ENN Energy Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Energy Holdings Bundle

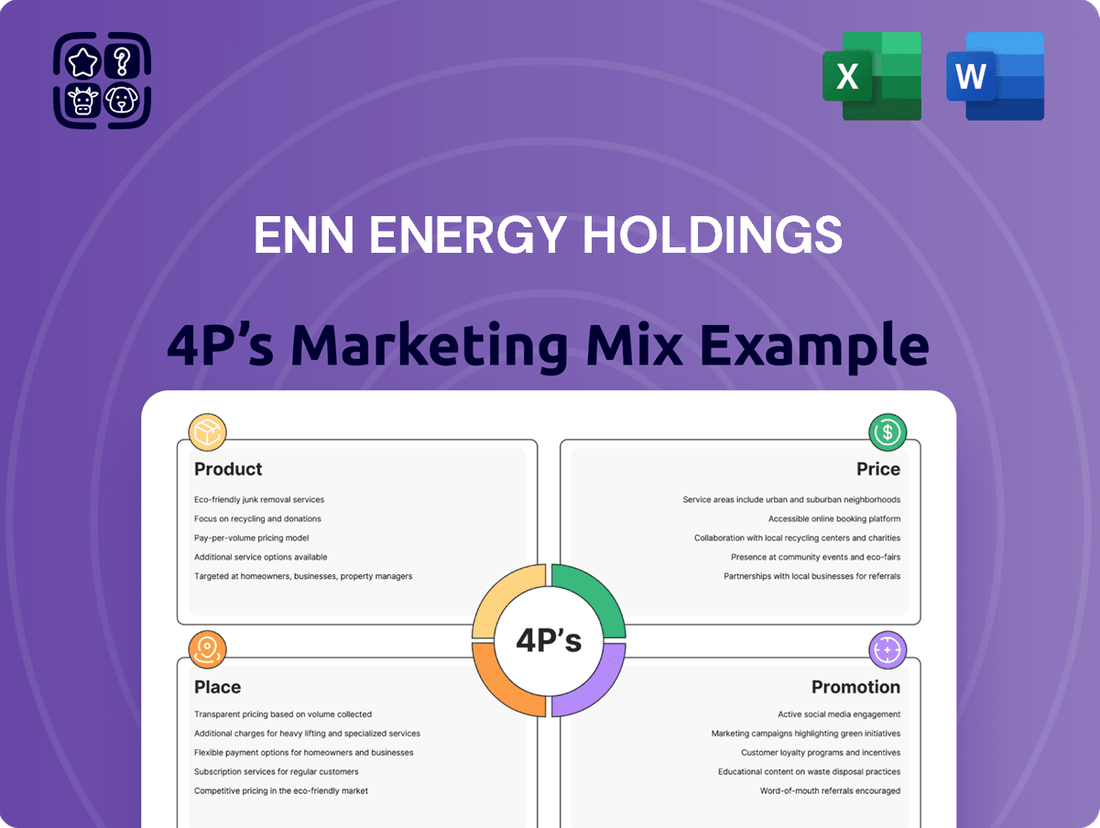

Discover how ENN Energy Holdings masterfully crafts its product offerings, sets competitive prices, strategically places its services, and executes impactful promotions. This analysis reveals the core of their market success.

Go beyond the surface and gain a comprehensive understanding of ENN Energy Holdings' 4Ps. This in-depth report provides actionable insights into their product portfolio, pricing strategies, distribution networks, and promotional campaigns, perfect for strategic planning.

Unlock the secrets to ENN Energy Holdings' marketing prowess with our complete 4Ps analysis. This professionally written, editable report offers a detailed breakdown of their product, price, place, and promotion strategies, saving you valuable research time.

Product

ENN Energy's core product is the distribution of natural gas, serving over 31 million residential customers, alongside commercial and industrial users in 21 Chinese provinces. This encompasses both piped gas and liquefied natural gas (LNG) sales, highlighting a broad market reach.

The company's product strategy emphasizes innovation, leveraging intelligent technologies to enhance natural gas offerings and service models. This focus aims to meet evolving customer demands while guaranteeing a secure and dependable energy supply, a critical factor in China's energy landscape.

Integrated Energy Solutions represent ENN Energy's commitment to providing comprehensive, low-carbon energy services. This segment focuses on developing and operating diverse clean energy projects, such as solar photovoltaics and biomass, to create tailored energy systems for industrial and enterprise clients. By integrating multiple energy sources and balancing supply with demand, these solutions are designed to accelerate the low-carbon transition.

In 2023, ENN Energy's integrated energy solutions segment saw significant growth, with the company actively expanding its distributed solar capacity. As of the end of 2023, ENN Energy reported a substantial increase in its installed clean energy capacity, demonstrating a tangible shift towards low-carbon offerings for its customer base.

ENN Energy Holdings' gas pipeline infrastructure is a core product, encompassing the investment, construction, operation, and management of extensive networks across China. This vital service ensures the safe and efficient delivery of natural gas, directly supporting the company's extensive urban gas projects.

As of the first half of 2024, ENN Energy operated 261 urban gas projects, serving a population of 143 million. This vast network represents a significant asset, underpinning the company's market presence and its ability to meet growing energy demands.

Value-Added Services (Household & Enterprise)

ENN Energy Holdings extends its offerings beyond basic utility provision by developing a suite of value-added services tailored to both household and enterprise needs. For residential customers, these services focus on enhancing the user experience and promoting efficiency. This includes smart meter installations and upgrades for better consumption tracking, alongside the promotion of energy-saving gas appliances, such as high-efficiency water heaters and stoves. These initiatives aim to improve household comfort and reduce energy bills, contributing to a better quality of life. For instance, by the end of 2023, ENN had connected over 10 million smart meters, facilitating more precise energy management for its household clients.

For its enterprise clients, ENN Energy provides more complex, integrated energy solutions. These offerings are designed to help businesses manage their energy consumption more effectively and achieve their carbon reduction targets. The company's comprehensive energy and carbon integration solutions encompass areas like distributed energy systems, energy storage, and carbon trading advisory services. This strategic focus allows enterprises to optimize their energy procurement, reduce operational costs, and enhance their environmental, social, and governance (ESG) performance. In 2024, ENN reported a significant increase in its industrial energy solutions segment, serving over 5,000 industrial parks and key accounts with tailored energy management strategies.

ENN's value-added services are crucial for differentiating its market position and fostering deeper customer relationships. The company's strategy involves leveraging its extensive gas distribution network to introduce these enhanced services. Key components of this strategy include:

- Intelligent Household Upgrades: Smart meter deployment and promotion of energy-efficient gas appliances to improve living standards.

- Enterprise Energy Optimization: Providing integrated solutions for energy management and carbon footprint reduction for businesses.

- Digitalization of Services: Enhancing customer engagement through digital platforms for service requests and energy monitoring.

- Sustainable Energy Solutions: Supporting the transition to cleaner energy sources for both residential and commercial sectors.

Digital Intelligence Services

ENN Energy Holdings' Digital Intelligence Services represent a key aspect of its product strategy, focusing on integrating advanced technologies to improve customer experience and operational performance. The company is actively developing digital product systems and offering specialized digital intelligence services, particularly within the realm of low-carbon integrated solutions. This strategic push aims to leverage data and digital platforms to provide more value-added services to its customer base.

The application of these digital services is extensive, encompassing the use of Internet of Things (IoT), big data analytics, and artificial intelligence (AI). These technologies are crucial for real-time monitoring of energy consumption and for enhancing safety management systems. For instance, ENN Energy reported in its 2023 annual report that its digital transformation initiatives contributed to improved operational efficiency, with specific metrics on reduced response times for service requests and enhanced predictive maintenance capabilities across its network.

- Digital Product Systems: Development of integrated digital platforms for energy management and customer interaction.

- Low-Carbon Solutions: Providing digital intelligence services that support and optimize the use of renewable and low-carbon energy sources.

- IoT, Big Data, AI Integration: Employing these technologies for real-time operational monitoring, predictive analytics, and AI-driven risk detection in safety systems.

- Operational Efficiency: Digital intelligence services are designed to streamline operations, reduce costs, and improve the reliability of energy supply.

ENN Energy's product portfolio centers on natural gas distribution, serving over 31 million residential and millions of commercial/industrial customers across China. This core offering is augmented by integrated energy solutions, including distributed solar and biomass projects, aiming to accelerate clients' low-carbon transitions. The company also provides value-added services like smart meter installations and energy-efficient appliance promotions for households, and comprehensive energy management for enterprises.

The company's product strategy is heavily influenced by digital intelligence services, leveraging IoT, big data, and AI for enhanced customer experience and operational efficiency. As of the first half of 2024, ENN operated 261 urban gas projects, serving 143 million people, underscoring the scale of its gas distribution product. By the end of 2023, over 10 million smart meters were connected for household clients, facilitating better energy management.

| Product Segment | Key Offerings | Customer Base | Key Data Point (as of H1 2024/End 2023) |

|---|---|---|---|

| Natural Gas Distribution | Piped gas and LNG sales | 31M+ residential, commercial & industrial | 261 urban gas projects, serving 143M people (H1 2024) |

| Integrated Energy Solutions | Distributed solar, biomass, tailored energy systems | Industrial and enterprise clients | Significant increase in installed clean energy capacity (End 2023) |

| Value-Added Services | Smart meters, energy-efficient appliances, enterprise energy management | Residential and enterprise clients | 10M+ smart meters connected (End 2023); 5,000+ industrial parks/key accounts served (2024) |

| Digital Intelligence Services | IoT, big data, AI for energy management & operations | All customer segments | Improved operational efficiency and reduced service response times (2023) |

What is included in the product

This analysis provides a comprehensive examination of ENN Energy Holdings's marketing strategies, detailing their Product offerings, Pricing structures, Place (distribution) networks, and Promotion tactics within the competitive energy sector.

This ENN Energy Holdings 4P's analysis acts as a pain point reliver by clearly outlining how their Product, Price, Place, and Promotion strategies address customer needs and market challenges, simplifying complex marketing decisions for leadership.

Place

ENN Energy Holdings boasts an incredibly extensive distribution network throughout China, a key element of its marketing strategy. This network spans 21 provinces, municipalities, and autonomous regions, encompassing 261 city gas projects.

This broad reach makes ENN's natural gas and other clean energy solutions readily available. By the end of 2023, the company served over 31 million residential users and more than 270,000 commercial and industrial clients, demonstrating the sheer scale of its distribution capabilities.

ENN Energy's strategic pipeline infrastructure is the backbone of its place strategy, enabling efficient and secure gas delivery. The company actively invests in building, operating, and managing an extensive network, ensuring product availability across its service areas. As of the first half of 2024, ENN Energy reported a total pipeline network length of approximately 169,000 kilometers, highlighting its significant commitment to this crucial asset.

ENN Energy's operation of the Zhoushan LNG terminal, China's first privately owned receiving facility, is a cornerstone of its 'Place' strategy. This terminal is crucial for ensuring a stable and cost-effective supply of liquefied natural gas, directly addressing potential supply chain disruptions.

The Zhoushan terminal enhances ENN's distribution capabilities, allowing for more efficient delivery of LNG to diverse markets and customers. This strategic asset significantly bolsters ENN's market reach and its capacity to meet growing energy demands competitively.

Integrated Energy Project Locations

ENN Energy Holdings strategically places its integrated energy projects in crucial areas throughout China. By the end of 2023, the company had 296 of these integrated energy projects up and running. These locations are designed to be local centers providing a range of energy options, such as solar power and biomass, to industrial parks and commercial properties.

These integrated energy projects are key to ENN Energy’s strategy of offering comprehensive energy solutions. They are situated in regions with high demand for clean energy, supporting the transition to more sustainable power sources for businesses. The company’s focus on these localized hubs allows for efficient delivery and management of multi-energy services.

The geographical spread of these projects is vital for ENN Energy’s market penetration and service delivery capabilities. Key facts include:

- 296 integrated energy projects in operation as of December 2023.

- Projects located in key regions across China to maximize reach.

- Services include photovoltaics and biomass energy solutions.

- Target customers are industrial parks and commercial buildings.

Customer Service Outlets and Digital Platforms

ENN Energy Holdings prioritizes customer convenience through a multi-channel approach. Their e-City e-Home platform serves as a central hub for intelligent energy solutions, offering households seamless access to services and enhancing their quality of life. This digital focus is complemented by traditional customer service outlets, ensuring broad accessibility for all user needs.

The company's commitment to customer engagement is evident in its digital strategy. ENN Energy actively facilitates direct interaction and efficient service delivery via its online platforms. This approach aims to build stronger customer relationships and streamline the user experience, reflecting a modern approach to energy provision.

- Digital Hub: The e-City e-Home platform provides integrated smart energy management.

- Customer Reach: ENN Energy maintains both digital channels and physical service points.

- Service Enhancement: The focus is on improving household quality of life through intelligent solutions.

ENN Energy Holdings' 'Place' strategy centers on its extensive distribution network and strategic asset deployment across China. This includes a vast pipeline infrastructure and integrated energy projects designed to serve diverse customer segments efficiently.

The company's commitment to accessibility is further demonstrated through its digital platforms and physical service points, ensuring customers can easily access and manage their energy needs.

| Metric | Value (as of H1 2024/End of 2023) | Significance |

|---|---|---|

| Pipeline Network Length | Approx. 169,000 km (H1 2024) | Underpins efficient gas delivery across service areas. |

| Integrated Energy Projects | 296 (End of 2023) | Provides localized clean energy solutions to industrial and commercial clients. |

| Residential Users Served | Over 31 million (End of 2023) | Highlights extensive reach and market penetration. |

| Commercial/Industrial Clients | Over 270,000 (End of 2023) | Demonstrates broad customer base for energy services. |

Same Document Delivered

ENN Energy Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ENN Energy Holdings 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies, providing you with a complete and ready-to-use resource.

Promotion

ENN Energy Holdings champions a customer-first philosophy, evident in its ongoing innovation within natural gas products and service delivery. Leveraging intelligent technologies, the company actively refines its offerings to align with evolving customer requirements and improve their daily lives.

This focus on tailored solutions and smart technology integration is central to ENN Energy's strategy for driving growth and enhancing customer satisfaction. For instance, in 2024, ENN Energy reported a significant increase in its digital service platform adoption, directly correlating with customer feedback on improved convenience and personalized offerings.

ENN Energy Holdings actively champions its dedication to a low-carbon future and sustainable growth, notably through its 2024 'Decarbonisation Action 2030 – The Journey to Net Zero' report. This initiative underscores their focus on critical areas like methane emission reduction, evolving their energy infrastructure, and integrating advanced green technologies.

These efforts are designed to resonate with stakeholders increasingly prioritizing environmental responsibility. For instance, ENN reported a 4.5% reduction in methane intensity in its 2023 operations, a tangible step towards its net-zero ambitions.

ENN Energy Holdings actively promotes its image as a premier integrated energy service provider, highlighting its ability to deliver end-to-end, tailored energy solutions. This encompasses natural gas distribution, comprehensive integrated energy systems, value-added business services, and low-carbon office environments.

This strategic positioning underscores ENN's commitment to being a one-stop shop for a wide array of energy requirements. For instance, in 2023, ENN's integrated energy projects achieved significant milestones, contributing to a substantial portion of their revenue growth, demonstrating the market's positive reception to their broad service offerings.

Financial Performance and Investor Relations

ENN Energy Holdings actively leverages its financial performance and investor relations to showcase stability and growth. The company provides detailed annual reports and regular presentations on operating data, highlighting its strong operational capabilities and sound financial management. This approach aims to build investor confidence and attract capital.

For instance, ENN Energy reported a significant increase in its net profit attributable to shareholders, reaching approximately RMB 10.5 billion for the fiscal year 2023. This financial strength is communicated through investor briefings and readily available annual reports, reinforcing its appeal to a financially astute audience seeking reliable investment opportunities.

- Financial Transparency: Annual reports and operating data presentations offer a clear view of ENN's financial health and operational efficiency.

- Growth Narrative: Consistent reporting on profit growth, such as the 2023 net profit of around RMB 10.5 billion, underscores the company's expansion trajectory.

- Investor Confidence: Prudent financial management and robust operational performance are key messages designed to attract and retain investment.

- Market Communication: Regular investor relations activities ensure that key financial and operational updates reach the target audience effectively.

ESG Ratings and Corporate Governance Transparency

ENN Energy Holdings highlights its robust Environmental, Social, and Governance (ESG) credentials, notably its MSCI ESG Rating of AAA, as a key promotional element. This strong rating underscores the company's dedication to sustainable and responsible business operations.

The company actively promotes transparency in its corporate governance and sustainability reporting. This commitment reassures stakeholders of ENN Energy's adherence to ethical practices and its focus on generating long-term value.

- MSCI ESG Rating: AAA (as of recent reporting periods, signifying leading ESG performance).

- Transparency Initiatives: Regular publication of comprehensive sustainability reports detailing environmental impact, social responsibility, and governance structures.

- Stakeholder Engagement: Demonstrates commitment to ethical operations through clear communication channels and robust governance frameworks.

- Value Creation: Links strong ESG performance to long-term financial stability and investor confidence.

ENN Energy Holdings effectively promotes its integrated energy solutions and commitment to a low-carbon future through targeted communication. Their strategy emphasizes customer-centric innovation and tangible progress towards sustainability goals. This dual focus aims to build brand loyalty and attract environmentally conscious investors.

The company actively showcases its financial strength and operational excellence to key stakeholders. By highlighting consistent profit growth and transparent reporting, ENN Energy reinforces its position as a reliable investment. This communication strategy is designed to foster investor confidence and attract capital for future expansion.

ENN Energy's promotional efforts also center on its leading Environmental, Social, and Governance (ESG) performance, exemplified by its AAA MSCI ESG Rating. This highlights their dedication to responsible operations and ethical practices, appealing to a growing segment of investors prioritizing sustainability.

| Promotional Focus | Key Message | Supporting Data/Initiative |

| Customer-Centric Innovation | Tailored energy solutions and improved daily life through technology | Increased digital service platform adoption (2024) |

| Low-Carbon Future | Commitment to sustainability and net-zero ambitions | Decarbonisation Action 2030 report; 4.5% methane intensity reduction (2023) |

| Integrated Energy Provider | End-to-end energy services | Revenue growth from integrated energy projects (2023) |

| Financial Strength | Stability and growth for investors | Net profit of approx. RMB 10.5 billion (2023) |

| ESG Leadership | Responsible and sustainable business operations | AAA MSCI ESG Rating |

Price

ENN Energy Holdings navigates China's dynamic natural gas market by employing a competitive pricing strategy. This approach ensures that rates for residential, commercial, and industrial consumers are both attractive and readily accessible, reflecting the company's commitment to market penetration and customer acquisition.

A key enabler of ENN's stable and competitive pricing is its strategic access to global energy markets. The company's investment in the Zhoushan LNG terminal, for instance, provides a significant advantage by allowing for cost-effective procurement of Liquefied Natural Gas. This direct import capability helps ENN manage procurement expenses, which in turn supports consistent and predictable pricing for its diverse customer base.

ENN Energy Holdings utilizes cost pass-through mechanisms, especially for residential gas sales, to buffer against volatile gas procurement expenses. This approach is crucial for maintaining a consistent dollar margin, even when wholesale gas prices fluctuate significantly. For instance, in 2023, ENN Energy's reported revenue from gas sales was RMB 124.8 billion, highlighting the scale at which managing these costs is vital for sustained profitability.

ENN Energy Holdings likely utilizes value-based pricing for its integrated energy solutions and low-carbon services. This strategy aligns pricing with the tangible benefits clients receive, such as long-term cost savings and enhanced environmental performance. For instance, in 2024, ENN reported significant contributions from its integrated energy solutions segment, indicating strong client adoption driven by these value propositions.

Discounts and Financing Options for Value-Added Services

ENN Energy Holdings, in its pursuit of driving adoption for its value-added services, such as household life solutions and energy-efficient appliances, is likely to implement strategic pricing adjustments. These might include targeted discounts on bundled services or special financing plans, making advanced energy-saving technologies more attainable for a broader customer base. This approach directly addresses price sensitivity, a key factor in consumer decision-making for such offerings.

For instance, ENN could offer a promotional discount of 10-15% on smart home energy management systems when purchased alongside an annual maintenance contract. Furthermore, partnerships with financial institutions could facilitate low-interest or interest-free financing over 12-24 months, reducing the upfront cost barrier. Such initiatives are crucial for increasing market penetration in the competitive energy services sector.

- Promotional Discounts: Offering percentage-based or fixed-sum discounts on specific value-added services to incentivize immediate purchase.

- Flexible Financing: Collaborating with banks or offering in-house financing for energy-saving appliances and smart home solutions, allowing customers to pay in installments.

- Loyalty Programs: Implementing tiered discount structures for repeat customers or those who upgrade to premium service packages, fostering long-term engagement.

- Bundled Offers: Creating package deals that combine core energy services with value-added products at a reduced overall price compared to individual purchases.

Capital Expenditure and Dividend Policy

ENN Energy Holdings' pricing strategy is intrinsically linked to its capital expenditure (CapEx) plans and its dividend policy. The company's approach to allocating capital, whether for infrastructure development or returning value to shareholders, shapes its financial flexibility and market perception.

Decisions about how to utilize any unspent funds are critical. These could be channeled into paying down debt, which strengthens the balance sheet and potentially lowers borrowing costs, or used for share buybacks, which can boost earnings per share. Alternatively, these funds may be distributed as dividends, directly rewarding investors.

For instance, ENN Energy's commitment to shareholder value, as reflected in its dividend distributions, can indirectly influence investor sentiment. A consistent or growing dividend payout can enhance the company's attractiveness to investors, potentially lowering its cost of capital and providing more favorable conditions for its pricing decisions.

- Capital Allocation: ENN Energy's CapEx budget for 2024 was projected to be substantial, supporting its extensive natural gas distribution network and integrated energy services.

- Dividend Focus: The company has historically maintained a stable dividend payout ratio, signaling a commitment to returning profits to shareholders. For example, in its 2023 financial results, ENN Energy declared a final dividend per share, reflecting its profitability and shareholder return strategy.

- Financial Flexibility: The management of unspent capital, whether through debt reduction or share repurchases, directly impacts ENN Energy's financial health and its ability to fund future growth initiatives, influencing its long-term pricing power.

ENN Energy Holdings' pricing strategy is multifaceted, balancing competitive rates for core gas supply with value-based pricing for integrated solutions. This approach aims to capture market share while maximizing revenue from higher-margin services.

The company leverages its global procurement capabilities, exemplified by its Zhoushan LNG terminal investment, to secure cost advantages. These savings are crucial for maintaining stable and attractive pricing for its diverse customer base, from households to industrial clients.

Cost pass-through mechanisms, particularly for residential gas, provide a buffer against market volatility, ensuring consistent margins. For instance, ENN's 2023 gas sales revenue of RMB 124.8 billion underscores the importance of efficient cost management in its pricing strategy.

Value-based pricing is applied to integrated energy solutions and low-carbon services, reflecting the benefits delivered to clients. Strong adoption in these segments in 2024 highlights the effectiveness of this strategy.

| Pricing Tactic | Description | Example Application |

|---|---|---|

| Competitive Pricing | Offering attractive and accessible rates for natural gas. | Residential, commercial, and industrial gas tariffs. |

| Cost Pass-Through | Adjusting prices to reflect changes in procurement costs. | Residential gas sales to maintain dollar margins. |

| Value-Based Pricing | Setting prices based on the benefits and value delivered. | Integrated energy solutions and low-carbon services. |

| Promotional Pricing | Utilizing discounts and financing to drive adoption. | Discounts on smart home systems or installment plans for appliances. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for ENN Energy Holdings is built upon a foundation of official company disclosures, including annual reports and investor presentations, alongside insights from industry publications and market research. We also leverage data from ENN's own corporate website and publicly available information on their distribution networks and promotional activities.