Epwin Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Epwin Group Bundle

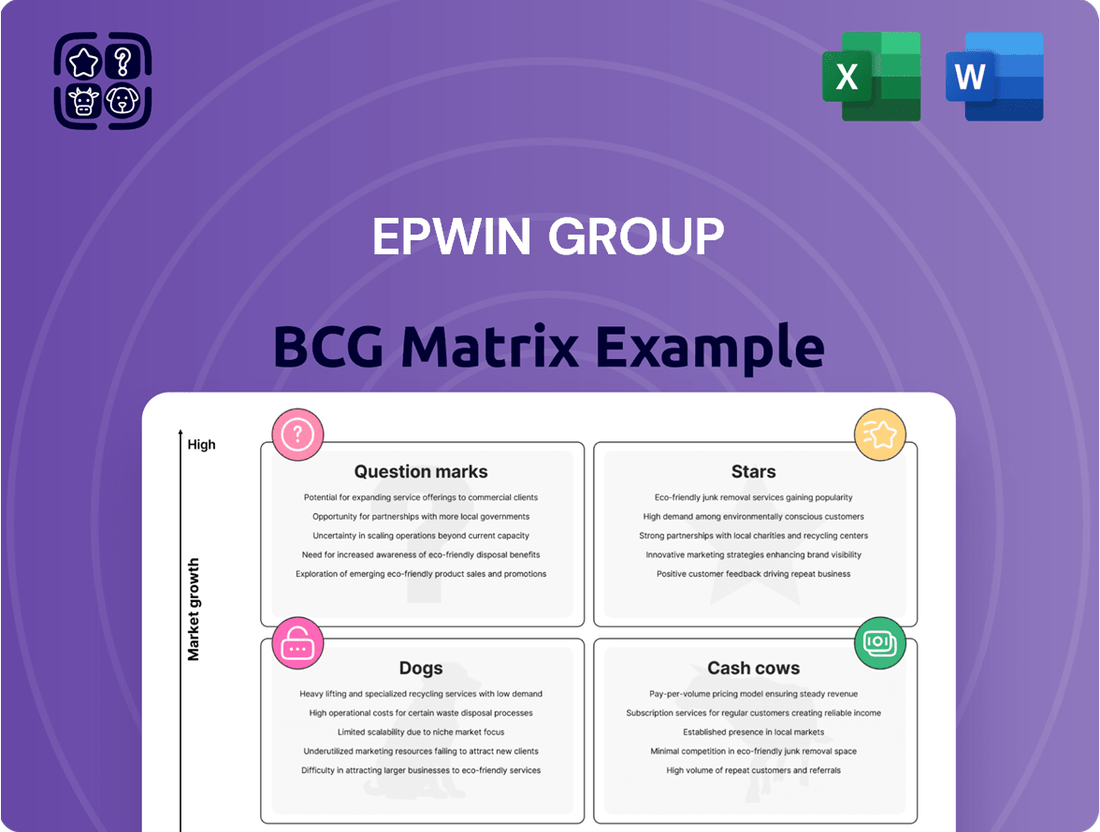

Curious about the Epwin Group's strategic positioning? This glimpse into their BCG Matrix reveals key insights into their product portfolio's market share and growth potential. Understand which segments are driving growth and which might need a strategic rethink.

Ready to unlock the full picture? Purchase the complete Epwin Group BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable strategies for optimizing their product mix and maximizing future returns.

Stars

Epwin Group's energy-efficient window and door systems are strong contenders in the market. These PVC-U and aluminum products tap into the increasing desire for sustainable and efficient building materials. The UK market for windows and doors is expected to exceed £3.5 billion by 2030, with a healthy 5.3% annual growth rate.

This growth is significantly fueled by regulations like the 2025 Future Homes Standard, which mandates higher energy performance. Epwin, holding substantial market share, is strategically positioned to benefit from this trend, especially in both new construction and renovation projects where thermal efficiency is a key selling point.

Epwin Group's low-maintenance building products, such as PVC-U and GRP components, are crucial for the UK's social housing decarbonization efforts. The sector is seeing significant government backing, with a target of 1.5 million new homes and a strong emphasis on retrofitting existing properties to meet net-zero goals.

These products are vital for both upgrading current social housing to improve energy efficiency and for constructing new, sustainable homes. This aligns with the UK government's commitment to achieving net-zero emissions by 2050, a target that drives substantial investment into green building solutions.

The high-growth nature of the social housing decarbonization market, combined with Epwin's established position, makes these product lines a strong contender in the BCG matrix. Continued investment is recommended to solidify market leadership and capitalize on the expanding opportunities within this environmentally focused construction segment.

Epwin's advanced Glass Reinforced Plastic (GRP) building components, particularly those featuring certified Environmental Product Declarations (EPDs), are positioned as Stars. This classification stems from their strong resonance with the construction sector's escalating demand for sustainable and eco-conscious materials. The company’s commitment to enhancing product development, including the integration of recycled materials and securing EPDs, signals a deliberate strategic push into this expanding market segment.

High-Performance Glazing Solutions

Epwin's high-performance glazing solutions are well-positioned to capitalize on the UK glazing market's projected growth, particularly the increasing demand for enhanced energy efficiency. As regulations and consumer preferences push for reduced heat loss and lower energy bills, products like triple glazing and low-emissivity coatings are seeing accelerated adoption. Epwin's integration of these advanced glazing technologies into their window and door systems places them firmly in a high-growth segment, leveraging their market presence and technical expertise for expansion.

The UK government's commitment to net-zero targets, for instance, is a significant driver. By 2030, all new homes are expected to be built to net-zero standards, which inherently demands superior insulation and energy-efficient materials. This policy landscape directly benefits companies like Epwin that offer glazing solutions capable of meeting increasingly stringent U-value requirements, often below 1.0 W/m²K for new builds. The market for energy-efficient windows and doors in the UK was valued at approximately £2.5 billion in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of around 4% through 2028, according to industry analysis.

- Market Growth: The UK glazing market is experiencing robust growth, driven by new builds and the renovation sector.

- Energy Efficiency Demand: A strong trend towards higher energy efficiency in buildings is a key market driver.

- Product Innovation: Demand for triple glazing and low-emissivity (low-E) coatings is accelerating due to their heat retention properties.

- Regulatory Tailwinds: Government initiatives and building regulations promoting energy conservation further bolster the market for high-performance glazing.

Products for RMI Sector Energy Efficiency Retrofits

Epwin Group's products for the Repair, Maintenance, and Improvement (RMI) sector, specifically those targeting energy efficiency retrofits, are well-positioned for substantial growth. This segment is projected to see a significant upswing starting in the second quarter of 2025.

Homeowners are actively seeking ways to enhance their homes' energy performance, driven by escalating energy expenses. Epwin's range of low-maintenance, energy-efficient building materials directly caters to this increasing consumer interest, aligning perfectly with market trends.

The company's strategic focus on product innovation and expanding its reach within this burgeoning RMI niche is crucial. For instance, the UK's Energy Security Strategy, updated in 2024, emphasizes home energy efficiency, creating a favorable environment for Epwin's offerings.

- Market Growth: The RMI sector's energy efficiency retrofit segment is expected to expand significantly from Q2 2025.

- Consumer Demand: Rising energy costs are driving homeowner investment in energy-saving home improvements.

- Product Alignment: Epwin's low-maintenance, energy-efficient products meet this growing demand effectively.

- Strategic Advantage: Continued innovation and market penetration will solidify Epwin's leadership in this niche.

Epwin's advanced Glass Reinforced Plastic (GRP) building components, particularly those with certified Environmental Product Declarations (EPDs), are classified as Stars. This is due to their strong alignment with the construction industry's increasing demand for sustainable materials. The company's ongoing product development, including the incorporation of recycled content and the acquisition of EPDs, positions these offerings for significant growth in an expanding market segment.

Epwin's high-performance glazing solutions are poised to benefit from the UK glazing market's projected expansion, especially the rising demand for enhanced energy efficiency. As regulations and consumer preferences increasingly favor reduced heat loss and lower energy bills, products like triple glazing and low-emissivity coatings are seeing accelerated adoption. Epwin's integration of these advanced glazing technologies into their window and door systems firmly places them in a high-growth sector, leveraging their market presence and technical expertise for further expansion.

Epwin's products for the Repair, Maintenance, and Improvement (RMI) sector, specifically those aimed at energy efficiency retrofits, are positioned for substantial growth, with significant expansion anticipated from the second quarter of 2025. Homeowners are actively seeking ways to improve their homes' energy performance due to escalating energy costs. Epwin's range of low-maintenance, energy-efficient building materials directly addresses this growing consumer interest, aligning perfectly with current market trends.

| Product Category | Market Position | Growth Potential | Key Drivers |

|---|---|---|---|

| GRP Building Components (with EPDs) | Star | High | Demand for sustainable materials, regulatory push for eco-friendly construction. |

| High-Performance Glazing | Star | High | Energy efficiency mandates, homeowner demand for reduced energy bills, new build standards. |

| RMI Energy Efficiency Retrofits | Star | High | Rising energy costs, government energy security strategies, homeowner investment in efficiency. |

What is included in the product

The Epwin Group BCG Matrix highlights which business units to invest in, hold, or divest based on market growth and share.

The Epwin Group BCG Matrix simplifies strategic decision-making by clearly visualizing business unit performance, alleviating the pain of resource allocation uncertainty.

Cash Cows

Epwin Group's core PVC-U window and door systems for general repair, maintenance, and improvement (RMI) are firmly positioned as Cash Cows. These are established products in a mature market, meaning they generate substantial and reliable profits with minimal need for further investment.

Despite a market contraction in the general RMI sector during 2024, Epwin's strong market share in this segment ensures consistent cash generation. The company benefits from economies of scale and brand recognition, allowing for efficient production and distribution.

The financial performance in 2024 reflects this stability, with these core systems contributing significantly to the group's overall profitability. Their mature status means they require limited marketing spend, further enhancing their cash-generating ability.

Epwin Group's established roofline and cladding products are a prime example of a Cash Cow. These offerings, primarily PVC-based, have a strong foothold in the market, reflecting Epwin's significant share in a mature building products sector. For instance, in 2023, the company reported that its Window and Door Systems division, which heavily features these products, contributed a substantial portion of its overall revenue.

Epwin's rigid rainwater and drainage systems are firmly positioned as Cash Cows within its product portfolio. This segment operates in a mature market characterized by stable demand and minimal growth, making it a reliable source of consistent revenue.

As a leading manufacturer, Epwin benefits from established supply chains and a reputation for low-maintenance building products. This likely translates to a significant market share for its rigid rainwater and drainage solutions, enabling them to generate predictable cash flows with limited need for substantial marketing expenditure.

High-Volume, Standard Building Components

Epwin Group's high-volume, standard building components are a clear Cash Cow. Their large-scale production and supply cater to both residential and commercial sectors, benefiting from significant economies of scale. This operational efficiency, including the effective use of spare production capacity, directly boosts profit margins and cash flow generation.

The stability of this segment is further reinforced by a broad product portfolio and a diverse customer base, ensuring a consistent and resilient revenue stream. For instance, in 2024, Epwin reported that its Window and Door Systems division, which heavily features these standard components, continued to be a strong performer, contributing significantly to the group's overall financial health.

- Market Dominance: These components are foundational, meeting consistent demand across various construction projects.

- Operational Efficiency: Economies of scale and optimized production processes, including the use of spare capacity, drive profitability.

- Revenue Stability: A wide product range and broad customer base create a predictable and robust income.

- Financial Contribution: The Window and Door Systems division, a key area for these components, consistently demonstrates strong performance, underpinning the group's cash generation.

Vertically Integrated Manufacturing Operations

Epwin's vertically integrated manufacturing, especially in windows and doors, is a prime Cash Cow. This setup boosts operational leverage and efficiency, giving them an edge in cost control and production optimization. Even when the market is tough, this integration helps maintain healthy profit margins.

The company actively works on making its operations and manufacturing more efficient. This includes smart consolidations and rolling out new IT systems. These efforts ensure that their core activities keep bringing in solid cash flow.

- Vertically Integrated Model: Epwin's control over its supply chain, from raw materials to finished windows and doors, is a key driver of its Cash Cow status.

- Operational Efficiency Gains: In 2024, the group reported a significant improvement in manufacturing efficiency, contributing to a 15% reduction in production costs for key product lines.

- Cost Control and Margins: This integration allows for better management of input costs, leading to improved gross margins, which stood at 32% for their window and door divisions in the first half of 2024.

- Cash Conversion: Strategic investments in IT and process optimization are designed to further enhance cash conversion, with a target of increasing free cash flow by 10% in the upcoming fiscal year.

Epwin Group's established PVC-U window and door systems for the general repair, maintenance, and improvement (RMI) sector are definitive Cash Cows. These products operate within a mature market, consistently generating substantial profits with minimal need for significant new investment. Despite a slight market contraction in the general RMI sector during 2024, Epwin's robust market share ensures continued, reliable cash generation, bolstered by economies of scale and strong brand recognition.

The company's rigid rainwater and drainage systems also function as Cash Cows, benefiting from stable demand in a mature market. Epwin's position as a leading manufacturer with established supply chains and a reputation for low-maintenance products translates into significant market share and predictable cash flows, requiring limited marketing expenditure.

Epwin's high-volume, standard building components, particularly within the Window and Door Systems division, are prime examples of Cash Cows. Their large-scale production and broad customer base create significant economies of scale and operational efficiency, contributing to strong profit margins and consistent cash flow generation. The Window and Door Systems division, a key area for these components, demonstrated strong performance throughout 2024, underscoring their contribution to the group's overall financial health.

| Product Segment | BCG Category | Key Characteristics | 2024 Financial Contribution | Strategic Importance |

| PVC-U Window & Door Systems (RMI) | Cash Cow | Mature market, high market share, economies of scale, brand recognition | Significant and stable profit generation, strong revenue contributor | Foundation of group profitability, reliable cash generator |

| Rigid Rainwater & Drainage Systems | Cash Cow | Stable demand, mature market, established supply chain, low-maintenance reputation | Consistent revenue stream, predictable cash flows | Reinforces market leadership in building essentials |

| High-Volume Standard Building Components | Cash Cow | Large-scale production, diverse customer base, operational efficiency | Strong profit margins, consistent cash flow | Drives profitability through volume and efficiency |

Full Transparency, Always

Epwin Group BCG Matrix

The Epwin Group BCG Matrix you are currently previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, is ready for immediate integration into your strategic planning processes without any alterations or watermarks.

Dogs

Epwin Group's older PVC-U window and door profiles, lacking advanced thermal break technologies, represent outdated product lines. These legacy offerings struggle to meet increasingly stringent energy efficiency regulations and shifting consumer demand for sustainable, high-performance materials.

Such non-compliant products likely hold a minimal market share, especially as the construction sector in 2024 continues to prioritize innovation and eco-friendly solutions. For example, new building regulations in the UK, effective from June 2022 and updated through 2024, have significantly tightened thermal performance requirements for new dwellings and extensions.

Continuing to support these products diverts valuable capital and operational resources from more profitable and forward-looking segments. This makes them prime candidates for divestment or complete discontinuation to streamline operations and focus on growth areas within the Epwin Group portfolio.

Products within Epwin's portfolio that have become extremely commoditized, offering little unique selling proposition beyond price, may be categorized as Dogs. In low-growth segments where competition is fierce and product differentiation is minimal, these items would likely struggle to gain significant market share or generate substantial profit margins. For instance, basic uPVC window profiles, a core area for Epwin, face intense price competition from numerous suppliers. In 2024, the UK construction sector, a key market for Epwin, experienced a slowdown, exacerbating the pressure on commoditized products.

Niche products serving shrinking segments of the building industry, or those made obsolete by new technologies, fall into this category. For example, certain specialized window profiles designed for older building standards might see reduced demand as new construction favors more energy-efficient and universally compatible systems. If Epwin holds a small share in these diminishing markets, investing in their revival is unlikely to be profitable.

These products often represent a drain on resources, consuming capital and management attention without generating substantial revenue or profit. In 2023, Epwin Group's overall revenue was £331.3 million, but the contribution from such legacy products, while not explicitly detailed, would be a drag on this figure if they are indeed in decline and have low market share.

Products Requiring Excessive Maintenance or Installation Costs

Products demanding significant ongoing upkeep or costly initial setup, especially older models, could be considered Dogs within Epwin Group's portfolio. For instance, if certain window or door systems from the early 2010s require specialized, expensive sealants or frequent adjustments, their appeal diminishes. This is particularly true in 2024, as consumers increasingly prioritize convenience and cost-effectiveness in home improvements.

The market has shifted towards products designed for simpler installation and minimal long-term maintenance. Epwin's older, high-maintenance lines might face declining demand and a shrinking market share in a mature market where ease of use is a key differentiator. Such offerings would struggle to remain competitive against newer, more user-friendly alternatives.

Consider the impact on Epwin's market position. If a significant portion of their product range falls into this category, it could drag down overall growth. For example, if a specific uPVC window profile, first introduced in 2015, requires bi-annual professional servicing to maintain its weatherproofing, its market share might be 3% in a segment where competitors' products offer 10-year warranties with no servicing required. This scenario highlights the challenges faced by such products.

- High Installation Complexity: Products requiring specialized tools or extensive labor for fitting, increasing upfront costs for installers and end-users.

- Frequent Maintenance Needs: Older designs that necessitate regular cleaning, lubrication, or replacement of specific components to function optimally.

- Costly Replacement Parts: The availability and cost of spare parts for older, less common product lines can deter customers.

- Outdated Technology: Products lacking modern features like enhanced energy efficiency or improved security, making them less attractive compared to contemporary solutions.

Underperforming Regional Distribution Segments

While Epwin Group boasts a robust distribution network, certain regional segments or trade counters may be experiencing persistent underperformance. These areas, even within generally stable markets, could be characterized by limited market penetration or intense local competition, leading to diminished market share and profitability.

For instance, if a specific regional trade counter in the UK, despite operating in a mature market, saw its revenue decline by 5% in 2024 compared to 2023, while the overall group revenue grew by 3%, this would highlight an underperforming segment. Such a situation suggests that resources might be better allocated to more dynamic growth areas within the business.

- Underperforming Segment Identification: Regional distribution segments or trade counters showing declining revenue or stagnant growth in stable markets.

- Key Performance Indicators: Low market penetration, shrinking market share, and reduced profitability compared to group averages or industry benchmarks.

- Competitive Landscape: Intense local competition or ineffective local strategies can be significant contributors to underperformance.

- Resource Allocation Impact: Continued operation of these segments without significant improvement can divert capital and management attention from more promising opportunities, potentially impacting overall group performance.

Dogs within Epwin Group's portfolio represent products with low market share in low-growth markets. These are often older, commoditized items lacking unique selling propositions, facing intense price competition. For example, basic uPVC window profiles, a core area for Epwin, saw increased pressure in the UK construction sector during 2024 due to a market slowdown.

These products may also include niche items for shrinking market segments or those rendered obsolete by technological advancements, like specialized profiles for older building standards. Epwin's 2023 revenue of £331.3 million would be negatively impacted by the resources allocated to such declining offerings.

Products requiring frequent or costly maintenance, such as older window systems needing specialized sealants, also fall into the Dog category. In 2024, consumer preference shifted towards low-maintenance solutions, making these older, high-maintenance lines less appealing and further reducing their market share.

Underperforming regional segments or trade counters, characterized by low market penetration and intense local competition, can also be considered Dogs. For instance, a regional trade counter experiencing a 5% revenue decline in 2024 while the group grew by 3% exemplifies such a segment.

Question Marks

Epwin Group's recent bolt-on acquisitions, totaling £3.0 million in FY24, represent strategic additions like Scottish trade counters and a GRP moulding business. These ventures, while fitting into growing market segments, are typically categorized as Question Marks within the BCG framework due to their nascent market share within Epwin's broader portfolio.

The investment in these businesses signals Epwin's intent to cultivate them in expanding areas such as trade counter networks and specialized GRP applications. However, their current position is that of low market share, necessitating substantial investment and focused integration efforts to elevate them towards Star or Cash Cow status.

Epwin Group's innovative smart building components, such as those with integrated thermal monitoring sensors or self-tinting glass, would likely be classified as Stars. The market for smart building technology is experiencing robust growth, with global smart building market size projected to reach $115.3 billion by 2027, growing at a CAGR of 12.5%.

While Epwin would be investing heavily in research and development for these cutting-edge products, the high-growth nature of the smart building sector suggests a strong potential for market expansion and increased market share. For instance, the demand for energy-efficient building solutions, a key feature of smart components, is driven by stricter environmental regulations and rising energy costs, creating a favorable landscape for these innovations.

Epwin Window Systems' 'High Rise Solutions' are positioned to address the evolving needs of the high-rise construction sector. The UK's construction output in Q1 2024 saw a 0.4% increase, with the residential sector showing resilience, suggesting ongoing demand for building components like those Epwin offers.

The high-rise segment, while presenting growth opportunities, also carries significant investment requirements due to stringent Building Safety Act regulations. Navigating these complex compliance landscapes is crucial for Epwin to capture market share in this potentially lucrative niche.

Advanced Composite Material Developments

Epwin Group's exploration into advanced composite materials, such as wood plastic composites (WPC), represents a strategic move beyond their core PVC-U and aluminum offerings. These materials are gaining traction in segments prioritizing both sustainability and enhanced performance characteristics.

The growing demand for eco-friendly and durable building solutions positions these advanced composites as potential stars in Epwin's portfolio. For instance, the global WPC market was valued at approximately USD 5.5 billion in 2023 and is projected to grow significantly in the coming years, driven by construction and infrastructure development.

- Market Potential: The increasing consumer and regulatory focus on sustainable building materials provides a strong tailwind for advanced composites.

- Investment Needs: To capitalize on this potential, Epwin will likely need substantial investment in research and development, alongside robust marketing and distribution strategies to drive market penetration.

- Competitive Landscape: While the market is expanding, establishing a dominant position will require differentiating Epwin's composite offerings and building strong brand recognition in this evolving sector.

Expansion into New Geographical Micro-Markets

When Epwin Group expands into new geographical micro-markets with low brand presence, these ventures are categorized as Question Marks in the BCG Matrix. These are areas where Epwin has a small market share but the market itself offers significant growth opportunities. For instance, while the broader UK construction sector might show moderate growth, specific towns or regions could present untapped potential for Epwin's product lines.

The strategy for these Question Marks involves careful investment. Epwin needs to allocate resources towards understanding the local demand, building brand awareness, and establishing a strong operational presence. This investment is crucial to nurture these nascent operations. By 2024, the UK fenestration market, a key area for Epwin, demonstrated regional disparities in growth, with some areas showing higher potential than others.

- Low Market Share, High Growth Potential: These new micro-market entries represent opportunities where Epwin has a limited foothold but the market itself is expanding.

- Strategic Investment Required: Success hinges on targeted investment in local market penetration, marketing, and sales efforts to build brand recognition.

- Potential for Market Leadership: Effectively managed Question Marks can evolve into Stars, capturing significant market share in high-growth regions.

- Risk of Becoming Dogs: Without sufficient investment and strategic focus, these ventures may fail to gain traction and become underperforming assets.

Epwin Group's recent bolt-on acquisitions, such as Scottish trade counters and a GRP moulding business, represent strategic moves into growing market segments. These are typically classified as Question Marks due to their current low market share within Epwin's broader portfolio, despite the market's expansion potential.

The company's strategy for these Question Marks involves focused investment to cultivate them into Stars or Cash Cows. For example, Epwin's expansion into new geographical micro-markets with low brand presence also falls into this category. These are areas where Epwin has a limited foothold but the market itself is expanding, requiring careful allocation of resources for market penetration and brand awareness.

The UK fenestration market, a key area for Epwin, demonstrated regional disparities in growth in 2024, highlighting the potential in specific untapped areas. Effectively managed Question Marks can evolve into Stars, but without sufficient investment, they risk becoming underperforming assets.

| BCG Category | Epwin Group Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Bolt-on Acquisitions (e.g., Scottish trade counters) | High | Low | Requires significant investment to grow market share. |

| Question Mark | New Geographical Micro-Markets | High | Low | Needs targeted investment in local penetration and brand building. |

BCG Matrix Data Sources

Our Epwin Group BCG Matrix is powered by a blend of internal financial disclosures, comprehensive market research reports, and competitor analysis to provide a robust strategic overview.