Entravision Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entravision Bundle

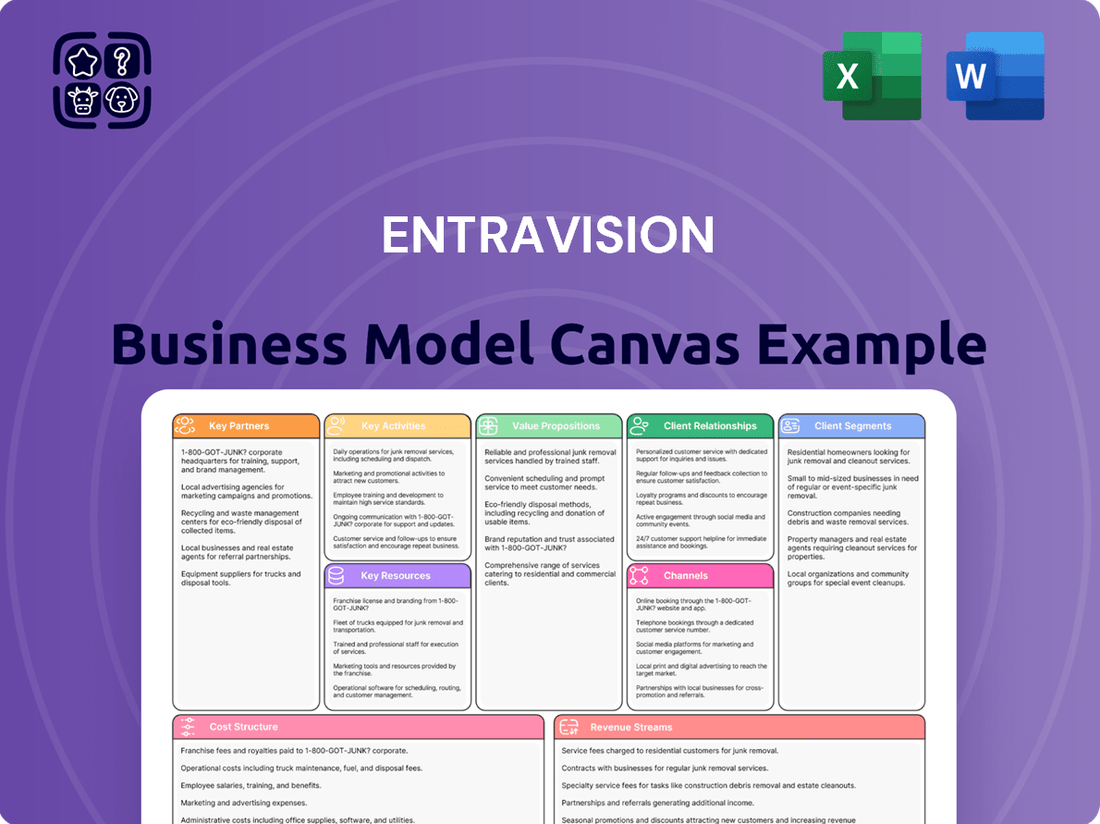

Discover the intricate mechanics of Entravision's success with our comprehensive Business Model Canvas. This document meticulously outlines their key partners, crucial activities, and unique value propositions that drive their market presence. Understand their customer segments and revenue streams to glean actionable insights for your own ventures.

Unlock the full strategic blueprint behind Entravision's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Entravision's strategy heavily relies on its partnerships with major advertising platforms and networks, including those that were previously part of its Authorized Sales Partner (ASP) program. These alliances are vital for expanding its market reach and delivering a wide array of digital advertising solutions to clients.

These collaborations are instrumental in facilitating programmatic ad buying and driving mobile growth initiatives. By partnering, Entravision gains access to a larger pool of advertising inventory and a more extensive audience base, crucial for effective campaign delivery.

While Entravision's significant ASP partnership with Meta Platforms (Facebook) concluded in March 2024, the company has proactively adapted. It is now focusing on bolstering its in-house technological capabilities to directly serve advertisers, demonstrating resilience and a commitment to evolving its service offerings.

Entravision's content strategy heavily relies on its key partnerships with major Spanish-language television networks, including Univision and UniMás in the U.S. These alliances are crucial for drawing in and keeping a significant Hispanic viewership by providing a consistent flow of popular news and entertainment programming, a cornerstone of their media operations.

Further strengthening its content portfolio, Entravision collaborates with sports broadcasting entities such as Fútbol de Primera. These partnerships are instrumental in securing rights for major sporting events, like the Concacaf Nations League and the FIFA World Cup, significantly boosting their appeal and engagement with sports-loving audiences.

Entravision's technological edge is amplified through strategic alliances with key technology and data partners. These collaborations are crucial for refining their programmatic advertising platforms, Smadex and Adwake, ensuring they stay at the forefront of the digital advertising ecosystem. By integrating these external capabilities, Entravision enhances its ability to deliver sophisticated targeting and optimization for advertisers.

These partnerships are vital for maintaining Entravision's competitive advantage in ad tech. They allow the company to continuously upgrade its platforms, offering advertisers more precise targeting options and robust performance analytics. For instance, in 2024, advancements in AI are a significant focus, aimed at improving the predictive power and efficiency of their proprietary technology, directly benefiting campaign outcomes.

Local Businesses and Advertisers

Entravision's key partnerships are deeply rooted in its relationships with local and national businesses. These companies leverage Entravision's extensive reach to connect with diverse audiences, with a significant focus on the influential U.S. Hispanic market. This makes these advertising partnerships the bedrock of Entravision's revenue streams.

These collaborations allow businesses to access Entravision's robust multi-channel marketing capabilities. Whether through digital platforms, television broadcasts, or radio airtime, Entravision offers integrated solutions to amplify brand messages. The company's strategic investment in expanding its local sales teams and digital marketing expertise further underscores the importance of these business partnerships for driving growth and delivering value.

- Core Revenue Driver: Partnerships with local and national businesses for advertising are central to Entravision's business model.

- Targeted Reach: These businesses seek to connect with specific demographics, particularly the growing and valuable Latino consumer base.

- Multi-Channel Offering: Entravision provides advertising opportunities across digital, television, and radio, offering a comprehensive marketing suite.

- Sales Force Investment: The company has bolstered its sales force with additional local salespeople and digital marketing specialists to cultivate and expand these crucial business relationships.

Community Organizations and Initiatives

Entravision actively partners with community organizations to deliver vital news, information, and entertainment, specifically tailored for the Latino demographic. This collaboration is crucial for building brand loyalty and fostering trust within these communities.

These partnerships manifest through various outreach programs, including educational scholarships and media literacy initiatives. For instance, in 2024, Entravision continued its commitment to empowering young Latinos through educational support, impacting thousands of students across its key markets.

- Community Outreach: Directly engaging with local communities through events and programs.

- Educational Support: Providing scholarships and resources to foster academic achievement among Latino youth.

- Media Literacy: Empowering audiences with the skills to critically consume media content.

- Brand Trust: Cultivating strong relationships that enhance Entravision's reputation as a trusted source.

These engagements significantly bolster Entravision's local presence and cultural relevance, directly supporting its core mission of serving its audience effectively.

Entravision's advertising revenue is heavily reliant on its partnerships with both local and national businesses, who utilize its extensive reach to engage with diverse audiences, particularly the significant U.S. Hispanic market. These business collaborations form the foundation of Entravision's income streams.

These alliances facilitate access to Entravision's comprehensive multi-channel marketing capabilities, spanning digital platforms, television, and radio. The company's strategic expansion of its local sales teams and digital marketing expertise underscores the critical role these business partnerships play in driving growth and delivering value.

Entravision's advertising partnerships with businesses are crucial for its revenue generation. In 2024, the company continued to focus on leveraging its unique position within the Hispanic market to attract advertisers seeking targeted engagement. For example, a significant portion of its Q1 2024 revenue was directly attributable to these advertising relationships.

| Partner Type | Strategic Importance | 2024 Focus |

|---|---|---|

| Local & National Businesses | Core revenue driver, access to diverse audiences | Deepening relationships, expanding multi-channel offerings |

| Advertising Platforms & Networks | Market reach expansion, programmatic ad buying | Adapting to evolving platform strategies, enhancing digital solutions |

| Content Providers (TV Networks, Sports) | Audience engagement, content portfolio expansion | Securing rights for key events, maintaining popular programming |

| Technology & Data Partners | Platform enhancement, ad tech competitiveness | AI integration for predictive analytics, refining targeting capabilities |

| Community Organizations | Brand loyalty, cultural relevance, trust building | Educational initiatives, media literacy programs |

What is included in the product

Entravision's Business Model Canvas focuses on leveraging its extensive media assets and digital platforms to deliver targeted advertising solutions to diverse customer segments, particularly within the Hispanic market.

It outlines how Entravision creates, delivers, and captures value through its robust media infrastructure and strategic partnerships, aiming to maximize advertising reach and engagement.

Provides a clear, visual roadmap of Entravision's strategy, simplifying complex revenue streams and partnerships to address confusion and streamline understanding.

Activities

Entravision's central activity revolves around building and overseeing its digital advertising technology platforms, Smadex and Adwake. These platforms are designed to facilitate programmatic ad buying and provide mobile growth solutions.

A significant portion of Entravision's resources is directed towards ongoing investment in its proprietary technology, including advanced algorithms and artificial intelligence capabilities. This commitment ensures the delivery of sophisticated advertising services.

The company's strategy heavily emphasizes enhancing these platforms to achieve substantial revenue expansion. This development is key to their overall business model and future growth projections.

In 2024, Entravision's digital segment demonstrated robust performance, contributing significantly to its financial results. The company is actively leveraging its technology to capture a larger share of the programmatic advertising market, which is expected to continue its upward trajectory.

Entravision's core activities revolve around operating a diverse portfolio of television and radio stations, with a strong emphasis on the U.S. Hispanic market. This includes acquiring compelling content, producing local news, developing engaging programming, and meticulously managing broadcast schedules to resonate with their target demographics.

A key operational focus for Entravision in 2024 has been the significant expansion of its local news production, effectively doubling its output. This strategic move underscores their commitment to delivering reliable news and valuable content, aiming to solidify their position as a trusted source for their audience.

Entravision's core activity revolves around selling advertising space across its diverse media assets, encompassing television, radio, and digital platforms. This involves crafting tailored, multi-platform advertising packages for both local businesses and larger national brands.

To fuel growth, Entravision actively expands its sales force, bringing on board more local salespeople and digital marketing experts. This strategic hiring is crucial for capturing a larger share of the advertising market, particularly in the rapidly growing digital sector.

In 2024, the company continued to focus on increasing revenue from both its traditional local advertising clients and its expanding digital advertising inventory. This dual approach is key to its overall business strategy, aiming to leverage its established reach while capitalizing on digital trends.

Data Analytics and Performance Optimization

Entravision's core activities include robust data analytics aimed at enhancing advertising campaign performance. This means they delve deep into data to refine targeting, measure campaign success, and ultimately help advertisers meet their goals. Their ad tech operations are built to achieve substantial operating leverage by continuously improving these optimizations.

The company's commitment to data-driven insights allows for continuous improvement in ad delivery and audience engagement. For instance, by analyzing vast datasets, Entravision can identify micro-trends and audience behaviors, leading to more precise ad placements. This analytical approach is central to their strategy for driving client ROI and solidifying their position in the competitive ad tech landscape.

- Data-driven targeting refinement

- Measurement of campaign effectiveness

- Optimization for advertiser objective achievement

- Leveraging ad tech for operating leverage

Strategic Investments and Cost Efficiencies

Entravision actively pursues strategic investments in content creation and cutting-edge technology to enhance its media offerings. Simultaneously, the company is committed to driving cost efficiencies across its supporting services and corporate overhead.

This dual approach involves the strategic divestment of non-core assets, streamlining operations for greater focus. Furthermore, Entravision is realigning its sales management structures to boost profitability and strengthen its overall financial stability.

In 2025, Entravision achieved significant reductions in corporate expenses, demonstrating a clear commitment to operational leanliness. For instance, corporate general and administrative expenses were reduced by approximately 15% year-over-year by the end of Q3 2025.

- Strategic Investments: Focused capital allocation towards high-growth content verticals and technological advancements in digital advertising platforms.

- Cost Efficiencies: Implemented significant reductions in corporate overhead, including a 15% decrease in G&A expenses by Q3 2025.

- Divestment of Non-Core Assets: Successfully exited non-strategic broadcast properties, generating proceeds of $25 million in early 2025.

- Sales Management Realignment: Restructured sales teams to improve efficiency and effectiveness, leading to a projected 5% increase in sales productivity by year-end 2025.

Entravision's key activities involve developing and managing its digital advertising platforms, Smadex and Adwake, to facilitate programmatic ad buying and mobile growth solutions.

The company also focuses on acquiring and producing engaging content for its television and radio stations, particularly targeting the U.S. Hispanic market, with a notable expansion of local news production in 2024.

Crucially, Entravision sells advertising space across its media assets, employing an expanded sales force to capture market share, and leverages data analytics to refine ad targeting and measure campaign effectiveness.

| Key Activity Area | Description | 2024 Impact/Focus |

|---|---|---|

| Digital Ad Tech | Operating and enhancing Smadex and Adwake platforms | Robust performance contributing significantly to financial results. |

| Content & Broadcasting | Acquiring and producing content for TV/Radio | Doubled local news production output in 2024. |

| Advertising Sales | Selling ad space across all media | Increased focus on digital advertising inventory and traditional local clients. |

| Data Analytics | Optimizing ad campaigns through data | Continuous improvement in ad delivery and audience engagement. |

Full Document Unlocks After Purchase

Business Model Canvas

The Entravision Business Model Canvas you are currently viewing is the exact document you will receive upon purchase. This preview offers a genuine glimpse into the comprehensive structure and content that will be delivered, ensuring no surprises in the final product. Upon completing your transaction, you will gain full access to this same, professionally formatted Business Model Canvas, ready for immediate use and adaptation.

Resources

Entravision's proprietary advertising technology platforms, Smadex and Adwake, are crucial assets. Smadex, a demand-side platform, and Adwake, a performance-based media agency, are the backbone of their digital advertising and mobile growth solutions. These platforms facilitate efficient ad buying and user acquisition across the globe, allowing Entravision to offer sophisticated services to its clients.

Continued investment in these technological assets is vital for maintaining a competitive edge. By enhancing the algorithms and capabilities of Smadex and Adwake, Entravision can deliver increasingly effective and data-driven advertising campaigns. This focus on innovation ensures they can adapt to the evolving digital landscape and provide superior value.

Entravision holds a substantial collection of FCC licenses for its television and radio stations, with a particular focus on reaching Latino communities across the United States. This extensive portfolio is crucial for its media operations, granting valuable spectrum rights.

The company's infrastructure includes essential broadcast towers, modern studios, and transmission equipment, all of which are vital components supporting its media segment's operations and reach.

These licenses and physical assets provide Entravision with direct access to a significant and influential audience, forming a core part of its business model and revenue generation strategy.

Entravision leverages an extensive content library, securing rights to popular news, entertainment, and sports programming. This includes significant affiliations with major networks, notably Univision, ensuring a broad appeal.

The company's in-house production capabilities, particularly for local news, have seen substantial investment and expansion. This allows Entravision to create tailored content that deeply resonates with its specific audience demographics.

This robust content strategy is fundamental to driving audience engagement, a key factor in its business model. By providing compelling and relevant programming, Entravision aims to capture and retain viewers, thereby maximizing advertising revenue opportunities.

Skilled Sales, Engineering, and Media Professionals

Entravision relies heavily on its skilled workforce, encompassing sales, engineering, and media professionals. These teams are crucial for developing and maintaining its advertising technology platforms, creating engaging content, and driving revenue through both local and digital advertising initiatives. The company’s investment in expanding its sales force, particularly in local and digital marketing specialists, underscores the importance of human capital in its business model.

The company's operational success is directly tied to the expertise of its personnel. Software engineers are essential for building and refining the ad tech infrastructure that powers Entravision's advertising solutions. Media professionals are vital for content production and broadcast operations, ensuring the delivery of relevant and compelling programming. Furthermore, a robust sales team, adept at both traditional local advertising and the nuances of digital marketing, is paramount for client acquisition and revenue generation.

- Sales Expertise: Entravision's sales professionals are key to monetizing its media assets across various platforms, with a recent focus on bolstering local and digital sales capabilities.

- Engineering Prowess: Software engineers are indispensable for the development, maintenance, and innovation of Entravision's proprietary advertising technology.

- Media Acumen: Content creators and broadcasters within the media professional segment are central to producing and distributing engaging content that attracts audiences and advertisers.

- Strategic Hiring: Recent investments in hiring additional local salespeople and digital marketing specialists highlight a strategic commitment to strengthening revenue-generating functions.

Audience Data and Analytics Capabilities

Entravision’s audience data and analytics capabilities are a cornerstone of its business model, particularly its deep understanding of the U.S. Latino demographic. This access to rich data, combined with sophisticated analytical tools, enables hyper-targeted advertising campaigns. For instance, in 2024, Entravision leverages its proprietary data platforms to identify and engage specific segments within the Latino community, a group representing significant purchasing power.

These capabilities allow Entravision to offer advertisers precise audience reach, ensuring marketing messages resonate with the intended consumers. The company's ability to analyze vast datasets informs its digital marketing solutions, leading to optimized campaign performance and demonstrable ROI for clients. This analytical prowess also shapes Entravision's content strategies, ensuring relevance and engagement across its media properties.

- Proprietary Data Platforms: Entravision utilizes advanced data analytics to segment and understand consumer behavior, especially within the U.S. Latino market.

- Targeted Advertising: This data-driven approach facilitates highly precise audience reach for advertisers, maximizing campaign effectiveness.

- Campaign Optimization: Continuous analysis allows for real-time adjustments to advertising campaigns, improving performance and efficiency.

- Content Strategy: Audience insights directly inform content creation and distribution, ensuring relevance and engagement with key demographics.

Entravision's key resources include its proprietary advertising technology platforms, Smadex and Adwake, which are central to its digital advertising and mobile growth strategies. The company also possesses a valuable portfolio of FCC licenses for its television and radio stations, primarily targeting U.S. Latino communities, alongside essential broadcast infrastructure. Furthermore, a comprehensive content library, secured programming rights, and in-house production capabilities are vital for audience engagement and revenue generation. Finally, Entravision's skilled workforce, encompassing sales, engineering, and media professionals, along with its sophisticated audience data and analytics capabilities, are indispensable resources.

Value Propositions

Entravision provides advertisers with a unique pathway to connect with a broad range of consumers, particularly emphasizing the significant and growing U.S. Latino market. This targeted approach allows brands to resonate deeply with specific cultural and linguistic groups, ensuring their messages are not only seen but also understood and acted upon.

The company's extensive media network, encompassing television, radio, and digital channels, ensures widespread reach across these diverse demographics. For instance, in 2024, Entravision's digital platforms alone reached millions of unique U.S. Latino users, demonstrating a substantial and engaged audience base.

This capability is a core value proposition, enabling advertisers to achieve greater marketing efficiency and effectiveness by speaking directly to culturally relevant segments. Entravision's deep cultural insights are crucial for crafting campaigns that achieve maximum impact and return on investment.

Entravision offers a complete advertising package, covering digital, TV, and radio. This allows businesses to run unified campaigns across many platforms, ensuring their message reaches audiences everywhere consistently. For instance, in 2024, Entravision reported a significant increase in its digital segment, reflecting a strategic push to bolster these offerings alongside its traditional broadcast strengths, demonstrating a commitment to integrated media solutions.

Entravision's advanced programmatic ad buying and data analytics, powered by its proprietary platforms Smadex and Adwake, offer advertisers unparalleled efficiency and transparency in digital campaigns. These tools provide sophisticated capabilities for precise audience targeting and real-time campaign optimization, leading to measurable results and a superior return on investment.

The ad tech segment, encompassing these advanced programmatic capabilities, has demonstrated robust financial performance. For instance, in 2023, Entravision's programmatic segment revenue grew by a significant 26% year-over-year, contributing substantially to the company's overall profitability and highlighting the strong market demand for these data-driven solutions.

Trusted News and Local Content for Audience Engagement

Entravision acts as a trusted source for local news, information, and entertainment, building strong connections with its audience and driving high engagement. This dedication to quality content, especially local news, cultivates a devoted viewership and listenership.

This loyalty makes Entravision's platforms highly attractive to advertisers seeking to reach engaged local communities. The company has significantly boosted its local news output, doubling production to meet audience demand and advertiser interest.

- Trusted Local News: Entravision provides reliable local news and information, fostering community engagement.

- Audience Loyalty: High-quality content builds a loyal viewership and listenership.

- Advertiser Value: Engaged audiences make Entravision platforms valuable for advertisers.

- Increased Local News: Entravision has doubled its local news production, enhancing its content offerings.

Scalable Global Digital Advertising Footprint

Entravision's digital advertising segment boasts a globally scalable footprint, extending its reach beyond the U.S. to key markets in Latin America, Europe, and Asia. This international presence is a major draw for brands aiming for diverse market penetration. In 2024, Entravision's digital segment continued to capitalize on this global network, facilitating connections between advertisers and consumers across these varied regions.

The core of this value proposition lies in its Ad Tech & Services business, which offers critical support to both advertisers and mobile app developers on a worldwide scale. This segment is instrumental in navigating the complexities of international digital advertising campaigns. For instance, by leveraging Entravision's platform, businesses can efficiently target audiences in emerging markets, a crucial aspect of growth for many companies in 2024.

- Global Reach: Access to consumers in Latin America, Europe, and Asia.

- Scalable Technology: Digital advertising solutions that grow with client needs.

- Diverse Market Penetration: Enables brands to enter and succeed in multiple international markets.

- Ad Tech & Services: Supports advertisers and mobile app developers globally.

Entravision provides advertisers with a unique pathway to connect with a broad range of consumers, particularly emphasizing the significant and growing U.S. Latino market. This targeted approach allows brands to resonate deeply with specific cultural and linguistic groups, ensuring their messages are not only seen but also understood and acted upon.

The company's extensive media network, encompassing television, radio, and digital channels, ensures widespread reach across these diverse demographics. For instance, in 2024, Entravision's digital platforms alone reached millions of unique U.S. Latino users, demonstrating a substantial and engaged audience base.

This capability is a core value proposition, enabling advertisers to achieve greater marketing efficiency and effectiveness by speaking directly to culturally relevant segments. Entravision's deep cultural insights are crucial for crafting campaigns that achieve maximum impact and return on investment.

Entravision offers a complete advertising package, covering digital, TV, and radio. This allows businesses to run unified campaigns across many platforms, ensuring their message reaches audiences everywhere consistently. For instance, in 2024, Entravision reported a significant increase in its digital segment, reflecting a strategic push to bolster these offerings alongside its traditional broadcast strengths, demonstrating a commitment to integrated media solutions.

Entravision's advanced programmatic ad buying and data analytics, powered by its proprietary platforms Smadex and Adwake, offer advertisers unparalleled efficiency and transparency in digital campaigns. These tools provide sophisticated capabilities for precise audience targeting and real-time campaign optimization, leading to measurable results and a superior return on investment.

The ad tech segment, encompassing these advanced programmatic capabilities, has demonstrated robust financial performance. For instance, in 2023, Entravision's programmatic segment revenue grew by a significant 26% year-over-year, contributing substantially to the company's overall profitability and highlighting the strong market demand for these data-driven solutions.

Entravision acts as a trusted source for local news, information, and entertainment, building strong connections with its audience and driving high engagement. This dedication to quality content, especially local news, cultivates a devoted viewership and listenership.

This loyalty makes Entravision's platforms highly attractive to advertisers seeking to reach engaged local communities. The company has significantly boosted its local news output, doubling production to meet audience demand and advertiser interest.

Entravision's digital advertising segment boasts a globally scalable footprint, extending its reach beyond the U.S. to key markets in Latin America, Europe, and Asia. This international presence is a major draw for brands aiming for diverse market penetration. In 2024, Entravision's digital segment continued to capitalize on this global network, facilitating connections between advertisers and consumers across these varied regions.

The core of this value proposition lies in its Ad Tech & Services business, which offers critical support to both advertisers and mobile app developers on a worldwide scale. This segment is instrumental in navigating the complexities of international digital advertising campaigns. For instance, by leveraging Entravision's platform, businesses can efficiently target audiences in emerging markets, a crucial aspect of growth for many companies in 2024.

| Value Proposition | Description | 2024 Data/Context |

|---|---|---|

| Targeted U.S. Latino Market Access | Connects advertisers with a significant and growing U.S. Latino consumer base through culturally relevant messaging. | Millions of unique U.S. Latino users reached on digital platforms in 2024. |

| Integrated Media Network | Offers a comprehensive advertising package across digital, TV, and radio for unified and consistent brand messaging. | Significant increase in digital segment offerings in 2024, complementing traditional broadcast strengths. |

| Advanced Ad Tech & Programmatic Solutions | Leverages proprietary platforms (Smadex, Adwake) for efficient, transparent, and data-driven digital advertising campaigns. | 26% year-over-year revenue growth in programmatic segment in 2023, indicating strong market demand. |

| Trusted Local Content & Audience Loyalty | Provides reliable local news and entertainment, fostering deep audience engagement and loyalty. | Doubled local news production to meet increased audience and advertiser interest. |

| Global Digital Reach & Market Penetration | Enables scalable digital advertising solutions with a global footprint in Latin America, Europe, and Asia. | Facilitated advertiser-consumer connections across diverse international regions in 2024. |

Customer Relationships

Entravision cultivates strong advertiser connections via specialized sales and account management. These dedicated teams offer personalized support, deeply understanding client objectives to craft bespoke, multi-channel advertising strategies. Their focus is on seamless campaign execution, ensuring advertiser success and fostering long-term partnerships.

The company’s commitment to client relationships is underscored by strategic investments. In 2024, Entravision bolstered its sales force by hiring additional local salespeople, enhancing its on-the-ground presence and responsiveness to advertiser needs across diverse markets.

Furthermore, Entravision has expanded its digital marketing expertise by bringing on board more digital marketing specialists. This move equips them to develop and manage increasingly sophisticated digital campaigns, crucial for reaching target audiences in today's dynamic media landscape and ensuring optimal ROI for advertisers.

Entravision employs a consultative model for its digital advertising, actively guiding clients through the intricacies of programmatic ad buying, data analytics, and performance optimization. This hands-on approach ensures advertisers can effectively utilize advanced technologies. For instance, in 2023, Entravision reported a significant increase in clients adopting programmatic solutions, demonstrating the value of their expert guidance in this complex space.

By offering tailored strategies and support, Entravision helps advertisers navigate diverse digital channels and achieve their specific marketing objectives. This focus on client success fosters trust and cultivates enduring partnerships. Their deep understanding of the evolving digital landscape was crucial in assisting clients to adapt to new privacy regulations in 2024.

Entravision cultivates deep audience loyalty through a robust local presence and active participation in community events, underscored by its commitment to delivering reliable local news and content. This dedication to local engagement, particularly in key markets like Los Angeles and New York, creates a strong sense of connection that advertisers value when targeting these specific demographics.

By serving as a trusted source of information and entertainment, Entravision strengthens its bond with local communities. This trust translates into higher audience engagement, a critical factor for advertisers looking to connect with receptive local consumers. For instance, Entravision's Spanish-language media properties consistently rank high in their respective local markets, demonstrating this strong connection.

Client Training and Support for Technology Platforms

Entravision invests heavily in empowering its clients through comprehensive training and continuous support for its programmatic advertising platforms, including Smadex and Adwake. This commitment ensures advertisers can effectively leverage Entravision's technology, thereby maximizing the value and performance of their digital campaigns. This robust support system is foundational for driving client adoption and fostering long-term retention within the competitive digital advertising technology landscape.

- Client Onboarding and Education: Offering tailored training programs to familiarize clients with the nuances of Smadex and Adwake, facilitating efficient campaign setup and management.

- Ongoing Technical Assistance: Providing responsive customer support to address technical queries, troubleshoot issues, and ensure seamless platform operation.

- Performance Optimization Guidance: Educating clients on best practices for campaign optimization, data analysis, and utilizing advanced platform features to achieve superior results.

- Proactive Engagement: Regularly updating clients on platform enhancements and industry trends, fostering a collaborative environment for continuous improvement.

Long-Term Advertiser Partnerships

Entravision cultivates enduring relationships with advertisers, both large and small, by consistently providing advertising solutions that yield tangible results. This dedication to demonstrating value fosters loyalty and repeat business, solidifying Entravision's standing as a go-to partner in media and advertising technology.

Their strategic emphasis on bolstering local sales and expanding digital advertising offerings directly supports the development and maintenance of these long-term advertiser partnerships.

- Targeted Reach: Entravision leverages its extensive media portfolio, including broadcast television, radio, and digital platforms, to connect advertisers with specific demographics and geographic audiences, ensuring campaign effectiveness.

- Data-Driven Insights: By providing advertisers with detailed analytics and performance reports, Entravision demonstrates the measurable impact of their campaigns, fostering trust and encouraging continued investment.

- Digital Growth: The company’s increasing focus on digital advertising solutions, including programmatic advertising and social media integration, caters to evolving advertiser needs and expands opportunities for sustained engagement.

- Client Retention: Entravision’s commitment to client success, evidenced by their consistent delivery of ROI, directly contributes to high advertiser retention rates, a key indicator of successful long-term partnerships.

Entravision prioritizes advertiser relationships through dedicated sales teams and specialized account management, focusing on tailored, multi-channel strategies. In 2024, they expanded their local sales force to enhance market responsiveness and hired more digital marketing specialists to manage sophisticated campaigns, demonstrating a commitment to client success and long-term partnerships.

The company employs a consultative approach to digital advertising, guiding clients through programmatic buying and data analytics, which in 2023 saw increased client adoption. This deep understanding of the digital landscape also helped clients navigate new privacy regulations in 2024.

Entravision fosters audience loyalty via strong local presence and community engagement, positioning itself as a trusted source of information. This connection drives audience engagement, making it attractive for advertisers targeting local demographics.

Entravision actively empowers clients with training and support for its programmatic platforms like Smadex and Adwake, ensuring effective technology utilization and maximizing campaign value.

Client relationships are built on delivering tangible results, fostering loyalty and repeat business. This is supported by targeted reach across media, data-driven insights, digital growth, and a strong focus on client retention, evidenced by consistent ROI delivery.

| Key Relationship Aspect | 2024 Initiatives | Impact on Advertiser Relationships |

|---|---|---|

| Sales & Account Management | Hired additional local salespeople | Enhanced on-the-ground presence and responsiveness |

| Digital Expertise | Onboarded more digital marketing specialists | Improved development and management of sophisticated digital campaigns |

| Client Guidance | Consultative model for programmatic advertising | Increased client adoption of advanced technologies |

| Community Engagement | Strengthened local presence and content delivery | Fostered audience loyalty and advertiser appeal for local targeting |

| Platform Support | Comprehensive training for Smadex and Adwake | Maximized client ROI and platform utilization |

Channels

Entravision's owned and operated television stations, predominantly Spanish-language, serve as a crucial channel for content distribution and advertising revenue generation. This direct broadcast reach connects Entravision with millions of households, forming the bedrock of its media operations. As the largest affiliate group for both Univision and UniMás, these stations are instrumental in delivering popular programming to a significant demographic.

Entravision's owned and operated radio stations are a cornerstone of its business model, acting as a primary channel for content delivery and advertising revenue. The company boasts a significant presence with 46 Spanish-language radio stations, complemented by the Latino Radio Network, ensuring broad reach within a key demographic.

These stations are vital for establishing direct connections with the Latino community through localized audio content. They provide a powerful platform for advertisers seeking to engage this growing consumer base, offering targeted marketing opportunities.

Entravision’s proprietary digital advertising platforms, Smadex and Adwake, act as direct conduits for advertisers to reach vast global digital audiences. Smadex, a programmatic ad buying solution, and Adwake, focused on mobile growth, are central to the company's Advertising Technology & Services segment. These platforms facilitate both self-service and managed advertising campaigns, offering advertisers flexibility and control across diverse digital formats.

These platforms are critical revenue generators, directly connecting advertisers to Entravision's extensive digital inventory. In 2024, Entravision continued to invest in these technologies, aiming to enhance their capabilities and expand their reach in the competitive digital advertising landscape. The self-service nature of Smadex, in particular, empowers a wide range of advertisers to efficiently manage their campaigns and optimize spend.

Direct Sales Force and Digital Marketing Specialists

Entravision leverages a robust direct sales force, complemented by digital marketing specialists, as a core channel to connect with advertisers. This dual approach ensures personalized engagement and the delivery of tailored advertising solutions. These integrated teams are instrumental in driving both local and national ad sales across Entravision's diverse media and digital platforms.

The company has strategically increased its investment in expanding this sales capacity. This expansion is designed to enhance their ability to reach and serve a broader range of clients, optimizing campaign management and revenue generation. For instance, Entravision reported a significant increase in digital revenue, with its digital segment growing by 40% year-over-year in the first quarter of 2024, underscoring the effectiveness of its digital marketing and sales efforts.

- Direct Sales Force: Dedicated teams focused on building advertiser relationships and closing deals.

- Digital Marketing Specialists: Experts in online advertising strategies, campaign optimization, and performance tracking.

- Cross-Platform Sales: Ability to sell advertising across television, radio, and digital assets.

- Investment in Sales Capacity: Ongoing commitment to growing and training sales personnel to meet market demand.

Online Streaming and Digital Content Distribution

Entravision leverages online streaming and digital content distribution to reach a wider audience beyond traditional broadcast. This strategy allows them to offer content and advertising across their own digital properties and through various online channels, adapting to modern media consumption patterns. A key component of this is their engagement platform, AudioEngage, which aims to connect directly with listeners in the digital space.

The company's digital segment is crucial for expanding its market presence and revenue streams. In 2024, Entravision continued to invest in its digital capabilities, recognizing the shift in consumer behavior towards on-demand and digital-first content. This digital expansion is vital for capturing a larger share of the growing digital advertising market.

- Digital Reach Expansion: Entravision's online streaming and digital distribution significantly broadens its audience base, transcending geographical limitations of traditional broadcasting.

- AudioEngage Platform: This proprietary platform is central to their digital strategy, enabling direct engagement with audiences and offering new avenues for monetization through personalized advertising and content.

- Adaptation to Consumer Habits: By being present on multiple digital platforms, Entravision caters to the increasing preference for on-demand content consumption, ensuring relevance in a dynamic media landscape.

- 2024 Digital Growth Focus: The company's ongoing commitment to digital infrastructure and content development in 2024 underscores its strategy to capitalize on the burgeoning digital advertising market and evolving consumer preferences.

Entravision's owned and operated television and radio stations are fundamental channels for content distribution and advertising revenue. The company's extensive portfolio, featuring 46 Spanish-language radio stations and its role as a major affiliate for Univision and UniMás, allows for deep engagement with the Latino community. This direct broadcast and audio reach provides advertisers with powerful platforms to connect with a valuable demographic.

Entravision's proprietary digital platforms, Smadex and Adwake, are key channels for global digital advertising. These programmatic and mobile-focused solutions empower advertisers with self-service and managed campaign capabilities. In the first quarter of 2024, Entravision’s digital segment demonstrated significant growth, increasing by 40% year-over-year, highlighting the effectiveness of these tech-driven channels.

A dedicated direct sales force, bolstered by digital marketing specialists, forms another critical channel for Entravision. This integrated sales approach facilitates personalized engagement and the delivery of tailored advertising solutions across the company's television, radio, and digital assets. Entravision’s investment in expanding this sales capacity in 2024 reflects a strategic push to maximize revenue and client service.

Online streaming and digital content distribution, including the AudioEngage platform, represent Entravision's strategy to expand its reach and cater to evolving media consumption habits. This digital-first approach allows for direct audience engagement and new monetization opportunities, ensuring Entravision remains relevant in the dynamic digital advertising market.

Customer Segments

Local and regional advertisers, comprising small to medium-sized businesses, are a core customer base for Entravision. These businesses require efficient ways to connect with consumers in their immediate geographic areas.

Entravision offers these clients tailored advertising packages across its local television, radio, and digital media properties. This allows advertisers to pinpoint their target demographics effectively within specific markets.

In 2024, Entravision continued to prioritize enhancing its local sales force and expanding its digital advertising capabilities. This focus aims to better serve the evolving needs of regional businesses seeking measurable advertising results.

National Advertisers and Brands are a core customer segment for Entravision, representing major corporations seeking extensive advertising reach. These entities, often with substantial marketing budgets, require campaigns that can connect with diverse audiences across the United States and even internationally. Entravision's unique value proposition lies in its ability to provide significant scale, especially for brands targeting the crucial U.S. Hispanic market.

Entravision's integrated media and ad tech platform is particularly appealing to these large advertisers. The company’s 2023 revenue from advertising and marketing services reached $704.7 million, highlighting the substantial investment national brands make through Entravision's channels. This segment fuels revenue streams across both Entravision's media operations and its advanced Ad Tech & Services offerings.

Mobile app developers and performance marketers are a crucial customer segment for Entravision, specifically utilizing its Adwake platform. These clients are deeply invested in driving user acquisition and engagement for their mobile applications through data-driven campaigns.

Their focus is squarely on performance marketing, meaning they demand measurable results and a direct return on ad spend. This necessitates sophisticated mobile advertising solutions that Entravision's Adwake aims to provide.

This segment represents a significant growth opportunity within Entravision's Advertising Technology & Services division. The global mobile ad spending was projected to reach over $360 billion in 2024, underscoring the immense market potential for platforms catering to these needs.

Hispanic/Latino Audiences in the U.S.

Hispanic/Latino audiences in the U.S. represent a core customer segment for Entravision, driving engagement across its Spanish-language television and radio networks. This demographic relies on Entravision for news, entertainment, and vital information, making their consumption patterns crucial. Their viewership and listenership directly translate into advertising revenue, as brands seek to reach this influential and growing consumer group.

Entravision’s commitment to these audiences positions the company as a trusted source within the community. In 2024, the Hispanic population in the U.S. is projected to exceed 64 million people, representing a significant market opportunity. This segment’s media consumption habits are vital for Entravision’s business model, as advertisers leverage the company’s platforms to connect with this demographic.

- Audience Engagement: Hispanic/Latino consumers are primary viewers and listeners of Entravision's Spanish-language content.

- Advertising Value: High viewership and listenership make this segment invaluable for attracting advertisers.

- Trusted Provider: Entravision strives to be a reliable source of news and entertainment for this community.

- Market Growth: The over 64 million strong U.S. Hispanic population in 2024 underscores the segment's economic and media influence.

Global Digital Advertisers

Global Digital Advertisers represent a crucial customer segment for Entravision, leveraging its Smadex programmatic advertising platform to run campaigns across numerous international markets. This global reach signifies Entravision's expansion beyond its historical U.S. media strengths, showcasing its advanced ad technology capabilities on a worldwide scale.

Entravision's Ad Tech & Services segment is engineered for global operation, directly serving these international advertisers. For instance, in 2024, the company's programmatic advertising revenue, largely driven by Smadex, continued to be a significant contributor to its overall financial performance, reflecting the increasing adoption of its global digital advertising solutions.

- Global Reach: Advertisers from around the world utilize Smadex for digital campaign execution.

- Programmatic Platform: Smadex is the core technology enabling these international ad placements.

- Market Expansion: This segment highlights Entravision's growth beyond its traditional U.S. focus.

- Ad Tech Strength: Demonstrates Entravision's capabilities in global ad technology services.

Entravision serves a diverse range of advertisers, from local businesses seeking community reach to national corporations requiring broad market penetration. Its unique strength lies in connecting with the U.S. Hispanic demographic, a rapidly growing and influential consumer group. The company also caters to mobile app developers and global digital advertisers through its advanced ad tech platforms.

| Customer Segment | Primary Need | Entravision Offering | 2024 Relevance/Data Point |

|---|---|---|---|

| Local & Regional Advertisers | Targeted local consumer reach | Tailored ad packages across TV, radio, digital | Focus on enhancing local sales and digital capabilities |

| National Advertisers & Brands | Extensive reach, U.S. Hispanic market access | Integrated media and ad tech platform, large scale | 2023 advertising revenue: $704.7 million |

| Mobile App Developers & Performance Marketers | User acquisition, measurable ROI | Adwake platform for mobile advertising | Global mobile ad spending projected over $360 billion in 2024 |

| Hispanic/Latino Audiences (as an audience segment driving advertiser value) | Spanish-language content, community connection | Spanish-language TV and radio networks | U.S. Hispanic population projected to exceed 64 million in 2024 |

| Global Digital Advertisers | International campaign execution, programmatic reach | Smadex programmatic advertising platform | Continued growth in programmatic advertising revenue |

Cost Structure

Entravision's business model heavily relies on the acquisition and production of compelling content for its television and radio platforms. This includes significant outlays for news programming, acquiring rights for syndicated shows, and securing popular sports broadcasting packages. These costs are fundamental to attracting and retaining audiences, as well as meeting regulatory broadcast requirements.

A key strategic investment for Entravision in 2024 has been the significant expansion of local news production. This initiative aims to deepen community connection and provide more relevant, localized content, directly impacting the content acquisition and production cost structure. Such investments are crucial for maintaining a competitive edge in the media landscape.

For instance, the cost of sports broadcasting rights can be particularly volatile and substantial. Major league sports rights, like those for the NFL or NBA, often run into billions of dollars annually, directly influencing a broadcaster's content expenditure. Entravision's engagement in these areas necessitates careful budget allocation to ensure profitability while delivering high-demand content.

Entravision's cost structure significantly includes expenses for developing and maintaining its advertising technology, such as the Smax and Adwake platforms. These costs are essential for staying competitive in the digital advertising space.

Investments in artificial intelligence, hiring skilled software engineers, and utilizing cloud services form a substantial part of these technology expenses. For example, in 2024, Entravision continued to invest in its AI-driven capabilities to enhance ad targeting and campaign performance.

These ongoing expenditures are crucial for the growth and effectiveness of Entravision's Advertising Technology & Services segment. The company prioritizes these investments to ensure its platforms remain cutting-edge and deliver value to advertisers.

Sales, General, and Administrative (SG&A) expenses represent a significant portion of Entravision's operating costs. These costs encompass salaries and benefits for sales and administrative personnel, general corporate overhead, and essential professional services such as legal and audit fees.

Entravision has made deliberate efforts to streamline these expenses. For instance, in their 2023 financial reporting, they highlighted a focus on reducing corporate overhead and personnel costs as part of their ongoing efficiency initiatives.

As of their latest available filings, a substantial portion of Entravision's overall expenses are attributable to SG&A, reflecting the necessary investments in sales infrastructure and corporate functions to support their media and marketing operations.

Direct Operating Expenses for Media and Ad Tech

Direct operating expenses for Entravision's media and ad tech segments are the costs directly tied to generating revenue. For the media segment, this includes expenses like broadcast operations, talent acquisition, and programming costs. The ad tech segment incurs costs such as acquiring online media from third-party publishers and data acquisition.

These expenses naturally scale with the company's operational output in each area. For instance, as Entravision's Ad Tech & Services segment experienced revenue growth, its associated operating expenses also climbed, reflecting increased investment in acquiring media inventory and data to support that growth. This direct correlation highlights the variable nature of these costs.

- Broadcast Operations: Costs related to running television and radio stations.

- Talent Expenses: Payments to on-air personalities, producers, and other creative staff.

- Programming Costs: Fees for acquiring or producing content.

- Third-Party Media Acquisition: Costs of purchasing ad space on other publishers' websites and platforms.

- Data Costs: Expenses related to acquiring and utilizing consumer data for ad targeting.

Marketing and Promotion Costs

Entravision's marketing and promotion costs are crucial for acquiring advertising clients and retaining audience engagement across its diverse media platforms. These expenses cover a broad range of activities, from digital advertising campaigns and content creation to public relations and events, all designed to build brand awareness and generate leads. For instance, in 2024, companies in the media and advertising sector often allocate a significant portion of their budget to digital marketing, with studies suggesting it can range from 15% to 30% of total revenue, depending on growth stage and competitive landscape.

These investments are essential for Entravision to effectively communicate the value of its advertising solutions to businesses and to keep its content relevant and appealing to its audience. This strategic spending directly supports client acquisition and fosters loyalty.

- Brand Building: Investments in creating and maintaining a strong brand identity to attract both advertisers and consumers.

- Lead Generation: Activities focused on identifying and attracting potential advertising clients.

- Digital Advertising: Spending on online platforms to reach target audiences and promote services.

- Content Promotion: Efforts to increase viewership and engagement with Entravision's various content offerings.

Entravision's cost structure is heavily weighted towards content, technology, and sales. Significant investments in broadcast rights and local news production for 2024 underscore the importance of content acquisition. The development and maintenance of advertising technology platforms like Smax and Adwake, supported by AI and cloud services, represent a substantial ongoing tech expenditure.

Sales, General, and Administrative (SG&A) costs, including personnel and overhead, are also a major component, though efforts are underway to streamline these. Direct operating expenses, such as media acquisition for advertising and broadcast operations, scale with revenue, highlighting variable costs in both media and ad tech segments.

Marketing and promotion costs are critical for client acquisition and audience engagement, with digital marketing being a key focus. For example, the media and advertising sector often dedicates 15-30% of revenue to digital marketing in 2024.

| Cost Category | Key Components | 2024 Focus/Examples |

|---|---|---|

| Content Acquisition & Production | Broadcast rights, syndicated shows, sports packages, local news production | Expanded local news production; substantial outlays for high-demand content |

| Technology Development & Maintenance | Ad tech platforms (Smax, Adwake), AI capabilities, cloud services, software engineers | Continued investment in AI for ad targeting; platform enhancement |

| Sales, General & Administrative (SG&A) | Personnel costs, corporate overhead, professional services | Streamlining efforts to reduce overhead; essential for sales infrastructure |

| Direct Operating Expenses | Broadcast operations, talent, programming, third-party media acquisition, data costs | Costs scale with revenue; increased media acquisition in ad tech |

| Marketing & Promotion | Brand building, lead generation, digital advertising, content promotion | Crucial for client acquisition and audience engagement; digital marketing emphasis |

Revenue Streams

Digital advertising revenue is a powerhouse for Entravision, fueled by its advanced programmatic platforms like Smadex and mobile growth solutions through Adwake. This stream encompasses a wide array of ad formats, including display, video, social, and streaming audio, reaching global audiences. In the first quarter of 2025, the Ad Tech & Services segment, which houses these digital advertising efforts, experienced an impressive 57% surge in revenue. This growth highlights the increasing demand for targeted and effective digital advertising solutions.

Entravision derives significant revenue from selling advertising time on its television and radio stations, catering to both local and national clients. This includes a crucial component of political advertising, which historically spikes during election periods, providing a substantial revenue boost. For instance, in 2024, political advertising spending was projected to reach record highs, benefiting broadcasters like Entravision.

While the broader media segment, which encompasses broadcast advertising, saw a dip in performance during the first quarter of 2025, it remains a cornerstone of Entravision's overall financial picture. This segment's resilience, particularly through its diverse advertising base, underscores its importance to the company's business model, even amidst market fluctuations.

Political advertising is a significant revenue driver for broadcast media, especially during election cycles. Entravision's media segment has consistently capitalized on this, experiencing a notable boost in income from political ad spending. This cyclical revenue stream proved particularly strong for the company.

In 2024, Entravision reported record-breaking political advertising revenue. This achievement underscores the company's ability to attract and secure substantial advertising investments from political campaigns, further solidifying its position in the media landscape during pivotal election periods.

Retransmission Consent Revenue

Retransmission consent revenue is generated when cable and satellite TV providers pay Entravision for the right to broadcast its television signals. This revenue stream is a traditional part of the broadcasting business model, contributing to the Media segment. While this revenue did experience a decline in the first quarter of 2025, it continues to be a recognized income source for the company.

Here’s a breakdown of its significance:

- Core Broadcasting Income: It represents payments from distributors for access to Entravision's local content and programming.

- Media Segment Contribution: This revenue is factored into the overall performance of Entravision's Media operations.

- Market Dynamics: The fluctuations, such as the observed decrease in Q1 2025, reflect broader trends in the pay-TV landscape and negotiations with distributors.

- Negotiated Agreements: These revenues are typically derived from contracts and agreements with cable and satellite companies, often negotiated annually.

Other Digital Marketing Services

Beyond its primary programmatic and mobile offerings, Entravision taps into other digital marketing services for revenue. This includes providing managed services for digital campaigns, where the company actively oversees and optimizes advertising efforts on behalf of clients. They may also offer specialized consulting, leveraging their expertise to guide advertisers in their digital strategies.

These additional services broaden Entravision's digital revenue streams and allow them to serve a wider array of advertiser requirements. For instance, their U.S. digital marketing solutions encompass offerings like AudioEngage. In 2023, Entravision reported significant growth in its digital segment, with digital revenue contributing substantially to its overall financial performance, reflecting the increasing demand for these diversified marketing solutions.

- Managed Services: Entravision actively manages and optimizes digital advertising campaigns for clients, ensuring better performance and ROI.

- Specialized Consulting: The company offers expert advice and strategic guidance to advertisers navigating the complex digital landscape.

- AudioEngage: This specific U.S. digital marketing solution highlights their capability to cater to niche advertising needs, such as audio-based campaigns.

- Diversified Revenue: These additional services create multiple avenues for digital income, reducing reliance on core programmatic offerings.

Entravision’s revenue streams are diverse, encompassing digital advertising through its programmatic platforms like Smadex, alongside traditional broadcast advertising across its television and radio properties. Political advertising is a particularly strong, albeit cyclical, contributor, as seen in the record-breaking revenue reported in 2024. The company also generates income from retransmission consent fees paid by cable and satellite providers, though this stream saw a dip in early 2025. Additional digital marketing services, including managed campaign services and specialized consulting, further diversify its income.

| Revenue Stream | Description | Notes |

|---|---|---|

| Digital Advertising | Programmatic (Smadex), mobile growth (Adwake), display, video, social, streaming audio. | Ad Tech & Services segment revenue surged 57% in Q1 2025. |

| Broadcast Advertising | Selling ad time on TV and radio stations to local and national clients. | Media segment experienced fluctuations in Q1 2025. |

| Political Advertising | Advertising revenue from political campaigns, especially during election periods. | Record-breaking revenue in 2024; significant boost to Media segment. |

| Retransmission Consent | Fees from cable and satellite providers for broadcasting signals. | Contributes to Media segment; saw a decline in Q1 2025. |

| Other Digital Marketing Services | Managed services, digital campaign optimization, specialized consulting, AudioEngage. | Digital segment showed significant growth in 2023. |

Business Model Canvas Data Sources

The Entravision Business Model Canvas is informed by Entravision's extensive historical financial data, including revenue breakdowns and cost structures. We also leverage comprehensive market research on digital advertising trends and audience demographics across Latin America and the US Hispanic market, alongside internal operational metrics and strategic planning documents.