Ennis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ennis Bundle

Ennis's competitive landscape is shaped by the interplay of buyer power, supplier leverage, and the threat of substitutes. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Ennis’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for essential raw materials like paper, ink, and specialized chemicals, vital for Ennis, Inc.'s printing operations, is characterized by a broad base of suppliers. This fragmentation means that no single supplier holds a dominant position, which inherently limits their ability to exert significant pricing power or dictate terms to Ennis.

Ennis, Inc.'s ability to source from numerous vendors provides a crucial advantage. In 2024, the printing industry continued to see diverse sourcing options for key inputs, preventing any one supplier from leveraging a monopolistic or oligopolistic position to unduly influence Ennis's costs or supply chain stability.

Many of the core materials Ennis uses, like different types of paper and basic printing inks, are considered commoditized. This means that if one supplier can't meet Ennis's needs or offers unfavorable terms, there are many other suppliers who can provide essentially the same product. For example, in 2024, the global paper and pulp market, a key input for Ennis, was valued at over $350 billion, indicating a highly competitive landscape with numerous suppliers.

Switching costs for Ennis, Inc. regarding basic commodity suppliers are relatively low. For instance, in 2024, the company's procurement of paper, a key commodity, involved multiple suppliers, with no single supplier dominating the market. This competitive landscape means that the administrative effort to change suppliers for such items is typically manageable, preventing suppliers from exerting excessive pricing power.

Supplier's Product Differentiation

Suppliers offering highly specialized printing equipment, unique security features for checks, or proprietary print management software can wield significant bargaining power. This is because their differentiated products are harder for companies like Ennis to substitute. For example, a supplier of advanced anti-counterfeiting inks for financial documents would have more leverage than a supplier of standard paper.

Conversely, for Ennis's primary production inputs such as standard paper and commodity inks, supplier differentiation is minimal. This lack of unique features means Ennis can more easily switch between suppliers for these materials, thereby reducing the bargaining power of any single supplier in these segments.

- Supplier Specialization: High differentiation in offerings, like unique security inks or proprietary software, grants suppliers greater bargaining power.

- Commodity Inputs: For standard paper and inks, differentiation is low, limiting supplier leverage.

- Ennis's Position: Ennis benefits from low differentiation in core inputs, allowing for easier supplier switching and cost control.

Threat of Forward Integration

The threat of suppliers integrating forward into the printed products manufacturing industry, such as Ennis, is generally low. This is because the paper and ink industries are distinct from the capital-intensive and highly competitive nature of printing operations.

Suppliers of raw materials like paper and ink typically operate in different value chains. For instance, major paper manufacturers focus on pulp and paper production, a sector with different economies of scale and market dynamics than the printing services industry. Similarly, ink manufacturers specialize in chemical formulations and production processes.

Ennis's established infrastructure, including its specialized manufacturing equipment and extensive distribution network, further deters suppliers from attempting forward integration. This specialized nature means suppliers would need to make significant capital investments and develop entirely new operational expertise to compete effectively. For example, in 2024, the capital expenditure required to set up a modern printing facility can run into tens of millions of dollars, a substantial barrier for raw material suppliers.

- Low Likelihood of Forward Integration: Suppliers of paper and ink are unlikely to enter the printed products manufacturing sector due to its high capital requirements and competitive intensity.

- Specialized Operations: Ennis's unique manufacturing processes and technology create a barrier for suppliers seeking to integrate forward.

- Distribution Network Advantage: Ennis's established distribution channels are difficult for potential integrating suppliers to replicate.

- Financial Barriers: The significant investment needed to enter printing manufacturing, potentially millions of dollars in 2024, discourages raw material suppliers.

The bargaining power of suppliers for Ennis, Inc. is generally low, particularly for its core inputs like paper and commodity inks. This is due to the fragmented nature of these supply markets, where numerous vendors compete, preventing any single supplier from dictating terms. For instance, the global paper and pulp market, valued at over $350 billion in 2024, demonstrates a highly competitive landscape with abundant sourcing options for Ennis.

Ennis benefits from low switching costs for these commoditized materials, allowing for easy transitions between suppliers. However, suppliers of highly specialized items, such as unique security inks or proprietary printing software, can command greater leverage due to the difficulty in finding substitutes. The threat of suppliers integrating forward into Ennis's printing operations is minimal, given the substantial capital investment and specialized expertise required, with new printing facilities potentially costing tens of millions of dollars as of 2024.

| Factor | Assessment for Ennis | Impact on Bargaining Power |

| Supplier Concentration | Low for commodity inputs (paper, ink) | Low |

| Availability of Substitutes | High for commodity inputs | Low |

| Switching Costs | Low for commodity inputs | Low |

| Supplier Differentiation | Low for commodity inputs, High for specialized items (security inks) | Low for commodity, High for specialized |

| Threat of Forward Integration | Low due to capital intensity and specialization of printing | Low |

What is included in the product

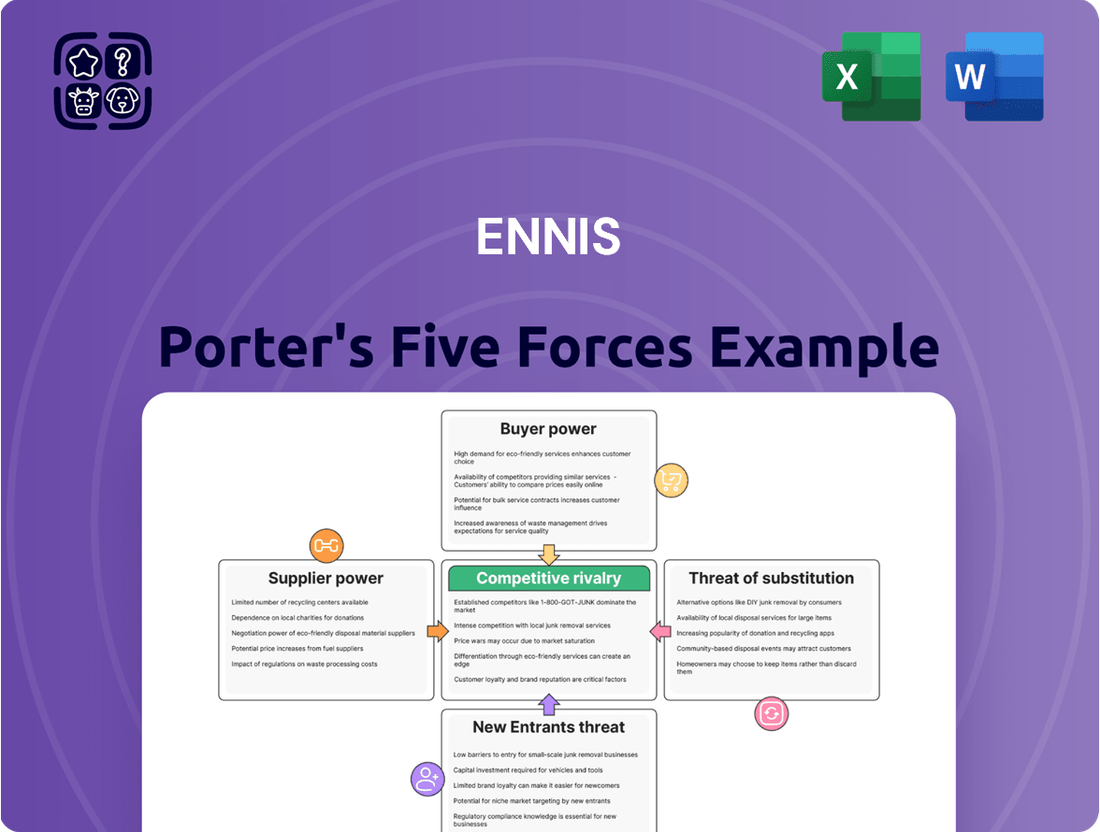

Ennis's Five Forces Analysis meticulously examines the competitive intensity and profitability potential within its industry, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly identify and prioritize competitive threats with a visual, actionable breakdown of each Porter's Five Forces component.

Customers Bargaining Power

Ennis, Inc.'s reliance on independent distributors as its primary sales channel means these entities hold considerable sway. If a distributor accounts for a substantial portion of Ennis’s revenue, their ability to demand favorable pricing or terms increases significantly.

The bargaining power of these distributors is further amplified if they have access to numerous alternative manufacturers of similar printed products. This competitive landscape allows them to switch suppliers if Ennis's offerings or pricing are not to their liking, thus pressuring Ennis to maintain competitive offerings.

When Ennis offers a broad selection of printed items, certain standard business forms or labels can be viewed as commodities by distributors. This standardization means distributors can readily switch to rivals if price is the primary factor, thereby enhancing their bargaining leverage and squeezing Ennis's profit margins.

Distributors typically face low costs when switching between printed product manufacturers. This ease of transition, especially for common items, means they can readily find alternative suppliers if Ennis Porter's pricing or service falls short of expectations. For instance, in 2024, the average cost for a distributor to onboard a new supplier for standard print runs was estimated to be under $500, highlighting the minimal financial barrier.

Customer Concentration

Customer concentration significantly amplifies buyer bargaining power. If a small number of major distributors handle a large percentage of Ennis's sales, these key clients gain leverage. For instance, if just two distributors accounted for over 60% of Ennis's revenue in 2024, they could effectively dictate terms.

This concentration allows these large customers to negotiate for better pricing, more flexible payment schedules, or specialized product modifications. Such demands can directly squeeze Ennis's profit margins and operational flexibility, as seen when major retailers in the building materials sector pushed for price reductions in early 2024, impacting manufacturers' profitability.

- High Customer Concentration: A few large distributors representing a significant portion of Ennis's sales.

- Leverage for Customers: Large order volumes enable demands for favorable pricing and terms.

- Impact on Profitability: Reduced margins and potential for customized service demands.

Threat of Backward Integration

The threat of backward integration by customers, particularly independent distributors, is generally low for manufacturers of business forms and printed products. This is primarily due to the substantial capital outlay required for advanced printing machinery and the need for specialized technical expertise. For instance, a high-quality offset printing press can cost upwards of $500,000, and achieving efficient production volumes necessitates significant scale, making it difficult for individual distributors to compete directly with established manufacturers.

This barrier significantly limits the bargaining power customers can exert through the threat of bringing production in-house. The complexity of managing diverse product lines, maintaining quality control, and achieving cost efficiencies through economies of scale are considerable hurdles. In 2024, the average manufacturing cost for specialized business forms, factoring in materials, labor, and overhead, often remains lower for large-scale producers compared to what a distributor could achieve independently.

- High Capital Investment: Acquiring modern printing technology, such as web offset presses, can easily run into millions of dollars, a prohibitive cost for most distributors.

- Specialized Expertise: Operating and maintaining sophisticated printing equipment requires trained technicians and skilled operators, a resource not readily available to distributors.

- Economies of Scale: Large manufacturers benefit from bulk purchasing of paper and ink, as well as optimized production runs, leading to lower per-unit costs that are hard for smaller entities to match.

- Limited Product Scope: Even if a distributor could afford basic equipment, replicating the wide range of specialized forms and finishes offered by established players would be economically unfeasible.

The bargaining power of customers, particularly Ennis's independent distributors, is a key factor in its profitability. When distributors have many alternative suppliers for similar printed products, their ability to negotiate favorable pricing and terms increases. This is especially true for standardized items that are easily commoditized, allowing distributors to switch suppliers based primarily on price, thereby putting pressure on Ennis's margins.

The ease with which distributors can switch suppliers, often with minimal costs, further amplifies their leverage. For instance, in 2024, the estimated cost for a distributor to switch to a new supplier for standard print runs was below $500, indicating a low barrier to entry and exit. This low switching cost empowers distributors to demand better pricing or service from Ennis.

Customer concentration, where a few large distributors account for a significant portion of Ennis's sales, also plays a crucial role. If a small number of clients represent a substantial percentage of revenue, they gain considerable power to dictate terms, impacting Ennis's profitability and operational flexibility. For example, if two major distributors were responsible for over 60% of Ennis's 2024 revenue, their negotiating position would be significantly strengthened.

| Factor | Impact on Distributor Bargaining Power | Ennis's Position |

|---|---|---|

| Availability of Alternatives | High | Depends on product specialization |

| Switching Costs | Low (for standard products) | Minimizing costs for distributors is key |

| Customer Concentration | High (if few dominant distributors) | Risk of margin erosion |

| Threat of Backward Integration | Low | High capital and expertise requirements |

What You See Is What You Get

Ennis Porter's Five Forces Analysis

You are previewing the final version of Ennis Porter's Five Forces Analysis—precisely the same document that will be available to you instantly after buying. This comprehensive analysis details the competitive landscape, examining industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. Understand the strategic implications for Porter's Five Forces and gain actionable insights for your business.

Rivalry Among Competitors

The business forms and printed products industry in North America is quite mature and spread out, with many regional and national companies competing. This fragmentation means there are a lot of players fighting for the same customers, which really heats up the competition.

This intense rivalry often results in companies lowering prices to win business, putting a strain on their profits. For instance, in 2024, the North American printing market saw continued price pressures, with many smaller print shops struggling to compete with larger, more efficient operations.

In mature industries like traditional printing, where digital alternatives are increasingly prevalent, demand often remains stable or experiences slow decline. This lack of overall market expansion forces companies to engage in intense competition for existing market share, rather than capitalizing on new growth opportunities. Consequently, rivalry intensifies as companies must gain ground by taking it directly from their competitors.

For instance, the global printing market, while still substantial, has seen subdued growth. Projections for 2024 indicate a compound annual growth rate (CAGR) of around 2.5% for the broader printing industry, with segments like commercial printing facing even flatter or negative growth. This environment means that any increase in a company's revenue is likely a direct result of outmaneuvering rivals, leading to price pressures and a focus on efficiency to maintain profitability.

While many printed products can be seen as commodities, companies like Ennis can stand out by offering customization, unique security features, exceptional quality, and faster delivery times. Superior customer service also plays a crucial role in setting them apart from competitors.

This differentiation helps to lessen the pressure of direct price competition. However, the market remains highly competitive, with rivals actively vying for customers across these very factors, making it a constant battle to maintain an edge.

High Fixed Costs

The printing industry is characterized by substantial fixed costs, particularly in areas like specialized printing presses and advanced finishing equipment. For instance, a high-quality offset printing press can easily cost hundreds of thousands, if not millions, of dollars. These investments necessitate high utilization rates to become profitable.

This pressure to maintain high capacity often drives intense price competition. Companies must secure enough business to cover their significant overheads, leading them to aggressively bid on contracts. This dynamic fuels a competitive rivalry where market share can be prioritized over immediate profit margins.

- High Capital Investment: The cost of advanced printing machinery and facilities represents a major barrier to entry and a significant ongoing expense.

- Economies of Scale Imperative: To spread these fixed costs, firms must operate at high volumes, creating a strong incentive for aggressive pricing to capture market share.

- Capacity Underutilization Risk: If demand falters, companies face the challenge of covering fixed costs with lower output, intensifying the need to win new business.

Exit Barriers

High capital investment in specialized printing equipment, often running into millions of dollars for advanced machinery, acts as a significant hurdle for companies looking to exit the printing industry. These substantial sunk costs mean that selling off assets might not recoup the initial investment, forcing firms to continue operations even when unprofitable. For instance, a commercial printer investing $5 million in a new offset press faces a substantial loss if they must divest it prematurely.

Furthermore, long-term contracts with clients, common in sectors like publishing or packaging, create additional exit barriers. Breaking these contracts can incur penalties, and fulfilling them at a loss is often preferable to facing legal repercussions. This situation can lead to persistent overcapacity within the industry, as companies remain operational despite weak demand or declining profitability.

The consequence of these high exit barriers is intensified competitive rivalry. Struggling firms, unable to absorb the costs of leaving, often continue to operate, accepting very low profit margins to cover at least some of their fixed costs. This dynamic can suppress overall industry profitability and lead to sustained price competition as these firms fight for market share.

- Exit Barriers: High capital investment in specialized printing machinery and long-term client contracts significantly impede firms from leaving the industry.

- Impact on Rivalry: These barriers contribute to overcapacity and sustained price competition, as companies may operate at low margins rather than incur exit costs.

- Industry Dynamics: For example, a printing company with $10 million in specialized equipment and multi-year contracts faces considerable financial risk in exiting, potentially leading to continued, albeit low-margin, operations.

The competitive rivalry within the business forms and printed products industry is fierce, driven by a mature market, numerous players, and the commoditized nature of many products. This environment forces companies to fight aggressively for market share, often leading to price wars and reduced profitability. For instance, in 2024, the North American printing market continued to experience significant price pressures, with smaller firms often struggling against larger, more efficient competitors.

Companies differentiate themselves through customization, quality, and service to mitigate direct price competition. However, the industry's high fixed costs, particularly for specialized machinery, necessitate high utilization rates. This often compels firms to bid aggressively on contracts, even at lower margins, to cover overheads and avoid capacity underutilization, further intensifying rivalry.

High exit barriers, such as substantial investments in printing equipment and long-term client contracts, mean that struggling firms may continue operations at low profitability rather than incur exit costs. This perpetuates overcapacity and sustained price competition, as companies prioritize covering fixed costs over maximizing margins.

SSubstitutes Threaten

The most potent threat of substitutes for Ennis's offerings stems from the accelerating shift towards digital document management. As businesses increasingly embrace electronic invoicing, digital workflows, and paperless communication, the demand for traditional paper-based products like checks and forms naturally diminishes. This digital transformation directly challenges Ennis's core business model.

For instance, the global electronic invoicing market was valued at approximately $10.8 billion in 2023 and is projected to grow significantly, indicating a clear move away from paper-based transactions. This trend means that Ennis faces a substantial risk as customers opt for more efficient and environmentally friendly digital solutions, bypassing the need for Ennis's physical document products.

The rise of cloud-based enterprise resource planning (ERP) systems and automation software presents a significant threat of substitutes for traditional printed business forms. These digital solutions enable businesses to manage operations, from inventory to customer relations, without relying on paper.

For instance, in 2024, the global cloud ERP market was valued at approximately $50 billion, with projections indicating continued strong growth. This widespread adoption highlights how readily businesses are embracing digital alternatives that offer enhanced efficiency and cost reduction compared to paper-based systems.

Businesses can now automate workflows, manage data digitally, and facilitate communication entirely online, effectively replacing the need for physical forms for many critical business processes. This shift is driven by the inherent advantages of cloud solutions, including accessibility, scalability, and reduced administrative overhead.

The increasing adoption of electronic funds transfers (EFTs), online banking, and digital payment platforms like PayPal and Square presents a significant threat of substitution for traditional payment methods. This shift directly impacts businesses that rely on older transaction systems, as consumers and businesses increasingly opt for faster, more convenient digital solutions. For example, the global digital payments market was valued at over $2.3 trillion in 2023 and is projected to grow substantially, indicating a clear move away from paper-based transactions.

Environmental and Sustainability Push

The increasing global focus on environmental sustainability is a significant factor influencing the threat of substitutes for paper products. As both businesses and consumers become more aware of their ecological footprint, there's a growing demand for eco-friendly alternatives and practices. This societal shift directly impacts industries reliant on paper, such as printing and packaging.

This environmental push encourages a move towards paperless operations, where digital solutions replace physical documents and communications. For instance, the digital transformation in many sectors has accelerated, with companies investing in cloud storage and electronic document management systems. In 2024, the global market for digital transformation was valued at over $1 trillion, indicating a substantial investment in technologies that reduce reliance on paper.

The preference for digital alternatives is not just about convenience; it's increasingly driven by sustainability goals. Many organizations are setting ambitious targets for reducing waste and carbon emissions, and minimizing paper usage is a key strategy. This trend presents a clear threat to traditional paper manufacturers and suppliers as demand for their products potentially declines in favor of digital substitutes.

- Growing Preference for Digital: Consumers and businesses are increasingly opting for digital communication and record-keeping, reducing the need for printed materials.

- Corporate Sustainability Goals: Many companies are actively pursuing paperless initiatives to meet their environmental, social, and governance (ESG) targets.

- Technological Advancements: Innovations in digital technology make paperless workflows more efficient and accessible than ever before.

- Consumer Awareness: Heightened environmental consciousness among the public drives demand for sustainable practices, including reduced paper consumption.

Cost-Effectiveness of Substitutes

Digital substitutes often present a compelling cost advantage over traditional printed products. For instance, businesses can bypass expenses associated with printing, physical distribution, and warehousing. This translates to significant savings, as highlighted by the fact that the global digital publishing market was projected to reach over $230 billion in 2024, demonstrating a clear preference for cost-efficient digital formats.

The cost-effectiveness of digital alternatives directly accelerates the substitution process for products like those Ennis Porter might offer. Companies are increasingly prioritizing digital solutions to reduce operational overhead. For example, a business moving from printed marketing materials to digital campaigns can save an estimated 20-30% on their advertising budget annually.

- Reduced Printing Costs: Eliminating paper, ink, and printing machinery expenses.

- Lower Distribution Expenses: Avoiding postage, shipping, and physical delivery logistics.

- Minimized Storage Needs: Removing the requirement for physical storage space and inventory management.

- Decreased Administrative Overhead: Streamlining processes by reducing manual handling and associated labor.

The threat of substitutes for Ennis's traditional paper products is substantial, driven by the pervasive digital transformation across industries. As businesses and consumers increasingly adopt digital workflows and communication methods, the demand for physical documents like checks and forms is declining. This shift is further amplified by the cost-effectiveness and environmental benefits offered by digital alternatives.

The global digital transformation market was valued at over $1 trillion in 2024, underscoring a significant investment in technologies that reduce reliance on paper. This trend means that Ennis faces considerable pressure as customers migrate to more efficient, paperless solutions. For example, the widespread adoption of electronic invoicing, which saw its market valued at approximately $10.8 billion in 2023, directly replaces the need for paper checks and invoices.

| Substitute Area | Example | Market Value (Approx.) | Trend |

|---|---|---|---|

| Digital Document Management | Electronic Invoicing | $10.8 billion (2023) | Significant Growth |

| Cloud-Based Systems | Cloud ERP | $50 billion (2024) | Continued Strong Growth |

| Digital Payments | EFTs, Online Banking | >$2.3 trillion (2023) | Substantial Growth Projected |

| Digital Transformation | Overall Tech Adoption | >$1 trillion (2024) | Accelerating Adoption |

Entrants Threaten

The manufacturing of business forms and printed products demands significant capital. Companies need to invest heavily in specialized printing presses, advanced finishing equipment, and suitable facilities. For instance, a new commercial printing operation in 2024 could easily see initial equipment costs range from $500,000 to over $5 million, depending on the scale and technology.

This substantial upfront investment acts as a formidable barrier to entry for potential new competitors. It makes it challenging for smaller or less-funded entities to establish a foothold in the market, thus protecting existing players.

Established players like Ennis, Inc. leverage significant economies of scale in purchasing, manufacturing, and distribution. For instance, Ennis's large production volumes in 2024 likely allowed them to secure better pricing on paper and ink compared to a newcomer. This cost advantage makes it challenging for new entrants to match Ennis's pricing strategies from the outset.

Ennis, Inc. benefits significantly from its established distribution networks, which act as a substantial barrier for potential new entrants. The company has cultivated a wide-reaching system of independent distributors throughout North America, a process that requires considerable time, investment, and relationship building to replicate.

For a new company to establish a comparable distribution footprint would likely involve years of dedicated effort and substantial capital outlay, making it a daunting challenge to effectively reach Ennis's diverse customer base across various industries.

Brand Reputation and Customer Loyalty

In mature industries, established companies often boast strong brand reputations and deep-rooted relationships with distributors and end-users. For instance, in the 2024 consumer electronics market, brands like Apple and Samsung benefit from decades of customer trust, making it incredibly difficult for newcomers to gain traction. New entrants face the significant hurdle of investing heavily in marketing and sales to build credibility and sway loyal customer bases, a costly and time-consuming endeavor.

This loyalty translates into a substantial barrier. Consider the automotive sector; in 2024, established brands like Toyota and Ford continue to command loyalty due to perceived reliability and service networks. A new electric vehicle startup, while innovative, must overcome this ingrained preference, often requiring massive advertising budgets and extensive dealership networks to even begin competing. The threat of new entrants is therefore considerably low when brand equity is high.

- Established Brand Equity: Companies with strong brand recognition and a history of positive customer experiences create a significant barrier for new competitors.

- Customer Loyalty: Long-standing relationships and customer satisfaction lead to repeat business, making it challenging for new entrants to capture market share.

- High Marketing & Sales Costs: New players must invest substantially in building awareness and trust, often outspending established players to achieve comparable reach.

- Distribution Channel Access: Existing players often have secured relationships with distributors, which can be difficult for new entrants to replicate.

Regulatory and Compliance Knowledge

For specialized printed products like secure checks or regulated forms, new entrants face a significant hurdle in understanding and complying with intricate regulatory frameworks. This isn't a minor detail; it's a fundamental barrier to entry that requires dedicated resources and expertise.

Acquiring the necessary knowledge and ensuring ongoing adherence to these standards, which can include data privacy laws, financial printing regulations, and specific industry certifications, represents a substantial investment. For instance, companies printing financial documents often need to comply with regulations like those from the Securities and Exchange Commission (SEC) or specific banking standards, which are constantly evolving.

- Regulatory Expertise: New entrants must develop deep understanding of sector-specific regulations, such as those governing financial documents or secure printing.

- Compliance Costs: The investment in legal counsel, compliance officers, and audit processes can be substantial, deterring smaller or less capitalized competitors.

- Industry Certifications: Obtaining and maintaining certifications, like those related to secure document printing or data handling, adds another layer of complexity and cost.

- Evolving Landscape: Staying abreast of changes in regulations, particularly concerning data security and privacy, requires continuous monitoring and adaptation, a challenge for newcomers.

The threat of new entrants in the business forms and printed products industry is generally low. High capital requirements for specialized equipment, such as advanced printing presses, can easily reach millions of dollars in 2024, deterring many potential competitors. Furthermore, established companies benefit from significant economies of scale, allowing them to offer competitive pricing that newcomers struggle to match.

Existing players also possess strong brand equity and established distribution networks, built over years of investment and customer relationship management. Replicating these advantages requires substantial time and financial resources, creating a significant barrier for any new company attempting to enter the market.

The need for regulatory expertise and compliance, particularly for specialized products like secure checks, adds another layer of difficulty. New entrants must invest heavily in understanding and adhering to complex, evolving legal frameworks and obtaining necessary industry certifications, further limiting the threat.

| Barrier to Entry | Description | 2024 Impact Example |

|---|---|---|

| Capital Requirements | High upfront investment in machinery and facilities. | New commercial printing setup: $500,000 - $5 million+ for equipment. |

| Economies of Scale | Cost advantages due to large-scale production and purchasing. | Ennis's bulk purchasing of paper and ink likely secured better rates than a startup. |

| Distribution Networks | Established relationships and logistics for reaching customers. | Years of effort and capital needed to build a comparable North American distributor base. |

| Brand Equity & Loyalty | Customer trust and preference for established brands. | New entrants must overcome decades of customer loyalty and invest heavily in marketing. |

| Regulatory Compliance | Meeting industry-specific legal and certification requirements. | Adhering to SEC or banking standards for financial documents requires ongoing expertise and cost. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, drawing from industry-specific market research reports, company annual filings, and government economic indicators to provide a comprehensive view of the competitive landscape.