Equals Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equals Group Bundle

The Equals Group operates within a dynamic financial services landscape, where buyer power and the threat of substitutes significantly influence its market position. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Equals Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Equals Group's reliance on banking partners for essential services like payment infrastructure and liquidity is a significant factor in the bargaining power of suppliers. The successful onboarding of Equals Money Europe by a Tier 1 banking partner in H1 2024 underscores the critical nature of these relationships for fintech operations.

Any adverse changes in terms or increased costs from these foundational banking partners could directly impact Equals Group's operational efficiency and profitability, demonstrating their considerable leverage.

Equals Group's reliance on technology and platform providers, such as those offering APIs, cloud infrastructure, and cybersecurity, means these suppliers hold significant bargaining power. Their continuous investment in product development directly impacts Equals Group's ability to innovate and maintain operational efficiency.

The cost and quality of these essential services are paramount for Equals Group's competitive standing. For instance, a disruption in cloud services or a breach in cybersecurity could have substantial financial and reputational consequences, highlighting the suppliers' leverage.

Furthermore, the integration of complex systems from these technology providers often entails high switching costs. This can lock Equals Group into existing relationships, further strengthening the bargaining position of these critical suppliers, especially as the digital economy continues to expand, with global cloud services market expected to reach over $1 trillion by 2025.

Regulatory bodies, while not typical suppliers, wield considerable power over Equals Group by dictating compliance standards. For instance, the Financial Conduct Authority (FCA) in the UK imposes strict operational guidelines, directly impacting the company's cost structure.

Equals Group's investment in robust Anti-Money Laundering (AML) measures, a direct response to regulatory demands, highlights this supplier-like influence. These requirements necessitate significant expenditure and a continuous focus on adapting to evolving legal landscapes.

The need to adhere to upcoming regulations such as PSD3 and the adoption of standards like ISO 20022 are critical operational imperatives. These frameworks shape how Equals Group conducts business, effectively acting as powerful external forces influencing strategic decisions and financial planning.

Payment Network Operators

Payment network operators, such as Mastercard, hold significant bargaining power over Equals Group. Equals Money Cards operate under a Mastercard license, making them reliant on these established global networks for transaction processing. This dependency means that changes in network fees, operating rules, or technological requirements directly impact Equals Group's costs and product offerings.

The limited number of dominant global payment networks further concentrates their power. For instance, in 2024, Mastercard and Visa continued to be the primary facilitators for international card transactions, giving them substantial leverage in negotiations with fintech companies like Equals Group. These networks dictate the terms of service and the interchange fees, which are crucial components of Equals Group's revenue model.

- Dependence on Licensing: Equals Group's reliance on Mastercard's license for its card products inherently grants Mastercard leverage.

- Network Fees: Interchange fees and other network charges set by operators are a direct cost for Equals Group, impacting profitability.

- Limited Alternatives: The concentrated nature of global payment networks restricts Equals Group's ability to switch providers without significant disruption.

- Technological Standards: Adherence to network-specific technological standards and updates can necessitate investment from Equals Group, further demonstrating the network operators' influence.

Data and Security Service Providers

Equals Group's reliance on data and security service providers significantly influences its bargaining power. To offer competitive foreign exchange rates, the company needs real-time market data, and to prevent fraud and ensure secure transactions, it depends on specialized cybersecurity providers. The increasing sophistication of cyber threats means continuous investment in advanced security solutions, giving powerful leverage to reliable and innovative security suppliers.

The need for robust data and security infrastructure places suppliers in a strong position. Equals Group's commitment to data security is highlighted by its ISO 27001 certification, a standard that requires rigorous security controls and continuous improvement, often necessitating close collaboration and reliance on expert service providers.

- Data Dependency: Equals Group requires real-time market data for competitive foreign exchange rates.

- Cybersecurity Imperative: Specialized cybersecurity providers are crucial for fraud prevention and transaction security.

- Supplier Leverage: The continuous need for advanced security against evolving cyber threats empowers innovative security suppliers.

- Certification Impact: Maintaining ISO 27001 certification underscores a commitment to data security, often strengthening supplier relationships.

Equals Group's bargaining power with its suppliers is notably influenced by its reliance on banking partners for core functionalities like payment processing and liquidity. The fintech sector's dependence on these foundational services means that any shifts in terms or pricing from these banking entities can directly impact Equals Group's operational costs and profitability.

Technology and platform providers, including those offering cloud infrastructure and cybersecurity solutions, also hold significant sway. Equals Group's need for innovation and operational resilience means these suppliers' product advancements and service quality are critical, with the global cloud services market projected to exceed $1 trillion by 2025, underscoring the scale of this dependency.

Payment network operators, such as Mastercard, exert considerable bargaining power due to Equals Group's licensing agreements for its card products. The limited number of dominant global payment networks, like Mastercard and Visa in 2024, further concentrates their influence, dictating essential terms and fees that directly affect Equals Group's revenue streams.

Equals Group's dependence on specialized data and security service providers is another key factor. The necessity for real-time market data and advanced cybersecurity solutions to combat evolving threats empowers these suppliers, especially as maintaining certifications like ISO 27001 requires robust partnerships with expert providers.

| Supplier Type | Key Dependencies for Equals Group | Impact on Bargaining Power | Relevant Data/Trend |

|---|---|---|---|

| Banking Partners | Payment infrastructure, Liquidity | High; adverse changes directly impact operations and profitability. | Tier 1 banking partner onboarding in H1 2024 highlights critical relationships. |

| Technology & Platform Providers | APIs, Cloud infrastructure, Cybersecurity | Significant; impacts innovation and operational efficiency. | Global cloud services market expected to exceed $1 trillion by 2025. |

| Payment Network Operators | Card licensing, Transaction processing | High; limited alternatives and network fees directly affect revenue. | Mastercard and Visa dominate global card transactions in 2024. |

| Data & Security Providers | Real-time market data, Cybersecurity solutions | Substantial; evolving threats necessitate continuous investment in advanced solutions. | ISO 27001 certification requires reliance on expert security providers. |

What is included in the product

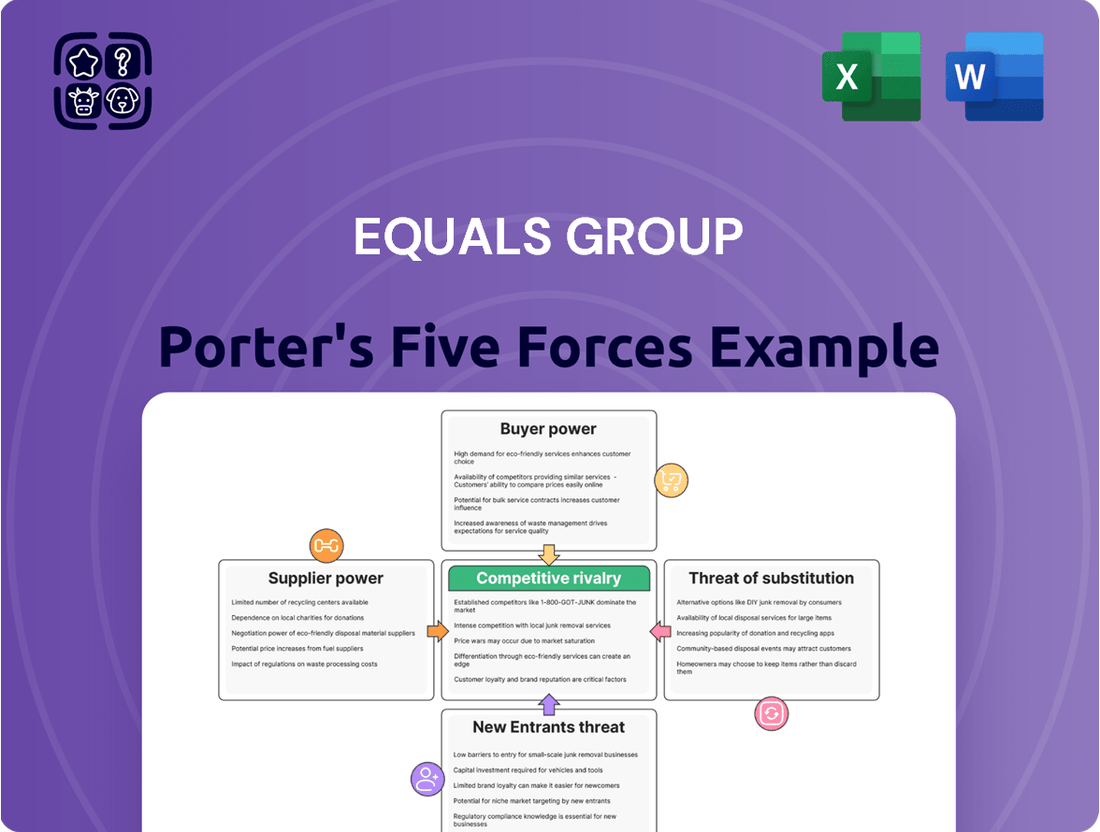

This analysis unpacks the competitive intensity for Equals Group by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Instantly visualize competitive intensity and identify strategic vulnerabilities with a dynamic, interactive Porter's Five Forces model.

Customers Bargaining Power

Equals Group serves a wide array of clients, from small businesses to large corporations and individuals. This broad customer base is a key factor in understanding their bargaining power.

The company's strategic shift towards business-to-business (B2B) services means they are increasingly dealing with corporate clients. These larger clients often have higher transaction volumes, which can give them more leverage when negotiating terms and pricing.

For instance, in 2023, Equals Group reported that its B2B segment accounted for a significant portion of its revenue, highlighting the importance of these relationships. While this diversification reduces reliance on any one group, it also means the company must manage the expectations and demands of its more sophisticated corporate customers.

For individual customers and many small businesses, the process of opening an account with a new fintech provider or even a traditional bank is increasingly straightforward. This low barrier to entry means switching costs are minimal, allowing customers to easily move if they find better interest rates, quicker transaction speeds, or a more intuitive user experience elsewhere. This directly enhances their bargaining power.

The highly competitive landscape of the fintech sector, with numerous players vying for market share, further amplifies this customer leverage. In 2024, the global fintech market was valued at approximately $1.1 trillion, demonstrating the intense competition for customer acquisition and retention, which naturally drives down switching costs and increases customer power.

Equals Group's core promise is to offer a cheaper, more efficient alternative to traditional banks, directly tapping into customer price sensitivity. This is especially true for international money transfers and foreign exchange services, where consumers actively hunt for better rates and lower fees. In 2024, the average cost of sending $200 internationally could range from 5% to 10% of the transaction value, highlighting the significant savings customers can achieve with competitive providers.

Availability of Numerous Alternatives

The sheer volume of fintech startups and established banks offering international payment solutions means customers have a wealth of options. This abundance of choice directly translates into increased bargaining power for customers, compelling companies like Equals Group to constantly refine their offerings and highlight unique selling propositions.

For instance, in 2024, the global fintech market was valued at over $1.1 trillion, with a significant portion dedicated to cross-border payments. This competitive landscape means customers can easily switch providers if they find better rates, lower fees, or superior service elsewhere.

- High Availability of Alternatives: Customers can choose from numerous fintechs and traditional banks for international payments.

- Increased Customer Bargaining Power: This wide selection forces providers to compete on price, service, and innovation.

- Market Dynamics: The over $1.1 trillion global fintech market in 2024 highlights the intense competition.

- Focus on Differentiation: Equals Group must continuously innovate to stand out in this crowded market.

Emphasis on Transparency

Equals Group's commitment to transparency in cross-border transactions significantly bolsters customer bargaining power. By clearly outlining fees and exchange rates, the company reduces information asymmetry, enabling users to make well-informed choices.

This clarity allows customers to easily compare Equals Group's offerings against competitors, driving competition on price and service quality. For instance, in 2024, the global cross-border payments market was valued at over $35 trillion, a figure that underscores the intense competition and the importance of transparent pricing to attract and retain customers.

- Transparency in Fees: Customers can readily see all charges, preventing hidden costs.

- Clear Exchange Rates: Real-time, understandable rates empower comparison.

- Informed Decision-Making: Reduced information asymmetry leads to greater customer confidence.

- Enhanced Competition: Customers can easily switch to providers offering better value.

The bargaining power of customers for Equals Group is substantial, driven by the ease of switching providers in the competitive fintech and payments sector. With a global fintech market valued at over $1.1 trillion in 2024, customers have a wealth of alternatives, including numerous fintech startups and established banks offering international payment solutions.

This abundance of choice, coupled with Equals Group's own mission to provide cheaper, more efficient alternatives, means customers actively seek better rates and lower fees, particularly for services like international money transfers where savings can be significant. For example, in 2024, the cost of sending $200 internationally could range from 5% to 10% of the transaction value, making price sensitivity a key factor for customers.

Furthermore, Equals Group's commitment to transparency in fees and exchange rates empowers customers to easily compare offerings, directly increasing their leverage. The sheer size of the global cross-border payments market, exceeding $35 trillion in 2024, underscores the intense competition and the necessity for providers to offer clear value to retain customers.

| Factor | Description | Impact on Equals Group | 2024 Data Point |

|---|---|---|---|

| Availability of Alternatives | Numerous fintechs and banks offer similar services. | Increases customer leverage and price sensitivity. | Global fintech market > $1.1 trillion. |

| Switching Costs | Low barriers to entry for new providers. | Customers can easily move to competitors for better terms. | N/A (Qualitative factor) |

| Price Sensitivity | Customers actively seek lower fees and better exchange rates. | Forces Equals Group to maintain competitive pricing. | International transfer costs 5-10% of value for $200. |

| Information Transparency | Clear fee structures and exchange rates. | Enables easy comparison, enhancing customer bargaining power. | Global cross-border payments market > $35 trillion. |

Same Document Delivered

Equals Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for the Equals Group, detailing the competitive landscape and strategic positioning. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The UK fintech market is incredibly crowded and moves at a breakneck pace, with new innovations constantly emerging. Equals Group faces a significant challenge from numerous companies offering very similar international payment and financial services, all competing fiercely for customers.

This intense rivalry means companies like Equals Group must constantly innovate and improve their offerings to stay ahead. For instance, the UK fintech sector saw significant investment in 2024, with reports indicating over £4 billion invested in the first half of the year, highlighting the active and competitive nature of the market.

Equals Group contends with established traditional banks that are actively integrating fintech solutions, blurring the lines between old and new financial services. These incumbents leverage their vast customer networks, extensive infrastructure, and substantial capital reserves to compete effectively on both scale and established trust. For instance, in 2023, major banks continued significant investments in digital transformation, with many reporting billions allocated to technology upgrades and new digital product development, aiming to retain and attract customers in an evolving market.

Competition in international payments is fierce, driven by speed, cost, user experience, and advanced technology like AI and embedded finance. Equals Group's strategic investments in its platform and payment infrastructure are crucial for maintaining a competitive edge in this dynamic market.

In 2024, the global cross-border payments market was valued at over $150 trillion, highlighting the immense scale and competitive intensity. Equals Group's focus on differentiating through technological sophistication and regulatory adherence positions it to capture a share of this vast market.

Market Growth and Consolidation

The UK fintech sector is experiencing robust growth, drawing in considerable investment. This influx of capital intensifies competition among existing players and new entrants alike, creating a dynamic market landscape.

This heightened competitive pressure is driving market consolidation. A prime example is the proposed £283 million acquisition of Equals Group by Alakazam Holdings Bidco Limited, a significant event in the UK fintech space.

The move by Equals Group to go private under well-funded ownership signals a strategic adaptation to the market's need for sustained investment and development.

- Projected UK Fintech Market Growth: The sector is set for substantial expansion, encouraging more investment.

- Increased Competition: Growth fuels a more competitive environment, impacting all players.

- Market Consolidation Trend: Competitive pressures are leading to mergers and acquisitions.

- Equals Group Acquisition: The £283 million deal for Equals Group highlights the consolidation trend and the appeal of private equity backing.

Regulatory Compliance as a Barrier and Differentiator

Equals Group sees its rigorous regulatory compliance not just as a cost, but as a significant competitive advantage. In an industry facing heightened regulatory oversight, strong Anti-Money Laundering (AML) protocols and certifications like ISO 27001 are crucial differentiators. These robust measures build essential institutional trust, setting Equals Group apart from competitors with weaker compliance frameworks.

The financial services landscape in 2024 continues to emphasize security and trustworthiness. Companies demonstrating superior adherence to regulations, such as those outlined by the FCA in the UK or similar bodies globally, are better positioned to attract and retain clients, particularly institutional ones. This focus on compliance acts as a substantial barrier to entry for new players and a key differentiator for established ones.

- Regulatory Adherence as a Moat: Equals Group leverages its strong compliance infrastructure as a strategic asset, distinguishing itself in a crowded market.

- Building Trust Through Standards: Adherence to critical standards like ISO 27001 for information security and robust AML procedures fosters client confidence and institutional trust.

- Competitive Edge in Scrutiny: In 2024, as regulatory scrutiny intensifies, companies like Equals Group with proven compliance records gain a distinct advantage over less diligent competitors.

- Barrier to Entry and Differentiation: The cost and complexity of maintaining high compliance standards create a significant barrier for new entrants and a clear differentiator for existing firms.

The competitive rivalry within the UK fintech sector, where Equals Group operates, is exceptionally intense. This is driven by a large number of players offering similar services, leading to constant pressure on pricing and innovation. The market's rapid evolution, fueled by significant investment, means companies must continually adapt to maintain market share.

Equals Group faces competition not only from other fintechs but also from traditional banks that are increasingly adopting digital strategies. This dynamic environment necessitates continuous investment in technology and customer experience to differentiate and retain clients.

| Competitor Type | Key Competitive Factors | Impact on Equals Group |

|---|---|---|

| Fintech Startups | Agility, niche offerings, disruptive technology | Pressure to innovate quickly, potential loss of market share to specialized providers |

| Established Fintechs | Brand recognition, existing customer base, economies of scale | Need for superior product features and customer service to compete |

| Traditional Banks | Customer loyalty, extensive infrastructure, regulatory experience, capital | Challenge to attract customers away from trusted institutions, need to offer comparable security and ease of use |

SSubstitutes Threaten

Traditional bank wire transfers and international payment services represent a significant threat of substitutes for Equals Group. For instance, in 2024, major banks continued to process trillions of dollars through their established wire networks, offering a familiar and deeply entrenched alternative, particularly for large corporations valuing existing relationships and perceived stability over potentially lower fees.

For individuals, especially those traveling, physical cash and traditional foreign exchange bureaus remain viable substitutes for currency cards and digital foreign exchange services. While digital options are growing, cash is still preferred for certain purchases and by a segment of travelers. In 2024, the demand for physical currency for travel purposes, though declining, still represents a significant market share that Equals Group must consider.

Blockchain and cryptocurrency solutions are rapidly emerging as powerful substitutes for traditional cross-border payment methods. These decentralized technologies offer enhanced security, often greater speed, and potentially lower transaction fees compared to established systems. As of early 2024, the global cryptocurrency market capitalization hovers around $1.5 trillion, indicating significant adoption and infrastructure development, which directly challenges incumbent payment providers.

The growing acceptance and regulatory clarity surrounding digital assets further bolster their threat. For instance, Ripple's XRP, a key player in blockchain-based payments, has been actively pursuing partnerships with financial institutions aiming to streamline international remittances. This increasing viability means that businesses and individuals alike are finding credible alternatives to traditional wire transfers and money orders, directly impacting the market share of existing players.

Digital Wallets and Embedded Finance

The increasing prevalence of digital wallets and super apps presents a significant threat of substitutes for traditional payment service providers. These platforms are integrating payment functionalities directly into user experiences, often within non-financial applications. For instance, in 2024, the global digital payment market was valued at over $1.5 trillion, with mobile payments accounting for a substantial portion of this growth.

Embedded finance, a key driver of this trend, allows consumers and businesses to make payments without explicitly using a separate payment gateway. This seamless integration means that transactions can occur as an almost invisible part of a larger process, such as purchasing goods within a social media app or managing business expenses directly within accounting software. This reduces the perceived need for standalone payment platforms.

- Digital Wallets and Super Apps: Platforms like Apple Pay, Google Pay, and WeChat Pay are becoming ubiquitous, offering convenience and often loyalty rewards that attract users away from traditional methods.

- Embedded Finance: Companies are embedding payment solutions into their core offerings, such as ride-sharing apps allowing in-app payments or e-commerce platforms managing the entire transaction lifecycle internally.

- Reduced Transaction Friction: The ease of use and reduced steps involved in these integrated payment solutions make them highly attractive substitutes, potentially diminishing the reliance on dedicated payment service providers.

Neobanks and Digital-Only Financial Institutions

Neobanks and digital-only financial institutions present a significant threat of substitution for Equals Group. These entities, such as Monzo and Revolut, provide a wide array of financial services, including international money transfers, directly challenging Equals Group's core business. Their lean, technology-driven models often translate into more competitive pricing, making them an attractive alternative for consumers and businesses alike.

The rapid growth of these digital players is a key indicator of their substitutive power. For instance, by the end of 2023, the global neobanking market was valued at over $50 billion and is projected to grow substantially. This expansion highlights a clear shift in customer preference towards more accessible and cost-effective digital financial solutions, directly impacting traditional and even newer fintech players like Equals Group.

- Digital-First Appeal: Neobanks offer user-friendly interfaces and seamless digital experiences, catering to a growing segment of customers who prefer managing their finances entirely online.

- Cost Competitiveness: Often operating with lower overheads than traditional banks, neobanks frequently offer more attractive fee structures for services like international payments, a key area for Equals Group.

- Service Expansion: Many neobanks are rapidly expanding their product suites to include lending, investments, and business banking, thereby becoming comprehensive financial hubs that can fully substitute for Equals Group's offerings.

- Market Penetration: By early 2024, neobanks had captured a significant portion of the retail banking market in several developed economies, demonstrating their increasing ability to erode the customer base of established financial service providers.

The threat of substitutes for Equals Group is multifaceted, encompassing traditional financial services, emerging digital solutions, and even alternative payment methods. Established banks, with their vast customer bases and existing infrastructure, continue to offer wire transfers, a familiar yet often more expensive alternative. For instance, in 2024, the global cross-border payments market was valued at approximately $156 trillion, with traditional channels still holding a substantial share.

Digital wallets and super apps are increasingly integrating payment functionalities, offering convenience and often loyalty programs that draw users away from dedicated payment providers. By early 2024, mobile payment transaction volume globally was projected to exceed $3 trillion, highlighting the significant adoption of these integrated solutions.

Neobanks and digital-only financial institutions are also posing a considerable threat. Their cost-competitive pricing and user-friendly digital interfaces are attracting customers who seek streamlined financial services, including international money transfers. The global neobanking market, valued at over $50 billion by the end of 2023, is a testament to their growing influence.

| Substitute Category | Key Players/Examples | 2024 Market Context/Data | Impact on Equals Group |

| Traditional Wire Transfers | Major Global Banks (e.g., JP Morgan, HSBC) | Global cross-border payments market ~ $156 trillion. Banks offer familiar, stable, but often higher-cost services. | Retains large corporate clients valuing existing relationships; represents a baseline for comparison. |

| Digital Wallets & Super Apps | Apple Pay, Google Pay, WeChat Pay | Mobile payment transaction volume projected > $3 trillion globally. Focus on convenience and integrated experiences. | Erodes user base for standalone payment services through seamless embedding in daily digital activities. |

| Neobanks/Digital Banks | Revolut, Monzo, N26 | Global neobanking market > $50 billion (end 2023). Offer competitive fees and digital-first experiences. | Directly competes with international payment services, attracting price-sensitive and digitally savvy customers. |

| Cryptocurrency & Blockchain | Ripple (XRP), Stablecoins | Global crypto market cap ~ $1.5 trillion (early 2024). Potential for faster, cheaper cross-border transactions. | Emerging alternative for specific use cases, challenging traditional speed and cost paradigms. |

Entrants Threaten

The international payments and fintech sector faces substantial regulatory hurdles that deter new competitors. Navigating intricate licensing, Anti-Money Laundering (AML) compliance, and consumer protection rules demands significant investment and expertise. For instance, obtaining a payment institution license in the UK alone can take many months and involve substantial legal and operational costs, making it a formidable barrier to entry.

Developing and scaling a competitive payment platform, like those operated by Equals Group, demands substantial upfront investment. This includes technology infrastructure, robust cybersecurity measures, and skilled operational teams. For instance, building a secure and reliable system capable of handling millions of transactions requires significant capital outlay, creating a formidable barrier for potential new entrants.

In the financial services sector, the need for brand trust and reputation acts as a significant barrier to entry. Newcomers must invest heavily in building credibility, a process that can take years. Equals Group, for instance, has cultivated a strong reputation over its 13+ years of operation, evidenced by its high Trustpilot scores, making it challenging for new entrants to quickly gain customer confidence.

Network Effects and Economies of Scale

The threat of new entrants in the B2B payments sector, particularly for companies like Equals Group, is significantly mitigated by powerful network effects and economies of scale enjoyed by established players. For instance, in B2B payments, the value of a platform often grows with each new user, creating a self-reinforcing loop that makes it challenging for newcomers to attract a critical mass of customers. This is a key barrier, as businesses prefer to integrate with widely adopted payment solutions to ensure broad compatibility and ease of transaction processing.

Moreover, existing participants benefit from substantial economies of scale. As transaction volumes increase, the cost per transaction typically decreases, allowing incumbents to offer more competitive pricing. For example, major payment processors often achieve lower operational costs due to their massive scale, a level that new entrants struggle to reach quickly. This cost advantage makes it difficult for new companies to compete on price, further deterring market entry.

- Network Effects: In B2B payments, a platform's utility increases with user adoption, making it harder for new entrants to gain traction.

- Economies of Scale: Larger transaction volumes lead to lower per-unit costs, a barrier for smaller, new competitors.

- Cost Advantage: Established players can offer more competitive pricing due to their scale, disadvantaging new entrants.

Technological Complexity and Innovation Pace

The rapid advancement of payment technologies, such as real-time payment systems, AI-driven fraud detection, and blockchain applications, presents a significant barrier for new entrants. These companies must demonstrate sophisticated technological prowess and a commitment to continuous innovation to compete effectively.

Developing and integrating these cutting-edge capabilities requires substantial investment in research and development, as well as specialized talent. For instance, in 2024, the global fintech market size was valued at over $1.1 trillion, underscoring the immense capital required to establish a foothold.

- High R&D Costs: New entrants face substantial costs in developing and maintaining advanced payment technologies.

- Talent Acquisition: Securing skilled engineers and data scientists proficient in areas like AI and blockchain is a significant challenge.

- Pace of Innovation: The need to constantly adapt to evolving technological landscapes demands agile development cycles and ongoing investment.

The threat of new entrants for Equals Group is significantly constrained by high capital requirements, regulatory complexities, and the need for established trust. Developing robust payment infrastructure and securing necessary licenses demand substantial upfront investment, acting as a formidable barrier. For example, in 2024, the global fintech market was valued at over $1.1 trillion, indicating the immense capital needed to compete.

Established players like Equals Group benefit from strong network effects and economies of scale, making it difficult for newcomers to achieve critical mass or compete on price. The trust and reputation built over years, as seen in Equals Group's operational history, are also critical deterrents, as new entrants struggle to quickly gain customer confidence in the financial services sector.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Significant investment needed for technology, licensing, and operations. | High barrier; deters undercapitalized entrants. |

| Regulatory Hurdles | Complex licensing, AML, and compliance rules. | Time-consuming and costly to navigate, favoring established firms. |

| Brand Trust & Reputation | Customer confidence built over time through reliable service. | New entrants struggle to quickly establish credibility. |

| Network Effects & Scale | Value increases with user base; lower costs at higher volumes. | New entrants face challenges in achieving critical mass and competitive pricing. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Equals Group is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate insights from reputable financial news outlets and competitor announcements to capture a comprehensive view of the competitive landscape.