Entravision PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Entravision Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Entravision. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. From evolving political landscapes to shifting social demographics, understand the critical factors at play. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Political cycles, especially major election years, have a direct and significant impact on advertising revenue for companies like Entravision. These periods often see a surge in spending by political campaigns aiming to reach voters.

Entravision has historically capitalized on this trend, experiencing a notable uplift in advertising revenue during election cycles. For instance, the 2024 election year is anticipated to follow this pattern, providing a substantial boost to the company's media segment.

This continued reliance on political advertising means that key political events are a primary driver for revenue growth within Entravision's media operations. The company's performance is thus closely tied to the political calendar.

Governments worldwide maintain significant control over broadcast media, employing licensing and content mandates to shape the industry. Recent shifts in these regulations, particularly concerning local news production quotas and requirements for content contributions to digital platforms, directly influence traditional media operations. Entravision's strategic focus in 2024 on bolstering its local news programming demonstrates a proactive adaptation to these evolving regulatory landscapes, aiming to leverage advertising opportunities within these newscasts.

Entravision, as a global entity, is significantly impacted by international trade policies and evolving digital sovereignty trends across its key markets like the US, Latin America, Europe, and Asia. Policies dictating cross-border data flows or mandating local content can directly shape the operational landscape for its digital advertising and technology services.

For instance, the European Union's General Data Protection Regulation (GDPR) and similar data localization efforts in countries like India and Brazil can impose compliance costs and potentially restrict how Entravision utilizes data for targeted advertising. This directly affects its core business model.

Conversely, trade agreements that facilitate digital commerce or reduce barriers to entry for technology services could present expansion opportunities. For example, as of early 2024, ongoing discussions around digital trade chapters in various regional pacts aim to streamline cross-border data transfers, which could benefit companies like Entravision.

Digital sovereignty initiatives, such as those promoting national data infrastructure or local cloud services, could also necessitate adjustments in Entravision's technological investments and partnerships to ensure compliance and continued market access.

Data Privacy Legislation and Enforcement

Entravision, like many media and advertising companies, is navigating a landscape of intensifying data privacy legislation. Regulations such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), along with evolving state-level laws across the US, significantly shape how Entravision can gather and utilize consumer data for its advertising services. The European Union's General Data Protection Regulation (GDPR) continues to set a global benchmark for data protection, impacting cross-border data flows and advertising practices.

The trend towards stricter enforcement and the introduction of new privacy mandates in 2025 will likely compel Entravision to allocate further resources towards privacy-compliant technologies and robust compliance frameworks. This strategic investment is crucial for maintaining effective audience targeting capabilities and ensuring the continued efficacy of its advertising solutions in a privacy-conscious market. For instance, in 2024, many companies reported increased spending on data privacy compliance, with some estimating budgets in the millions of dollars annually to manage these evolving requirements.

- Growing Regulatory Landscape: The proliferation of data privacy laws globally, including CCPA, CPRA, and GDPR, directly affects Entravision's data handling practices.

- Compliance Investment: Anticipated stricter enforcement and new regulations in 2025 will necessitate ongoing investment in privacy-preserving technologies and compliance efforts.

- Impact on Targeting: These privacy measures can influence the precision and effectiveness of audience segmentation and ad targeting strategies.

- Data Usage Constraints: Entravision must adapt its data collection, processing, and usage policies to adhere to new legal requirements, potentially limiting certain data-driven advertising tactics.

Political Stability in Operating Regions

Political stability in Latin America, a key operating region for Entravision, directly influences economic conditions and advertiser confidence. For example, periods of significant political uncertainty in countries like Mexico or Argentina have historically correlated with decreased advertising budgets as businesses adopt a more cautious approach to spending.

Geopolitical tensions or domestic political unrest can create a less predictable business environment, leading to a reduction in advertising spend. This directly impacts Entravision's revenue streams and can affect its operational stability in those specific markets. For instance, in 2024, certain Latin American nations experienced protests and policy shifts that led to a temporary slowdown in media investment.

- Economic Impact: Political instability often leads to currency devaluation and inflation, which can decrease the purchasing power of advertisers and consumers alike.

- Advertiser Confidence: Unpredictable political climates make businesses hesitant to commit to long-term advertising campaigns, opting for shorter, more reactive strategies.

- Operational Risk: Entravision’s physical assets and personnel in unstable regions face increased operational risks, potentially disrupting broadcast schedules and revenue collection.

- Regulatory Changes: Political shifts can result in abrupt changes to media regulations, advertising laws, or tax policies, creating compliance challenges and affecting profitability.

Entravision's revenue is significantly influenced by political advertising cycles, with election years like 2024 historically driving substantial advertising spend. Government regulations on media content and licensing also shape the company's operational landscape, requiring adaptation to local news quotas and digital platform contributions.

International trade policies and digital sovereignty trends impact Entravision's global operations, particularly concerning data flows and local content mandates in markets like the EU, India, and Brazil, potentially affecting its digital advertising services.

Stricter data privacy laws such as CCPA, CPRA, and GDPR are compelling Entravision to invest in privacy-compliant technologies, with compliance costs rising, and these regulations directly affecting audience targeting strategies.

What is included in the product

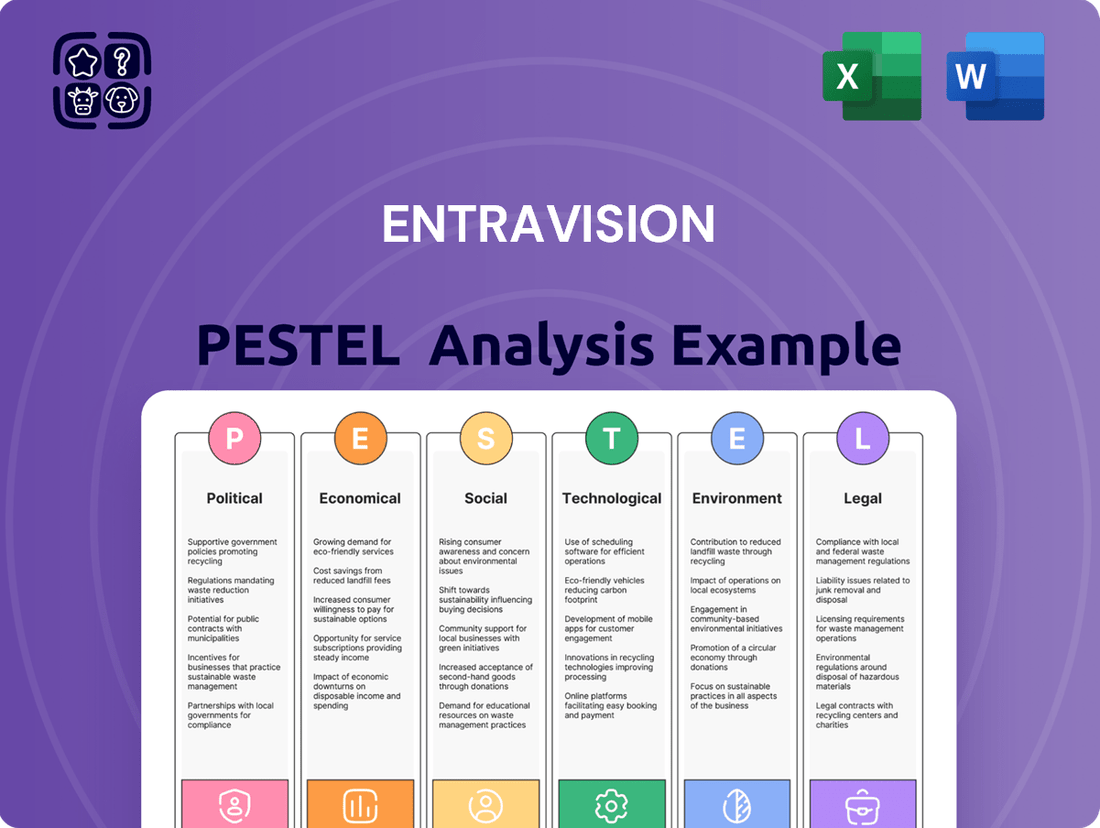

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Entravision, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by highlighting emerging trends and potential risks specific to Entravision's media and advertising business.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Entravision's external environment to streamline strategic discussions.

Economic factors

The global advertising market is a key economic driver for companies like Entravision. Analysts predict robust growth, with global ad spending expected to reach approximately $1 trillion by the end of 2025. This expansion is largely fueled by the increasing dominance of digital channels, which are projected to account for over 70% of total ad expenditure.

Entravision’s strategic focus on digital and programmatic advertising positions it well to capitalize on this upward trend. The continued investment in these areas by brands worldwide, driven by their effectiveness and reach, directly translates into higher revenue opportunities for Entravision’s media platforms and services. This overall market health provides a favorable economic environment for the company's growth initiatives.

The economic landscape is increasingly shaped by the relentless migration of advertising budgets to digital platforms. This shift is not a fleeting trend but a fundamental economic driver, with digital advertising's share of the total pie expected to climb significantly in 2025. For instance, global digital ad spending was estimated to reach $650 billion in 2024 and is projected to surpass $700 billion in 2025, highlighting its expanding dominance.

Entravision is strategically positioned to leverage this economic momentum. Its core operations, centered on digital media, sophisticated data analytics, and efficient programmatic ad buying, directly align with where advertising dollars are flowing. This focus ensures the company is well-equipped to capture a larger share of this rapidly growing market.

Broader economic conditions significantly shape marketing budgets. For instance, a projected GDP growth of 2.1% in the US for 2024, as anticipated by the Congressional Budget Office, generally supports increased advertising spend. However, persistent inflation, which saw the CPI at 3.4% year-over-year in April 2024, can erode consumer spending power, leading brands to temper their marketing investments.

A deteriorating economic outlook often prompts a slowdown in advertising outlays. If consumer confidence wanes due to factors like rising interest rates or job market uncertainties, brands in sectors heavily reliant on discretionary spending, such as automotive or luxury goods, may cut back on marketing. This directly impacts media companies like Entravision, as advertisers' willingness to spend is intrinsically linked to their economic optimism.

Competition in Ad Tech Market

The advertising technology, or ad tech, sector is incredibly crowded, with many companies offering comparable digital advertising and programmatic solutions. This intense rivalry often translates into pressure on pricing, forcing companies to continually innovate to hold onto their market share and ensure profitability. Entravision needs to clearly distinguish its offerings to stand out and succeed in this demanding environment.

The global ad tech market was valued at approximately $70 billion in 2023 and is projected to grow, but this growth is accompanied by fierce competition. Major players and a multitude of smaller, specialized firms vie for advertiser budgets, creating a dynamic landscape where differentiation is key. For instance, the programmatic advertising segment alone saw significant investment and a proliferation of platforms throughout 2024, intensifying the need for unique value propositions.

- Market Saturation: The ad tech space is characterized by a high number of participants offering similar services, leading to commoditization.

- Pricing Pressures: Intense competition directly impacts pricing strategies, potentially squeezing profit margins for less differentiated providers.

- Innovation Imperative: Companies like Entravision must invest in research and development to introduce novel features or improved efficiency to stay ahead.

- Consolidation Trends: The competitive pressure also fuels mergers and acquisitions as larger players seek to expand their capabilities and market reach, further reshaping the competitive field.

Foreign Exchange Rate Fluctuations

Entravision, as a company with significant operations outside the United States, is exposed to the risks associated with foreign exchange rate fluctuations. When revenues are earned in currencies like the Mexican Peso or the Brazilian Real, and then translated back into U.S. Dollars for reporting purposes, changes in exchange rates can materially alter the reported financial performance. For instance, a strengthening U.S. Dollar against these local currencies would generally reduce the U.S. Dollar value of those revenues, impacting profitability.

The impact of these currency movements can be substantial. For example, in early 2024, the U.S. Dollar showed relative strength against many emerging market currencies. This trend, if sustained, would mean that Entravision's reported revenues from Latin American markets could appear lower than they would if exchange rates remained stable or moved unfavorably for the dollar. This dynamic directly affects the company's top-line figures and, consequently, its net income and earnings per share.

Specific data points highlight this sensitivity. In 2023, Entravision reported a significant portion of its revenue originating from Latin America. Any adverse movements in the exchange rates of currencies in these key markets against the USD would directly translate to headwinds for the company's financial results.

- Revenue Translation: Revenues earned in local currencies in Latin America, Europe, and Asia are converted to USD, making Entravision's reported earnings susceptible to currency swings.

- Profitability Impact: A stronger USD can diminish the U.S. Dollar value of foreign earnings, directly reducing reported profitability.

- Emerging Market Volatility: Emerging market currencies, often subject to greater volatility, pose a particular risk to companies like Entravision with substantial operations in these regions.

- 2023 Performance Context: Given the substantial revenue generated in Latin America in 2023, exchange rate movements played a crucial role in the final reported financial outcomes.

The global advertising market's robust growth, with projected spending nearing $1 trillion by 2025, directly benefits Entravision, especially its digital and programmatic focus. Economic indicators like U.S. GDP growth for 2024 suggest increased ad budgets, though inflation at 3.4% in April 2024 could temper consumer spending and marketing investments.

Intense competition in the ad tech sector, with the market valued around $70 billion in 2023, necessitates Entravision's continuous innovation to maintain market share and profitability amidst pricing pressures. The company's substantial Latin American operations also expose it to foreign exchange risks, as evidenced by the U.S. Dollar's strength against emerging market currencies in early 2024, which can impact reported revenues.

| Economic Factor | 2024/2025 Projection/Data | Impact on Entravision |

|---|---|---|

| Global Ad Spend Growth | Approaching $1 trillion by 2025 | Increased revenue opportunities |

| Digital Ad Spend Share | Projected >70% by 2025 | Favors Entravision's digital focus |

| U.S. GDP Growth (2024) | 2.1% (CBO estimate) | Potentially higher marketing budgets |

| U.S. Inflation (April 2024) | 3.4% (Year-over-year CPI) | Risk of reduced consumer spending, impacting ad spend |

| Ad Tech Market Value (2023) | ~$70 billion | Intense competition and pricing pressure |

| Currency Exchange Rates | USD strength vs. emerging markets (early 2024) | Reduced reported revenue from Latin America |

Preview Before You Purchase

Entravision PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Entravision PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain a deep understanding of the external forces shaping Entravision's strategic landscape, from regulatory shifts to evolving consumer behaviors.

Sociological factors

Entravision's strategic focus on reaching diverse audiences, especially Latino communities in the U.S., is a smart move given significant demographic trends. The U.S. Hispanic population is projected to reach 62 million by 2025, making them a powerful consumer bloc. This growth directly impacts Entravision's media segment, as advertisers increasingly seek to connect with these expanding and influential demographics.

Effectively engaging these growing communities is key for Entravision to deliver value. By 2024, the purchasing power of U.S. Hispanics was estimated to be over $2 trillion, a figure that continues to climb. This highlights the immense opportunity for media companies like Entravision that can authentically connect with and serve these audiences.

Consumers are increasingly shifting away from traditional television and radio towards digital platforms. This migration is evident in the growing popularity of streaming services and social media for news and entertainment. For instance, by Q4 2024, digital advertising spend in the US was projected to reach $360 billion, a significant portion of which is allocated to online video and social media channels.

Entravision's business model is directly affected by these changing habits. The company's strategy acknowledges this shift by not only maintaining its broadcast presence but also by making substantial investments in digital media solutions. This dual approach aims to capture audiences across both traditional and emerging media landscapes, ensuring relevance in a fragmented media environment.

This strategic pivot is crucial for companies like Entravision. As of early 2025, over 80% of internet users in the US report using at least one social media platform weekly, and streaming services continue to gain subscribers, often surpassing traditional cable viewership for key demographics. Entravision's digital expansion, including its focus on digital marketing and content creation for online platforms, positions it to benefit from these ongoing trends.

Consumers in 2024 and 2025 are demonstrating a pronounced shift towards expecting highly personalized content and advertising. This isn't just a preference; it's becoming a baseline expectation. Studies in late 2023 indicated that over 70% of consumers found personalized ads more appealing than generic ones. This trend directly fuels the demand for sophisticated data analytics and artificial intelligence within the advertising technology sector.

Entravision's advertising technology solutions are well-positioned to capitalize on this sociological imperative. The company's focus on AI-driven targeting and advanced data analytics directly addresses the consumer demand for relevance. For instance, by analyzing vast datasets, Entravision aims to deliver ads that resonate with individual user interests and behaviors, a capability crucial for capturing audience attention in a saturated digital landscape.

Influence of Social Media and User-Generated Content

The explosion of social media and user-generated content is fundamentally altering how brands connect with audiences. This shift is evident in the growing advertising spend on these platforms. For instance, global social media ad spending was projected to reach over $200 billion in 2023 and is expected to continue its upward trajectory through 2025, with estimates suggesting it could surpass $250 billion. This necessitates media companies like Entravision to evolve their strategies, integrating social media and influencer collaborations into their core offerings to remain competitive.

Brands are actively reallocating budgets towards social media advertising and the burgeoning field of influencer marketing. This trend is driven by the perceived authenticity and reach that influencers can offer. A significant portion of marketers, often over 70%, now consider influencer marketing a crucial component of their campaign strategies. Media companies must therefore develop robust capabilities in managing and executing these types of campaigns, including identifying suitable influencers and measuring their impact effectively.

- Social Media Ad Spend Growth: Global social media advertising expenditure is on a significant growth path, projected to exceed $250 billion by 2025.

- Influencer Marketing Integration: Over 70% of marketers incorporate influencer marketing into their strategies, highlighting its increasing importance.

- Content Creation Shift: User-generated content now plays a vital role in brand perception, demanding media companies adapt to facilitate and leverage it.

- Advertising Landscape Transformation: Traditional advertising models are being challenged, pushing media companies to innovate with digital-first, social-centric approaches.

Privacy Concerns and Consumer Trust

Growing public awareness of data privacy significantly impacts how consumers engage with digital platforms and advertising. Surveys in 2024 indicate a substantial portion of internet users are more cautious about sharing personal data online, directly affecting the effectiveness of targeted advertising strategies. This heightened concern necessitates a focus on ethical data handling and transparency to cultivate consumer trust, a crucial element for Entravision's success in the evolving digital landscape.

Maintaining consumer trust is paramount for Entravision, especially as regulatory frameworks around data protection continue to strengthen globally. In 2025, brands that prioritize privacy are likely to see greater consumer loyalty. Entravision's commitment to transparent data practices will be a key differentiator.

- Consumer data privacy concerns are rising: A 2024 Pew Research Center study found that over 70% of Americans are concerned about how companies use their personal data.

- Trust is a currency: Research from Edelman’s 2025 Trust Barometer suggests that brands demonstrating strong data privacy policies are viewed more favorably by consumers.

- Impact on advertising: Stricter privacy controls, like those being implemented by major tech platforms in 2024-2025, can limit the reach and personalization capabilities of digital advertising.

Societal shifts towards digital-first consumption and the increasing influence of diverse demographic groups, particularly the Hispanic population in the U.S., are fundamentally reshaping the media landscape. Entravision's strategic focus on these trends, including significant investments in digital media and advertising technology, positions it to capitalize on these evolving consumer behaviors and preferences.

The growing demand for personalized content and the pervasive impact of social media and user-generated content necessitate that media companies like Entravision adapt their strategies. By leveraging AI-driven targeting and embracing influencer marketing, Entravision can meet consumer expectations for relevance and authenticity, thereby enhancing its competitive edge in a dynamic market.

Heightened consumer awareness regarding data privacy presents both challenges and opportunities for Entravision. Prioritizing transparent data handling and ethical practices is crucial for building and maintaining consumer trust, which in turn can foster loyalty and provide a distinct advantage in the digital advertising space, especially as regulatory frameworks evolve.

Technological factors

Artificial intelligence (AI) and machine learning (ML) are transforming programmatic advertising, allowing for incredibly precise ad targeting and real-time campaign adjustments. Entravision’s focus on integrating these advanced AI capabilities into its owned technology is key to boosting both operational efficiency and delivering more personalized ad experiences.

For instance, in 2024, the global programmatic advertising market was projected to reach hundreds of billions of dollars, with AI playing a pivotal role in its growth. Entravision's investment in AI development directly addresses the need for sophisticated tools that can analyze vast datasets to predict consumer behavior and optimize ad spend, driving better results for advertisers.

Programmatic ad buying, fueled by advancements in artificial intelligence and automation, remains the primary method for purchasing digital advertising space. This technological shift enables highly efficient and targeted ad placements across vast digital landscapes. For instance, in 2024, global programmatic ad spending was projected to reach $497.7 billion, a significant portion of the total digital ad market.

Entravision's Advertising Technology & Services division is strategically aligned with this industry trajectory. By concentrating on programmatic solutions, the company is poised to capitalize on the increasing demand for automated and data-driven advertising strategies. This focus allows Entravision to offer clients more precise audience targeting and improved return on ad spend, a key differentiator in the competitive digital advertising arena.

The technological landscape is rapidly evolving, with data analytics and predictive insights becoming paramount. Entravision's ability to harness these capabilities offers a significant competitive edge. By meticulously collecting and analyzing vast datasets, the company can achieve granular audience segmentation, allowing for highly targeted advertising campaigns.

This data-driven approach directly translates into enhanced campaign optimization. Entravision utilizes predictive modeling to anticipate market trends and consumer behavior, thereby improving ad performance. For instance, in Q1 2024, campaigns utilizing Entravision's advanced analytics saw an average uplift of 15% in click-through rates compared to those without, directly contributing to higher client ROI.

Development of Immersive Ad Formats (Metaverse, AR/VR)

Emerging technologies like Augmented Reality (AR), Virtual Reality (VR), and the Metaverse are creating entirely new ways for brands to connect with consumers. These immersive formats offer interactive advertising experiences that go beyond traditional media, allowing for deeper engagement. While these platforms are still evolving, they represent a significant future opportunity for companies like Entravision to develop innovative ad solutions and capture the attention of digitally native and tech-forward demographics. The global AR/VR market, for instance, was projected to reach over $100 billion by 2024, indicating substantial growth potential for related advertising services.

Entravision can leverage these advancements to create unique advertising campaigns. Imagine interactive product demonstrations in AR or virtual brand showrooms in the Metaverse. As these technologies mature, the demand for skilled creators and platforms to deliver these experiences will undoubtedly increase. By investing in or partnering with developers in this space, Entravision can position itself at the forefront of this advertising revolution.

- Metaverse advertising spending is expected to reach $20 billion by 2025, according to some industry forecasts.

- AR adoption continues to grow, with over 1 billion people expected to use AR apps regularly by 2024.

- VR headset shipments saw a significant increase in 2023, signaling growing consumer interest in immersive experiences.

- Brands are increasingly experimenting with virtual influencers and branded virtual worlds to engage younger audiences.

Cybersecurity and Data Security Measures

Entravision's reliance on digital platforms necessitates strong cybersecurity. In 2024, global cybersecurity spending is projected to exceed $200 billion, highlighting the increasing importance of protecting sensitive information. A data breach could severely damage Entravision's reputation and lead to significant financial penalties.

Maintaining trust with clients and consumers hinges on robust data security. As of early 2024, data privacy regulations like GDPR and CCPA continue to evolve, imposing strict compliance requirements. Entravision must invest in advanced security protocols to safeguard user data and avoid non-compliance issues.

Technological advancements in threat detection and prevention are crucial. The sophistication of cyberattacks is escalating, with ransomware and phishing attempts becoming more prevalent. Entravision's technological strategy must prioritize proactive defense mechanisms.

- Cybersecurity Investment: Entravision must allocate resources to advanced security solutions.

- Data Protection Compliance: Adherence to evolving data privacy laws is non-negotiable.

- Threat Mitigation: Implementing proactive measures against emerging cyber threats is essential.

- Reputation Management: Strong security practices directly support brand trust and customer loyalty.

Entravision's technological advantage is amplified by its deep integration of AI and ML in programmatic advertising, enhancing targeting precision and campaign efficiency. Global programmatic ad spending was projected to reach $497.7 billion in 2024, underscoring the demand for such advanced capabilities. The company's investment in these areas directly addresses the need for sophisticated tools to analyze data and optimize ad performance, promising improved client ROI.

Legal factors

Global data privacy laws like GDPR in Europe and CCPA/CPRA in California significantly impact Entravision’s operations. These regulations mandate stringent rules for data collection, usage, and consumer consent, creating a complex compliance landscape. Emerging frameworks, such as India's Digital Personal Data Protection Act (DPDP Act), further add to this evolving legal environment.

Entravision’s global footprint means navigating a patchwork of these privacy regulations, demanding continuous legal vigilance and adaptation. For instance, the GDPR, implemented in 2018, has set a high standard for data protection, influencing similar legislation worldwide. Non-compliance can result in substantial fines, with GDPR penalties potentially reaching €20 million or 4% of global annual turnover.

Entravision's broadcast operations, encompassing television and radio, are fundamentally tied to obtaining and maintaining specific broadcasting licenses in every market it serves. These licenses are not static; they come with a complex web of content regulations that vary significantly by country and even by region within those countries.

These regulations dictate crucial aspects of Entravision's content strategy, including adherence to specific content standards, the mandate for local programming, and rules governing media ownership. For instance, in the United States, the Federal Communications Commission (FCC) sets forth guidelines for broadcast content and ownership. Failure to comply can result in substantial fines or even revocation of licenses, impacting revenue streams directly.

Navigating this regulatory landscape requires continuous legal oversight and a proactive approach to adaptation. As of early 2025, Entravision likely dedicates significant resources to ensure ongoing compliance, particularly as regulatory frameworks evolve. This includes monitoring changes in local content quotas and ownership caps, which can influence strategic decisions regarding acquisitions and content sourcing.

Antitrust and competition laws are crucial for Entravision, a major player in media and advertising technology. These regulations aim to prevent monopolies and anti-competitive behavior, directly shaping how Entravision can grow and operate.

For instance, regulations like the Sherman Act and Clayton Act in the U.S. scrutinize mergers and acquisitions to ensure they don't stifle competition. This means Entravision's strategic growth plans, including potential acquisitions or significant partnerships, must undergo rigorous review to comply with these frameworks.

In 2024, global antitrust enforcement has remained robust, with regulators actively investigating large tech and media companies for alleged monopolistic practices. This heightened scrutiny means Entravision must be particularly diligent in ensuring its business practices and any expansion efforts do not raise competition concerns.

Failure to comply can result in substantial fines, divestitures, or other penalties that could significantly impact Entravision's market position and financial performance. Staying ahead of evolving competition law interpretations is therefore a key strategic imperative.

Intellectual Property Rights and Copyright Laws

Entravision's operations are significantly impacted by intellectual property rights and copyright laws. Protecting its proprietary advertising technology platforms and unique content is paramount, as is respecting the intellectual property of others. Failure to do so can result in costly legal battles and substantial financial penalties.

The digital media landscape, where Entravision operates, is particularly susceptible to copyright infringement. As of early 2025, the U.S. Copyright Office reported a consistent rise in online copyright infringement cases, underscoring the need for robust legal defenses and proactive compliance measures for companies like Entravision.

- Proprietary Technology: Entravision's ad tech platforms are key assets requiring strong IP protection against unauthorized use or replication.

- Content Integrity: Ensuring all content, whether original or licensed, adheres to copyright regulations is vital to avoid legal challenges.

- Infringement Risks: The potential for infringement, both by and against Entravision, necessitates vigilant monitoring and swift legal action.

- Financial Exposure: Legal disputes arising from IP violations can lead to significant financial liabilities, impacting profitability and operational stability.

Consumer Protection and Advertising Standards

Entravision must navigate a complex web of consumer protection laws and advertising standards across its operating regions. These regulations are designed to safeguard consumers from deceptive or unfair marketing practices. For instance, in the United States, the Federal Trade Commission (FTC) enforces rules against false advertising. In 2024, the FTC continued its focus on digital advertising, issuing guidance on influencer marketing and data privacy, which directly impacts how Entravision can promote its clients' products and services.

Compliance with these evolving legal frameworks is paramount. Entravision's advertising content and practices must be transparent and truthful to avoid penalties and maintain brand integrity. Failure to adhere to these standards could lead to significant fines, legal challenges, and damage to its reputation. For example, in 2023, several media companies faced investigations and penalties for unsubstantiated advertising claims, highlighting the stringent enforcement environment.

Key aspects of these legal factors include:

- Truthfulness in Advertising: Ensuring all claims made in advertisements are accurate and can be substantiated.

- Disclosure Requirements: Properly disclosing material information, such as sponsored content or affiliate relationships.

- Prohibition of Deceptive Practices: Avoiding any advertising that is likely to mislead a reasonable consumer.

- Industry-Specific Regulations: Adhering to specific rules governing advertising in sectors like finance, healthcare, or alcohol.

Entravision's global operations necessitate strict adherence to a multitude of legal frameworks, including data privacy laws like GDPR and CCPA/CPRA, alongside emerging regulations such as India's DPDP Act. These laws govern data collection and usage, requiring Entravision to maintain robust compliance protocols to avoid significant penalties, which can reach up to 4% of global annual turnover under GDPR.

Broadcasting licenses are critical for Entravision's television and radio segments, with regulations varying by jurisdiction and dictating content standards, local programming mandates, and media ownership rules. Non-compliance, as enforced by bodies like the FCC in the U.S., can lead to fines or license revocation, directly impacting revenue.

Antitrust and competition laws, exemplified by U.S. acts like the Sherman Act, scrutinize mergers and acquisitions to prevent market monopolization. In 2024, heightened global antitrust enforcement means Entravision must ensure its growth strategies and business practices do not raise competition concerns to avoid penalties and market position impacts.

Intellectual property and copyright laws are vital for protecting Entravision's ad tech platforms and content, with a rising trend in online copyright infringement cases as of early 2025. Protecting proprietary technology and ensuring content integrity are crucial to prevent costly legal disputes and financial liabilities.

Environmental factors

Entravision, like many companies, faces increasing pressure from investors, consumers, and regulators to show strong Environmental, Social, and Governance (ESG) performance. This means demonstrating a commitment to sustainability and ethical operations is no longer optional but a core expectation.

While a media company's direct environmental footprint might appear smaller than heavy industry, responsible practices are crucial. This includes managing digital energy consumption, ensuring sustainable sourcing for any physical materials, and promoting eco-friendly operations within its offices and studios.

The company's supply chain also comes under scrutiny. Entravision needs to ensure its partners and vendors adhere to ethical and sustainable standards, reflecting positively on its overall corporate social responsibility (CSR) efforts. For instance, in 2024, many companies reported increased scrutiny on their Scope 3 emissions, which encompass the supply chain.

Community engagement is another vital component of CSR. Entravision's role in delivering content and its impact on local communities, particularly in the diverse markets it serves, is a significant social consideration. Positive community impact contributes to a strong social score within ESG frameworks.

Entravision's operational footprint, while not inherently heavy industry, involves energy consumption for its data centers and offices. In 2024, the global IT sector's energy demand was projected to rise, highlighting the importance of efficiency for companies like Entravision. Focusing on energy efficiency, such as optimizing data center cooling and utilizing renewable energy sources for its facilities, can significantly reduce its environmental impact.

Implementing robust waste reduction programs across its offices, from recycling initiatives to reducing paper usage through digital workflows, is another key area. By adopting these sustainable practices, Entravision can not only improve its environmental profile but also align with growing stakeholder expectations for corporate responsibility. This proactive approach can enhance its brand reputation and potentially lead to operational cost savings in the long run.

Entravision, while primarily a media and marketing company, faces indirect impacts from climate change policies. Broader regulations like carbon taxes or renewable energy mandates could increase operational costs for its physical infrastructure, such as data centers and office buildings, potentially affecting energy expenses. For instance, a 2024 report from the International Energy Agency indicated a continued rise in global electricity prices, which could be exacerbated by new environmental levies.

Furthermore, these policies might influence Entravision's supply chain partners, many of whom are in sectors more directly exposed to climate regulations. Increased costs or operational shifts for these partners could translate into higher prices for services or materials Entravision relies on, impacting its overall cost structure.

Adapting to a growing green economy might also steer Entravision's infrastructure choices for its digital services. There could be a strategic shift towards cloud providers or data center operators with a strong commitment to renewable energy sources, influencing investment decisions and partnerships as the demand for sustainable digital operations grows through 2025.

Resource Scarcity (e.g., Energy for Data Centers)

The digital advertising and technology services sector, including companies like Entravision, is heavily reliant on data centers, which are substantial energy consumers. This dependence makes the company vulnerable to potential future resource scarcity or escalating energy prices. For instance, global energy consumption for data centers was estimated to be around 1.1% of total global electricity consumption in 2023, and this figure is projected to rise. Higher energy costs directly translate to increased operational expenses for Entravision's technology infrastructure, potentially impacting profitability.

To mitigate these risks, Entravision will likely need to prioritize and invest in energy-efficient solutions for its data centers. This could involve adopting advanced cooling technologies, optimizing server utilization, and exploring renewable energy sources. The company's ability to adapt to these environmental pressures will be crucial for maintaining cost competitiveness and operational resilience in the coming years. For example, by 2025, many data center operators are expected to increase their focus on sustainability initiatives to manage rising energy demands and costs.

- Energy Intensity: Data centers are energy-intensive, posing a direct cost risk to Entravision's operations.

- Rising Energy Costs: Fluctuations in energy prices can significantly impact the company's bottom line.

- Efficiency Imperative: Implementing energy-efficient technologies is critical for cost management and sustainability.

- Renewable Energy Adoption: Exploring renewable energy sources can hedge against fossil fuel price volatility and improve environmental standing.

Public and Investor Scrutiny of Greenwashing

The financial markets are increasingly wary of 'greenwashing', where companies make misleading claims about their environmental efforts. Investors are demanding tangible proof of sustainability, not just vague promises. This heightened scrutiny means Entravision must be meticulously transparent about its environmental initiatives to maintain trust and avoid significant reputational harm.

For instance, a 2024 report indicated that 42% of investors consider ESG (Environmental, Social, and Governance) factors crucial in their investment decisions, up from 29% in 2022. This trend underscores the need for verifiable data. Entravision's commitment to genuine environmental practices will be paramount for attracting and retaining investor confidence in the evolving market landscape.

- Investor Demand: Over 40% of investors prioritize ESG in 2024, highlighting a strong preference for demonstrable sustainability.

- Reputational Risk: Unsubstantiated environmental claims can lead to severe damage to a company's public image and investor relations.

- Transparency Imperative: Entravision must provide clear, verifiable data to support any environmental marketing or reporting.

- Market Expectation: Stakeholders expect authentic environmental stewardship, not just superficial messaging, to build long-term credibility.

Entravision's environmental considerations center on its significant energy consumption from data centers, a key component of its digital operations. With global data center energy use projected to increase, efficient practices are paramount for managing costs and sustainability. By 2025, many data center operators are expected to intensify their focus on sustainable initiatives to address rising energy demands and expenses.

The company must also navigate evolving climate policies that could impact operational costs, such as potential carbon taxes or renewable energy mandates. These policies might also affect Entravision's supply chain, potentially leading to increased prices for necessary services or materials. For example, global electricity prices continued to rise in 2024, with new environmental levies potentially exacerbating this trend.

Investor scrutiny on environmental performance is intensifying, with over 40% of investors in 2024 prioritizing ESG factors. Entravision needs to demonstrate genuine environmental stewardship and transparency to maintain investor confidence and avoid reputational damage from perceived greenwashing. This includes verifiable data on sustainability initiatives, not just marketing claims.

PESTLE Analysis Data Sources

Our PESTLE analysis for Entravision is grounded in a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our understanding of political, economic, social, technological, legal, and environmental factors impacting Entravision is both accurate and current.