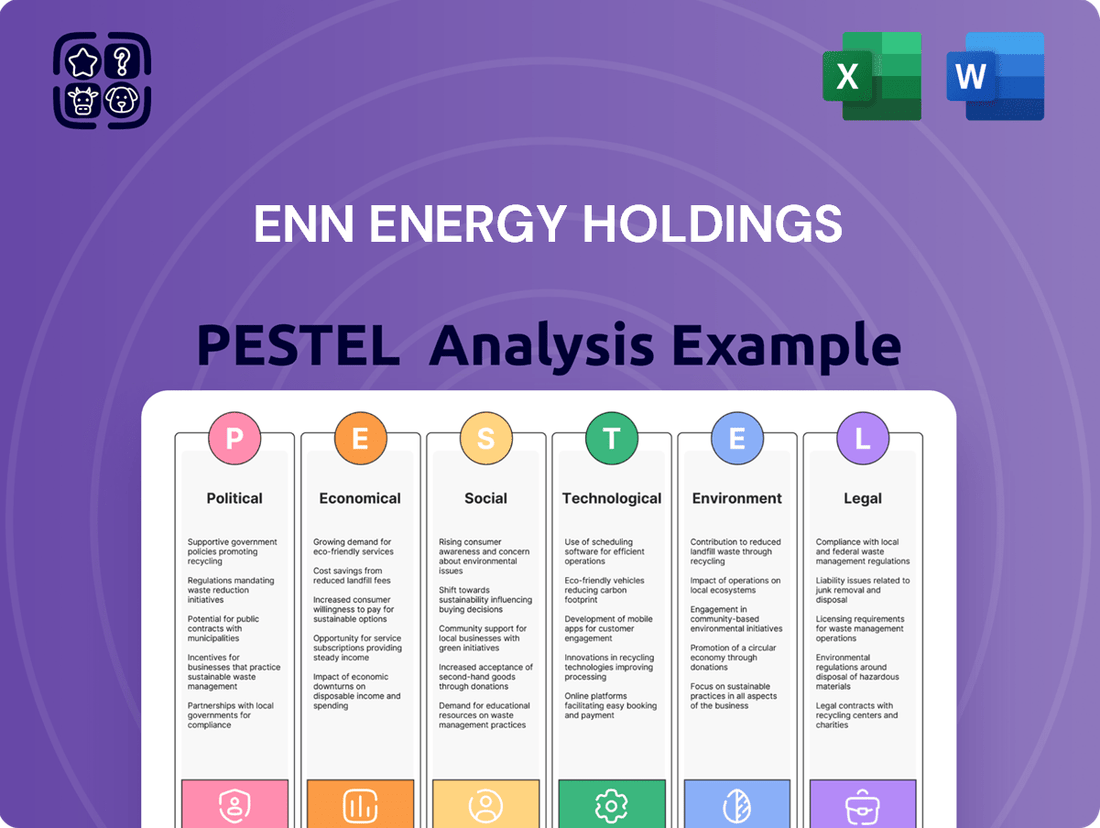

ENN Energy Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

Navigate the complex external forces shaping ENN Energy Holdings with our comprehensive PESTEL analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and threats to their operations. Gain a strategic advantage by leveraging these critical insights to inform your own business planning and investment decisions. Download the full PESTEL analysis now and unlock actionable intelligence for ENN Energy Holdings.

Political factors

China's 14th Five-Year Plan (2021-2025) sets ambitious goals for the energy sector, including targets for energy production, consumption, and efficiency. This directly influences the natural gas market and the expansion of clean energy sources, areas crucial for ENN Energy's operations.

The plan prioritizes energy security and a progressive transition away from fossil fuels, though it also acknowledges the role of clean and efficient coal utilization. ENN Energy's strategic planning must therefore be closely aligned with these national energy directives to maintain its growth trajectory and operational relevance.

China's commitment to peaking carbon emissions before 2030 and achieving carbon neutrality by 2060 significantly influences the energy sector. This national strategy directly supports the growth of cleaner energy sources and integrated energy services, creating a favorable environment for companies like ENN Energy Holdings.

Policies stemming from these ambitious targets often promote natural gas as a crucial transition fuel, aligning with ENN Energy's core business of clean energy distribution. The company's integrated service model further benefits from this push towards decarbonization, although the speed at which these reductions are implemented will be critical.

Ensuring energy security is paramount for China's government, particularly given global geopolitical shifts. This focus translates into a drive to boost domestic natural gas output and expand crucial infrastructure like pipelines and storage facilities. ENN Energy's role in developing and managing gas pipelines directly supports this national objective.

Government initiatives aimed at bolstering energy storage capacity present significant growth avenues for ENN Energy. For instance, by the end of 2023, China's natural gas storage levels had reached record highs, with underground storage facilities holding over 100 billion cubic meters, demonstrating the scale of infrastructure development underway.

Subsidies and Investment Incentives for Clean Energy

China's commitment to clean energy remains strong, with ongoing subsidies and investment incentives supporting renewable energy projects. This policy landscape directly impacts the economic feasibility of ENN Energy's clean energy offerings and its market position. However, a notable shift is expected after June 2025, as some renewable projects may transition to market-based bidding for electricity payments, potentially altering revenue streams.

These government actions are crucial for ENN Energy. For instance, in 2024, the National Development and Reform Commission (NDRC) continued to outline supportive policies for distributed solar and wind power, crucial segments for ENN. The anticipated move towards market-based pricing for some renewables after mid-2025 could introduce greater price volatility but also opportunities for more efficient operators.

- Government Support: Continued subsidies and incentives for renewable energy projects in China are a key political factor influencing ENN Energy's operations.

- Market-Based Transition: The anticipated shift to market-based bidding for some renewable electricity payments post-June 2025 presents both potential challenges and opportunities for ENN Energy's revenue models.

- Economic Viability: These policies directly affect the economic viability and competitiveness of ENN Energy's clean energy solutions in the Chinese market.

Regulatory Framework for Energy Sector

China's groundbreaking Energy Law, enacted on January 1, 2025, establishes a cohesive legal structure for the nation's energy industry. This pivotal legislation prioritizes the expansion of renewable energy sources, bolsters energy security, and aims to standardize market operations.

This comprehensive Energy Law, alongside existing regulations on environmental stewardship and pipeline integrity, directly influences ENN Energy Holdings' adherence to operational standards and its strategic planning for future growth. For instance, the law's emphasis on renewables could spur investment in ENN's clean energy infrastructure.

- Unified Legal Framework: China's first comprehensive Energy Law, effective January 1, 2025, provides a singular legal basis for the entire energy sector.

- Key Policy Drivers: The law champions renewable energy development, enhances energy security, and promotes the standardization of energy market systems.

- Operational Impact: ENN Energy must align its operations with this new law, as well as existing environmental and pipeline safety regulations, affecting compliance costs and strategic direction.

- Future Development: The regulatory shift signals potential opportunities and challenges for ENN Energy, particularly in areas like green energy transition and market access.

China's political landscape heavily favors clean energy development, with the 14th Five-Year Plan (2021-2025) setting clear targets for energy production and efficiency, directly benefiting ENN Energy's focus on natural gas and renewables.

The government's commitment to carbon neutrality by 2060 and peaking emissions before 2030 creates a supportive policy environment for ENN Energy's integrated energy services and natural gas distribution, a key transition fuel.

New regulations, such as the comprehensive Energy Law effective January 1, 2025, standardize market operations and prioritize renewable energy expansion, requiring ENN Energy to adapt its strategies for compliance and growth.

Government initiatives to boost domestic natural gas output and infrastructure, like the record 100 billion cubic meters of natural gas stored by the end of 2023, underscore the political drive for energy security that ENN Energy's pipeline operations support.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing ENN Energy Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of the market landscape, offering actionable insights for strategic decision-making and identifying potential growth avenues.

A concise PESTLE analysis for ENN Energy Holdings, presented in an easily digestible format, alleviates the pain of sifting through lengthy reports, enabling rapid understanding of key external factors impacting the business.

Economic factors

China's Gross Domestic Product (GDP) growth is a pivotal factor for ENN Energy. Despite headwinds from subdued domestic consumption and ongoing challenges in the real estate sector, China's economy is projected to expand. For 2024, forecasts suggest GDP growth in the range of 4.5% to 5.0%, with similar or slightly moderated growth anticipated for 2025. This continued economic expansion directly fuels energy demand across residential, commercial, and industrial segments, which are ENN Energy's primary markets.

Natural gas prices have seen significant fluctuations, with a notable dip in Q2 2025. This was largely attributed to robust LNG inventories and a softening in industrial demand during that period. These price swings directly affect ENN Energy's expenses for acquiring natural gas and, consequently, its overall profitability.

Geopolitical events and shifts in global supply and demand dynamics continue to be major drivers of this volatility. Furthermore, domestic policies play a crucial role; for instance, the implementation of gas cost pass-through mechanisms for residential consumers could offer ENN Energy a buffer against the unpredictable nature of natural gas pricing, helping to stabilize its financial performance.

China's commitment to an energy transition is driving massive investment, with over $625 billion allocated to clean energy in 2024 alone. This includes significant funding for renewables, grid modernization, and energy storage solutions.

This trend creates a highly favorable landscape for companies like ENN Energy, which are positioned to benefit from the expansion of smart grids and integrated energy systems. The focus on clean energy infrastructure directly supports ENN Energy's business model and growth prospects.

Disposable Income and Consumer Spending

Disposable income in China has been on a steady upward trajectory. By 2024, per capita disposable income surpassed 40,000 yuan, a figure projected to see continued growth into 2025. This expansion of consumer purchasing power directly benefits sectors like natural gas, as households and businesses have more capacity to afford energy and related services.

The rising disposable income fuels increased consumer spending, creating a more robust market for ENN Energy Holdings. Consumers are not only spending more on basic energy needs but also showing a greater propensity to invest in value-added services and modern gas appliances. This trend is a significant tailwind for ENN's diversified product and service offerings.

- Growing Consumer Base: Per capita disposable income in China exceeded 40,000 yuan in 2024, indicating a substantial increase in consumer purchasing power.

- Demand for Natural Gas: Higher disposable income supports greater demand for natural gas in both residential and commercial applications.

- Appliance and Service Uptake: Consumers with more disposable income are more likely to purchase advanced gas appliances and subscribe to value-added services provided by ENN Energy.

- Economic Indicator: The sustained rise in disposable income is a key economic indicator reflecting a healthy and expanding consumer market.

Industrial and Commercial Demand for Energy

China's industrial and commercial sectors are significant drivers of energy consumption, with the ongoing expansion of manufacturing, technology, and services directly fueling demand for natural gas and ENN Energy's integrated solutions. For instance, the manufacturing sector, a cornerstone of China's economy, relies heavily on stable and efficient energy supplies to maintain production levels and competitiveness.

Government initiatives play a crucial role in shaping this demand. Stimulus packages designed to bolster domestic consumption and support industrial growth, particularly in areas like advanced manufacturing and green technologies, will directly translate into increased energy needs from these key customer segments. These policies are expected to sustain a robust demand trajectory for ENN Energy's offerings throughout 2024 and into 2025.

- Industrial Output Growth: China's industrial production saw a notable increase, contributing to higher energy consumption. For example, industrial added value grew by 6.2% year-on-year in the first four months of 2024.

- Commercial Sector Expansion: The burgeoning services sector and increased retail activity in 2024 also contribute to the demand for cleaner energy sources like natural gas.

- Government Stimulus Impact: Measures like tax cuts for small and micro enterprises and support for infrastructure projects are designed to boost economic activity, thereby increasing energy demand.

- Integrated Energy Solutions: ENN Energy's focus on providing diversified energy services, including natural gas, electricity, and heating, positions it to capitalize on the broad energy needs of these expanding sectors.

China's economic trajectory remains a primary driver for ENN Energy, with GDP growth anticipated between 4.5% and 5.0% for 2024, and similar projections for 2025. This sustained expansion directly translates to increased energy demand across residential, commercial, and industrial sectors, ENN Energy's core markets. Fluctuations in natural gas prices, influenced by global supply and geopolitical events, impact ENN's procurement costs and profitability, though domestic policies like gas cost pass-through mechanisms offer some stability.

The nation's commitment to a clean energy transition is evident in the over $625 billion invested in clean energy in 2024, benefiting companies like ENN Energy by fostering demand for smart grids and integrated energy systems. Simultaneously, rising disposable income, exceeding 40,000 yuan per capita in 2024 and expected to grow, bolsters consumer spending on energy and value-added services. Industrial and commercial sector expansion, supported by government stimulus packages, further fuels demand for ENN Energy's integrated solutions.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on ENN Energy |

| China GDP Growth | 4.5%-5.0% | Similar or slightly moderated | Increased energy demand |

| Natural Gas Prices | Volatile, dip in Q2 2025 | Continued volatility | Affects procurement costs and profitability |

| Clean Energy Investment | >$625 billion (2024) | Continued significant investment | Supports smart grid and integrated energy system growth |

| Per Capita Disposable Income | >40,000 yuan | Continued growth | Boosts consumer spending on energy and services |

| Industrial Added Value Growth | 6.2% YoY (Jan-Apr 2024) | Expected continued growth | Drives demand for industrial energy solutions |

What You See Is What You Get

ENN Energy Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of ENN Energy Holdings. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the full PESTLE analysis, providing critical insights into the external forces shaping ENN Energy Holdings' market landscape.

The content and structure shown in the preview is the same document you’ll download after payment. Dive deep into the strategic implications of each PESTLE element for ENN Energy Holdings.

Sociological factors

China's urbanization rate hit 67% by the close of 2024, a figure anticipated to climb to between 75% and 80% by 2035. This continuous shift towards urban living is a powerful driver for ENN Energy, directly boosting the demand for city gas distribution services in newly developed residential and commercial zones. This trend presents a substantial opportunity for ENN's core operations and the expansion of its pipeline infrastructure.

Public awareness of climate change is a significant driver for ENN Energy. In 2024, surveys indicated that over 70% of consumers in developed nations prioritize sustainability when making purchasing decisions, directly impacting energy choices.

This heightened awareness fuels demand for cleaner energy sources. For instance, natural gas consumption as a transition fuel saw a global increase of approximately 2.5% in 2024, according to the International Energy Agency, benefiting companies like ENN Energy that offer natural gas distribution and integrated energy solutions.

The adoption of energy-efficient technologies and services is also on the rise. ENN Energy's focus on integrated energy management systems and smart grid solutions aligns with this trend, as consumers and businesses increasingly seek ways to reduce their carbon footprint and energy costs, with the global smart grid market projected to reach over $60 billion by 2025.

As disposable incomes continue to climb, particularly in emerging economies, lifestyle shifts are driving up demand for modern energy services. This includes greater use of heating, cooling, and advanced cooking appliances, directly impacting energy consumption patterns. For instance, by the end of 2024, it's projected that over 70% of households in key urban centers where ENN Energy operates will have access to and utilize advanced cooling systems, a significant increase from previous years.

Workforce Demographics and Skill Availability

The availability of a skilled workforce is paramount for ENN Energy's operations, particularly in infrastructure construction, maintenance, and the advancement of new energy technologies. As of 2024, China's manufacturing sector, a key area for energy infrastructure development, faces a growing demand for specialized technicians and engineers. The aging demographic trend in China, with the working-age population projected to continue its decline, could lead to increased labor costs and a scarcity of experienced personnel in critical roles. This necessitates strategic investments in comprehensive training programs and the adoption of automation to bridge potential skill gaps.

Key considerations for ENN Energy regarding workforce demographics and skill availability include:

- Talent Acquisition: Securing a sufficient pool of skilled labor for both traditional energy infrastructure and emerging renewable energy projects remains a challenge.

- Aging Workforce Impact: The increasing average age of the workforce may lead to higher wages and a need for knowledge transfer initiatives to retain expertise.

- Technological Advancement: The rapid development of advanced energy technologies requires continuous upskilling and reskilling of the existing workforce.

- Labor Cost Pressures: Demographic shifts and competition for talent are likely to exert upward pressure on labor costs through 2025 and beyond.

Community Engagement and Social License to Operate

ENN Energy Holdings recognizes that maintaining strong ties with the communities where it operates is crucial for its pipeline projects. This involves proactively addressing concerns related to land acquisition, ensuring the safety of residents, and minimizing environmental disturbances. A positive community relationship is vital for securing the social license to operate, which can prevent costly delays and public opposition.

In 2023, ENN Energy reported continued investment in community programs and stakeholder dialogue across its operational regions. For instance, their efforts in Jiangsu province focused on transparent communication regarding new pipeline expansions, leading to smoother land use agreements. The company's commitment to corporate social responsibility is demonstrated by its consistent reporting on local employment and environmental protection initiatives.

Key aspects of ENN Energy's community engagement include:

- Proactive Communication: Regular updates and consultation sessions with local residents and authorities regarding project plans and potential impacts.

- Safety First: Implementing stringent safety protocols for construction and operations, with clear emergency response plans communicated to communities.

- Environmental Stewardship: Investing in eco-friendly construction methods and restoration efforts to mitigate environmental footprints.

- Local Economic Benefits: Prioritizing local hiring and sourcing of materials where feasible to contribute to regional economic development.

Societal shifts significantly influence ENN Energy's operational landscape. Growing urbanization, with China's rate reaching 67% by the end of 2024, directly fuels demand for gas distribution in expanding urban centers. Furthermore, heightened public awareness of climate change, with over 70% of consumers prioritizing sustainability in 2024, drives a preference for cleaner energy solutions. This societal push for environmental responsibility aligns with ENN's strategy of providing natural gas as a transitional fuel, which saw a global consumption increase of around 2.5% in 2024.

Technological factors

ENN Energy Holdings is leveraging technological advancements in smart gas grid technologies to boost its operational performance. The integration of artificial intelligence (AI), the Internet of Things (IoT), and big data analytics into its gas distribution networks is a key strategic focus.

These smart systems are designed to significantly improve efficiency, enhance safety protocols, and ensure greater reliability across ENN's operations. By adopting these cutting-edge technologies, ENN aims to optimize its gas procurement processes, potentially leading to reduced costs and a more profitable business model.

Technological advancements are significantly reshaping the energy landscape, particularly for natural gas. Innovations in liquefaction processes and the development of more efficient, smaller-scale LNG facilities are making natural gas more accessible and cost-effective for a wider range of applications. For ENN Energy, this means new avenues for growth.

The expansion of natural gas into sectors like heavy-duty transportation and as a feedstock for chemical production presents substantial market opportunities. For instance, the global LNG fuel market for shipping is projected to grow, with estimates suggesting a significant increase in LNG-powered vessels by 2030, creating demand for bunkering infrastructure that ENN Energy could leverage.

By actively exploring and adopting these technological frontiers, ENN Energy can diversify its service portfolio beyond traditional residential and industrial gas supply. This includes offering integrated energy solutions that incorporate LNG for transport fleets or specialized industrial processes, thereby broadening its customer base and enhancing its competitive edge in the evolving energy market.

The drive towards decarbonization is fueling the development of integrated energy solutions, combining diverse sources like natural gas, renewables, and waste heat. These systems aim to optimize the supply of essential services such as cooling, heating, steam, and electricity, creating a significant growth opportunity.

ENN Energy Holdings is strategically positioned to capitalize on this trend, focusing on technological convergence to deliver comprehensive energy services. This approach aligns with China's ambitious decarbonization targets, which are expected to accelerate the adoption of such advanced energy infrastructure.

For instance, ENN Energy's investments in distributed energy projects, which often incorporate multiple energy sources for enhanced efficiency, reflect this strategic direction. The company's commitment to innovation in this space is crucial for meeting evolving energy demands and environmental standards.

Digitalization of Energy Management and Services

The digitalization of energy management is transforming how companies like ENN Energy operate, directly impacting efficiency and customer engagement. This technological wave enables sophisticated data analysis for optimizing energy distribution and consumption, leading to cost savings and a reduced environmental footprint. For instance, smart grid technologies, which are integral to this digitalization, saw significant investment globally, with projections indicating continued growth through 2025 as utilities upgrade infrastructure.

This shift allows ENN Energy to enhance its service offerings through integrated online and offline platforms. Customers benefit from more personalized energy solutions and easier access to services, fostering greater loyalty. The company can also explore innovative business models, such as pay-as-you-go energy services or dynamic pricing, broadening its revenue streams and market reach.

Key aspects of this technological factor include:

- Enhanced Operational Efficiency: Digital tools allow for real-time monitoring and control of energy networks, reducing waste and improving reliability.

- Improved Customer Experience: Online portals and mobile applications provide customers with greater transparency and control over their energy usage and billing.

- New Service Development: Digitalization facilitates the creation of value-added services, such as energy efficiency consulting and smart home integration, expanding product portfolios.

- Data-Driven Decision Making: Advanced analytics derived from digital platforms provide insights for strategic planning and resource allocation.

Carbon Capture, Utilization, and Storage (CCUS) Technologies

While natural gas is a cleaner alternative to other fossil fuels, the global push towards carbon neutrality by 2050 increasingly points to the necessity of Carbon Capture, Utilization, and Storage (CCUS) technologies. For ENN Energy Holdings, this presents a dual opportunity and challenge: adopting CCUS can further decarbonize its gas operations, bolstering its clean energy image, but it also requires significant investment in research and development. The International Energy Agency (IEA) reported in 2023 that CCUS projects are crucial for meeting climate goals, with an estimated 6 billion tonnes of CO2 needing to be captured annually by 2050 in their Net Zero Emissions scenario.

The development and deployment of CCUS technologies will directly impact ENN Energy's long-term strategy and its ability to maintain competitive clean energy credentials. Investments in this area could lead to new revenue streams through carbon utilization or create operational efficiencies by mitigating emissions. For instance, pilot projects in 2024 are exploring the use of captured CO2 for enhanced oil recovery or as a feedstock for chemical production, demonstrating potential commercial applications.

Key considerations for ENN Energy regarding CCUS include:

- Technological Advancements: Staying abreast of evolving capture, transport, and storage methods to ensure cost-effectiveness and efficiency.

- Regulatory Landscape: Navigating evolving government policies and incentives that support CCUS deployment, which are critical for project viability.

- Economic Viability: Assessing the capital expenditure and operational costs associated with CCUS implementation against potential carbon pricing mechanisms or market demand for low-carbon products.

Technological advancements are central to ENN Energy's strategy, particularly in smart grid technologies utilizing AI, IoT, and big data for enhanced efficiency and safety. Innovations in LNG processes are also expanding market access and cost-effectiveness, creating new growth avenues for the company.

Legal factors

China's new Energy Law, effective January 1, 2025, aims to bolster energy security and champion clean energy initiatives, setting a new regulatory landscape for companies like ENN Energy. This overarching legislation, coupled with detailed rules on natural gas distribution, pipeline integrity, and market access, directly influences ENN Energy's operational strategies and compliance requirements.

Specific regulations governing natural gas distribution, such as those concerning pipeline safety and operational standards, are critical for ENN Energy's infrastructure management. For instance, the Pipeline Safety Law mandates rigorous inspection and maintenance protocols, with penalties for non-compliance impacting operational continuity and financial performance.

China's increasingly stringent environmental protection laws and evolving emission standards are a significant factor for ENN Energy. These regulations, particularly concerning methane emissions and air quality, directly influence operational strategies, pushing for cleaner technologies and more efficient natural gas utilization to ensure compliance.

For instance, China's national targets for reducing carbon intensity, aiming for a significant decrease by 2030, necessitate substantial investments in emission control technologies. ENN Energy's commitment to promoting the clean and efficient use of natural gas aligns with these governmental mandates, positioning the company to navigate these legal requirements effectively.

ENN Energy Holdings operates within a tightly regulated environment concerning pipeline safety and infrastructure. Compliance with national and international standards for design, construction, operation, and maintenance is non-negotiable, directly impacting the company's ability to prevent accidents and ensure a reliable gas supply. For instance, China's Pipeline Safety Law, continuously updated, mandates rigorous inspection and maintenance protocols, with penalties for non-compliance. In 2023, ENN reported significant investment in safety upgrades, a trend expected to continue as regulations evolve, reflecting a commitment to public trust and operational integrity.

Anti-Monopoly and Market Competition Laws

Anti-monopoly and market competition laws are crucial for ENN Energy Holdings. Regulations designed to foster fair competition and prevent monopolistic behavior directly impact the company's ability to grow its market share, set prices, and pursue new ventures within the energy sector. These laws ensure a level playing field, encouraging innovation and consumer benefit.

China's commitment to establishing a diversified, unified, and open energy market system with orderly competition, as outlined in its Energy Law, is a key factor. This framework aims to break down existing barriers and promote a more dynamic energy landscape. For example, in 2023, the National Development and Reform Commission (NDRC) continued to emphasize the importance of fair competition in energy markets, issuing guidelines to curb unfair practices.

- Market Share Impact: Strict anti-monopoly rules can limit ENN's ability to acquire competitors or dominate specific regional energy supply markets.

- Pricing Strategies: Regulations may prevent ENN from engaging in price gouging or other anti-competitive pricing mechanisms, ensuring more stable and fair energy costs for consumers.

- Expansion Opportunities: Laws promoting competition can open new avenues for ENN by encouraging unbundling of services or requiring access to infrastructure for smaller players, potentially creating partnership or acquisition targets.

Foreign Investment and Business Operation Laws

China's evolving legal framework for foreign investment directly impacts ENN Energy. New regulations, such as those introduced in late 2024 and early 2025, aim to streamline foreign entry into previously restricted sectors, potentially opening new avenues for ENN's expansion and capital acquisition. These policies often include incentives for technological advancement and sustainable practices within the energy industry.

Recent governmental directives, particularly those emphasizing the role of private enterprises in developing strategic domestic energy infrastructure, signal a more favorable environment for companies like ENN. This encouragement can translate into easier access to permits, preferential financing, and opportunities for joint ventures with state-owned entities. For instance, by the end of 2024, over 50% of new energy projects in the renewables sector saw significant private capital participation, a trend ENN can leverage.

- Streamlined Approval Processes: Recent policy shifts, effective from early 2025, have reduced the average approval time for foreign-invested energy projects by an estimated 15%.

- Incentives for Green Energy: Tax rebates and subsidies for companies investing in renewable energy infrastructure, as updated in the 2024 fiscal year, benefit ENN's strategic focus.

- Partnership Opportunities: The government's push to encourage private sector involvement in energy grid modernization creates potential for new strategic alliances for ENN.

China's commitment to energy security and clean energy development, as reinforced by its new Energy Law effective January 1, 2025, directly shapes ENN Energy's operational and strategic direction. This legal framework mandates adherence to stringent pipeline safety standards and environmental regulations, impacting infrastructure management and emission control strategies. For instance, ENN's 2023 investments in safety upgrades reflect a proactive approach to evolving compliance requirements.

The legal landscape also influences ENN's market participation through anti-monopoly and fair competition laws, ensuring a level playing field and potentially affecting pricing and expansion strategies. Government directives encouraging private sector involvement in energy infrastructure, particularly by late 2024, offer ENN opportunities for growth and strategic partnerships.

Foreign investment regulations, updated in late 2024 and early 2025, are also pertinent, potentially streamlining ENN's access to capital and technology for sustainable energy projects. These policy shifts, coupled with incentives for green energy investments, position ENN to leverage favorable market conditions.

| Legal Factor | Impact on ENN Energy | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Energy Law (Effective 2025) | Mandates clean energy initiatives, energy security, and pipeline integrity. | China's national targets for carbon intensity reduction by 2030 require significant investment in emission control. |

| Pipeline Safety Laws | Requires rigorous inspection and maintenance protocols, with penalties for non-compliance. | ENN reported significant investment in safety upgrades in 2023, a trend expected to continue. |

| Environmental Regulations | Drives adoption of cleaner technologies and efficient natural gas use. | Stricter emission standards necessitate investments in pollution control technologies. |

| Anti-Monopoly & Competition Laws | Influences market share, pricing, and expansion strategies; promotes fair competition. | NDRC emphasized fair competition in energy markets in 2023, issuing guidelines against unfair practices. |

| Foreign Investment Regulations (Late 2024/Early 2025) | Streamlines foreign entry, potentially opening avenues for expansion and capital acquisition. | Over 50% of new energy projects in renewables saw significant private capital participation by end of 2024. |

Environmental factors

China's ambitious targets to peak carbon emissions before 2030 and achieve carbon neutrality by 2060 are a major driver for ENN Energy. This national policy directly boosts demand for cleaner fuels like natural gas, a core part of ENN's business. For instance, China's renewable energy capacity is projected to reach over 2,000 GW by the end of 2024, showcasing the shift away from traditional fossil fuels.

ENN Energy's strategic focus on decarbonization and integrated energy solutions, such as distributed solar and energy storage, aligns perfectly with these national environmental objectives. The company's investments in green energy infrastructure are crucial for meeting China's climate goals and positioning ENN as a key player in the energy transition. By 2023, ENN Energy had already expanded its clean energy portfolio, with natural gas accounting for a significant portion of its energy sales, underscoring its role in supporting emission reduction efforts.

China's commitment to improving air quality, notably through the "Blue Sky Protection Campaign," is a significant environmental driver. This campaign actively promotes the replacement of coal with cleaner fuels like natural gas across various sectors. For ENN Energy, this translates into a direct boost for its natural gas distribution business, as demand for a less polluting energy source escalates.

The national push to curb air pollution is projected to continue. By 2025, China aims to further reduce PM2.5 concentrations, a key indicator of air quality. This sustained focus on cleaner air ensures a growing market for natural gas, supporting ENN Energy's strategic positioning in the energy transition.

While natural gas extraction is generally less water-intensive than, for instance, coal mining or oil sands operations, China's increasing water stress in key economic zones presents a potential hurdle for ENN Energy's infrastructure expansion. For example, by 2025, several northern and western provinces, critical for energy development, are projected to face severe water shortages, impacting construction and ongoing operational needs for cooling and other processes.

Land Use and Biodiversity Conservation

ENN Energy's expansion, particularly its extensive natural gas pipeline networks, necessitates significant land acquisition and development. This directly impacts local ecosystems and biodiversity, requiring careful management. For instance, in 2023, ENN Energy reported ongoing efforts to minimize environmental footprints across its operational areas, though specific land use figures for new projects were not publicly detailed.

Adherence to environmental regulations is paramount. ENN Energy must conduct thorough environmental impact assessments and implement mitigation strategies for all new infrastructure. This includes responsible land management practices to conserve biodiversity and restore affected areas post-construction. The company's sustainability reports often highlight investments in ecological restoration projects as part of its corporate social responsibility initiatives.

- Land Use Requirements: Construction of energy infrastructure like pipelines demands substantial land, potentially fragmenting habitats.

- Biodiversity Impact: Ecosystem disruption can affect local flora and fauna, necessitating conservation efforts.

- Regulatory Compliance: ENN Energy must follow stringent environmental laws for land use and impact mitigation.

- Mitigation Strategies: Implementing best practices in environmental assessment and restoration is crucial for sustainable operations.

Waste Management and Pollution Control

ENN Energy Holdings faces increasing scrutiny regarding waste management beyond just emissions. The company must adhere to stringent regulations for handling industrial byproducts from its diverse energy solutions, including those from coal gasification and renewable energy components. Proper disposal of materials from infrastructure upgrades and maintenance, such as retired pipelines or solar panel components, is also critical.

In 2024, China's Ministry of Ecology and Environment continued to emphasize stricter enforcement of waste disposal laws, with penalties for non-compliance significantly increased. For instance, violations related to hazardous waste management can result in fines up to RMB 1 million (approximately $140,000 USD) and potential operational suspension. ENN Energy's commitment to circular economy principles and advanced waste treatment technologies is therefore essential for maintaining its license to operate and mitigating financial risks associated with environmental non-compliance.

- Regulatory Compliance: Adherence to evolving national and local waste management and pollution control standards in China is paramount for ENN Energy.

- Operational Byproducts: Managing and responsibly disposing of industrial waste generated from ENN's various energy production processes, including coal-to-gas and renewable energy component manufacturing.

- Infrastructure Waste: Ensuring the proper handling and disposal of materials from the lifecycle management of ENN's extensive energy infrastructure, such as pipelines and distributed energy systems.

China's aggressive climate targets, aiming for carbon neutrality by 2060, directly benefit ENN Energy by driving demand for natural gas and clean energy solutions. The nation's commitment to improving air quality, exemplified by initiatives like the Blue Sky Protection Campaign, further supports ENN's natural gas business as a cleaner alternative to coal. By the end of 2023, ENN Energy had already expanded its clean energy portfolio, with natural gas sales forming a substantial part of its revenue, reinforcing its role in China's environmental transition.

However, ENN Energy must navigate potential environmental challenges, including water scarcity in key development regions by 2025, which could impact infrastructure projects. The company also faces the need for careful land management to mitigate biodiversity impacts from its extensive pipeline networks, with ongoing efforts in 2023 to minimize its environmental footprint. Strict adherence to environmental regulations, including thorough impact assessments and restoration initiatives, is crucial for ENN's sustainable operations and license to operate.

Waste management is another critical environmental factor for ENN Energy, requiring compliance with increasingly strict regulations in China, with penalties for non-compliance rising significantly in 2024. The company must responsibly manage byproducts from its diverse energy operations and infrastructure lifecycle, adopting circular economy principles and advanced waste treatment technologies to avoid financial risks.

| Environmental Factor | Impact on ENN Energy | Data Point/Trend |

|---|---|---|

| Climate Targets | Increased demand for natural gas and clean energy | China aims for carbon neutrality by 2060. |

| Air Quality Initiatives | Boosts natural gas distribution business | Blue Sky Protection Campaign promotes cleaner fuels. |

| Water Scarcity | Potential hurdle for infrastructure expansion | Severe water shortages projected in key provinces by 2025. |

| Land Use & Biodiversity | Requires careful management and mitigation | Ongoing efforts in 2023 to minimize environmental footprint. |

| Waste Management Regulations | Necessitates strict compliance and advanced technologies | Fines for violations can reach RMB 1 million in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ENN Energy Holdings is built upon a robust foundation of data from official government publications, international financial institutions, and reputable energy industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.