Enfusion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enfusion Bundle

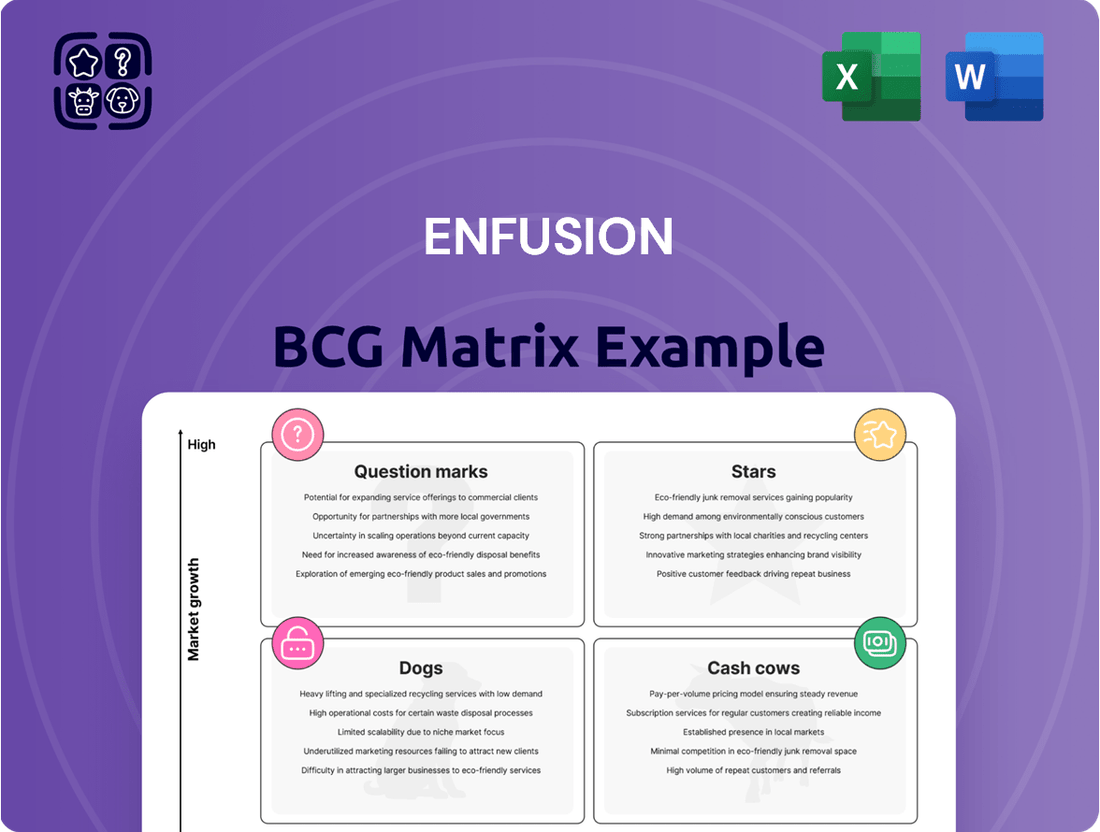

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See where your investments are generating growth and where they might be faltering. Purchase the full BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, along with actionable strategies to optimize your business.

Stars

Enfusion's integrated cloud-native SaaS platform is a prime example of a Stars category product within the BCG Matrix. This platform streamlines front-, middle-, and back-office functions, directly addressing the need for modernizing legacy systems among institutional investment managers.

The platform's ability to unify operations offers significant efficiency gains, positioning it as a leader in the evolving investment technology landscape. While its overall market share might be smaller than established players, its high-growth trajectory and comprehensive feature set are indicative of strong future potential.

Enfusion's client acquisition strategy is proving highly effective, as evidenced by its consistent growth throughout 2024. The company added 41 new clients in the fourth quarter of 2024 alone, building on the 33 clients acquired in Q1 and 39 in Q2. This robust expansion brought Enfusion's total client base to 916 by the end of the year.

Enfusion's dedication to advancing its platform is evident in the upcoming August 2024 release of the next phase of Portfolio Workbench. This update will introduce sophisticated portfolio construction and rebalancing tools, designed to streamline workflows for asset managers.

These enhancements, including deeper integration with leading third-party optimizers, will significantly boost efficiency and refine decision-making processes. This commitment to continuous innovation ensures Enfusion remains a competitive force in the rapidly expanding asset management technology sector.

Strong Revenue Growth

Enfusion is demonstrating robust revenue expansion, a key indicator for its position in the BCG matrix. The company achieved total revenue of $201.6 million in fiscal year 2024, marking a significant 15.5% increase compared to the previous year. This consistent upward trend is further evidenced by strong quarterly performances.

Quarterly reports highlight this sustained growth, with Q1 2024 reporting a 17.3% revenue increase and Q2 2024 showing a 16% rise. These figures reflect a dynamic and expanding market presence for Enfusion's products and services.

This sustained financial momentum, characterized by double-digit year-over-year revenue growth, firmly places Enfusion within the "Star" category of the BCG matrix. This classification signifies a high-growth, high-market-share business unit that requires ongoing investment to maintain its leading position.

- FY 2024 Total Revenue: $201.6 million

- Year-over-Year Revenue Growth (FY 2024): 15.5%

- Q1 2024 Revenue Growth: 17.3%

- Q2 2024 Revenue Growth: 16%

Strategic Market Positioning

Enfusion has carved out a strong niche as a modern, cloud-native solution for investment management firms navigating digital transformation. This strategic positioning attracts clients seeking agility and scalability.

The company's deliberate move into higher-value market segments and its focus on larger asset managers are key indicators of its growth strategy. This approach aims to capture significant market share in a dynamic financial technology landscape.

- Cloud-Native Advantage: Enfusion's cloud-native architecture provides inherent scalability and flexibility, crucial for firms modernizing their operations.

- Digital Transformation Focus: The platform directly addresses the needs of investment managers undergoing digital overhauls, offering a contemporary alternative to legacy systems.

- Market Segment Expansion: Targeting larger asset managers signifies an ambition to compete at a higher level and secure more substantial contracts, potentially increasing revenue streams significantly.

- Competitive Differentiation: By emphasizing its modern technology stack, Enfusion differentiates itself from competitors still reliant on older, on-premise solutions.

Enfusion's position as a Star in the BCG matrix is solidified by its impressive growth and strong market standing. The company's cloud-native SaaS platform is attracting significant interest from institutional investment managers looking to upgrade their systems. This focus on modernization and efficiency is driving substantial client acquisition and revenue expansion.

The platform's ability to unify front-, middle-, and back-office operations offers a compelling value proposition. Enfusion's commitment to continuous innovation, such as the upcoming Portfolio Workbench enhancements, further strengthens its competitive edge. This dedication ensures the platform remains relevant and valuable in the fast-paced asset management technology sector.

Enfusion's financial performance in 2024 underscores its Star status. With a 15.5% year-over-year revenue increase, reaching $201.6 million for the fiscal year, the company demonstrates robust market penetration. Quarterly growth, with Q1 at 17.3% and Q2 at 16%, highlights sustained momentum and a strong market demand for its integrated solutions.

| Metric | FY 2024 Data | Significance |

|---|---|---|

| Total Revenue | $201.6 million | Demonstrates significant market traction and revenue generation. |

| Year-over-Year Revenue Growth | 15.5% | Indicates strong expansion and increasing market share. |

| New Clients Acquired (Q4 2024) | 41 | Highlights successful client acquisition strategy and platform appeal. |

| Total Client Base (End of FY 2024) | 916 | Shows substantial adoption and a growing user base. |

What is included in the product

The Enfusion BCG Matrix analyzes a company's portfolio by categorizing products into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

Visualize your portfolio's strategic positioning with a clear, actionable Enfusion BCG Matrix.

Cash Cows

Enfusion's Annual Recurring Revenue (ARR) reached $210.4 million by the close of December 2024. This figure reflects a solid 13.6% growth compared to the previous year, underscoring the company's ability to generate consistent income.

This stable and increasing ARR is a hallmark of a cash cow. Clients depend on Enfusion's Software as a Service (SaaS) platform for their essential business functions, creating a dependable revenue stream that fuels growth and stability.

The company demonstrates robust financial health with impressive gross profit margins. For the entirety of 2024, these margins stood at a healthy 67.8%, and in the fourth quarter of 2024, they reached an even more favorable 69.0%.

These elevated gross profit margins are a clear indicator of operational efficiency and the company's ability to command strong pricing power. This translates into substantial cash flow generation, exceeding the direct costs associated with producing their goods or services.

Enfusion's exceptional client retention, evidenced by a Net Dollar Retention Rate (NDR) of 103.0% as of December 2024, firmly places it within the Cash Cows quadrant of the BCG Matrix. This means existing clients are spending more with Enfusion, not less.

This strong NDR signifies a highly sticky platform where clients find significant ongoing value, leading to increased service adoption and a reliable, growing revenue stream from its established customer base.

Established Client Base and Managed Services

Enfusion's significant global client base, exceeding 900 entities, forms the bedrock of its Cash Cow status. Many of these clients rely on Enfusion's integrated managed services, encompassing critical middle and back-office functions.

These deeply embedded services generate consistent, high-margin revenue streams. The reliance of clients on these operational workflows ensures a stable and predictable income for Enfusion.

- Established Client Base: Over 900 clients globally.

- Managed Services: Comprehensive middle and back-office support.

- Revenue Stability: High-margin, recurring revenue from embedded services.

- Operational Integration: Services are integral to client workflows, fostering loyalty and reducing churn.

Predictable Cash Flow Generation

Enfusion's position as a Cash Cow is strongly supported by its predictable cash flow generation. In the fourth quarter of 2024, the company reported positive operating cash flow of $9.7 million. This consistent inflow of cash is crucial for maintaining stability.

Furthermore, Enfusion achieved an adjusted free cash flow of $7.7 million during the same period. This metric highlights the company's ability to generate cash after accounting for capital expenditures.

- Consistent Cash Generation: Enfusion's ability to generate positive operating cash flow, as evidenced by the $9.7 million in Q4 2024, indicates a stable and reliable income stream.

- Financial Flexibility: The reported adjusted free cash flow of $7.7 million in Q4 2024 provides the company with the financial resources to manage its operations and explore investment opportunities without immediate external funding needs.

- Operational Efficiency: Strong cash flow generation often reflects efficient operations and effective cost management, key characteristics of a Cash Cow business.

- Foundation for Growth: This predictable cash generation acts as a solid foundation, allowing Enfusion to fund ongoing operations and potentially reinvest in areas that offer future growth prospects.

Enfusion's strong financial performance, characterized by a substantial Annual Recurring Revenue (ARR) of $210.4 million in 2024 and impressive gross profit margins reaching 69.0% in Q4 2024, solidifies its position as a Cash Cow.

The company's exceptional client retention, demonstrated by a Net Dollar Retention Rate (NDR) of 103.0% as of December 2024, and its extensive client base of over 900 entities relying on integrated managed services, underscore its stable, high-margin revenue streams.

Consistent positive operating cash flow, reported at $9.7 million in Q4 2024, alongside adjusted free cash flow of $7.7 million for the same period, highlights Enfusion's ability to generate significant, predictable cash, a key attribute of a mature, profitable business.

| Metric | Value (as of Dec 2024) | Significance |

|---|---|---|

| ARR | $210.4 million | Indicates stable and growing recurring revenue. |

| Gross Profit Margin (FY 2024) | 67.8% | Demonstrates operational efficiency and pricing power. |

| Net Dollar Retention Rate (NDR) | 103.0% | Shows existing clients are increasing their spend. |

| Operating Cash Flow (Q4 2024) | $9.7 million | Confirms consistent cash generation from operations. |

| Adjusted Free Cash Flow (Q4 2024) | $7.7 million | Highlights cash available after capital expenditures. |

Delivered as Shown

Enfusion BCG Matrix

The Enfusion BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content; you'll get a professionally designed, analysis-ready report ready for immediate strategic application. Once you complete your purchase, this comprehensive tool will be instantly downloadable, empowering you to make informed business decisions with confidence. You can use it directly for internal planning, client presentations, or competitive analysis without any need for further editing or revisions.

Dogs

Within Enfusion's comprehensive platform, certain niche features, perhaps those developed for very specific early use cases or older functionalities that haven't garnered widespread client uptake, could be categorized as 'dogs' in the BCG matrix. These might represent functionalities that require ongoing maintenance and support from Enfusion's development teams but do not contribute substantially to new client acquisition or revenue generation. For instance, if a particular module designed for a unique, now-obsolete trading strategy saw minimal adoption beyond a handful of legacy clients, it would fit this description.

Legacy system components, if still in operation within Enfusion's ecosystem, represent a potential drag on resources. These might include older software modules or hardware that require dedicated, often costly, maintenance and support. For instance, a 2024 report indicated that companies still relying on significant legacy IT infrastructure often spend upwards of 70% of their IT budget on maintaining these systems, rather than on innovation.

These non-integrated elements, by their nature, may not align with Enfusion's strategic direction towards a fully cloud-native and agile environment. If these legacy functionalities are not critical to future growth or are easily replicable with modern solutions, they become prime candidates for divestment or significant reduction. Their continued existence could hinder overall operational efficiency and the ability to adapt quickly to market changes.

A notable trend observed in Q2 2024 was a general slowdown in upselling across various client segments and geographies. This broad-based deceleration suggests that current product suites may not be effectively demonstrating their value proposition to encourage further adoption or additional purchases by existing clients.

This lack of incremental value realization from current offerings means that these segments are likely contributing less to incremental revenue growth. If proactive measures to enhance product utility or client engagement are not successful, these areas could be categorized as 'dogs' within a strategic framework, indicating a need for careful evaluation and potential repositioning.

High-Maintenance, Low-Return Features

Certain product features or modules can become a drain on resources, much like the 'dogs' in the Enfusion BCG Matrix. These are typically elements that require significant ongoing investment in maintenance, updates, or customer support, yet they don't generate a proportionate amount of revenue or strategic value. For instance, a legacy software module that needs constant patching to maintain security, consuming valuable developer hours that could be spent on new, revenue-generating features, exemplifies this category.

The challenge with these 'dogs' is that their operational burden can easily outweigh their strategic contribution. Think of a specialized reporting tool that a small segment of users relies on, but which requires extensive custom development for every minor change. By 2024, many companies found that such niche functionalities, while perhaps initially strategic, had become cost centers rather than profit drivers.

Identifying these high-maintenance, low-return features is crucial for optimizing resource allocation. Consider these indicators:

- Disproportionate Maintenance Costs: Features consuming over 30% of IT support budget without contributing significantly to top-line growth.

- Low User Engagement Metrics: Modules with consistently low adoption rates or feature usage, often below 15% of the active user base.

- Declining Revenue Contribution: Products or features whose revenue has stagnated or declined year-over-year, falling behind market trends.

- High Customization Requirements: Elements demanding frequent, costly modifications to meet specific, limited user needs.

Underperforming Geographic Pockets

Within Enfusion's global strategy, certain geographic pockets may exhibit underperformance, acting as 'dogs' in the BCG matrix. These are areas where investment in resources, such as sales teams or marketing campaigns, does not translate into proportional revenue growth or client acquisition.

For instance, while APAC and EMEA are strong performers for Enfusion, a specific smaller market, perhaps in parts of Latin America or a niche segment within North America, might show stagnant or declining revenue. If these underperforming areas consume significant resources without a clear path to improvement, they fit the 'dog' profile.

Consider a hypothetical scenario where Enfusion invested $1 million in a new market in 2023, aiming for a 15% revenue increase. By mid-2024, that market had only generated $300,000, a mere 3% increase, while still requiring ongoing operational expenses. This would clearly mark it as an underperforming pocket.

- Stagnant Revenue Growth: Specific regions or client segments within Enfusion show minimal to no year-over-year revenue increases.

- Low Client Acquisition Rates: Efforts to onboard new clients in these pockets are yielding poor results compared to other markets.

- Resource Drain: Continued investment in sales, marketing, and support for these underperforming areas detracts from resources that could be allocated to high-growth segments.

- Lack of Competitive Advantage: These pockets may lack the market conditions or competitive positioning necessary for Enfusion to thrive.

In the Enfusion BCG Matrix, 'dogs' represent functionalities or market segments that have low market share and low growth potential. These are often features that require significant upkeep but offer minimal returns, or geographic areas where Enfusion's presence is weak and unlikely to expand substantially.

For example, a specific, rarely used reporting module within Enfusion that consumes development resources for maintenance but is only utilized by a small fraction of clients, perhaps less than 10% in 2024, would be a 'dog'. Similarly, a geographic market where Enfusion has invested marketing dollars but seen minimal client acquisition, with revenue growth below 2% year-over-year in 2024, also fits this category.

The strategic implication for these 'dogs' is typically divestment, discontinuation, or a significant reduction in investment. The goal is to free up resources that can be reallocated to more promising areas, such as 'stars' or 'question marks', to improve overall portfolio performance.

Consider the following characteristics of 'dogs' within Enfusion's portfolio:

| Category | Characteristic | Example within Enfusion | 2024 Data Point/Implication |

|---|---|---|---|

| Product Feature | Low Usage & High Maintenance | Legacy integration module for a discontinued third-party system. | Required 25% of a specialized development team's time in Q1 2024, with less than 5% of clients actively using it. |

| Market Segment | Stagnant Revenue & Low Growth | A niche vertical market with declining adoption of financial technology solutions. | Revenue from this segment was flat in 2023 and projected to decline by 1% in 2024, despite continued sales efforts. |

| Geographic Region | Low Market Share & Limited Potential | A specific country where Enfusion has minimal brand recognition and faces entrenched local competitors. | Enfusion's market share in this region remained below 3% in 2024, with a projected growth rate of only 2% annually. |

Question Marks

Enfusion's ambition to penetrate new market segments, specifically targeting larger asset managers and broadening its service ecosystem beyond hedge funds, places it squarely in the 'question mark' quadrant of the BCG matrix. This strategic pivot represents a high-risk, high-reward scenario.

Achieving success in capturing larger asset managers and expanding its service offerings requires considerable investment in product development, sales, and marketing. For instance, in 2024, the financial technology sector saw significant M&A activity as firms sought to expand their capabilities, with deal values often reflecting the perceived future growth potential in new market segments.

The conversion of these new segments into robust revenue streams is not guaranteed. Enfusion must demonstrate a compelling value proposition that resonates with the complex needs of institutional investors, a segment often characterized by longer sales cycles and stringent due diligence processes. Failure to gain market acceptance could lead to significant capital expenditure without commensurate returns.

The integration of advanced analytics and AI within Enfusion's platform is a prime area for future growth, though its market share is still developing. This push into sophisticated data processing and machine learning is expected to significantly enhance client decision-making and operational efficiency.

Achieving widespread adoption of these AI capabilities necessitates substantial investment in research and development, alongside robust marketing efforts. Enfusion must clearly articulate the competitive edge these innovations provide to clients, ensuring they understand the tangible benefits and return on investment.

Following Clearwater Analytics' acquisition of Enfusion, realizing post-acquisition integration synergies presents a significant question mark. The potential for combining Enfusion's robust platform and client base with Clearwater's existing offerings is substantial, promising enhanced value for both companies.

Achieving these synergies, however, is not guaranteed and hinges on meticulous execution. The process could demand considerable investment in technology, personnel, and operational adjustments, potentially impacting short-term resource allocation and profitability. For instance, integrating disparate technology stacks often involves significant upfront costs, which can range from millions to tens of millions of dollars depending on the complexity.

Expansion into New Asset Classes

Enfusion's platform, while designed for multi-asset class operations, faces a potential question mark regarding deeper penetration into rapidly growing but complex markets like private credit. Successfully navigating these areas requires more than just a broad offering; it demands specialized expertise and tailored solutions.

Building scalable, intelligent workflows for these niche markets is a significant undertaking. It necessitates specialized development and substantial investment to effectively capture market share and establish a strong competitive position. For instance, the private credit market saw substantial growth, with global private debt fundraising reaching approximately $1.5 trillion in 2023, indicating a vast opportunity but also intense competition requiring sophisticated operational capabilities.

- Private Credit Market Growth: The global private credit market has experienced significant expansion, with fundraising figures consistently rising, presenting a substantial opportunity for platforms like Enfusion.

- Operational Complexity: The unique characteristics of private credit, including bespoke deal structures and less standardized reporting, demand specialized workflows and technological investment.

- Competitive Landscape: Capturing market share in these complex asset classes requires Enfusion to differentiate itself through efficient and intelligent operational solutions, overcoming the inertia of established players.

- Investment Requirements: Developing the necessary technology and expertise for deep dives into asset classes like private credit represents a considerable investment, a key consideration for Enfusion's strategic expansion.

Global Market Expansion Beyond Current Presence

Enfusion's current global footprint spans four continents, but the question remains whether further expansion into untapped international markets is a strategic imperative. This move presents a significant "question mark" in the BCG matrix, as it involves substantial upfront investment.

Entering new regions necessitates considerable expenditure on localization efforts, navigating complex regulatory landscapes, and building robust sales infrastructures. The initial market share gains in these new territories are inherently uncertain, making this a high-risk, high-reward proposition.

For example, a recent analysis of emerging markets suggests that the average cost for a technology company to establish a significant presence in a new continent can range from $50 million to $150 million, with a payback period of 5-7 years.

- Investment Required: Significant capital is needed for market entry, including localization, legal compliance, and infrastructure development.

- Regulatory Hurdles: Navigating diverse international regulations can be time-consuming and costly, potentially delaying market penetration.

- Market Uncertainty: Initial market share and revenue projections in new territories carry a high degree of uncertainty, impacting ROI calculations.

- Competitive Landscape: Understanding and adapting to local competition is crucial for successful market penetration.

Question marks represent areas where Enfusion is investing heavily but has not yet established a strong market position or guaranteed returns. These are often new product initiatives or market entries with high growth potential but also high risk. Success hinges on effective execution and market acceptance.

Enfusion's expansion into larger asset managers and new service areas, like private credit, are prime examples of question marks. These ventures require substantial investment in technology and sales, with uncertain outcomes. The firm's recent acquisition by Clearwater Analytics also introduces integration synergies as a significant question mark.

The success of these question mark initiatives is critical for Enfusion's future growth. The company must demonstrate a clear value proposition and navigate complex markets and integration processes to convert these investments into market share and profitability.

| Initiative | Market Potential | Investment Required (Est.) | Risk Level | Potential Return |

| Targeting Larger Asset Managers | High | Significant (Sales, Product Dev) | High | High |

| Expanding Service Ecosystem (e.g., Private Credit) | High | Substantial (R&D, Specialized Expertise) | High | High |

| Post-Acquisition Integration Synergies (Clearwater) | High | Considerable (Tech, Ops) | High | High |

| International Market Expansion | High | Very High (Localization, Regulatory, Infrastructure) | Very High | Very High |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of public company filings, detailed market research reports, and reputable industry databases to provide a robust foundation for strategic analysis.