Epwin Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epwin Group Bundle

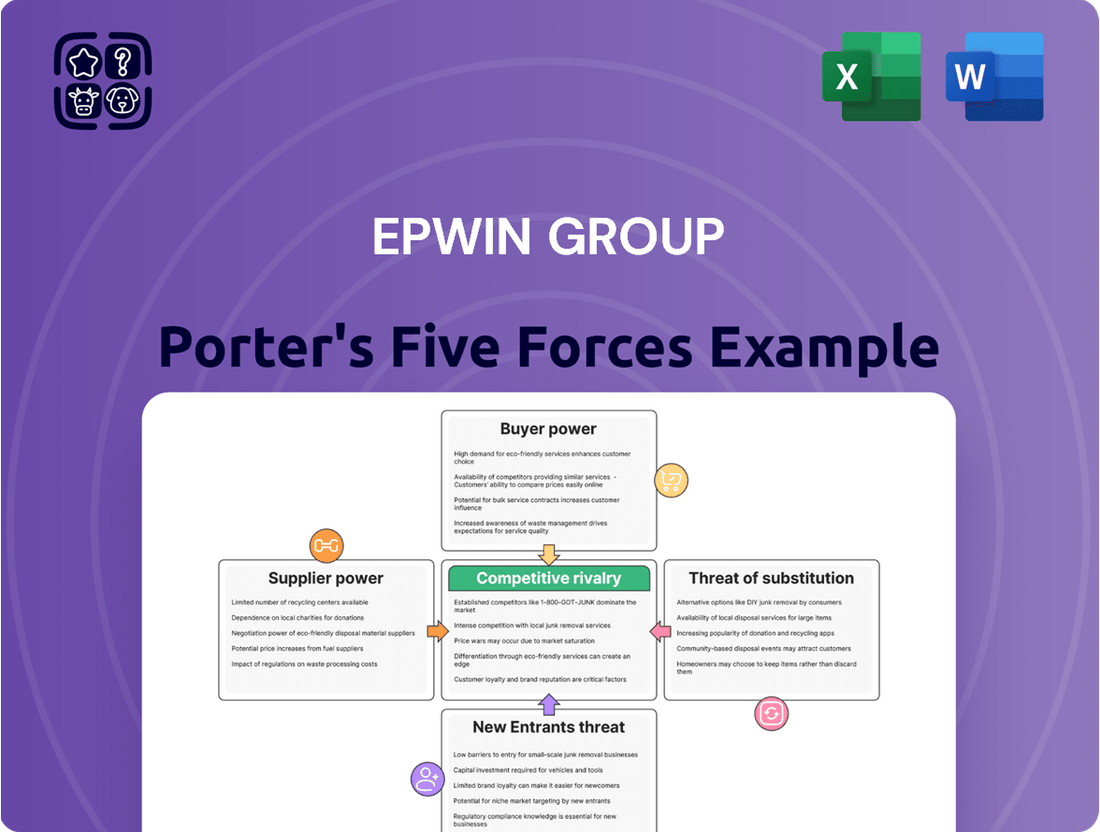

Epwin Group navigates a landscape shaped by moderate buyer power and intense rivalry within the building materials sector. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Epwin Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Epwin Group, a significant player in building products manufacturing, depends on key raw materials like PVC-U, PVC-UE, and aluminum. The concentration of suppliers for these essential inputs directly influences their bargaining power. A limited number of major suppliers for a crucial material can empower them to set higher prices and stricter terms, thereby increasing Epwin's operational expenses.

The availability of substitute inputs significantly impacts supplier bargaining power for Epwin Group. If Epwin can readily source alternative materials, such as different grades of PVC or even entirely different polymers, their dependence on any single supplier is lessened. This flexibility allows Epwin to negotiate more effectively, as suppliers know that Epwin has other options, thereby reducing the risk of price hikes or supply disruptions.

The bargaining power of suppliers for Epwin is significantly influenced by switching costs. If Epwin faces substantial expenses when changing suppliers, such as retooling manufacturing equipment or redesigning its window and door products to accommodate new materials, suppliers gain leverage. These costs can make it economically unfeasible to switch, even if current supplier terms are less than ideal, thereby increasing the suppliers' ability to dictate terms.

Importance of Supplier's Input to Epwin's Product

The bargaining power of suppliers for Epwin Group is significantly influenced by the criticality of their inputs to Epwin's product quality and performance. For instance, if suppliers provide specialized, high-performance materials essential for Epwin's energy-efficient window and door systems, their leverage in negotiations increases substantially. This is because such specialized inputs are integral to Epwin's value proposition and differentiation in the market.

Epwin's reliance on specific suppliers for unique or proprietary components can also amplify supplier power. In 2024, Epwin Group's focus on innovative and sustainable building materials, such as advanced uPVC compounds for window profiles, means that suppliers of these niche materials can command greater influence. The ability of these suppliers to offer materials that directly contribute to Epwin's product performance and market appeal underpins their bargaining strength.

- Criticality of Inputs: Suppliers of specialized materials, like advanced uPVC compounds, hold more power when these inputs are vital for Epwin's product quality and energy efficiency.

- Proprietary Components: Reliance on suppliers for unique or proprietary components strengthens their negotiating position.

- Market Differentiation: Suppliers whose materials enhance Epwin's product performance and market appeal gain significant leverage.

- 2024 Focus: Epwin's emphasis on sustainable and high-performance building materials in 2024 increases the bargaining power of suppliers providing these niche inputs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Epwin Group's business, such as manufacturing windows or doors themselves, significantly strengthens their bargaining power. This potential for suppliers to become direct competitors can make Epwin hesitant to negotiate aggressively on price or terms, fearing it might incentivize such a move.

For instance, if a key supplier of uPVC extrusions were to start producing finished window frames, they could capture a larger share of the value chain. This would directly challenge Epwin's core operations and market position.

- Supplier Forward Integration Risk: Suppliers entering the downstream market (e.g., manufacturing windows/doors) increases their leverage over Epwin.

- Deterrent to Price Pressure: Epwin may temper its demands for lower prices or better terms to avoid provoking suppliers into direct competition.

- Market Structure Impact: A supplier's ability to integrate forward depends on their existing capabilities, financial resources, and market knowledge.

- Strategic Consideration: Epwin must continuously assess the capabilities and strategic intentions of its key suppliers to mitigate this threat.

The bargaining power of suppliers for Epwin Group is a critical factor, particularly concerning essential raw materials like PVC-U and aluminum. In 2024, Epwin's reliance on a concentrated supplier base for these key inputs means suppliers can exert significant influence on pricing and terms. For example, fluctuations in global aluminum prices, a key input for many of Epwin's products, directly impact their cost structure and supplier leverage.

The availability of substitutes and switching costs also play a vital role. If Epwin can easily find alternative materials or switch suppliers without incurring substantial costs, supplier power diminishes. However, the specialized nature of some advanced uPVC compounds used in energy-efficient windows, a focus area for Epwin in 2024, can increase switching costs and thus supplier leverage.

Suppliers who provide materials integral to Epwin's product quality and market differentiation, such as those offering enhanced thermal performance or specific aesthetic finishes, command greater bargaining power. The threat of suppliers integrating forward into Epwin's manufacturing processes further strengthens their position, making Epwin cautious about pushing for unfavorable terms.

| Factor | Impact on Epwin Group | 2024 Relevance |

| Supplier Concentration | High power for limited suppliers of key inputs | Significant due to reliance on PVC-U and aluminum |

| Availability of Substitutes | Lowers supplier power if alternatives exist | Moderate; specialized compounds may have fewer substitutes |

| Switching Costs | High costs empower suppliers | Potentially high for specialized materials and equipment adjustments |

| Criticality of Inputs | Suppliers of essential, high-performance materials have more power | High for materials contributing to energy efficiency and product appeal |

| Forward Integration Threat | Suppliers becoming competitors increases their leverage | A constant strategic consideration for Epwin |

What is included in the product

This analysis unpacks the competitive forces shaping the window and door manufacturing industry, specifically for Epwin Group, by examining buyer and supplier power, new entrant threats, substitutes, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the Epwin Group's Porter's Five Forces, empowering proactive strategy adjustments.

Customers Bargaining Power

Epwin Group's customer base is spread across various segments like the Repair, Maintenance, and Improvement (RMI) sector, new build construction, and social housing. This diversity generally dilutes the bargaining power of any single customer.

However, if a small number of very large customers represent a substantial chunk of Epwin's revenue, those specific customers gain considerable leverage. For instance, if just two or three major housebuilders accounted for over 20% of Epwin's sales in 2024, they could negotiate more aggressively on price or payment terms.

The bargaining power of Epwin's customers is significantly influenced by customer switching costs. If customers can easily find and transition to alternative window and door manufacturers, their ability to negotiate for lower prices or better terms increases. For instance, if a customer needs standard-sized windows and doors, the market offers numerous readily available alternatives, giving them considerable leverage.

Conversely, if Epwin's customers face high switching costs, their bargaining power diminishes. These costs can arise from factors such as the need for bespoke product designs that are specific to Epwin's manufacturing capabilities, or from deeply integrated supply chain relationships that would be disruptive and expensive to replicate with a new supplier. In 2024, the construction sector saw continued demand for customized building materials, potentially increasing switching costs for some of Epwin's B2B clients.

Customer price sensitivity is a key driver of their bargaining power. When customers are highly attuned to price, especially in competitive sectors or during economic slowdowns, they exert greater pressure for lower costs. For instance, in the UK construction materials market, where Epwin Group operates, price fluctuations can significantly impact purchasing decisions, particularly for bulk orders from developers.

Epwin's strategy to counter this involves enhancing product differentiation. By emphasizing features such as superior energy efficiency in their window and door systems, or increased durability in their building components, Epwin aims to reduce the direct price comparison by customers. This focus on added value can make customers less inclined to switch based solely on minor price differences.

Availability of Substitute Products for Customers

The availability of substitute building products significantly empowers Epwin Group's customers. If customers can easily switch to timber or aluminum windows from competing manufacturers, or opt for alternative repair methods, their leverage over Epwin grows. This is because viable alternatives diminish customer dependence on Epwin's specific product lines and pricing.

For instance, the global window and door market is highly competitive, with numerous manufacturers offering a wide range of materials and styles. In 2024, the market for windows and doors was valued at approximately $230 billion, with a substantial portion attributed to PVC, aluminum, and timber segments, all of which can serve as substitutes for Epwin's offerings.

- Increased Customer Choice: A broad array of substitute products means customers aren't locked into a single supplier.

- Price Sensitivity: The presence of alternatives often leads customers to be more sensitive to price changes from Epwin.

- Market Dynamics: Competitors offering similar or lower-priced products can directly impact Epwin's market share and pricing power.

- Innovation Pressure: To retain customers, Epwin must continuously innovate and differentiate its products from readily available substitutes.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly influences Epwin Group's bargaining power. If Epwin's customers, such as large construction firms or housing associations, possess the capability or incentive to manufacture their own building components, their leverage increases. This scenario, though less frequent for specialized manufactured goods like windows and doors, becomes a tangible concern when dealing with entities that command substantial purchasing volumes.

In 2024, the UK construction sector saw continued demand, with housing starts projected to reach around 200,000 units, indicating a substantial market for component suppliers like Epwin. However, major developers are increasingly exploring vertical integration to control costs and supply chains. For instance, some large housebuilders have invested in their own timber frame or component manufacturing facilities. This strategic move allows them to bypass external suppliers, directly impacting the pricing power of companies like Epwin.

- Customer Leverage: The ability of customers to produce components in-house directly enhances their bargaining power against suppliers.

- Industry Trends: Major construction firms in the UK are showing a growing inclination towards vertical integration to gain greater control over their supply chains.

- Market Dynamics: In 2024, with robust housing demand, large developers are better positioned to absorb the costs associated with setting up their own manufacturing capabilities.

- Competitive Impact: This threat necessitates Epwin to maintain competitive pricing and superior product quality to deter customers from pursuing self-sufficiency.

Customers' bargaining power is influenced by their concentration and the availability of substitutes. Epwin's diverse customer base generally limits individual customer power, but large clients can exert significant influence, especially if they represent a substantial portion of revenue. For example, if a few major housebuilders accounted for over 20% of Epwin's 2024 sales, they could negotiate more aggressively on price and payment terms.

High switching costs, such as the need for bespoke products or integrated supply chains, reduce customer leverage. Conversely, readily available standard products empower customers. The global window and door market, valued at approximately $230 billion in 2024, offers numerous alternatives, increasing customer price sensitivity and pressure on Epwin. This necessitates Epwin's focus on product differentiation through features like energy efficiency and durability to mitigate price-based competition.

The threat of backward integration by customers, particularly large construction firms exploring vertical integration to control costs, also enhances their bargaining power. Some UK housebuilders invested in their own manufacturing facilities in 2024, directly impacting suppliers like Epwin. To counter this, Epwin must maintain competitive pricing and superior product quality.

| Factor | Impact on Epwin's Customer Bargaining Power | 2024 Market Context |

| Customer Concentration | Low overall, but high for key accounts | Diverse RMI, new build, social housing segments |

| Switching Costs | Higher for bespoke, lower for standard products | Demand for customized materials increased switching costs for some B2B clients |

| Availability of Substitutes | High, with numerous alternatives in the market | Global window/door market ~$230B, strong competition from PVC, aluminum, timber |

| Backward Integration Threat | Moderate, increasing for large clients | Major UK developers explored vertical integration; ~200,000 housing starts in 2024 |

Same Document Delivered

Epwin Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for the Epwin Group, detailing the competitive landscape and strategic positioning within its industry. You're looking at the actual document, which will be delivered to you instantly upon purchase, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. The document you see here is exactly what you’ll be able to download after payment, offering a complete and ready-to-use strategic assessment.

Rivalry Among Competitors

The UK building products sector, particularly for windows and doors, is quite crowded. This means Epwin Group faces competition from many companies, making the market fragmented.

In 2024, the UK window and door market is home to numerous manufacturers and installers, creating a highly competitive landscape. This sheer volume of players, many of comparable size to Epwin, means companies are constantly battling to win customers and gain market share.

The growth rate of the building products market significantly shapes competitive rivalry. When the market expands, companies can more easily gain customers without directly taking them from competitors, easing competitive pressures. Conversely, a slow-growing or contracting market intensifies competition as firms vie for a limited pool of demand, often resorting to price reductions and heightened promotional activities.

The residential windows and doors sector, a key area for companies like Epwin Group, faced a challenging period but is projected to see a return to growth in 2025. This anticipated rebound suggests that while rivalry may have been high during the downturn, the improving market conditions could offer some relief, though competition will likely remain robust as companies seek to capture market share in an expanding environment.

Epwin Group's efforts to differentiate its products significantly influence the competitive rivalry within the fenestration industry. When products are highly similar, or commoditized, competition often devolves into a price war, squeezing profit margins for all players.

Epwin's strategic emphasis on developing and marketing energy-efficient, low-maintenance, and sustainably produced fenestration solutions serves as a key differentiator. For instance, their Kömmerling brand is recognized for its advanced uPVC profiles, contributing to improved thermal performance in buildings. This focus allows Epwin to command a premium and move away from purely price-driven competition, as customers value the long-term benefits these features offer.

Exit Barriers

Epwin Group likely faces moderate exit barriers. The building materials sector often involves specialized manufacturing assets, which can be costly to repurpose or sell. For instance, companies in this space might have significant investments in extrusion machinery or specific finishing lines. These sunk costs make it challenging for underperforming firms to exit gracefully, potentially keeping them in the market and intensifying rivalry.

The difficulty in exiting can lead to prolonged periods of low profitability for all participants. If Epwin Group's competitors are unable to divest their assets easily, they might continue operating even when making minimal profits, simply to cover variable costs. This dynamic can suppress overall industry margins.

- Specialized Assets: Many operations within the building materials sector, including those of Epwin Group, rely on highly specialized machinery that is difficult to sell or redeploy elsewhere.

- Long-Term Contracts: The presence of long-term supply or customer contracts can obligate companies to remain in the market, even if current operations are not profitable.

- Employee Severance Costs: Significant costs associated with employee layoffs and severance packages can act as a deterrent to exiting the market.

- Brand Value and Reputation: A company's established brand and reputation, built over years, can be difficult to divest and may encourage continued operation.

Strategic Objectives of Competitors

Competitors' strategic objectives significantly shape the intensity of rivalry within the fenestration industry. Companies prioritizing aggressive market share expansion, for instance, are more likely to engage in price wars or ramp up research and development spending to gain a competitive edge. This contrasts with firms focused on maintaining profitability or serving specific niche markets.

Epwin Group's own strategy, marked by ongoing mergers and acquisitions, indicates a clear pursuit of growth. This ambition can provoke a more robust response from rivals who may also be seeking to consolidate their positions or counter Epwin's expanding influence. For example, in 2023, the industry saw continued consolidation, with companies like Conservatory Outlet acquiring smaller fabricators to bolster their regional presence.

- Aggressive Growth Strategies: Competitors aiming for rapid expansion may initiate price reductions or increase marketing expenditure, directly impacting Epwin's market share.

- Focus on Profitability: Rivals prioritizing profit margins might avoid aggressive price competition but could focus on product differentiation and service quality.

- M&A Activity: Epwin's acquisition strategy necessitates monitoring competitors' own consolidation efforts, which can alter the competitive landscape and introduce new, larger players.

- Innovation and R&D: Competitors investing heavily in new product development or manufacturing technologies can challenge Epwin's technological leadership and product offerings.

The competitive rivalry within the UK building products sector, particularly for windows and doors, is intense due to a fragmented market with numerous players. Epwin Group faces this challenge from many companies of comparable size, leading to constant battles for customer acquisition and market share. The market's growth rate significantly influences this rivalry; a growing market eases pressure, while a slow market intensifies it through price wars and promotions.

Epwin's differentiation strategy, focusing on energy efficiency and sustainability through brands like Kömmerling, helps it move beyond price competition. However, moderate exit barriers, stemming from specialized assets and long-term contracts, mean less profitable firms may persist, suppressing industry margins. Competitors' aggressive growth strategies, such as the consolidation observed in 2023 with Conservatory Outlet's acquisitions, also amplify rivalry, forcing Epwin to continually adapt its own growth and innovation efforts.

| Factor | Impact on Epwin Group | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | Intensifies competition for market share. | UK window and door market remains highly fragmented. |

| Product Differentiation | Allows for premium pricing and reduced price wars. | Epwin's focus on Kömmerling's uPVC profiles for thermal performance. |

| Exit Barriers | Can lead to prolonged low profitability for all players. | Specialized machinery and long-term contracts are common. |

| Competitor Strategy | Requires Epwin to respond to rivals' growth and M&A. | Industry consolidation continues; Conservatory Outlet acquisitions in 2023. |

SSubstitutes Threaten

The threat of substitutes for Epwin Group's PVC-U and aluminum windows and doors is significant, as customers can opt for timber, steel, or even alternative construction techniques that minimize the need for traditional fenestration. For instance, the increasing adoption of modular construction methods might reduce the demand for bespoke window and door units.

The attractiveness of these substitutes hinges on their price-performance trade-off. While timber offers a natural aesthetic, its maintenance costs and potential for warping can be higher than PVC-U. Steel provides strength but can be prone to corrosion and offers less thermal insulation compared to modern composite materials, impacting its overall value proposition.

In 2024, the rising cost of raw materials for PVC-U and aluminum, driven by global supply chain pressures, could make traditional substitutes like engineered wood more competitive on a price basis, especially for projects where long-term durability is less critical. However, the energy efficiency ratings mandated by building regulations continue to favor advanced materials.

Customer propensity to substitute for Epwin Group's products, primarily uPVC windows and doors, is influenced by how aware consumers are of alternatives and the perceived advantages they offer. For instance, if there's a growing trend towards environmentally friendly building materials, customers might actively seek out timber or advanced composite options, especially if these alternatives are marketed effectively and demonstrate clear benefits.

The ease with which customers can switch also plays a crucial role. A readily available and cost-competitive substitute that meets similar functional and aesthetic needs will naturally attract more customers. In 2024, the growing emphasis on energy efficiency in new builds and renovations means that products offering superior thermal performance, regardless of material, are becoming more attractive, potentially increasing the threat from substitutes if Epwin's offerings don't keep pace.

Technological advancements in substitute products pose a significant threat to Epwin Group. Innovations in smart home technology, for example, are creating integrated window and door systems that offer enhanced energy efficiency and security, potentially drawing customers away from traditional offerings. Furthermore, new insulation materials and building techniques are emerging that could provide superior performance, thereby reducing demand for Epwin's core products.

Relative Quality of Substitutes

If substitute products, such as traditional building materials like brick or timber, offer comparable or even better quality, durability, or lower maintenance needs at a similar or lower price point, the threat to Epwin Group intensifies. This means customers might switch if they perceive better overall value elsewhere.

Epwin Group actively addresses this by emphasizing the long-term benefits of its uPVC and aluminum products, focusing on low-maintenance features and enhanced energy efficiency. For instance, their window and door systems are designed to reduce heating and cooling costs, presenting a compelling value proposition that differentiates them from less efficient alternatives.

- Comparable Quality: Traditional materials like brick offer proven long-term durability, a factor that can challenge uPVC's perceived longevity in some markets.

- Maintenance Benefits: While uPVC is marketed as low-maintenance, some consumers may prefer the aesthetic or tactile qualities of natural materials like wood, despite higher upkeep.

- Energy Efficiency Focus: Epwin's investment in energy-efficient designs, such as their thermally broken aluminum systems, directly counters the threat from older, less insulated building materials.

- Price Sensitivity: Fluctuations in raw material costs for both uPVC and traditional materials can impact price competitiveness, directly influencing customer choice between substitutes.

Industry Trends and Regulations Favoring Substitutes

Shifting building regulations and environmental policies are increasingly favoring alternative materials, thereby amplifying the threat of substitutes for Epwin Group's core offerings. For instance, a growing emphasis on natural materials or enhanced sustainability in construction could significantly boost the appeal of timber or recycled content options. In 2024, the UK government's updated Building Regulations, particularly Part L concerning energy efficiency, have spurred greater interest in materials with superior thermal performance, potentially benefiting substitutes if Epwin’s products do not meet evolving standards.

Consumer preferences are also evolving, with a notable trend towards highly sustainable and aesthetically diverse building components. This shift can make alternatives more attractive, especially in residential and light commercial sectors. For example, the demand for low-embodied carbon materials is on the rise, and if Epwin Group's product lifecycle assessments are not competitive, substitutes like sustainably sourced wood or advanced composite materials could gain market share.

- Increased demand for low-embodied carbon materials: This trend directly challenges traditional PVC and aluminum products if not matched by sustainable sourcing and manufacturing.

- Stricter energy efficiency mandates: New building codes in 2024 and beyond prioritize superior insulation, potentially favoring materials offering higher R-values.

- Consumer preference for natural aesthetics: A growing segment of the market is opting for natural materials like timber, presenting a direct substitute for uPVC and aluminum profiles.

- Growth in recycled content mandates: Regulations encouraging or requiring the use of recycled materials in construction could see companies offering recycled-content alternatives gain an advantage.

The threat of substitutes for Epwin Group's window and door products is substantial, with alternatives like timber, steel, and even innovative building techniques presenting viable choices for consumers. The increasing focus on energy efficiency and sustainability in construction, particularly highlighted by the UK's 2024 Building Regulations, means that substitutes offering superior thermal performance or lower environmental impact can gain traction. For instance, while uPVC offers low maintenance, a growing consumer preference for natural aesthetics or materials with lower embodied carbon, such as sustainably sourced timber, can shift demand away from Epwin's core offerings.

| Substitute Material | Key Advantages vs. Epwin's Products | Potential Threats to Epwin Group | 2024 Market Trend Impact |

|---|---|---|---|

| Timber | Natural aesthetic, perceived sustainability, lower embodied carbon | Consumer preference for natural look, potential for higher maintenance costs | Increased demand for sustainable building materials |

| Steel | High strength, durability, modern industrial aesthetic | Lower thermal insulation than advanced composites, potential for corrosion | Niche applications in high-end or industrial designs |

| Advanced Composites | Superior thermal performance, high durability, customizable aesthetics | Potentially higher initial cost, less established market presence | Growing adoption due to energy efficiency mandates |

| Alternative Construction Techniques (e.g., Modular) | Faster build times, potential cost savings, integrated design | Reduced demand for bespoke fenestration units | Increasing market share in new residential and commercial builds |

Entrants Threaten

Establishing a presence in the building products sector demands considerable capital. New entrants face substantial upfront costs for manufacturing plants, advanced machinery, and robust distribution channels, creating a significant hurdle.

For instance, in 2024, the average cost to set up a new, moderately sized manufacturing facility for window and door systems could easily range from £5 million to £15 million, depending on automation levels and production capacity. This high barrier makes it challenging for smaller, less capitalized firms to enter the market and compete effectively with established players like Epwin Group.

Epwin Group’s substantial production volumes likely grant it significant economies of scale in manufacturing, procurement, and distribution. This means they can spread their fixed costs over more units, leading to lower average costs per item. For instance, in 2023, Epwin reported revenue of £363.1 million, indicating a large operational footprint that supports these scale advantages.

New entrants would find it incredibly difficult to match these cost efficiencies. Without the same production scale, they would inevitably face higher average costs per unit, placing them at a distinct competitive disadvantage from the outset. This barrier makes it challenging for new players to enter the market and compete on price.

Established brands within the fenestration industry, such as Epwin, have cultivated significant brand loyalty through consistent delivery of quality and reliable products. This loyalty makes it challenging for new entrants to capture market share.

Newcomers must invest heavily in differentiating their offerings and building consumer trust, a process that often requires substantial marketing expenditure and time. For example, in 2024, the UK window and door market saw continued demand for sustainable and energy-efficient products, a segment where established players like Epwin have already built strong brand recognition.

Access to Distribution Channels

New companies often struggle to secure shelf space or partnerships with established builders' merchants and developers. Epwin Group benefits from its deep-rooted relationships within the construction supply chain, making it difficult for newcomers to replicate this access.

For instance, in 2024, the UK fenestration market, where Epwin operates, continued to show strong demand from both new build and renovation sectors. New entrants would find it challenging to immediately gain the trust and volume orders from major housebuilders that Epwin already commands.

- Established relationships with key distributors: Epwin has cultivated long-term partnerships with major builders' merchants and social housing providers, giving it preferential access.

- Volume purchasing power: This extensive network allows Epwin to negotiate favorable terms and secure consistent demand, a feat difficult for smaller, unproven competitors.

- Barriers to entry for newcomers: The cost and time required to build comparable distribution networks represent a significant threat to potential new entrants in the market.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the window and door industry, a sector Epwin Group operates within. Strict building regulations, for instance, often mandate specific performance standards for windows and doors, such as thermal insulation and security features. For example, in the UK, Approved Document L of the Building Regulations sets stringent energy efficiency requirements for new dwellings, which directly affects the specifications for windows and doors. New companies must invest heavily in research and development to meet these evolving standards, alongside obtaining necessary certifications like CE marking or specific accreditations for energy performance. This compliance burden can be substantial, acting as a considerable barrier to entry for smaller or less capitalized competitors.

Environmental standards and certifications further elevate this barrier. Growing emphasis on sustainability and green building practices means new entrants must not only comply with existing regulations but also anticipate future environmental mandates. This could include requirements for recycled content, low volatile organic compound (VOC) emissions, or cradle-to-gate lifecycle assessments for products. For instance, schemes like BREEAM (Building Research Establishment Environmental Assessment Method) or LEED (Leadership in Energy and Environmental Design) influence material choices and product performance, requiring suppliers to demonstrate environmental credentials. The cost and complexity of navigating these regulatory landscapes, coupled with the need for specialized knowledge and potentially new manufacturing processes, can deter potential new market participants.

- Stringent Building Codes: Regulations like the UK's Approved Document L necessitate high thermal performance for windows, increasing R&D and compliance costs for new entrants.

- Environmental Certifications: Requirements for green building standards (e.g., BREEAM, LEED) demand products with demonstrable sustainability credentials, adding complexity and investment for newcomers.

- Navigating Regulatory Landscapes: The sheer volume and evolving nature of building and environmental regulations require significant legal and technical expertise, creating a barrier to entry.

- Compliance Costs: Meeting these diverse standards and obtaining necessary certifications can involve substantial upfront investment in product development, testing, and manufacturing upgrades.

The threat of new entrants in the building products sector, particularly for companies like Epwin Group, is generally low. Significant capital investment is required for manufacturing facilities, advanced machinery, and establishing robust distribution networks. For example, setting up a new window and door manufacturing plant in 2024 could cost between £5 million and £15 million, a substantial barrier for smaller firms.

Epwin Group benefits from considerable economies of scale, evidenced by its 2023 revenue of £363.1 million, which allows for lower average production costs. New entrants would struggle to match these efficiencies, facing higher per-unit costs and a competitive disadvantage from the start.

Established brand loyalty and deep-rooted relationships within the construction supply chain, cultivated by companies like Epwin, also pose significant challenges. Newcomers must invest heavily in marketing and building trust to gain access to distributors and volume orders, a process that is both time-consuming and costly.

Furthermore, stringent building codes and evolving environmental standards, such as the UK's Approved Document L for energy efficiency, necessitate substantial investment in R&D and compliance. Navigating these regulatory landscapes, including obtaining certifications for sustainability, adds further complexity and cost, deterring potential new market participants.

| Barrier Type | Description | Estimated Cost/Impact (2024) |

|---|---|---|

| Capital Requirements | Setting up manufacturing facilities and machinery | £5M - £15M for a new plant |

| Economies of Scale | Cost advantages from high production volumes | Epwin's £363.1M revenue (2023) indicates significant scale |

| Brand Loyalty & Distribution | Building trust and securing supply chain access | High marketing and partnership development costs |

| Regulatory Compliance | Meeting building codes and environmental standards | R&D, testing, and certification expenses |

Porter's Five Forces Analysis Data Sources

Our Epwin Group Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial reports, industry-specific market research, and competitor disclosures. We also incorporate insights from trade publications and economic indicators to provide a comprehensive view of the competitive landscape.