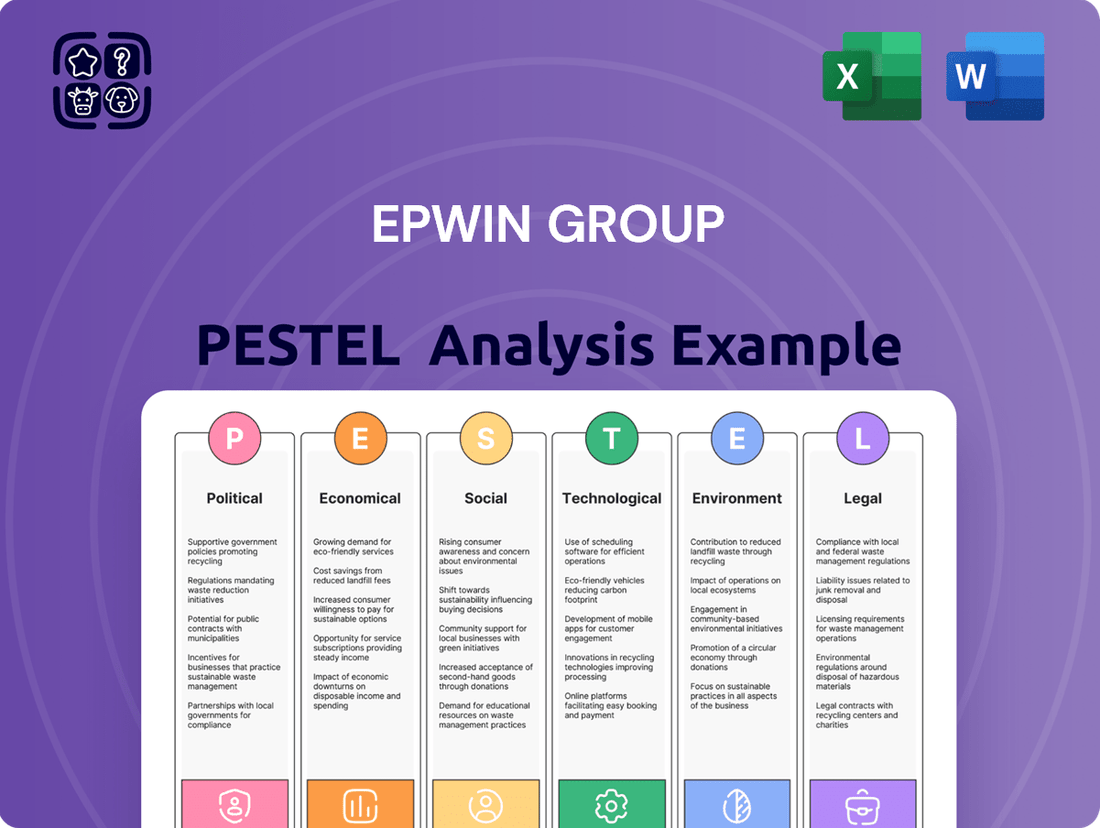

Epwin Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epwin Group Bundle

Navigate the complex external forces shaping Epwin Group's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Unlock actionable intelligence to refine your strategy and gain a competitive edge.

Gain a critical understanding of how macro-environmental shifts are impacting Epwin Group's operations and market position. Our expertly crafted PESTLE analysis provides the deep insights you need to anticipate trends and make informed decisions. Download the full version now and empower your strategic planning.

Political factors

Government housing policies are a significant driver for Epwin Group. Initiatives like the Affordable Homes Programme in England, which aims to deliver 160,000 homes by 2026, directly boost demand for construction materials. Changes to planning regulations or the introduction of new grants for energy-efficient retrofits also shape the market for Epwin's window, door, and conservatory products.

The UK government's commitment to net-zero targets influences building regulations, encouraging the use of sustainable and energy-efficient materials, which aligns with Epwin's product offerings. For example, the Boiler Upgrade Scheme, while not directly housing policy, incentivizes home improvements that often include window and door replacements. The stability and clarity of these policies are crucial for Epwin's long-term investment and production planning.

Evolving building regulations, particularly concerning energy efficiency and fire safety, directly influence Epwin Group's product development. For instance, the UK's Future Homes Standard, aiming for net-zero ready homes by 2025, mandates higher thermal performance for windows and doors, requiring Epwin to innovate in materials and design. This focus on sustainability and safety means compliance is not optional, but a driver for new product specifications.

Meeting these increasingly stringent standards, such as enhanced fire resistance for facade systems and improved accessibility features in door designs, requires continuous investment in research and development. Epwin's commitment to these areas ensures their product range remains compliant and competitive in the 2024-2025 market, where regulatory adherence is paramount for market access and customer trust.

Changes in trade policies, such as new tariffs or import/export regulations, directly impact Epwin Group's operational costs. For instance, increased tariffs on aluminum, a key material, could significantly raise production expenses, affecting their competitive pricing. A stable trade environment, conversely, is crucial for maintaining predictable supply chain costs and ensuring access to necessary raw materials like PVC.

Political Stability and Investment Climate

Epwin Group's operations are heavily influenced by the political stability within the United Kingdom. A predictable political environment fosters investor confidence, which is crucial for long-term strategic planning and capital allocation within the construction materials sector. The UK government's commitment to infrastructure development and housing targets directly impacts demand for Epwin's products.

Political uncertainty, however, can create significant headwinds. For instance, the period leading up to and following the 2024 general election in the UK could introduce a degree of caution in investment decisions, potentially delaying new construction projects. This can translate into slower order books for companies like Epwin, impacting revenue streams.

- Political Stability: The UK has generally maintained a stable political system, though recent years have seen increased volatility.

- Government Policy: Policies related to housing, construction, and environmental regulations (e.g., Building Regulations) directly affect Epwin's market. For example, the government's Net Zero targets by 2050 encourage demand for sustainable building materials.

- Investor Confidence: In 2024, investor sentiment in the UK construction sector is cautiously optimistic, with a focus on government spending on infrastructure and housing initiatives.

- Regulatory Environment: Changes in building codes and planning permissions can significantly impact the pace and type of construction, thereby affecting Epwin's product demand.

Public Sector Spending on Infrastructure

Government investment in public infrastructure, including schools, hospitals, and civic buildings, directly benefits companies like Epwin Group that supply high-quality, durable building materials. For instance, the UK government's commitment to levelling up the country through infrastructure development, with significant allocations in the 2024 budget, translates into demand for construction products. This focus on public sector projects offers Epwin a stable revenue source and broadens its market reach beyond the cyclical nature of private residential construction.

Monitoring government budget announcements is crucial for Epwin. The Autumn Statement 2024, for example, highlighted continued investment in public services and infrastructure, signaling ongoing opportunities. This sustained public sector spending provides a vital diversification strategy for Epwin, mitigating risks associated with solely relying on the housing market.

- Government infrastructure spending: The UK government's continued investment in public buildings and infrastructure projects creates consistent demand for Epwin's products.

- Market diversification: Public sector projects offer Epwin a valuable avenue to diversify its revenue streams away from solely residential markets.

- Budgetary influence: Government budget allocations and spending priorities directly impact the pipeline of opportunities for building product suppliers like Epwin.

Government housing policies remain a primary driver for Epwin Group, with initiatives like the Affordable Homes Programme aiming to boost demand for construction materials. Changes in planning regulations and grants for energy-efficient retrofits directly shape the market for Epwin's window, door, and conservatory products, with the UK government's commitment to net-zero targets influencing building regulations and encouraging sustainable materials.

Evolving building standards, particularly concerning energy efficiency and fire safety, necessitate continuous R&D for Epwin. The UK's Future Homes Standard, targeting net-zero ready homes by 2025, mandates higher thermal performance for windows and doors, driving innovation in materials and design for compliance and competitiveness in the 2024-2025 market.

Political stability in the UK is crucial for Epwin's long-term planning and investor confidence, with government infrastructure spending, such as that outlined in the 2024 budget, creating consistent demand for building materials. This public sector investment offers Epwin market diversification beyond residential construction.

| Policy Area | Impact on Epwin | 2024/2025 Relevance |

|---|---|---|

| Affordable Homes Programme | Increased demand for construction materials | Targeting 160,000 homes by 2026 |

| Net Zero Targets/Future Homes Standard | Demand for energy-efficient products | Mandates higher thermal performance for windows/doors by 2025 |

| Public Infrastructure Spending | Stable revenue from civic projects | Continued government investment in schools, hospitals |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Epwin Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within the Epwin Group's operating landscape.

A concise PESTLE analysis of the Epwin Group, presented in a clear, summarized format, acts as a pain point reliever by enabling quick referencing during meetings and facilitating efficient strategy discussions.

Economic factors

Fluctuations in interest rates directly impact mortgage affordability, which in turn influences demand for new homes and renovation projects. For instance, the Bank of England's base rate, which stood at 5.25% in early 2024, affects the cost of borrowing for homebuyers. Higher rates can lead to reduced consumer spending on significant purchases like home improvements or new properties, impacting Epwin Group's sales across both its new build and repair, maintenance, and improvement (RMI) segments.

The availability of attractive mortgage products is a key driver for market activity. When mortgage rates are competitive, it encourages more people to enter the housing market or invest in their existing homes. This buoyancy is essential for companies like Epwin Group, which supply materials and components to these sectors.

Rising inflation in 2024 and into 2025 significantly impacts Epwin Group by increasing the cost of essential raw materials like PVC resin and aluminum. For instance, global PVC prices saw substantial volatility throughout 2023, with some key benchmarks experiencing double-digit percentage increases at various points, directly affecting manufacturing input costs for companies like Epwin. This inflationary pressure directly squeezes profit margins if these higher costs cannot be effectively passed on to customers.

Epwin Group's profitability hinges on its capacity to implement price adjustments for its window, door, and conservatory products. The challenge lies in balancing the need to recover increased material expenses with the risk of alienating customers and losing market share in a competitive environment. Successfully navigating this requires careful market analysis and strategic pricing to maintain sales volumes while protecting margins.

Ensuring supply chain resilience against these persistent inflationary pressures is a paramount economic consideration for Epwin Group. Diversifying suppliers, securing long-term contracts where feasible, and optimizing inventory management are crucial strategies to mitigate the impact of fluctuating material costs and maintain operational stability throughout 2024 and 2025.

Consumer confidence is a key driver for Epwin Group's performance, particularly in the RMI (Repair, Maintenance, and Improvement) sector. When households feel secure about their financial future, they tend to spend more on home upgrades. For instance, in Q1 2024, the GfK Consumer Confidence Index in the UK showed a slight improvement, reaching -19, up from -27 in Q4 2023. This uptick suggests a potential willingness among consumers to invest in their homes.

Disposable income levels directly correlate with spending on non-essential items like home renovations. As wages rise and inflation moderates, consumers have more discretionary funds available. Data from the Office for National Statistics (ONS) indicated that real household disposable income saw an increase in late 2023 and early 2024. Higher disposable income empowers homeowners to undertake projects that require products like those offered by Epwin Group, such as new windows or conservatory upgrades.

Construction Sector Growth and Output

The construction sector's health is crucial for Epwin Group, as its output directly correlates with demand for building components. In 2024, the UK construction sector experienced a mixed performance. While new housing starts saw some slowdown due to economic headwinds, commercial property development and infrastructure projects provided a more stable demand base.

The overall growth rate of the construction industry, including both residential and commercial aspects, is a key indicator for Epwin Group. Trends such as new housing starts, commercial property development, and public sector construction initiatives are significant drivers of demand for the company's products. A healthy construction pipeline is essential for maintaining consistent order books.

Latest data from the Office for National Statistics (ONS) for Q1 2024 indicated a slight contraction in construction output, but forecasts for the remainder of 2024 and into 2025 suggest a gradual recovery, particularly driven by infrastructure spending and a stabilization in the housing market.

- UK Construction Output: Forecasts suggest a modest rebound in 2025, with growth projected between 1.5% and 2.5%.

- New Housing Starts: While facing challenges in 2024, a projected increase in mortgage approvals could stimulate new housing starts by late 2024 and into 2025.

- Infrastructure Investment: Government commitments to infrastructure projects, such as HS2 and renewable energy developments, are expected to bolster demand for construction materials throughout 2024-2025.

- Commercial Property: The office and retail sectors are seeing shifts, but logistics and industrial property development remain strong, supporting demand for building components.

Housing Market Dynamics

House price movements and supply shortages directly influence Epwin Group's demand for building components. For instance, in the UK, while house price growth showed some moderation in early 2024, it remained a key indicator of market health. A persistent shortage of new housing stock, exacerbated by planning delays and construction costs, continues to underpin demand for renovations and extensions, benefiting companies like Epwin.

Demographic shifts, such as increasing household formation rates, particularly among younger generations seeking independent living, also drive long-term demand. This trend is evident in the UK's ongoing need for new housing units, with projections suggesting a continued need for hundreds of thousands of new homes annually to meet demand. This sustained need translates into consistent requirements for windows, doors, and other essential building materials.

The strength and activity within the housing market are crucial. A robust market with a high volume of transactions and new developments creates a steady demand for Epwin's product range. For example, the UK new build market, despite facing economic headwinds, saw activity levels that supported the supply chain. Understanding these dynamics across different regions is vital for Epwin to tailor its strategies and product offerings effectively.

- UK house price growth in early 2024: While varying by region, prices generally showed resilience, indicating underlying demand.

- Housing supply shortages in the UK: The deficit in new homes continues to drive demand for extensions and renovations.

- Household formation rates: Increasing numbers of younger individuals forming new households necessitate more housing, boosting the construction sector.

- Regional market variations: Differences in housing market performance across the UK require localized strategic approaches.

Economic factors significantly shape Epwin Group's operating environment. Fluctuations in interest rates, such as the Bank of England's 5.25% base rate in early 2024, directly affect mortgage affordability and, consequently, demand in both new build and RMI sectors. Inflation, a persistent concern in 2024 and into 2025, drives up raw material costs like PVC and aluminum, impacting Epwin's profit margins if these increases cannot be passed on.

Consumer confidence and disposable income are vital. A slight improvement in the GfK Consumer Confidence Index to -19 in Q1 2024, coupled with ONS data showing real household disposable income increases in late 2023/early 2024, suggests growing consumer willingness to invest in home improvements. The UK construction sector's performance is also critical; while experiencing mixed signals in 2024, forecasts for 2025 indicate a gradual recovery, particularly in infrastructure, which will support demand for Epwin's products.

| Economic Factor | 2024/2025 Data Point | Impact on Epwin Group |

|---|---|---|

| Bank of England Base Rate | 5.25% (Early 2024) | Influences mortgage affordability, impacting housing demand. |

| UK Consumer Confidence (GfK Index) | -19 (Q1 2024) | Improved confidence can lead to increased RMI spending. |

| Real Household Disposable Income (UK) | Increased late 2023/early 2024 | Higher disposable income supports home renovation spending. |

| UK Construction Output Forecast | Projected 1.5%-2.5% growth in 2025 | Recovery in construction boosts demand for building components. |

| PVC Resin Prices | Volatile with double-digit increases in 2023 | Increases raw material costs, impacting manufacturing expenses. |

Preview Before You Purchase

Epwin Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Epwin Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the external forces shaping the building materials and home improvement sectors.

Sociological factors

The aging population in key markets like the UK presents a significant opportunity for Epwin Group. As the proportion of individuals aged 65 and over continues to grow, there's a projected increase in demand for housing solutions that are low-maintenance and accessible. For instance, by 2030, it's estimated that over 20% of the UK population will be aged 65 or older, a trend that directly benefits companies offering durable and easy-to-care-for building materials.

This demographic shift means older homeowners are likely to prioritize products that reduce upkeep and enhance safety, such as PVC-U and aluminum window and door systems. These materials offer longevity and require minimal maintenance compared to traditional options. This focus on practicality and durability creates a resilient market segment for Epwin Group's core product lines.

Homeowners are increasingly investing in their properties, with a significant portion of spending directed towards comfort and energy efficiency. This trend directly fuels the repair, maintenance, and improvement (RMI) sector, which is a core market for companies like Epwin Group. For instance, in 2024, the UK home improvement market was valued at approximately £58 billion, with a notable portion attributed to upgrades driven by sustainability concerns and a desire for enhanced living spaces.

A robust home improvement culture, amplified by media coverage and social media trends showcasing aspirational living, consistently drives demand for contemporary building products. This cultural shift, prioritizing personalized and functional homes, ensures a steady market for innovative materials and solutions. The growing popularity of indoor-outdoor living spaces, for example, has led to increased demand for bi-fold doors and other connected architectural elements, a segment where Epwin Group actively operates.

Ongoing urbanization continues to drive demand for higher-density housing, particularly in major cities. This trend directly impacts the building products sector, as urban developments increasingly favor compact living spaces and multi-story structures. Consequently, there's a growing need for innovative window and door solutions that maximize space and enhance energy efficiency in these denser environments.

For instance, in the UK, the Office for National Statistics reported that in 2023, over 84% of the population resided in urban areas, a figure projected to climb. This demographic shift necessitates building components that are not only space-saving but also structurally sound and energy-efficient for the numerous apartment blocks and terraced housing projects being constructed. Epwin Group's product portfolio, encompassing a wide range of uPVC and aluminum window and door systems, is well-positioned to meet these evolving urban building requirements, offering solutions adaptable to various densities and architectural styles.

Sustainability Awareness and Eco-conscious Choices

Growing public awareness of environmental issues is significantly shaping consumer preferences, with a marked increase in demand for sustainable and eco-friendly products. This trend directly impacts the building materials sector, as homeowners increasingly prioritize energy efficiency in their choices. For instance, studies in 2024 indicated that over 60% of new home buyers consider energy efficiency a top priority when selecting windows and doors.

Epwin Group's strategic focus on products with strong insulating properties, such as their energy-efficient window and door systems, directly addresses this societal shift. This alignment positions them favorably to capture market share as the demand for greener building materials continues to rise. In the UK, the government's net-zero targets, reinforced by policies in 2024, are further incentivizing the adoption of such materials.

- Growing consumer demand for sustainable building materials.

- Homeowner preference for energy-efficient windows and doors.

- Societal pressure for reduced carbon footprints in construction.

- Government policies promoting eco-friendly building practices.

Aesthetic Preferences and Design Trends

Aesthetic preferences significantly shape the demand for Epwin Group's window and door products. Evolving architectural styles, from the resurgence of mid-century modern to the continued popularity of Scandinavian minimalism, directly influence the types of designs, colors, and finishes consumers seek. For instance, a growing preference for clean lines and natural materials might boost demand for slim-profile aluminum windows and wood-effect uPVC doors.

Staying ahead of these design trends is crucial for Epwin Group's competitiveness. The company must monitor shifts in interior design, such as the increasing adoption of specific color palettes like muted earth tones or bold jewel tones, to ensure its product offerings align with contemporary tastes. This proactive approach allows Epwin to tailor its product development and marketing strategies effectively, ensuring its range remains desirable in the market.

- Minimalist Design Influence: Reports from the interior design sector in late 2024 and early 2025 indicate a sustained strong preference for minimalist aesthetics, driving demand for windows with thinner frames and concealed hardware.

- Color Palette Trends: Market research for the 2025 season highlights a growing interest in sustainable and nature-inspired color palettes, with shades like sage green, terracotta, and deep blues gaining traction in both residential and commercial projects.

- Material Innovation: Consumer surveys conducted in Q4 2024 revealed an increasing demand for sustainable and aesthetically pleasing materials, pushing manufacturers like Epwin to explore innovative finishes and composite materials that mimic natural textures.

The increasing focus on home renovation and improvement, driven by a desire for enhanced living spaces and energy efficiency, presents a significant opportunity for Epwin Group. In 2024, the UK home improvement market was valued at approximately £58 billion, with a notable portion attributed to upgrades driven by sustainability concerns and a desire for improved comfort.

Aesthetic preferences are also a key driver, with trends favoring minimalist design and natural color palettes influencing demand for specific window and door styles. For instance, market research for the 2025 season highlights a growing interest in sustainable and nature-inspired color palettes, with shades like sage green and terracotta gaining traction.

The aging demographic in key markets like the UK continues to create demand for low-maintenance and accessible housing solutions. By 2030, over 20% of the UK population is projected to be aged 65 or older, directly benefiting companies offering durable and easy-to-care-for building materials.

Technological factors

Ongoing research into materials like PVC-U, PVC-UE, and aluminum is significantly boosting product performance, durability, and eco-friendliness. For instance, advancements in PVC formulations in 2024 are focusing on greater UV resistance and improved thermal insulation, directly impacting the energy efficiency of building products.

Innovations in material compounds are yielding better insulation, fire resistance, and recyclability. In 2025, expect to see new PVC compounds with up to 30% recycled content becoming more mainstream, offering Epwin Group a distinct competitive edge in a market increasingly driven by sustainability metrics.

Staying ahead of these material science breakthroughs is paramount for maintaining product leadership. Companies that integrate next-generation materials, such as those with enhanced acoustic dampening properties, will likely capture greater market share in the premium building materials segment through 2025.

Epwin Group's manufacturing process automation is seeing significant advancements. The adoption of robotics and AI in window and door fabrication is enhancing efficiency and product consistency. For instance, automated assembly lines can increase output by up to 30% compared to manual processes, while also reducing material waste by an estimated 5-10%.

These technological shifts directly impact Epwin's cost structure and competitiveness. By automating tasks like cutting, welding, and assembly, the company can achieve lower production costs per unit. This allows for quicker turnaround times, a crucial advantage in meeting market demand, especially with the projected 7% growth in the UK fenestration market for 2024-2025.

Investing in smart factory technologies, such as IoT sensors and data analytics, further boosts operational effectiveness. Epwin can leverage real-time data to optimize production schedules, predict maintenance needs, and ensure higher quality control, contributing to a stronger market position.

The construction sector is rapidly embracing digital tools like Building Information Modeling (BIM) and advanced design software. This trend directly influences how companies like Epwin Group, a manufacturer of building products, need to present their offerings. For instance, by 2024, the global BIM market was projected to reach over $10 billion, highlighting its widespread adoption.

Epwin Group can gain a competitive edge by providing comprehensive digital product libraries that seamlessly integrate with BIM workflows. Furthermore, ensuring compatibility with emerging smart home technologies is crucial. The smart home market in the UK alone was valued at approximately £1.6 billion in 2023, indicating a significant demand for connected building solutions.

Emerging technologies like digital twins, which create virtual replicas of physical assets, and virtual reality (VR) for design visualization are also transforming project planning. By adapting to these advancements, Epwin Group can enhance its relevance and appeal to contractors and specifiers working on forward-thinking projects.

Energy Efficiency and Smart Product Development

Technological leaps in glazing, thermal breaks, and sealing are allowing Epwin Group to produce windows and doors that are significantly more energy-efficient. This directly addresses growing consumer demand and increasingly stringent building regulations, such as those aimed at reducing carbon emissions in the construction sector. For instance, advancements in triple glazing and low-emissivity coatings are becoming standard, enhancing thermal performance considerably.

The potential for 'smart' windows and doors, incorporating features like integrated sensors for light and temperature control or automated locking mechanisms, presents a compelling avenue for future market growth. These innovations could cater to the burgeoning smart home market, offering enhanced convenience and energy savings for end-users. Epwin's focus on continuous innovation in energy performance is therefore not just about compliance but also about unlocking new revenue streams.

In 2024, the UK government continued to emphasize energy efficiency in new builds, with regulations like Part L of the Building Regulations driving demand for high-performance fenestration products. Epwin Group's commitment to R&D in areas like advanced uPVC profiles and improved sealing systems directly supports this trend, positioning them to capitalize on the market's shift towards sustainability. The company's investment in new manufacturing technologies also plays a crucial role in maintaining a competitive edge in delivering these advanced products.

Recycling and Circular Economy Technologies

Technologies that enable the recycling of PVC-U and aluminum are vital for Epwin Group's sustainability efforts. These innovations allow for the incorporation of recycled materials into new products, reducing reliance on virgin resources. For instance, advanced sorting and purification technologies are key to increasing the quality and quantity of recycled content. Epwin's commitment to this area aligns with the growing market demand for eco-friendly building materials.

Investing in or collaborating with firms specializing in cutting-edge recycling processes can significantly benefit Epwin. This strategy not only lowers raw material costs but also bolsters the company's reputation for environmental responsibility. The global market for recycled plastics, including PVC, is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend underscores the financial and operational advantages of embracing circular economy principles.

- Advanced Recycling Technologies: Innovations in chemical and mechanical recycling are enhancing the quality and usability of recovered PVC-U and aluminum.

- Circular Economy Integration: Technologies facilitating the closed-loop system for materials reduce waste and create new revenue streams.

- Market Growth for Recycled Content: Increased consumer and regulatory pressure is driving demand for products with higher percentages of recycled materials.

- Sustainability Credentials: Adoption of these technologies directly supports Epwin's environmental, social, and governance (ESG) targets and improves its brand image.

Technological advancements in materials science are a cornerstone for Epwin Group's product development, with ongoing research in PVC-U, PVC-UE, and aluminum driving improvements in durability and eco-friendliness. For example, 2024 saw a significant focus on PVC formulations with enhanced UV resistance and thermal insulation, directly impacting the energy efficiency of building products.

Innovations in material compounds are yielding better insulation, fire resistance, and recyclability. By 2025, new PVC compounds incorporating up to 30% recycled content are expected to become more mainstream, offering Epwin a competitive edge in a sustainability-focused market.

Epwin Group's manufacturing processes are benefiting from automation, with robotics and AI enhancing efficiency and product consistency in window and door fabrication. Automated assembly lines can boost output by up to 30% while reducing material waste by an estimated 5-10%.

These technological shifts directly impact Epwin's cost structure and competitiveness. Automating tasks like cutting and assembly leads to lower production costs per unit and quicker turnaround times, crucial for meeting market demand, especially with the UK fenestration market projected to grow by 7% in 2024-2025.

Legal factors

Epwin Group must strictly adhere to evolving building safety regulations, particularly in the UK, following incidents like the Grenfell Tower fire. This includes ensuring all products meet stringent fire safety, structural integrity, and material traceability standards, a non-negotiable legal requirement.

Failure to comply with these regulations, such as the Building Safety Act 2022, can result in substantial fines, severe reputational damage, and costly product recalls, impacting financial performance and market trust.

Environmental Protection Laws significantly influence Epwin Group's manufacturing processes and its entire supply chain. Regulations concerning waste management, emissions control, and the handling of hazardous materials, particularly in PVC production and aluminum smelting, are critical for compliance. For instance, the UK's Environment Act 2021, which came into full effect in late 2023, sets ambitious targets for biodiversity and pollution reduction, potentially increasing compliance costs for manufacturers like Epwin.

Adherence to these environmental standards is not just a legal necessity but also a strategic imperative. Failure to comply can result in substantial fines and reputational damage. Epwin Group's commitment to sustainability, as highlighted in its 2023 annual report, suggests proactive measures to meet evolving environmental legislation, which may include capital expenditure on advanced, eco-friendly production technologies to minimize its environmental footprint.

Epwin Group must adhere to a range of product standards and certifications, including British Standards and European Norms, to ensure its windows, doors, and building components meet quality and safety benchmarks. The UKCA marking is now a key legal requirement for goods placed on the market in Great Britain, replacing CE marking in many cases following Brexit. Maintaining these certifications, often requiring regular audits, is crucial for continued market access and customer trust.

Health and Safety Legislation

Health and safety legislation is a critical legal factor for Epwin Group, directly impacting its manufacturing and installation activities. These laws mandate a safe working environment for all employees, covering everything from machinery safety standards to the proper handling of materials. For instance, in the UK, the Health and Safety at Work etc. Act 1974 sets out the general duties employers owe to their employees and others. Adherence to these regulations is not just a legal requirement but also crucial for minimizing operational risks, preventing accidents and injuries, and avoiding significant legal liabilities and reputational damage.

Recent data highlights the ongoing importance of workplace safety. In 2023/24, the UK's Health and Safety Executive (HSE) reported that while the overall trend in workplace fatalities has been downwards, specific sectors still face challenges. For companies like Epwin Group, operating in manufacturing and construction-related services, understanding and implementing robust safety protocols is paramount. This includes:

- Compliance with specific regulations: Ensuring all manufacturing processes and on-site installations meet or exceed legal safety standards, such as those outlined by the HSE.

- Risk assessment and mitigation: Regularly identifying potential hazards in the workplace and implementing measures to control them, as required by law.

- Employee training: Providing adequate training on safe working practices, machinery operation, and emergency procedures to fulfill legal duty of care.

- Incident reporting and investigation: Establishing procedures for reporting and investigating any accidents or near misses to prevent recurrence and comply with reporting obligations.

Competition Law and Anti-Trust Regulations

Epwin Group operates under stringent competition laws designed to prevent monopolistic behavior, such as price fixing or exploiting market dominance. These anti-trust regulations are crucial for maintaining a level playing field within the competitive building products sector. For instance, the UK's Competition and Markets Authority (CMA) actively investigates and penalizes anti-competitive practices, ensuring fair play among businesses.

Any strategic moves like mergers, acquisitions, or market collaborations undertaken by Epwin Group require thorough scrutiny to ensure compliance with these competition and anti-trust frameworks. Failure to adhere can result in significant fines and reputational damage. In 2023, the CMA imposed fines totaling millions of pounds on companies for breaches of competition law, underscoring the seriousness of these regulations.

- Compliance with Competition Laws: Epwin Group must ensure its operations do not involve anti-competitive practices like price collusion or abuse of dominant market positions.

- Anti-Trust Scrutiny: Mergers, acquisitions, and joint ventures are subject to review by regulatory bodies to prevent undue market concentration.

- Market Fairness: Adherence to these laws fosters a fair competitive environment, benefiting consumers and smaller market participants.

- Regulatory Enforcement: Breaches of competition law can lead to substantial financial penalties and legal sanctions, as seen in past CMA actions.

Epwin Group must navigate evolving building safety regulations, including the UK's Building Safety Act 2022, which mandates stringent product standards and traceability to prevent risks like those highlighted by the Grenfell Tower fire. Non-compliance can lead to significant financial penalties and damage to its reputation. Environmental laws, such as the UK's Environment Act 2021, also impose strict requirements on waste management and emissions, potentially increasing operational costs for manufacturers like Epwin. Furthermore, adherence to product certification standards like UKCA marking is essential for market access in Great Britain, requiring ongoing compliance and audits.

Health and safety legislation, exemplified by the UK's Health and Safety at Work etc. Act 1974, mandates safe working environments, impacting Epwin's manufacturing and installation operations. For 2023/24, the UK's HSE reported ongoing challenges in specific sectors, underscoring the need for robust safety protocols, risk assessments, and employee training to avoid liabilities. Competition laws, enforced by bodies like the UK's Competition and Markets Authority (CMA), also require Epwin to avoid anti-competitive practices, with the CMA imposing substantial fines for breaches, as seen in 2023.

Environmental factors

The global push towards net-zero emissions, with many nations setting ambitious carbon reduction targets, is significantly shaping the construction sector. This trend directly fuels demand for building materials that offer lower embodied carbon and enhanced energy efficiency, areas where Epwin Group can leverage its product portfolio.

Epwin Group's commitment to sustainability is increasingly vital. Demonstrating the lifecycle carbon benefits of its products, from manufacturing to end-use, is key to meeting customer and regulatory expectations aligned with these environmental goals. For example, by 2024, the UK government's Future Homes Standard aims to ensure new homes are net-zero ready, impacting material choices.

Stricter regulations on construction waste, such as those introduced in the UK aiming to divert 70% of non-hazardous waste from landfill by 2025, directly influence Epwin Group's operational focus. This industry-wide pressure necessitates a robust approach to circular economy principles, impacting everything from material sourcing to end-of-life product management.

Epwin Group's commitment to recycling PVC-U and aluminum, alongside the incorporation of recycled content in its products, addresses these environmental demands. For instance, the company's efforts in 2023 saw a significant increase in the use of recycled materials, contributing to a reduction in virgin resource consumption and aligning with the UK Green Building Council's Net Zero Carbon Buildings framework.

The development of take-back schemes and strategies for managing products at the end of their lifecycle are crucial for Epwin Group to meet evolving environmental standards. These initiatives not only mitigate waste but also create opportunities for material recovery, supporting a more sustainable and resource-efficient business model within the construction sector.

Epwin Group's reliance on materials like PVC resin and aluminum means resource scarcity is a significant environmental factor. Growing global concerns about the depletion of natural resources are pushing companies to adopt more sustainable sourcing practices. This means looking for materials that are responsibly harvested or, ideally, recycled.

The pressure to demonstrate environmental responsibility extends to supply chains. Investors and consumers alike are paying closer attention to a company's environmental footprint, making the use of recycled aluminum or PVC a key differentiator. For instance, the global aluminum market saw prices fluctuate significantly in 2024 due to supply chain disruptions, highlighting the vulnerability to resource availability.

To counter the risks posed by potential shortages and price volatility of key raw materials, Epwin Group can benefit from diversifying its material inputs. Exploring alternative or supplementary materials, alongside a strong focus on recycled content, can build resilience into its operations and supply chain.

Energy Efficiency in Buildings

The increasing focus on energy efficiency in buildings is a significant driver for companies like Epwin Group. Their high-performance windows and doors are crucial for reducing heat loss and enhancing thermal insulation, directly impacting energy consumption and utility costs for homeowners and businesses. This trend is supported by government mandates and consumer demand for sustainable living solutions.

For instance, the UK government's Future Homes Standard, aiming for all new homes to be net-zero ready by 2025, necessitates advanced fenestration solutions. Similarly, retrofitting existing buildings to improve their energy performance is a major market opportunity. Epwin Group's products, such as their uPVC and aluminum window systems, are designed to meet stringent thermal performance standards, contributing to reduced carbon footprints.

- Demand Driver: Growing regulatory pressure and consumer desire for energy-efficient homes directly boosts demand for Epwin's insulating window and door products.

- Product Contribution: Epwin's fenestration solutions help buildings achieve better U-values, a key metric for thermal performance, leading to lower heating and cooling expenses.

- Market Alignment: The company's offerings are well-positioned to capitalize on the global shift towards greener construction practices and net-zero building targets, with the UK alone aiming to improve the energy efficiency of 27 million homes by 2030.

Climate Change Adaptation and Resilience

The increasing frequency of extreme weather events, such as intense rainfall and heatwaves, necessitates that buildings adapt to changing climate conditions. This directly impacts the demand for more resilient and durable building products, a key consideration for Epwin Group. For instance, in the UK, the Met Office reported 2023 as the warmest year on record, with several areas experiencing flash flooding, highlighting the need for robust construction materials.

Epwin Group's product portfolio must therefore be designed to withstand a wider range of weather conditions. This involves a focus on material resilience and enhanced structural integrity to ensure long-term performance and sustainability. The company's uPVC window and door systems, for example, are engineered for durability and resistance to weathering, contributing to the overall resilience of buildings.

- Material Resilience: Ensuring products can endure prolonged exposure to UV radiation, extreme temperatures, and moisture without degradation.

- Structural Integrity: Designing products, like roofline systems and conservatory components, to withstand increased wind loads and potential impact from debris during storms.

- Performance Standards: Meeting and exceeding industry standards for weatherproofing and thermal performance, which are becoming more critical in a changing climate.

- Sustainability Focus: Developing products that contribute to energy efficiency and reduce the need for frequent replacements, aligning with long-term resilience goals.

The global drive towards sustainability and net-zero emissions is a major environmental factor influencing Epwin Group. This includes stringent regulations on carbon emissions and construction waste, such as the UK's goal to divert 70% of non-hazardous waste from landfill by 2025. Epwin's focus on recycling PVC-U and aluminum, and incorporating recycled content, directly addresses these pressures, aligning with the UK Green Building Council's Net Zero Carbon Buildings framework.

Energy efficiency in buildings is another key environmental driver, with the UK's Future Homes Standard aiming for new homes to be net-zero ready by 2025. Epwin's high-performance windows and doors contribute to reduced heat loss and lower energy consumption, a critical aspect for both new builds and retrofitting existing properties. The company's uPVC and aluminum systems are designed to meet these demanding thermal performance standards.

Climate change and its impact on extreme weather events also necessitate more resilient building products. Epwin's durable uPVC and aluminum systems offer resistance to weathering, UV radiation, and temperature fluctuations, ensuring long-term performance and reduced maintenance. This focus on material resilience is crucial as buildings must increasingly withstand conditions like intense rainfall and heatwaves, with the UK experiencing its warmest year on record in 2023.

| Environmental Factor | Impact on Epwin Group | Relevant Data/Initiatives |

| Net-Zero Emissions Push | Increased demand for low-carbon and energy-efficient building materials. | UK Future Homes Standard (net-zero ready by 2025); UK Green Building Council Net Zero Carbon Buildings framework. |

| Waste Reduction & Circular Economy | Need for robust recycling and use of recycled content in products. | UK target: 70% non-hazardous waste diversion from landfill by 2025; Epwin's increased use of recycled materials in 2023. |

| Energy Efficiency Mandates | Demand for high-performance fenestration solutions. | UK aim to improve energy efficiency of 27 million homes by 2030; Epwin's uPVC and aluminum window systems meet stringent thermal performance standards. |

| Extreme Weather Events | Requirement for more resilient and durable building products. | UK 2023 warmest year on record; Epwin's uPVC and aluminum systems designed for durability and resistance to weathering. |

PESTLE Analysis Data Sources

Our Epwin Group PESTLE analysis is built on a foundation of diverse and credible data sources, including official government publications, reputable industry associations, and leading financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.