ENN Energy Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

Curious about ENN Energy Holdings' market position? This preview offers a glimpse into their product portfolio's potential, hinting at where their strengths and weaknesses lie within the BCG Matrix framework. Understand which segments are driving growth and which might require a strategic rethink.

To truly unlock ENN Energy Holdings' strategic potential, dive into the complete BCG Matrix analysis. Gain a granular understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you with the knowledge to make informed investment and resource allocation decisions. Purchase the full report for actionable insights and a clear path forward.

Stars

ENN Energy's integrated energy solutions represent a significant growth area, showcasing a robust 19.8% surge in sales volume during 2024. This segment is well-positioned to capitalize on national decarbonization efforts and the drive for energy efficiency, making it a crucial contributor to ENN's future earnings. As of March 31, 2025, the company reported a 9.9% year-on-year increase in cumulative integrated energy sales volume, underscoring its expanding market presence.

Commercial and Industrial (C&I) natural gas sales represent a strong performer for ENN Energy. In the first nine months of 2024, the company saw a healthy 5.7% year-on-year rise in sales volume for this segment.

The acquisition of new industrial clients throughout fiscal year 2024 is a key factor anticipated to boost gas volume growth in fiscal year 2025.

This segment's strength is underpinned by China's continued industrial expansion and a growing preference for cleaner energy sources within the industrial sector.

Renewable energy project development, particularly in photovoltaic and biomass, is a key growth area for ENN Energy, reflecting its commitment to decarbonization. By March 31, 2025, the company had achieved a substantial 1,029 MW of grid-connected photovoltaic capacity. This significant investment underscores the strategic importance of these projects for future expansion and a cleaner energy portfolio.

Digital Low-Carbon Services

Digital Low-Carbon Services represent a key growth area for ENN Energy Holdings, leveraging digital technologies for intelligent energy solutions. This segment is experiencing strong demand driven by the push for greener energy and operational efficiency. For instance, ENN's smart energy management platforms are designed to optimize consumption and reduce carbon footprints for its clients, aligning with global decarbonization trends. The company's investment in these digital capabilities positions it to capture a significant share of the evolving energy services market.

The strategic focus on digital and intelligent services directly addresses customer and industry challenges by providing customized energy solutions. This approach not only enhances operational efficiency but also fosters deeper customer engagement. By infusing intelligence into the energy sector, ENN aims to create more sustainable and cost-effective energy ecosystems. The market for energy management and optimization services is projected for substantial growth, with digital solutions being a primary driver.

- Digital Transformation: ENN is integrating digital technologies to offer intelligent upgrades and comprehensive energy solutions.

- Market Demand: Growing demand for green solutions and intelligent systems fuels the expansion of these services.

- Efficiency and Engagement: Digital services improve operational efficiency and customer interaction, boosting market competitiveness.

- Industry Impact: ENN's goal is to infuse intelligence into the energy industry to solve critical customer and sector challenges.

Strategic Decarbonization Initiatives

ENN Energy's strategic decarbonization initiatives are a cornerstone of its future growth, placing it firmly in the "Stars" quadrant of the BCG Matrix. The company has set aggressive targets, aiming for a 50% reduction in greenhouse gas emission intensity for its city-gas operations by 2030, using 2019 as a baseline. This forward-thinking approach not only addresses environmental concerns but also unlocks significant business potential in China's rapidly expanding low-carbon economy.

These efforts are already yielding tangible results and attracting substantial investment. ENN Energy's integrated energy business has shown considerable progress, demonstrating the viability of its green energy solutions. By aligning with China's national decarbonization goals, ENN Energy is not just meeting regulatory requirements but actively driving innovation and positioning itself as a key player in the sustainable development landscape.

- Decarbonization Targets: 50% reduction in GHG emission intensity for city-gas business by 2030 (vs. 2019).

- Integrated Energy Growth: Significant progress reported, indicating strong market adoption.

- Market Positioning: Leader in China's low-carbon transition, attracting green finance.

- Strategic Alignment: Initiatives support national environmental goals and foster sustainable development.

ENN Energy's integrated energy solutions and renewable energy projects, particularly in photovoltaic and biomass, are clear "Stars." The company achieved 1,029 MW of grid-connected photovoltaic capacity by March 31, 2025, and saw integrated energy sales volume increase by 9.9% year-on-year as of the same date. These segments demonstrate high market growth and strong competitive positions, driven by China's decarbonization efforts and increasing demand for cleaner energy.

| Segment | Market Growth | Competitive Position | 2024/2025 Data Highlight |

|---|---|---|---|

| Integrated Energy Solutions | High | Strong | 19.8% sales volume surge (2024), 9.9% YoY increase (as of Mar 31, 2025) |

| Renewable Energy Projects (PV & Biomass) | High | Strong | 1,029 MW grid-connected PV capacity (as of Mar 31, 2025) |

What is included in the product

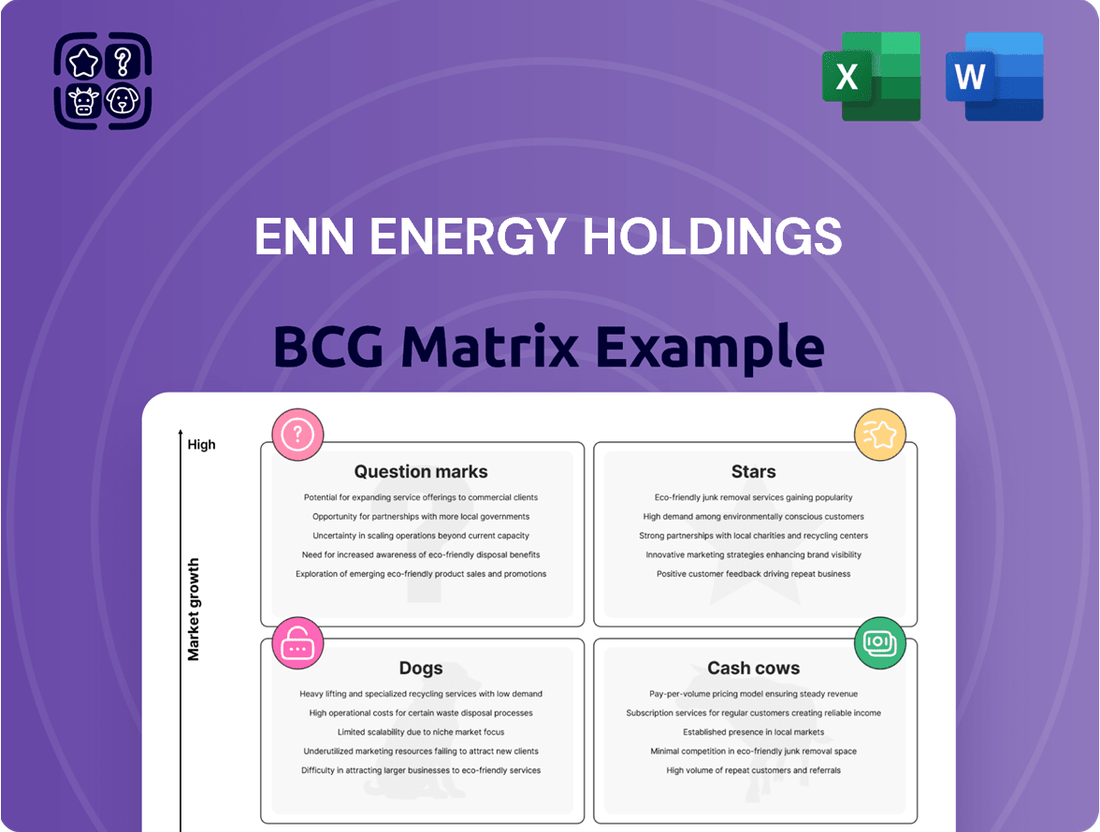

This BCG Matrix overview for ENN Energy Holdings analyzes its business units, identifying which units to invest in, hold, or divest based on market growth and share.

The ENN Energy Holdings BCG Matrix provides a clear, one-page overview of each business unit's position, simplifying strategic decision-making.

This optimized layout is export-ready for PowerPoint, offering a clean, distraction-free view for C-level presentations.

Cash Cows

ENN Energy's residential natural gas distribution is a definite Cash Cow. It's a cornerstone of their operations, making them one of China's top three gas distributors. In 2024, they held a significant 6.1% market share based on gas sales volume.

This segment generates predictable and steady cash flow, thanks to a massive customer base exceeding 31 million residential households. Even though the pace of new customer acquisition has moderated, the sheer size of their existing network guarantees dependable revenue streams.

ENN Energy's natural gas pipeline infrastructure is a classic Cash Cow. Operating across 21 provinces with 261 city-gas projects in China, this mature segment generates consistent revenue from transmission and distribution fees. The substantial asset base and high entry barriers solidify its stable income stream, contributing significantly to ENN's overall financial health.

ENN Energy's domestic wholesale natural gas business is a cornerstone of its operations, benefiting from a secure gas supply and efficient procurement strategies. This segment consistently delivers stable volumes and margins, underpinning the company's financial resilience.

Despite a minor dip in overall revenue for 2024, ENN Energy's dedicated focus on its domestic natural gas segment has resulted in a notable increase in core profit from these activities. This strategic emphasis highlights the segment's importance in driving profitability.

Established Value-Added Services

ENN Energy's established value-added services, encompassing gas appliances and other customer-focused offerings, are key cash cows. These services consistently deliver strong profit margins, benefiting from ENN's extensive customer base. This strategy not only secures a stable revenue stream but also deepens customer loyalty.

- High Profit Margins: These services are designed to be highly profitable, contributing significantly to ENN's overall financial health.

- Customer Stickiness: By offering integrated solutions, ENN enhances customer retention, making it harder for customers to switch providers.

- Stable Revenue Stream: The consistent demand for these essential services provides a reliable income source, even during economic fluctuations.

- Online-Offline Integration: ENN's strategic blend of digital and physical touchpoints further bolsters the growth and accessibility of these offerings.

Strong Financial Position and Dividend Payouts

ENN Energy Holdings demonstrates robust financial health, evidenced by a consistently low net gearing ratio, which stood at approximately 45% as of the end of 2023. This healthy leverage position, coupled with strong operating cash flow generation, provides a solid foundation for its mature business segments.

The company has a commendable track record of returning value to shareholders through consistent dividend payouts. In 2023, ENN Energy declared a final dividend of HK$1.05 per share, resulting in a total dividend for the year of HK$1.50 per share, offering an attractive dividend yield of around 4.5% based on its share price in early 2024. This reflects its capacity to convert substantial cash from its established operations into shareholder returns.

This financial stability is crucial, as it allows ENN Energy to confidently allocate capital towards other strategic initiatives and growth opportunities within its portfolio, including its investments in emerging energy solutions.

- Stable Financial Position: Low net gearing ratio (approx. 45% in 2023) and strong operating cash flow.

- Consistent Dividend Payouts: Total dividend of HK$1.50 per share in 2023, yielding around 4.5%.

- Shareholder Value: Demonstrates ability to generate and return substantial cash from mature operations.

- Funding Capability: Financial strength supports investment in other ventures and growth areas.

ENN Energy's residential natural gas distribution and its extensive pipeline infrastructure are prime examples of Cash Cows within the company's BCG Matrix. These segments, characterized by high market share and low growth, generate substantial and stable cash flows, underpinning ENN's overall financial strength.

The company's commitment to its domestic natural gas business, including wholesale operations and value-added services, further solidifies its Cash Cow status. These mature segments consistently deliver strong profit margins and reliable revenue streams, benefiting from ENN's vast customer base and efficient operational strategies.

ENN Energy's financial stability, evidenced by a low net gearing ratio of approximately 45% at the end of 2023 and consistent dividend payouts totaling HK$1.50 per share in 2023, highlights its ability to extract significant value from these mature operations.

| Segment | BCG Category | Key Characteristics | Financial Contribution |

| Residential Natural Gas Distribution | Cash Cow | High market share, stable customer base (>31 million), predictable revenue | Consistent cash generation, supports overall profitability |

| Natural Gas Pipeline Infrastructure | Cash Cow | Mature segment, extensive network (21 provinces), high entry barriers | Stable income from transmission/distribution fees |

| Domestic Wholesale Natural Gas | Cash Cow | Secure supply, efficient procurement, stable volumes and margins | Underpins financial resilience |

| Value-Added Services (Appliances, etc.) | Cash Cow | High profit margins, customer stickiness, stable demand | Strong profit contribution, deepens customer loyalty |

Full Transparency, Always

ENN Energy Holdings BCG Matrix

The ENN Energy Holdings BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase, containing no watermarks or demo content. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of ENN Energy Holdings' business units. Upon purchase, you will gain immediate access to this professionally designed, analysis-ready document, perfect for integration into your business planning and presentations.

Dogs

International LNG trading, once a strong performer for ENN Energy Holdings, saw a notable dip in profitability for the first nine months of 2024. Pre-tax gains in this segment were considerably lower compared to the same period in the prior year, signaling a shift in the company's strategic priorities.

Management has explicitly stated that the company's core focus remains on its domestic operations. This suggests a deliberate de-emphasis on international LNG trading, potentially due to lower anticipated returns or increased market volatility in that sector.

Consequently, international LNG trading can be categorized as a low-growth, low-return area within ENN Energy's portfolio, especially when contrasted with its more robust domestic energy distribution and services segments.

New residential gas connection installations for ENN Energy Holdings are currently in the "cash cow" or "dog" quadrant of the BCG matrix, reflecting a significant slowdown. The pace of new installations has decelerated, with a notable 19.2% year-on-year decrease in newly developed residential households during the first nine months of 2024. This decline is largely attributed to a sluggish real estate market in China, impacting the growth prospects of this segment.

This business line, historically a strong contributor with high margins, is now seeing reduced contributions and lower average connection fees. The market conditions indicate a low-growth prospect for new residential gas connections, making it a less attractive area for significant investment or expansion compared to other business units within ENN Energy Holdings.

ENN Energy's lower-margin power generation segment shows a declining contribution as the company prioritizes more profitable areas. This indicates it's not a key growth engine for ENN Energy.

The limited profitability and market share of this segment suggest it might be a candidate for divestment or reduced investment. For instance, in 2023, ENN Energy's revenue from gas distribution and integrated energy services significantly outpaced its power generation revenue, highlighting the strategic shift.

Underperforming City Gas Projects

ENN Energy's portfolio includes city gas projects that are currently facing headwinds, classifying them as potential Dogs in the BCG Matrix. These projects are likely situated in areas experiencing sluggish economic development or intense local competition, which directly impacts their ability to expand gas sales. For instance, the company reported a modest overall gas sales volume growth in Q1 2025, indicating that not all segments are performing at peak capacity.

These underperforming projects are characterized by low growth in gas sales volume and a potentially shrinking market share within their operational areas. Consequently, they demand more investment and resources than they currently generate in returns. This situation necessitates careful management and strategic decisions to either revitalize these operations or consider divestment.

Key indicators for these underperforming city gas projects include:

- Stagnant or declining gas sales volume growth rates.

- Erosion of market share in their respective local markets.

- Higher operational costs relative to revenue generated.

- Limited prospects for significant future growth due to external market conditions.

Outdated or Niche Gas Appliances Sales

Outdated or niche gas appliances within ENN Energy Holdings' value-added services represent a classic 'dog' in the BCG matrix. These products, characterized by low market share and low market growth, are likely seeing declining sales volumes as consumers shift towards more energy-efficient and technologically advanced options.

For instance, while specific 2024 sales figures for these niche appliances are not publicly detailed by ENN Energy Holdings, the broader trend in the gas appliance market shows a significant push towards smart home integration and enhanced energy efficiency. Products failing to meet these evolving consumer expectations will naturally fall into the dog category.

These underperforming products typically demand significant marketing resources for minimal sales uplift, diverting attention from ENN Energy's strategic focus on innovation and upgrading its existing product lines to better align with current market demands and sustainability goals.

- Low Market Share: Sales of outdated gas appliances are minimal compared to the overall market for modern, efficient alternatives.

- Low Market Growth: The demand for these older models is stagnant or declining as consumer preferences evolve.

- High Marketing Costs: Significant investment is required to promote these niche products, yielding poor returns.

- Strategic Divergence: These appliances do not align with ENN Energy's focus on smart, energy-efficient solutions.

International LNG trading at ENN Energy Holdings, while previously strong, experienced a profitability dip in the first nine months of 2024. This segment, characterized by low growth and returns, is being de-emphasized in favor of domestic operations, making it a 'dog' in the BCG matrix.

New residential gas connection installations also fall into the 'dog' category due to a significant 19.2% year-on-year decrease in new households in the first nine months of 2024, driven by a weak real estate market.

The lower-margin power generation segment shows a declining contribution, with gas distribution and integrated energy services significantly outperforming it in 2023 revenue, further solidifying its 'dog' status.

Outdated gas appliances in value-added services are also 'dogs,' facing declining sales as consumers opt for more efficient, modern alternatives, demanding significant marketing resources for minimal returns.

| Segment | BCG Category | Key Indicators |

| International LNG Trading | Dog | Low profitability, de-emphasized by management |

| New Residential Gas Connections | Dog | 19.2% YoY decrease in installations (Jan-Sep 2024), weak real estate market |

| Power Generation | Dog | Declining contribution, lower revenue than gas distribution (2023) |

| Outdated Gas Appliances | Dog | Low market share, declining sales, high marketing costs |

Question Marks

ENN Energy is actively pursuing hydrogen energy applications, recognizing its critical role in China's ambitious decarbonization goals. This sector represents a significant growth opportunity, aligning with the nation's push for cleaner energy sources.

While the hydrogen market in China is poised for substantial expansion, ENN's current involvement is likely in its early stages. As of recent data, China aims to have over 50,000 fuel cell vehicles by 2025 and a hydrogen production capacity of 100 million tons per year by 2030, indicating a vast, developing landscape where ENN is still building its presence and scale.

ENN Energy Holdings is actively investigating advanced geothermal and air energy solutions, leveraging its established integrated energy micro-grid model. These innovative clean energy technologies hold substantial growth potential, though they currently constitute a minor segment of ENN's broader operations.

Significant investment is necessitated in research, development, and pilot initiatives to validate market feasibility and achieve scalability for these advanced energy solutions. For instance, in 2024, ENN Energy continued its focus on diversifying its clean energy portfolio, with investments in new energy sources like geothermal and air-source heat pumps forming a key part of its long-term strategy to reduce carbon intensity.

ENN Energy is actively investing in new digital platforms to boost customer engagement, aiming to seamlessly blend online and offline experiences and broaden its service portfolio. This strategic push reflects a growing emphasis on customer-centricity and smart technologies.

These novel digital initiatives, designed to foster customer loyalty and introduce new offerings, are likely in their nascent stages. Consequently, they represent a significant cash investment with an uncertain path to market penetration and profitability, characteristic of question marks in the BCG matrix.

Specific Pilot Projects in Zero-Carbon Energy

ENN Energy is actively exploring cutting-edge zero-carbon energy solutions to meet its 2050 carbon neutrality goal. Beyond established areas like solar and biomass, these ventures represent significant investments with initially uncertain commercial viability.

These ambitious pilot projects, such as advanced hydrogen production and carbon capture utilization and storage (CCUS) initiatives, are positioned as potential Stars in the BCG matrix. For instance, ENN Energy's commitment to hydrogen is evident in its participation in projects aiming for large-scale green hydrogen production, a sector projected to grow significantly. By 2024, global investment in clean hydrogen is expected to reach tens of billions, highlighting the potential scale of these ENN ventures.

- Green Hydrogen Production: ENN Energy is investing in pilot projects for green hydrogen generation, utilizing renewable energy sources.

- Carbon Capture, Utilization, and Storage (CCUS): The company is exploring CCUS technologies to reduce emissions from existing energy infrastructure.

- Advanced Energy Storage: Research and development into next-generation battery technologies and other storage solutions are underway.

- Geothermal Energy Exploration: ENN is also investigating the potential of geothermal energy as a stable, zero-emission power source.

Overseas Market Expansion in New Energy

Overseas market expansion for ENN Energy's new energy initiatives, such as solar or hydrogen projects, would likely fall into the question mark category of the BCG matrix. These ventures demand substantial upfront capital and face considerable hurdles in establishing a foothold in unfamiliar territories. For instance, ENN's reported total assets in 2024 were approximately RMB 220.7 billion, with a significant portion dedicated to its domestic infrastructure. Expanding this footprint internationally would require a strategic allocation of capital towards new, unproven markets.

The inherent risks associated with entering new geographical markets, including regulatory complexities and varying consumer adoption rates for clean energy solutions, contribute to their question mark status. ENN's commitment to sustainable development is evident, but translating its successful integrated energy model from China to diverse global landscapes presents a significant challenge. The company's 2024 revenue from integrated energy services reached RMB 79.8 billion, highlighting the scale of its domestic success that needs to be replicated abroad.

- High Initial Investment: International expansion necessitates significant capital outlay for infrastructure, market research, and regulatory compliance, potentially diverting funds from established domestic operations.

- Market Entry Challenges: Navigating diverse regulatory frameworks, competitive landscapes, and differing customer preferences in new overseas markets poses a substantial risk.

- Unproven Market Share: ENN's established dominance in China does not guarantee similar success abroad; building brand recognition and market share in new regions requires time and strategic effort.

- Technological Adaptation: Tailoring new energy solutions to meet the specific environmental conditions and energy demands of different countries is crucial for adoption and profitability.

ENN Energy's exploration into advanced geothermal and air energy solutions, alongside its digital platform initiatives, represent significant investments with uncertain market penetration and profitability. These ventures require substantial capital for research, development, and pilot programs to prove their scalability. For example, in 2024, ENN Energy continued to allocate resources towards diversifying its clean energy portfolio, with a particular focus on these innovative but nascent technologies.

Overseas expansion for ENN's new energy projects also falls into the question mark category. These initiatives demand considerable upfront capital and face significant hurdles in establishing a presence in unfamiliar territories, with risks including regulatory complexities and varying consumer adoption rates for clean energy. ENN's 2024 revenue from integrated energy services was RMB 79.8 billion, underscoring the scale of domestic success that needs to be replicated internationally.

| BCG Category | ENN Energy Initiatives | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Question Marks | Geothermal & Air Energy Solutions | High investment, uncertain profitability, nascent stage | Continued focus on diversifying clean energy portfolio |

| Question Marks | Digital Platforms for Customer Engagement | Significant cash investment, uncertain market penetration | Emphasis on customer-centricity and smart technologies |

| Question Marks | Overseas Market Expansion (New Energy) | High initial investment, market entry challenges, unproven market share | Total assets ~RMB 220.7 billion, primarily domestic; revenue from integrated energy services RMB 79.8 billion |

BCG Matrix Data Sources

Our BCG Matrix is informed by ENN Energy Holdings' official financial statements, industry growth projections, and internal performance data to provide a comprehensive strategic overview.