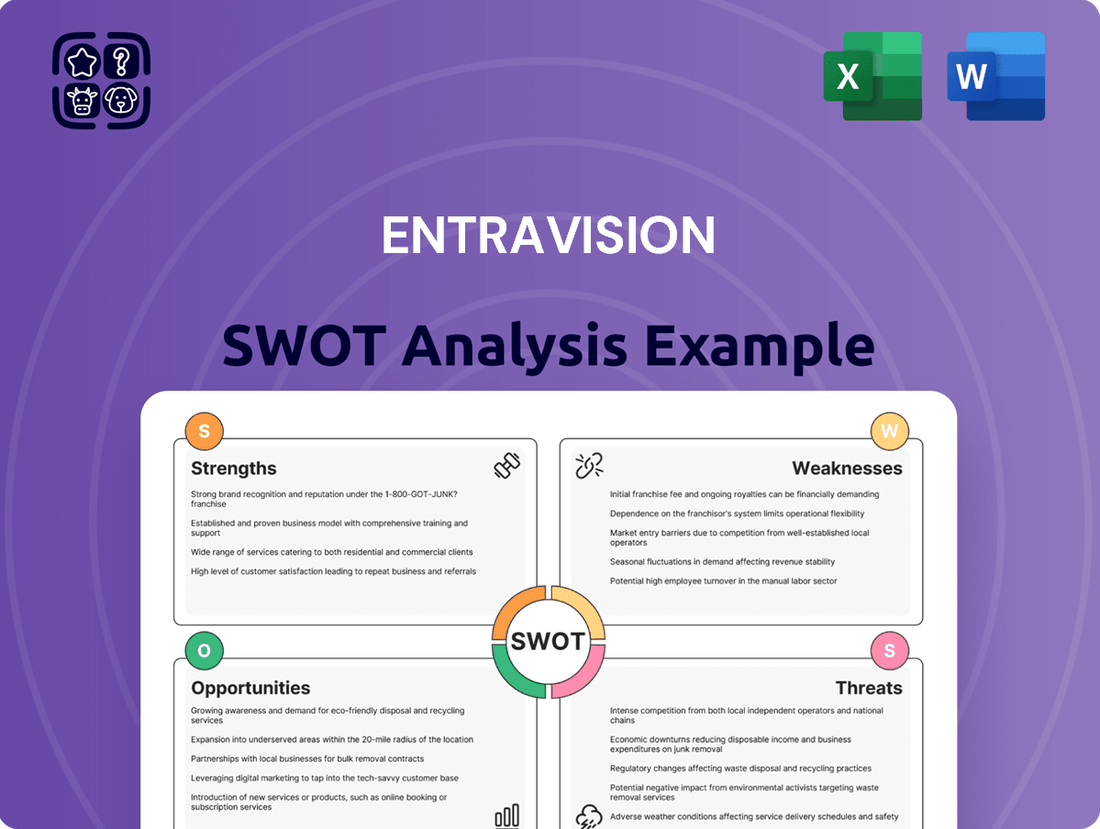

Entravision SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entravision Bundle

Entravision's strengths lie in its strong presence in underserved Hispanic markets and its diverse media portfolio, including television, radio, and digital. However, the company faces challenges from evolving media consumption habits and increasing competition. Its opportunities include expanding its digital footprint and leveraging its audience data for targeted advertising. A key threat is the potential for economic downturns impacting advertising spend.

Discover the complete picture behind Entravision’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Entravision's strength lies in its diverse revenue streams, primarily from its Media segment and Advertising Technology & Services. The Media segment, focusing on television, radio, and digital marketing within the U.S., particularly caters to the significant Latino demographic. This targeted approach allows for specialized content and advertising, driving engagement and revenue. For instance, in the first quarter of 2024, Entravision reported a 10% increase in revenue, reaching $218.4 million, with its digital segment showing robust growth.

Complementing its media operations, Entravision's Advertising Technology & Services segment provides programmatic advertising solutions on a global scale. This dual approach, combining content creation and distribution with advanced advertising technology, creates a synergistic effect. The company's global reach, spanning the United States, Latin America, Europe, and Asia, further diversifies its income sources and reduces dependence on any single market. This broad operational footprint positions Entravision to capitalize on varied consumer bases and advertising trends worldwide.

Entravision's Advertising Technology & Services segment is a significant strength, showcasing impressive growth. In the first quarter of 2025, this segment saw a remarkable 57% jump in net revenue when compared to the same period in 2024.

Furthermore, the operating profit for this segment experienced an even more substantial surge, increasing by 296% in Q1 2025 versus Q1 2024. This robust financial performance highlights the segment's vital role in driving Entravision's overall revenue expansion.

Key proprietary platforms such as Smadex, which facilitates programmatic ad purchasing, and Adwake, focused on mobile growth solutions, are central to this success. These technologies not only contribute to revenue but also position Entravision as a leader in the evolving digital advertising landscape.

Entravision is strategically bolstering its proprietary technology platform and aggressively building artificial intelligence capabilities. This focus is designed to significantly enhance its digital advertising solutions and offer advertisers more sophisticated targeting and analytics.

By integrating these advanced AI-driven features with its existing traditional media assets, Entravision aims to deliver truly comprehensive, multi-channel advertising solutions. This approach is crucial for adapting to the rapidly changing media consumption habits and advertiser demands in the current landscape.

For instance, in Q1 2024, Entravision reported that its digital segment revenue grew by 13% year-over-year, demonstrating the early impact of these technological investments. The company specifically highlighted advancements in its AI-powered audience segmentation tools as a key driver of this growth.

Targeted Reach to Diverse Audiences, Especially Hispanic Markets

Entravision's significant strength lies in its ability to precisely target diverse audiences, with a notable emphasis on the influential Hispanic market within the United States. As the largest affiliate group for Univision and UniMás television networks, Entravision possesses an unparalleled connection to this rapidly growing demographic.

This specialized reach translates into a powerful advantage for advertisers. Brands can leverage Entravision's platforms to implement highly customized advertising strategies, ensuring their messages resonate effectively with specific consumer segments. This focused approach provides a clear competitive edge in reaching and engaging these valuable audiences.

For instance, Entravision's robust presence in key Hispanic markets allows for deep cultural understanding and tailored content delivery. This strategic positioning is vital in a landscape where authentic connection drives consumer behavior. In 2023, Entravision reported that approximately 50% of its revenue was derived from its digital segment, indicating a successful diversification beyond traditional media while maintaining its core audience strengths.

- Largest Affiliate Group: Entravision is the largest affiliate group for Univision and UniMás, providing extensive reach within the Hispanic community.

- Targeted Advertising: This specialized reach enables tailored advertising approaches that resonate deeply with specific demographic segments.

- Competitive Differentiator: Entravision's focus on diverse audiences, especially Hispanics, sets it apart in the media landscape.

- Digital Growth: By 2023, around half of Entravision's revenue came from its digital operations, showcasing a forward-thinking strategy alongside its traditional strengths.

Strong Balance Sheet and Cost Efficiency Initiatives

Entravision is actively prioritizing financial health by maintaining a robust balance sheet characterized by low leverage. This prudent financial management provides a solid foundation for navigating market fluctuations and pursuing growth opportunities.

The company has also made significant strides in enhancing cost efficiency. These initiatives are designed to streamline operations and bolster profitability.

A key indicator of these efforts is the substantial reduction in corporate expenses. Specifically, corporate expenses saw a notable decrease of 36% in the first quarter of 2025 when compared to the same period in 2024. This demonstrates a commitment to controlling operational overhead and improving the company's bottom line.

- Strong Balance Sheet: Maintained with low leverage, providing financial stability.

- Cost Efficiency Initiatives: Focused on streamlining operations and improving profitability.

- Reduced Corporate Expenses: Decreased by 36% in Q1 2025 versus Q1 2024.

Entravision's strength is its position as the largest affiliate group for Univision and UniMás, giving it unparalleled access to the growing Hispanic market in the U.S. This allows for highly targeted advertising, a key differentiator. By 2023, about half of its revenue came from digital operations, showing a balanced approach.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Digital Segment Revenue Growth | 13% | N/A | N/A |

| Advertising Technology & Services Net Revenue Growth | N/A | 57% | N/A |

| Advertising Technology & Services Operating Profit Growth | N/A | 296% | N/A |

| Corporate Expenses Reduction | N/A | 36% | N/A |

What is included in the product

Analyzes Entravision’s competitive position through key internal and external factors, detailing its strengths in diverse media, weaknesses in financial performance, opportunities in emerging markets, and threats from digital disruption.

Highlights key growth opportunities and competitive threats, enabling proactive strategy development.

Weaknesses

Entravision's traditional media segment, encompassing television and radio, faced a significant challenge in early 2025. For the first quarter of 2025, this segment saw its net revenue drop by 10% when compared to the same period in 2024. This downturn was largely attributed to a reduction in broadcast advertising income and less revenue from retransmission consent agreements. Furthermore, the company observed a decrease in the number of advertisers actively utilizing this segment's platforms.

Entravision faced significant headwinds in early 2025, reporting substantial non-cash charges that impacted its operating results. In the first quarter of 2025, these charges amounted to $48.9 million. This figure primarily stemmed from the divestiture of assets, such as two television stations located in Mexico, and the costs associated with abandoning the lease for its former corporate headquarters.

These considerable non-cash expenses directly contributed to Entravision posting an operating loss of $3.9 million for the first quarter of 2025. Furthermore, the net loss attributable to common stockholders reached a substantial $47.97 million during the same period. These financial outcomes highlight the challenges Entravision encountered in its early 2025 operational and financial performance.

The termination of Meta Platforms' Authorized Sales Partner program in March 2024 dealt a significant blow to Entravision, as Meta previously accounted for over half of its revenue and 40% of its EBITDA. This abrupt shift necessitated the sale of Entravision's EGP business in June 2024, underscoring a critical dependency on large platform partnerships. The event exposed Entravision's vulnerability to the strategic decisions of major digital advertising players.

Underperformance of Stock and Dividend Coverage Concerns

Entravision's stock has faced significant headwinds, with its share price declining by 35.71% over the past five years. This underperformance suggests challenges in market perception and operational execution compared to broader market indices.

Further compounding investor concerns is the company's dividend coverage. Entravision offers a dividend yield of 10.53%, which appears attractive on the surface. However, this yield is not adequately supported by the company's earnings, creating a potential risk for shareholders reliant on dividend income.

- Stock Underperformance: Entravision's stock has seen a 35.71% decrease over the last five years, lagging behind market performance.

- Dividend Yield: The company currently offers a dividend yield of 10.53%.

- Dividend Coverage: The dividend payout is not well-covered by earnings, posing a sustainability risk for investors.

- Investor Confidence: The combination of stock underperformance and dividend concerns may erode investor confidence in Entravision's financial stability.

Intense Competition in the Advertising and Media Industry

Entravision operates within a fiercely competitive advertising and media landscape. The company contends with a broad array of competitors, ranging from established traditional broadcasters to agile digital advertising platforms and major tech giants. This intense rivalry, particularly amplified by the rapid evolution of digital media, presents ongoing challenges in maintaining and growing market share and ensuring sustained profitability.

The digital advertising sector, where Entravision has a significant presence, is characterized by constant innovation and the dominance of large technology players. For instance, in 2024, digital advertising spending is projected to exceed $300 billion in the US alone, with a substantial portion captured by Google and Meta. This market dynamic necessitates continuous adaptation and investment to remain competitive.

- Market Saturation: The sheer number of media outlets and advertising channels available to consumers and businesses creates a crowded marketplace.

- Digital Disruption: Traditional media companies like Entravision must constantly innovate to counter the disruptive forces of digital-native competitors.

- Platform Dominance: Large technology platforms control significant portions of digital ad spend, creating barriers to entry and growth for smaller players.

- Price Sensitivity: Intense competition often leads to downward pressure on advertising rates, impacting revenue and margins.

Entravision's reliance on Meta's Authorized Sales Partner program proved to be a significant weakness, as its termination in March 2024, which previously accounted for over half of Entravision's revenue and 40% of its EBITDA, forced the sale of its EGP business. This highlights a critical dependency on major digital advertising platforms. Furthermore, the company's stock experienced a substantial decline of 35.71% over the past five years, indicating market concerns about its performance and strategy. Additionally, Entravision's high dividend yield of 10.53% is not adequately covered by its earnings, raising questions about its sustainability and potentially impacting investor confidence.

What You See Is What You Get

Entravision SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Entravision's Strengths, Weaknesses, Opportunities, and Threats. Explore key internal and external factors impacting the company's strategic positioning. This detailed analysis is designed to inform your business decisions.

Opportunities

Entravision's Advertising Technology & Services segment is a powerhouse, consistently fueling its overall revenue growth. This segment's robust performance is a key driver for the company's financial success.

By continuing to invest in its cutting-edge proprietary technology platforms, like Smadex and Adwake, Entravision is positioning itself for even greater market penetration. These investments are crucial for staying ahead in the competitive ad tech landscape.

Expanding its sales capacity within this high-growth area presents a clear opportunity to further accelerate both revenue and operating profit. In 2023, Entravision reported that its digital segment, which heavily features its ad tech offerings, saw a substantial increase in revenue, underscoring the strength of this strategic focus.

Entravision's strategic focus on expanding its digital advertising solutions and integrating artificial intelligence (AI) capabilities into its platforms presents a significant growth opportunity. This move allows for more precise audience targeting and improved performance measurement.

By leveraging AI, Entravision can enhance its offerings to advertisers, providing them with more effective campaigns and a deeper understanding of their return on investment. This capability is crucial in today's data-driven advertising landscape.

This strategic direction enables Entravision to offer more comprehensive, multi-channel solutions to a wider array of advertisers, strengthening its competitive position. For instance, in 2024, the digital advertising market is projected to reach over $600 billion globally, underscoring the immense potential for companies like Entravision to capture market share through advanced solutions.

Entravision has a proven track record of capitalizing on political advertising, a trend that is expected to continue. In 2024, the company achieved record political advertising revenue, demonstrating its ability to attract significant ad spending during election periods. This success highlights a key opportunity for sustained growth by focusing on this lucrative segment.

By strategically enhancing its local news programming and bolstering its sales teams, Entravision can further solidify its position as a preferred platform for political campaigns. This proactive approach will allow the company to effectively capture and maximize political ad revenue in upcoming election cycles, building on the momentum of its 2024 performance.

Strategic Partnerships and Acquisitions in Digital Media

Entravision's divestiture of its EGP business to Aleph Group in July 2024, a deal valued at approximately $35 million, highlights a strategic shift. Moving forward, Entravision can leverage this capital for targeted acquisitions or strategic partnerships within the digital media and ad-tech sectors. This approach could unlock new revenue streams and strengthen its existing digital capabilities by integrating complementary technologies or expanding into adjacent markets.

Such alliances could prove particularly beneficial for Entravision's global expansion strategy. By partnering with or acquiring entities that possess strong footholds in emerging economies, Entravision can accelerate its market penetration. This would allow for a more rapid build-out of its digital platform relationships and a broader reach across diverse consumer segments.

- Strategic Acquisitions: Pursuing acquisitions in areas like programmatic advertising technology or data analytics could enhance Entravision's ad-tech stack.

- Partnership Expansion: Forging new partnerships with global digital publishers or content creators can broaden its inventory and audience access.

- Geographic Focus: Prioritizing partnerships or acquisitions in high-growth emerging markets, such as Latin America or Southeast Asia, aligns with current digital media trends.

- Synergistic Integration: Ensuring acquired or partnered entities offer synergistic benefits to Entravision's current business model is crucial for maximizing value.

Potential for Spectrum Rights Monetization

Entravision possesses valuable television and radio spectrum rights, especially in crucial U.S. markets. This presents a significant opportunity for monetization.

With potential shifts in FCC policy, including renewed interest in spectrum auctions, Entravision could unlock substantial value. The company has a precedent for successfully divesting non-core assets for significant financial gain.

- Spectrum Holdings: Entravision controls broadcast spectrum in numerous top U.S. markets.

- FCC Policy Influence: A more favorable regulatory environment for spectrum auctions could emerge.

- Monetization Strategy: Sale of non-core spectrum assets offers a path to significant proceeds.

- Past Successes: Entravision has a track record of realizing value from asset sales.

Entravision's robust digital advertising technology, including platforms like Smadex and Adwake, offers a prime opportunity for continued growth, especially as the global digital ad market is projected to exceed $600 billion in 2024. The company's proven success in capturing significant political advertising revenue, evidenced by record performance in 2024, positions it well for future election cycles. Furthermore, the strategic divestiture of its EGP business in July 2024 for approximately $35 million provides capital for targeted acquisitions or partnerships to enhance its digital capabilities and expand into new markets.

Threats

The digital advertising landscape is incredibly crowded and changes at a breakneck pace, with new technologies emerging constantly. Entravision is up against major tech giants and focused ad-tech companies, which could squeeze their pricing power and make it harder to keep their slice of the market.

Entravision faces a significant threat from the ongoing decline in traditional media consumption, with audiences increasingly shifting to digital platforms. This trend directly impacts its Media segment, which has experienced revenue decreases as advertisers reallocate budgets away from television and radio. For instance, in 2023, while specific Entravision segment data isn't publicly detailed for this exact threat, the broader advertising market saw a continued migration; digital advertising spending globally was projected to reach over $600 billion in 2024, a stark contrast to the shrinking traditional media ad spend.

This erosion of its traditional revenue base poses a substantial risk if Entravision cannot effectively pivot and expand its digital advertising capabilities. The company's reliance on its established broadcast assets could become a liability as consumer habits evolve. Failing to adequately counterbalance this decline with robust digital growth could lead to further financial challenges for the Media segment in the coming years.

Entravision's advertising revenue is particularly vulnerable to economic downturns, as brands tend to cut back on marketing spend during uncertain times. For instance, if the U.S. experiences a recession in late 2024 or 2025, it could significantly reduce advertising budgets, directly impacting Entravision's top line. Similarly, economic instability in key Latin American markets, where Entravision has a strong presence, poses a direct threat to its media and advertising revenues across both its television and digital segments.

Regulatory Changes and Media Ownership Limitations

Entravision's traditional broadcast and advertising businesses operate under the watchful eye of U.S. media ownership regulations. These rules, which dictate how many stations or how much market share a single entity can control, pose a direct threat. Any tightening of these regulations, such as lower local market ownership caps, could directly limit Entravision's ability to grow through acquisitions or even force divestitures of existing assets, impacting its revenue streams and market presence.

For instance, the Federal Communications Commission (FCC) regularly reviews and can amend media ownership rules. While specific recent changes directly impacting Entravision's core markets are not publicly detailed for 2024-2025, the ongoing regulatory environment means potential shifts are always a consideration. Such changes could affect Entravision's strategic planning and its capacity to consolidate or expand its reach within key Hispanic markets where it holds significant leverage.

- Regulatory Uncertainty: Changes in FCC ownership rules can create uncertainty for future expansion or operational adjustments.

- Market Concentration Limits: Stricter limits on owning multiple stations in a single market could hinder growth strategies.

- Cross-Media Ownership Restrictions: Regulations on owning different types of media (e.g., TV, radio, digital) within the same market could impact diversified business models.

- Compliance Costs: Adapting to new regulations may incur significant compliance and legal expenses for Entravision.

Dependence on Key Digital Platforms and Technology Evolution

Entravision's digital advertising operations remain significantly tethered to major digital platforms, which are crucial for audience reach and ad delivery. For instance, while specific diversification efforts are ongoing, the core of their digital business still hinges on partnerships with giants like Google and Meta. Any shift in these platforms' algorithms, advertising policies, or even the rise of entirely new dominant players could directly impact Entravision's ability to serve its clients effectively.

The rapid pace of technological evolution presents another significant challenge. As new ad technologies emerge and older ones become obsolete, Entravision must continuously adapt its offerings and infrastructure. Failure to keep pace could lead to a loss of competitive advantage and reduced effectiveness of its digital advertising solutions. For example, the ongoing evolution of AI in ad targeting and creative generation demands constant investment and strategic adjustments.

- Platform Dependency: Entravision's digital segment relies heavily on major platforms like Google and Meta for ad placement and audience access, creating vulnerability to policy changes.

- Technological Disruption: Rapid advancements in digital advertising technology, such as AI-driven ad optimization, require continuous adaptation and investment to remain competitive.

- Emergence of New Platforms: The potential rise of new dominant digital platforms could disrupt Entravision's established relationships and market positioning.

- Policy Changes: Modifications to platform policies regarding data usage, ad formats, or privacy could directly impact Entravision's revenue streams and operational efficiency.

Entravision's digital operations are heavily reliant on major platforms like Google and Meta, making it susceptible to their policy shifts and algorithm changes. The constant evolution of digital advertising technology, including AI advancements, necessitates continuous investment and strategic adaptation to maintain competitiveness. The potential emergence of new dominant platforms could also disrupt Entravision's existing market position and partnerships.

SWOT Analysis Data Sources

This Entravision SWOT analysis is built upon robust data from financial reports, comprehensive market intelligence, and expert industry evaluations. These sources provide a solid foundation for understanding the company's current standing and future potential.