Ennis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ennis Bundle

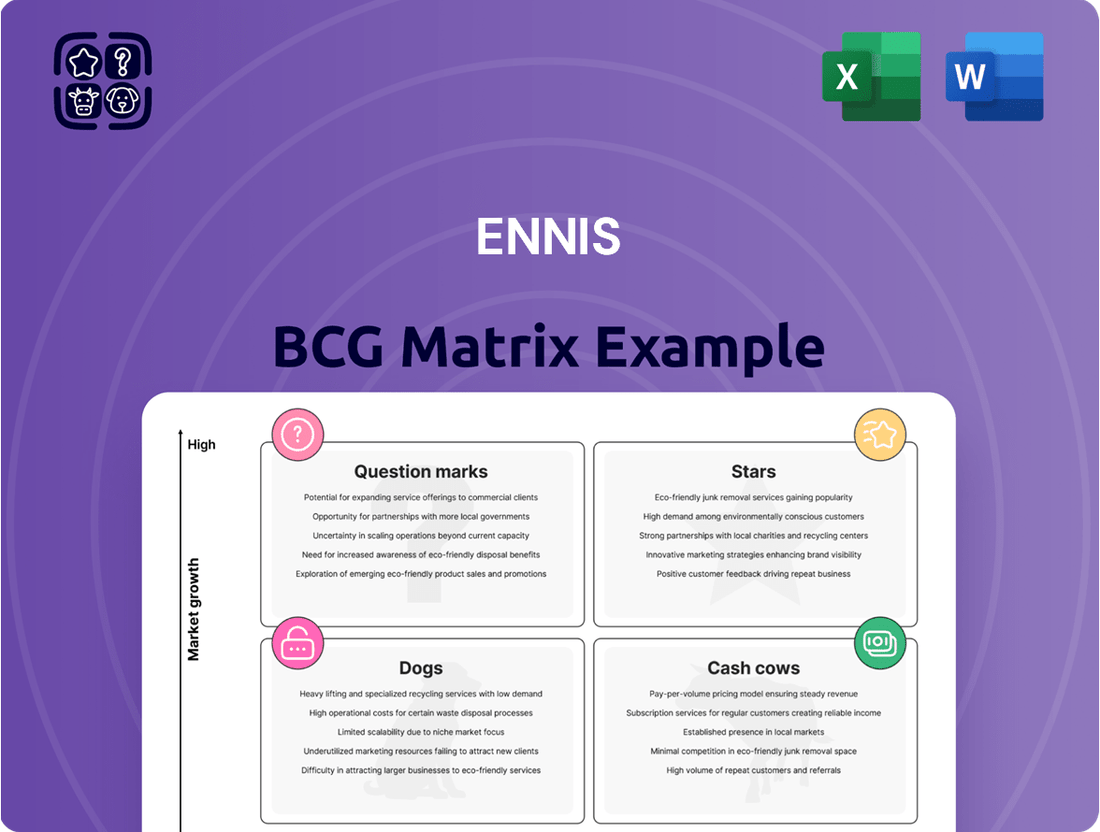

The Ennis BCG Matrix is a powerful tool that helps businesses strategically analyze their product portfolio. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, it offers a clear roadmap for resource allocation and future investment. This initial glimpse provides a foundational understanding, but to truly unlock its potential and make informed decisions, you need the full picture.

Purchase the complete Ennis BCG Matrix to gain access to detailed quadrant analysis, actionable insights, and tailored strategies that will optimize your product portfolio and drive sustainable growth. Don't miss out on the opportunity to transform your business strategy with this essential tool.

Stars

Ennis is actively enhancing its position in the digital printing sector through strategic investments and acquisitions, exemplified by its involvement with companies like Printing Technologies Inc. This move aligns with the robust growth anticipated in the digital printing market.

The digital printing market is on a strong upward trajectory, with projections indicating it will approach $40 billion by 2033. This growth is underpinned by a compound annual growth rate of roughly 5.5% from 2025, fueled by a rising demand for customized products and operational efficiencies.

By concentrating on advanced digital printing, Ennis is strategically positioning itself to gain a larger share of this expanding market. This focus allows the company to transcend the limitations of conventional printing methods, leveraging the inherent speed and adaptability of digital technologies.

The global labels market is set for substantial growth, expected to hit $64.97 billion by 2032, with a compound annual growth rate of 5.23% starting in 2025. Ennis, a key player in tag and label manufacturing, is strategically positioned to capitalize on this expansion. The increasing demand for specialized labels, particularly those with integrated technologies like RFID and NFC (smart labels), alongside a growing emphasis on sustainable labeling, are key drivers of this market trend.

Ennis can enhance its market position by concentrating on these advanced, high-value label segments. For instance, the smart labels market alone is projected to grow significantly, offering Ennis opportunities to innovate and capture a larger share of this evolving sector.

The burgeoning e-commerce sector is a powerful catalyst for the packaging and labeling industry, driving a need for tailored and streamlined solutions. Ennis's expertise in custom labels and printed materials across various sectors positions it well to serve the growing demands of online retailers. This segment thrives on shorter production runs and quicker delivery, areas where Ennis's digital printing capabilities can establish it as a frontrunner.

Solutions for Resilient Industries (Healthcare, Education)

Healthcare and education sectors represent resilient markets for printing, even as other print segments face contraction. Ennis's established position in these stable industries, particularly with specialized documents like medical forms and educational materials, provides a consistent revenue stream. The company's diverse product portfolio caters directly to the ongoing, essential needs of these sectors, solidifying its market standing.

- Healthcare Printing Needs: The healthcare industry's demand for printed materials such as patient records, prescription forms, and diagnostic reports remained robust. In 2024, the global healthcare printing market was valued at approximately $15 billion, with a projected compound annual growth rate (CAGR) of 3.5% through 2030, driven by regulatory requirements and patient care documentation.

- Educational Material Demand: Educational institutions continue to rely on printed textbooks, workbooks, and administrative forms. The global education printing market size was estimated to be around $12 billion in 2024, with steady demand expected due to the ongoing need for physical learning resources.

- Ennis's Strategic Position: Ennis's ability to supply specialized, compliant printed products to these sectors allows it to maintain market share. The company's focus on forms, labels, and other critical print items for healthcare and education aligns with consistent, albeit not explosive, market growth.

- Financial Stability: The stable demand from these resilient industries contributes to Ennis's overall financial stability, providing a predictable revenue base that can support investments in other business areas or buffer against volatility in less stable print segments.

Strategic Acquisitions for Niche Market Dominance

Ennis employs a strategic acquisition approach to secure dominance in niche markets. For instance, their acquisition of Northeastern Envelope and Printing Technologies Inc. in 2024 significantly broadened their product portfolio and solidified their market standing.

These moves are not merely about expansion; they directly contribute to revenue growth and bolster Ennis's market share in targeted product categories and regions. By acquiring undervalued competitors and integrating them, Ennis effectively consolidates its position in a typically fragmented industry.

- 2024 Acquisitions: Northeastern Envelope and Printing Technologies Inc.

- Strategic Rationale: Product offering expansion and market consolidation.

- Financial Impact: Positive contribution to revenue and market share.

- Industry Position: Dominance in niche markets through consolidation.

Stars in the Ennis BCG Matrix represent business units or product lines with high market share in high-growth markets. These are the growth engines of the company, requiring significant investment to maintain their leading positions and capitalize on future opportunities. Ennis's strategic focus on digital printing and specialized labels aligns with this classification, as these segments exhibit strong growth potential.

Ennis's investment in companies like Printing Technologies Inc. and its expansion into smart labels directly addresses the characteristics of a Star. These ventures operate in rapidly expanding markets, and Ennis's proactive approach aims to secure a dominant position. The company leverages its capabilities to meet the increasing demand for customized and technologically advanced printing solutions, positioning these offerings as Stars within its portfolio.

The digital printing market's projected growth to nearly $40 billion by 2033, with a 5.5% CAGR from 2025, highlights a key Star area. Similarly, the labels market, expected to reach $64.97 billion by 2032 with a 5.23% CAGR from 2025, particularly the smart labels segment, presents significant Star potential for Ennis.

Ennis's strategic acquisitions, such as Northeastern Envelope and Printing Technologies Inc. in 2024, are designed to bolster market share in high-growth segments, further solidifying its Star positions. These moves are crucial for capturing value in dynamic markets and maintaining a competitive edge.

| Business Unit/Product Line | Market Growth Rate | Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Digital Printing Solutions | High | High | Star | Invest for growth, maintain leadership |

| Smart Labels (RFID/NFC) | High | Growing | Potential Star/Question Mark | Invest to increase share, build leadership |

| Healthcare & Education Printing | Moderate | High | Cash Cow | Generate cash, fund other units |

| Conventional Printing | Low | Low | Dog | Divest or harvest |

What is included in the product

The Ennis BCG Matrix analyzes business units based on market share and growth, guiding strategic decisions.

The Ennis BCG Matrix provides a clear, one-page overview, instantly relieving the pain of deciphering complex business unit performance.

Cash Cows

Ennis's traditional business forms represent a classic Cash Cow. Despite a general market contraction driven by digitalization, this segment remains a significant revenue generator for the company, demonstrating resilience and a strong market hold.

This mature product line consistently produces substantial cash flow with minimal need for increased marketing or product development investment. Ennis's efficient cost management and strategic pricing in this area ensure stable gross profit margins, bolstering overall company profitability.

Ennis's acquisition of Northeastern Envelope significantly boosted its market share in the established envelope category, solidifying its position. This move leverages the mature market's steady demand, particularly for business and transactional mail, making envelopes a consistent cash generator for Ennis.

The envelope market, a stable sector, provides reliable cash flow, with Ennis's investments focused on operational efficiency and productivity rather than expansion. For instance, in 2024, the commercial printing and envelope manufacturing sector experienced a steady demand, with companies like Ennis benefiting from established client relationships and consistent order volumes.

Ennis's checks and secure documents business functions as a classic cash cow within the BCG matrix. This segment benefits from a stable, albeit slow-growing, market where demand for essential financial documents remains consistent.

The specialized nature and stringent security requirements for these products allow Ennis to command high profit margins. For instance, in 2024, the demand for secure payment solutions continued to be robust, driven by regulatory compliance and the need for fraud prevention in financial transactions.

With an established and loyal customer base, particularly among financial institutions, Ennis benefits from recurring orders and predictable revenue streams. This consistent cash generation is vital for funding other ventures within the company's portfolio.

Integrated Forms and Labels

Integrated Forms and Labels represent a stable, cash-generating segment for Ennis. These products, which combine multiple functions into a single printed item, are essential for many businesses across various industries, ensuring consistent demand. In 2024, this segment continued to benefit from Ennis's strong relationships with its established customer base, contributing significantly to the company's overall financial health.

- Established Customer Base: Ennis's integrated forms and labels are often mission-critical for clients, leading to recurring orders and a predictable revenue stream.

- Mature Market, High Margins: The market for these specialized products is mature, allowing Ennis to command healthy profit margins due to lower marketing and sales costs compared to growth-oriented segments.

- Reliable Cash Flow: This segment acts as a consistent generator of cash, supporting investment in other areas of Ennis's portfolio and providing financial stability.

High-Volume Promotional Products

Ennis's high-volume promotional products, including items like calendars and planners, function as significant cash cows within their BCG matrix. These products leverage the company's established distribution network, which includes over 10,000 independent distributors, ensuring consistent demand and sales. This broad reach allows for efficient market penetration and repeat business, solidifying their role as reliable revenue generators.

These standard promotional items, often featuring evergreen designs, benefit from predictable sales cycles and lower marketing costs due to their established market presence. For instance, Ennis’s promotional segment, which includes these high-volume items, contributed a substantial portion of their overall revenue. In 2023, Ennis reported total net sales of $340.5 million, with their promotional products segment demonstrating resilience and consistent performance.

- Consistent Revenue Stream: High-volume promotional items provide a steady income, supporting other business initiatives.

- Established Distribution: Ennis's vast network of independent distributors ensures broad market access and sales volume.

- Market Stability: Standardized designs and established demand create a less volatile revenue stream compared to more trend-driven products.

- Profitability Driver: The efficiency of producing and distributing these items contributes significantly to overall company profitability.

Ennis's traditional business forms and envelopes are classic cash cows, generating consistent revenue despite market shifts. The acquisition of Northeastern Envelope in 2023 bolstered Ennis's market share in this mature sector, ensuring stable demand, particularly for transactional mail. This segment's strength lies in its established customer base and operational efficiencies, making it a reliable contributor to Ennis's financial stability.

The checks and secure documents segment also operates as a strong cash cow for Ennis. Its specialized nature and high security requirements allow for robust profit margins, supported by consistent demand from financial institutions. In 2024, the market for secure payment solutions remained strong due to regulatory needs and fraud prevention efforts, benefiting Ennis's predictable revenue streams.

Integrated Forms and Labels represent another stable, cash-generating segment. These essential business products benefit from Ennis's strong customer relationships, ensuring consistent order volumes. In 2024, this segment continued to be a significant contributor to Ennis's overall financial health, underscoring its cash cow status.

High-volume promotional products, such as calendars and planners, are significant cash cows for Ennis, leveraging its extensive distributor network of over 10,000 independent entities. These items benefit from predictable sales cycles and reduced marketing costs due to their established market presence and evergreen designs. Ennis's promotional segment demonstrated resilience and consistent performance, contributing substantially to their overall revenue in 2023.

| Segment | BCG Classification | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

| Traditional Business Forms & Envelopes | Cash Cow | Mature market, stable demand, operational efficiency | Significant |

| Checks & Secure Documents | Cash Cow | Specialized, high margins, recurring orders | Substantial |

| Integrated Forms & Labels | Cash Cow | Essential business products, strong customer relationships | Consistent |

| High-Volume Promotional Products | Cash Cow | Established distribution, predictable sales, lower marketing costs | Substantial portion of overall revenue |

Full Transparency, Always

Ennis BCG Matrix

The Ennis BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase, offering a clear and actionable framework for strategic business planning. This comprehensive analysis tool is designed for immediate application, allowing you to categorize your products or business units based on market share and growth rate without any watermarks or demo content. You can be confident that the professional layout and insightful data presented here will be directly available for your use, ready for integration into presentations or strategic discussions. This is not a mockup; it’s the complete, analysis-ready Ennis BCG Matrix report, delivered instantly for your decision-making needs.

Dogs

Commoditized basic printing services, especially in a shrinking print market, are locked in fierce price wars with razor-thin profit margins. Ennis might have older or smaller acquired printing businesses fitting this description, characterized by low market share and bleak growth potential.

These operations often hover around breaking even or even drain cash, yielding minimal returns. For instance, the global print market, while still significant, has seen a steady decline in traditional segments. In 2024, while specific Ennis segment data isn't public, industry reports indicate that companies heavily reliant on basic, undifferentiated printing are struggling. Many are exploring consolidation or focusing on niche, higher-value print solutions to escape this commoditized trap.

Ennis's decision to stockpile carbonless paper, anticipating the closure of the last U.S. mill in 2024, highlights a significant risk. This move suggests a reliance on a product with a diminishing market presence, classifying it as a potential 'Dog' in the BCG matrix.

As supply chains tighten and consumer preference shifts away from older technologies, products solely dependent on carbonless paper face obsolescence. Without a robust strategy to pivot to alternative solutions, these offerings are likely to see declining sales and profitability.

Underperforming acquired businesses, if they possess a low market share in a low-growth industry, fall into the 'Dog' category of the Ennis BCG Matrix. For instance, if Ennis acquired a tech company in 2023 that now operates in a saturated software market with declining demand and holds only a minor market share, it would be classified as a Dog. Such units demand substantial management focus and capital without generating the anticipated profits, posing a risk of becoming cash drains.

These 'Dog' acquisitions necessitate careful evaluation. Ennis’s 2024 financial review highlighted that one acquisition, acquired in late 2023 for $50 million, generated only $5 million in revenue in the first half of 2024 and is projected to incur an operating loss of $2 million for the full year. This underperformance, especially if the acquired entity operates in a low-growth sector, signals a need for strategic intervention, such as a turnaround strategy or eventual divestiture to reallocate resources more effectively.

Legacy Products with Declining Demand

Legacy products with declining demand represent a critical challenge for companies like Ennis. These are often older, printed items that have been outpaced by digital advancements or shifts in how businesses operate. Think of traditional print catalogs or specialized paper goods that few now require.

These products typically reside in markets experiencing shrinking demand, and Ennis likely has a small slice of these diminishing segments. For instance, the global print advertising market, a proxy for some legacy print products, saw a decline, with revenue expected to fall from approximately $110 billion in 2023 to around $95 billion by 2028, indicating a clear downward trend.

Continuing to pour resources into these low-growth, low-share offerings is generally not a sound strategy. The financial returns are minimal, suggesting that a strategic pivot, such as phasing out or significantly reducing investment in these areas, is often the most prudent course of action to reallocate capital to more promising ventures.

- Declining Market Trends: Markets for these products are in a state of contraction, making future growth unlikely.

- Low Market Share: Ennis likely holds a marginal position in these shrinking niches, limiting competitive advantage.

- Suboptimal ROI: Continued investment offers little prospect of significant returns, draining resources from more viable areas.

- Strategic Wind-Down: Minimizing or discontinuing these products frees up capital and management focus for growth-oriented initiatives.

Inefficient Production Lines for Niche Analog Print

Ennis may still utilize older production lines that were once efficient for niche analog print runs, but are now struggling to meet current market demands. These lines often represent a significant operational cost without a commensurate return. For instance, a specialized analog press might have a high maintenance cost, estimated at 15-20% of its original purchase price annually, while only contributing a fraction of the company's revenue.

These aging assets are characterized by their inefficiency. Their setup times for small, specialized jobs can be lengthy, and their output per hour is significantly lower compared to modern digital printing equipment. This leads to a higher cost per unit produced, making them unprofitable in a market that increasingly favors speed and flexibility. In 2024, the average operational cost for such legacy analog equipment could be 30-40% higher than for comparable digital lines.

- High Maintenance Costs: Older analog machinery often incurs substantial repair and upkeep expenses, diverting capital from more productive investments.

- Low Throughput: These lines are typically slower and less adaptable, leading to lower output volumes and longer lead times for niche jobs.

- Limited Growth Potential: The demand for many specialized analog print products is declining, offering minimal opportunity for expansion or increased market share.

- Suboptimal Resource Allocation: Resources, including skilled labor and energy, are consumed by these inefficient lines, impacting overall profitability.

Dogs in the Ennis BCG Matrix represent business units or products with low market share in low-growth industries. These segments, often characterized by commoditized offerings or declining demand, are unlikely to generate significant returns. Ennis's strategic focus should be on minimizing investment in these areas, potentially through divestiture or a managed wind-down, to reallocate resources to more promising growth opportunities.

For instance, Ennis’s potential reliance on carbonless paper, with the last U.S. mill closing in 2024, exemplifies a Dog. This product operates in a shrinking market with diminishing demand. Similarly, an underperforming acquisition in a saturated software market with declining sales, like the one generating only $5 million in revenue with a projected $2 million loss in the first half of 2024, fits the Dog profile. These units drain capital and management attention without offering substantial future growth prospects.

Legacy products, such as traditional print catalogs, also fall into this category. The global print advertising market, a relevant proxy, was projected to decline from approximately $110 billion in 2023 to around $95 billion by 2028. Ennis's small share in such shrinking niches offers minimal competitive advantage and a suboptimal return on investment. Continuing to invest in these areas is generally not a sound strategy.

Aging analog production lines also represent Dogs due to their inefficiency and high maintenance costs, estimated at 15-20% of original purchase price annually. With lower throughput and higher cost per unit compared to modern digital equipment, these lines contribute minimally to revenue. In 2024, their operational costs could be 30-40% higher than comparable digital lines, making them a prime candidate for divestiture or phasing out.

| BCG Category | Ennis Examples | Market Characteristic | Ennis Share Characteristic | Strategic Implication |

|---|---|---|---|---|

| Dogs | Carbonless paper products | Shrinking market, declining demand | Low market share | Divest or wind-down |

| Dogs | Underperforming acquired software unit (e.g., $5M revenue, $2M loss H1 2024) | Saturated market, declining demand | Low market share | Divest or turnaround |

| Dogs | Legacy print products (e.g., traditional catalogs) | Declining market trends (e.g., print advertising market ~$95B by 2028) | Marginal position in shrinking niches | Minimize investment, phase out |

| Dogs | Aging analog production lines | Low growth potential, decreasing relevance | Inefficient operations, low output | Divest, reallocate capital |

Question Marks

The digital printing sector is booming, largely due to a growing consumer desire for personalized products and tailored marketing. Ennis is actively expanding its digital printing infrastructure to capitalize on this trend. However, their presence in advanced areas like variable data printing (VDP) for deeply customized marketing campaigns might still be developing, meaning their current market share in these specific niches could be modest.

Developing and establishing a foothold in these cutting-edge applications, such as VDP, demands substantial financial investment. These investments are necessary for both the technological advancements and the efforts to gain market acceptance. The outlook for these emerging digital print applications is promising; if Ennis can successfully drive market adoption, they have the potential to evolve into Stars within the BCG framework, signifying high growth and significant market share.

The market for smart and connected labels, incorporating technologies like RFID, NFC, and QR codes, is experiencing robust growth, driven by demand for enhanced supply chain transparency and direct consumer engagement. This sector is projected to reach approximately $12.5 billion by 2027, up from an estimated $6.8 billion in 2022, showcasing a compound annual growth rate of over 12%.

While Ennis currently manufactures labels, its penetration into these advanced, technology-driven segments may still be developing. Entering this space requires significant capital for research and development, alongside dedicated marketing efforts to foster adoption and capture substantial market share, positioning these products as potential Stars within the BCG framework.

The demand for sustainable printing materials is surging, with the global sustainable packaging market expected to reach $437.5 billion by 2027, growing at a CAGR of 6.7% from 2022. Ennis is navigating this trend by exploring eco-friendly options, though its current market share in cutting-edge biodegradable films or water-based inks might be less dominant than specialized competitors.

While Ennis is positioned within a high-growth sector for sustainable printing solutions, achieving a leading edge necessitates substantial investment in research and development for truly innovative materials. This strategic focus aligns with broader industry shifts towards environmental responsibility and circular economy principles.

Expansion into New Geographic Markets or Distribution Channels

Expanding Ennis into new geographic markets or distribution channels would likely place these initiatives in the question mark category of the BCG matrix. Initially, these ventures would represent high-growth opportunities, but Ennis would hold a low market share as it establishes its presence.

For instance, if Ennis were to enter the European market, which has a projected print market growth rate of around 3-4% annually through 2025, it would be starting from scratch, thus a low market share. Similarly, a direct-to-consumer digital print service for small businesses, a rapidly growing segment, would also see Ennis begin with a minimal share of this evolving market.

These expansions demand significant capital investment for market research, setting up operations, and marketing. For example, establishing a new distribution network in Asia could cost millions, similar to the initial investment required to build a robust e-commerce platform for direct sales.

- High Growth Potential: New markets and channels offer significant revenue expansion opportunities.

- Low Initial Market Share: Ennis would be a new entrant, needing time to capture market share.

- Substantial Investment Required: Establishing operations and brand awareness demands considerable upfront capital.

- Strategic Importance: These moves are crucial for long-term diversification and competitive positioning.

Integration of AI and Automation in Print Workflows

The print industry is increasingly leveraging AI and automation to boost efficiency and minimize errors. Ennis is making strides by integrating ERP systems into its acquisitions, a move that signals a commitment to automation.

While these ERP integrations are a positive step, Ennis has a significant opportunity to deepen AI integration across its entire print workflow. This would enable the company to offer highly automated, personalized, and on-demand services, a segment poised for substantial growth. Realizing this potential requires considerable investment in advanced technology and infrastructure. For instance, the global print automation market was valued at approximately $1.8 billion in 2023 and is projected to grow significantly, with AI playing a crucial role in this expansion.

- AI-driven workflow optimization enhances efficiency and reduces manual errors in print production.

- ERP system integration by Ennis facilitates a more automated operational foundation.

- Personalized, on-demand print services represent a high-growth area for Ennis through deeper AI adoption.

- Significant investment in technology and infrastructure is necessary to capture this market share.

Question Marks in Ennis's BCG Matrix represent business areas with low market share in high-growth industries. These ventures require significant investment to develop and capture market share, with the potential to become Stars if successful. Ennis's exploration into advanced digital printing technologies like variable data printing and smart labels falls into this category. Similarly, expanding into new geographic markets or adopting AI-driven automation for enhanced services are also current Question Marks.

| Business Area | Industry Growth | Ennis Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Variable Data Printing (VDP) | High | Low | High | Star |

| Smart/Connected Labels | High | Low | High | Star |

| New Geographic Markets (e.g., Europe) | Moderate | Low | High | Star/Cash Cow |

| AI-driven Print Workflow | High | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, including sales figures, market share reports, industry growth rates, and competitor analysis to provide actionable strategic guidance.