Entravision Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entravision Bundle

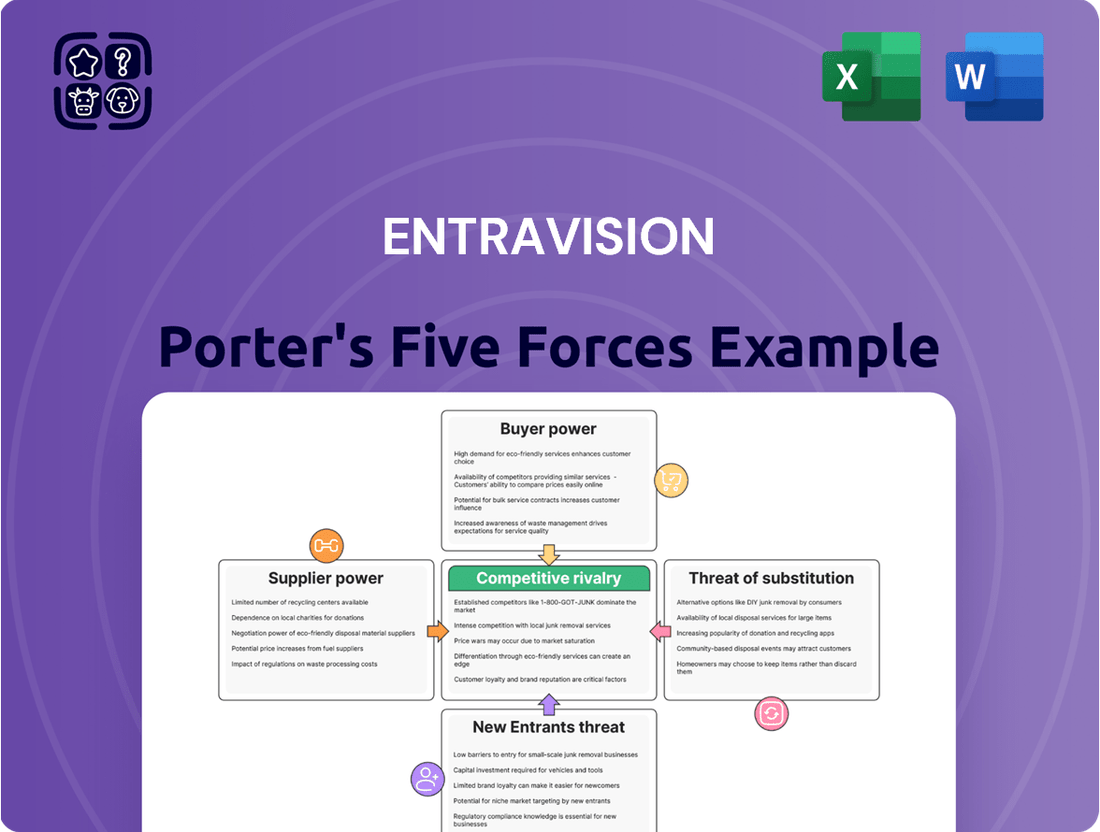

Entravision operates in a dynamic media landscape, where understanding the competitive forces is crucial for success. Our analysis delves into the bargaining power of buyers and suppliers, examining how they influence Entravision's pricing and profitability. We also assess the threat of new entrants and the intensity of rivalry among existing players, revealing the competitive pressures Entravision faces.

Furthermore, the threat of substitute products and services plays a significant role in shaping Entravision's market position. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Entravision’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Entravision's digital advertising business, especially its programmatic platform Smadex, hinges on specialized technology and data. Suppliers of these critical components, particularly those with unique or hard-to-replicate solutions, wield considerable bargaining power. For instance, if a key data analytics provider for Smadex were to significantly increase its fees, Entravision would face challenges in finding comparable alternatives quickly.

Entravision's reliance on content and media inventory suppliers, particularly for its television and radio broadcasting, means these suppliers hold considerable sway. The exclusivity of the content they provide, coupled with the often fragmented nature of the media industry, amplifies their bargaining power.

This is especially critical for political advertising, a substantial revenue stream for Entravision. The availability and cost of broadcast time, directly influenced by these suppliers, significantly impact the company's ability to capitalize on this lucrative market.

In 2024, the broadcast television advertising market saw robust growth, with political advertising being a key driver. For instance, national political ad spending in the US was projected to reach over $3 billion in 2024, highlighting the importance of securing inventory for companies like Entravision.

The specialized nature of digital advertising, data analytics, and media operations makes a skilled talent pool a critical supplier for companies like Entravision. The competitive market for professionals in areas such as AI, sales, and ad-tech significantly amplifies their bargaining power, often translating into higher salary and benefits demands.

In 2024, the demand for data scientists and AI specialists in the advertising technology sector remained exceptionally high, with reported salary increases averaging 15-20% for experienced professionals in key markets. This intense competition for talent directly impacts operational costs and the ability to scale specialized teams.

Entravision has proactively addressed this by investing in hiring additional local salespeople and digital marketing specialists. This strategic move aims to secure essential human capital and mitigate the impact of escalating talent acquisition costs driven by supplier (employee) bargaining power.

Infrastructure and Network Providers

Media companies like Entravision rely heavily on infrastructure and network providers for broadcasting and digital content distribution. Suppliers of essential services such as cloud computing, data transmission, and broadcast transmission facilities can wield significant bargaining power. This power is amplified when switching to alternative providers involves substantial costs or when the availability of comparable services is limited. For instance, in 2024, the global cloud computing market was valued at over $600 billion, indicating the critical role these providers play.

The ability of these suppliers to influence terms is often tied to the specialized nature of their offerings and the investment required for Entravision to integrate their services. High switching costs can lock companies into existing provider relationships, reducing Entravision's flexibility and negotiation leverage. Maintaining robust technical operations across diverse platforms, from traditional broadcast to digital streaming, necessitates dependable infrastructure partnerships.

- High Switching Costs: For example, migrating Entravision's extensive digital content delivery networks could incur millions in setup and integration expenses, making suppliers with established infrastructure formidable.

- Limited Alternatives: In certain regions, the number of providers capable of offering the specific broadcast transmission or high-speed data services Entravision requires might be few, concentrating power with those providers.

- Infrastructure Investment: The significant capital investment required by suppliers to build and maintain advanced broadcasting and digital infrastructure often translates into pricing power.

- Technical Dependence: Entravision's operational efficiency is directly linked to the reliability and performance of its infrastructure providers, creating a dependence that suppliers can leverage.

Data Providers for Audience Targeting

Data providers hold significant bargaining power over Entravision, especially given its reliance on granular audience data for effective advertising campaigns. Suppliers offering specialized or proprietary datasets, such as detailed demographic, psychographic, and behavioral insights, can command premium pricing. For instance, in 2024, the digital advertising market continued to see increased demand for first-party data solutions, allowing providers of such unique data to negotiate more favorable terms.

The ability of these data suppliers to differentiate their offerings, whether through data accuracy, breadth of coverage, or advanced analytics capabilities, directly impacts their leverage. Entravision’s need for high-quality data to ensure precise audience targeting means it is sensitive to disruptions or cost increases from these crucial suppliers. This dynamic is further amplified as privacy regulations evolve, making access to compliant and comprehensive data even more valuable and concentrated among fewer providers.

- Data Uniqueness: Suppliers with exclusive or hard-to-replicate data sets gain a stronger negotiating position.

- Market Concentration: A limited number of high-quality data providers can lead to increased supplier power.

- Data Quality & Accuracy: Superior data accuracy and reliability allow suppliers to charge higher prices.

- Regulatory Impact: Evolving data privacy laws can consolidate the market, empowering remaining compliant data providers.

Suppliers of critical technology, data, and specialized talent hold considerable sway over Entravision. The specialized nature of programmatic advertising, data analytics, and the high demand for AI and ad-tech professionals in 2024, with salary increases averaging 15-20%, underscore this power. Entravision's investment in local salespeople and digital marketing specialists in 2024 aims to secure this vital human capital.

Infrastructure providers, including cloud computing and data transmission services, also possess significant bargaining power due to high switching costs and limited alternatives. The global cloud computing market exceeding $600 billion in 2024 highlights the essential role and leverage of these suppliers.

Data providers offering unique datasets or advanced analytics capabilities are crucial. The increasing demand for first-party data solutions in 2024 empowered these suppliers, impacting Entravision's targeting precision and costs.

| Supplier Category | Key Factors Influencing Power | Impact on Entravision | 2024 Data/Trend Example |

|---|---|---|---|

| Technology & Data Platforms (e.g., Smadex) | Specialized, hard-to-replicate solutions | Potential for increased fees, limited alternatives | High demand for AI/Ad-tech talent drove salary increases (15-20%) |

| Content & Media Inventory | Exclusivity of content, fragmented industry | Influence on broadcast time availability and cost | Political ad spending projected over $3 billion in US for 2024 |

| Skilled Talent (Employees) | Competitive market for AI, sales, ad-tech professionals | Higher salary/benefits demands, operational cost increases | Entravision's investment in local sales/digital marketing hires in 2024 |

| Infrastructure & Network Providers | High switching costs, limited alternatives, specialized services | Pricing power, reduced flexibility, dependence on reliable services | Global cloud computing market >$600 billion in 2024 |

| Data Providers | Data uniqueness, quality, accuracy, market concentration | Premium pricing for specialized datasets, sensitivity to cost increases | Increased demand for first-party data solutions in 2024 |

What is included in the product

This Porter's Five Forces analysis for Entravision dissects the competitive intensity within the media and advertising sector, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing players.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, simplifying complex market dynamics for Entravision.

Customers Bargaining Power

Large advertising agencies and major brands wield considerable bargaining power, as they account for a substantial portion of advertising expenditure. This allows them to negotiate more favorable rates and demand tailored solutions, directly impacting Entravision's revenue streams.

Their sheer volume gives these clients leverage to influence terms and conditions, potentially pressuring Entravision on pricing and service delivery. For instance, in 2024, major national advertisers continued to consolidate their media buys, seeking greater efficiency and cost savings across their campaigns.

Entravision's reliance on advertising revenue makes it particularly vulnerable to shifts in spending by these significant clients. A slowdown in ad spend from a few key accounts can have a material effect on the company's financial performance.

The availability of alternative advertising channels significantly enhances customer bargaining power for Entravision. Advertisers can readily access a vast ecosystem of digital platforms like Google and Meta, alongside established social media networks and traditional media outlets. This abundance of substitutes means clients aren't reliant on a single provider.

In 2024, digital advertising spending is projected to reach over $600 billion globally, with a significant portion allocated to platforms outside of traditional broadcast media. This broad market competition allows advertisers to easily shift their budgets if Entravision's pricing or the perceived value of its advertising solutions isn't competitive.

The increasing adoption of performance-based advertising models significantly enhances customer bargaining power. In 2024, a substantial portion of digital advertising budgets is allocated to campaigns where payment is directly linked to measurable results such as customer acquisition or sales, forcing companies like Entravision to prove tangible return on investment.

This shift necessitates a strong focus on demonstrating concrete ROI, which intensifies pressure on Entravision's pricing strategies and overall service quality. Clients are more empowered to negotiate terms when they can directly attribute revenue increases to advertising spend, making Entravision’s ability to deliver quantifiable success paramount.

Fragmented Customer Base in Specific Segments

While Entravision's larger advertising clients certainly hold significant sway, a substantial portion of its customer base, especially within the Media segment, is comprised of smaller and medium-sized local businesses. This fragmentation means that individual smaller advertisers possess less bargaining power on their own. However, the sheer volume of these smaller clients can still collectively influence Entravision's pricing and service offerings.

For example, in the 2024 fiscal year, Entravision's media advertising revenue was primarily driven by a broad range of local and regional clients across its broadcast and digital platforms. The company's strategy often involves tailoring packages for these diverse advertisers, acknowledging that while each may be small, their cumulative business is vital. This dynamic creates a balancing act for Entravision, managing the influence of a few large players against the aggregated impact of many smaller ones.

- Fragmented Local Advertiser Base: Entravision serves a wide array of smaller and medium-sized local businesses in its Media segment, reducing individual customer leverage.

- Collective Influence: Despite individual weakness, the numerous smaller advertisers can exert pressure through their collective purchasing decisions.

- Tailored Service Models: The company adapts its offerings to cater to the needs of this diverse local clientele, reflecting their importance.

- 2024 Revenue Dynamics: A significant portion of Entravision's 2024 media advertising revenue stemmed from this broad base of regional and local advertisers.

Price Sensitivity in a Competitive Market

Advertisers, the primary customers for Entravision’s media platforms, operate in a highly budget-conscious landscape. They are constantly scrutinizing their spending, seeking the most cost-effective avenues to connect with their target audiences. This makes them acutely price-sensitive.

In 2024, the digital advertising market, in particular, saw continued pressure on ad rates. Companies like Google and Meta, dominant players, often set benchmarks that smaller media companies, including Entravision, must contend with. This intense price sensitivity among advertisers directly translates into downward pressure on Entravision’s advertising rates, especially when competing in crowded digital and traditional media sectors.

- Advertiser Budget Focus: Marketers are increasingly ROI-driven, demanding demonstrable results for every dollar spent on advertising.

- Competitive Landscape: The proliferation of digital platforms and niche media outlets in 2024 provides advertisers with numerous alternatives, amplifying their bargaining power.

- Rate Sensitivity: A significant portion of advertisers will readily switch vendors if a competitor offers a comparable reach or engagement at a lower price point.

- Entravision’s Challenge: Maintaining premium pricing for its advertising inventory becomes difficult when alternatives offer similar audience access at a reduced cost.

Entravision's customers, primarily advertisers, possess significant bargaining power due to the abundance of alternative advertising channels and the increasing demand for performance-based advertising. This allows them to negotiate favorable rates and demand measurable returns on investment, directly impacting Entravision's revenue and profitability.

The global digital advertising market, projected to exceed $600 billion in 2024, is dominated by large platforms, intensifying price competition. Advertisers are highly price-sensitive, readily switching to lower-cost alternatives if Entravision’s offerings are not competitive on price or demonstrable ROI.

While large clients have substantial leverage, Entravision also serves numerous smaller local businesses. Although individually weak, their collective purchasing power can influence pricing and service. Entravision’s 2024 media advertising revenue was significantly bolstered by this diverse base of regional and local clients, requiring a balanced approach to managing customer influence.

| Customer Segment | Bargaining Power Factors | Impact on Entravision | 2024 Data/Context |

|---|---|---|---|

| Large National Advertisers | High volume purchasing, ability to consolidate media buys | Negotiate lower rates, demand tailored solutions, pressure on pricing | Consolidation of media buys increased for efficiency |

| Alternative Channel Availability | Abundance of digital platforms (Google, Meta), social media, traditional media | Easily shift budgets, intensifies competition, limits Entravision's pricing power | Digital ad spending projected over $600 billion globally |

| Performance-Based Advertising | Demand for measurable ROI (customer acquisition, sales) | Requires Entravision to prove tangible results, intensifies pricing pressure | Significant portion of budgets linked to measurable results |

| Fragmented Local Advertisers | Individual low power, but collective influence from volume | Collective pressure on pricing/services, but less individual leverage | Major driver of 2024 media advertising revenue |

Same Document Delivered

Entravision Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Entravision Porter's Five Forces Analysis meticulously examines the competitive landscape, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. Understand the strategic positioning and potential challenges facing Entravision through this in-depth analysis.

Rivalry Among Competitors

The digital advertising landscape where Entravision's technology segment operates is intensely competitive. Global behemoths like Google and Meta dominate, alongside a multitude of specialized ad-tech companies and programmatic advertising platforms vying for advertising budgets. This crowded environment means Entravision faces significant pressure from rivals for market share and ad spend.

Entravision's Advertising Technology & Services segment experienced notable growth in Q1 2025, highlighting its active participation in this dynamic and crowded market. The fierce competition necessitates continuous innovation and efficient service delivery to capture and retain clients in a space where numerous players offer similar solutions.

Entravision's traditional media segment, encompassing television and radio, faces significant rivalry from established broadcasters and publishers. Many of these competitors are also actively investing in and expanding their digital platforms, intensifying the battle for audience engagement and advertising dollars. This competition is particularly fierce in both local and national markets where Entravision operates.

For instance, in 2024, the U.S. local TV advertising market was projected to reach approximately $14.7 billion, according to industry estimates, a figure shared among numerous players. Similarly, the radio advertising sector, while facing its own shifts, remains a competitive landscape with many established stations vying for listener share and advertiser budgets.

This broad competitive pressure means Entravision must continuously innovate its content and distribution strategies to maintain its market position. The ongoing digitization by rivals necessitates a robust digital-first approach to complement its traditional broadcast strengths.

Advertisers can readily move their advertising spend between various media channels and platforms, including digital, broadcast, and print. This low switching cost means companies like Entravision face constant pressure to demonstrate superior ROI and service to keep clients. For instance, in 2024, the digital advertising market saw continued growth, with platforms offering flexible campaign management and performance-based pricing, making it easier for advertisers to experiment and reallocate budgets.

Rapid Technological Evolution in Ad-Tech

The ad-tech industry is a hotbed of innovation, meaning companies like Entravision face intense rivalry. New platforms and groundbreaking solutions are appearing all the time, forcing players to constantly update their offerings. This rapid pace of change means significant and ongoing investment in research and development is a must to stay competitive. Companies are in a constant race to provide the most cutting-edge and impactful advertising tools available.

Entravision's competitive rivalry is amplified by the relentless technological advancements in ad-tech. The market is dynamic, with new platforms and solutions emerging frequently, creating a challenging environment. This necessitates substantial and continuous investment in technology and R&D to maintain a competitive edge. Companies are driven to offer the most advanced and effective advertising solutions to capture market share.

- Constant Innovation: Ad-tech sees new platforms and solutions emerge rapidly.

- R&D Investment: Continuous investment in technology and R&D is crucial for competitiveness.

- Feature Wars: Companies compete to offer the most advanced and effective advertising solutions.

- Market Dynamics: Entravision operates in a fast-paced and evolving technological landscape.

Market Consolidation and Strategic Divestitures

The media and advertising industry is characterized by significant consolidation, where larger entities frequently acquire smaller competitors. This trend intensifies competition as fewer, more dominant players emerge. For instance, Entravision Communications strategically divested its digital advertising representation business to Aleph Group in a deal finalized in 2024, a move indicative of this industry-wide consolidation.

This ongoing merger and acquisition activity fundamentally alters the competitive dynamics. As companies divest non-core assets or are acquired, the market becomes more concentrated, potentially increasing the bargaining power of remaining major players. Such strategic moves can reshape Entravision's market position and its rivals.

- Industry Consolidation: Ongoing mergers and acquisitions are a defining characteristic of the media and advertising sector.

- Strategic Divestitures: Companies like Entravision actively manage their portfolios through asset sales, such as its 2024 digital advertising representation business divestiture.

- Market Concentration: M&A activity leads to a more concentrated market, potentially impacting competitive intensity and pricing power.

- Reshaping Landscape: These transactions redefine the competitive environment, influencing the strategies of all industry participants.

The competitive rivalry Entravision faces is intense across both its digital and traditional media segments. In the digital ad-tech space, global giants and specialized platforms create a crowded marketplace, demanding continuous innovation and efficient service to secure market share. This dynamic is further fueled by rapid technological advancements, pushing companies to invest heavily in R&D. The traditional media sector also sees fierce competition from established broadcasters and publishers increasingly focused on digital expansion.

Entravision's strategic divestiture of its digital advertising representation business to Aleph Group in 2024 exemplifies the industry's consolidation trend. This ongoing merger and acquisition activity leads to market concentration, potentially altering competitive dynamics and the bargaining power of major players. Advertisers' low switching costs between various media channels also exert constant pressure on Entravision to deliver superior ROI and client service.

| Segment | Key Competitors | Competitive Pressures | 2024 Market Data Point |

|---|---|---|---|

| Digital Advertising Technology | Google, Meta, specialized ad-tech firms | Intense competition for market share, need for constant innovation, rapid technological change | Digital advertising spend projected to exceed $600 billion globally in 2024. |

| Traditional Media (TV & Radio) | Established broadcasters, local and national publishers | Competition from digital platforms, audience engagement battles, advertising dollar contention | U.S. local TV advertising market estimated at $14.7 billion in 2024. |

SSubstitutes Threaten

Brands are increasingly building their own advertising departments or striking direct deals with content platforms. This bypasses traditional advertising intermediaries, like Entravision, lessening the reliance on their services. For instance, in 2024, many large consumer brands continued to invest in their internal digital marketing teams, aiming for greater control over ad spend and campaign execution.

This shift represents a significant substitute threat because it directly reduces the demand for third-party ad sales and media buying services. Companies can achieve similar reach and engagement by managing their campaigns in-house or through direct publisher relationships. This trend highlights a move towards greater vertical integration within the advertising ecosystem.

Organic content and social media marketing present a significant threat of substitutes for traditional paid advertising channels. Companies can bypass costly ad buys by investing in content marketing and SEO to attract audiences organically. This approach builds a lasting brand presence without the ongoing expense of paid media, making it an attractive alternative for many businesses aiming for sustainable growth.

For instance, the global content marketing market was estimated to reach $412.88 billion in 2021 and is projected to grow significantly. This indicates a substantial shift towards organic strategies. Businesses can leverage platforms like blogs, YouTube, and Instagram to create valuable content that resonates with their target audience, fostering loyalty and reducing reliance on paid promotions.

Furthermore, strong organic social media presence acts as a direct substitute for paid social media advertising. Companies like HubSpot have demonstrated success by building massive followings through consistent, valuable content, thereby reducing their need for paid social campaigns. This organic reach can be more cost-effective and lead to higher engagement rates over time.

The burgeoning landscape of influencer marketing and novel digital channels presents a significant threat of substitutes for traditional advertising. Platforms facilitating influencer collaborations are rapidly growing, with the global influencer marketing market projected to reach $21.1 billion in 2023, and expected to continue its upward trajectory. This growth signifies a powerful alternative for brands seeking direct audience engagement, potentially siphoning advertising budgets from established players.

Emerging avenues like in-game advertising and immersive metaverse experiences further diversify the options available to marketers. For instance, in-game advertising revenue in the US alone was estimated to be around $13.5 billion in 2023. These innovative channels offer unique, often highly targeted, ways to connect with consumers, providing a compelling substitute for conventional ad placements and potentially impacting demand for traditional ad-tech services.

Traditional Marketing Alternatives

Beyond the digital realm, traditional marketing channels remain potent substitutes, especially for businesses aiming for localized impact or reaching specific demographic segments. Direct mail, for instance, continues to offer a tangible connection, while out-of-home (OOH) advertising like billboards can capture broad local attention. Experiential marketing events provide immersive brand interactions that digital channels often cannot replicate.

These traditional avenues can be particularly effective when digital saturation is high or when a more personal touch is desired. For example, in 2024, the direct mail industry continued to show resilience, with many businesses leveraging personalized mailers for targeted promotions and customer retention efforts. Similarly, OOH advertising saw renewed investment, with programmatic buying and dynamic content enhancing its appeal for brand awareness campaigns.

- Direct Mail: Continues to offer a high response rate for targeted campaigns, especially when personalized.

- Outdoor Advertising (OOH): Effective for broad local reach and brand visibility, with digital OOH offering dynamic content capabilities.

- Experiential Marketing: Provides memorable, in-person brand engagement that can foster stronger customer loyalty.

- Print Media: Niche publications still command loyal audiences for highly specific demographic targeting.

Subscription-Based Content Models

The rise of subscription-based content models poses a significant threat of substitutes for companies like Entravision that rely on advertising revenue. Consumers are increasingly choosing ad-free viewing experiences through platforms like Netflix, Disney+, and HBO Max, diverting viewership away from traditional ad-supported media. This trend directly impacts the audience available for advertising, potentially reducing the effectiveness and reach of Entravision's media offerings.

This shift means less inventory for advertisers seeking to reach audiences, as consumers actively avoid ads by paying for premium, uninterrupted content. For instance, by mid-2024, global streaming subscriptions were projected to exceed 1.7 billion, showcasing the massive consumer adoption of these substitute models.

This migration to paid subscriptions directly diminishes the pool of eyeballs available to ad-supported platforms. Entravision, operating within a competitive media landscape, must contend with this growing preference for ad-free content, which directly impacts its advertising inventory and pricing power.

The threat is amplified by the continuous expansion of these subscription services, offering vast libraries of content across various genres. This makes it harder for ad-supported platforms to retain and grow their audience share, a critical factor for advertising revenue generation.

The threat of substitutes for Entravision is multifaceted, encompassing both digital and traditional alternatives. Brands increasingly bypass intermediaries by building in-house advertising departments or striking direct deals with content platforms, a trend evident in 2024 as major brands bolstered their internal digital marketing teams for greater control.

Organic content marketing and social media engagement offer cost-effective reach, with the global content marketing market's significant growth underscoring this shift. Influencer marketing also provides a direct substitute, projected to reach $21.1 billion in 2023, while emerging channels like in-game advertising, with US revenue around $13.5 billion in 2023, offer novel engagement avenues.

| Substitute Channel | Key Characteristic | 2023/2024 Relevance |

|---|---|---|

| In-house Digital Marketing | Direct control, cost efficiency | Increased investment by brands in 2024 |

| Organic Content Marketing | Sustainable brand building, lower ongoing cost | Global market projected for significant growth |

| Influencer Marketing | Direct audience engagement, authenticity | Projected to reach $21.1 billion in 2023 |

| In-game Advertising | Targeted, immersive brand placement | US revenue estimated at $13.5 billion in 2023 |

Entrants Threaten

Establishing new television or radio broadcasting operations demands immense capital for licenses, transmitters, studios, and ongoing content creation. For instance, acquiring broadcast licenses can cost millions, as demonstrated by FCC auctions. This high upfront investment acts as a formidable barrier, deterring many potential competitors from entering Entravision's traditional media markets.

The digital advertising landscape, while vast, presents opportunities for new entrants in specialized niches. Startups or smaller agencies can enter specific segments of the market, like performance marketing for e-commerce or advertising targeting Gen Z consumers on emerging social platforms, with relatively modest capital investment compared to establishing a broad-based media company. This allows them to focus on innovative technologies or unique service offerings, thereby intensifying competition for established players like Entravision. For instance, the rise of influencer marketing platforms and specialized programmatic buying tools demonstrates how focused expertise can disrupt established advertising models.

The digital advertising landscape demands substantial investment in data analytics and advanced technology infrastructure. Newcomers face a steep climb to build or acquire the sophisticated platforms necessary for effective programmatic advertising and data management.

Companies like Entravision, operating in this sector, rely on established data sets and proprietary technology that new entrants would struggle to replicate quickly. For instance, the global programmatic advertising market was valued at approximately $340 billion in 2023 and is projected to grow significantly, highlighting the scale of investment required.

Developing the in-house expertise and the technological backbone to compete effectively in real-time bidding and audience segmentation presents a formidable barrier. This necessity for advanced, capital-intensive infrastructure significantly deters potential new competitors from entering the market.

Brand Recognition and Existing Client Relationships

Entravision has cultivated significant brand recognition, especially within the valuable Latino demographic, and enjoys deep-seated relationships with advertisers. This established trust is a formidable barrier for newcomers. For instance, in 2024, Entravision continued to leverage its strong brand presence to secure advertising partnerships, a testament to its market penetration.

New entrants must invest heavily to overcome Entravision's proven track record and established client loyalty. Building comparable brand equity and forging new relationships takes considerable time and resources, making it difficult to gain immediate traction.

- Entravision's established brand recognition in the Latino market provides a competitive edge.

- Long-standing advertiser relationships create switching costs for clients.

- New entrants face the hurdle of building trust and market share against incumbents with proven success.

- The cost and time required to replicate Entravision's market position are substantial deterrents.

Regulatory Hurdles and Compliance Costs

New entrants in the media and advertising sectors face significant challenges due to increasingly stringent regulatory environments. For instance, in 2024, the continued evolution of data privacy laws like GDPR and CCPA demands substantial investment in compliance infrastructure and expertise, creating a high barrier to entry.

These compliance costs can be particularly daunting for smaller startups. Navigating complex content guidelines and advertising standards requires dedicated legal and operational resources, diverting capital that could otherwise be used for market penetration and innovation.

The sheer volume of regulatory changes means ongoing expenditure is necessary. For example, the digital advertising industry in 2024 continues to grapple with evolving rules around programmatic advertising and consumer consent, necessitating continuous adaptation and spending.

- Data Privacy Compliance: Significant investment needed to adhere to evolving global data protection regulations.

- Content Moderation: Costs associated with ensuring content meets various platform and governmental guidelines.

- Advertising Standards: Expenses for legal review and adherence to advertising ethics and disclosure requirements.

- Industry-Specific Regulations: Media companies must also comply with broadcast licenses, intellectual property laws, and other sector-specific mandates.

The threat of new entrants for Entravision is moderate in traditional broadcasting due to high capital requirements for licenses and infrastructure. However, the digital advertising space offers lower barriers for specialized niche players. For instance, the global programmatic advertising market's substantial size, valued at approximately $340 billion in 2023, indicates significant investment is needed to compete effectively, but also highlights opportunities for focused digital strategies.

Entravision's strong brand recognition, particularly within the Latino demographic, and established advertiser relationships create significant hurdles for new entrants aiming to replicate its market position. Building comparable brand equity and client loyalty demands substantial time and resources, making it difficult for newcomers to gain immediate traction.

Stricter regulatory environments, especially concerning data privacy and content, also pose a considerable barrier. Companies like Entravision must invest in compliance infrastructure and expertise, with ongoing costs for adapting to evolving rules around programmatic advertising and consumer consent, as seen with regulations like GDPR and CCPA in 2024.

| Barrier Type | Description | Example Impact on Entrants |

| Capital Requirements | High initial investment for broadcast licenses, studios, and transmitters. | Newcomers face millions in costs for FCC auctions alone. |

| Brand Recognition & Relationships | Established trust and deep advertiser ties, especially with the Latino demographic. | Requires significant time and resources to build comparable market penetration and loyalty. |

| Technological Sophistication | Need for advanced data analytics, programmatic advertising platforms, and AI capabilities. | Startups struggle to replicate proprietary technology and extensive data sets used by incumbents. |

| Regulatory Compliance | Adherence to data privacy laws (GDPR, CCPA) and content guidelines. | Ongoing expenditure for legal review, content moderation, and adaptation to evolving industry rules in 2024. |

Porter's Five Forces Analysis Data Sources

Our Entravision Porter's Five Forces analysis is built upon a foundation of diverse data, including company financial statements, investor relations materials, and industry-specific market research reports.

We leverage insights from reputable sources such as Nielsen, Kantar, and advertising industry trade publications to accurately assess market dynamics and competitive pressures within Entravision's operating environment.