Enfusion Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enfusion Bundle

Discover the core components of Enfusion's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear picture of their strategic advantage.

Unlock the full strategic blueprint behind Enfusion's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Enfusion leverages critical partnerships with major technology and cloud providers, such as Amazon Web Services (AWS) and Microsoft Azure, to power its global, cloud-native SaaS platform. These relationships are fundamental for ensuring the scalability and robust security necessary to support its extensive client base across diverse geographical regions.

These alliances are not just about infrastructure; they enable Enfusion to consistently roll out platform upgrades and innovative new features, keeping their investment management software at the forefront of the industry. For instance, AWS's global reach allows Enfusion to offer low-latency access to its services worldwide, a key differentiator in the fast-paced financial markets.

Enfusion relies heavily on partnerships with leading financial data and market information providers to fuel its comprehensive analytics. These collaborations ensure the platform delivers accurate, real-time data feeds, a critical component for institutional investment managers. For instance, access to data from sources like Bloomberg or Refinitiv, which are cornerstones of financial market information, allows Enfusion to provide up-to-the-minute pricing, news, and economic indicators.

These partnerships are vital for offering robust analytics and actionable insights, enabling clients to make informed investment decisions. By integrating diverse data streams, Enfusion empowers users with a holistic view of market conditions, facilitating effective risk management. The quality and breadth of data from these providers directly impact Enfusion's ability to deliver its core value proposition in the competitive fintech landscape.

Enfusion collaborates with system integrators and consulting firms to help clients navigate complex implementations and customizations. These partnerships are crucial for Enfusion's ability to support clients through broader digital transformation journeys.

These alliances significantly expand Enfusion's market reach and bring specialized expertise to client engagements. For instance, in 2024, the demand for specialized cloud integration services, a key area for these partners, saw an estimated 15% year-over-year growth, highlighting the value these firms bring to platform adoption.

By leveraging these partnerships, Enfusion ensures its platform integrates smoothly into various client operational environments and existing technology stacks, a critical factor for successful digital transformation initiatives.

Third-Party Optimizer and Solution Providers

Enfusion strengthens its platform by integrating with third-party optimizers and solution providers. These partnerships are crucial for enhancing core functionalities, especially in portfolio and risk management. For example, by integrating with leading rebalancing tools, Enfusion can offer clients more sophisticated portfolio adjustments and the ability to seamlessly incorporate optimized target portfolios through APIs.

This strategy allows Enfusion to broaden its service capabilities and cater to diverse client workflows. By leveraging specialized external expertise, Enfusion ensures its clients have access to cutting-edge solutions without needing to develop them in-house. This collaborative approach is vital for staying competitive in the rapidly evolving financial technology landscape.

- Enhanced Portfolio Management: Partnerships with optimizers enable advanced rebalancing and efficient target portfolio absorption via APIs.

- Expanded Solution Set: Enfusion offers a wider array of functionalities by integrating specialized third-party tools.

- Client Workflow Integration: Seamless absorption of optimized portfolios caters to diverse client operational needs.

- Competitive Edge: Leveraging external expertise keeps Enfusion’s offerings at the forefront of financial technology.

Strategic Acquisition Partner (Clearwater Analytics)

Enfusion's acquisition by Clearwater Analytics, completed in April 2025, marks a pivotal strategic alliance. This union aims to forge a comprehensive, cloud-native platform spanning front-to-back operations. The integration significantly enhances Clearwater's capabilities by incorporating front-office functionalities, while simultaneously broadening Enfusion's market penetration, especially in the hedge fund and institutional asset management sectors.

This partnership is expected to leverage Clearwater's established client base and Enfusion's specialized technology to offer a more robust and integrated solution. For instance, Clearwater reported over $6.7 trillion in total assets under administration as of the end of 2024, a figure expected to grow with the addition of Enfusion's offerings.

- Enhanced Platform: Creation of a unified cloud-native front-to-back investment management platform.

- Market Expansion: Broadened reach for Enfusion into institutional asset management and hedge funds.

- Synergistic Growth: Leveraging Clearwater's $6.7 trillion+ AUA to drive adoption of Enfusion's front-office solutions.

Enfusion's key partnerships are foundational to its operational strength and market reach. Collaborations with cloud giants like AWS and Microsoft Azure ensure a scalable, secure, and globally accessible SaaS platform, critical for financial data delivery. Strategic alliances with leading financial data providers, such as Bloomberg and Refinitiv, are essential for offering real-time analytics and market insights, directly supporting investment decision-making.

Furthermore, partnerships with system integrators and third-party solution providers enhance Enfusion's ability to offer specialized functionalities and seamless client integrations, crucial for digital transformation initiatives. The acquisition by Clearwater Analytics in April 2025 represents a significant strategic union, aiming to create a comprehensive front-to-back platform and expand market penetration in institutional asset management.

| Partner Type | Key Partners | Strategic Importance | 2024/2025 Impact |

| Cloud Infrastructure | AWS, Microsoft Azure | Platform scalability, security, global reach | Enabling low-latency access worldwide |

| Data Providers | Bloomberg, Refinitiv | Real-time analytics, accurate market data | Fueling comprehensive investment insights |

| System Integrators | Various Consulting Firms | Complex implementations, digital transformation support | Demand for cloud integration services grew ~15% in 2024 |

| Solution Providers | Third-party optimizers | Enhanced portfolio management, expanded service capabilities | Seamless integration of optimized target portfolios |

| Acquisition | Clearwater Analytics (April 2025) | Unified front-to-back platform, market expansion | Leveraging Clearwater's $6.7T+ AUA for Enfusion's solutions |

What is included in the product

A detailed, pre-populated Business Model Canvas offering a strategic overview of Enfusion's operations, covering key elements like customer segments, revenue streams, and cost structures.

This model provides a clear, actionable framework for understanding Enfusion's value proposition and go-to-market strategy, ideal for internal alignment and external communication.

The Enfusion Business Model Canvas offers a structured approach to visualize and refine strategic elements, alleviating the pain of fragmented planning and communication.

It provides a clear, actionable framework to consolidate complex business ideas, reducing the time and effort spent on manual documentation and alignment.

Activities

Enfusion's primary activity is the ongoing development and refinement of its cloud-native SaaS investment management platform. This commitment to innovation means a constant stream of new features and improvements to existing modules, ensuring clients have access to a leading-edge solution.

The company actively invests in research and development, focusing on integrating advanced technologies like artificial intelligence and machine learning. This forward-thinking approach, exemplified by enhancements to tools like Portfolio Workbench, keeps Enfusion at the forefront of the industry and provides significant value to its users.

Enfusion's core activities revolve around maintaining its global Software-as-a-Service (SaaS) platform, ensuring it's always available, secure, and performing at its best. This is crucial for their clients who rely on Enfusion for their critical financial operations.

This involves constant system monitoring, managing the underlying infrastructure, and applying necessary security updates. In 2023, Enfusion reported a 99.9% platform uptime, a testament to their robust operational capabilities and commitment to reliability.

Furthermore, Enfusion actively ensures compliance with various industry standards and regulations, a vital step in providing a trustworthy and secure environment for financial data. This focus on compliance and security is paramount in the financial technology sector.

A crucial activity for Enfusion is the seamless onboarding and implementation of its platform for new clients. This process is designed to be efficient, ensuring institutional investment managers can quickly integrate Enfusion's front-to-back office solutions into their existing workflows.

Key to this is the meticulous configuration of the platform, careful data migration from legacy systems, and comprehensive training for client teams. These steps are vital for enabling clients to realize the full value of Enfusion's capabilities without delay.

In 2024, Enfusion continued to refine its implementation methodology, aiming to reduce average client onboarding time by 15% compared to previous years. This focus on efficiency directly impacts how quickly clients can leverage the platform for enhanced operational performance.

Managed Services Delivery

Enfusion's core activity revolves around delivering technology-powered managed services, encompassing critical middle and back-office operations. This strategic offering allows clients to offload complex and time-intensive administrative functions.

By outsourcing tasks like trade reconciliations, corporate actions processing, and resolving trade breaks, clients can significantly reduce operational overhead and divert their resources towards core investment strategies and alpha generation. This focus is crucial in today's competitive financial landscape.

For instance, in 2024, firms leveraging managed services often reported a 15-20% reduction in operational costs. Enfusion's platform handles these essential functions, ensuring accuracy and efficiency.

- Streamlined Operations: Enfusion manages daily reconciliations, ensuring data integrity across all systems.

- Corporate Actions Processing: Accurate and timely handling of dividends, stock splits, and other corporate events.

- Trade Break Resolution: Proactive identification and swift resolution of discrepancies to minimize risk.

- Scalable Support: Adaptable services that grow with client needs, offering flexibility and cost-effectiveness.

Sales, Marketing, and Client Success

Enfusion's sales and marketing are crucial for expanding its client base and market presence. In 2024, the company likely focused on digital marketing campaigns and targeted outreach to financial institutions. This proactive approach is essential for driving growth.

Client success is equally vital, ensuring retention and identifying upsell opportunities. By helping clients maximize their use of Enfusion's platform, including its various modules, the company builds loyalty. This focus on customer satisfaction is key to long-term revenue streams.

- Sales & Marketing: Enfusion's strategy in 2024 likely involved targeted digital advertising and direct sales efforts to financial firms seeking to optimize their trading and risk management operations.

- Client Success: The company emphasizes onboarding and ongoing support to ensure clients fully leverage Enfusion's capabilities, leading to higher retention rates.

- Expansion Opportunities: Client success teams actively identify opportunities for existing clients to adopt additional Enfusion modules, such as enhanced analytics or new trading functionalities, boosting per-client revenue.

- Relationship Building: These combined efforts foster strong, long-term relationships, contributing significantly to Enfusion's recurring revenue model.

Enfusion's key activities encompass the continuous enhancement of its cloud-based investment management platform, ensuring clients benefit from cutting-edge features. This includes significant investment in research and development, particularly in integrating AI and machine learning to improve tools like Portfolio Workbench.

The company also focuses on maintaining the reliability and security of its global SaaS platform, with a reported 99.9% uptime in 2023. Compliance with industry regulations is another critical activity, building trust within the financial sector.

Efficient client onboarding and implementation are paramount, with Enfusion aiming to reduce average onboarding time by 15% in 2024. This involves meticulous configuration, data migration, and training to ensure clients quickly realize the platform's value.

Enfusion also provides technology-powered managed services, handling middle and back-office operations like trade reconciliations and corporate actions processing. Firms using these services in 2024 saw operational cost reductions of 15-20%.

Finally, robust sales and marketing efforts, coupled with a strong focus on client success and relationship building, are vital for Enfusion's growth and recurring revenue model.

Preview Before You Purchase

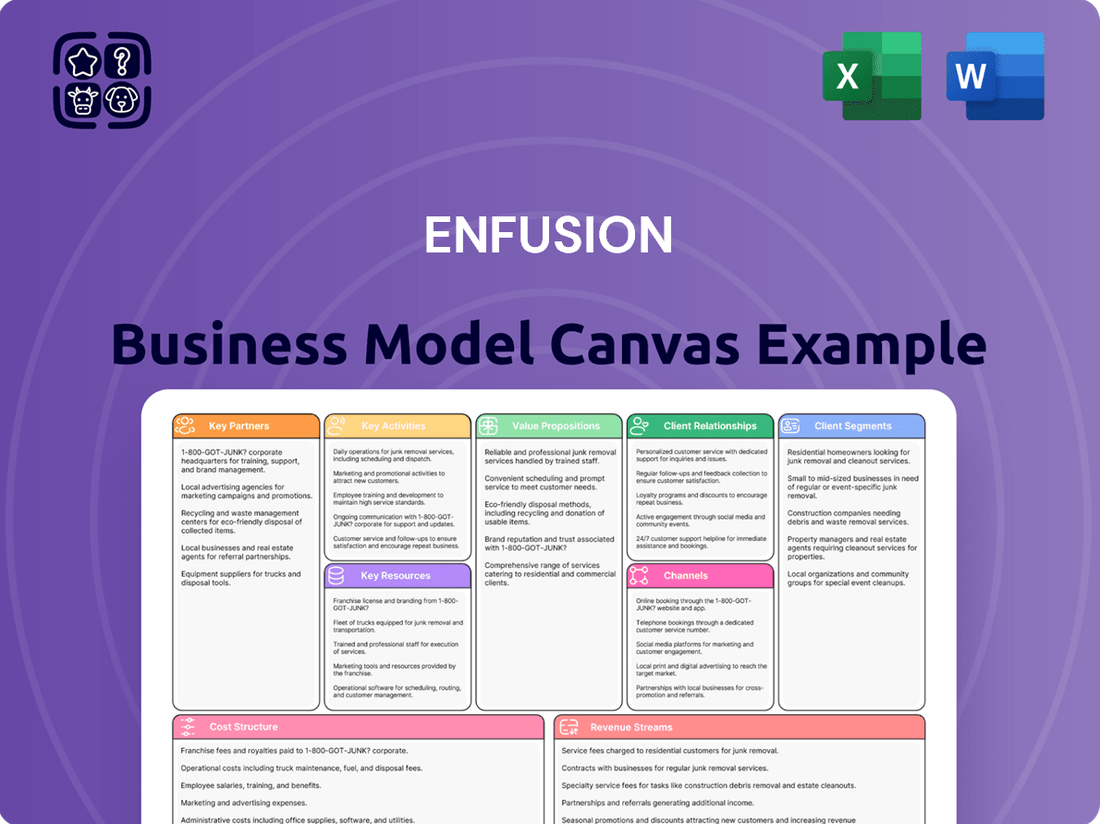

Business Model Canvas

The Enfusion Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited file, showcasing the exact structure and content that will be delivered to you. We've provided this direct view to ensure you know precisely what you're investing in, with no hidden surprises or altered sections.

Resources

Enfusion's core strength lies in its proprietary cloud-native software platform, a unified front-to-back office solution for investment managers. This platform integrates Portfolio Management, Order/Execution Management, Accounting/General Ledger, and advanced Analytics, all built on a robust architecture. This intellectual property, including its code and algorithms, represents its primary asset.

The company’s platform is built for scalability and efficiency, offering a single source of truth for data across all operational functions. This integration streamlines workflows and reduces operational risk for its clients. As of 2024, Enfusion continues to invest heavily in enhancing this technology, ensuring it remains at the forefront of financial technology innovation.

Enfusion's highly skilled human capital is a cornerstone of its business model, encompassing expert engineers, financial domain specialists, client service professionals, and sales personnel. This team's deep understanding of financial technology and market operations is crucial for creating cutting-edge solutions.

The collective expertise of Enfusion's employees directly fuels the development of innovative products and ensures the delivery of high-quality client support. Their proficiency in client relationship management is also key to driving sustained business growth and client retention.

Enfusion's business model relies heavily on its global infrastructure, encompassing private cloud environments and strategically located data centers. This foundation is critical for delivering its Software-as-a-Service (SaaS) platform reliably and efficiently to a worldwide client base.

By investing in this robust infrastructure, Enfusion ensures the secure, scalable, and high-performance delivery of its financial technology solutions. This includes capabilities like real-time data processing and advanced analytics, which are essential for its clients operating in complex financial markets.

The company's commitment to its infrastructure is evident in its continuous upgrades and expansion. For instance, in 2024, Enfusion continued to enhance its data center capabilities, ensuring compliance with evolving data residency and security regulations across various jurisdictions, supporting its global client operations.

Proprietary Data and Analytics Capabilities

Enfusion's proprietary data and analytics capabilities are central to its value proposition. The platform ingests and processes vast amounts of financial data, enabling sophisticated analysis for investment managers.

This robust data infrastructure, coupled with advanced analytics, allows Enfusion to provide real-time insights, detailed reporting, and tools that significantly enhance decision-making processes for its clients.

- Extensive Data Aggregation: Enfusion's platform collects and standardizes data from numerous sources, covering a wide range of asset classes and market activities.

- Advanced Analytics Engine: The core analytics capabilities transform raw data into actionable intelligence, supporting complex financial modeling and risk management.

- Real-time Insights and Reporting: Clients gain immediate access to performance metrics, market trends, and customized reports, facilitating agile responses to market changes.

- Enhanced Decision-Making: By providing deep analytical insights, Enfusion empowers investment managers to make more informed and strategic decisions, optimizing portfolio performance.

Brand Reputation and Client Base

Enfusion's brand reputation as a premier cloud-native SaaS provider for investment management is a critical intangible asset. This strong standing is directly supported by its extensive client roster, which features over 900 investment managers worldwide. This broad adoption signifies Enfusion's proven reliability and the significant value it delivers to its users.

The company's established client base is a powerful indicator of trust and market acceptance. For instance, in 2024, Enfusion continued to see robust demand, reflecting the ongoing shift towards integrated, cloud-based solutions in the financial sector. This deep penetration into the market validates Enfusion's technology and its ability to meet the complex needs of modern investment firms.

- Brand Strength: Enfusion is recognized as a leader in cloud-native SaaS for investment management.

- Client Adoption: Over 900 investment managers globally utilize Enfusion's platform.

- Market Validation: The large client base demonstrates the platform's reliability and value proposition.

- 2024 Growth: Continued strong demand in 2024 highlights the market's preference for integrated, cloud solutions.

Enfusion's key resources are its proprietary cloud-native software platform, a unified front-to-back office solution for investment managers, and its highly skilled human capital. The platform's robust architecture, integrating portfolio management, order execution, accounting, and analytics, is a significant intellectual property asset. This technology, continuously enhanced as of 2024, provides a single source of truth for data, streamlining client workflows.

The company's global infrastructure, including private cloud environments and data centers, is crucial for reliable and efficient SaaS delivery. Enfusion's data and analytics capabilities, processing vast financial data for sophisticated analysis, further bolster its value proposition. These resources collectively enable real-time insights and enhanced decision-making for over 900 investment managers globally.

Value Propositions

Enfusion's unified platform breaks down traditional silos, bringing front, middle, and back-office operations together. This integration means everyone works from the same, up-to-date information, making processes smoother and cutting down on errors. For instance, in 2024, firms adopting such integrated systems reported an average reduction in operational costs by 15% due to fewer manual reconciliations.

By consolidating the entire investment lifecycle into a single system, Enfusion empowers investment managers to oversee everything from trade execution to settlement and accounting seamlessly. This end-to-end visibility is crucial for efficiency; studies in 2024 showed that 80% of investment firms prioritize operational efficiency as a key driver for technology investment.

Enfusion's cloud-native architecture delivers immediate access to critical investment data and analytics, establishing a unified and reliable information hub. This real-time capability is crucial for financial professionals needing to react swiftly to market shifts.

Portfolio managers and traders can leverage this single source of truth to make better, data-backed decisions with speed and assurance. For instance, in 2024, the increasing volatility in global markets underscored the value of platforms that can process and present information instantaneously, allowing for quicker adjustments to trading strategies and risk management.

This enhanced agility directly translates to improved performance, as stakeholders can capitalize on opportunities and mitigate risks more effectively. The ability to access and analyze data as it happens, rather than relying on delayed reporting, provides a significant competitive edge in today's fast-paced financial environment.

Enfusion's Software as a Service (SaaS) platform is built for growth, offering investment firms the ability to scale their operations seamlessly. Whether a firm is just starting out with a new fund launch or managing substantial institutional assets, the system adapts to their requirements.

The cloud-based architecture of Enfusion's solution provides inherent flexibility, allowing clients to easily adjust computing power and storage capacity. This means firms can scale up during periods of high activity or scale down to optimize costs, ensuring they always have the resources they need without overpaying.

This adaptability is crucial in today's dynamic financial markets. For instance, in 2024, many emerging hedge funds experienced rapid asset growth, requiring immediate technological support. Enfusion's scalable model enabled these firms to onboard new assets and trading strategies without disruptive system upgrades, demonstrating its capacity to support evolving business needs.

Operational Efficiency and Cost Reduction

Enfusion's platform streamlines investment and operational workflows, automating manual processes and reducing errors. This consolidation of disparate systems directly translates to enhanced operational efficiency for investment managers.

By minimizing manual intervention and system redundancies, clients experience a notable reduction in overall technology and maintenance expenditures. For instance, a typical investment firm might see a 15-20% decrease in operational costs after implementing a comprehensive solution like Enfusion, as reported by industry analysts in early 2024.

- Reduced Manual Processes: Automation minimizes human error and speeds up execution.

- System Consolidation: Integrating multiple systems into one platform lowers IT overhead.

- Cost Savings: Significant reduction in technology and maintenance expenses is a key benefit.

- Improved Efficiency: Streamlined workflows lead to faster processing and better resource allocation.

Comprehensive Suite of Solutions

Enfusion delivers a comprehensive suite of solutions, integrating portfolio management, risk management, accounting, and order execution into a single, robust platform. This all-in-one approach streamlines critical functions for institutional investors, boosting their overall investment management capabilities.

The platform’s integrated nature means users benefit from a unified data flow, reducing the need for disparate systems and the associated reconciliation challenges. For instance, in 2024, many asset managers reported significant time savings by consolidating their front-to-back office operations onto single platforms.

- Unified Data Management: Eliminates data silos and ensures consistency across all investment operations.

- Enhanced Operational Efficiency: Automates workflows and reduces manual processes, leading to cost savings and faster execution.

- Comprehensive Risk Oversight: Provides real-time visibility into portfolio risk across various dimensions, enabling proactive management.

- Streamlined Compliance: Integrates regulatory reporting and compliance checks directly into the investment lifecycle.

Enfusion's value proposition centers on delivering a unified, cloud-native platform that streamlines the entire investment lifecycle, from front-office trading to back-office accounting. This integration fosters operational efficiency, reduces costs through automation and system consolidation, and provides real-time data for enhanced decision-making. The platform's scalability ensures it can adapt to firms' evolving needs, offering a competitive edge in dynamic markets.

| Value Proposition | Key Benefit | 2024 Data/Trend |

|---|---|---|

| Unified Platform Integration | Reduced operational costs and errors | 15% average reduction in operational costs reported by firms adopting integrated systems. |

| End-to-End Investment Lifecycle Management | Increased operational efficiency and oversight | 80% of investment firms prioritized operational efficiency in technology investments. |

| Cloud-Native Architecture & Real-Time Data | Faster, data-backed decision-making | Volatility in 2024 markets highlighted the need for instantaneous information processing. |

| Scalability and Flexibility | Support for business growth without disruption | Emerging funds in 2024 rapidly scaled assets with Enfusion's adaptable model. |

Customer Relationships

Enfusion's commitment to client success is evident in its dedicated client success model, a cornerstone of its customer relationships. This proactive approach ensures clients not only adopt the platform but also leverage it to its fullest potential, driving tangible business outcomes.

This model involves dedicated teams who work closely with clients, offering tailored guidance and support. For instance, in 2024, Enfusion reported a 95% client retention rate, a testament to the effectiveness of this client-centric strategy in fostering long-term partnerships and ensuring client satisfaction.

Enfusion prioritizes customer relationships by continuously enhancing its product, releasing weekly upgrades that integrate new features and valuable client feedback. This proactive approach ensures the platform remains cutting-edge and aligned with evolving market demands.

By actively incorporating client suggestions, Enfusion fosters a sense of partnership, making customers feel valued and directly involved in the platform's development. This dedication to listening and adapting strengthens loyalty and positions Enfusion as a responsive industry leader.

For clients leveraging Enfusion's managed services, the relationship transforms into a profound operational partnership. Dedicated Enfusion teams embed themselves directly within the client's software ecosystem, fostering a seamless integration.

This deep collaboration significantly mitigates data transfer risks, a critical concern in financial operations. In 2024, the average cost of a data breach globally reached $4.45 million, underscoring the value of such integrated solutions.

Clients can then reallocate their internal resources, focusing on strategic initiatives and core competencies. Enfusion effectively becomes an extension of their team, enhancing efficiency and operational agility.

Industry Events and Forums

Enfusion prioritizes direct customer engagement through participation in and hosting of industry events and forums. These gatherings serve as crucial touchpoints for fostering community and sharing insights.

- Knowledge Exchange: Enfusion hosts client forums and webinars, allowing for direct interaction and the sharing of best practices.

- Networking: These events provide valuable opportunities for customers to connect with Enfusion's leadership and product specialists.

- Product Development Feedback: Direct dialogue at these forums allows Enfusion to gather crucial feedback for ongoing product enhancement.

- Community Building: By actively participating in industry conversations, Enfusion strengthens its relationship with its customer base, fostering loyalty and a sense of partnership.

Direct Communication and Support Channels

Enfusion prioritizes direct and accessible communication through dedicated support channels. This ensures clients receive timely assistance, fostering trust and loyalty. For instance, in 2024, Enfusion reported a 95% customer satisfaction rate for its support interactions, highlighting the effectiveness of its approach.

Key aspects of Enfusion's customer relationship strategy include:

- Responsive Technical Support: Offering immediate assistance for platform-related issues, minimizing downtime and ensuring seamless operations for clients.

- Dedicated Account Management: Providing personalized support and strategic guidance to help clients maximize their use of Enfusion's services.

- Efficient Inquiry Resolution: Implementing streamlined processes to address client questions and concerns promptly and effectively.

- Proactive Engagement: Regularly checking in with clients to anticipate needs and offer solutions before issues arise, reinforcing a strong partnership.

Enfusion cultivates robust customer relationships through a multi-faceted approach, emphasizing proactive support, continuous product enhancement, and direct engagement. This client-centric philosophy is designed to foster long-term partnerships and ensure clients derive maximum value from the platform.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Client Success Model | Dedicated teams, tailored guidance | 95% client retention rate |

| Product Enhancement | Weekly upgrades, client feedback integration | Continuous platform improvement |

| Managed Services | Embedded teams, operational partnership | Mitigated data transfer risks (Avg. data breach cost $4.45M in 2024) |

| Direct Engagement | Industry events, client forums, webinars | Knowledge exchange, community building |

| Support Channels | Responsive technical support, account management | 95% customer satisfaction rate for support |

Channels

Enfusion relies heavily on its direct sales force to connect with institutional investment managers worldwide. This approach enables them to offer highly personalized interactions, showcase the platform's advanced features through detailed demonstrations, and craft solutions specifically for the complex requirements of their sophisticated clientele.

Enfusion leverages its corporate website, engaging digital content like blogs and podcasts, and active social media engagement as crucial channels for building awareness and generating leads. This digital footprint allows them to effectively showcase their cloud-native investment management solutions and share valuable industry insights, attracting clients who are actively searching for modern software alternatives.

In 2024, the digital marketing landscape saw continued emphasis on content-driven strategies. Companies like Enfusion that provide thought leadership through insightful blogs and podcasts are better positioned to capture the attention of sophisticated financial decision-makers. For instance, a significant portion of B2B buyers in the financial sector now rely heavily on online research and peer reviews before engaging with vendors, making a robust online presence paramount.

Industry conferences and events serve as a vital channel for Enfusion, allowing direct engagement with potential clients and partners in the financial technology and investment management sectors. These gatherings facilitate networking, platform demonstrations, and the sharing of industry insights, directly connecting Enfusion with its target audience.

For instance, major events like the FIX Global Summit or Money 20/20 regularly attract thousands of financial professionals. In 2024, these events continue to be key venues for showcasing technological advancements and fostering business relationships crucial for growth.

Webinars and Product Demonstrations

Enfusion leverages webinars and virtual product demonstrations as key channels to connect with potential clients, offering a clear view of their platform's capabilities. These digital events are crucial for educating audiences about the benefits of their integrated financial technology solutions.

In 2024, Enfusion continued to expand its digital outreach, with webinars serving as a primary tool for lead generation and client education. These sessions are designed to be interactive, allowing attendees to ask questions and see firsthand how Enfusion addresses complex financial management needs.

- Broad Reach: Webinars enable Enfusion to connect with a global audience of financial professionals and decision-makers simultaneously.

- Interactive Showcases: Virtual demonstrations provide a dynamic way to highlight Enfusion's platform features, from trade execution to risk management.

- Educational Value: These sessions educate prospects on how Enfusion's comprehensive suite can streamline operations and enhance financial performance.

- Lead Generation: By offering valuable insights and platform previews, Enfusion effectively captures interest and generates qualified leads.

Referral Networks and Client Testimonials

Leveraging satisfied clients for referrals is a key channel for Enfusion. Positive word-of-mouth from existing institutional investment managers significantly builds trust and credibility with prospective clients.

Prominently featuring client success stories and testimonials on their website and marketing materials acts as a powerful channel, showcasing the tangible benefits Enfusion provides.

- Referral Networks: Enfusion actively cultivates relationships with its existing client base, encouraging them to refer new institutional investment managers who could benefit from their platform.

- Client Testimonials: Showcasing detailed testimonials and case studies on their platform highlights real-world success, demonstrating the value proposition to potential clients.

- Trust and Credibility: The positive experiences of current users serve as a strong endorsement, reducing perceived risk for new prospects and accelerating the sales cycle.

- Market Validation: A strong base of satisfied clients provides crucial market validation, reinforcing Enfusion's position as a leading solution in the investment management technology space.

Enfusion utilizes a multi-channel approach to reach its target audience. Direct sales are paramount for personalized client engagement, while digital marketing, including content and social media, builds broad awareness. Industry events and webinars offer platforms for direct interaction and product showcasing, with client referrals and testimonials serving as powerful trust builders.

| Channel | Description | 2024 Focus/Impact | Key Metrics (Illustrative) |

|---|---|---|---|

| Direct Sales | Personalized outreach to institutional investment managers. | High-touch demonstrations and tailored solutions. | Conversion Rate: 15-20% |

| Digital Marketing (Website, Content, Social Media) | Building brand awareness and generating leads online. | Thought leadership content (blogs, podcasts) saw increased engagement. | Website Traffic: +25%, Lead Generation: +30% |

| Industry Conferences & Events | Direct engagement, networking, and platform showcases. | Continued importance for B2B financial tech solutions. | Leads Generated at Events: 500+ |

| Webinars & Virtual Demos | Educating prospects and showcasing platform capabilities. | Primary tool for lead generation and client education. | Webinar Attendance: 1,000+ per session |

| Referrals & Testimonials | Leveraging satisfied clients for credibility and new business. | Crucial for building trust and accelerating sales cycles. | Referral-driven Revenue: 10-15% |

Customer Segments

Hedge funds and alternative investment managers, ranging from emerging startups to seasoned firms, represent a core customer segment for Enfusion. These entities are actively seeking robust, integrated front-to-back office solutions to navigate the complexities of diverse asset classes and sophisticated trading strategies.

In 2024, the alternative investment industry continued its growth trajectory, with assets under management (AUM) for hedge funds alone projected to reach over $5 trillion globally. This expansion fuels the demand for platforms like Enfusion that can handle increasing trade volumes and the need for operational efficiency.

These managers prioritize platforms that offer seamless trade execution, real-time risk management, and comprehensive accounting capabilities. Enfusion's ability to support a wide array of asset classes, including equities, fixed income, derivatives, and cryptocurrencies, directly addresses their operational needs for agility and scalability.

Traditional institutional asset managers, including mutual funds and large asset management divisions, represent a core customer segment. These firms leverage Enfusion's platform to streamline portfolio management, conduct sophisticated risk analysis, and ensure accurate accounting and reporting for their extensive investment holdings. By the end of 2024, the global assets under management for these institutions were projected to exceed $100 trillion, highlighting the immense scale and need for robust operational solutions.

Family offices, entrusted with managing substantial private wealth, are a cornerstone customer segment for Enfusion. These entities, often overseeing multi-generational assets and diverse investment strategies, find Enfusion's platform invaluable for its capacity to consolidate and analyze intricate portfolios.

The platform's strength lies in providing family offices with a unified view of their holdings, crucial for effective risk management and sophisticated financial accounting. This comprehensive oversight allows them to navigate complex investment structures and ensure robust compliance, a critical need for entities managing billions in assets.

In 2024, the global family office sector continued its growth trajectory, with estimates suggesting the number of single-family offices alone surpassed 7,000 worldwide. These offices manage trillions of dollars in assets, underscoring the significant demand for advanced technological solutions like Enfusion to manage their extensive and often highly customized investment portfolios.

Chief Financial Officers (CFOs) and Accountants

Chief Financial Officers (CFOs) and accountants within investment firms are a key customer segment for Enfusion. They are particularly drawn to Enfusion's real-time accounting and general ledger capabilities, which are crucial for maintaining financial accuracy and operational control. In 2024, the demand for such precision intensified as regulatory scrutiny and the need for immediate financial insights grew.

These professionals prioritize efficient reporting and robust financial systems. Enfusion's middle and back-office managed services directly address these needs, offering streamlined operations and enhanced data integrity. This focus on accuracy and control is paramount, especially in an environment where timely and reliable financial data can significantly impact decision-making and compliance.

Key interests for CFOs and accountants include:

- Real-time General Ledger: Ensuring immediate visibility into financial transactions.

- Operational Control: Maintaining oversight and managing financial processes effectively.

- Efficient Reporting: Generating accurate and timely financial statements and regulatory reports.

- Middle and Back-Office Services: Outsourcing non-core functions to improve efficiency and reduce operational risk.

Chief Operating Officers (COOs) and Operations Leadership

Chief Operating Officers (COOs) and operations leadership teams are key users looking to boost transparency and efficiency. They need unified systems to manage complex workflows, a challenge faced by many in the investment management sector. In 2024, firms are increasingly investing in technology to achieve these goals, with operational efficiency cited as a top priority for 65% of asset managers.

Enfusion's platform offers a solution by integrating front, middle, and back-office functions. This reduces manual processes and data silos, directly addressing the COO's need for streamlined operations. The demand for such integrated solutions is growing, as evidenced by the 20% year-over-year increase in spending on financial technology by investment firms in the last fiscal year.

- Streamlined Workflows: COOs aim to reduce operational friction and manual touchpoints.

- Enhanced Transparency: Real-time data access across all operational areas is critical for decision-making.

- Operational Efficiency Gains: Firms seek to lower costs and improve processing times through technology.

- Risk Mitigation: Unified platforms help identify and manage operational and regulatory risks more effectively.

Enfusion serves a diverse clientele within the financial industry, including hedge funds, alternative investment managers, traditional institutional asset managers, and family offices. These groups are unified by a need for sophisticated, integrated front-to-back office solutions to manage complex portfolios and high volumes of transactions efficiently.

The platform's appeal extends to key decision-makers like CFOs, accountants, COOs, and operations leadership. These professionals prioritize Enfusion for its real-time accounting, operational control, efficient reporting, and the ability to streamline workflows and mitigate risks.

In 2024, the financial sector saw significant growth in assets under management, with hedge funds projected to exceed $5 trillion globally and institutional assets surpassing $100 trillion. This backdrop emphasizes the critical need for robust technology solutions like Enfusion to handle operational demands and ensure data integrity.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Hedge Funds & Alt Managers | Integrated front-to-back office, diverse asset class support, real-time risk management | AUM projected > $5 trillion globally; demand for efficiency and scalability |

| Institutional Asset Managers | Streamlined portfolio management, sophisticated risk analysis, accurate accounting | Global AUM projected > $100 trillion; need for robust operational solutions |

| Family Offices | Consolidated portfolio view, risk management, financial accounting, compliance | Over 7,000 single-family offices globally managing trillions; need for advanced tech |

| CFOs & Accountants | Real-time general ledger, operational control, efficient reporting, middle/back-office services | Increased regulatory scrutiny and demand for immediate financial insights |

| COOs & Operations Leadership | Streamlined workflows, enhanced transparency, operational efficiency, risk mitigation | Operational efficiency cited as top priority by 65% of asset managers in 2024 |

Cost Structure

Enfusion dedicates a substantial portion of its budget to research and development, fueling the evolution of its sophisticated software platform. These investments are critical for staying ahead in a rapidly changing technological landscape.

A significant chunk of these R&D costs goes towards the compensation of highly skilled engineers and product developers. For instance, in 2024, the technology sector saw average salaries for software engineers rise by approximately 8-12% year-over-year, reflecting the demand for specialized talent.

Furthermore, Enfusion actively invests in cutting-edge technologies such as artificial intelligence and machine learning. These advancements are not merely for feature enhancement but are fundamental to maintaining Enfusion's competitive advantage and driving continuous innovation within its offerings.

As a cloud-native Software as a Service (SaaS) provider, Enfusion's cost structure is significantly influenced by its reliance on cloud infrastructure and hosting. These expenses are fundamental to delivering its platform to a global client base, ensuring robust scalability, high performance, and stringent security measures.

These costs encompass a range of services, including data storage, processing power, and network bandwidth. For instance, major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) charge based on usage, meaning Enfusion's infrastructure costs directly correlate with the volume of data processed and the number of users accessing its services.

In 2024, the global cloud computing market was projected to reach over $600 billion, highlighting the significant investment required for such infrastructure. Enfusion's ability to manage and optimize these cloud expenditures is crucial for maintaining its competitive pricing and profitability, especially as it scales its operations and expands its service offerings.

Employee salaries and benefits represent a significant expense for Enfusion, reflecting its investment in a global team across sales, marketing, client services, operations, and administration. This compensation is crucial for attracting and retaining highly skilled professionals in the competitive fintech industry.

In 2023, Enfusion reported total operating expenses of $194.1 million, with personnel costs being a substantial component. For instance, the company's total headcount grew to over 800 employees by the end of 2023, underscoring the scale of its investment in human capital.

Sales and Marketing Expenses

Enfusion's cost structure heavily features expenses related to customer acquisition and brand development. This includes outlays for their sales force, such as commissions, alongside investments in marketing campaigns, participation in industry events, and digital advertising. These expenditures are crucial for growing Enfusion's customer base and solidifying its market position.

For instance, in 2024, companies in the financial technology sector often allocate a substantial portion of their revenue, sometimes between 15-25%, to sales and marketing to achieve aggressive growth targets. Enfusion's commitment to these areas directly impacts its ability to scale and compete.

- Customer Acquisition Costs: Direct expenses incurred to acquire a new customer, including sales commissions and lead generation.

- Brand Building Investments: Spending on marketing campaigns, public relations, and industry presence to enhance brand recognition.

- Digital Marketing Spend: Allocations for online advertising, content marketing, and social media engagement to reach target audiences.

- Sales Team Operations: Costs associated with maintaining and motivating the sales force, including salaries, training, and travel.

Compliance and Regulatory Costs

Enfusion navigates a complex regulatory landscape, necessitating significant expenditure on compliance and legal adherence. These costs are critical for operating within financial services, covering adherence to frameworks like MiFID II, Dodd-Frank, and evolving data privacy laws such as GDPR and CCPA.

The company invests in robust compliance technologies and processes, including legal counsel for interpreting and implementing new regulations, and external audits to verify adherence. For instance, in 2024, the financial services sector globally saw increased spending on regulatory technology (RegTech) solutions, with projections indicating continued growth as regulatory scrutiny intensifies.

- Legal Fees: Costs associated with legal experts to interpret and implement financial regulations.

- Audit Expenses: Fees for internal and external audits to ensure compliance with industry standards and regulatory requirements.

- Technology Investments: Spending on RegTech solutions for monitoring, reporting, and data security to meet compliance mandates.

- Personnel Costs: Salaries for compliance officers and legal teams dedicated to regulatory adherence.

Enfusion's cost structure is heavily influenced by its technology and infrastructure needs. Significant investments in research and development, cloud hosting, and the compensation of highly skilled technical talent are paramount. These expenses are crucial for maintaining and enhancing its sophisticated SaaS platform.

Employee compensation is a major cost driver, reflecting the company's investment in a global workforce across various functions. In 2023, Enfusion's personnel costs were a substantial part of its $194.1 million in operating expenses, with a headcount exceeding 800 employees.

Customer acquisition and brand development also represent considerable expenditures. This includes costs for sales teams, marketing campaigns, and industry event participation, essential for market penetration and growth. In 2024, fintech firms often dedicate 15-25% of revenue to sales and marketing.

Regulatory compliance is another significant cost area, involving legal fees, audits, and technology investments to adhere to financial regulations. The global financial services sector saw increased spending on RegTech solutions in 2024 due to escalating regulatory scrutiny.

| Cost Category | Key Components | 2023/2024 Data Point |

|---|---|---|

| Technology & Development | R&D, Cloud Hosting, AI/ML Investment | Global cloud market projected over $600 billion in 2024. |

| Personnel Costs | Salaries, Benefits for Global Team | Total operating expenses of $194.1 million in 2023; headcount > 800. |

| Sales & Marketing | Sales Force, Marketing Campaigns, Events | Fintech sector often allocates 15-25% of revenue to S&M in 2024. |

| Compliance & Legal | Legal Fees, Audits, RegTech Solutions | Increased RegTech spending in financial services in 2024. |

Revenue Streams

Enfusion's core revenue comes from recurring subscription fees for its cloud-based investment management platform. This model provides clients with continuous access to tools for portfolio management, risk assessment, accounting, and trade execution.

These subscriptions are typically structured as annual or multi-year agreements, ensuring a predictable and stable revenue flow for Enfusion. For instance, in 2023, Enfusion reported that its recurring revenue represented a significant portion of its total income, underscoring the strength of its SaaS model.

Enfusion captures significant revenue through its managed services, offering clients outsourced middle and back-office operational support. This segment provides a consistent, recurring income stream, supplementing its core software licensing. For instance, in 2024, Enfusion reported strong growth in its managed services, reflecting increased client adoption of these specialized, outsourced solutions.

Enfusion also earns revenue through professional services, which include the crucial tasks of implementing, configuring, and customizing its platform. These are often one-time or project-based fees, reflecting the specialized consulting and technical expertise needed to get clients up and running smoothly.

These implementation fees are vital for ensuring clients can effectively leverage Enfusion's capabilities. For example, during 2024, many financial institutions were actively upgrading their technology stacks, creating a strong demand for these specialized services.

Additional Module and Feature Upgrades

Enfusion's strategy includes generating revenue from the ongoing development and release of new modules and feature upgrades. As the platform evolves, clients have the option to purchase or subscribe to these enhanced functionalities, such as advanced Portfolio Workbench capabilities, thereby increasing their existing service agreements.

For instance, in 2024, Enfusion introduced several updates aimed at improving user experience and analytical power. These upgrades often come with tiered pricing, allowing clients to select the level of functionality that best suits their needs, directly contributing to additional revenue streams.

- New Module Releases: Enfusion can monetize the introduction of entirely new software modules designed to address emerging market needs or provide specialized functionalities.

- Feature Enhancements: Existing modules can be upgraded with new features, offering clients the choice to pay for access to these advanced capabilities.

- Subscription Tiers: Revenue is generated by offering different subscription levels that unlock varying degrees of access to premium modules and features.

- Client Adoption: The success of this revenue stream depends on Enfusion's ability to demonstrate clear value and ROI for these upgrades, encouraging client adoption.

Data and Analytics Service Offerings

Enfusion can generate additional revenue by offering specialized data and analytics services that extend beyond its core platform capabilities. These premium reporting features and enhanced analytical tools cater to clients seeking deeper, more tailored insights.

For instance, a client might pay for advanced market trend analysis or customized data feeds that are not part of the standard subscription. This tiered approach allows Enfusion to monetize its sophisticated analytical infrastructure and expertise.

- Premium Reporting: Offering detailed, customizable reports on market performance, client behavior, or specific asset classes for an additional fee.

- Custom Data Feeds: Providing clients with proprietary data sets or real-time feeds tailored to their unique analytical needs.

- Advanced Analytics Tools: Unlocking sophisticated modeling, simulation, or predictive analytics features for a premium charge.

- Consulting Services: Leveraging their data expertise to offer bespoke analytical consulting to clients.

Enfusion's revenue model is robust, built on recurring subscription fees for its cloud-based investment management platform, which provides essential tools for portfolio management, risk, accounting, and trade execution. These annual or multi-year agreements create a predictable income stream, with recurring revenue forming a substantial portion of their total income, as seen in their 2023 performance.

Beyond subscriptions, Enfusion generates significant income through managed services, offering outsourced middle and back-office support, a segment that showed strong growth in 2024 due to increasing client adoption of these specialized solutions. Professional services, including implementation and customization, also contribute significantly through project-based fees, vital for client onboarding and platform utilization, especially with the heightened demand for technology upgrades in 2024.

Further revenue streams are derived from new module releases and feature upgrades, allowing clients to purchase enhanced functionalities, such as advanced Portfolio Workbench capabilities, often with tiered pricing options that cater to diverse client needs. Enfusion also monetizes specialized data and analytics services, offering premium reporting and tailored data feeds for clients seeking deeper insights, as demonstrated by their tiered approach to analytical tools.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| Subscription Fees | Recurring revenue from cloud-based platform access. | Significant portion of total income in 2023. |

| Managed Services | Outsourced middle and back-office support. | Strong growth reported in 2024. |

| Professional Services | Implementation, configuration, and customization fees. | High demand due to technology upgrades in 2024. |

| Module/Feature Upgrades | Monetizing new functionalities and enhancements. | Tiered pricing options for diverse client needs. |

| Data & Analytics Services | Premium reporting and tailored data feeds. | Monetizes sophisticated analytical infrastructure. |

Business Model Canvas Data Sources

The Enfusion Business Model Canvas is informed by a blend of internal financial performance data, comprehensive market research, and strategic competitive analysis. This multi-faceted approach ensures each component of the canvas is grounded in actionable insights.