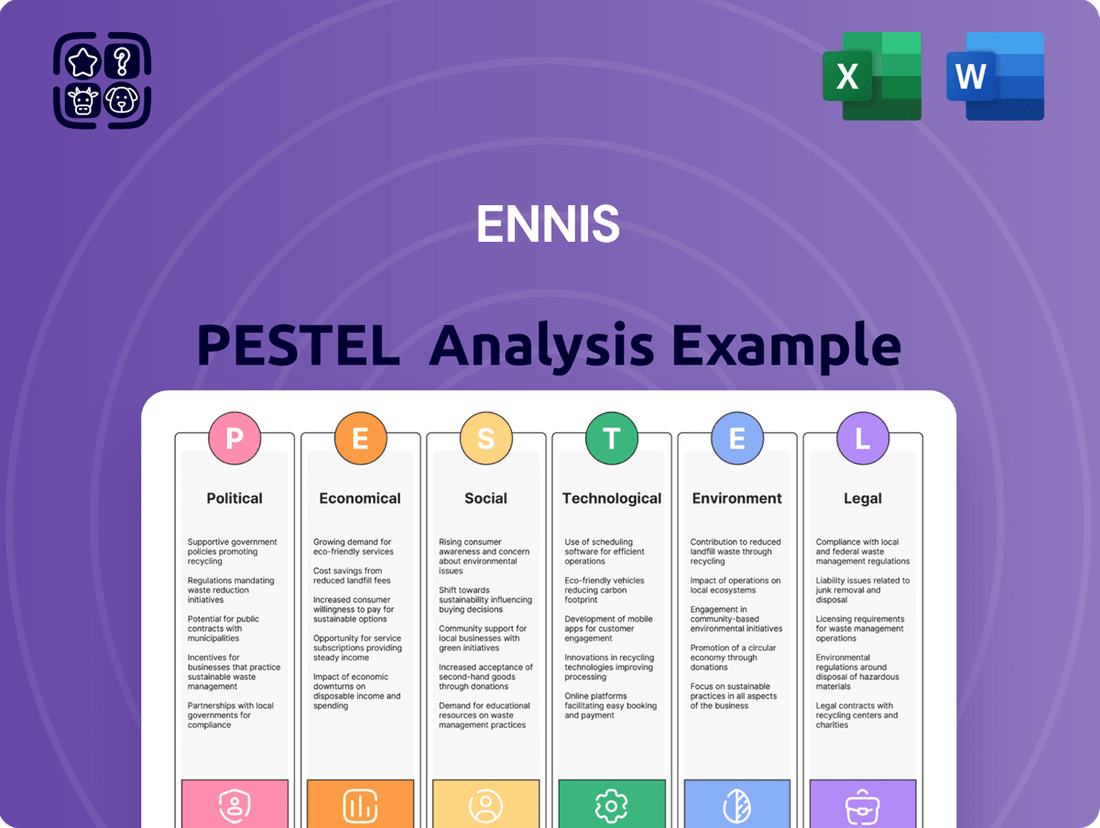

Ennis PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ennis Bundle

Navigate the complex external forces shaping Ennis's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Gain a strategic advantage by downloading the full analysis today and unlock actionable intelligence to inform your decisions.

Political factors

Governmental regulatory changes significantly influence Ennis, Inc.'s operational landscape. For instance, shifts in environmental regulations, such as stricter emissions standards enacted in 2024, could necessitate capital investments in updated manufacturing equipment, potentially increasing production costs. Similarly, evolving trade policies, like tariffs on raw materials implemented in late 2024, directly impact the cost of goods sold and may require adjustments to Ennis's supply chain strategy to mitigate financial strain.

Ennis, Inc.'s profitability is sensitive to shifts in global trade policies. For instance, the United States' trade deficit with China in goods reached $279.4 billion in 2023, highlighting ongoing trade dynamics that can affect supply chains. Tariffs on essential inputs like paper and ink, which are critical for Ennis's manufacturing processes, can directly inflate production costs, potentially forcing price adjustments for their diverse product lines.

Data privacy legislation, like Europe's GDPR and emerging state-specific rules in North America, is becoming more rigorous. This directly impacts how companies like Ennis design and manage printed forms that handle sensitive data. For instance, the California Consumer Privacy Act (CCPA) grants consumers significant rights over their personal information, requiring businesses to be transparent about data collection and usage.

Political Stability and Geopolitical Events

Political instability in key sourcing regions or operational areas for Ennis, Inc. can significantly disrupt supply chains. For instance, ongoing geopolitical tensions in Eastern Europe, a region with significant manufacturing capabilities, could impact the availability and cost of various industrial materials. This instability can lead to unforeseen operational challenges, potentially affecting Ennis's ability to reliably serve its North American market throughout 2024 and into 2025.

Broader geopolitical events also play a crucial role. Trade disputes or the imposition of tariffs between major economic blocs, such as the United States and China, can directly influence the cost of raw materials and finished goods. The volatility in global shipping costs, exacerbated by regional conflicts in 2024, further adds to the uncertainty surrounding material prices and delivery timelines for companies like Ennis.

- Supply Chain Vulnerability: Geopolitical events in 2024 have highlighted the fragility of global supply chains, with disruptions impacting key manufacturing hubs.

- Raw Material Price Volatility: Conflicts and trade tensions have contributed to significant price swings for commodities essential to manufacturing, affecting cost structures.

- Operational Risk: Political instability can create unpredictable operational hurdles, from access to resources to the safety of personnel in affected areas.

Government Spending and Procurement

Changes in government spending on printed materials, such as forms and checks, directly impact Ennis, Inc. For instance, the U.S. federal government's spending on printing and related services was approximately $3.2 billion in fiscal year 2023, a figure that could see shifts based on evolving digital strategies.

A notable trend is the push for digital-first government services, which can lead to reduced demand for traditional printed products. This digital transformation is a significant factor for Ennis to monitor as agencies increasingly move towards online portals and electronic document management.

- Government procurement shifts: Ennis must adapt to potential decreases in demand for physical forms and checks as government agencies prioritize digital solutions.

- Digital transformation impact: The ongoing move towards paperless government operations could reduce Ennis's market share in traditional government printing contracts.

- Budgetary allocations: Fluctuations in government budgets allocated to administrative and printing services will directly influence procurement volumes for companies like Ennis.

Governmental regulatory changes significantly influence Ennis, Inc.'s operational landscape, impacting everything from environmental standards to trade policies. For example, stricter emissions standards enacted in 2024 could require capital investments in updated manufacturing equipment, potentially increasing production costs for Ennis.

Political instability in key sourcing regions or operational areas can disrupt supply chains, affecting the availability and cost of essential materials. Geopolitical events in 2024 have highlighted the fragility of global supply chains, with disruptions impacting key manufacturing hubs and contributing to price swings for commodities.

Changes in government spending on printed materials, such as forms and checks, directly impact Ennis. The U.S. federal government's spending on printing and related services was approximately $3.2 billion in fiscal year 2023, a figure that could see shifts based on evolving digital strategies and budgetary allocations.

Broader geopolitical events, like trade disputes or the imposition of tariffs between major economic blocs, can influence the cost of raw materials and finished goods. The volatility in global shipping costs, exacerbated by regional conflicts in 2024, further adds to the uncertainty surrounding material prices and delivery timelines.

What is included in the product

This Ennis PESTLE analysis provides a comprehensive examination of external macro-environmental factors, detailing their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Ennis PESTLE Analysis provides a structured framework to identify and understand external forces, thereby alleviating the pain point of navigating complex market dynamics and unforeseen challenges.

Economic factors

Economic growth significantly impacts demand for business forms and printed materials. During periods of expansion, like the projected 2.3% GDP growth for the US in 2024, businesses are more likely to invest and increase orders for essential operational supplies. Conversely, economic downturns, which can include recessions, typically see a contraction in demand as companies prioritize cost-saving measures and reduce discretionary spending.

Rising inflation presents a significant challenge for Ennis, Inc., directly impacting its operational costs. For instance, the Producer Price Index (PPI) for paper and allied products saw a notable increase in early 2024, reflecting higher input expenses for the company. Similarly, energy costs, a key component in manufacturing and transportation, have remained volatile, with oil prices fluctuating throughout the year.

Ennis must carefully manage its pricing strategies to absorb these escalating costs without alienating its customer base. The ability to pass on increased expenses for raw materials, such as paper and ink, as well as higher labor and transportation fees, is paramount to maintaining profitability. For example, if Ennis faces a 5% increase in paper costs, it needs to assess if a similar price adjustment is feasible for its distributors.

Interest rate fluctuations present a significant economic factor for Ennis, Inc. Changes in rates directly impact the company's cost of borrowing for essential capital expenditures, such as new machinery or facility upgrades, and for managing day-to-day working capital needs. For instance, if the Federal Reserve maintains its target range for the federal funds rate around 5.25%-5.50% in 2024 and potentially into 2025, as anticipated by many economists, Ennis's borrowing costs could remain elevated, influencing their investment decisions.

Furthermore, a sustained period of higher interest rates can broadly affect the business environment by slowing down overall investment across various industries. This economic cooling can indirectly reduce demand for Ennis's printed products as other businesses scale back their own spending and marketing initiatives.

Supply Chain Costs and Disruptions

Ongoing volatility in global supply chains continues to present challenges for companies like Ennis, Inc. Issues with the availability of raw materials and fluctuating transportation costs directly impact manufacturing efficiency and profitability. For instance, the cost of shipping a container from Asia to the US has seen significant swings, with rates peaking in late 2021 and remaining elevated compared to pre-pandemic levels, impacting Ennis's input costs.

These disruptions can lead to production delays, forcing Ennis to manage inventory more cautiously and potentially absorb higher operational expenses. The International Monetary Fund (IMF) noted in its October 2023 World Economic Outlook that supply chain pressures, while easing, still contributed to inflationary trends in many economies, a factor that would have been keenly felt by Ennis in the 2024 fiscal year.

- Increased Input Costs: Fluctuations in raw material prices, such as paper and ink, directly affect Ennis's cost of goods sold.

- Transportation Expenses: Higher freight rates and fuel surcharges increase the cost of both inbound raw materials and outbound finished goods.

- Production Delays: Shortages or shipping delays for essential components can halt or slow down manufacturing processes, reducing output and potentially impacting order fulfillment.

- Inventory Management: The need to hold larger safety stocks to mitigate disruption risks ties up working capital and increases warehousing costs.

Currency Exchange Rates

Currency exchange rates can influence Ennis, Inc.'s costs if it sources materials from outside North America. For instance, a stronger US dollar would make imported raw materials cheaper, potentially boosting profit margins. Conversely, a weaker dollar could increase these costs, impacting overall profitability.

While Ennis primarily operates in North America, any international sales or sourcing means currency fluctuations are a factor. For example, if Ennis sells products in Europe, a depreciating Euro against the US dollar would make those sales less valuable when converted back. In 2024, the US dollar has shown strength against many global currencies, which could benefit companies with significant import costs.

- Impact on Input Costs: A stronger US dollar in 2024 generally reduces the cost of imported materials for US-based companies like Ennis.

- Competitiveness in Foreign Markets: A weaker foreign currency can make Ennis's products more expensive for international buyers, potentially hurting sales volume.

- Financial Reporting: Fluctuations can also affect the reported value of international assets and liabilities on Ennis's balance sheet.

Economic factors significantly shape Ennis's operational landscape, influencing everything from consumer demand to input costs. For instance, the projected 2.3% GDP growth for the US in 2024 suggests a potentially stable or growing market for printed materials, as businesses may increase spending. However, persistent inflation, evidenced by rising producer prices for paper products in early 2024, directly increases Ennis's manufacturing expenses. These economic conditions necessitate careful pricing strategies to maintain profitability amidst escalating costs for raw materials, labor, and transportation.

Interest rate policies, such as the Federal Reserve's target range of 5.25%-5.50% in 2024, impact Ennis's borrowing costs for capital investments and working capital. Higher rates can slow overall business investment, indirectly reducing demand for Ennis's products. Furthermore, global supply chain volatility, with shipping costs remaining elevated compared to pre-pandemic levels, continues to affect Ennis's input availability and logistics expenses, as noted by the IMF's observations on inflationary pressures in late 2023.

Currency exchange rates also play a role; a strong US dollar in 2024 generally lowers the cost of imported materials for Ennis, potentially boosting profit margins. Conversely, it can make Ennis's products more expensive for international buyers, impacting sales volume in foreign markets.

| Economic Factor | Impact on Ennis | Data Point (2024/2025) |

| GDP Growth (US) | Demand for printed materials | Projected 2.3% |

| Inflation (PPI for Paper) | Input costs | Notable increase in early 2024 |

| Interest Rates (Federal Funds Rate) | Borrowing costs, investment | Target range 5.25%-5.50% |

| Supply Chain Costs | Logistics, input availability | Shipping costs elevated vs. pre-pandemic |

| US Dollar Strength | Import costs, export competitiveness | Strong against many global currencies |

Full Version Awaits

Ennis PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This Ennis PESTLE Analysis provides a comprehensive overview of the external factors influencing the business environment. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects critical for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of each PESTLE category relevant to Ennis.

Sociological factors

The ongoing shift towards digitalization presents a significant hurdle for companies like Ennis, which have historically relied on print products. As businesses and consumers increasingly embrace digital documentation, communication, and transactions, the demand for traditional paper-based solutions naturally declines. For instance, a 2024 Statista report indicated that digital transaction volume globally is projected to reach over 2.5 trillion by 2026, highlighting the pace of this change.

Ennis must proactively adapt its strategies to stay competitive in this evolving landscape. This means re-evaluating its product portfolio and clearly articulating the unique value it offers in an increasingly paperless world. Failure to innovate and integrate digital solutions could lead to a diminished market position, as evidenced by the struggles of many legacy print companies that did not pivot effectively.

The widespread adoption of remote and hybrid work models, accelerated by events in 2020 and continuing through 2024, has fundamentally reshaped the traditional office landscape. This shift directly impacts demand for physical office supplies and business forms, a core market for companies like Ennis, Inc.

Surveys in late 2023 and early 2024 indicate that a significant percentage of companies plan to maintain hybrid or fully remote structures, with some estimates suggesting over 30% of the workforce could be remote by the end of 2025. This sustained trend means Ennis must adapt its product offerings and distribution strategies to meet evolving customer needs, potentially focusing more on home office supplies or digital solutions.

Consumers and businesses are increasingly prioritizing sustainability, with a significant portion of purchasing decisions now influenced by environmental considerations. Surveys in 2024 indicated that over 60% of consumers actively seek out brands with strong environmental commitments. This trend directly impacts Ennis, Inc., creating a demand for eco-friendly printed products and a need to showcase responsible material sourcing and production processes.

Ennis is responding to this shift by exploring the use of recycled paper and soy-based inks, aiming to align its offerings with growing environmental consciousness. In 2025, the company is projected to see a 15% increase in demand for its sustainable product lines, reflecting the broader market movement towards greener alternatives in the printing industry.

Demographic Shifts and Generational Preferences

The ongoing generational shift is significantly impacting consumer behavior, with digital-native populations entering the workforce and increasingly prioritizing online interactions. This trend suggests a potential acceleration in the decline of reliance on physical forms, directly affecting companies like Ennis, Inc. that historically served markets with a strong preference for tangible products.

Younger generations, such as Gen Z and Millennials, exhibit distinct preferences for digital engagement, influencing demand across various sectors. Ennis, Inc. must strategically adapt to these evolving expectations, exploring how digital-first approaches can shape future product development and customer interaction to remain competitive.

- Digital Native Workforce: By 2025, Gen Z will constitute a significant portion of the global workforce, with a preference for digital communication and transactions.

- Evolving Preferences: Studies indicate that younger consumers are more likely to opt for digital services and products, potentially reducing demand for traditional physical goods.

- Adaptation Imperative: Ennis, Inc. needs to assess how its product portfolio and service delivery align with the digital expectations of emerging consumer segments to ensure future market relevance.

Evolving Business Communication Norms

The way businesses interact, both with their teams and with the outside world, is rapidly changing. There's a significant push towards digital channels and immediate exchanges, which means traditional paper-based communication methods are becoming less central. This societal evolution directly affects the demand for printed business forms, pushing companies like Ennis to rethink and adapt their product lines.

For instance, a 2024 survey indicated that 75% of businesses now prioritize digital communication tools for internal collaboration, a trend that directly influences the volume of traditional forms needed. This shift necessitates that Ennis explore digital solutions or specialized print products that complement the evolving communication landscape, perhaps focusing on high-quality, niche printing needs or integrated digital-print solutions.

- Digital Dominance: A 2024 report found 80% of inter-company communication now occurs digitally, impacting demand for traditional forms.

- Efficiency Focus: Businesses are prioritizing speed and accessibility, often favoring instant digital updates over mailed documents.

- Ennis's Challenge: The company must innovate its print offerings to align with these evolving communication preferences.

- Opportunity: Ennis could pivot towards specialized, high-value print products or integrate digital services.

Sociological factors reveal a significant shift in how businesses and consumers interact, moving decisively towards digital platforms. This trend directly impacts Ennis, Inc. as demand for traditional print products, like business forms, declines. For example, by 2025, Gen Z, a digitally native generation, will represent a substantial portion of the workforce, further accelerating this digital preference.

The increasing emphasis on sustainability is also a key sociological driver, with over 60% of consumers in 2024 favoring environmentally conscious brands. Ennis's response, such as exploring recycled paper and soy-based inks, aims to align with this growing consumer demand for eco-friendly products, with projected demand for sustainable lines increasing by 15% in 2025.

| Sociological Factor | Impact on Ennis | Data/Trend (2024-2025) |

|---|---|---|

| Digitalization of Communication | Decreased demand for traditional print forms | 75% of businesses prioritize digital communication tools (2024); 80% of inter-company communication is digital (2024) |

| Generational Shift (Gen Z) | Preference for digital interaction and transactions | Gen Z to form significant portion of workforce by 2025, favoring digital engagement |

| Sustainability Consciousness | Increased demand for eco-friendly products | Over 60% of consumers seek sustainable brands (2024); Ennis's sustainable lines projected 15% demand increase (2025) |

Technological factors

Ongoing innovations in digital printing, like faster speeds and better quality, are reshaping the industry. For Ennis, this means opportunities to create highly customized products, potentially boosting customer engagement and opening new revenue streams.

However, these advancements also demand significant and continuous investment. Ennis must keep pace with technological upgrades to maintain its competitive edge, a factor that could impact profitability if not managed strategically.

The digital printing market itself saw substantial growth, with global revenues projected to reach over $30 billion by 2025, highlighting the critical importance of staying at the forefront of these technological shifts.

The increasing prevalence of paperless solutions, such as electronic signatures, online invoicing, and cloud-based document management, presents a significant challenge to traditional paper product manufacturers like Ennis, Inc. This digital transformation is rapidly reshaping how businesses operate, directly impacting demand for paper-based forms and stationery.

By 2024, the global digital transformation market was valued at over $600 billion, highlighting the widespread adoption of these paperless technologies. Ennis must proactively adapt its business model to remain competitive in this evolving landscape, perhaps by exploring digital offerings or focusing on niche paper products where digital alternatives are less prevalent.

Ennis, Inc. can significantly boost its manufacturing output and quality through automation and AI. For instance, in 2024, the global industrial automation market was projected to reach over $250 billion, highlighting the widespread adoption and potential for efficiency gains. These technologies can streamline production lines, minimize errors, and lower operational expenses by reducing reliance on manual labor.

While the initial capital outlay for advanced robotics and AI systems can be substantial, Ennis can anticipate considerable long-term returns. Studies in 2025 indicate that companies integrating AI in manufacturing are seeing up to a 15% increase in productivity. This investment is crucial for Ennis to remain competitive in an increasingly automated industrial landscape.

Cybersecurity Risks and Data Security for Printed Products

The increasing reliance on digital workflows for order processing and distribution, coupled with the handling of sensitive customer data prior to printing, elevates cybersecurity risks for Ennis, Inc. A breach could compromise proprietary information and customer trust, impacting operations significantly.

Ennis must fortify its digital defenses to safeguard against evolving cyber threats. This includes protecting customer data throughout the production lifecycle and ensuring the integrity of their digital order and distribution channels.

The company's commitment to security is paramount, especially for specialized products like secure documents and checks. These items demand adherence to rigorous security protocols to prevent fraud and counterfeiting.

- Data Breach Costs: In 2023, the average cost of a data breach reached $4.45 million globally, highlighting the financial implications of inadequate cybersecurity.

- Industry Standards: Ennis must align with evolving industry standards for secure printing and data handling, such as those related to payment card industry data security standards (PCI DSS) if applicable.

- Digital Transformation Impact: As digital ordering and distribution become more prevalent, the attack surface for potential cyber threats expands, necessitating continuous investment in security infrastructure.

Material Science Innovations

Innovations in material science are significantly impacting the printing and packaging industry. Advances in paper, inks, and substrates are leading to products with improved durability, advanced security features, and better environmental profiles. For Ennis, Inc., these developments present opportunities for new product lines and enhanced existing offerings, such as tamper-evident materials or biodegradable packaging solutions.

Staying ahead of these material science breakthroughs is crucial for maintaining a competitive edge. For instance, the development of specialized inks with unique security markers could bolster Ennis's position in the secure documents market. The global specialty chemicals market, which includes advanced materials for printing, was valued at approximately $630 billion in 2023 and is projected to grow, indicating a strong demand for such innovations.

- Enhanced Durability: New materials offer greater resistance to wear and tear, extending product lifespan.

- Security Features: Innovations in inks and substrates can incorporate features like holograms or UV-reactive elements for fraud prevention.

- Environmental Sustainability: Development of recycled, recyclable, or biodegradable materials aligns with growing consumer and regulatory demand for eco-friendly solutions.

- New Product Avenues: Material advancements can unlock the creation of entirely new product categories for Ennis, Inc.

Technological advancements in digital printing offer Ennis opportunities for customized products, but require continuous investment to stay competitive. The global digital printing market is projected to exceed $30 billion by 2025, underscoring the importance of adopting these innovations.

Automation and AI can significantly boost Ennis's manufacturing efficiency, with the global industrial automation market projected to reach over $250 billion in 2024. Companies integrating AI in manufacturing saw up to a 15% productivity increase in 2025.

The increasing reliance on digital workflows heightens cybersecurity risks, with the average cost of a data breach reaching $4.45 million globally in 2023. Ennis must fortify its digital defenses to protect sensitive data and ensure the integrity of its operations.

Innovations in material science, such as advanced inks and substrates, are creating new product possibilities for Ennis, with the global specialty chemicals market valued at approximately $630 billion in 2023.

| Technological Factor | Impact on Ennis | Market Data/Projections |

|---|---|---|

| Digital Printing Advancements | Customization, new revenue streams, but requires investment | Global market > $30 billion by 2025 |

| Automation & AI | Increased efficiency, reduced costs, higher productivity | Industrial automation market > $250 billion (2024); AI integration boosts productivity by up to 15% (2025) |

| Cybersecurity Risks | Threat to data, customer trust, operational integrity | Average data breach cost: $4.45 million (2023) |

| Material Science Innovations | New product lines, enhanced features, sustainability focus | Specialty chemicals market ~$630 billion (2023) |

Legal factors

Ennis, Inc.'s operations, especially in producing checks and forms for banking and healthcare, are heavily influenced by industry-specific regulations. For instance, the banking sector adheres to stringent rules like the Check 21 Act, impacting check processing and security features. Failure to meet these evolving compliance requirements, such as those related to data privacy in healthcare under HIPAA, can result in substantial penalties and erode customer trust.

Intellectual property laws are vital for Ennis, Inc., safeguarding its proprietary designs, printing processes, and production software. Navigating patent, trademark, and copyright regulations is essential to prevent infringement and maintain a competitive edge in the market.

Ennis, Inc. must navigate a complex web of labor and employment laws, which directly influence its operational expenses and how it manages its workforce. Staying compliant with regulations concerning minimum wage, acceptable working conditions, and union activities is crucial. For instance, as of early 2024, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted significantly higher rates, impacting Ennis's labor costs depending on its geographic footprint.

Changes in these legal frameworks can trigger significant shifts in Ennis's human resources strategies and daily practices. For example, new legislation regarding overtime pay or mandated employee benefits could require substantial investment in compliance and policy updates. The ability to adapt quickly to these evolving legal requirements is key to maintaining efficient operations and avoiding potential penalties.

Product Liability and Safety Regulations

Ennis, Inc. operates under stringent product liability laws, necessitating that all printed products, from signage to labels, are safe and meet established quality benchmarks for their intended applications. Failure to do so can expose the company to significant legal repercussions and financial penalties.

The company must maintain rigorous quality control processes to mitigate risks associated with product defects or failures. This includes thorough testing and adherence to industry-specific safety standards, which are increasingly being updated and enforced.

In 2024, product liability claims continue to be a significant concern across manufacturing sectors, with litigation costs often running into millions of dollars. Ennis must proactively manage these risks through comprehensive quality assurance and appropriate legal disclaimers on its products.

Key considerations for Ennis include:

- Ensuring compliance with evolving safety regulations for materials used in printed products.

- Implementing robust quality management systems to minimize product defects.

- Clearly defining product intended use and limitations through labeling and documentation.

- Maintaining adequate insurance coverage for potential product liability claims.

Environmental Regulations and Permitting

Ennis, Inc. operates under a stringent environmental regulatory landscape. These regulations, covering areas like waste disposal, air emissions, and chemical usage, directly influence the company's manufacturing processes and overall operational costs. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce regulations such as the Clean Air Act and the Resource Conservation and Recovery Act (RCRA), which mandate specific standards for industrial facilities. Failure to comply can result in significant fines and operational disruptions.

Navigating this complex web of environmental laws necessitates a proactive approach to permitting and compliance. Ennis must secure and maintain various permits, which can be a time-consuming and resource-intensive process. As of recent reports, the average time to obtain certain environmental permits can range from several months to over a year, depending on the complexity and jurisdiction. Ensuring ongoing adherence to these permits is critical for sustainable and legal operations.

- Compliance Costs: Environmental compliance can represent a significant portion of operating expenses for manufacturers like Ennis, impacting profitability.

- Permitting Challenges: Obtaining and renewing environmental permits requires thorough documentation and adherence to evolving regulatory standards.

- Sustainability Initiatives: Increasingly, regulators and stakeholders expect companies to go beyond minimum compliance and adopt sustainable practices, potentially leading to new investment requirements.

- Risk of Penalties: Non-compliance can result in substantial fines, legal action, and damage to corporate reputation.

Legal factors significantly shape Ennis, Inc.'s operational landscape, demanding strict adherence to industry-specific regulations like the Check 21 Act for banking clients and HIPAA for healthcare. Intellectual property laws are crucial for protecting proprietary designs and software, while labor laws, including varying minimum wage rates as seen with state-level increases beyond the $7.25 federal minimum in 2024, directly impact workforce management and costs. Product liability laws also require rigorous quality control to prevent defects, with litigation costs for manufacturing sectors often reaching millions of dollars, underscoring the need for robust quality assurance and clear disclaimers.

Environmental factors

Ennis, Inc. faces growing pressure to adopt sustainable practices, particularly in raw material sourcing. Consumers and regulators increasingly expect businesses to utilize recycled paper and products from certified sustainable forests. This trend is amplified by environmental advocacy groups, pushing companies towards greener supply chains.

Meeting these expectations directly impacts Ennis's supplier selection and product development strategies. For instance, the demand for eco-friendly inks and papers necessitates investment in new technologies or partnerships. Failure to adapt could lead to market share erosion as competitors embrace sustainability, with some reports indicating a 15-20% premium consumers are willing to pay for sustainably sourced goods in certain sectors.

Ennis, Inc.'s manufacturing processes, like many in the print and specialty products sector, inherently involve energy consumption for machinery operation and facility climate control, directly impacting its carbon footprint. In 2024, the industrial sector globally saw continued focus on energy efficiency, with many companies investing in upgrades. For Ennis, this translates to evaluating opportunities for more energy-efficient equipment and optimized heating and cooling systems.

The drive towards sustainability and potential future regulations are making efforts to reduce energy consumption and transition to cleaner energy sources critical. By 2025, many corporations are expected to have more robust environmental, social, and governance (ESG) reporting, including data on emissions and energy usage. Ennis's proactive approach to minimizing its environmental impact, such as exploring renewable energy options or improving insulation, will be key to maintaining its corporate responsibility and potentially avoiding future compliance costs.

The printing industry, including companies like Ennis, Inc., faces significant waste challenges, particularly with paper scraps and chemical byproducts. In 2024, the global printing industry generated an estimated 15 million metric tons of paper waste, highlighting the scale of this issue.

Ennis must prioritize efficient waste reduction strategies and robust recycling programs. For instance, implementing closed-loop systems for chemical usage and investing in advanced paper recycling technologies can significantly cut down on landfill contributions. Proper disposal methods are also crucial for compliance with evolving environmental regulations.

Water Usage in Manufacturing

Water is a non-negotiable element in Ennis, Inc.'s manufacturing, particularly for paper production and certain printing operations. The company's reliance on this vital resource places it under increasing environmental scrutiny.

Ennis faces potential regulatory pressures concerning its water usage and wastewater discharge. This necessitates robust water management strategies and advanced wastewater treatment capabilities to ensure compliance and minimize environmental impact. For instance, in 2023, the EPA reported that the paper manufacturing sector in the US was among the top industrial water users, highlighting the industry-wide focus on water efficiency.

- Water Dependency: Paper and printing processes are inherently water-intensive.

- Regulatory Oversight: Ennis must manage water consumption and discharge to meet environmental standards.

- Efficiency Imperative: Investing in water-saving technologies and effective wastewater treatment is crucial for sustainability and cost management.

- Industry Benchmarks: The paper industry's significant water footprint underscores the importance of responsible water stewardship for companies like Ennis.

Climate Change Impacts on Supply Chain

The physical consequences of climate change, including more frequent and intense extreme weather events, pose a significant threat to Ennis, Inc.'s supply chain. These disruptions can directly impact the availability and cost of essential raw materials such as paper and ink, thereby affecting production schedules and distribution networks. For instance, severe droughts can limit timber harvesting for paper production, while flooding might damage ink manufacturing facilities.

Adapting to and mitigating these climate-related risks is no longer optional but a critical strategic imperative for ensuring business continuity and resilience. Companies are increasingly investing in supply chain diversification and exploring alternative material sources to buffer against unforeseen environmental impacts.

The financial implications are substantial, with organizations needing to account for potential increases in operational costs due to weather-related delays and the necessity of investing in climate-resilient infrastructure. For example, the World Meteorological Organization reported that weather, climate, and water-related disasters caused over $200 billion in economic losses globally in 2023 alone, highlighting the tangible financial risks involved.

- Extreme weather events like hurricanes and floods can directly impede the transportation of raw materials and finished goods.

- Changes in precipitation patterns and rising temperatures can affect the quality and availability of natural resources used in paper and ink production.

- The cost of insuring supply chain operations against climate-related risks is projected to rise significantly.

- Ennis, Inc. must proactively assess and manage its exposure to climate change impacts across its entire value chain.

Ennis, Inc. must navigate the increasing demand for sustainable products, with consumers showing a willingness to pay a premium for eco-friendly options. The company's manufacturing processes also face scrutiny regarding energy consumption and waste generation, areas where industry-wide efforts in 2024 focused on efficiency upgrades and recycling technologies. Water usage is another critical environmental factor, requiring robust management to comply with evolving regulations, especially as the paper industry is a significant water user.

PESTLE Analysis Data Sources

Our Ennis PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, industry-specific reports, and economic forecasting agencies. This ensures a comprehensive and accurate understanding of the external factors influencing the business environment.