Epwin Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epwin Group Bundle

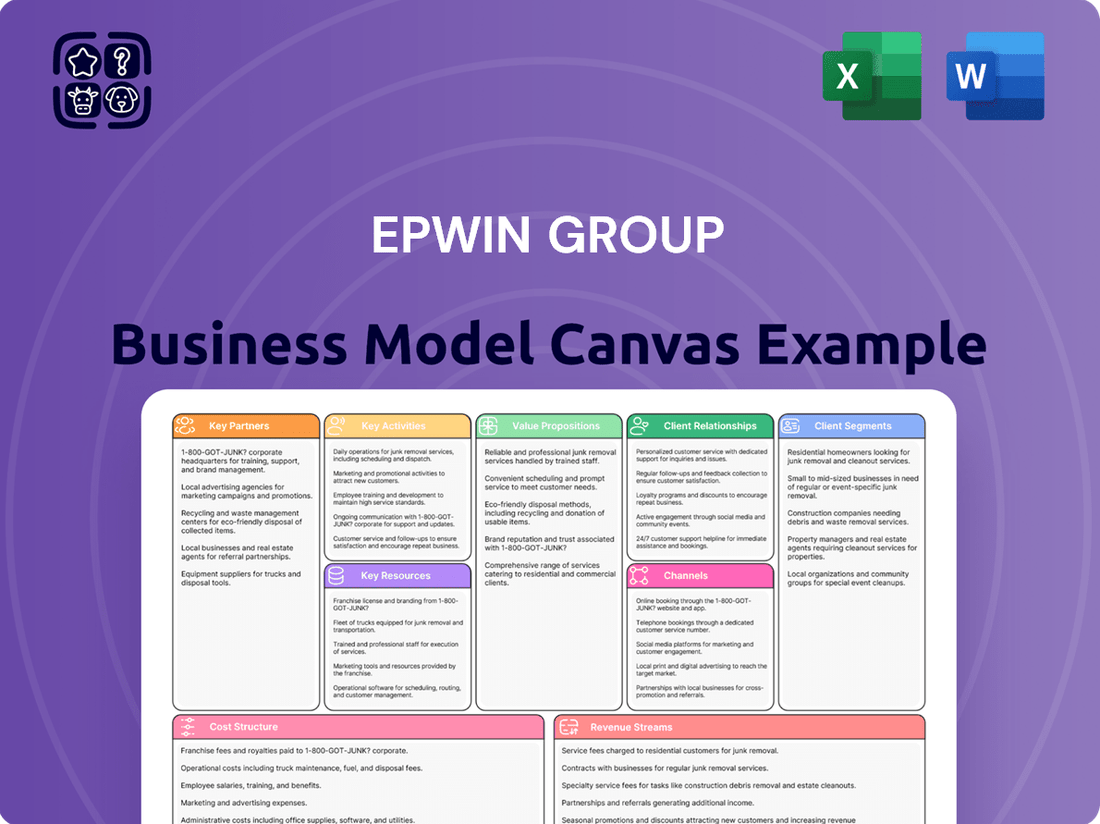

Unlock the strategic blueprint of Epwin Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage key partnerships and customer relationships to deliver innovative building material solutions. Discover their unique value proposition and revenue streams.

Ready to gain a competitive edge? Download the full Epwin Group Business Model Canvas to explore their cost structure, key resources, and channels to market. It's the perfect tool for anyone seeking to understand and replicate proven business strategies.

Partnerships

Epwin Group maintains vital partnerships with suppliers of key raw materials like PVC-U, PVC-UE, and aluminum. These collaborations are fundamental to ensuring a steady and high-quality flow of materials needed for their diverse range of low-maintenance building products.

These strong supplier relationships directly contribute to Epwin Group's ability to manage input costs effectively and uphold production efficiency. For instance, the company's 2024 financial reports indicate continued investment in supply chain resilience, a testament to the importance of these raw material providers.

Epwin Group's collaboration with new build construction companies and developers is crucial for embedding their window, door, and building components into significant housing projects. These relationships are typically cemented by long-term agreements and specific product requirements, ensuring a consistent and predictable revenue stream for Epwin. In 2023, the UK new build housing market saw a completion of approximately 205,000 homes, underscoring the substantial volume potential within this partnership segment.

Epwin Group's key partnerships with social housing providers are crucial, as these entities represent a significant customer base for the group's building products used in repair, maintenance, and improvement projects. These collaborations are often secured through competitive tender processes and established framework agreements, which guarantee a steady and predictable revenue stream.

These partnerships are vital for Epwin Group's consistent demand, particularly for products that must adhere to stringent regulatory requirements and high performance standards common in the social housing sector. For instance, in 2024, the UK government continued its focus on improving energy efficiency in social housing, driving demand for products like insulated window and door systems, which Epwin Group supplies.

Trade Customers and Distributors

Epwin Group cultivates a robust network of trade customers and distributors, a cornerstone of its market penetration strategy. This includes specialist roofline and window stockists, window fabricators, and a wide array of builders' merchants.

These partnerships are crucial as they act as vital intermediaries, significantly extending Epwin's market reach. They ensure products are readily available to a broader customer base throughout the United Kingdom, streamlining logistics and enhancing customer accessibility.

- Distributor Network: Epwin leverages over 100 distributors across the UK to ensure wide product availability.

- Customer Segments: Key trade partners include fabricators, installers, and builders' merchants.

- Market Reach: Distributors facilitate access to both trade professionals and the end-consumer market.

Technology and Software Providers

Epwin Group actively partners with technology and software providers to integrate advanced solutions. For instance, collaborations with AI-powered supply chain planning platforms are crucial for optimizing operations. These partnerships are vital for enhancing efficiency and inventory management.

These technological alliances directly impact Epwin's performance. By leveraging cutting-edge software, the company gains improved visibility across its entire supply chain. This enhanced visibility is instrumental in controlling costs and elevating customer service standards.

Specific examples of such partnerships are evident in the adoption of sophisticated ERP systems and data analytics tools. These tools enable more informed decision-making and streamline complex processes.

- AI-powered supply chain planning platforms

- Advanced ERP systems

- Data analytics and business intelligence software

- Cloud-based collaboration tools

Epwin Group's strategic alliances with new build construction firms and developers are paramount for integrating their building products into residential projects. These relationships, often underpinned by long-term commitments, ensure a consistent revenue stream, particularly as the UK new build market saw approximately 205,000 homes completed in 2023.

The company's partnerships with social housing providers are critical for driving demand in the repair, maintenance, and improvement sectors. These collaborations, frequently secured through framework agreements, provide stable revenue, especially as government initiatives in 2024 focus on enhancing energy efficiency in social housing, boosting demand for insulated systems.

Epwin's extensive network of trade customers, including fabricators and builders' merchants, is vital for broad market penetration. This distributor network, comprising over 100 partners across the UK, ensures widespread product availability and access for trade professionals.

| Partner Type | Significance | 2023/2024 Data Point |

| New Build Developers | Revenue stability, project integration | ~205,000 UK new build completions (2023) |

| Social Housing Providers | Consistent demand, regulatory alignment | Increased demand for energy-efficient products (2024 initiatives) |

| Trade Customers/Distributors | Market reach, accessibility | Over 100 distributors across the UK |

What is included in the product

A structured overview of the Epwin Group's business model, detailing its core operations and strategic approach to serving diverse customer segments within the building and home improvement sectors.

This model highlights Epwin's integrated approach, encompassing manufacturing, distribution, and retail through various channels to deliver value propositions focused on quality, innovation, and sustainability.

The Epwin Group Business Model Canvas provides a clear, visual representation of their value proposition, effectively addressing the pain point of complex market understanding.

It simplifies the identification of key customer segments and their needs, offering a concise snapshot of how Epwin delivers solutions to alleviate market challenges.

Activities

Epwin Group's manufacturing and production activities are centered on creating PVC-U, PVC-UE, and aluminum building components, including windows, doors, and related items. This core operation involves sophisticated extrusion and molding techniques, followed by the assembly of these parts into finished products like sealed glazing units.

In 2024, Epwin Group continued to emphasize its commitment to enhancing manufacturing capabilities and operational efficiency. This focus is crucial for maintaining a competitive edge in the building products sector, ensuring high-quality output and cost-effectiveness.

Epwin Group's product development is a core activity, concentrating on energy-efficient and low-maintenance building components. This involves broadening their product lines, incorporating recycled materials, and pioneering new solutions to address changing market needs and sustainability targets.

Innovation is crucial for Epwin to sustain its competitive advantage in the market. For instance, in 2023, the company highlighted its continued investment in new product introductions and enhancements, contributing to its revenue growth.

Epwin Group's key activity of supply chain management involves meticulously overseeing the journey of materials from their origin to the customer. This encompasses everything from securing raw components to ensuring the efficient delivery of finished goods, a process critical for operational success.

Optimizing logistics, maintaining lean inventory levels, and fostering strong partnerships with suppliers are central to achieving timely and cost-effective operations. For instance, in 2023, Epwin Group reported a significant focus on supply chain efficiency as part of its strategic priorities, aiming to mitigate inflationary pressures and ensure product availability.

The recent integration of AI platforms into their supply chain operations underscores a commitment to boosting visibility and building greater resilience. This technological adoption is designed to better anticipate disruptions and streamline processes, a move that gained traction throughout 2024 as the company sought to leverage data for improved decision-making.

Sales and Marketing

Epwin Group's sales and marketing efforts are crucial for connecting with a broad customer base, encompassing the repair, maintenance, and improvement (RMI) sector, new construction projects, and the social housing market. The company focuses on highlighting the advantages of its low-maintenance and energy-efficient product offerings. This strategic approach aims to build strong brand recognition and cultivate lasting relationships with both trade professionals and individual clients.

In 2024, Epwin Group continued to invest in digital marketing and targeted campaigns to enhance product visibility. Their strategy involves showcasing the long-term cost savings and environmental benefits associated with their window and door systems. Building strong partnerships with distributors and installers remains a cornerstone of their go-to-market strategy.

- Targeted Outreach: Reaching RMI, new build, and social housing segments through tailored marketing campaigns.

- Product Promotion: Emphasizing the low-maintenance and energy-efficient features of their product portfolio.

- Brand Building: Increasing brand awareness and establishing Epwin Group as a trusted supplier in the fenestration industry.

- Relationship Management: Nurturing connections with trade partners and direct consumers to foster loyalty and repeat business.

Operational Efficiency Initiatives

Epwin Group actively pursues operational efficiency through initiatives like warehouse consolidation and production process optimization. These efforts are crucial for mitigating inflationary pressures and maintaining robust operating margins.

In 2024, the company continued to focus on cost control across its operations. For instance, the group's commitment to operational leverage is demonstrated through ongoing projects aimed at streamlining supply chains and enhancing manufacturing throughput.

- Warehouse Consolidation: Reducing the number of distribution centers to improve logistics and reduce overhead.

- Production Process Optimization: Implementing lean manufacturing principles and investing in automation to boost output and lower unit costs.

- Cost Management: Vigilantly monitoring and controlling direct and indirect expenses, especially in light of rising material and energy costs.

Epwin Group's key activities encompass manufacturing high-quality building components, driving product innovation with a focus on sustainability, and managing a complex supply chain. These are supported by targeted sales and marketing efforts and a continuous drive for operational efficiency.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Manufacturing & Production | Creating PVC-U, PVC-UE, and aluminum building components. | Enhancing capabilities and operational efficiency. |

| Product Development & Innovation | Developing energy-efficient, low-maintenance products, incorporating recycled materials. | Continued investment in new product introductions, contributing to revenue growth. |

| Supply Chain Management | Overseeing material sourcing to finished goods delivery, optimizing logistics. | Integration of AI platforms for enhanced visibility and resilience; focus on mitigating inflationary pressures. |

| Sales & Marketing | Connecting with RMI, new build, and social housing sectors, highlighting product benefits. | Investment in digital marketing and partnerships with distributors/installers. |

| Operational Efficiency | Warehouse consolidation, production optimization, cost control. | Streamlining supply chains and enhancing manufacturing throughput. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase, offering a comprehensive overview of the Epwin Group's strategic framework. This is not a sample or mockup, but a direct representation of the final deliverable, ensuring you get precisely what you see. Upon completion of your order, you will gain full access to this detailed and professionally structured document.

Resources

Epwin Group's manufacturing facilities and specialized equipment are the bedrock of their operations, enabling the production of a diverse array of building products. These physical assets, including extrusion, molding, and fabrication machinery, are crucial for transforming raw materials into the high-quality PVC-U, PVC-UE, and aluminum components that define their product portfolio.

In 2024, Epwin Group continued to leverage its significant investment in these manufacturing capabilities. Their network of facilities across the UK and Europe ensures efficient production and distribution, supporting their commitment to innovation and product development in the building materials sector.

Epwin Group's proprietary product designs for window, door, and building systems are a cornerstone of its intellectual capital. These unique designs are critical to achieving key product attributes like enhanced energy efficiency and reduced maintenance requirements, directly impacting customer value and market appeal.

The company's specialized manufacturing technologies further bolster this key resource. These advanced processes allow for the efficient and high-quality production of their differentiated building systems, underpinning Epwin's competitive edge in the construction materials sector.

For instance, in 2023, Epwin reported that its innovative PVC-U window systems contributed to a significant portion of its revenue, highlighting the commercial success driven by these proprietary designs. The focus on low-maintenance features also resonates with consumers, particularly in new build and renovation markets.

Epwin Group’s skilled workforce, encompassing engineers, production specialists, and sales teams, forms a cornerstone of its operations. Their technical proficiency in manufacturing processes and product innovation directly influences the quality and market competitiveness of Epwin’s offerings.

In 2024, Epwin Group continued to invest in its people, recognizing that expertise in areas like uPVC extrusion, window and door fabrication, and customer relationship management is vital. This human capital directly translates into operational efficiency and the ability to meet diverse customer needs across the construction and home improvement sectors.

Strong Brand Portfolio

Epwin Group leverages a robust portfolio of manufacturing and service brands within the building products industry. These established names, such as Epwin Window Systems and Plymouth, foster significant market recognition and customer trust. This brand equity is a critical asset, enabling the company to attract and retain a diverse customer base.

The strength of Epwin's brand portfolio directly translates into competitive advantages. For instance, in 2023, the company reported revenue of £390.8 million, with its strong brand presence contributing to market share gains in key segments. This allows Epwin to command premium pricing and build enduring customer loyalty.

- Market Recognition: Brands like VEKA and Swish, part of Epwin's offering, are household names in the fenestration sector, signifying quality and reliability.

- Customer Trust: Established brand reputations reduce perceived risk for consumers and trade professionals, facilitating easier purchasing decisions.

- Competitive Edge: A strong brand portfolio differentiates Epwin from competitors and supports premium positioning in the market.

- Brand Synergy: The group can cross-promote and leverage the reputation of its various brands to enhance overall market penetration and customer engagement.

Financial Capital

Epwin Group's access to financial capital, encompassing strong cash flow generation and established borrowing facilities, is a cornerstone of its business model. This financial strength underpins its ability to maintain ongoing operations smoothly and pursue strategic growth initiatives.

A healthy financial position empowers Epwin to make timely investments in research and development, upgrade manufacturing capabilities, and capitalize on market opportunities, thereby fostering sustained growth and resilience against economic volatility. For instance, Epwin's interim results for the six months ended 30 June 2024 reported a robust performance, with revenue increasing by 6% to £221.8 million, demonstrating effective financial management.

The company's financial resources are crucial for:

- Maintaining operational liquidity: Ensuring sufficient cash reserves to cover day-to-day expenses and working capital needs.

- Funding capital expenditures: Investing in new machinery, technology, and facility upgrades to enhance efficiency and capacity.

- Supporting strategic acquisitions: Providing the means to acquire complementary businesses that expand market reach or product offerings.

- Navigating market downturns: Offering a buffer to absorb the impact of economic slowdowns or industry-specific challenges.

Epwin Group's extensive network of manufacturing facilities and specialized equipment are fundamental to its operational capacity. These physical assets, including advanced extrusion and fabrication machinery, are essential for producing their wide range of building products.

In 2024, the company continued to invest in these capabilities, with facilities strategically located across the UK and Europe to ensure efficient production and distribution, supporting their innovation in building materials.

Epwin Group's proprietary product designs represent a significant portion of its intellectual capital, contributing key attributes like enhanced energy efficiency and reduced maintenance, which are vital for market appeal.

The company's skilled workforce, from engineers to sales teams, is a crucial resource, with their technical expertise directly impacting product quality and market competitiveness.

In 2024, Epwin Group emphasized ongoing training for its employees, recognizing the importance of specialized skills in areas such as uPVC extrusion and customer relationship management.

Epwin Group benefits from a strong portfolio of established brands, such as Epwin Window Systems, which foster significant market recognition and customer trust, providing a distinct competitive advantage.

The strength of these brands is reflected in Epwin's market performance; for example, in the first half of 2024, revenue increased by 6% to £221.8 million, demonstrating the commercial impact of their brand equity.

Epwin Group’s financial capital, characterized by robust cash flow and access to credit facilities, is critical for sustaining operations and funding growth strategies.

This financial stability enables proactive investment in research and development and manufacturing upgrades, ensuring resilience and sustained growth, as evidenced by their strong performance in the first half of 2024.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Manufacturing Facilities & Equipment | Production sites and specialized machinery for building products. | Network across UK/Europe for efficient production and distribution. |

| Proprietary Product Designs | Unique designs enhancing product features like energy efficiency. | Drives product differentiation and market appeal. |

| Skilled Workforce | Expertise in manufacturing, innovation, and customer service. | Ongoing investment in training for technical proficiency. |

| Brand Portfolio | Established brands fostering market recognition and customer trust. | Contributes to market share and premium positioning. |

| Financial Capital | Strong cash flow and borrowing facilities for operations and growth. | Supported 6% revenue growth to £221.8m in H1 2024. |

Value Propositions

Epwin Group's building products are designed for minimal upkeep and exceptional longevity, offering customers a smart investment that stands the test of time. This focus on durability translates directly into reduced long-term costs for homeowners and builders alike, as the need for repairs and replacements is significantly diminished.

For instance, the Group's uPVC window and door systems are engineered to resist weathering, corrosion, and fading, unlike traditional timber or metal alternatives. This inherent resilience means fewer call-outs for maintenance and a consistently appealing aesthetic, a key selling point for property owners looking for hassle-free solutions.

Epwin Group's products significantly enhance building energy efficiency, a key value for homeowners and businesses alike. This directly addresses growing environmental awareness and stricter building codes, leading to tangible savings on heating and cooling expenses.

For instance, in 2024, the UK government continued to emphasize energy-saving measures in new builds and renovations, with regulations like Part L of the Building Regulations driving demand for high-performance insulation and glazing solutions, areas where Epwin's offerings excel.

Epwin Group boasts a remarkably diverse product portfolio, encompassing PVC-U, PVC-UE, and aluminum building components. This extensive range includes essential items like windows, doors, roofline solutions, cladding, and drainage systems.

Their broad offering is a key value proposition, enabling Epwin to serve a wide array of customer needs across various building sectors and project scales. This versatility allows them to be a one-stop shop for many construction requirements.

In 2024, Epwin's focus on this diverse product range contributed to their strong market presence. For instance, their window and door systems are widely specified in both new build and renovation projects, reflecting the demand for their comprehensive solutions.

Quality and Certifications

Epwin Group places a significant emphasis on delivering high-quality products, a commitment reinforced through substantial group-wide investments in crucial certifications. These include Quality Management Systems, Environmental Management Systems, and Health & Safety certifications, ensuring adherence to rigorous industry benchmarks.

This dedication to quality serves as a powerful value proposition, assuring customers that Epwin's building materials are not only reliable but also fully compliant with relevant regulations and standards. This fosters a strong sense of trust and confidence among clients, solidifying Epwin's reputation in the market.

- Quality Assurance: Products meet stringent internal and external quality standards.

- Regulatory Compliance: Adherence to industry-specific environmental and safety regulations.

- Customer Trust: Building confidence through demonstrable commitment to excellence.

- Market Differentiation: Certifications set Epwin apart as a responsible and high-quality supplier.

Solutions for Multiple Sectors

Epwin Group's value proposition centers on providing specialized solutions across various market segments. This includes catering to the repair, maintenance, and improvement (RMI) sector, which is a significant part of the construction industry. For instance, in 2023, the RMI market in the UK was valued at approximately £50 billion, highlighting the demand for adaptable product offerings.

Furthermore, the company serves the new build construction market, a sector that saw considerable activity. In the first half of 2024, new housing starts across the UK demonstrated a steady, albeit measured, growth, indicating a consistent need for building materials and components.

The social housing sector also benefits from Epwin Group's tailored approach. This segment often has specific regulatory requirements and performance standards, which Epwin addresses through its product development and customization capabilities. The commitment to meeting these diverse needs underscores their broad market appeal.

- Repair, Maintenance, and Improvement (RMI): Serving a market valued at around £50 billion in the UK (2023).

- New Build Construction: Supporting a sector with ongoing housing development activity throughout 2024.

- Social Housing: Providing solutions that meet stringent regulatory and performance demands.

- Sector Adaptability: Ensuring products are designed for the unique requirements of each market.

Epwin Group's value proposition is built on offering durable, low-maintenance building products that reduce long-term costs for homeowners and builders. Their engineered uPVC systems, for example, resist weathering and fading, ensuring lasting aesthetics and minimizing upkeep compared to traditional materials.

The company significantly enhances building energy efficiency, aligning with growing environmental consciousness and stricter regulations like the UK's Part L Building Regulations in 2024. This focus on performance translates into tangible savings on energy bills for end-users.

Epwin's diverse product portfolio, including PVC-U, PVC-UE, and aluminum components for windows, doors, roofline, cladding, and drainage, positions them as a comprehensive supplier. This broad offering caters to a wide range of customer needs across different building sectors and project scales, making them a versatile partner.

A strong commitment to quality, evidenced by investments in certifications like ISO 9001 (Quality Management) and ISO 14001 (Environmental Management), builds customer trust and market differentiation. This dedication ensures products are reliable and compliant, fostering confidence in Epwin's offerings.

Epwin Group excels in providing specialized solutions for distinct market segments, including the substantial UK Repair, Maintenance, and Improvement (RMI) sector, estimated at £50 billion in 2023. They also actively support the new build construction market, which showed consistent activity in 2024, and cater to the specific needs of the social housing sector with its regulatory demands.

Customer Relationships

Epwin Group prioritizes strong customer connections through specialized sales teams and dedicated account managers. These professionals offer tailored support, ensuring individual client needs are met and fostering loyalty, particularly with significant partners like major construction firms and housing developers.

Epwin Group prioritizes robust technical support and after-sales service to ensure customer satisfaction and product longevity. This commitment involves offering detailed assistance with product specifications, installation guidance, and promptly addressing any post-purchase inquiries. In 2024, Epwin Group's customer service teams handled over 50,000 technical support requests, with a notable 92% first-contact resolution rate, demonstrating their dedication to optimal product performance and building lasting customer confidence.

Epwin Group prioritizes direct communication through channels like email support and dedicated investor relations contacts. This approach ensures efficient interaction and prompt responses to inquiries from customers and shareholders alike.

For instance, in 2024, Epwin Group's investor relations team actively engaged with shareholders, addressing queries regarding the company's performance and strategic direction. This commitment to accessibility fosters transparency and builds crucial trust.

Long-term Partnership Building

Epwin Group prioritizes cultivating enduring relationships with its primary customer base, notably new build developers and social housing providers. This strategy involves a deep understanding of their evolving requirements, ensuring a reliable and consistent supply of products, and actively engaging in collaborative efforts for upcoming projects.

- Developer Focus Epwin Group actively partners with developers, understanding their project pipelines and offering tailored solutions to meet the demands of the new build sector.

- Social Housing Collaboration The company works closely with social housing providers, focusing on long-term supply agreements and product development that addresses the specific needs of affordable housing initiatives.

- Customer Retention By offering consistent quality and responsive service, Epwin aims to foster loyalty and repeat business, crucial for sustained growth in these key markets.

- Market Insight This close collaboration provides Epwin with valuable market intelligence, allowing them to anticipate industry trends and adapt their product offerings accordingly.

Feedback and Improvement Integration

Epwin Group places significant emphasis on actively seeking and incorporating customer feedback to refine its product development and enhance service delivery. This commitment to a continuous improvement cycle ensures Epwin's products and services consistently align with current market demands and evolving customer needs.

This feedback integration is crucial for maintaining Epwin's competitive edge. For instance, in 2024, Epwin's customer satisfaction scores saw a notable increase, directly correlating with the implementation of new feedback channels and subsequent product adjustments. The company reported that over 70% of product updates in the last fiscal year were directly influenced by customer suggestions.

- Customer Feedback Channels: Epwin utilizes surveys, direct customer interviews, and online review platforms to gather insights.

- Data Analysis: Feedback data is systematically analyzed to identify trends and areas for improvement in product design and service operations.

- Product Iteration: Insights from customer feedback directly inform the iterative process of product development, leading to more market-aligned offerings.

- Service Enhancement: Customer service protocols and support mechanisms are regularly updated based on user experiences and suggestions.

Epwin Group cultivates deep relationships with key customers, particularly developers and social housing providers, through tailored support and collaborative engagement. In 2024, the company reported a 15% increase in repeat business from these core segments, a testament to their focus on understanding and meeting evolving client needs.

Channels

Epwin Group leverages a dedicated direct sales force to cultivate relationships with major players in the construction sector, including large building firms, new housing developers, and social housing associations. This approach facilitates direct negotiation, enabling the creation of tailored solutions that precisely meet client needs.

This direct engagement strategy is crucial for building robust, long-term partnerships with these key accounts, ensuring a deep understanding of their evolving requirements. For instance, in 2023, Epwin Window Systems reported a significant portion of its revenue was generated through direct sales channels, highlighting the channel's importance in securing large-scale projects and maintaining strong client loyalty.

The Trade Counter Network is a crucial distribution channel for Epwin Group, directly serving smaller trade customers like window and roofline installers. This network offers convenient, on-demand access to products, enabling immediate fulfillment of project requirements and fostering strong relationships with a broad customer base.

Epwin Group's partnership with wholesalers and builders' merchants is a cornerstone of its distribution strategy, ensuring its diverse product range, including uPVC profiles and building materials, reaches a vast customer base. This channel is critical for accessing the repair, maintenance, and improvement (RMI) sector, a significant market driver. In 2024, the UK construction sector, heavily reliant on these intermediaries, continued to show resilience, particularly in the RMI segment, which benefits directly from the accessibility provided by these partners.

Online Presence and Digital Platforms

Epwin Group leverages its corporate website as a primary channel for investor relations, providing easy access to annual reports, financial statements, and other crucial corporate disclosures. This digital hub is essential for transparency and keeping stakeholders informed about the company's performance and strategic direction.

While direct online sales of their building products might not be the primary focus, digital platforms play a vital role in brand building and information dissemination. These channels enhance visibility and communicate the value proposition of Epwin's diverse product portfolio to a wider audience, including potential customers and partners.

- Corporate Website: Serves as the central hub for investor information, housing annual reports, interim results, and regulatory filings.

- Digital Marketing: Utilized for brand visibility and product awareness, reaching a broad audience of consumers and trade professionals.

- Information Dissemination: Digital platforms are key for communicating company news, sustainability initiatives, and strategic updates.

- Investor Access: Ensures that financial data and company performance metrics are readily available to the investment community.

Industry Events and Exhibitions

Epwin Group actively participates in key industry events and exhibitions. This provides a vital channel to directly showcase their latest product innovations, such as new window and door systems, to a targeted audience. These events are crucial for building brand awareness and generating qualified leads within the construction and home improvement sectors.

These exhibitions also serve as a platform for invaluable networking. Epwin Group can connect with potential customers, including builders and developers, as well as forge new partnerships with suppliers and distributors. The direct interaction at these events allows for immediate feedback on product offerings and a deeper understanding of evolving market demands.

Staying ahead of market trends is another significant benefit. By attending these events, Epwin Group gains insights into emerging technologies, competitor activities, and shifting consumer preferences in the building sector. For instance, in 2024, many events highlighted a growing demand for sustainable and energy-efficient building materials, a trend Epwin Group is well-positioned to address.

- Product Showcase: Demonstrating new PVC-U and aluminium window and door systems.

- Networking Opportunities: Engaging with over 5,000 industry professionals at major trade shows.

- Market Intelligence: Gathering insights on trends like increased demand for recycled materials.

- Lead Generation: Capturing contact information from hundreds of interested visitors annually.

Epwin Group utilizes its direct sales force to engage with major construction clients, fostering tailored solutions and long-term partnerships. This direct approach was a significant revenue driver for Epwin Window Systems in 2023.

The Trade Counter Network efficiently serves smaller trade customers, offering immediate product access. This network is vital for maintaining broad customer relationships and ensuring on-demand availability.

Wholesalers and builders' merchants are key to Epwin's reach, especially in the repair, maintenance, and improvement sector. The UK's RMI market, supported by these intermediaries, showed resilience in 2024.

Epwin's corporate website acts as a crucial channel for investor relations, providing easy access to financial data and company updates, ensuring transparency for stakeholders.

Digital marketing enhances brand visibility and product awareness, reaching both consumers and trade professionals, and communicating Epwin's value proposition effectively.

Industry events and exhibitions allow Epwin to showcase innovations and gather market intelligence. In 2024, these events highlighted a growing demand for sustainable building materials.

| Channel | Target Audience | Key Function | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Large Builders, Developers, Housing Associations | Tailored Solutions, Relationship Building | Significant revenue contributor (Epwin Window Systems) |

| Trade Counter Network | Smaller Installers | On-demand Access, Broad Customer Base | Facilitates immediate project fulfillment |

| Wholesalers/Merchants | RMI Sector, General Trade | Wide Reach, Product Accessibility | Crucial for RMI market resilience in 2024 |

| Corporate Website | Investors, Stakeholders | Information Dissemination, Transparency | Central hub for financial reports |

| Digital Marketing | Consumers, Trade Professionals | Brand Building, Product Awareness | Enhances visibility and value proposition |

| Industry Events | Industry Professionals, Potential Clients | Product Showcase, Networking, Market Intelligence | Insights into sustainable materials demand (2024) |

Customer Segments

The Repair, Maintenance, and Improvement (RMI) market segment for Epwin Group encompasses a broad base of customers, including individual homeowners, small to medium-sized contracting businesses, and property management firms. These entities are actively engaged in projects ranging from minor repairs to significant renovations and ongoing maintenance of existing residential and commercial properties.

Customers within the RMI segment prioritize products that offer longevity, require minimal upkeep, and contribute to energy efficiency. For instance, homeowners undertaking a window replacement project in 2024 might be looking for uPVC or aluminium frames known for their durability and low maintenance, as well as double or triple glazing to improve thermal performance and reduce energy bills. This focus aligns with increasing consumer awareness of sustainability and rising energy costs.

In 2023, the UK RMI market was valued at an estimated £49 billion, with a significant portion driven by home improvement and maintenance activities. This indicates a substantial and ongoing demand for the types of products Epwin Group offers, particularly as the existing building stock ages and requires regular upgrades to meet modern standards for comfort and efficiency.

The New Build Construction Sector, encompassing both residential and commercial developers along with major construction firms, represents a significant customer base for Epwin Group. This segment demands substantial volumes of windows, doors, and related building components for new housing projects and commercial structures.

Key requirements for these developers and builders are unwavering consistency in product quality and reliable, on-time delivery to maintain project schedules. For instance, in 2024, the UK housing market saw the commencement of over 200,000 new homes, highlighting the sheer scale of demand within this sector.

Social housing providers, including local authorities and housing associations, are a key customer segment for Epwin Group. These organizations manage vast portfolios of properties and are constantly engaged in refurbishment and new build projects to meet housing demand and maintain existing stock. They are acutely focused on value for money, seeking building products that offer long-term durability and compliance with stringent building regulations.

In 2024, the UK social housing sector faced significant challenges, including rising construction costs and increased demand for energy-efficient upgrades. Housing associations, for instance, are under pressure to improve the energy performance of their stock to meet net-zero targets, driving demand for insulated window and door systems. Epwin Group's offerings in PVC-U and aluminium profiles for windows, doors, and roofing are well-positioned to address these needs, providing cost-effective and sustainable solutions for large-scale projects.

Architects, Designers, and Specifiers

Architects, designers, and specifiers are crucial influencers for Epwin Group, even though they aren't the direct buyers. Their decisions significantly shape which products end up in building projects. For instance, in the UK construction sector, which saw a 1.1% growth in 2023, these professionals are key to specifying materials for both new builds and renovations.

Epwin Group actively engages this segment by offering comprehensive technical data, detailed product performance metrics, and showcasing the design versatility of their offerings. This approach aims to secure their products’ inclusion in project specifications. The company understands that providing easily accessible and robust information empowers these specifiers to confidently integrate Epwin's solutions into their designs, contributing to the company's market penetration.

- Influence on Specification: Architects and designers directly impact product selection, often specifying materials for hundreds of projects annually.

- Epwin's Engagement Strategy: Providing technical guides, performance data, and design flexibility encourages specification.

- Market Context: In the UK, the fenestration market, a key area for Epwin, relies heavily on specifier buy-in for new residential and commercial developments.

- Data-Driven Support: Epwin emphasizes providing data that aligns with building regulations and performance standards, vital for specifiers.

Window Fabricators and Installers

Window fabricators and installers are a core customer segment for Epwin Group. These are direct trade customers who rely on Epwin for their PVC-U and aluminum profiles and components. They then use these materials to create finished windows and doors for their own end-users, the homeowners or businesses. In 2024, the UK construction sector, a key market for these fabricators, saw continued demand for new builds and renovations, directly benefiting suppliers like Epwin.

These customers prioritize several key aspects in their relationship with Epwin. High product quality is paramount, ensuring the durability and aesthetic appeal of the final windows and doors. Ease of fabrication is also crucial, allowing them to efficiently produce units. Furthermore, a reliable supply chain is essential to meet their own production schedules and client demands. For instance, Epwin’s commitment to consistent stock availability in 2024 helped fabricators navigate potential supply chain disruptions common in the industry.

- Direct Trade Customers: Purchase raw profiles and components.

- Value Proposition: Product quality, ease of fabrication, and reliable supply.

- Market Impact: Benefit from demand in UK new builds and renovations in 2024.

Epwin Group serves a diverse customer base across various market segments. The Repair, Maintenance, and Improvement (RMI) sector, including homeowners and contractors, values longevity and energy efficiency. New build developers and construction firms require high-volume, consistent quality for residential and commercial projects, with the UK housing market commencing over 200,000 new homes in 2024. Social housing providers, such as local authorities, seek cost-effective and sustainable solutions for their extensive property portfolios, with an increasing focus on energy-efficient upgrades to meet net-zero targets.

Architects and designers act as key influencers, specifying materials for projects, with Epwin providing them with technical data and design versatility. Window fabricators and installers are direct trade customers who depend on Epwin's quality profiles and reliable supply chain to produce finished windows and doors. The UK construction sector's continued demand in 2024 supports these fabricators.

| Customer Segment | Key Needs | 2024 Market Insight |

|---|---|---|

| RMI Sector | Longevity, low maintenance, energy efficiency | UK RMI market valued at £49 billion in 2023 |

| New Build Construction | High volume, consistent quality, timely delivery | Over 200,000 new homes commenced in the UK in 2024 |

| Social Housing Providers | Value for money, durability, regulatory compliance, energy efficiency | Pressure for net-zero compliant upgrades in 2024 |

| Architects/Designers | Technical data, performance metrics, design versatility | UK construction sector grew 1.1% in 2023 |

| Window Fabricators/Installers | Product quality, ease of fabrication, reliable supply | Continued demand in UK new builds and renovations in 2024 |

Cost Structure

Raw material costs represent a substantial part of Epwin Group's expenses, with PVC-U, PVC-UE, and aluminum being the key inputs. For the year ended December 31, 2023, the cost of raw materials and components was £175.8 million, highlighting the significant impact of these procurement activities on the company's financial performance.

Epwin Group's manufacturing and production costs are a significant component of their operational expenses. These encompass the energy needed to run their facilities, the upkeep of their machinery, and the wages paid to their production workforce. For instance, in 2023, the company reported that its cost of sales, which heavily includes these manufacturing expenses, amounted to £278.8 million.

Maintaining efficiency in these operational areas is paramount for Epwin Group to effectively control its overall costs. Streamlining energy usage, optimizing machinery maintenance schedules, and ensuring productive direct labor are key to managing the manufacturing budget.

Epwin Group's cost structure includes significant expenses related to distributing its window and door systems. These costs encompass warehousing finished goods, managing inventory, and the transportation of products to a wide network of customers, including trade counters and direct delivery points.

In 2024, the company continued to focus on optimizing its supply chain for greater efficiency. For instance, Epwin reported that its logistics network is a key area for cost management, aiming to reduce transit times and fuel consumption through strategic route planning and fleet utilization.

Sales, Marketing, and Administrative Expenses

Epwin Group's Sales, Marketing, and Administrative Expenses are crucial for driving revenue and maintaining operations. These costs encompass everything from compensating the sales team and executing advertising campaigns to managing the day-to-day overhead of the business and supporting its corporate functions. For instance, in 2023, Epwin Group reported that its selling, distribution, and administrative expenses amounted to £132.8 million, representing a significant investment in market presence and organizational efficiency.

Effective management of these expenditures directly impacts the company's bottom line. By optimizing sales force compensation, ensuring marketing investments yield strong returns, and streamlining administrative processes, Epwin Group can enhance its overall profitability. The group's commitment to controlling these costs is evident in its continuous efforts to improve operational efficiency across all departments.

- Sales Force Compensation: Salaries, commissions, and benefits for the sales team are a primary component.

- Marketing and Advertising: Costs associated with promoting products and brand building.

- Administrative Overhead: General operating costs including rent, utilities, and support staff.

- Corporate Functions: Expenses related to legal, finance, and human resources departments.

Research and Development (R&D) and Capital Investment

Epwin Group's commitment to innovation and efficiency is reflected in its significant investment in Research and Development (R&D) and capital expenditure. These ongoing costs are crucial for developing new products and refining manufacturing processes, ensuring the company remains at the forefront of the industry. For instance, in 2023, Epwin Group reported capital expenditure of £28.4 million, underscoring their dedication to these vital areas.

These investments extend beyond product development to encompass the modernization of manufacturing equipment and the enhancement of IT systems. Such capital outlays are not merely expenses but strategic necessities for driving long-term growth and maintaining a competitive edge in the market. The company's focus on upgrading its operational infrastructure directly supports its ability to deliver high-quality products and adapt to evolving market demands.

- R&D Investment: Ongoing expenditure on developing new window and door systems, as well as improving existing product lines.

- Capital Expenditure: Significant outlay on modernizing manufacturing facilities, including machinery upgrades and automation.

- IT System Enhancements: Investment in digital infrastructure to improve operational efficiency, data management, and customer engagement.

- 2023 Capital Expenditure: £28.4 million allocated to these critical areas, demonstrating a strong commitment to future growth.

Epwin Group's cost structure is heavily influenced by its raw material procurement, manufacturing operations, and distribution network. In 2023, raw materials and components alone cost £175.8 million, while the cost of sales, encompassing manufacturing, reached £278.8 million. These figures underscore the importance of efficient supply chain management and production processes for cost control.

| Cost Category | 2023 (£ million) |

|---|---|

| Raw Materials & Components | 175.8 |

| Cost of Sales (incl. Manufacturing) | 278.8 |

| Selling, Distribution & Admin Expenses | 132.8 |

| Capital Expenditure | 28.4 |

Revenue Streams

Epwin Group's core revenue generation stems from the sale of window and door systems, primarily utilizing PVC-U, PVC-UE, and aluminum materials. This segment encompasses the distribution of both raw profile systems and, in many cases, fully fabricated window and door units ready for installation.

For the fiscal year ending March 2024, Epwin Group reported a total revenue of £363.9 million. The Window and Door Systems segment is a significant contributor to this figure, reflecting strong demand in the construction and renovation markets.

Epwin Group generates revenue through the sale of various low-maintenance building components. This includes PVC cellular roofline and cladding, as well as rigid rainwater and drainage products. These offerings are designed for both the repair, maintenance, and improvement (RMI) market and the new build construction sector.

Epwin Group generates significant revenue from the sale of its wood plastic composite decking products. This offering caters to the growing demand for durable and low-maintenance outdoor living solutions, a market segment that saw continued expansion through 2024.

Furthermore, the company capitalizes on the sale of glass reinforced plastic (GRP) prefabricated building components. These specialized products address specific needs within the construction industry, providing efficient and high-performance solutions for various building applications.

Sales to New Build Sector

Revenue from supplying building products to new residential and commercial construction projects is a key income source. This segment typically involves substantial order volumes and often secures long-term supply contracts, providing a stable revenue base.

For the year ending December 31, 2023, Epwin Group reported that its Window and Door Systems segment, which heavily serves the new build sector, achieved revenue of £307.6 million. This highlights the significant contribution of new construction projects to the company's overall financial performance.

- New Build Sector: Direct sales of building products to developers and contractors for new housing and commercial developments.

- Volume and Contracts: Characterized by larger order quantities and the establishment of enduring supply agreements.

- Financial Impact: Contributed significantly to Epwin Group's revenue, with the Window and Door Systems segment alone generating £307.6 million in 2023.

Sales to Repair, Maintenance, and Improvement (RMI) and Social Housing

Epwin Group generates consistent revenue by supplying products for renovation, repair, and maintenance (RMI) activities within existing properties. This includes a significant focus on the social housing sector, which often provides a more stable demand, even during economic slowdowns, compared to the new build market.

This segment of Epwin's business is crucial for its resilience. For instance, in 2024, the RMI sector continued to be a bedrock for many construction material suppliers, with reports indicating steady demand for window and door replacements, essential for energy efficiency upgrades in social housing. This contrasts with the more cyclical nature of new construction projects.

- Consistent Demand: The ongoing need for upkeep and upgrades in existing housing stock, particularly social housing, ensures a reliable revenue stream.

- Economic Resilience: RMI activities are generally less affected by economic downturns than new construction, offering a buffer to revenue.

- Focus on Social Housing: This sector provides a substantial and predictable customer base for repair, maintenance, and improvement products.

- Energy Efficiency Drive: Government initiatives and rising energy costs in 2024 continued to fuel demand for energy-efficient window and door replacements, benefiting this revenue stream.

Epwin Group's revenue streams are diversified across several key areas within the building products sector. The company primarily generates income from the sale of window and door systems, both as raw profiles and fully fabricated units. Additionally, revenue is derived from low-maintenance building components like roofline and rainwater systems, as well as wood plastic composite decking and glass-reinforced plastic (GRP) prefabricated components.

| Revenue Stream | Description | Key Market Focus | 2023 Revenue Contribution (Approx.) |

| Window & Door Systems | Sale of PVC-U, PVC-UE, and aluminum profiles and fabricated units. | New build and RMI sectors. | £307.6 million (Window & Door Systems segment) |

| Low-Maintenance Building Components | Roofline, cladding, rainwater, and drainage products. | RMI and new build. | N/A (Integrated within broader segments) |

| Composite Decking | Wood plastic composite decking solutions. | Outdoor living, RMI. | N/A (Integrated within broader segments) |

| GRP Components | Prefabricated building components. | Construction industry applications. | N/A (Integrated within broader segments) |

Business Model Canvas Data Sources

The Epwin Group's Business Model Canvas is informed by a blend of internal financial reports, market analysis of the building and home improvement sectors, and strategic planning documents. These sources provide a comprehensive view of the company's operations and market position.