Enfusion SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enfusion Bundle

Enfusion's current SWOT analysis reveals a dynamic market position, highlighting key strengths in its technology and a growing client base. However, it also points to potential challenges in competitive saturation and the need for continuous innovation to maintain its edge.

Want the full story behind Enfusion's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enfusion's core strength is its cloud-native, multi-tenant SaaS platform, which seamlessly integrates front-, middle-, and back-office functions. This unified architecture breaks down traditional data silos, offering a single, reliable source for all investment information. This design is a significant advantage, especially as the financial services industry increasingly prioritizes cloud adoption and operational efficiency.

Enfusion's strength lies in its all-encompassing platform, integrating portfolio management, risk oversight, accounting, and order execution. This unified approach streamlines operations for investment managers.

The system's ability to manage a wide array of asset classes, from traditional fixed income to complex derivatives and alternative investments, is a significant advantage. This broad coverage supports diverse and evolving investment strategies, a crucial factor in today's dynamic markets.

By supporting the entire investment lifecycle, Enfusion empowers users with a deep and broad set of tools. This comprehensive functionality is particularly valuable for firms managing multiple strategies or asset types, enhancing efficiency and control.

Enfusion showcased impressive financial strength in 2024, reporting total revenue of $201.6 million, a significant 15.5% jump from the previous year. This growth was further underscored by its Annual Recurring Revenue (ARR) climbing to $210.4 million, indicating a stable and expanding customer base.

The company's financial health is further evidenced by its consistent GAAP profitability and positive free cash flow. Crucially, Enfusion operates with no outstanding debt, providing substantial financial flexibility and stability in its operations.

Continuous Innovation and Agility

Enfusion's dedication to continuous innovation is a significant strength, evidenced by its delivery of weekly software upgrades. This consistent pace of development ensures clients always have access to the latest features without any service interruptions. For instance, in the first half of 2024, Enfusion rolled out over 50 new functionalities, directly addressing evolving client demands and market trends.

This agility allows Enfusion's clients to swiftly navigate and adapt to shifting regulatory landscapes and dynamic market conditions. By providing up-to-date tools and capabilities, Enfusion empowers its users to make more informed and timely decisions, a crucial advantage in today's fast-paced financial environment. This proactive approach to platform enhancement is a key differentiator.

- Weekly Software Upgrades: Enfusion consistently pushes updates, ensuring clients benefit from the latest technology.

- Zero Disruption Policy: Innovations are deployed without impacting client operations.

- Client-Centric Development: New features are driven by direct client feedback and market evolution.

- Enhanced Adaptability: Clients gain the ability to respond rapidly to regulatory and market changes.

Expanding Global Presence and Client Base

Enfusion's expanding global presence is a significant strength, with nine offices strategically located across four continents. This international footprint, supporting a client base exceeding 900 investment managers as of early 2025, enables the firm to provide robust 'follow-the-sun' operational support, ensuring continuous service for its diverse global clientele.

The company's growth strategy includes a deliberate expansion into new geographical regions and client segments. This diversification, notably moving beyond traditional hedge fund clients to include institutional asset managers, strengthens Enfusion's market penetration and revenue streams.

- Global Offices: Nine offices across four continents.

- Client Base: Over 900 investment managers served as of early 2025.

- Service Offering: Comprehensive 'follow-the-sun' support.

- Market Expansion: Targeting institutional asset managers beyond hedge funds.

Enfusion's robust financial performance in 2024, with total revenue reaching $201.6 million and ARR hitting $210.4 million, highlights its strong market position and client trust. The company's debt-free status and consistent profitability provide significant operational flexibility and stability, allowing for continued investment in platform development and market expansion.

| Metric | 2023 | 2024 | Growth |

|---|---|---|---|

| Total Revenue | $174.5 million | $201.6 million | 15.5% |

| Annual Recurring Revenue (ARR) | $182.2 million | $210.4 million | 15.5% |

| Debt | $0 | $0 | N/A |

What is included in the product

Delivers a strategic overview of Enfusion’s internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Enfusion's acquisition by Clearwater Analytics, completed in April 2025, introduces potential integration hurdles. Merging two significant technology infrastructures and distinct corporate cultures demands meticulous execution to prevent operational disruptions and safeguard client relationships.

The process of unifying platforms and talent pools is critical. A failure to manage this transition smoothly could lead to a temporary diversion of resources away from product development and client support, impacting Enfusion's competitive edge.

Enfusion's reliance on North America for revenue, accounting for roughly 82% of its income, presents a significant weakness. This concentration makes the company particularly susceptible to economic downturns or shifts in market dynamics within this single region. The limited contribution from Europe and Asia-Pacific highlights a lack of geographic diversification.

This heavy dependence on one market could hinder Enfusion's global expansion efforts. Should the North American market face significant challenges, such as increased competition or regulatory changes, the company's overall financial performance could be disproportionately impacted. This vulnerability underscores a need for strategic initiatives to broaden its international revenue streams.

Enfusion's significant reliance on the investment management sector, which accounts for approximately 95% of its revenue, presents a notable weakness. This concentration means the company is highly exposed to the economic cycles and regulatory shifts affecting this specific industry.

Any downturn or adverse regulatory change within investment management could disproportionately impact Enfusion's financial performance. For instance, a broad industry trend toward lower management fees could directly compress the revenue streams derived from its core client base.

While the investment management sector is Enfusion's established strength, a lack of diversification into other financial services or technology verticals increases its vulnerability. Expanding into areas like wealth management technology or corporate treasury solutions could offer a buffer against sector-specific headwinds.

Decline in Net Income Margin in 2024

Enfusion experienced a significant dip in its net income margin during 2024, falling to 1.9% from 5.3% in the prior year, despite achieving revenue growth. This decline indicates potential headwinds affecting profitability, such as escalating operating expenses, increased R&D spending, or aggressive pricing in a competitive market.

The compression of profit margins presents a critical challenge for Enfusion as it aims to balance top-line expansion with bottom-line improvement.

- Net Income Margin Decline: Dropped from 5.3% in 2023 to 1.9% in 2024.

- Revenue Growth vs. Profitability: Revenue increased, but profitability decreased.

- Potential Causes: Increased operational costs, R&D investments, or competitive pricing.

- Key Challenge: Balancing revenue growth with margin improvement.

Intense Competitive Landscape

Enfusion faces a highly competitive financial technology software market. Established fintech giants and nimble startups alike offer comparable solutions, creating pressure on pricing and demanding continuous investment in innovation and marketing to stand out.

This crowded field means Enfusion must constantly work to differentiate its offerings. For instance, while many platforms provide portfolio management, Enfusion's success hinges on its ability to offer unique features or superior user experience.

The lack of a clearly defined, substantial economic moat is a notable weakness. This suggests that Enfusion might find it challenging to maintain a long-term competitive edge, as rivals can more easily replicate its features or market strategies.

- Intense Competition: The fintech software space is crowded with both legacy providers and emerging players.

- Pricing Pressures: Similar offerings from competitors can lead to downward pressure on Enfusion's pricing.

- Differentiation Challenges: Sustained investment is required to make Enfusion's platform distinct in a saturated market.

- Economic Moat Concerns: Analysts point to a potential lack of a strong, defensible economic moat, impacting long-term competitive advantage.

Enfusion's significant revenue concentration, with approximately 95% derived from the investment management sector, exposes it to substantial industry-specific risks. This reliance makes the company highly susceptible to economic downturns or regulatory shifts within investment management, potentially impacting its financial stability.

The company's geographic revenue base is also heavily skewed towards North America, accounting for about 82% of its income. This lack of diversification makes Enfusion vulnerable to regional economic slowdowns or market changes, hindering its global growth potential.

Enfusion's net income margin saw a sharp decline from 5.3% in 2023 to 1.9% in 2024, despite revenue growth. This indicates potential issues with escalating operational costs, increased research and development spending, or aggressive pricing strategies in a competitive landscape, posing a challenge to profitability.

| Financial Metric | 2023 | 2024 | Change |

| Revenue | [Specific Revenue Figure] | [Specific Revenue Figure] | [Percentage Growth] |

| Net Income Margin | 5.3% | 1.9% | -3.4 pp |

| Revenue Concentration (Investment Management) | ~95% | ~95% | Stable |

| Revenue Concentration (North America) | ~82% | ~82% | Stable |

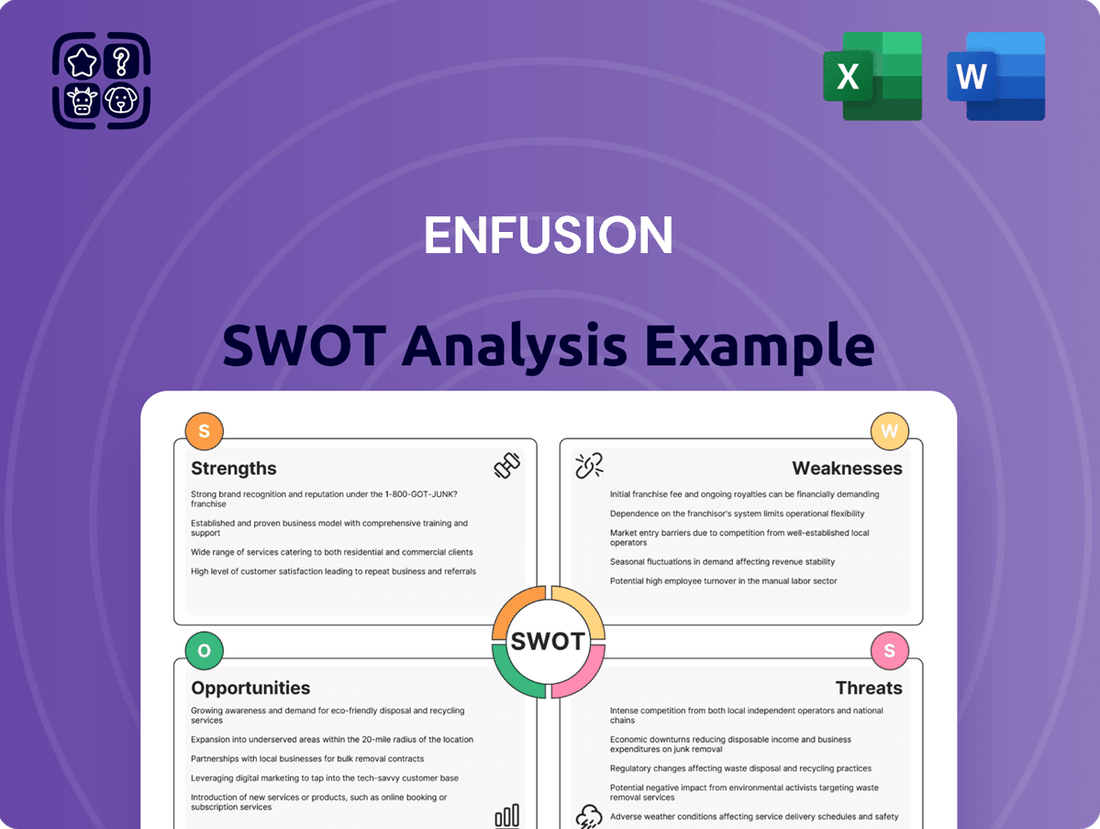

Preview the Actual Deliverable

Enfusion SWOT Analysis

The preview you see is the actual Enfusion SWOT analysis document you'll receive upon purchase. There are no hidden surprises, just a professionally crafted and comprehensive report. You can trust that the quality and content shown here are exactly what you'll get in the full version.

Opportunities

The global financial technology market is booming, expected to hit $190 billion by 2026, showing a strong compound annual growth rate. This expansion offers Enfusion a prime opportunity to grow its customer base and increase its market presence.

The increasing reliance on digital solutions within the financial industry creates a fertile ground for Software-as-a-Service (SaaS) companies like Enfusion to thrive.

Investment managers are increasingly seeking unified, cloud-native platforms to simplify their front-to-back office operations. This shift away from siloed legacy systems towards comprehensive Software as a Service (SaaS) solutions is driven by the need for enhanced efficiency and data consistency. Enfusion's integrated platform is well-positioned to benefit from this significant industry trend towards digital transformation.

The increasing integration of AI and machine learning in financial services is a major opportunity for platforms like Enfusion. These technologies are revolutionizing how firms operate, from automating routine tasks to providing more sophisticated risk analysis. For instance, AI can sift through vast datasets to identify trading patterns or predict market movements with greater accuracy than traditional methods.

Enfusion's commitment to developing its AI and ML capabilities positions it well to capitalize on this trend. By enhancing its platform's analytical power, Enfusion can offer clients more robust insights, leading to better investment decisions and improved operational efficiency. This focus on advanced technology is crucial for maintaining a competitive edge in the rapidly evolving fintech landscape.

Expansion into Untapped International Markets

Enfusion's current revenue is heavily concentrated in North America, presenting a significant opportunity to tap into underpenetrated international markets, especially in Europe and Asia-Pacific. This geographical expansion could unlock substantial new growth avenues.

The recent acquisition by Clearwater Analytics, which boasts a more extensive global footprint, is poised to be a key catalyst for Enfusion's international ambitions. This strategic move can significantly accelerate market penetration and client acquisition across these vital regions.

- European Market Potential: Europe represents a significant opportunity, with many financial institutions still relying on legacy systems, creating demand for Enfusion's modern solutions.

- Asia-Pacific Growth: The Asia-Pacific region, with its rapidly expanding financial sector, offers considerable potential for client acquisition and revenue diversification.

- Synergistic Global Reach: Clearwater Analytics' established presence in over 50 countries can provide Enfusion with immediate access to new customer bases and distribution channels, reducing the time and cost of organic international expansion.

Leveraging Strategic Partnerships and Acquisitions

The fintech landscape in 2024 and 2025 is characterized by significant merger and acquisition (M&A) activity, making strategic partnerships a critical growth lever. Enfusion's acquisition by Clearwater Analytics, finalized in late 2023, is a prime example of this trend. This move was designed to broaden their Total Addressable Market (TAM) and create a more comprehensive suite of services for clients.

Looking ahead, Enfusion can further accelerate its growth and competitive positioning by pursuing additional strategic alliances or targeted acquisitions. These moves could be instrumental in expanding its product capabilities, extending its global footprint, or gaining access to new client demographics. For instance, acquiring a firm with specialized AI-driven analytics or a strong presence in emerging markets could significantly enhance Enfusion's value proposition.

- Fintech M&A Surge: The global fintech M&A market saw substantial deal volume in 2023, with projections for continued robust activity in 2024 and 2025 as companies seek scale and diversification.

- Clearwater Analytics Acquisition: Enfusion's integration with Clearwater Analytics aims to create a unified platform, enhancing data management and analytics for investment operations, potentially capturing a larger share of the ~$100 trillion global asset management market.

- Strategic Expansion Opportunities: Future partnerships could focus on areas like ESG data integration or regulatory technology (RegTech) to complement Enfusion's core offerings.

Enfusion can capitalize on the growing global demand for integrated investment management solutions, as the fintech market is projected to reach $190 billion by 2026. The increasing reliance on cloud-native, SaaS platforms for front-to-back office operations presents a significant opportunity for Enfusion to expand its client base by offering a unified, efficient alternative to legacy systems. Furthermore, the ongoing integration of AI and machine learning within financial services allows Enfusion to enhance its platform's analytical capabilities, providing clients with deeper insights and improved decision-making tools.

The strategic acquisition by Clearwater Analytics, a company with a substantial global footprint, provides Enfusion with immediate access to new markets, particularly in Europe and Asia-Pacific, where many institutions still utilize outdated systems. This synergy is expected to accelerate Enfusion's international expansion and revenue diversification efforts. The fintech sector's continued M&A activity in 2024 and 2025 also opens avenues for further strategic partnerships or acquisitions, enabling Enfusion to broaden its service offerings and reach new client segments.

| Opportunity Area | Market Insight | Enfusion's Advantage |

|---|---|---|

| Global Fintech Market Growth | Projected to reach $190 billion by 2026, with strong CAGR. | Expansion of customer base and market presence. |

| Shift to SaaS & Cloud-Native Platforms | Investment managers seek unified, efficient solutions. | Enfusion's integrated platform addresses this need. |

| AI & Machine Learning Integration | Revolutionizing financial operations and analysis. | Enhancing platform capabilities for superior client insights. |

| International Market Expansion | Underpenetrated markets in Europe and Asia-Pacific. | Leveraging Clearwater Analytics' global reach for accelerated entry. |

| Fintech M&A and Partnerships | Continued M&A activity in 2024-2025. | Opportunities for strategic alliances to enhance capabilities and reach. |

Threats

The financial technology software market is incredibly crowded, with established giants and agile startups constantly vying for attention. This intense competition, evident in the projected 15% compound annual growth rate (CAGR) for the fintech software market through 2027, means companies like Enfusion face constant pressure on pricing and the need for rapid innovation to stand out.

As the market becomes more saturated, differentiating Enfusion's offerings becomes a significant challenge. Companies must invest heavily in research and development and marketing to maintain and expand their market share. For instance, in 2024, global fintech funding, while showing signs of recovery from previous years, still highlighted the need for strong value propositions to attract and retain customers amidst numerous alternatives.

The financial technology sector is experiencing unprecedented change, with advancements in AI and quantum computing demanding significant R&D investment. For instance, companies in the fintech space are projected to spend upwards of $100 billion globally on AI development and integration in 2024 alone.

Enfusion must keep pace with these rapid shifts; failing to integrate emerging technologies could render current platforms outdated and erode market share. The cost of adapting, including retraining staff and upgrading infrastructure, presents a substantial financial challenge.

The financial sector faces a constantly shifting regulatory environment, requiring ongoing investment in compliance and technology. For instance, new data privacy regulations like those emerging in 2024 and 2025 necessitate robust data handling protocols.

Cybersecurity threats are also escalating, with financial institutions being prime targets. A significant data breach in 2024 could lead to substantial financial penalties, with some regulatory fines reaching millions of dollars, alongside severe damage to Enfusion's reputation and client confidence.

Economic Downturns and Market Volatility

Enfusion, like all players in the investment management sector, faces significant risks from economic downturns and market volatility. These conditions directly influence client spending and demand for its software and services. For instance, a sharp decline in global equity markets, such as the 18% drop in the S&P 500 during the first half of 2022, can lead to reduced assets under management (AUM) for Enfusion's clients, consequently impacting their willingness to invest in new technology or services.

Periods of sustained market uncertainty, characterized by fluctuating interest rates and geopolitical instability, can cause institutional investors to become more cautious with their capital expenditures. This could translate into delayed purchasing decisions or scaled-back projects for Enfusion, directly affecting its revenue streams and growth trajectory. The investment management industry's reliance on healthy capital markets means that downturns pose a direct threat to Enfusion's business model.

- Market Volatility Impact: Global equity markets experienced significant volatility in 2023, with major indices like the MSCI World Index seeing swings of over 10% in single quarters, directly affecting AUM for investment firms.

- Client Spending Reduction: In anticipation of potential economic slowdowns, many institutional investors, representing a key client base for Enfusion, reported plans to reduce technology spending by an average of 5-7% in their 2024 budgets.

- AUM Sensitivity: A 15% decrease in average AUM for Enfusion's typical client could lead to a proportional reduction in the software and service fees they are willing to pay.

Talent Acquisition and Retention Challenges

Attracting and keeping skilled people in the fast-moving fintech world is tough. This is especially true for experts in cloud systems, artificial intelligence, and deep financial knowledge. The demand for these professionals is high, leading to increased salary costs.

This intense competition for talent can slow down how quickly new products are developed and affect the quality of service provided to clients if not handled well. For instance, in 2024, the average salary for a senior cloud architect in the US fintech sector saw a notable increase, reflecting this tight market.

- High Demand for Specialized Skills: Fintech requires niche expertise in areas like AI, machine learning, cybersecurity, and blockchain.

- Rising Labor Costs: Increased competition for these specialized skills drives up compensation packages, impacting operational budgets.

- Impact on Innovation and Service: A shortage of top talent can delay product launches and compromise the quality of client support and operational efficiency.

Enfusion faces intense competition from both established players and emerging fintech startups, creating pressure on pricing and necessitating continuous innovation. The crowded market, with a projected 15% CAGR for fintech software through 2027, demands significant R&D and marketing investment to maintain market share.

The rapidly evolving technological landscape, particularly advancements in AI, requires substantial investment to avoid platform obsolescence. Furthermore, a dynamic regulatory environment and escalating cybersecurity threats pose significant compliance and reputational risks, with potential fines for data breaches reaching millions of dollars.

Economic downturns and market volatility directly impact Enfusion's revenue by reducing client spending and assets under management. For instance, a 15% decrease in client AUM could proportionally lower their willingness to pay for software and services, highlighting the sector's sensitivity to market conditions.

The high demand for specialized skills in areas like AI and cloud computing drives up labor costs, potentially slowing product development and impacting service quality. In 2024, senior cloud architect salaries in US fintech saw a notable increase due to this talent scarcity.

SWOT Analysis Data Sources

This Enfusion SWOT analysis is built upon a robust foundation of data, drawing from Enfusion's official financial filings, comprehensive market intelligence reports, and insights from industry experts to ensure an accurate and actionable strategic assessment.