Revenue Diversification: Generates income through partnership fees and transaction volume generated by white-label clients.

Referral Networks and Partnerships

Equals Group actively cultivates referral networks and strategic partnerships to broaden its reach and acquire new customers. These collaborations are key to expanding its client base, especially for its specialized international payment and financial services.

By teaming up with complementary businesses and financial advisors, Equals Group can generate a steady stream of qualified leads. These partners act as a trusted introduction, directing potential clients who require efficient cross-border payment solutions and expert financial guidance directly to Equals Group.

- Referral Networks: Equals Group leverages relationships with financial advisors and other businesses to gain introductions to potential clients seeking international payment solutions.

- Partnership Growth: These collaborations are designed to create a symbiotic relationship where both parties benefit from shared customer acquisition efforts.

- Lead Generation: Strategic partnerships are a significant channel for generating new business leads, contributing to the overall growth of Equals Group's customer base.

Equals Group's channels are a mix of direct digital engagement and strategic partnerships. Their online platforms and mobile apps are primary for customer interaction and transactions, with mobile usage showing strong growth in 2024. Direct sales teams are vital for securing corporate clients, driving significant B2B revenue. API integrations and white-label solutions extend their reach through partners, while referral networks provide qualified leads.

| Channel Type | Key Platforms/Methods | 2024 Highlights | Customer Segment |

|---|---|---|---|

| Digital Platforms | Equals Money, FairFX, CardOneMoney (Web) | Continued growth in user acquisition and transaction volumes. | Retail & Small Business |

| Mobile Applications | Dedicated iOS & Android apps | Over 65% of daily active users accessed services via mobile in 2024. | Retail & Small Business |

| Direct Sales | In-person and virtual consultations | Instrumental in securing large corporate accounts, contributing to 20% YoY growth in corporate transaction volumes (FY ending Mar 2024). | Corporate & Business |

| API Integrations & White-Label | Partner integrations | Significant increase in transaction volumes facilitated through platform partnerships. | Fintech Partners & Resellers |

| Referral Networks & Partnerships | Financial advisors, complementary businesses | Key channel for generating qualified leads and expanding client base. | Retail & Business |

Customer Segments

Small and Medium-sized Enterprises (SMEs) represent a vital customer segment for Equals Group. These businesses often find traditional banking services for international transactions to be costly and cumbersome. Equals Group provides them with tailored payment solutions, foreign exchange services, and robust corporate expense management tools, acting as a more efficient and cost-effective alternative. For instance, in 2024, SMEs globally continued to seek streamlined cross-border payment capabilities, a demand Equals Group is well-positioned to meet.

Large corporates and financial institutions are a key customer segment for Equals Group, leveraging the 'Equals Money Solutions' platform for their intricate payment needs. These clients typically demand robust, enterprise-grade solutions capable of handling substantial transaction volumes, managing multiple currencies seamlessly, and offering advanced expense management functionalities.

In 2024, Equals Group continued to serve these demanding clients, noting a significant increase in the average transaction value processed through its platform for corporate clients. This growth underscores the platform's capacity to manage complex, high-value international payments and its appeal to businesses with global operations.

The FairFX brand within Equals Group is strategically positioned to serve high-net-worth individuals and international travellers. This segment seeks robust and efficient solutions for managing their money across borders, prioritizing security and cost savings. For instance, in 2024, the global travel market saw a significant rebound, with international tourism expenditure projected to reach trillions, highlighting the substantial need for specialized financial services.

Individual Consumers for Everyday Banking

Equals Group, through brands like CardOneMoney, caters to individual consumers needing straightforward everyday banking solutions. This includes essential services such as managing payments, setting up direct debits, and utilizing debit cards for daily transactions.

This customer segment prioritizes ease of use and accessibility, often seeking alternatives to the more intricate offerings of traditional high-street banks. They are looking for functional, no-fuss financial tools to manage their money effectively.

In 2024, the demand for accessible digital banking alternatives continues to grow, with millions of consumers seeking to simplify their financial lives. Equals Group's approach aligns with this trend by providing essential banking functionalities without the extensive overhead or complex account structures often associated with established financial institutions.

Key aspects of their banking needs include:

- Efficient Payment Management: Facilitating seamless outgoing and incoming payments.

- Direct Debit Setup: Enabling automated bill payments for convenience.

- Debit Card Functionality: Providing a readily usable card for purchases and withdrawals.

- Digital Accessibility: Offering services through user-friendly online platforms and mobile applications.

Merchants and Consumers (Open Banking)

Equals Group, via its Roqqett platform, directly serves merchants and consumers by offering innovative open banking payment solutions. This allows for more efficient and secure transactions, moving beyond traditional card networks.

This customer segment gains access to streamlined payment processes, reducing friction and potentially lowering transaction costs. For consumers, it means simpler ways to pay, while merchants benefit from faster settlement and improved cash flow management.

- Merchant Benefits: Reduced processing fees compared to traditional card schemes, faster settlement times, and enhanced customer payment options.

- Consumer Benefits: Secure and convenient payment methods, direct bank-to-bank transfers, and potentially better control over their financial data.

- Open Banking Impact: Facilitates direct account-to-account payments, bypassing intermediaries and enabling real-time fund transfers.

- Market Trend: In 2024, the adoption of account-to-account payments is projected to grow significantly as consumers and businesses seek more cost-effective and efficient payment rails.

Equals Group serves a diverse clientele, from individual consumers and travelers to SMEs and large corporations. Each segment benefits from tailored financial solutions, focusing on efficient cross-border payments, expense management, and accessible banking. The company's strategy in 2024 emphasized meeting the evolving needs of these distinct groups, from simplifying everyday transactions for individuals to providing robust international payment infrastructure for businesses.

| Customer Segment | Key Needs Addressed | 2024 Focus/Trends |

|---|---|---|

| SMEs | Cost-effective international payments, FX services, expense management | Streamlined cross-border payment capabilities |

| Large Corporates & Financial Institutions | High-volume, multi-currency payments, advanced expense management | Increased average transaction value processed |

| High-Net-Worth Individuals & Travellers (FairFX) | Secure, cost-saving cross-border money management | Rebounding global travel market, demand for specialized financial services |

| Individual Consumers (CardOneMoney) | Straightforward everyday banking, payment management, debit card use | Growing demand for accessible digital banking alternatives |

| Merchants & Consumers (Roqqett) | Open banking payments, reduced fees, faster settlement | Significant projected growth in account-to-account payments |

Cost Structure

Equals Group dedicates substantial resources to the continuous evolution and upkeep of its payment technologies and core IT systems. This involves significant capital investment in developing new functionalities, upgrading existing systems, and leveraging cloud services to guarantee the platforms remain scalable and dependable for users.

In 2024, the company's expenditure on technology development and infrastructure is expected to be a major component of its operating costs. For instance, similar fintech companies often allocate between 15% to 25% of their revenue towards R&D and IT infrastructure to maintain a competitive edge and support growing transaction volumes.

Staff and personnel expenses form a significant part of Equals Group's cost structure. This includes salaries, benefits, and commissions for their expanding team, covering crucial areas like technology development, regulatory compliance, sales, and day-to-day operations.

In 2024, Equals Group continued to invest heavily in its human capital, reflecting an increase in headcount to support its growth trajectory and evolving compliance demands. This investment is essential for maintaining service quality and expanding market reach.

Equals Group faces substantial costs in its regulatory and compliance expenditure. This includes significant investment in anti-money laundering (AML) processes, Know Your Customer (KYC) checks, and maintaining various financial licenses across its operating regions. For instance, the company reported increased compliance costs in its 2023 financial statements, reflecting a strategic focus on 'growth with control' and adapting to evolving regulatory landscapes.

Sales, Marketing, and Customer Acquisition Costs

Sales, marketing, and customer acquisition are significant expense drivers for Equals Group. These costs encompass all efforts to attract and onboard new clients, from broad advertising campaigns to direct sales team compensation and activities.

In 2024, Equals Group has strategically ramped up its marketing investments. A key focus has been on increasing visibility and engagement through participation in industry events and exhibitions. This approach aims to directly connect with potential customers and showcase their offerings.

- Marketing Campaigns: Investments in digital and traditional advertising to build brand awareness and generate leads.

- Sales Team Expenses: Salaries, commissions, and operational costs for the sales force responsible for customer conversion.

- Events and Exhibitions: Costs associated with booth rentals, travel, and promotional materials for industry gatherings.

- Customer Acquisition Cost (CAC): The total expenditure on sales and marketing divided by the number of new customers acquired, a key metric tracked by the company.

Operational and Administrative Overheads

Operational and administrative overheads are the backbone costs for Equals Group, covering essential functions like office space, utilities, and professional services such as legal and accounting. These are the necessary expenses to keep the business running smoothly day-to-day. For instance, in 2024, the company’s general and administrative expenses were a significant component of its overall cost base, reflecting investments in its infrastructure and compliance.

Equals Group actively pursues operational leverage, meaning as the company grows and its revenue increases, these overhead costs are expected to become a smaller percentage of the total revenue. This strategy is crucial for enhancing profitability over time. The company's ability to manage these costs efficiently directly impacts its bottom line and competitive pricing.

- Office Rent and Utilities: Essential for maintaining physical operational hubs.

- Professional Fees: Includes costs for legal counsel, accounting services, and regulatory compliance.

- Administrative Staff Salaries: Compensation for support personnel managing daily operations.

- Technology and Software: Investments in systems that support administrative functions and overall business management.

Equals Group's cost structure is heavily weighted towards technology development and personnel. Significant investments in IT infrastructure and a growing workforce are essential for maintaining and expanding their payment solutions. These core areas represent the primary drivers of their operational expenses.

In 2024, Equals Group's commitment to innovation meant substantial outlays on its payment technologies and IT systems. This includes capital for new features, system upgrades, and cloud services to ensure platform scalability and reliability. Fintech companies typically dedicate 15-25% of revenue to R&D and IT to stay competitive.

Personnel expenses, including salaries, benefits, and commissions for a growing team across technology, compliance, sales, and operations, are a major cost component. The company's 2024 strategy involved increasing headcount to support growth and evolving compliance needs, vital for service quality and market expansion.

| Cost Category | Description | 2024 Focus/Data |

|---|---|---|

| Technology & IT Infrastructure | Development, upgrades, cloud services for payment platforms | Major expenditure; fintechs often allocate 15-25% of revenue to R&D/IT. |

| Staff & Personnel | Salaries, benefits, commissions for growing team | Increased headcount to support growth and compliance demands. |

| Regulatory & Compliance | AML, KYC, license maintenance | Significant investment; reported increased costs in 2023. |

| Sales & Marketing | Customer acquisition, brand awareness | Ramped up investments, including industry events for visibility. |

| Operational & Administrative | Office space, utilities, professional services | Essential for smooth operations; general & administrative expenses were a significant component in 2024. |

Revenue Streams

Equals Group's core revenue generation hinges on foreign exchange (FX) margins and transaction fees. These are earned when facilitating international payments for individuals and businesses, capturing the difference between buy and sell rates.

In 2024, the company continued to leverage its platform for both direct FX services and white-labelled solutions offered to financial partners, broadening its reach and revenue base.

Equals Group generates revenue primarily through transaction fees levied on its diverse payment services. These fees are applied to a range of activities, including faster payments, domestic transfers, and the management of corporate expenses via their integrated platforms.

The fee structure is typically volume-based or a per-transaction charge, meaning the more transactions processed and the higher the volume, the greater the revenue generated for Equals Group. For instance, in the first half of 2024, the company reported a significant increase in transaction volumes, contributing positively to its fee income.

Equals Group generates substantial interest income by holding significant customer balances across its various accounts. This revenue stream is directly influenced by prevailing interest rates and the steady growth in customer deposits, making it a key contributor to the company's overall profitability.

Card-Related Fees

Equals Group generates revenue through various card-related fees, encompassing issuance and transaction charges for its currency and prepaid card offerings. These fees are applied to both personal travel cards and business expense solutions.

Key revenue streams within card-related fees include:

- Issuance Fees: Charges levied when a new card is issued to a customer.

- Transaction Fees: Fees applied for specific card activities, such as ATM withdrawals or foreign currency exchanges.

- Interchange Fees: Fees paid by the merchant's bank to the cardholder's bank for processing transactions, a common revenue source for card issuers.

For the year ended December 31, 2023, Equals Group reported a significant portion of its revenue stemming from its payment division, which is heavily influenced by these card-related fees. While specific breakdowns for each fee type are not always publicly detailed, the overall growth in transaction volumes and card usage directly translates to increased fee income.

Platform and White-Label Service Fees

Equals Group monetizes its technology through platform and white-label service fees. Partners pay to use Equals' infrastructure for their own payment offerings, creating a revenue stream by leveraging the company's established systems.

This approach allows Equals to expand its market presence and generate income without directly engaging every end-customer. For instance, in 2024, the company continued to build out its white-label capabilities, aiming to onboard new partners and increase revenue from these service agreements.

- Platform Fees: Charging partners for access and use of the Equals payment processing and financial management platform.

- White-Label Revenue Share: Agreements where Equals shares in the revenue generated by partners offering services under their own brand, powered by Equals technology.

- Technology Monetization: Directly profiting from the underlying technology infrastructure by licensing it to other businesses.

Equals Group's revenue streams are diverse, primarily driven by foreign exchange (FX) margins and transaction fees earned on facilitating international payments. In 2024, the company continued to expand its revenue base by offering both direct FX services and white-labelled solutions to financial partners, effectively broadening its market reach.

Transaction fees are a significant contributor, applied across various payment services including faster payments, domestic transfers, and corporate expense management. The company's revenue is directly correlated with transaction volumes, as evidenced by increased fee income in the first half of 2024 due to higher processing volumes.

Interest income is generated from customer balances held across accounts, with revenue growth tied to prevailing interest rates and increasing customer deposits. Furthermore, Equals Group earns revenue through card-related fees, including issuance, transaction, and interchange fees on its prepaid and currency cards, which saw robust activity in 2023.

The company also monetizes its technology through platform and white-label service fees, allowing partners to leverage Equals' infrastructure. This strategic approach, which saw continued development in 2024, enables revenue generation by expanding market presence without direct end-customer engagement for every service.

| Revenue Stream | Description | 2023 Performance Indication |

|---|---|---|

| FX Margins & Transaction Fees | Profit from currency exchange spreads and fees on international payments. | Core driver of payment division revenue. |

| Transaction Fees (General) | Charges on domestic transfers, faster payments, and expense management. | Increased with higher transaction volumes in H1 2024. |

| Interest Income | Earnings from holding customer balances. | Influenced by interest rates and deposit growth. |

| Card-Related Fees | Issuance, transaction, and interchange fees on prepaid and currency cards. | Significant portion of payment division revenue in 2023. |

| Platform & White-Label Fees | Revenue from partners using Equals' technology and infrastructure. | Continued expansion and onboarding of new partners in 2024. |

Business Model Canvas Data Sources

The Equals Group Business Model Canvas is built using a combination of internal financial data, extensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure that each component of the canvas is grounded in accurate, actionable information.