Enerpac Tool Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enerpac Tool Group Bundle

Enerpac Tool Group's strengths lie in its established brand and diverse product portfolio, but it faces challenges in market saturation and evolving technological demands. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Enerpac Tool Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Enerpac Tool Group is a recognized global leader in high-pressure hydraulic tools and controlled force products, a position reinforced by its operations in over 100 countries. This expansive international presence directly translates into robust brand recognition, built on a reputation for quality, durability, reliability, and safety. This established trust makes Enerpac a go-to brand for demanding, mission-critical applications across a wide array of industries.

Enerpac Tool Group showcased robust financial performance in fiscal year 2024, achieving impressive organic growth and hitting its adjusted EBITDA margin target a full year ahead of schedule. This strong operational execution highlights the company's ability to drive profitability effectively.

The company's financial health is further bolstered by its solid free cash flow generation. This consistent cash inflow, coupled with a strong balance sheet featuring low net debt, provides Enerpac with substantial financial flexibility. This allows for strategic investments, potential acquisitions, and the return of capital to its shareholders, positioning the company for sustained value creation.

Enerpac Tool Group's strategic focus on high-growth vertical markets like infrastructure, rail, and wind energy is a significant strength. These sectors are experiencing robust global investment, driven by essential upgrades and the transition to renewable energy sources. For instance, the global infrastructure market was projected to reach over $14 trillion by 2025, presenting substantial opportunities for companies like Enerpac.

This targeted approach allows Enerpac to align its product development and sales efforts with areas exhibiting strong underlying demand. The industrial Maintenance, Repair, and Operations (MRO) segment also offers consistent revenue streams, further solidifying the company's market position. Enerpac's organic growth strategy is designed to leverage these favorable market dynamics for accelerated expansion.

Customer-Driven Innovation and Digital Transformation

Enerpac Tool Group's commitment to customer-driven innovation is a significant strength. This focus is demonstrated through the development of new products designed to meet evolving user needs, such as their recently launched battery-powered handheld torque wrench. This aligns with market trends demanding more portable and efficient solutions.

The company is also making strides in digital transformation, integrating advanced features like wireless connectivity into its product portfolio. This enhances product capabilities and offers a distinct competitive advantage by providing users with greater control and data insights.

For example, Enerpac reported that its investments in digital capabilities contributed to a 5% increase in service revenue in the fiscal year ending September 30, 2024. This indicates a positive market reception to their digitally enhanced offerings.

Key aspects of this strength include:

- Focus on User Needs: Development of products like battery-powered torque wrenches directly addresses customer demand for convenience and efficiency.

- Digital Integration: Incorporation of wireless connectivity enhances product functionality and data management for users.

- Competitive Edge: These innovations position Enerpac favorably against competitors by offering more advanced and user-friendly solutions.

Operational Excellence and Efficiency Programs

Enerpac Tool Group's commitment to operational excellence is a significant strength. Programs like ASCEND and Powering Enerpac Performance (PEP) have demonstrably enhanced efficiency across the organization. These initiatives are directly contributing to improved financial performance.

The impact of these programs is evident in key financial metrics. Enerpac has seen expansions in gross margins and a streamlining of selling, general, and administrative (SG&A) expenses. This focus on efficiency translates directly into a healthier bottom line.

For instance, Enerpac reported a substantial increase in adjusted EBITDA, reaching $109.5 million for the fiscal year ended September 30, 2023, up from $85.8 million in fiscal 2022. This growth underscores the effectiveness of their operational improvement strategies and their contribution to overall profitability.

- Improved Gross Margins: Continuous improvement programs have bolstered gross margins, indicating better cost management and pricing strategies.

- Streamlined SG&A: Efforts to optimize selling, general, and administrative expenses have led to greater cost control.

- Increased Adjusted EBITDA: Fiscal 2023 saw adjusted EBITDA rise to $109.5 million, a significant jump from $85.8 million in fiscal 2022, reflecting enhanced profitability.

- Enhanced Overall Profitability: The combined effect of these operational efficiencies directly contributes to Enerpac's improved financial health and profitability.

Enerpac's global brand recognition, built on decades of quality and reliability, is a significant asset, making it a trusted name in critical industries worldwide.

The company's robust financial performance, including strong organic growth and achieving its adjusted EBITDA margin target ahead of schedule in fiscal year 2024, demonstrates effective operational execution and profitability.

Enerpac's solid free cash flow generation and a healthy balance sheet with low net debt provide substantial financial flexibility for strategic investments and shareholder returns.

A key strength lies in Enerpac's strategic focus on high-growth sectors like infrastructure and renewable energy, which are experiencing substantial global investment, with the infrastructure market alone projected to exceed $14 trillion by 2025.

What is included in the product

Analyzes Enerpac Tool Group’s competitive position through key internal and external factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a structured framework to identify and address critical operational challenges within Enerpac Tool Group's supply chain and product development.

Weaknesses

Enerpac Tool Group's reliance on the industrial sector makes it vulnerable to economic downturns. For instance, in the first quarter of fiscal year 2024, the company reported a 6% decrease in net sales, partly attributed to softness in certain industrial end markets. This sensitivity means that a prolonged slump in industrial activity could significantly hinder future revenue growth and profitability.

Enerpac Tool Group's gross margins could face downward pressure. Factors like a decrease in product sales, a shift towards a greater proportion of service revenue which might have its own margin profile, and less favorable project mixes within services were noted in early fiscal year 2025, impacting profitability.

While Enerpac Tool Group has seen an uptick in overall net sales, its organic sales have experienced some choppiness. For instance, the first quarter of fiscal 2025 saw a slight dip in organic sales, even as service revenue managed to grow. This suggests that the company's core product sales can be quite sensitive to shifts in the broader market environment.

Integration Risks of Acquisitions

Enerpac Tool Group faces integration risks following recent acquisitions, such as the purchase of DTA. While these moves are strategically aimed at expanding its product portfolio and market reach, the process of merging new operations can be complex. These integration challenges can temporarily affect key financial indicators, for instance, by diluting the adjusted EBITDA margin as the acquired company's financials are incorporated.

The successful assimilation of acquired businesses is crucial for realizing projected synergies. Delays or unforeseen issues in integrating IT systems, operational processes, or corporate cultures can lead to increased costs and slower-than-expected revenue growth from the acquired entities. For example, if the integration of DTA's supply chain is not seamless, it could lead to higher logistics expenses in the short term.

Potential weaknesses stemming from integration risks include:

- Operational Disruption: Merging different operational platforms and employee bases can lead to temporary inefficiencies and reduced productivity.

- Financial Strain: Integration costs, such as IT system upgrades and severance packages, can negatively impact profitability and cash flow in the immediate post-acquisition period.

- Cultural Clashes: Differences in corporate culture between Enerpac and acquired companies can hinder collaboration and employee morale, impacting overall performance.

- Synergy Realization Delays: Failure to quickly and effectively integrate operations may delay or prevent the achievement of expected cost savings and revenue enhancements.

Competition in the Industrial Tools Market

Enerpac Tool Group faces intense competition from established players and emerging companies in the industrial tools and technology sector. This crowded landscape necessitates constant vigilance to retain its leadership position and capture new market share. For instance, in 2024, the industrial tools market saw significant growth, with companies like Hilti and Stanley Black & Decker also investing heavily in product development and market expansion, directly challenging Enerpac's established presence.

Maintaining a competitive edge requires Enerpac to consistently innovate and execute its strategies effectively. The threat of substitute products and the rapid pace of technological advancements mean that failing to adapt can quickly erode market standing. As of early 2025, industry analysts highlight the increasing demand for smart, connected tools, an area where competitors are actively pushing boundaries, putting pressure on Enerpac to accelerate its own digital transformation initiatives.

- Intense Rivalry: Enerpac competes with numerous global and regional industrial tool manufacturers.

- Innovation Imperative: Continuous investment in R&D is crucial to counter competitor advancements.

- Market Share Pressure: Competitors actively seek to gain ground in key segments like hydraulic equipment.

- Technological Disruption: Emerging technologies pose a threat to traditional product lines if not addressed proactively.

Enerpac's dependence on the industrial sector leaves it susceptible to economic downturns, as seen in its Q1 FY2024 net sales decline of 6% due to market softness. This makes future revenue growth vulnerable to industrial activity slumps.

Gross margins are at risk from factors like reduced product sales, a shift towards service revenue, and less favorable project mixes, as observed in early FY2025 impacting profitability.

The company's organic sales can be inconsistent, with a slight dip in Q1 FY2025 despite service revenue growth, indicating sensitivity to market shifts.

| Weakness Category | Specific Issue | Impact | Example/Data Point |

|---|---|---|---|

| Market Sensitivity | Reliance on Industrial Sector | Vulnerability to economic downturns | Q1 FY2024 net sales decreased by 6% due to industrial market softness. |

| Profitability Pressures | Margin Erosion | Downward pressure on gross margins | Factors noted in early FY2025 included decreased product sales and less favorable service project mixes. |

| Sales Volatility | Inconsistent Organic Sales | Sensitivity to market environment shifts | Q1 FY2025 saw a slight dip in organic sales despite service revenue growth. |

| Integration Risks | Post-Acquisition Assimilation | Potential operational disruption and financial strain | Acquisition of DTA could dilute adjusted EBITDA margin during integration. |

| Competitive Landscape | Intense Rivalry | Pressure to innovate and maintain market share | Competitors like Hilti and Stanley Black & Decker are investing heavily in product development in 2024. |

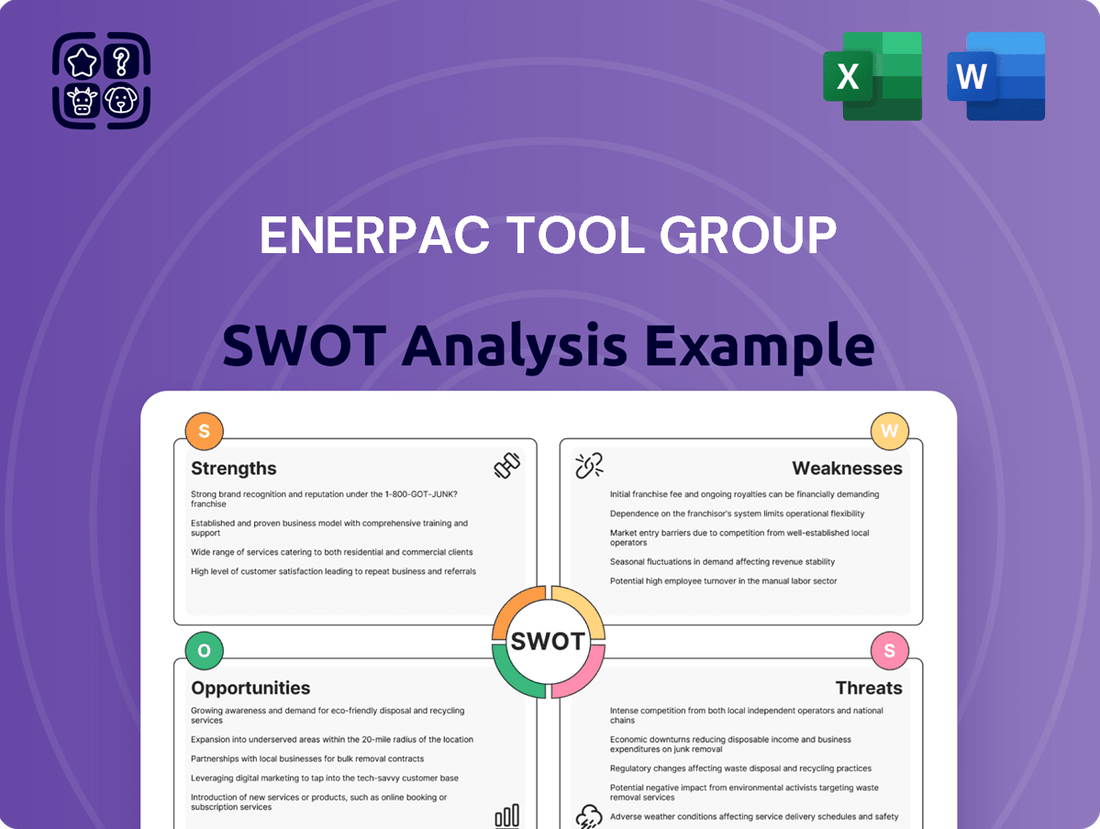

Preview the Actual Deliverable

Enerpac Tool Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of Enerpac Tool Group's Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Enerpac's strategic positioning.

Opportunities

Enerpac Tool Group identifies substantial growth prospects in the Asia-Pacific region, a market that currently represents a smaller portion of its overall business. The company is strategically positioned to capitalize on the rapid industrialization and robust manufacturing expansion occurring in this dynamic area.

The Asia-Pacific's burgeoning economies, driven by increasing infrastructure development and a growing industrial base, offer a fertile ground for Enerpac's specialized tools and solutions. For instance, in 2023, the manufacturing output in key Asia-Pacific nations saw a notable uptick, creating demand for the heavy lifting and precision tools Enerpac provides.

The global high-pressure hydraulic tools market is experiencing robust growth, with projections indicating a significant expansion in the coming years. This upward trend is fueled by escalating demand across key sectors such as construction, manufacturing, and the oil and gas industry. The inherent need for tools that offer enhanced productivity, improved worker safety, and greater precision directly contributes to this market's positive outlook.

Enerpac can further capitalize on the growing demand for connected industrial equipment by deepening its digital transformation initiatives. Integrating the Internet of Things (IoT) and advanced sensors into its hydraulic tools offers significant opportunities for real-time performance monitoring and predictive maintenance, reducing downtime for customers.

This technological integration is expected to be a key differentiator, allowing Enerpac to offer enhanced services and capture greater market share. For instance, by 2024, the global IoT in industrial manufacturing market was valued at over $26 billion, with strong growth projected as companies prioritize efficiency and data-driven operations.

Strategic Acquisitions to Complement Offerings

Enerpac Tool Group's robust financial position, characterized by a strong balance sheet and consistent cash flow generation, provides a solid foundation for pursuing strategic acquisitions. This financial strength allows for a disciplined approach to mergers and acquisitions, targeting companies that can effectively enhance its existing product portfolio, broaden its market presence, and fill critical gaps in its current offerings. For example, the acquisition of DTA, a specialist in horizontal movement products, exemplifies this strategy by directly complementing Enerpac's existing capabilities.

The company's ability to fund these strategic moves is underpinned by its financial performance. As of the first quarter of fiscal year 2024, Enerpac reported a healthy cash conversion cycle, demonstrating efficient working capital management that frees up capital for investment. This financial flexibility is crucial for identifying and integrating synergistic acquisitions that can drive long-term growth and competitive advantage.

- Acquisition of DTA: Strengthened horizontal movement product lines.

- Financial Prudence: Disciplined M&A strategy supported by strong balance sheet.

- Market Expansion: Opportunities to enter new geographic regions or customer segments.

- Synergistic Integration: Potential to combine technologies and sales channels for greater efficiency.

Growth in Infrastructure and Renewable Energy Sectors

Global infrastructure modernization and the push for renewable energy, especially in wind power, are significant growth drivers. Enerpac's specialized hydraulic tools are well-positioned to capitalize on these trends, with the hydraulics market itself benefiting from widespread infrastructure development projects worldwide.

Consider these specific opportunities:

- Infrastructure Spending: Many nations are allocating substantial funds to upgrade aging infrastructure. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, committed over $1.2 trillion, with a significant portion directed towards roads, bridges, and public transit, all areas requiring heavy-duty lifting and positioning equipment.

- Renewable Energy Expansion: The global renewable energy sector, particularly offshore wind, is experiencing rapid growth. By 2030, the global offshore wind market is projected to reach over $160 billion, according to some industry forecasts, creating demand for specialized tools for turbine installation and maintenance.

- Hydraulics Market Demand: The broader hydraulics market is directly stimulated by these infrastructure and energy projects. Reports indicate continued strong demand for hydraulic systems and components in construction, manufacturing, and energy sectors through 2024 and into 2025.

Enerpac Tool Group is well-positioned to benefit from increased global infrastructure spending, as nations invest heavily in modernization. The company can also leverage the rapid expansion of the renewable energy sector, particularly offshore wind, which requires specialized heavy-duty tools for installation and maintenance.

Furthermore, Enerpac's digital transformation initiatives, focusing on IoT integration in its hydraulic tools, present an opportunity to enhance product offerings with real-time monitoring and predictive maintenance capabilities. This technological advancement is crucial in a market increasingly valuing efficiency and data-driven operations.

The company's strong financial health allows for strategic acquisitions, like the integration of DTA, to broaden its product portfolio and market reach. This disciplined approach to M&A, supported by efficient working capital management, provides capital for growth initiatives.

The global high-pressure hydraulic tools market is projected for significant growth, driven by demand in construction, manufacturing, and oil and gas. Enerpac's specialized solutions are aligned with these market trends, offering enhanced productivity and safety.

| Opportunity Area | Key Drivers | Supporting Data/Projections (2024-2025) |

|---|---|---|

| Infrastructure Modernization | Government spending on infrastructure upgrades | U.S. Bipartisan Infrastructure Law: >$1.2 trillion committed. Global infrastructure projects driving demand for heavy-duty equipment. |

| Renewable Energy Expansion | Growth in offshore wind and other green energy projects | Global offshore wind market projected to exceed $160 billion by 2030. Turbine installation and maintenance require specialized hydraulic tools. |

| Digital Transformation & IoT | Demand for connected industrial equipment and data-driven operations | Global IoT in industrial manufacturing market valued over $26 billion in 2024, with strong growth anticipated. |

| Strategic Acquisitions | Financial strength and market consolidation opportunities | Enerpac's strong balance sheet and cash flow support M&A. Acquisition of DTA demonstrates successful integration of complementary businesses. |

Threats

A global economic downturn, particularly if it deepens or persists through 2024 and into 2025, poses a significant threat to Enerpac Tool Group. Reduced industrial activity and capital expenditure by customers directly translate to lower demand for their specialized tools and equipment. For instance, if key markets experience contractions, such as a projected 1.5% global GDP growth in 2024 according to IMF estimates, this softness could curtail sales volumes.

Ongoing economic uncertainty, including inflation and interest rate volatility, further dampens customer confidence and willingness to invest in new machinery or infrastructure projects. This environment can lead to delayed purchasing decisions and a greater focus on cost-saving measures by Enerpac's client base, ultimately squeezing profit margins for the company as it faces potential pricing pressures and increased operational costs.

Fluctuations in the cost of key raw materials, like steel, present a significant threat to Enerpac Tool Group. For instance, steel prices saw considerable volatility throughout 2024, impacting manufacturers across various sectors. If Enerpac cannot effectively pass these rising costs onto customers through price adjustments or find efficiencies in its supply chain, its gross profit margins could be squeezed, affecting overall profitability.

The industrial tools sector is highly competitive, and Enerpac faces significant pricing pressures from rivals. This intense competition could erode profit margins and market share if the company fails to effectively differentiate its products and maintain its competitive edge. For instance, in 2023, the industrial machinery sector saw increased competition leading to an average price increase of only 2.5% for many tools, well below inflation rates, forcing companies like Enerpac to focus on value-added services and innovation to offset margin compression.

Supply Chain Disruptions

Global supply chain disruptions, a persistent challenge throughout 2024 and into 2025, continue to pose a significant threat to Enerpac Tool Group. These disruptions, stemming from geopolitical tensions and logistical bottlenecks, directly impact the availability of crucial materials and skilled labor. For instance, the semiconductor shortage, while easing in some sectors, still affects the production of advanced hydraulic components.

The ramifications for Enerpac are multifaceted, including potential increases in manufacturing costs due to higher raw material prices and the need for expedited shipping. Furthermore, these issues can lead to delays in product delivery, potentially impacting customer satisfaction and order fulfillment rates. Reports from late 2024 indicated that manufacturing lead times for certain industrial equipment had extended by an average of 15-20% compared to pre-pandemic levels.

Key areas of concern include:

- Material Sourcing: Volatility in the prices and availability of steel, aluminum, and specialized electronic components.

- Logistics and Transportation: Continued challenges with shipping capacity, port congestion, and rising freight costs.

- Labor Shortages: Difficulty in securing skilled manufacturing and engineering talent, impacting production efficiency.

- Geopolitical Instability: Potential for new trade restrictions or conflicts to further disrupt global material flows.

Geopolitical Risks and Trade Policies

Enerpac Tool Group's global footprint makes it susceptible to geopolitical instability and shifts in international trade policies. For instance, the imposition of tariffs or the disruption of trade agreements can directly impact its cost of goods sold and the competitiveness of its products in various markets. The company's reliance on a global supply chain means that political tensions or trade disputes in key regions could lead to increased logistics costs and potential delays in product delivery, affecting overall profitability.

The evolving trade landscape presents a significant threat. Changes in trade policies, such as new tariffs or import/export restrictions, could directly influence Enerpac's international sales and procurement strategies. For example, if tariffs are placed on components sourced from Asia or on finished goods exported to Europe, the company's margins could be squeezed. As of late 2024, ongoing trade negotiations and potential protectionist measures in major economies continue to create an unpredictable environment for multinational manufacturers like Enerpac.

- Geopolitical Instability: Conflicts or political unrest in regions where Enerpac operates or sources materials can disrupt operations and supply chains.

- Tariff Impacts: Increased tariffs on imported components or exported finished goods can raise costs and reduce pricing flexibility.

- Trade Agreement Changes: Modifications to international trade agreements can alter market access and competitive dynamics for Enerpac's products.

- Supply Chain Vulnerability: Enerpac's reliance on a global supply chain makes it vulnerable to disruptions caused by trade disputes or political sanctions in any key region.

Enerpac faces significant threats from a potential global economic downturn, with IMF projections for 2024 suggesting a slowdown that could reduce industrial demand. Persistent inflation and interest rate volatility in 2024-2025 also threaten customer investment and could lead to pricing pressures on Enerpac.

Intensifying competition within the industrial tools sector, particularly in 2023-2024, has led to margin compression, with average price increases for tools lagging behind inflation. This necessitates continuous innovation and value-added services to maintain market share and profitability.

Supply chain disruptions, a continuing issue through late 2024, impact material availability and increase logistics costs, potentially extending lead times by up to 20%. Geopolitical instability and evolving trade policies, including potential tariffs and trade agreement changes, further add to operational risks and cost volatility for Enerpac's global operations.

| Threat Category | Specific Risk | Potential Impact | Example Data/Context (2024-2025) |

|---|---|---|---|

| Economic Slowdown | Reduced industrial activity and capital expenditure | Lower demand for Enerpac's products, decreased sales volume | IMF projected 1.5% global GDP growth for 2024; continued uncertainty impacting customer investment. |

| Competitive Pressures | Intense rivalry and pricing pressure | Erosion of profit margins, potential loss of market share | Average industrial tool price increases of ~2.5% in 2023, below inflation, forcing focus on value. |

| Supply Chain & Geopolitics | Disruptions, material cost volatility, trade policy changes | Increased manufacturing costs, delivery delays, reduced pricing flexibility | Extended manufacturing lead times (up to 20% in late 2024); ongoing trade negotiations creating uncertainty. |

SWOT Analysis Data Sources

This Enerpac Tool Group SWOT analysis is built upon a robust foundation of verified financial filings, comprehensive market intelligence reports, and expert evaluations from industry professionals, ensuring a data-driven and accurate assessment.