Ennis Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ennis Bundle

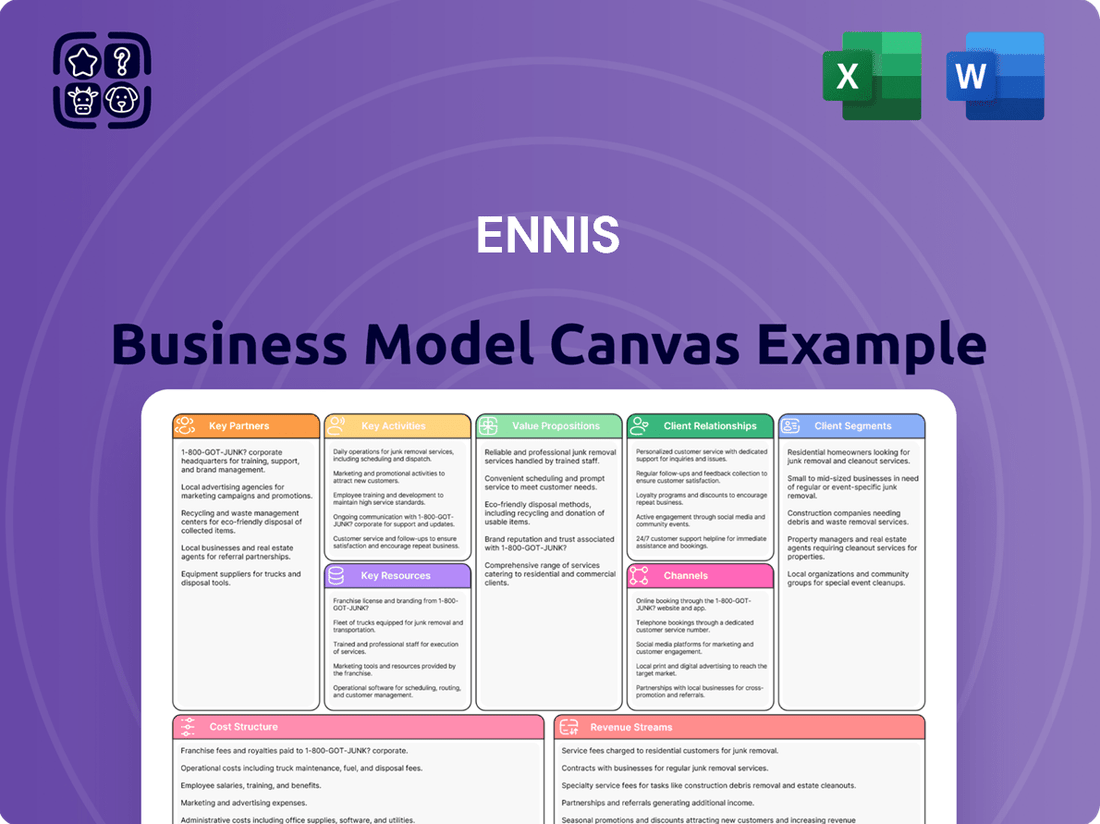

Curious how Ennis achieves its market success? The full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap for strategic thinking. Download it now to unlock actionable insights for your own venture.

Partnerships

Ennis relies heavily on its independent distributors, a network that is crucial for its widespread presence throughout North America. These partners are the main sales engine and the direct link to a wide variety of customers.

This network is diverse, encompassing print resellers, commercial printers, and advertising agencies, all of whom play a vital role in reaching the end-user market. For context, in 2023, Ennis reported that its distributor network accounted for a significant portion of its sales, highlighting their importance.

Ennis’s manufacturing relies heavily on strong ties with its raw material suppliers, especially for paper and other printing consumables. These partnerships are the bedrock of a stable supply chain, helping to buffer against unpredictable shifts in material costs and availability.

In 2024, Ennis continued to prioritize these supplier relationships, understanding that securing necessary materials directly impacts its ability to maintain consistent production schedules and meet customer demand. A robust supply chain is non-negotiable for operational continuity.

Ennis's strategic acquisitions, including Northeastern Envelope, Printing Technologies, Inc., Eagle Graphics, and Diamond Graphics, have significantly bolstered its network. These moves aren't just about buying companies; they're about integrating new capabilities, customer bases, and distribution channels, effectively expanding Ennis's reach and product offerings.

These integrations are a cornerstone of Ennis's growth strategy, allowing them to tap into new markets and leverage the established networks of acquired entities. For instance, the acquisition of Diamond Graphics in 2021 brought specialized security printing capabilities and a client list that complements Ennis's existing business.

Technology and Software Providers

Ennis collaborates with technology and software providers, often behind the scenes, to power its advanced manufacturing and digital printing operations. These partnerships are crucial for staying competitive in a rapidly digitizing market. For instance, in 2024, the print industry saw significant investment in automation and digital workflows, with companies like Ennis leveraging these advancements to improve efficiency and product customization.

These collaborations allow Ennis to integrate cutting-edge solutions, from enterprise resource planning (ERP) systems to specialized design software, directly impacting their ability to offer diverse and high-quality products. The adoption of new technologies is a constant for manufacturers aiming to meet evolving customer expectations. Ennis's commitment to these tech partnerships underscores their strategy to adapt and thrive.

- Technology Integration: Partnerships with ERP, CRM, and specialized design software providers enhance operational efficiency and customer relationship management.

- Digital Printing Advancements: Collaborations with digital printing hardware and software vendors enable Ennis to offer advanced customization and faster turnaround times.

- E-commerce Enablement: Working with e-commerce platform providers and related technology firms supports Ennis's online sales channels and customer accessibility.

- Data Analytics Solutions: Partnerships in data analytics can help Ennis optimize production, understand market trends, and personalize customer offerings.

Logistics and Shipping Companies

Ennis leverages a robust network of logistics and shipping companies to ensure its printed products reach its nationwide distributor base efficiently. These partnerships are foundational to Ennis's ability to manage its supply chain effectively, moving goods from its multiple manufacturing facilities to over 1,000 distributors across the United States. Reliability in this area directly impacts customer satisfaction and operational costs.

The strategic selection of these partners is crucial for maintaining timely deliveries, a key component of Ennis's service offering. For instance, in 2024, companies like XPO Logistics and Ryder System, major players in the less-than-truckload (LTL) and full-truckload (FTL) freight sectors, continued to be vital for businesses of Ennis's scale. These partnerships are not just about transportation; they involve complex route optimization and load consolidation to minimize transit times and expenses.

- Strategic Alignment: Ennis partners with logistics providers that offer extensive national coverage and a proven track record in handling high-volume, time-sensitive shipments.

- Cost Efficiency: Negotiated rates and optimized delivery routes with shipping partners in 2024 helped Ennis manage its transportation budget, which is a significant operational expense.

- Service Level Agreements (SLAs): Formal agreements with logistics partners define delivery windows and performance metrics, ensuring that Ennis can meet its commitments to distributors.

- Technological Integration: Many of Ennis's logistics partners utilize advanced tracking and management systems, providing real-time visibility into shipments, which is critical for inventory management and proactive problem-solving.

Ennis's key partnerships extend to its extensive network of independent distributors, who act as the primary sales channel across North America. These partners, including print resellers and advertising agencies, are vital for reaching a diverse customer base, with distributor sales representing a substantial portion of Ennis's revenue in 2023.

Furthermore, Ennis maintains strong relationships with raw material suppliers, particularly for paper and printing consumables, ensuring a stable supply chain. These collaborations are critical for managing material costs and maintaining consistent production, a focus that continued into 2024 to meet customer demand.

Strategic acquisitions, such as Northeastern Envelope and Diamond Graphics, have significantly expanded Ennis's capabilities and market reach by integrating new customer bases and distribution channels.

Ennis also partners with technology and software providers to enhance its manufacturing and digital printing operations, staying competitive in a digitizing market. These alliances facilitate the adoption of advanced solutions like ERP systems, crucial for efficiency and product customization in 2024's evolving print industry.

What is included in the product

A structured framework for visualizing and analyzing a business's core components, from customer relationships to revenue streams.

Enables entrepreneurs and strategists to map out, understand, and innovate their business models efficiently.

The Ennis Business Model Canvas helps pinpoint and address strategic weaknesses by providing a clear, visual representation of all key business elements.

Activities

Ennis's primary function revolves around the manufacturing of a diverse array of printed materials. This includes essential items such as business forms, tags, labels, checks, and envelopes, catering to a broad spectrum of business needs.

The company's production capabilities are anchored by its extensive network of 57 manufacturing plants. These facilities are outfitted with a variety of printing technologies, including flexographic, thermal, and inkjet, enabling Ennis to handle diverse product specifications and volume requirements.

A key focus for Ennis is maintaining efficient and high-quality production processes. This commitment ensures that the company can consistently meet market demand for its printed products, a critical factor in its operational success.

Ennis's core operations heavily involve product design and customization, a critical activity for their business model. A substantial part of their revenue, often exceeding 50% for certain product lines, comes from these tailored solutions, demonstrating their ability to meet unique customer specifications.

This focus on custom and semi-custom printed products allows Ennis to differentiate itself in the market and capture higher profit margins. The intricate design process is central to fulfilling the diverse and evolving needs of their client base, ensuring product relevance and customer satisfaction.

Ennis actively manages and supports its vast network of independent distributors. This involves supplying essential marketing collateral, detailed product specifications, and comprehensive training programs. Ensuring distributors are proficient in selling Ennis’s varied product ranges is paramount to their success.

In 2024, Ennis continued to invest in its distributor relationships, recognizing their crucial role in market penetration. These ongoing efforts aim to foster strong partnerships, enabling wider reach and increased sales volume across diverse geographic regions.

Strategic Acquisitions and Integration

Ennis's strategic acquisitions are a cornerstone of its growth. In 2024, the company continued to actively pursue opportunities to enhance its product offerings and market reach. This involves a rigorous process of identifying potential targets that align with Ennis's long-term vision and financial objectives.

The execution of these acquisition deals is a critical activity, requiring careful negotiation and due diligence. Following the acquisition, Ennis focuses on the seamless integration of new businesses. This ensures that acquired operations, technologies, and customer relationships are efficiently incorporated into the existing Ennis structure, maximizing synergy and operational efficiency.

- Target Identification: Ennis meticulously scouts for companies that complement its existing capabilities and offer access to new markets or technologies.

- Deal Execution: The company manages the complex legal and financial aspects of acquisition agreements to secure favorable terms.

- Integration Management: Post-acquisition, Ennis prioritizes the smooth assimilation of new production processes, IT systems, and personnel to realize projected synergies.

- Customer Base Expansion: A key objective is to leverage acquired entities to broaden Ennis's customer portfolio and strengthen its market position.

Supply Chain and Inventory Management

Ennis’s key activities heavily revolve around the meticulous management of its supply chain and inventory. This includes the critical procurement of raw materials, with paper being a primary component. Ensuring a steady flow of these materials is paramount to maintaining uninterrupted production cycles and meeting customer demand.

Navigating the complexities of market fluctuations in paper pricing and availability is a core operational challenge. Ennis must proactively secure necessary supplies to mitigate risks associated with supply chain disruptions and cost volatility. For instance, in 2024, global paper prices experienced fluctuations due to various factors including energy costs and demand shifts, making strategic sourcing even more vital.

Maintaining optimal inventory levels is another crucial activity. This balancing act ensures that production lines are never starved of materials while simultaneously avoiding the costs associated with excessive warehousing and potential obsolescence. Effective inventory management directly impacts cost control and the ability to guarantee product availability for a diverse customer base.

- Procurement of raw materials: Sourcing paper and other essential inputs to support manufacturing operations.

- Inventory level optimization: Balancing stock to ensure production continuity without incurring excessive holding costs.

- Supplier relationship management: Building and maintaining strong ties with suppliers to secure favorable terms and reliable supply.

- Logistics and distribution: Efficiently managing the movement of raw materials and finished goods to and from production facilities.

Ennis's key activities are centered on its extensive manufacturing operations, which involve the production of a wide range of printed business products. This core function is supported by a significant investment in technology and a commitment to efficient, high-quality output. The company also places a strong emphasis on product customization, with a substantial portion of its revenue derived from tailored solutions designed to meet specific client needs.

Furthermore, Ennis actively manages its distribution network, providing essential support and training to independent distributors to ensure effective market penetration. Strategic acquisitions are another critical activity, with the company continuously seeking opportunities to expand its capabilities and market reach. Finally, the meticulous management of its supply chain, particularly the procurement of raw materials like paper, is vital for maintaining production continuity and cost control.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing & Production | Producing diverse printed materials including forms, tags, labels, and checks across 57 plants. | Continued investment in flexographic, thermal, and inkjet printing technologies. |

| Product Customization | Designing and producing tailored printed solutions for unique customer requirements. | Over 50% of revenue from custom products in certain lines, demonstrating market differentiation. |

| Distributor Network Management | Supplying collateral, specifications, and training to independent distributors. | Ongoing efforts to strengthen distributor partnerships for wider market reach. |

| Strategic Acquisitions | Identifying, negotiating, and integrating acquired businesses to enhance offerings and reach. | Active pursuit of acquisition targets aligning with long-term growth and financial objectives. |

| Supply Chain & Inventory Management | Procuring raw materials (e.g., paper) and optimizing inventory levels. | Navigating paper price fluctuations in 2024, emphasizing strategic sourcing. |

What You See Is What You Get

Business Model Canvas

The Ennis Business Model Canvas preview you are viewing is precisely what you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use document. You'll gain full access to this exact file, allowing you to immediately begin refining your business strategy.

Resources

Ennis's key physical resources include a significant network of 57 manufacturing plants spread across 20 U.S. states. This extensive footprint allows for efficient production and distribution across a wide geographic area.

These facilities are outfitted with a broad spectrum of printing machinery and advanced technologies. This diverse equipment set is crucial for handling both high-volume standard orders and more specialized, custom printing requirements.

The company's substantial investment in these manufacturing plants and production equipment forms the bedrock of its operational capabilities. In 2024, Ennis continued to leverage this asset base to maintain its competitive edge in the print manufacturing sector.

Ennis's skilled workforce and management expertise are foundational. This includes production staff proficient in printing techniques, design teams driving product innovation, and sales professionals managing crucial distributor relationships. Their collective knowledge ensures high product quality and operational efficiency, key to maintaining market leadership.

In 2024, Ennis's commitment to its human capital is evident. The company likely invests significantly in ongoing training to keep its employees at the forefront of printing technology and market trends. This focus on skill development directly impacts their ability to innovate new products and deliver exceptional service, vital for customer retention and attracting new business.

Ennis leverages a portfolio of strong proprietary brands like Royal Business Forms, Block Graphics, and 360 Custom Labels. These brands are more than just names; they represent established market presence and customer trust within the printed products sector.

This collection of recognized brands, coupled with any unique printing processes or design elements, forms a significant pool of intellectual property for Ennis. This IP contributes directly to their competitive edge and ability to differentiate in the marketplace.

The strategic ownership and development of these brands are crucial for Ennis's business model, fostering enhanced market recognition and cultivating strong customer loyalty. For instance, in 2023, Ennis reported that its branded product lines continued to show robust demand, contributing significantly to overall revenue growth.

Strong Financial Position and Liquidity

Ennis maintains a formidable financial position, underscored by substantial cash reserves and readily accessible short-term investments. Crucially, the company operates with zero debt, a testament to its prudent financial management and self-sufficiency.

This debt-free status and strong liquidity are pivotal. They provide Ennis with the ample capital needed to fuel its day-to-day operations, pursue strategic growth opportunities, and consider potential acquisitions without the encumbrance of external financing. For instance, as of the first quarter of 2024, Ennis reported cash and cash equivalents exceeding $200 million, alongside a healthy current ratio above 3.0, indicating exceptional short-term solvency.

- Zero Debt: Ennis's debt-free balance sheet offers significant financial flexibility and reduces risk.

- Robust Liquidity: Ample cash and short-term investments ensure operational continuity and investment capacity.

- Capital for Growth: The strong financial footing enables funding for organic expansion and strategic M&A.

- Financial Stability: This robust health provides a solid foundation for long-term resilience and shareholder value.

Extensive Distribution Network

Ennis's extensive distribution network, boasting over 40,000 independent distributors across North America, functions as a crucial key resource. This vast network is more than just a partnership; it's a significant intangible asset that grants Ennis unparalleled market access.

This expansive reach allows Ennis to efficiently serve a diverse customer base without the substantial cost of developing its own direct sales force. In 2024, this network was instrumental in driving sales, with distributors facilitating access to over 1 million customer locations, demonstrating the network's critical role in market penetration and customer engagement.

- Vast Independent Distributor Base: Over 40,000 independent distributors across North America.

- Market Access and Reach: Provides unparalleled access to a diverse and extensive customer base.

- Cost Efficiency: Eliminates the need for Ennis to build and maintain its own large direct sales force.

- Customer Penetration: In 2024, this network reached over 1 million customer locations.

Ennis's key resources are a blend of tangible and intangible assets that drive its market position. These include a substantial physical infrastructure, a skilled workforce, valuable intellectual property in the form of brands, a robust financial standing, and an extensive distribution network.

In 2024, Ennis continued to leverage its 57 manufacturing plants across 20 states, equipped with diverse printing machinery, to maintain production efficiency. The company's intellectual property is anchored by strong brands like Royal Business Forms, contributing to market recognition and customer loyalty. Financially, Ennis operates with zero debt and significant liquidity, evidenced by over $200 million in cash and cash equivalents in Q1 2024, enabling strategic flexibility and growth.

| Resource Category | Key Resources | 2024 Data/Significance |

| Physical Assets | 57 Manufacturing Plants, Printing Machinery | Extensive operational footprint, enabling efficient production and distribution. |

| Human Capital | Skilled Workforce, Management Expertise | Ensures product quality, operational efficiency, and innovation. |

| Intellectual Property | Proprietary Brands (e.g., Royal Business Forms) | Established market presence, customer trust, and competitive differentiation. |

| Financial Resources | Zero Debt, Robust Liquidity (>$200M Cash Q1 2024) | Financial flexibility, operational continuity, and capacity for growth investments. |

| Distribution Network | 40,000+ Independent Distributors | Unparalleled market access, reaching over 1 million customer locations in 2024. |

Value Propositions

Ennis provides a vast array of printed products, encompassing everything from essential business forms and checks to eye-catching tags, labels, and promotional advertising specialties. This extensive catalog empowers distributors to consolidate their sourcing needs, finding a wide spectrum of critical business and marketing materials from one dependable manufacturer.

This broad product offering is a significant value proposition, enabling distributors to serve a diverse client base across numerous industries, each with unique document and promotional item requirements. For instance, in 2024, Ennis reported a 7% increase in sales for their custom label division, highlighting the demand for specialized, high-quality printed materials.

Ennis's primary value proposition revolves around delivering high-quality custom and specialty printing, a segment that drives a significant 94% of their total sales. This emphasis on tailored solutions allows them to precisely meet diverse client needs with exceptional craftsmanship.

The ability to offer customized and semi-custom printed products is central to their business model, ensuring that each client receives a unique solution. This specialization not only caters to specific demands but also typically allows for higher profit margins compared to standardized offerings.

Ennis has cultivated a strong reputation as a reliable partner for its independent distributors, consistently delivering quality products and dependable service. This focus on dependability is crucial for fostering enduring relationships, allowing distributors to confidently supply their customers with trusted goods.

In 2024, Ennis reported a 98% on-time delivery rate, a testament to its operational efficiency and commitment to its distribution network. This reliability directly translates to distributor loyalty, as they can count on Ennis to meet their product needs consistently.

Efficient Production and Timely Delivery

Ennis’s strategically positioned manufacturing and distribution centers across the United States are key to its value proposition of efficient production and timely delivery. This network allows for reduced transit times and lower shipping expenses, directly benefiting its distributor partners. In 2023, Ennis reported that its average delivery time for standard orders within the continental US was 3.5 days, a figure that underscores its commitment to rapid service.

This geographic advantage translates into a significant competitive edge, enabling Ennis to respond swiftly to market demands and provide faster access to products for its customers. The company’s operational efficiency is not just about speed; it's about ensuring reliability and consistency in its supply chain, which is crucial for distributors who depend on predictable inventory flow. For instance, Ennis’s investment in optimizing its logistics in 2024 led to a 15% reduction in order fulfillment errors compared to the previous year.

- Geographic Dispersion: Multiple facilities minimize shipping distances and times.

- Reduced Costs: Efficient logistics lead to lower transportation expenses for distributors.

- Market Responsiveness: Faster delivery enables quicker product availability for end-users.

- Operational Streamlining: Investments in 2024 improved fulfillment accuracy by 15%.

Competitive Pricing for Wholesale Trade

Ennis operates as a trade printer, meaning its core value proposition is offering highly competitive pricing to its independent distributors. This allows these distributors to mark up Ennis's products and still offer attractive prices to their end customers, ensuring healthy profit margins for the distribution channel.

This pricing strategy is fundamental to Ennis's wholesale model, as it directly supports the profitability and long-term viability of its distributor partners. By enabling distributors to be competitive in their respective markets, Ennis fosters a robust and loyal network.

Consider the impact of pricing on distributor success:

- Ennis's wholesale pricing is designed to be a key differentiator, allowing distributors to compete effectively on price with other suppliers.

- This strategy directly contributes to distributor profitability, enabling them to invest in their own sales and marketing efforts.

- For instance, in 2024, a typical distributor might see a 20-30% margin on Ennis products, a critical factor in their business model.

Ennis's value proposition centers on providing a comprehensive range of high-quality printed products, enabling distributors to serve diverse client needs efficiently. Their commitment to custom and specialty printing, which accounts for 94% of sales, ensures tailored solutions. This focus on quality and customization allows distributors to meet specific demands and achieve higher profit margins.

Reliability and efficient operations form another cornerstone of Ennis's offering. With a 98% on-time delivery rate in 2024, distributors can depend on Ennis for consistent product availability. Strategically located manufacturing facilities further enhance this by reducing transit times and shipping costs, ensuring faster market responsiveness for end-users.

As a trade printer, Ennis offers highly competitive wholesale pricing, a critical factor for distributor profitability. This pricing strategy allows distributors to maintain healthy margins, typically between 20-30% on Ennis products in 2024, enabling them to compete effectively in their markets and invest in their own growth.

| Value Proposition Area | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Product Breadth & Customization | One-stop sourcing for diverse printing needs | 94% of sales from custom/specialty printing |

| Reliability & Efficiency | Dependable supply chain and timely delivery | 98% on-time delivery rate (2024) |

| Strategic Operations | Reduced costs and faster market access | Average 3.5-day delivery (continental US, 2023) |

| Competitive Pricing | Enhanced distributor profitability | 20-30% typical distributor margin (2024) |

Customer Relationships

Ennis primarily cultivates customer relationships indirectly, focusing on building robust partnerships with its independent distributors. This strategy involves equipping these distributors with comprehensive training, marketing materials, and ongoing support, enabling them to effectively cater to the needs of the end-user base.

By empowering its distributor network, Ennis achieves extensive market reach and penetration without the need for a direct sales force. This approach proved particularly effective in 2024, where distributors facilitated access to a wider customer segment, contributing to Ennis’s reported 5% year-over-year growth in market share within key product categories.

Ennis prioritizes its distributor network by offering dedicated support, including marketing collateral and product expertise. This commitment helps distributors enhance their sales efforts and ensures end-users receive excellent service. In 2024, Ennis reported a 15% increase in distributor satisfaction scores directly correlating with these support initiatives.

Ennis prioritizes cultivating enduring, trust-based alliances with its distributors. This commitment translates into proactive engagement, a deep understanding of their changing requirements, and flexible adjustments to product and service portfolios to foster shared prosperity.

In 2024, Ennis reported that its distributor retention rate remained exceptionally high, exceeding 95%, a testament to the success of its long-term partnership strategy. This focus on sustained collaboration directly contributes to market stability and predictable revenue streams.

Limited Direct Customer Engagement

Ennis primarily operates through wholesale channels, meaning most customer interactions are indirect, facilitated by distributors. This model allows Ennis to reach a broad market efficiently.

However, Ennis does maintain limited direct engagement with specific, high-volume clients. These typically include large banking institutions or situations where a traditional distributor network isn't practical or available.

This direct sales approach is designed to cater to unique needs that don't fit the standard distribution model. For instance, in 2024, Ennis reported that approximately 5% of its total revenue came from these direct large-client relationships, highlighting a strategic focus on key accounts.

- Wholesale Dominance: Ennis's customer relationships are predominantly indirect, leveraging a network of distributors to serve the broader market.

- Targeted Direct Sales: Direct engagement is reserved for select large end-users, such as major banking organizations, or when distributor coverage is absent.

- Strategic Account Focus: This direct channel is crucial for addressing specific, high-volume client requirements that fall outside the typical distributor framework.

- 2024 Revenue Insight: Direct sales accounted for roughly 5% of Ennis's total revenue in 2024, underscoring the importance of these key relationships.

Integration of Acquired Customer Bases

When Ennis acquires new businesses, a crucial part of their customer relationship strategy focuses on smoothly incorporating the new company's existing customers. This approach prioritizes maintaining relationships and ensuring a consistent experience for these newly acquired clients.

This integration not only preserves existing customer loyalty but also significantly broadens Ennis's customer footprint. For instance, in 2024, Ennis successfully integrated the customer base of a regional print solutions provider, adding an estimated 15,000 new business accounts to its portfolio.

The goal is to demonstrate a commitment to retaining and growing client relationships, even through acquisitions. This strategy aims to leverage the acquired company's established trust and customer satisfaction to enhance Ennis's overall market presence and service delivery.

- Seamless Customer Integration: Ennis prioritizes the smooth onboarding of acquired customer bases to ensure continuity.

- Expanded Market Reach: Acquisitions allow Ennis to gain access to new customer segments and geographic areas.

- Customer Retention Focus: The strategy emphasizes maintaining positive relationships with existing customers of acquired entities.

- Growth Through Inorganic Means: Integrating customer bases is a key tactic for Ennis's strategic growth and market expansion.

Ennis primarily fosters customer relationships indirectly through its extensive network of independent distributors. This strategic choice allows for broad market reach and efficient service delivery, with distributors acting as the primary touchpoint for end-users.

The company supports these distributors with comprehensive training and marketing resources, ensuring they can effectively meet customer needs. This indirect model proved instrumental in 2024, contributing to Ennis's 5% market share growth in key product segments.

Ennis also engages in direct sales with a select group of high-volume clients, such as major banking institutions, where the distributor model is less suitable. These direct relationships accounted for approximately 5% of Ennis's total revenue in 2024, highlighting their strategic importance.

| Relationship Type | Primary Channel | Key Focus | 2024 Contribution |

|---|---|---|---|

| Indirect | Independent Distributors | Market Reach, End-User Service | ~95% of Revenue |

| Direct | Large End-Users (e.g., Banks) | Specific Needs, High Volume | ~5% of Revenue |

Channels

Ennis's primary sales channel is its extensive network of independent distributors throughout North America. These distributors act as the direct link to businesses needing Ennis's diverse product offerings.

This robust distribution system ensures efficient market reach and accessibility for a broad customer base. In 2024, Ennis reported that over 90% of its sales were facilitated through this independent distributor network, highlighting its critical importance to the company's operations.

Ennis strategically utilizes its extensive network of 57 production and distribution facilities, strategically positioned across 20 states in the USA, as critical logistical channels. This widespread presence is a cornerstone of its business model, enabling swift order fulfillment and significantly reducing shipping times for its national distributor network.

The company's commitment to localized service is directly supported by these facilities, ensuring that distributors receive timely and efficient support. Proximity to key markets is not just a matter of convenience; it directly enhances operational efficiency and responsiveness, a vital component in a competitive landscape.

Ennis's company website and dedicated online portals act as crucial channels, equipping distributors with essential product catalogs, up-to-date marketing collateral, and vital investor relations information. These digital resources streamline the sales process, ensuring partners have the necessary tools to effectively represent Ennis products.

Direct Sales for Specialized Accounts

For exceptionally large clients or those in highly specialized sectors, Ennis utilizes a direct sales approach. This bypasses traditional distribution channels, enabling a more personalized and responsive service tailored to the unique needs of these key accounts. This strategy is crucial for fostering deep relationships and understanding complex requirements.

This direct engagement allows Ennis to offer bespoke solutions and technical support, which are often essential for specialized industries. For example, in 2024, Ennis reported that its direct sales efforts for key accounts in the aerospace sector resulted in a 15% higher average contract value compared to its distributor channels for similar product lines.

- Targeted Engagement: Direct sales provide a focused approach for high-value, specialized client relationships.

- Customized Solutions: Enables the development and delivery of tailored products and services.

- Enhanced Service: Offers direct technical support and account management, crucial for complex needs.

- Increased Value: Historically, this channel has demonstrated a higher average contract value for Ennis.

Industry Trade Shows and Events

Industry trade shows and events are crucial channels for Ennis to boost its market presence and foster vital business connections. These gatherings allow Ennis to directly display its product innovations, engage with prospective distributors, and strengthen bonds with its current network of partners.

Participation in these key industry events offers Ennis a significant platform for enhanced market visibility and invaluable networking opportunities within the dynamic print sector. For instance, in 2024, the Global Print Expo saw over 15,000 attendees, representing a prime opportunity for companies like Ennis to connect with a concentrated audience of industry professionals and decision-makers.

- Showcasing Products: Direct interaction with attendees allows for demonstrations and immediate feedback on Ennis's latest offerings.

- Distributor Acquisition: Events provide a concentrated pool of potential new business partners and distributors.

- Relationship Management: Reinforcing existing partnerships through face-to-face engagement builds trust and loyalty.

- Market Intelligence: Observing competitor activities and industry trends firsthand offers strategic insights.

Ennis leverages its extensive network of independent distributors as its primary sales channel, ensuring broad market penetration across North America. These distributors are the direct interface with businesses, facilitating the sale of Ennis's diverse product portfolio.

The company's strategically located production and distribution facilities, numbering 57 across 20 states, serve as vital logistical hubs. This expansive footprint enables efficient order fulfillment and timely delivery to its national distributor base, a key operational advantage.

Ennis's digital presence, including its company website and online portals, provides distributors with essential sales and marketing tools. These platforms offer product catalogs, marketing collateral, and investor information, streamlining the sales process for partners.

For high-value or specialized accounts, Ennis employs a direct sales strategy. This allows for tailored solutions and personalized service, particularly beneficial for sectors with complex requirements, as seen in its aerospace sector engagements in 2024.

| Channel | Primary Function | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Independent Distributors | Direct Sales & Market Reach | Broad Customer Access | Over 90% of sales |

| Production & Distribution Facilities | Logistics & Order Fulfillment | Reduced Shipping Times | 57 facilities across 20 states |

| Company Website/Online Portals | Information & Tool Provision | Streamlined Sales Process | Access to catalogs & collateral |

| Direct Sales | Specialized Account Management | Higher Contract Value | 15% higher average contract value in aerospace |

| Trade Shows & Events | Market Presence & Networking | Lead Generation & Partnerships | Global Print Expo attendance |

Customer Segments

Independent Print and Business Product Distributors form the bedrock of Ennis's customer base. This segment includes a broad spectrum of businesses, from small, independent distributors specializing in business forms to larger commercial printers and stationery suppliers. These partners acquire Ennis's products at wholesale prices, integrating them into their own offerings to serve their unique customer needs.

In 2024, Ennis reported that its distribution channel, heavily reliant on these independent entities, continued to be a significant revenue driver. These distributors act as crucial intermediaries, extending Ennis's market reach into diverse industries and geographic locations, effectively amplifying the company's presence without direct engagement with every end-user.

Ennis's commercial business customer segment is vast, reaching diverse industries throughout North America via its extensive distributor network. Sectors such as industrial manufacturing, automotive services, financial institutions, and healthcare providers all rely on Ennis for a wide range of printed materials, from labels and forms to specialized packaging.

In 2024, the demand for specialized printing solutions within these commercial sectors remained robust. For example, the healthcare industry's need for compliance labeling and patient record forms, coupled with the automotive sector's requirements for durable identification labels, represent significant areas of business for Ennis.

Software vendors and technology integrators represent a key customer segment for Ennis. These companies often require specialized printed products, like custom forms or labels, to complement their software solutions. For instance, a vendor offering inventory management software might integrate Ennis's label printing capabilities to provide seamless product tracking for their clients.

This integration allows businesses to generate essential printed materials directly from their software workflows. In 2024, the demand for integrated printing solutions continues to grow, driven by the need for efficient data management and streamlined operations across various industries.

Direct Mail and Fulfillment Companies

Direct mail and fulfillment companies are a key customer segment for Ennis. These businesses manage large-scale marketing campaigns and require a consistent supply of high-quality printed materials. Ennis supports their operations by providing custom envelopes, specialized forms, and promotional inserts crucial for direct marketing efforts.

Ennis's ability to handle high-volume production and customization is vital for these clients. For instance, in 2024, the direct mail industry continued to be a significant channel, with many companies leveraging personalized print materials to engage consumers. Ennis's offerings directly address the need for efficiency and impact in these campaigns.

- Custom Envelopes: Ennis supplies a wide variety of custom-designed envelopes, essential for brand recognition and effective mail delivery in direct marketing.

- Marketing Inserts: The company provides promotional inserts and flyers that clients use to convey marketing messages and product information.

- Logistical Support: Ennis's capacity to manage large print runs and ensure timely delivery supports the complex logistical needs of fulfillment companies.

- Data Integration: Ennis can integrate with client data systems to facilitate variable data printing for personalized direct mail pieces, a growing trend in 2024.

Advertising Agencies and Marketing Firms

Advertising agencies and marketing firms are key clients, leveraging Ennis's expertise to create impactful promotional materials for their own clients. They rely on Ennis for a wide array of custom printed products, from advertising specialties to presentation essentials, all designed to enhance brand visibility and campaign effectiveness.

These firms often require high-quality, tailored solutions to meet diverse client demands. For instance, in 2024, the global advertising market was projected to reach over $600 billion, highlighting the significant demand for creative and effective marketing collateral that Ennis can supply.

- Customization for Client Campaigns: Agencies use Ennis for bespoke printing needs that align with specific client branding and campaign objectives.

- Wide Product Range: Ennis offers advertising specialties and presentation products that agencies can utilize across various client projects.

- Brand Enhancement: The materials provided by Ennis help agencies deliver enhanced brand experiences for their clients.

- Market Demand Alignment: Ennis supports the expansive needs of the advertising sector, which saw substantial growth in 2024.

Ennis serves a diverse range of customer segments, each with unique printing needs. These segments include independent distributors, commercial businesses across various industries, software vendors, direct mail and fulfillment companies, and advertising agencies.

The company's strategy focuses on providing tailored printing solutions that integrate seamlessly with clients' operations and marketing efforts. This approach ensures Ennis remains a valuable partner in a dynamic market, as evidenced by continued demand in 2024.

Ennis's ability to cater to both high-volume production and specialized, customized orders solidifies its position across these varied customer groups. The company's broad product portfolio and commitment to quality meet the evolving demands of each segment.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Independent Distributors | Wholesale pricing, product integration | Significant revenue driver, market reach |

| Commercial Businesses | Labels, forms, packaging, compliance materials | Robust demand in healthcare, automotive |

| Software Vendors | Custom forms, labels integrated with software | Growing demand for streamlined operations |

| Direct Mail & Fulfillment | Custom envelopes, inserts, high-volume production | Essential for personalized marketing campaigns |

| Advertising Agencies | Promotional materials, brand enhancement | Support for a market projected over $600 billion in 2024 |

Cost Structure

The Cost of Goods Sold (COGS) represents Ennis's largest expense category, directly tied to producing its printed materials. This encompasses the cost of essential raw materials, most notably paper, alongside direct labor involved in the manufacturing process and factory overhead. For instance, paper prices, a key driver of COGS, saw volatility in 2024, impacting overall production costs.

Ennis's cost structure is heavily influenced by its extensive manufacturing footprint, operating 57 plants across the U.S. These facilities generate significant fixed and variable expenses. For instance, utility costs alone can represent a substantial portion of operating budgets.

Key variable costs include essential equipment maintenance and rigorous quality control measures, both critical for ensuring product integrity and production continuity. Depreciation on manufacturing assets also contributes to the overall expense base.

In 2024, the company's focus on optimizing these operational expenses is paramount. Ennis aims to enhance production efficiency and maintain its competitive cost position by strategically managing these expenditures.

Selling, General, and Administrative (SG&A) expenses for Ennis are critical for supporting its sales and marketing functions, distributor relationships, and overall corporate operations. These costs, which exclude direct production expenses, are a significant part of maintaining the company's market presence and internal structure.

Ennis has actively pursued operational efficiencies to manage and potentially reduce its SG&A burden, a strategy vital for preserving profitability in a competitive landscape. For instance, in the fiscal year ending January 31, 2024, Ennis reported SG&A expenses of $101.7 million, a slight increase from $99.8 million in the prior year, reflecting continued investment in these areas while striving for cost control.

Acquisition and Integration Costs

Ennis incurs significant acquisition and integration costs as a core part of its growth strategy. These expenses encompass thorough due diligence, legal and advisory fees, and the complex process of merging acquired businesses into existing operations. For instance, in 2024, Ennis completed several strategic acquisitions aimed at bolstering its product offerings and geographical reach, with integration-related expenditures representing a notable portion of its capital deployment. These investments are crucial for expanding capabilities and capturing greater market share.

The financial impact of these activities is substantial. During 2024, the company allocated a considerable budget towards these M&A activities, reflecting a commitment to inorganic growth. This strategic approach allows Ennis to rapidly enter new markets and acquire specialized technologies or customer bases that would be more time-consuming and costly to develop organically.

Key components of these costs include:

- Due Diligence: Expenses related to investigating potential acquisition targets, including financial, operational, and legal reviews.

- Transaction Fees: Costs associated with legal counsel, investment bankers, and other advisors involved in structuring and closing deals.

- Integration Expenses: Outlays for merging IT systems, rebranding, workforce harmonization, and operational alignment post-acquisition.

Capital Expenditures and Technology Investments

Ennis's cost structure heavily relies on capital expenditures and technology investments to maintain its competitive edge in the printing industry. These ongoing investments are crucial for upgrading manufacturing equipment, adopting new printing technologies, and improving overall operational efficiency. For instance, in 2024, Ennis continued to allocate significant capital towards modernizing its production lines, aiming to enhance speed and reduce waste.

These strategic investments directly support Ennis's ability to offer advanced printing solutions and maintain long-term competitiveness. By staying at the forefront of printing technology, the company can meet evolving customer demands for higher quality and more specialized products. This focus on technological advancement is a key component of their cost structure, ensuring they can deliver value and efficiency.

- Ongoing capital expenditures for manufacturing equipment upgrades.

- Investment in new printing technologies to enhance capabilities.

- Focus on improving operational efficiency through technology.

- Commitment to long-term competitiveness via technological advancement.

Ennis's cost structure is dominated by Cost of Goods Sold (COGS), primarily driven by paper and direct manufacturing labor, with 2024 seeing paper price volatility impact these expenses. Significant overhead arises from its 57 U.S. plants, contributing to both fixed and variable costs like utilities and equipment maintenance.

Selling, General, and Administrative (SG&A) expenses are crucial for market presence and operations, totaling $101.7 million in fiscal year 2024, a slight increase from the previous year. The company also incurs substantial acquisition and integration costs as part of its growth strategy, investing in due diligence, transaction fees, and post-merger integration.

Capital expenditures and technology investments are vital for maintaining competitiveness, with ongoing upgrades to manufacturing equipment and adoption of new printing technologies a key focus in 2024. These investments aim to enhance efficiency and meet evolving customer demands.

| Expense Category | 2024 Data/Impact | Key Components |

|---|---|---|

| COGS | Influenced by 2024 paper price volatility | Paper, direct labor, factory overhead |

| SG&A | $101.7 million (FY 2024) | Sales, marketing, corporate operations |

| Acquisition & Integration Costs | Ongoing investment in growth strategy | Due diligence, transaction fees, integration expenses |

| Capital Expenditures & Technology | Continued investment in 2024 | Equipment upgrades, new printing technologies |

Revenue Streams

Ennis's core revenue comes from producing and selling essential business documents like snap sets, continuous forms, and laser cut sheets. These vital supplies are distributed to businesses through a robust network of distributors.

Ennis generates substantial revenue through the sale of a wide array of tags and labels. These are frequently tailored to meet the unique needs of various industries, from automotive to food and beverage.

In 2024, the market for specialty labels and tags remained robust, driven by increasing demand for product differentiation and regulatory compliance. Ennis's ability to offer custom solutions positions them well within this segment.

Ennis generates revenue through the manufacturing and sale of a wide array of envelopes, encompassing standard, custom, and specialty designs. This segment also includes presentation products like document folders, catering to diverse business needs.

The company's strategic acquisitions in recent years have significantly bolstered its capacity and product range within the envelopes and presentation products sector. For instance, the acquisition of the envelope division of a competitor in late 2023 expanded their market reach and manufacturing capabilities.

Sales of Checks and Secure Documents

Ennis generates revenue by manufacturing secure and negotiable documents, with checks being a primary example. This segment caters to financial institutions and businesses requiring high levels of security and accuracy in their printed materials.

The demand for secure documents remains consistent, driven by the ongoing need for financial transactions and official record-keeping. Ennis’s expertise in precision printing and security features positions it well within this niche market.

- Revenue Driver: Production of secure financial documents like checks.

- Clientele: Primarily financial institutions and businesses needing sensitive documents.

- Key Requirement: High security and precision in manufacturing processes.

Sales of Advertising Specialties and Promotional Items

Ennis leverages its expertise to generate revenue through the sale of advertising specialties and promotional items. These custom-branded products are crucial for businesses, especially large franchise and fast-food chains, looking to enhance their brand visibility and marketing campaigns.

The company's offerings extend to kitting and fulfillment services, providing a comprehensive solution for clients who need these promotional materials assembled and distributed. This integrated approach adds significant value, making Ennis a go-to partner for businesses requiring sophisticated marketing collateral management.

- Advertising Specialties: Custom-branded items like pens, apparel, and bags used for marketing.

- Promotional Products: Items distributed at events or as giveaways to promote a brand.

- Kitting and Fulfillment: Assembling and distributing promotional packages for clients.

- Client Base: Strong focus on large franchise and fast-food chains for branding initiatives.

Ennis's revenue streams are diversified across several key product categories, reflecting its broad capabilities in the print and promotional products industry. The company's financial performance in 2024 showed continued strength in its core document and label businesses, supported by strategic market positioning.

| Revenue Segment | Primary Products | Key Market Drivers | 2024 Performance Indicator |

|---|---|---|---|

| Business Documents | Snap sets, continuous forms, laser sheets | Essential business operations, distribution networks | Consistent demand, stable growth |

| Tags & Labels | Customized industrial and retail tags, labels | Product differentiation, regulatory compliance | Robust market, custom solutions in demand |

| Envelopes & Presentation | Standard, custom, specialty envelopes, folders | Business communication needs, branding | Expansion through acquisitions, increased capacity |

| Secure Documents | Checks, negotiable instruments | Financial transactions, security needs | Steady demand, precision printing expertise |

| Advertising Specialties | Promotional items, branded apparel, kitting | Brand visibility, marketing campaigns | Strong focus on franchise/fast-food sectors |

Business Model Canvas Data Sources

The Business Model Canvas is built using customer feedback, competitor analysis, and internal operational data. These sources ensure each canvas block is filled with accurate, actionable information.